Rainbow Wallet has grown into a significant presence in the Ethereum and Layer‑2 ecosystem. Over recent years, it has gained attention for its intuitive design, rewards framework, and built‑in swap and bridge features. In practice, the wallet is used by collectors managing NFTs and by DeFi users executing frequent token swaps. These real-world cases show how wallets are no longer passive storage tools but active financial hubs. Read on to discover the key stats shaping Rainbow Wallet today.

Editor’s Choice

- The wallet has raised about $21 million over 4 funding rounds.

- In a recent month, Rainbow processed ~$5.4 million in swap volume, generating approximately $47,000 in revenue.

- Quarterly fees (protocol fees) in Q3 2025 hit $833,625.

- Rainbow supports at least 9 blockchains or networks (Ethereum, Optimism, Base, Zora, etc.).

- The usage rank of Rainbow in the U.S. (finance apps) is lower; it is not yet among the top wallets in app rankings.

- Its swap function was used by ~2,100 wallets in one recent reporting period.

- Rainbow’s open release notes indicate new network support (e.g., Degen Chain) and UI improvements in 2024–2025.

Recent Developments

- Rainbow announced adding full support for Degen Chain (send, swap, connect to dApps) in its 2024–2025 updates.

- In those updates, they improved quote price estimates and simulation previews in Swap flows.

- They added warnings in swaps when the price impact is unknown.

- The app also fixed bugs where NFTs might not display properly in certain galleries.

- Improved reliability for WalletConnect pairing and better telemetry were released.

- They resolved duplicate token metadata display (e.g., “DEGEN”) when richer metadata was introduced.

- UI fixes in dark mode and fixes to scrolling behavior on transaction screens were part of the update.

- In 2025, the team continues refining on‑chain UX and expanding network support (as per their “Updates” log).

Bitcoin Rainbow Chart Insights

- Bitcoin price on August 31, 2025, was trading between $7,015 – $10,200, placing it in the orange band titled “Is this The Flippening?”. This suggests cautious optimism, where market sentiment is heating up but hasn’t reached speculative extremes.

- The “Maximum Bubble Territory” band starts at $14,581 and goes up to $20,778, highlighted in dark red. Historically, prices in this zone indicate overheated market conditions and a strong risk of correction.

- The “But have we ‘earned’ it?” zone spans $10,200 – $14,581, marked in red. This band often reflects euphoric sentiment that may not be grounded in fundamentals.

- The “HODL!” band ranges from $4,835 – $7,015, representing a midpoint where seasoned holders remain confident. Prices here are seen as reasonable by long-term investors.

- The yellow “Steady…” zone covers $3,352 – $4,835, indicating neutral sentiment. Bitcoin is viewed as stable and gradually maturing when in this range.

- The “Still Cheap” band is between $2,359 – $3,352, suggesting mild undervaluation. This range often appeals to opportunistic buyers waiting for lower-risk entries.

- “Accumulate” zone spans $1,680 – $2,359, highlighted in green. This is typically viewed as an ideal entry point for long-term investors seeking strong upside potential.

- The light blue “Undervalued” zone includes prices between $1,217 – $1,680. Historically, this range has occurred during fear-driven selloffs or bear market bottoms.

- The “Fire Sale” band, from $899 – $1,217, is the deepest blue zone, indicating extreme undervaluation. Buying here has historically yielded outsized returns, albeit during high market panic.

Rainbow Wallet Overview

- Founded in 2019, Rainbow positions itself as a mobile-first Ethereum wallet.

- It is non‑custodial, meaning users hold their own keys (private key control).

- Rainbow supports the Ethereum mainnet and several Layer‑2 chains: Polygon, Optimism, Base, Zora, etc.

- It includes built‑in swap and bridge features to allow on‑wallet token exchanges without leaving the app context.

- It supports NFT viewing, gallery organization, and ENS name resolution to simplify address handling.

- Rainbow is open source, letting the community audit and verify its code.

- The wallet’s design emphasizes simplicity and aesthetics, aiming to attract non-technical users.

- The web extension (browser version) is under ongoing development to integrate with desktop dApp usage.

User Growth and Adoption

- Rainbow has raised awareness and user adoption via its “Rainbow Points” reward system, which encourages on‑chain activity.

- In November (recent data), ~2,100 wallets used the swap function.

- Swap volume that month was $5.4 million, showing active trading interest.

- The wallet’s app ranking in finance in the U.S. suggests moderate penetration (not yet dominant).

- On Android, Rainbow’s total installs appear limited (data shows “1K” installs in some listings), likely because of limited distribution or data gaps.

- Among crypto wallets, Rainbow was listed among the top 5 software wallets in 2024.

- The adoption rate is more concentrated in Ethereum and closely related Layer‑2 ecosystems, rather than across many blockchains.

- Some community users report app errors or failures when stored in secure folders on devices, an anecdotal sign of UX or stability risk.

Wallet Fee Revenue Breakdown

- Phantom Wallet generated $3.23 million in user fees, leading all competitors during the week. This reflects Solana’s strong DeFi and NFT activity and Phantom’s dominance in its ecosystem.

- Coinbase Wallet earned $2.3 million in fees, holding the second spot. The wallet continues to benefit from deep integration with the Coinbase exchange and growing institutional adoption.

- MetaMask collected $1.45 million in fees across Ethereum and Layer‑2 networks. It remains the go-to choice for DeFi traders and Web3 users seeking multichain access.

- Rabby Wallet recorded $1 million in total fees, signaling increased traction. Its built-in dApp support and clean UX are resonating with power users and developers alike.

- Trust Wallet saw $92,932 in weekly fees, showing modest but stable usage. Its appeal remains strongest within the BNB Chain and mobile-first DeFi users.

- Rainbow Wallet generated $74,660 in fees, highlighting its niche among NFT collectors and Ethereum-native users. Despite a smaller volume, its clean UI and points system help retain loyalty.

- Zerion Wallet captured $17,231 in fees, reflecting lower but consistent usage. Known for its portfolio management tools, it continues to attract Web3-savvy investors.

Supported Chains and Networks

- Rainbow supports at least 9 chains, including Ethereum, Polygon, Optimism, Base, Zora, etc.

- The addition of Degen Chain was a recent network expansion.

- Support includes full token send, swap, and dApp access on those chains.

- Rainbow uses WalletConnect to interface with dApps across supported networks.

- Users can follow addresses (watch mode) even if not held in a wallet, across supported networks.

- ENS resolution (i.e., sending to .eth names) simplifies cross‑chain address handling in supported environments.

- Network additions are tracked via their “Updates” log, showing active roadmap expansion.

- Because it’s non‑custodial, users must use network‑native gas tokens per chain for transactions.

Mobile vs. Desktop Usage Statistics

- The wallet began as mobile-first, with its core growth on iOS initially.

- Android install data is modest or opaque, with some listings showing only “1K” installs.

- In Similarweb rankings, its usage is mainly tracked in mobile finance apps.

- Desktop/browser usage is less quantified publicly, but the extension is still under development to compete with MetaMask.

- The mobile UI is optimized for quick touches, swaps, and gallery interactions, moves that suit on-the-go users.

- Desktop usage will target more active traders or heavy dApp users once the browser version matures.

- Mobile usage may have limitations (e.g., app stability, background restrictions), and users report issues in secure folders.

- As of now, most analytics emphasize mobile performance; desktop metrics are less visible in public data.

In‑App Swap and Bridge Statistics

- Rainbow did $5.4 million in swap volume in one month, generating ~$47,000 in revenue.

- That same period saw about 2,100 wallets actively use its swap function.

- Rainbow’s 30‑day fees are $176,979, implying active swap usage.

- Its annualized revenue (fees) is estimated at $2.16 million, based on current swap flows.

- Rainbow’s swap aggregator shows 24h volume of ~$23,492 in certain weeks.

- Swap DEX aggregator charts suggest fluctuation, but consistent baseline volume.

- Cross‑chain bridging is supported, letting users swap or move assets between Ethereum, Optimism, Zora, etc.

- Rainbow’s bridge & swap UI offers gas editing, slippage toggles, and route simulation.

- The RainbowRouter smart contract handles cross-chain interactions for swaps and bridging across supported chains.

Wallet Security Features

- Rainbow is open source, allowing community code audits to catch vulnerabilities early.

- It is noncustodial, meaning users retain direct control of private keys and funds.

- The wallet offers iCloud backup (for iOS) to help restore wallets if devices are lost, while keeping seed phrases secure.

- Warnings appear for unverified tokens or high slippage, helping prevent poor trades.

- It integrates with hardware wallets (e.g., via Ledger), so transactions must be physically confirmed on the external device.

- Rainbow displays review screens before swaps with breakdowns of gas, minimum received, and price impact.

- As users reported, the team is actively working on Android performance fixes to avoid crashes and slowdowns.

- Community feedback suggests the swap fee is 0.85%, lower than MetaMask’s 0.875% on certain networks.

- The wallet adds telemetry and diagnostics in updates (e.g., improved WalletConnect v2 logging) to better detect security issues.

NFT Management and Usage Data

- Rainbow allows users to view NFTs directly in the wallet with gallery layouts and filtering.

- It supports ERC‑721 and ERC‑1155 tokens on networks compatible with the wallet.

- Users can sort, filter, and follow collections to track drops and transfers.

- NFT display is part of the core UX, making wallets more than transaction tools.

- NFT metadata (images, media) rendering is improved in recent updates to reduce display errors.

- Some users report delays or failed loading for large NFT collections.

- While public stats on NFT volume in Rainbow are limited, the wallet’s emphasis on artwork suggests meaningful engagement.

- Because Rainbow supports ENS, NFT owners can more easily associate human-readable names with their token collections.

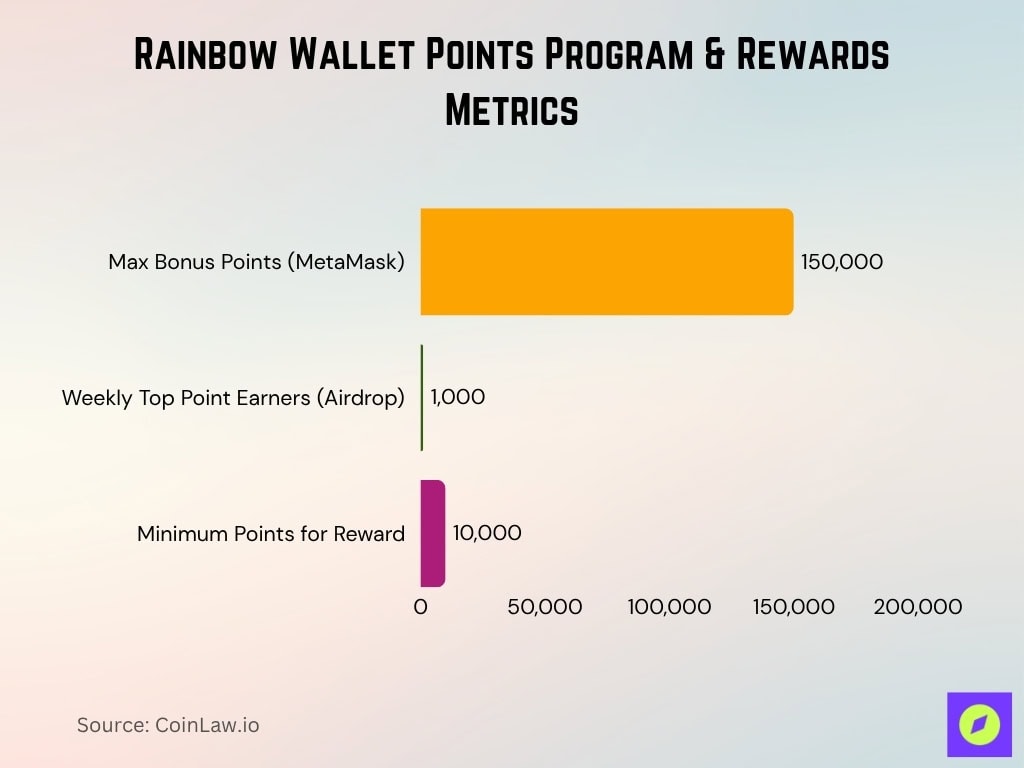

Points Program and Rewards Metrics

- It awarded up to 150,000 bonus points to early users who imported swap history from MetaMask.

- Every Tuesday, eligible users in the top 1,000 by points can claim ETH airdrops.

- To qualify, users must hold at least 10,000 points.

- Rainbow introduced “Rainbow Points” based on users’ past swap, bridge, and wallet activity (including MetaMask imports).

- Referral rewards grant 10% of points earned by referred friends.

- The referral threshold requires a $10 cumulative swap from the friend to begin earning.

- Rainbow pays gas costs for claiming rewards on supported L2s, easing friction.

- The points program is explicitly designed to increase retention and incentivize frequent on-chain activity.

Transaction Volume and Fees

- $176,979 in 30‑day fees, implying underlying swap volume of ~$20.8 million.

- The protocol’s annualized fees are ~$2.16 million based on current trends.

- In Q3 2025, the wallet collected $161,045 in fees.

- Q4 2024 fees were ~$945,158, while Q3 2025 is much lower.

- In some weeks, daily fees are ~$8,033.

- Swap aggregator stats show 24h volumes in the $20,000 range on some chains.

- Fees are consistently 0.85% of swaps per Rainbow’s revenue model.

- Over time, cumulative protocol fees exceed $7 million.

- Development activity (commits) remains active: ~14 weekly commits, ~304 monthly as of mid‑2025.

Rainbow Wallet Funding and Financials

- Rainbow has raised about $21 million across four funding rounds.

- The business remains free to users; revenue depends on swap/bridge fee share and partnerships.

- It does not appear to rely heavily on token emission or tokenomics for revenue.

- On‑chain swap fees (0.85%) are the primary monetization route.

- Growth funding may support new network integrations, improved performance, marketing, and security.

- Public data show no large token sale or controversial funding round recently.

- Financials remain fairly lean, possibly because the team prioritizes product development over monetization.

- Developer activity is healthy (commits, updates), which suggests active reinvestment of resources into features.

Comparative Analysis with Competitors

- MetaMask remains the dominant Ethereum wallet, boasting >10 million monthly active users, while Rainbow is still niche.

- MetaMask’s swap fee is ~0.875%, slightly higher than Rainbow’s 0.85%.

- Rainbow ranks #4,933, indicating room to grow.

- Competing wallets like SafePal, Guarda, and Exodus appear in “same users also use” lists.

- Some users praise Rainbow’s UX over heavy‑feature wallets, calling it “ugly, slow, but got everything I need.”

- MetaMask’s extension and deep dApp integration remain strengths, whereas Rainbow’s desktop presence is still under development.

- Rainbow’s points program is distinctive; few competitors offer built‑in gamification or reward layers at the wallet level.

- Rainbow’s open‑source transparency contrasts with some wallets whose codebases are closed or partially closed.

- In terms of fee share and volume, Rainbow is far behind leading DEX platforms like Uniswap, but within the wallet‑centric niche, it shows competitive positioning.

Key Milestones and Feature Updates

- In 2021, Rainbow closed an $18 million Series A round led by Seven Seven Six.

- The wallet launched its Points program in late 2023 to reward on‑chain activity and attract users from MetaMask.

- Rainbow expanded support to Base, Coinbase’s L2.

- The team published updates improving UI, metadata rendering, swap simulation previews, and warning prompts.

- The roadmap includes a “King of the Hill” gamified feature tied to its upcoming token system.

- Rainbow has reserved 4% of the RNBW token supply for acquiring the Clanker token‑launch protocol.

- It intends to release 20% of the circulating supply at the Token Generation Event (TGE) in Q4 2025.

- New features slated include real‑time portfolio pricing, integrated charts, and deeper DeFi tools within the wallet UI.

Hardware Wallet Integration Stats

- Rainbow supports hardware wallets (e.g., Ledger), allowing users to sign transactions externally.

- Users confirm transactions on the device, ensuring air‑gapped security for sensitive operations.

- This integration reduces exposure to key theft within the mobile or desktop environment.

- As hardware adoption grows, wallets that integrate with cold storage may gain an advantage among high‑net‑worth users.

- Integration encourages trust among users wary of mobile‑only custody.

- No detailed public numbers yet on how many users leverage hardware integration via Rainbow.

- In community forums, users often demand better support for more hardware models and smooth pairing.

Demographics of Rainbow Users

- Rainbow ranks #4,933 in U.S. finance apps, indicating its penetration is still modest.

- In the Philippines, it ranks #7665 overall, #586 in finance.

- Rainbow on Google Play shows 500K+ downloads.

- The wallet supports multiple blockchains, including Ethereum, Base, Optimism, Zora, etc., attracting users in various Ethereum ecosystems.

- 1 in 3 dApp users connect via mobile wallets.

- Community feedback suggests a global and diverse user base, not limited to one geography.

- Forums reveal Android users complain about performance lags, affecting retention in some regions.

- Because Rainbow focuses on Ethereum‑centric chains, users in non‑EVM ecosystems are less likely to adopt it.

Community Engagement and Support Metrics

- Rainbow’s community is active in Reddit threads, where developers sometimes answer questions live.

- Users confirmed that swap fees are 0.85%, less than MetaMask’s 0.875%.

- Users also frequently request Android performance improvements and give feedback on features.

- The “Updates” page logs many bug fixes, UI tweaks, and feature enhancements.

- Rainbow supports user referrals, offering 10% of points earned by referred users.

- Weekly ETH airdrops are granted to the top 1,000 point earners.

- All gas costs for claiming rewards are covered by Rainbow.

- The team publicly outlines future phases for the reward program, showing a roadmap of community incentives.

Strategic Partnerships Statistics

- Rainbow publicly supports Base, aligning with Coinbase’s L2 strategy.

- The upcoming RNBW token launch is tied to partnerships with protocols like Hyperliquid.

- 4% of the token supply is allocated for acquiring Clanker, a token‑launch protocol.

- Rainbow’s Points program enticed users from MetaMask.

- Because Rainbow is open source, it is easier to integrate with external dApps and protocols.

- Rainbow works across multiple layer‑2 networks.

- The community speculation around Rainbow vs MetaMask token strategies fuels media partnerships and coverage.

Market Position and Share

- Among software wallets, Rainbow ranks among the Top 5 in 2024.

- MetaMask remains dominant, with over 30 million monthly active users in early 2024.

- Rainbow’s usage rank in U.S. finance apps (#4,933) shows it has a low share in general mobile finance.

- Its market share is stronger in Ethereum‑centric or NFT‑oriented niche segments.

- Rainbow’s growth is being driven not by sheer volume but by user engagement, rewards, and ecosystem integration.

- The upcoming RNBW token could shift shares by offering ownership incentives and token economics.

- Compared to heavyweights like MetaMask, Rainbow’s fee revenue is modest, so its market share in value terms remains small.

- Its design, UX focus, and reward gamification give it a distinct positioning advantage in the wallet market.

Frequently Asked Questions (FAQs)

About $244,180 in fees were generated in the last 30 days.

Its annualized fee revenue is estimated at around $2.98 million.

Approximately 2,100 wallets used Rainbow’s swap function in November.

In Q3 2025, Rainbow collected $833,625 in fees.

The 24‑hour swap aggregator volume is around $23,492.

Conclusion

Rainbow Wallet straddles the line between a sleek Ethereum wallet and a growing DeFi ecosystem hub. Its Points program, expanding chain support, upcoming RNBW token, and community incentives all point to a maturing product that’s aiming to raise its stakes. While it still trails giants like MetaMask in total user count and revenue scale, Rainbow’s strength lies in user loyalty, incentives, and ecosystem integrations. As the token launch and deeper DeFi tools arrive later this year, its trajectory will be one to watch closely.