The stablecoin mUSD has emerged as a noteworthy entrant in the dollar‑pegged token space. As digital finance continues to evolve, mUSD aims to offer a bridge between traditional U.S. dollar liquidity and on‑chain transactions, providing users with stability and interoperability. Early adoption data suggests mUSD could reshape how wallets, platforms, and users handle stable value. Read on to explore the full statistical picture.

Editor’s Choice

- As of November 2025, mUSD’s circulating supply sits at 25.81 million tokens.

- Its market capitalization is roughly $25.8 million, reflecting its current supply and price level.

- mUSD maintains a stable peg, currently trading at approximately $1.00 per token.

- The token is fully backed by liquid dollar‑equivalent reserves, cash, and short-term U.S. Treasury assets, ensuring 1:1 backing for each mUSD in circulation.

- mUSD supports both the Ethereum mainnet and the L2 network Linea, enabling cross-chain and cheaper gas usage.

Recent Developments

- The stablecoin was officially launched by MetaMask in September 2025, marking the wallet’s entry into native currency issuance.

- The stablecoin is issued via infrastructure from Stripe, through its Bridge platform, using the protocol M0, underlining regulatory and technical backing.

- mUSD integrates with the MetaMask wallet and its upcoming card system, aiming to enable fiat‑onramps, swaps, and spending at merchants, potentially bridging traditional payment rails with crypto networks.

- The release of mUSD coincided with a broader expansion in overall stablecoin supply, contributing incrementally to the overall dollar‑pegged token ecosystem.

- As of late 2025, stablecoin supply across EVM and major networks continues to grow, indicating increasing demand for dollar‑linked liquidity across DeFi and Web3 applications.

Holders and Wallet Distribution

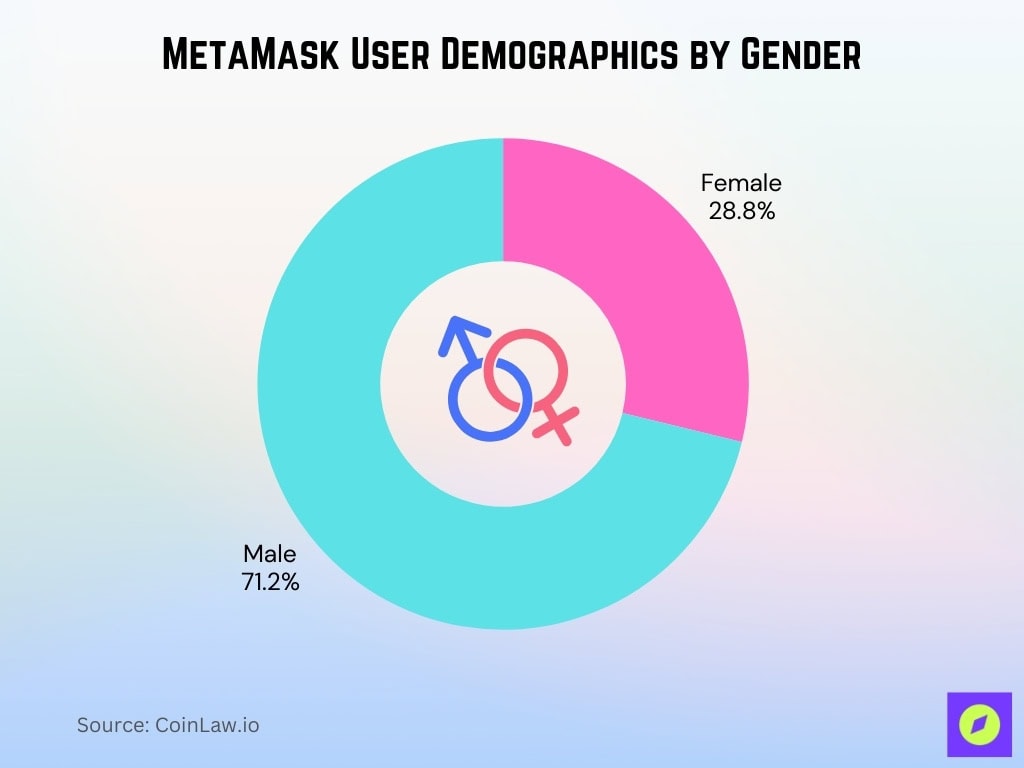

- Gender breakdown shows 71.2% male and 28.8% female among MetaMask users globally.

- On CoinMarketCap, mUSD shows about 14.94 K holders listed.

- Given a supply of 25.81 million mUSD, the holder count suggests many wallets hold small to moderate token amounts, on average, ~1,700 mUSD per wallet, though real distribution varies.

- MetaMask, the issuer wallet platform, claims ~30 million monthly active users (MAUs) in 2025, providing a large potential base for mUSD adoption.

- The self‑custodial nature of MetaMask means many users may hold mUSD in private wallets rather than centralized exchange custody, which can diffuse distribution broadly.

- Early supply growth dynamics, a jump from 15 million to 65 million, suggest many new wallets entered the ecosystem in a short period, indicating user onboarding likely outpaced consolidation.

mUSD Market Capitalization Statistics

- Market cap as of November 2025, $25.81 million.

- Circulating supply, 25.81 million mUSD tokens.

- Price per token, ~$1.00, reflecting a stable peg near the U.S. dollar.

- Fully diluted valuation equals current market cap, approx. $25.81 million.

- 24‑hour trading volume recently registered at about $1.16 million, showing moderate trading activity relative to the cap.

- Volume-to-market-cap ratio (24h) around 4–5%, indicating reasonable liquidity given the size.

On-Chain Activity and Transactions

- mUSD launched in September 2025, which means on-chain activity is still in its early phase but growing rapidly.

- The majority of mUSD transactions and supply currently occur on the Linea network, reflecting early adoption of L2 for cost‑efficient transfer and smart‑contract activity.

- Initial 24‑hour trading volume reached ~$1.16 million, indicating a reasonable level of liquidity and user activity.

- The volatility risk appears low so far; the price remains stable around $1.00, suggesting that on‑chain transactions have not triggered major depeg events yet.

- With mUSD integrated into a widely used wallet, MetaMask, with ~30 M MAUs, potential transaction volume could scale quickly as more users adopt the token.

- As of late 2025, the broader stablecoin ecosystem across blockchains continues to expand, meaning mUSD participates in a growing on‑chain liquidity pool, which may help its transaction volume and utility over time.

mUSD Circulating Supply and Chain Distribution

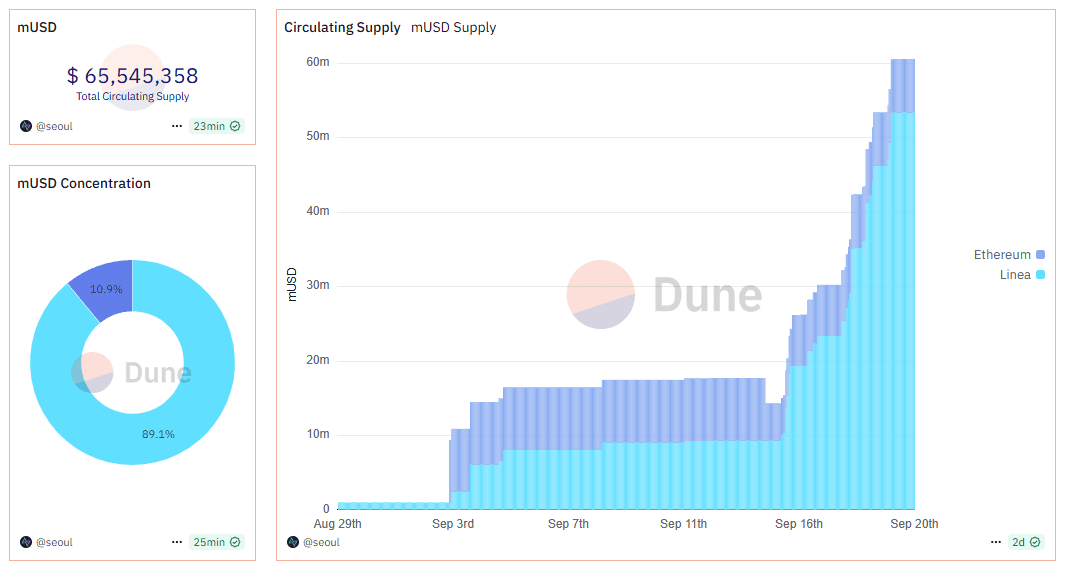

- $65.5 million is the latest recorded total circulating supply of mUSD.

- Linea holds the dominant share with 89.1% of the mUSD supply.

- Ethereum accounts for the remaining 10.9% of the circulating supply.

- mUSD supply was relatively flat from Sept 3 to Sept 15, hovering around 17–18 million tokens.

- A rapid supply surge occurred between Sept 16 and Sept 20, with mUSD climbing past 60 million tokens.

- The expansion during this final phase was primarily driven by mUSD issuance on the Linea network, not Ethereum.

- On Aug 29, the circulating supply was close to zero, highlighting the token’s rapid early growth.

Stablecoin Issuance and Growth

- The total stablecoin market cap grew from $205 billion to $300 billion in 2025, adding nearly $100 billion.

- Stablecoin supply jumped nearly 3% in May 2025 to reach $244 billion total.

- Stablecoin transaction volume hit a record $4 trillion from January to July 2025, up 83% year-over-year.

- Overall stablecoin market cap reached $303 billion in November 2025, despite the first monthly decline of 1.48%.

- USDT supply expanded 0.56% to $184 billion, holding 60.9% market dominance in November 2025.

- Total U.S. dollar-pegged stablecoin supply stood at $279.8 billion around mUSD launch, led by USDT at $172.3 billion.

Adoption Across Platforms and Networks

- MetaMask boasts 30 million monthly active users in mid-2025, providing a massive built-in adoption base for mUSD.

- mUSD is natively integrated into the MetaMask wallet, the first self-custodial wallet to launch its own stablecoin on September 15, 2025.

- Starting September 15, 2025, US and EU users will access mUSD via Transak fiat on-ramps directly in MetaMask.

- MetaMask supports 11 blockchains, including Linea and Ethereum, enabling mUSD cross-chain swaps and bridging.

- Transak integration reduced onboarding friction by 30% via Social Login, boosting mUSD wallet adoption.

- Linea stablecoin supply hit an all-time high of $74.5 million amid mUSD launch and liquidity incentives.

- MetaMask reaches 143 million total users globally in 2025, with 12.7% from Nigeria driving emerging market adoption.

- mUSD supports DeFi protocols on Linea, including lending, DEXs, with $62.6 million 24-hour trading volume in the first week.

Top 10 Challenges for Web3 User Adoption

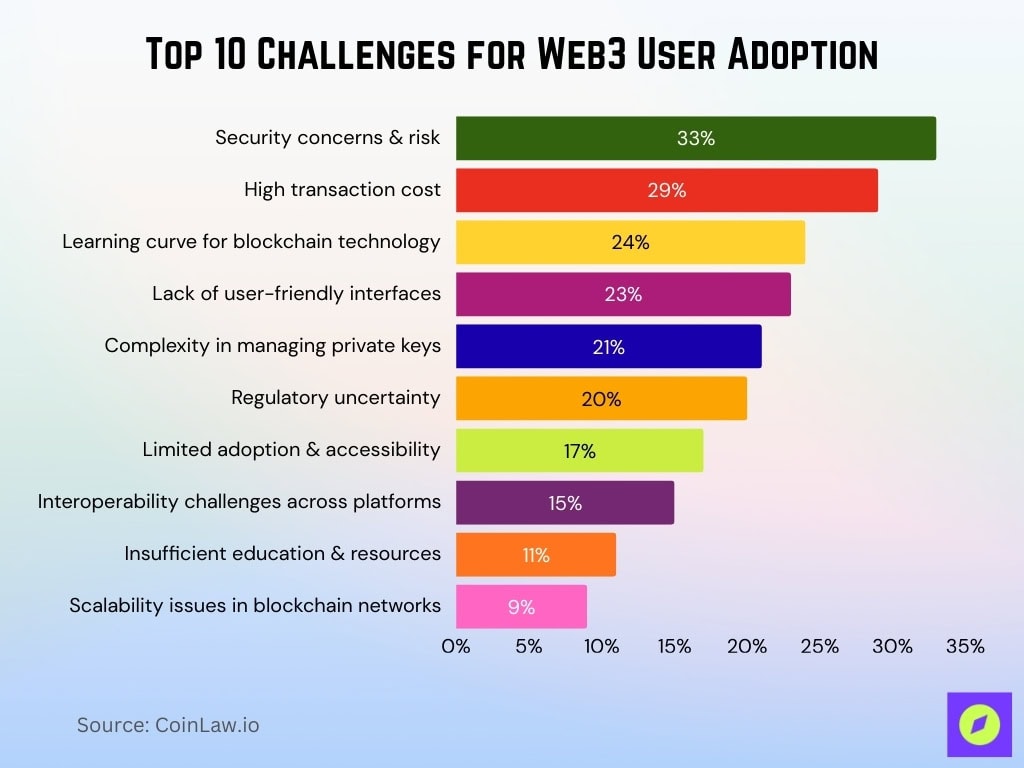

- 33% of users cite security concerns and risk as the biggest hurdle to using Web3.

- 29% are discouraged by high transaction costs, especially during network congestion.

- 24% struggle with the steep learning curve of blockchain and crypto technology.

- 23% say the lack of user-friendly interfaces makes platforms hard to navigate.

- 21% find the complexity of managing private keys to be a significant barrier.

- 20% are concerned about regulatory uncertainty, which affects confidence in long-term use.

- 17% point to limited adoption and accessibility as a reason for hesitation.

- 15% face interoperability challenges when using multiple blockchain platforms.

- 11% believe there is insufficient education and resources for onboarding into Web3.

- 9% highlight ongoing scalability issues in blockchain networks as a roadblock.

Peg Stability and Depeg Events

- As of November 2025, mUSD remains pegged at $1.00 consistently with no significant deviation.

- The 1:1 backing by cash and short-term U.S. Treasuries under Bridge ensures robust reserve coverage for every mUSD token.

- Market data shows zero reported depeg events for mUSD since launch in September 2025.

- Decentralized infrastructure using M0 and regulated reserve custody reduces systemic risk and peg instability for mUSD.

- Compared to risky algorithmic stablecoins, mUSD’s collateralization model eliminates volatility-induced depeg risks.

- The broader stablecoin market continues expanding, with over 90% pegged to the US dollar, supporting market stability.

- Recent major depeg incidents in 2025 involved algorithmic stablecoins like USDe, which dropped as low as $0.65.

- The peg stability of mUSD is reinforced by transparent 1:1 reserve mechanisms regulated for compliance and risk mitigation.

Collateral and Reserve Backing Statistics

- mUSD maintains a 1:1 backing ratio by high-quality dollar-equivalent assets held via Bridge custodians.

- Bridge holds mUSD reserves in segregated accounts, separating custody from token issuance logic.

- 98.9% of USDC reserves (comparable model) consist of cash and short-term U.S. Treasuries.

- Tether allocates $98.5 billion to U.S. Treasury bills as primary reserve backing in Q1 2025.

- 60-65% of major stablecoin reserves are dominated by cash and government money market funds.

- GENIUS Act 2025 mandates monthly audited reserve reports for all U.S. payment stablecoin issuers.

- Circle generated $658 million reserve income in Q2 2025, up 53% year-over-year from backing assets.

- 60-75% of leading stablecoins publish real-time proof-of-reserves dashboards in 2025.

User Demographics and Geographic Distribution

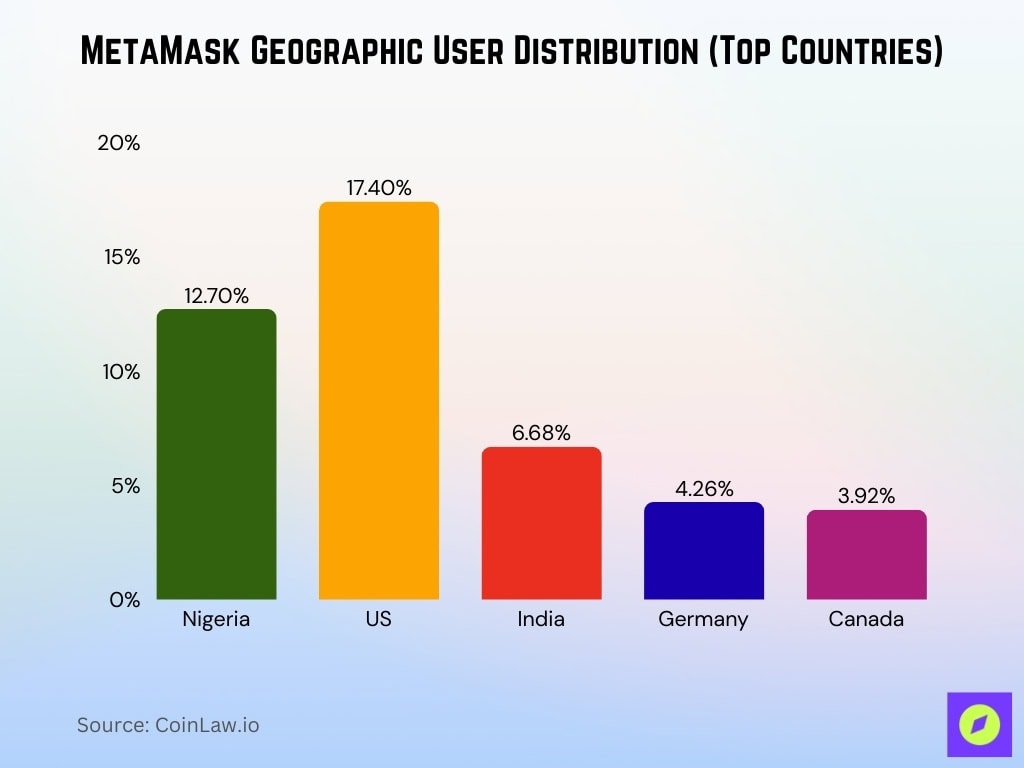

- Nigeria represents 12.7% of all MetaMask users, leading single-country adoption worldwide.

- United States drives 17.4% of metamask.io traffic and top app downloads in July 2025.

- India contributes 6.68% of MetaMask web traffic with 63% wallet dominance in August 2025.

- Germany accounts for 4.26% of MetaMask traffic, while Canada holds a 3.92% share.

- MetaMask holds 30 million monthly active users globally in early 2025, providing mUSD instant access to a massive user base.

- 25-34 year-olds comprise 31% of crypto users, the core MetaMask demographic in 2025.

- 99% of fiat-backed stablecoins are pegged to the U.S. dollar, driving global stablecoin adoption patterns.

- Stablecoin transfer volume hit $27.7 trillion in 2025, powering cross-border remittances.

Yield, Staking, and Rewards Metrics

- MetaMask launched $30 million LINEA rewards program in October 2025, including mUSD incentives on LINEA.

- Users swapping to mUSD on Linea receive 50% extra MetaMask Rewards points through early December 2025.

- mUSD liquidity pools against USDT, USDC, ETH, and LINEA started receiving rewards from September 15, 2025.

- Linea Ignition Program offers up to 11.9% APR in LINEA rewards for depositing USDC, USDT.

- M0 protocol supports rebasing $M tokens, where balances automatically increase with yield accrual.

- Linea Native Yield provides 3-5% APY on bridged ETH via Lido v3 staking integration.

- Ethereum staking yields averaged 4.6% APY across major platforms throughout 2025.

- USDT liquidity on Linea receives 0.1 LINEA per $1 while mUSD/ETH pools offer higher yields.

- Reserve yield from U.S. Treasuries backing stablecoins generated $658 million for Circle in Q2 2025.

Trading Pairs and Exchange Listings

- mUSD available on Ethereum mainnet and Linea DEXs, including Lynex, NILE, PancakeSwap V3 with $4.06 million 24h volume.

- Linea DEX volume reached $19.5 million daily, with USDC/mUSD pairs dominating 44.2% market share on Lynex.

- mUSD trading pairs include mUSD/USDT, mUSD/USDC, mUSD/ETH, and mUSD/LINEA across major Linea protocols.

- SyncSwap Linea lists mUSD with $127,567 24h volume in the mUSD/USDC pair.

- PancakeSwap V3 Linea handles $155,401 daily mUSD swaps, capturing 13.4% of Linea DEX activity.

- iZiSwap Linea supports mUSD trading with $76,909 volume across 10 pairs.

- mUSD integrates with core EVM DeFi protocols, lending markets, and DEXs since the September 2025 launch.

- Linea total DEX dominance at 0.2% of all blockchains, boosted by mUSD liquidity incentives.

- NILE V1 Linea records $178,367 in mUSD pairs, holding 5.1% network volume share.

Ranking Among Stablecoins

- As of November 27, 2025, mUSD has a market cap of approximately $25.8 million with a ranking around #674–#675.

- By late November 2025, the total stablecoin market cap stood near $300–303 billion, up strongly from roughly $200 billion at the start of the year.

- USDT and USDC together account for roughly 87% of the stablecoin market by market cap, with USDT near $184 billion (~61%) and USDC around $73–75 billion (~25–26%) as of November 2025.

- USDT alone commands roughly 58–60%, while USDC holds 24–25%.

- Other stablecoins like USDe have expanded but remain far smaller than incumbents.

- mUSD represents less than 0.01% of the global stablecoin market.

- Its ranking reflects early‑stage adoption rather than broad use.

Cross-Chain and Bridged Liquidity Statistics

- Linea stablecoin market cap reached $23.74 million with 6.54% weekly growth in late November 2025.

- Linea DEX volume hit $10.62 million in 24 hours, driven by mUSD cross-network swaps.

- L2 stablecoin supply share grew from 65% to 55% for Arbitrum while Base surged in 2025.

- 84% of the 2025 new stablecoin issuance is dominated by USDT, USDC, and USDe combined supply growth.

- Ethereum L1 hosts 70% of the total stablecoin supply, and BSC holds 15% across chains.

- Stablecoin transfer volume reached $27.6 trillion in 2024, projected $325 billion market cap by the end of 2025.

- Linea bridged TVL stands at $527.14 million with $294.46 million of canonical liquidity.

Risks, Security Incidents, and Audit Statistics for mUSD

- No major mUSD security incidents reported as of November 2025, unlike broader crypto losses exceeding $2.17 billion.

- mUSD daily trading volume averages $1.16 million, with low liquidity constraining large-scale operations.

- Consensys Diligence completed the mUSD token smart contract audit in August 2025 with no critical vulnerabilities found.

- Daily reserve audits verify mUSD 1:1 backing by dollar-equivalent assets, exceeding industry transparency standards.

- MetaMask ecosystem reports ≈500 user attacks daily via phishing, but no core mUSD infrastructure breaches.

- GENIUS Act mandates monthly independent audits for permitted stablecoins like mUSD by registered public accounting firms.

- Small market cap limits systemic risk but increases vulnerability during market stress events.

- Linea network Astera exploited and lost $880,000 in October 2025, highlighting L2 protocol risks near mUSD pools.

Frequently Asked Questions (FAQs)

The recent 24‑hour trading volume for mUSD is about $1.16 million

The circulating supply of mUSD is approximately 25.81 million tokens.

The current price of 1 mUSD token is $1.00.

Conclusion

The data today paint a clear picture: mUSD remains a niche, early‑stage stablecoin. Its market capitalization and circulation are tiny compared with legacy staples like USDT and USDC, which dominate roughly 80–90% of total stablecoin value. Yet mUSD’s architecture, combining regulated reserves, wallet-native issuance via MetaMask, and deployment on Layer‑2 networks, shows a thoughtful design aligned with evolving regulatory expectations and user needs.

That said, limited liquidity, opaque auditing history, and uncertain adoption beyond early users present meaningful hurdles. For mUSD to grow beyond niche status, it must scale reserve transparency, build deeper liquidity, and reach a broader, more geographically diverse user base.