Injective Protocol (INJ) sits at the intersection of decentralized finance and cross‑chain interoperability, combining derivatives, spot trading, and smart contract flexibility into one ecosystem. The network has shown sustained activity with notable trading volume and market cap figures that reflect ongoing adoption by traders and developers alike. Real‑world use cases range from gasless spot and perpetual derivatives trading to institutional access to tokenized assets and ETFs on a decentralized layer‑1 network. These trends shape its narrative, making this article essential for anyone tracking INJ’s key metrics today.

Editor’s Choice

- Market cap around $500 million–$570 million, positioning INJ among mid‑tier DeFi tokens in 2025, 2026.

- 24‑hour trading volumes often exceed $40 million–$100 million, signaling active trader engagement.

- Cumulative trading volume reached nearly $57 billion in H1 2025, underlining deep liquidity in derivatives markets.

- Daily transaction counts exceed 1,000, indicative of meaningful on‑chain usage.

- Historical price range 2025–2026 includes ~$4.2–$7.8, reflecting volatility in market cycles.

- Daily active address growth surged YoY, pointing to expanding network participation.

- Development of EVM‑compatible features in 2025, expanding smart contract utility.

Recent Developments

- INJ ranked consistently in the top 100 crypto assets by market cap through late 2025.

- MultiVM mainnet roadmap scheduled for rollout in early 2026 to enable EVM, SVM support.

- ETF review process underway in 2026 through Canary Capital, indicating institutional interest.

- Chainlink Data Streams integration expanded real‑world price feeds on Injective dApps.

- Second community buyback and token burn executed, signaling supply‑management actions.

- Research hub launched by Injective Labs highlights transparency and ecosystem data access.

- Network improvements in 2025 targeted cross‑chain DeFi and RWA adoption.

- Broader DeFi ecosystem partnerships continued through late 2025.

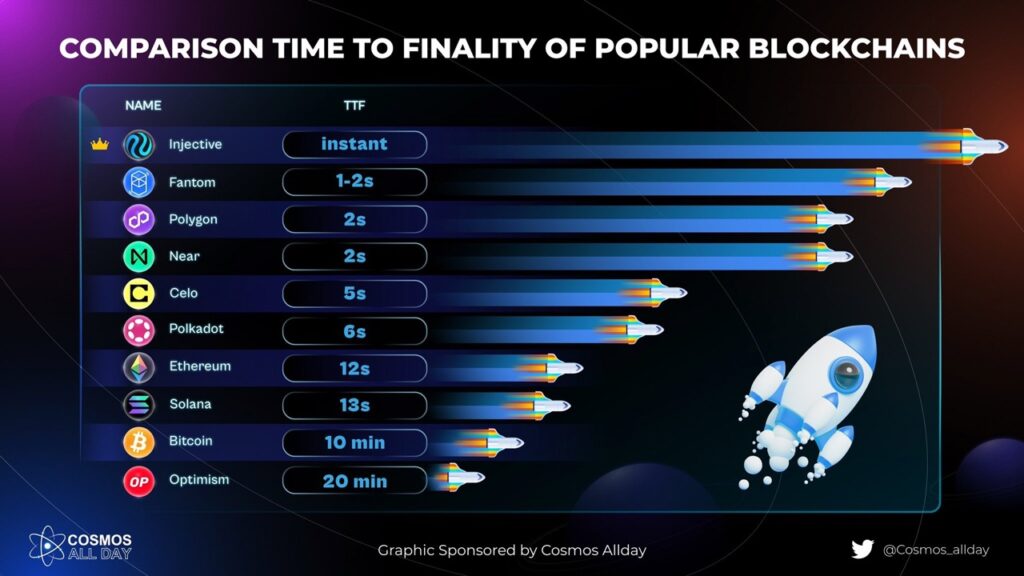

Blockchain Time to Finality Comparison

- Injective achieves instant finality, enabling near-real-time transaction confirmation.

- Fantom finalizes transactions in 1–2 seconds, supporting fast DeFi and dApp activity.

- Polygon and Near both reach finality in ~2 seconds, balancing speed and scalability.

- Celo records a 5-second time to finality, optimized for mobile-first payments.

- Polkadot confirms transactions in ~6 seconds, reflecting its relay chain architecture.

- Ethereum has a ~12-second finality window, typical of its proof-of-stake block production.

- Solana reaches finality in ~13 seconds, prioritizing high throughput at scale.

- Bitcoin remains the slowest with ~10 minutes to finality due to proof-of-work consensus.

- Optimism posts the longest delay at ~20 minutes, driven by optimistic rollup settlement mechanics.

Injective Price Performance Overview

- As of early 2026, INJ trades near $5.0–$5.3 per token, aligned with recent spot prices.

- Historical data from Dec 2025 shows prices fluctuating between $4.18 and $5.84.

- Year‑to‑date 2025 saw wide swings but an overall trend of higher lows compared to early 2025.

- Long‑term all‑time high remains above $50, though 2025 levels are materially lower.

- Price performance has correlated with major network upgrades and liquidity expansions.

- Daily price movements regularly exceed ±5%, highlighting volatility.

- Short‑term indicators in early 2026 suggest consolidation around ~$4.9–$5.0.

Trading Volume Statistics

- 24‑hour volume often surpasses $40 million–$100 million, reflecting active spot and derivatives markets.

- Data shows daily volumes above $43 million in recent sessions.

- Cumulative trading volume in 2025 reached approximately $57 billion by mid‑year.

- Volume peaks often occurred on days with major network announcements.

- Trading activity remains strong on both centralized and decentralized venues.

- Relative volume levels show resilience despite broader crypto market shifts.

- Increased volume correlates with derivatives interest on the Injective DEX.

- Volume metrics remain a key gauge of ecosystem health.

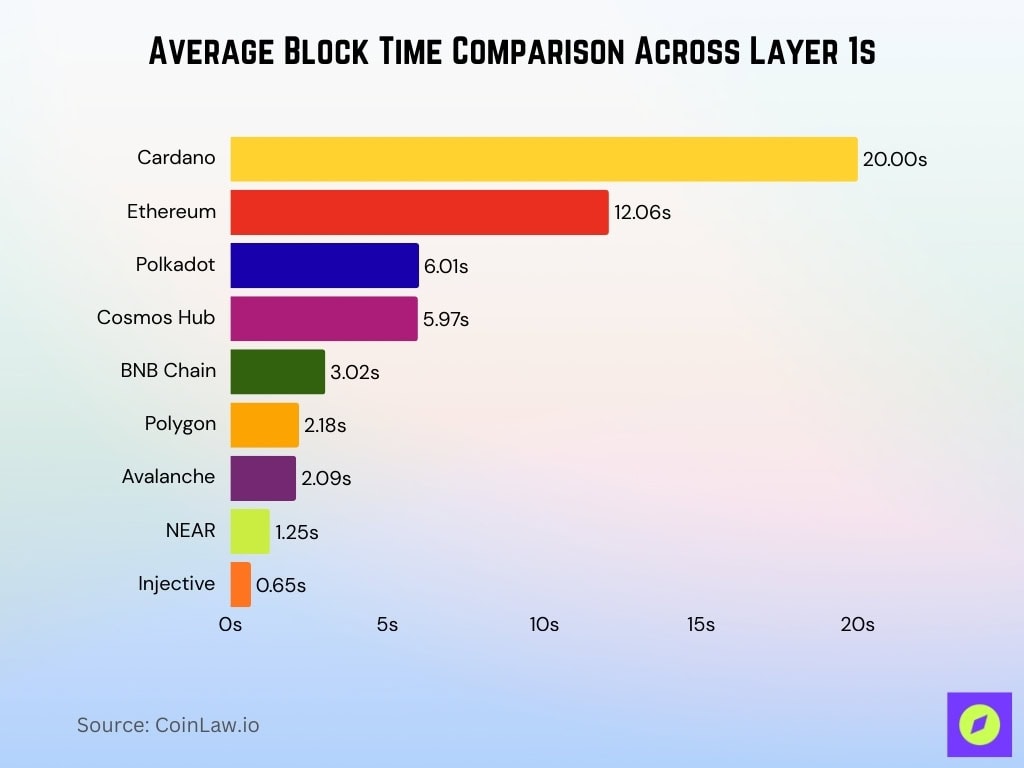

Average Block Time Comparison Across Layer 1s

- Injective leads all compared networks with an ultra-fast 0.65-second average block time.

- NEAR follows with a 1.25-second block time, supporting rapid transaction confirmation.

- Avalanche records an average block time of 2.09 seconds, balancing speed and decentralization.

- Polygon processes blocks in 2.18 seconds, enabling efficient scaling for applications.

- BNB Chain maintains a 3.02-second average block time for high-throughput use cases.

- Cosmos Hub averages 5.97 seconds, reflecting its modular and interoperable design.

- Polkadot posts a 6.01-second block time across its relay chain.

- Ethereum averages 12.06 seconds, consistent with its proof-of-stake block production.

- Cardano has the slowest cadence at 20.00 seconds per block among the networks compared.

Liquidity and Order Book Metrics

- On top CEXs like Binance and Bybit, INJ order books typically show $1–3 million in visible cumulative bids and asks within the top 1% price band for INJ/USDT alone.

- Injective’s on-chain orderbook records around $69.8 million in 24h INJ trading volume, with CEXs contributing about $51.0 million, underscoring deep liquidity for both spot and derivatives.

- Combined INJ spot and futures volume regularly exceeds $260 million in 24h (spot $18.5 million, futures $248.2 million), with noticeable volume spikes around major market and protocol events.

- Typical INJ/USDT spreads on leading exchanges compress to well under 0.10% during high-volume sessions, reflecting tight order books and efficient price discovery.

- INJ/USDT and INJ/USD pairs jointly account for well over 70% of centralized spot turnover, making them the dominant liquidity pools for INJ trading activity.

- Orderbook analytics platforms tracking large INJ trades routinely flag block orders above 20,000 INJ (often over $150,000 per trade) as whale activity absorbed without major slippage.

Volatility and Risk Indicators

- Injective’s price shows regular daily swings of ±5% or more in early 2026, reflecting persistent short-term volatility.

- Over the last 7 days in early 2026, INJ recorded 0.72% price volatility with 4/7 green days.

- In the past 30 days leading into 2026, INJ volatility measured 8.83% with 10/30 green days.

- Recent ATR for INJ stands at $0.37, indicating elevated daily volatility in late 2025 extending to 2026.

- 30-day historical volatility for INJ reached 11.58% to 16.98% in recent periods entering 2026.

- Implied volatility on INJ futures exceeds spot levels, with recent options showing 27-29% IV ranges applicable to the 2026 outlook.

- 95% VaR for similar crypto assets calculated at -0.63%, with CVaR at -0.82% for tail risk in 2026 scenarios.

- INJ 7-day price change hit +4.82% with 24-hour swings of +3.72% in early 2026 trading.

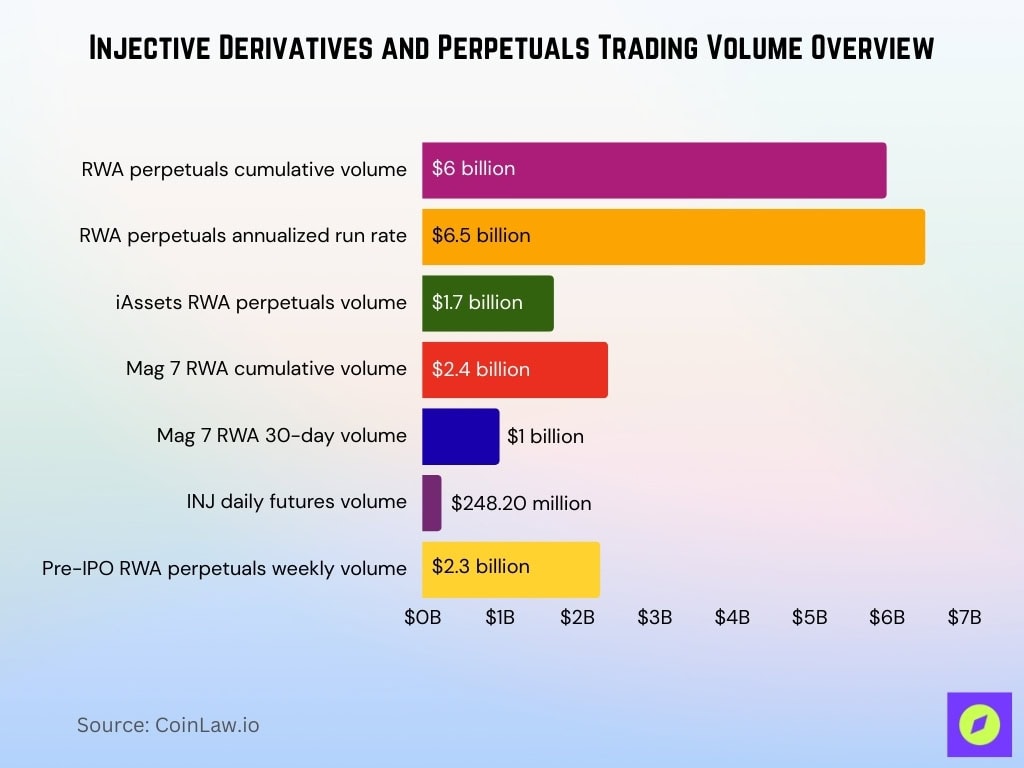

Derivatives and Perpetuals Statistics

- RWA perpetuals traded over $6 billion in cumulative volume in 2025, extending momentum into 2026.

- RWA’s perpetual annualized run-rate projects $6.5 billion by the end of 2025 with continued 2026 growth.

- iAssets RWA perpetuals generated $1.7 billion in trading volume, expanding equities and ETF access.

- Mag 7 equities RWA segment achieved $2.4 billion cumulative and $1 billion 30-day volume.

- Daily futures trading volume for INJ reached $248.20 million in recent 2026 sessions.

- Pre-IPO perpetuals for OpenAI and SpaceX drove $2.3 billion in weekly volumes recently.

- Derivatives offer up to 5x leverage on private equities like OpenAI, Anthropic on Injective.

- Cumulative RWA perpetuals grew 221% in ten weeks, signaling institutional adoption.

Supply and Emission Statistics

- The total circulating supply of INJ stands at 99.97 million tokens in early 2026.

- Total supply fixed at 100 million INJ with 99.97% circulating and fully unlocked.

- Burn auctions have removed over 6.4 million INJ worth $121 million from circulation by early 2026.

- Recent community buyback burned 6.8 million INJ valued at $32 million to reduce supply.

- Cumulative burns exceed 13 million INJ since launch, enhancing deflationary pressure into 2026.

- INJ staking rewards offer approximately 16% APR with emissions adjusted by an 85% target staking ratio.

- Inflation rate targeted at 5-10% annually, declining with higher staking participation in 2026.

- Weekly burn auctions continue, with the recent round burning 12,427 INJ worth $262,743.

- Fully diluted valuation (FDV) near $520 million reflects pricing against the original 100 million INJ supply, even though cumulative burns have marginally reduced effective circulating tokens.

Staking and Validator Metrics

- As of mid‑2025, ~57.5 million INJ were staked, a slight decline from earlier totals but still representing significant network security participation.

- Delegator count reached ~204,440 addresses, making up roughly 32% of active network participants.

- Staking redelegations totaled over 6.5M INJ during key staking campaigns.

- Monthly stake changes show 4% increases during peak activity months.

- Validator set decentralization remains stable with multiple nodes organizing the distribution of staking rewards.

- Staking yields for participants stayed competitive relative to general PoS benchmarks.

- Validator participation in governance votes remains high, reinforcing decentralization goals.

- Validator uptime and consensus performance maintain near‑optimal levels for network continuity.

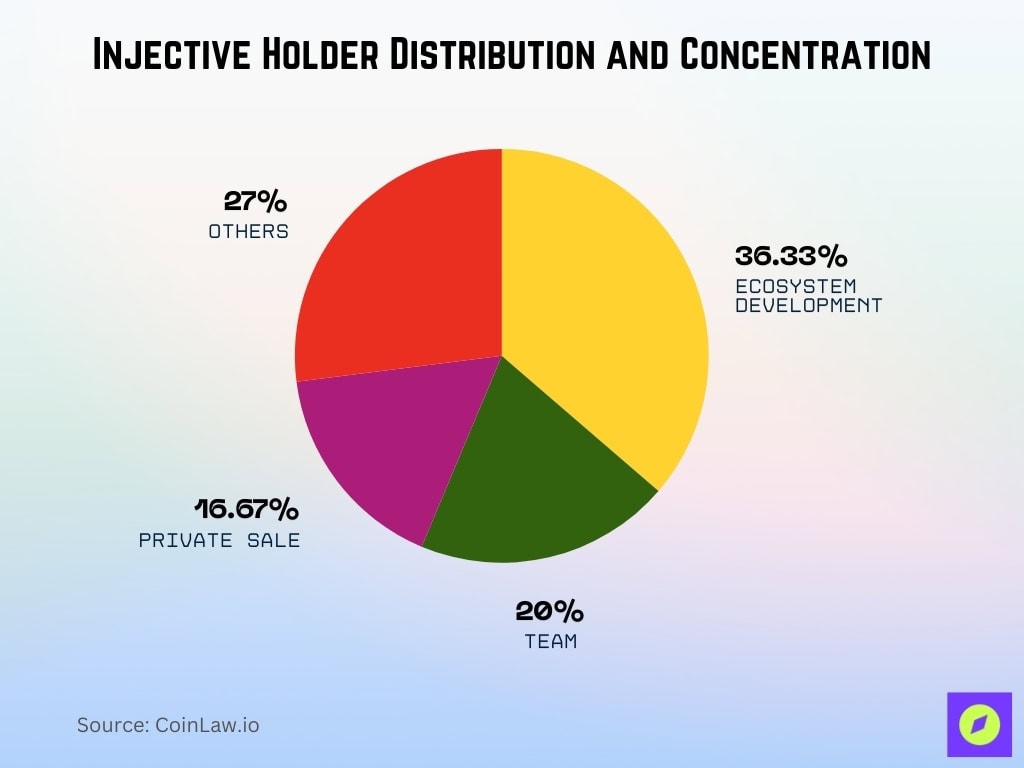

Holder Distribution and Concentration

- Initial allocation: 36.33% ecosystem development, 20% team, 16.67% private sale.

- Circulating supply fixed at 99.97 million INJ out of 100 million total, fully unlocked since 2024.

- The top 10 wallets collectively hold nearly 90% of INJ’s total supply, indicating a high degree of concentration, though there are thousands of total holders, including exchanges and individual wallets.

- 10% allocated to community growth, 9% Binance Launchpad, 6% seed sale.

- Staking delegators and long-term holders represent the majority of the circulating supply.

- Exchange wallets hold significant portions for liquidity, alongside investor allocations.

- Top holders control substantial shares, with historical data showing 90% in the top 10 wallets.

On‑Chain Activity Statistics

- Injective recorded more than 2 billion on‑chain transactions by mid‑2025, reflecting robust usage.

- Cumulative trading volume on‑chain topped $56.9 billion, largely driven by derivatives and iAssets activity.

- Active address counts increased from 561,017 to 634,609 within six months, a ~13% jump.

- Monthly active addresses reached notable highs over the year, indicating sustained interest.

- Daily transaction counts fluctuate but remain consistently above baseline thresholds for DeFi utilization.

- Protocol events linked to new features often spur on‑chain growth bursts.

- 24‑hour active user (DAU) metrics show regular network engagement, tracking user behavior.

- Average transactions per active address grew year‑over‑year, suggesting deeper engagement per user.

Network Usage and Adoption Metrics

- Monthly active addresses on Injective reached 561,017 at the end of 2025, doubling from 291,228.

- iAssets tokenized equities achieved $500 million trading volume with 60% weekly market share YTD 2025.

- Cumulative RWA perpetual volume hit $6 billion with 221% growth in ten weeks entering 2026.

- Network processes 25,000+ TPS with sub-second 640ms block times and instant finality.

- Google Cloud and Deutsche Telekom serve as validators, boosting security and decentralization in 2026.

- TVL surged 14% in a single day amid buyback, with $55 billion cumulative trading volume.

- Daily active addresses peaked above 100,000 on high-volume days in recent periods.

- On-chain equities like OpenAI and SpaceX derivatives offer 5x leverage for institutional access.

Developer and Ecosystem Activity

- Injective ranks 2nd among Layer 1 blockchains in code commits over the last 365 days, entering 2026.

- 1,684 GitHub commits across 82 core repositories reflect strong developer activity recently.

- iBuild platform registered over 5,000 users with 60% non-technical backgrounds by late 2025.

- iBuild enabled deployment of 20+ applications, boosting ecosystem TVL 11% to $215,600.

- Injective Summit drew 1,000 attendees and 20,000+ livestream viewers with 30+ speakers.

- MultiVM public testnets and EVM mainnet attract developers using Ethereum-compatible tooling.

- Grant programs like Illuminate Hackathon funded 11 teams with a 1,500 INJ (~$70,000) matching pool.

- iBuild uses natural language prompts for dApp creation, reducing development time to minutes.

- Developer work focuses on performance, front-running resistance, and financial modules for 2026.

Exchange Listings and Trading Pairs

- INJ is listed on 65+ exchanges, including Binance, Coinbase, OKX, Bybit, Kraken, HTX, and Upbit in 2026.

- 24-hour spot trading volume totals $49.86 million across all INJ pairs recently.

- Binance INJ/USDT perpetual futures volume hits $112.26 million in 24 hours.

- CoinW INJUSDT.P records $44.08 million 24h volume, second second-highest perpetual pair.

- Bybit INJUSDT perpetual swap sees $41.78 million 24h trading activity.

- The total 24h INJ futures volume reaches $146.89 million across exchanges.

- Binance delisted the INJ/ETH spot pair on Dec 26, 2025, due to low liquidity.

- Revolut added INJ listing and staking support for European users in late 2025.

- Spot volume $18.95 million vs futures $146.89 million highlights derivatives dominance.

Institutional and Whale Activity

- 21Shares filed for a spot INJ ETF with the SEC in Oct 2025, the second product after Canary Capital.

- Canary Capital proposed a staked INJ ETF (INJV) integrating PoS rewards for institutions.

- Pineapple Financial launched $100 million Injective digital asset treasury in December 2025.

- Agora partnered for AUSD stablecoin backed by US Treasuries, custodied by State Street.

- Google Cloud provides infrastructure for institutional onboarding and developer tools.

- Whale accumulation patterns mirror broader crypto trends with strategic position shifts.

- Institutional interest grows via RWA perpetuals exceeding $6 billion in volume.

- 355 wallets support INJ, enabling secure management for whales and institutions.

Technical Indicators Snapshot

- Short‑term price forecasts suggest INJ may trade around $5.20–$5.80 as technical momentum improves.

- Alternative projections estimate $7.78–$9.03 as potential 2026 highs, though ranges vary by model.

- Per technical metrics, 50‑day moving averages and RSI levels indicate mixed sentiment with some bearish pressure.

- Fear & Greed indices remain on the cautious side, reflecting market uncertainty.

- Technical resistance zones range near $5.80–$6.50, often cited for breakout scenarios.

- Moving averages and MACD indicators help traders pinpoint momentum shifts in intraday to weekly charts.

- Volatility indicators signal elevated risk, aligning with INJ’s broader market behavior.

- Fibonacci retracement levels often guide support and resistance mapping for price action.

Price Forecast and Prediction Metrics

- Several models forecast a modest upward trend toward ~$7.78 average in 2026, contingent on adoption and market conditions.

- Short‑term forecasts place INJ in the $5.20–$5.80 range, based on technical indicator rebounds.

- Some platforms offer conservative growth estimates of ~5% annual increase, projecting mid‑single‑digit price gains.

- Price projections vary widely, with highly bullish models suggesting much larger potential gains under optimistic adoption scenarios.

- Consensus views on the 2026 price remain mixed, balancing fundamentals with technical insights.

- Forecast accuracy remains speculative and should not be construed as investment advice.

- Macro crypto trends and regulatory clarity, including ETF developments, will materially influence outcomes.

- Predictive metrics often use historical volatility and trend analysis to estimate future ranges.

Frequently Asked Questions (FAQs)

INJ’s all‑time high stands near $52.9 per token.

The lowest recorded price for INJ is approximately $0.66.

Injective’s price rose about +8% over the past 7 days in recent trading data.

Injective currently ranks around #90–#95 in overall market capitalization rankings.

Conclusion

Injective continues to combine robust derivatives markets, expanding institutional interfaces, and active technical momentum to define its latest narrative. While price forecasts vary, integrating on‑chain adoption, whale dynamics, and ecosystem growth metrics reveals a complex but engaged network. As regulatory clarity and RWA integrations progress, INJ’s role in both retail and professional trading ecosystems remains a key watch point.