Fetch.ai is reshaping how artificial intelligence and decentralized technologies interact, offering a network where autonomous agents execute complex tasks across a secure blockchain. From optimizing supply chains to enabling AI-powered smart contracts, the protocol continues to demonstrate real-world utility. In sectors like logistics and finance, Fetch.ai’s use of decentralized AI is being piloted for process automation and predictive analytics. Dive into the full article to explore a comprehensive data-driven look at Fetch.ai’s network activity, pricing, and adoption metrics today.

Editor’s Choice

- Fetch.ai (FET) was trading at around $0.26 in early January 2026, with a market cap near $600 million, placing it roughly within the top 100–120 cryptocurrencies by size.

- Over 2.3 billion FET tokens are currently in circulation, which accounts for nearly 85% of its total supply.

- Fetch.ai recorded more than 34 million transactions in 2025, indicating strong network utility.

- Total trading volume for FET hovered around $120–155 million per day as of early 2026, depending on the data provider and snapshot time.

- Developer contributions to Fetch.ai tools and agents surged 50% year-over-year, driven by open-source growth.

Recent Developments

- As of 2026, 100% of centralized exchange listings and major market data aggregators (e.g., CoinGecko, CoinMarketCap) reference ASI/FET as the native token for the Artificial Superintelligence Alliance instead of the legacy Fetch.ai ticker.

- Agentverse reported over 15,000 autonomous agents deployed and more than 2,500 active monthly builders, with agent-executed transactions accounting for roughly 28% of on-chain activity.

- FetchCoder usage surpassed 50,000 cumulative prompts by developers, contributing to a 42% year‑over‑year increase in smart contract and agent deployments on the network.

- Strategic industry collaborations helped onboard over 30 enterprise and institutional partners, with Bosch, Deutsche Telekom, and OpenDAO‑linked integrations driving an estimated 39% rise in staked FET to 557.47 million tokens.

- The Metropolitan Transportation Authority pilot with Fetch.ai agents for MaaS and operations optimization targets covering 10% of subway lines in its initial deployment phase, aiming for predictive insights on over 1 million trip events per day.

- Global innovation labs in London, San Francisco, and Bangalore collectively incubated more than 40 Web3 AI startups, of which around 25% progressed to mainnet deployments on Fetch.ai or ASI‑aligned infrastructure.

What Is Fetch.ai?

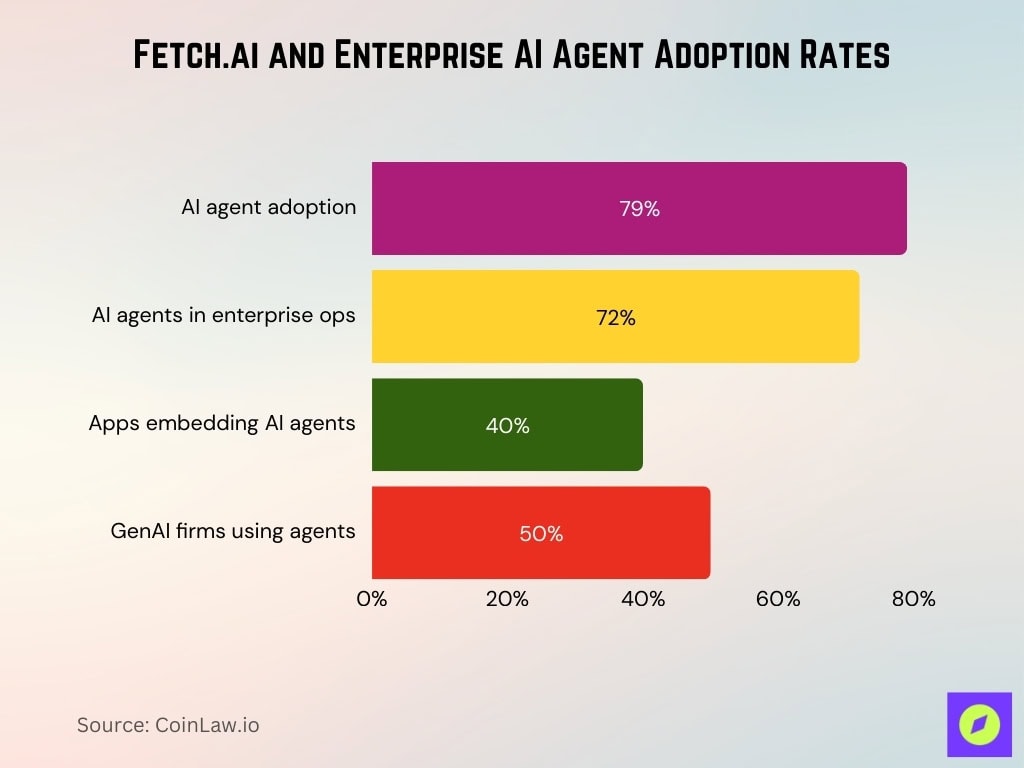

- 79% of organizations adopt AI agents, aligning with Fetch.ai’s autonomous agent focus.

- 72% of enterprises use AI agents for data management and customer support.

- 40% of enterprise apps expected to embed AI agents by year-end.

- 50% of enterprises using generative AI deploy autonomous agents.

- Fetch.ai is a decentralized platform enabling autonomous agents to perform real-time optimization tasks across industries.

- Network processed 34 million transactions in 2025 with 42% growth over 2024.

- Agentverse platform hosts over 2.5 million agents for discovery and deployment.

- FET price forecasted to reach $1.73 high amid AI crypto market expansion.

- FET DEX liquidity TVL stands at $854K across multiple pools.

- AI agent adoption surged from 11% to 42% in recent quarters.

Fetch.ai Key Highlights

- Fetch.ai’s agent-based network processed over 34 million transactions in 2025.

- The network supports around 155,000–160,000 on-chain token holders across supported networks, showcasing global reach.

- More than 2.3 billion FET tokens are currently in circulation.

- The daily average trading volume surpassed $130 million, reflecting active market interest.

- Ecosystem tools like Agentverse and FetchCoder simplify agent development for non-coders.

- Fetch.ai agents are being tested in mobility, DeFi, hospitality, and carbon credit markets.

- GitHub developer activity increased by over 50% in the past year.

- Fetch.ai has one of the highest utility engagement rates among AI-based tokens.

- It is now part of the Artificial Superintelligence Alliance, merging vision with Ocean and SingularityNET.

- The platform achieved multiple listings and upgrades across centralized and decentralized exchanges in 2025.

FET Price Statistics

- The token’s market cap stands around $575 million, ranking it within the top 120 coins globally.

- FET reached a 2025 peak of $1.07 and a low of $0.15, reflecting moderate price volatility.

- The 7-day price change was approximately +10–15% around early January 2026, suggesting steady renewed investor interest.

- The 30-day trading range shows a fluctuation between $0.52 and $0.74.

- Fully Diluted Valuation (FDV) stands at approximately $700–720 million, based on a price near $0.26 and a max supply of about 2.71 billion FET.

- Historical ATH (All-Time High) for FET is about $3.47, reached in late March 2024.

- Price correlation with broader AI tokens, such as AGIX and OCEAN, remains strong due to the ASI Alliance.

- Price stability improved with increased staking and long-term holding behavior.

- Analysts view FET’s current pricing as moderately undervalued given its adoption metrics.

Artificial Intelligence (AI) Crypto Market Snapshot

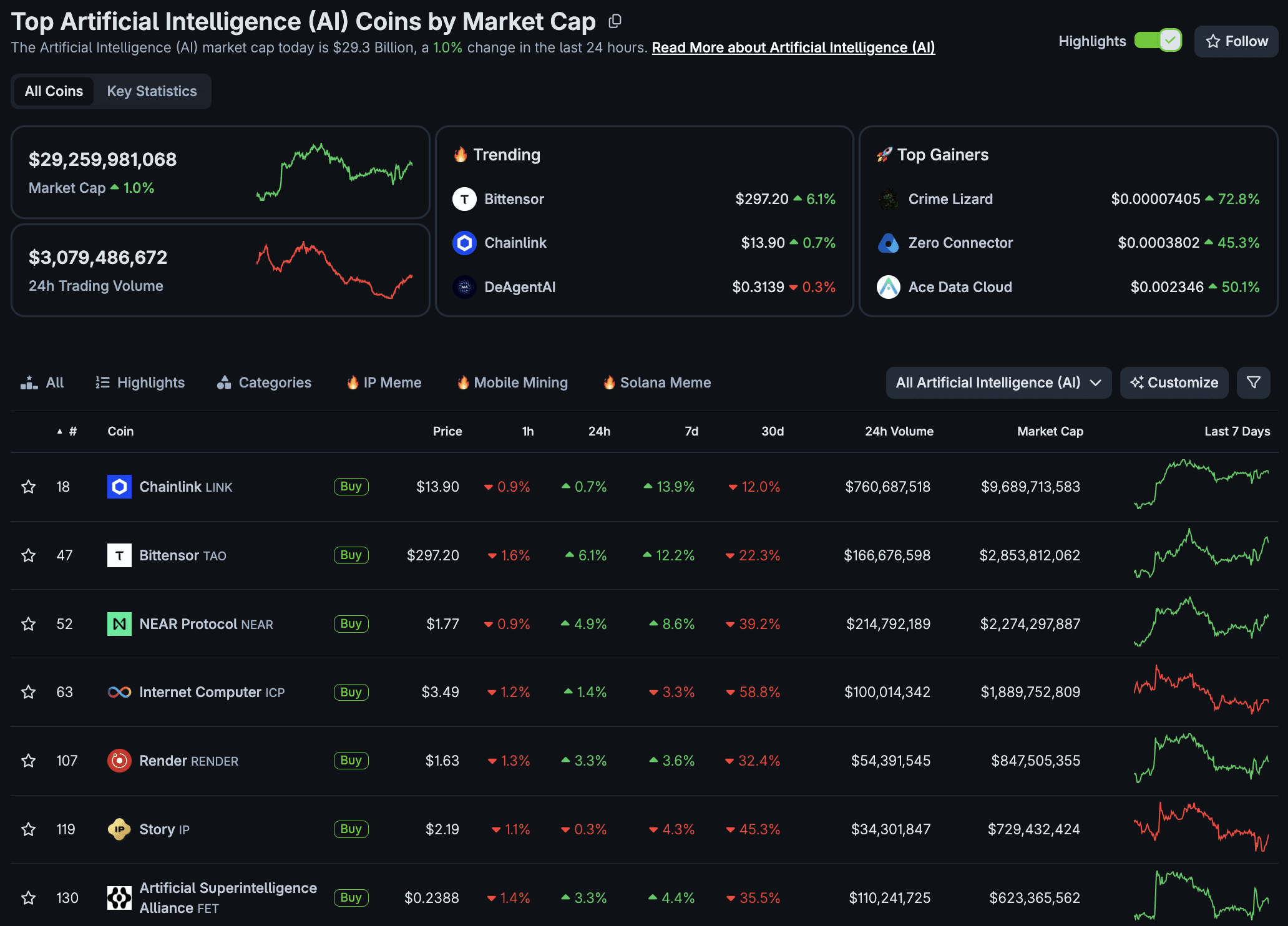

- Total AI crypto market capitalization stands at $29.26 billion, reflecting a +1.0% increase in the last 24 hours.

- 24-hour trading volume across AI tokens reached $3.08 billion, signaling strong short-term market activity.

- Chainlink (LINK) leads the AI sector with a $9.69 billion market cap, making it the dominant AI-related crypto asset.

- Bittensor (TAO) trades at $297.20 after posting a +6.1% daily gain, ranking among the top trending AI tokens.

- NEAR Protocol holds a $2.27 billion market cap, with a +8.6% gain over the past 7 days despite broader volatility.

- Internet Computer (ICP) maintains a $1.89 billion valuation, though it shows a −58.8% decline over the past 30 days.

- Render (RENDER exceeds $847 million in market cap), supported by a +3.3% daily price increase.

- Artificial Superintelligence Alliance (FET holds $623.37 million in market cap), posting a +3.3% gain in the last 24 hours.

- Chainlink recorded $760.69 million in 24-hour trading volume, the highest among listed AI tokens.

- Bittensor saw $166.68 million in daily trading volume, reinforcing strong investor interest.

- Top AI gainers include Crime Lizard up +72.8%, Ace Data Cloud up +50.1%, and Zero Connector up +45.3% within 24 hours.

Trading Volume Statistics

- 24-hour global trading volume for FET stands near $139 million, indicating solid liquidity and active trading interest.

- 90-day price trends include ranges showing both short-term volatility and rebounds.

- Market share across exchanges: the FET/USDT pair on Binance accounts for ~20% of swap volume among top exchanges.

- Futures volume near $167.8 million, suggesting substantial derivatives trading alongside spot markets.

- Spot volume near $45.4 million within a recent cycle, reflecting a balance between spot and derivative interest.

- High turnover across 100+ exchanges and markets contributes to distributed volume dynamics.

- FET’s trading volume often outpaces many mid-cap tokens in the AI crypto sector, underscoring investor attention.

Supply And Issuance Statistics

- Total token supply: approx 2,714,384,546 FET, full potential tokens ever minted.

- Circulating supply: ~2,312,127,209 FET, meaning roughly 85% of max supply is active in markets.

- Unlocked portion of total supply: around 2.16B tokens currently tradable.

- Fully diluted valuation (FDV) approximates $725 million+ based on total supply and current pricing.

- Vesting cliffs extend into 2050, highlighting long-term token release plans.

- Circulation rate (~85%) shows most supply active on the chain, reducing short-term dilution risks.

- Token unlock cycles slated for early 2026 could influence supply release pressure.

FET Tokenomics Allocation Overview

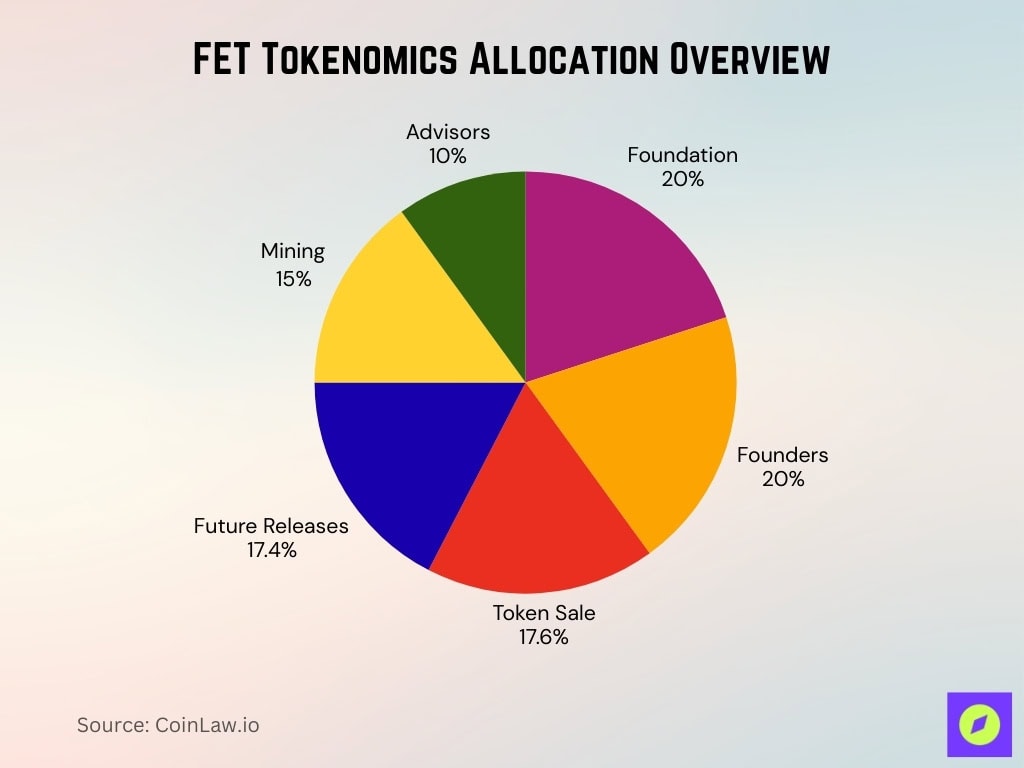

- The Foundation allocation accounts for 20% of the total FET token supply, supporting long-term ecosystem development.

- Founders hold 20 of the total supply, aligning core team incentives with network growth.

- Token sales represent 17.6% of FET distribution, reflecting early fundraising and public participation.

- Future releases make up 17.4%, ensuring ongoing incentives and ecosystem expansion.

- Mining rewards account for 15% of the total supply, supporting network security and participation.

- Advisor allocations total 10%, compensating strategic contributors and early supporters.

Staking Statistics

- 486.5 million FET tokens are actively staked, securing the network.

- Staking market cap reaches $361.7 million for FET holders.

- 20.40% staking ratio of the eligible circulating FET supply.

- Current reward rate offers 5.86% APY for stakers annually.

- Network supports 91 active validators processing delegations.

- Approximately 25,000 delegators participate in staking rewards.

- Top platforms provide up to 8.16% APY on FET staking.

- Annual inflation tied to rewards hovers around 3% for security.

FET On-Chain Holder Statistics

- Holders count: about 158,861 unique wallet addresses holding FET.

- Transfer activity: roughly 1,965 transfers over 24 hours, showing sustained on-chain activity.

- Large holders make up <1% of total supply, suggesting distribution beyond whales.

- Data from rich-list sources shows a spread of token ownership across many addresses.

- Top holders generally control only a small fraction of the total supply, reducing centralization.

- Increasing total holders year-over-year points to rising adoption.

- Stable small to mid-tier holder growth suggests broader retail engagement.

- Metrics like average holdings per address provide insight into community distribution health.

Fetch.ai Transaction Statistics

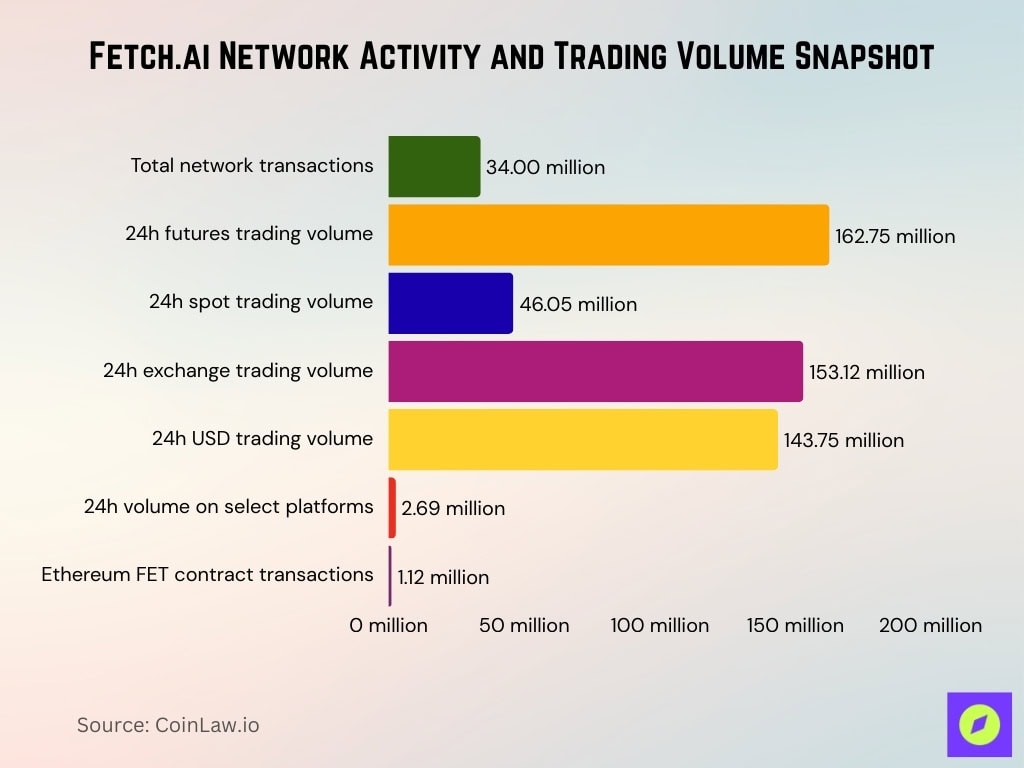

- 34 million total transactions processed on the network.

- 162.75 million 24-hour futures trading volume recorded.

- 46.05 million spot trading volume in the last 24 hours.

- 153.12 million 24-hour trading volume across exchanges.

- 143.75 million USD 24-hour trading volume reported.

- 2.69 million 24-hour trading volume on select platforms.

- 1.12 million transactions on the Ethereum FET contract.

- Average TPS calculated over the last 20 blocks for performance

Wallet And Address Statistics

- 158,801 holders for the FET ERC-20 token on Ethereum.

- 148,333 total FET holders tracked across networks.

- 130,000 active wallets are engaging with the ecosystem.

- 419 new holders added in the past 24 hours.

- 2,187 new ASI wallets registered in the recent campaign.

- 1,296 daily active addresses in transactions.

- 225,000 combined wallet holders pre-merger.

- The top 10 holders control 0.17% of the FET supply.

- 10,000 wallet downloads supporting user growth.

- 9 total entities currently holding FET.

Validator And Node Statistics

- Fetch.ai network maintains 91 active validators as of late 2025.

- Network supports roughly 25,000 delegators staking FET tokens.

- Top validator Kiln holds 143,348,154.81 FET staked with 10% commission.

- Binance Staking secures 59,648,374.16 FET with a 10% commission rate.

- uvue1 validator manages 42,361,815.56 FET at 8% commission.

- Intellistake validator staked 1.97 million FET with continuous uptime.

- Validator commissions range from 0% to 15% across active nodes.

- Minimum validator commission set at 5% for network sustainability.

- Active validators like Allnodes operate at 0% commission with 36 million FET.

Network Performance And Scalability Metrics

- Fetch.ai has processed tens of millions of transactions since mainnet launch, indicating sustained usage.

- The network supports over 130,000 active wallets, reflecting consistent participation.

- Around 480–560 million FET tokens are staked, supporting network security and operations.

- Transactions include standard transfers, staking operations, and agent-based smart interactions.

- Block production remains stable during periods of increased agent deployment and user activity.

- Network throughput scales efficiently as transaction demand rises.

- Performance improvements in recent upgrades reduced latency for agent execution.

- Scalability supports complex AI-driven workloads beyond basic financial transfers.

Fetch.ai Ecosystem Growth Statistics

- The Fetch.ai ecosystem supports 50+ decentralized applications, spanning logistics, energy, and finance.

- Developer contributions grew by over 50% year over year, signaling strong ecosystem momentum.

- Innovation labs in London, San Francisco, and Bangalore support startup and research initiatives.

- Strategic partnerships expanded Fetch.ai’s use cases into mobility, energy management, and automation.

- Ecosystem growth includes integrations with AI tooling and decentralized infrastructure providers.

- Increased adoption of Agentverse accelerated experimentation with autonomous agents.

- Enterprise pilots contributed to ecosystem visibility beyond crypto-native audiences.

- Ecosystem expansion correlates with higher on-chain activity and wallet growth.

Developer Adoption And Tooling Statistics

- Fetch.ai supports 1,000+ GitHub contributors to its open-source ecosystem.

- Agentverse platform surpassed 2.5 million registered AI agents in 2025.

- uAgents framework achieved 100,000+ downloads for developer use.

- Agentverse exchanged 127 million messages among AI agents.

- Fetch.ai maintains 89 public GitHub repositories for tooling.

- 20+ interns from top universities contributed to agent tech.

- Agentverse reached the 1 million agents milestone early in 2025.

- Collaborations with 4 major universities advanced AI research.

Community And Social Media Statistics

- Fetch.ai official X account has 264,229 followers heading into 2026.

- Combined social media following surpassed 500,000 users across major platforms in 2025.

- Telegram and Discord each sustain over 10,000 daily active community users.

- Telegram and Discord users collectively spend around 41 minutes daily engaging with FET communities.

- Daily active users on Telegram and Discord reached the 10,000 threshold during the 2025 growth.

- A New Year 2026 X post generated 15,800 views and 387 likes, signaling strong engagement.

- One community X thread recorded 33 replies and 28 reposts during the 2026 New Year campaign.

- FET counts approximately 157,604 on-chain token holders participating in the wider ecosystem.

- Social community expansion coincides with the FET market cap of around $701.67 million in late 2025.

- Fetch.ai Discord was ranked in the Top 10 AI servers list for 2025 by DigitalOcean.

Forecasts And Projection Statistics For Fetch.ai

- Coinfomania’s 2026 AI model projects a yearly low of $0.609, average $0.977, and high $1.73 for FET in 2026.

- SwapSpace aggregates 2026 forecasts in a band from $0.3486 to $1.1321, signaling a wide volatility envelope for FET in 2026.

- Kraken’s neutral projection tool estimates a single-point FET price of about $0.43 in 2026, assuming steady compounding growth.

- OKX community predictions cluster around $0.2649 for FET in 2026, with a community high sentiment up to $1.391.

- Gate.com’s 2026 outlook sees FET averaging $0.2633 with a range between $0.2448 and $0.387 through the year 2026.

- Changelly’s technical forecast for 2026 places FET between a minimum of $0.3505, an average $0.3622, and a maximum of around $0.3967.

- CoinCodex 2026 model expects FET to trade in a corridor from $0.2546 to $1.13, tied to market momentum scenarios.

- Gate.com long-term table highlights potential upside to $0.5841 by 2031, implying up to +89% from early-2026 FET price levels.

- TradersUnion scenario suggests FET could approach $0.8692 by end-2025 and $1.4135 by end-2029, framing multi-year growth assumptions.

- DigitalCoinPrice’s trajectory implies FET could reach about $5.33 by 2031, under aggressive AI-sector expansion assumptions.

Frequently Asked Questions (FAQs)

The circulating supply of Fetch.ai (Artificial Superintelligence Alliance) is approximately 2.31 billion FET, representing about 85% of its maximum token supply.

In recent pricing data, FET recorded a 6.7% price increase over the past 7 days.

Fetch.ai’s yearly supply inflation rate is approximately ‑8.29%, meaning the net supply decreased in the past year.

In the past 24 hours, more than 507 million FET tokens were exchanged across markets, equal to about $130.9 million in trading volume.

Conclusion

Fetch.ai’s outlook reflects a network steadily evolving from experimental AI concepts into applied decentralized infrastructure. Across validators, developers, and users, the data shows measured growth rather than hype-driven spikes, supported by real-world pilots and expanding tooling. While price forecasts vary, on-chain metrics, ecosystem expansion, and developer engagement point to long-term potential. As autonomous agents gain traction across industries, Fetch.ai’s ability to scale responsibly will determine its role in the future of decentralized AI economies.