Crypto exchanges have become the backbone of digital finance. They power trillions in daily volume and support investments from retail traders to institutions. From enabling cross‑border payments to facilitating token launches, they reshape how assets move and grow. Explore how these platforms drive everything from portfolio access to global liquidity.

Editor’s Choice

- As of early 2026, there are over 260 listed spot crypto exchanges, with roughly 210–230 consistently active.

- Binance’s spot trading volume in 2026 is nearly 5× higher than that of the second‑largest exchange.

- Total centralized perpetual volume reached a record $862 trillion in 2025, up 47.4% year over year.

- Decentralized perp DEX volume grew 346% in 2025 to around $6.7 trillion.

- Combined spot trading volume across CEXs and DEXs reached roughly $18.6 trillion in 2025, up 9% year over year.

- Overall crypto exchange trading (spot plus derivatives) exceeded $79 trillion in 2025, with futures and perpetuals contributing about $62 trillion.

- Binance maintained a close to 50% share of BTC and ETH centralized trading volume heading into 2026.

Recent Developments

- In early 2026, combined monthly volume across the top 10 exchanges averages about $1.4 trillion, down roughly 15% from late‑2025 peaks.

- Binance retains roughly 38%–40% centralized spot market share, with monthly spot volume fluctuating around $450–$500 billion.

- Coinbase’s global spot share has slipped to about 4.5%, even as its quarterly trading volume reached multi‑year highs.

- Total monthly volume for the top 10 exchanges fell about 16% in April 2025 to $1.3 trillion, signaling ongoing normalization into 2026.

- Daily combined trading volume of the top 10 exchanges now exceeds $200 billion, reflecting deep and persistent liquidity.

- Binance’s lifetime trading volume has surpassed $125 trillion, with a user base approaching 280 million by mid‑2025 and continuing to rise into 2026.

- By late 2025, Binance, OKX, Bybit, and Bitget together account for over 70% of spot trading among leading centralized exchanges.

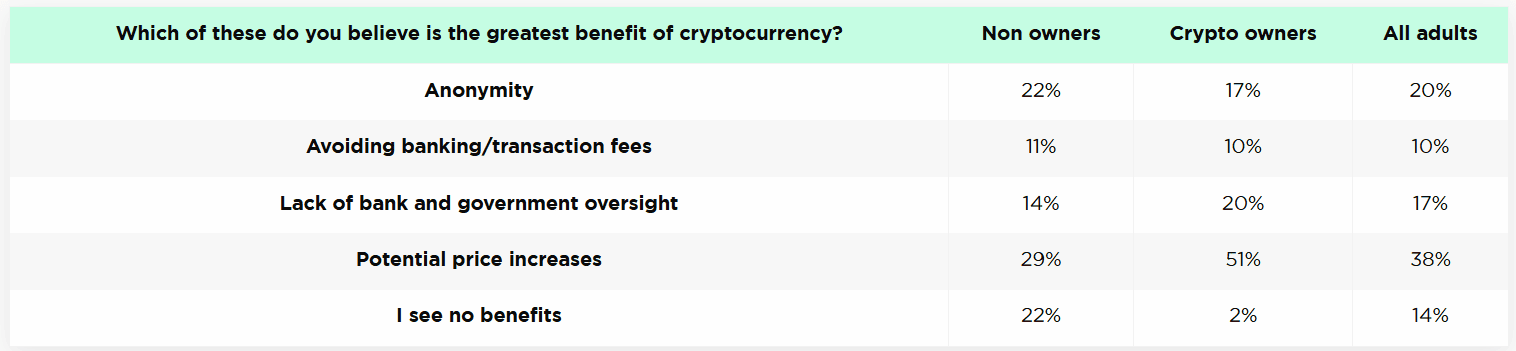

Greatest Perceived Benefits of Cryptocurrency

- Potential price increases are the top perceived benefit, cited by 51% of crypto owners and 38% of all adults, highlighting speculation and investment returns as the main driver of adoption.

- Anonymity remains a notable appeal, with 22% of non-owners and 20% of all adults viewing privacy as crypto’s greatest advantage.

- Lack of bank and government oversight is seen as a major benefit by 20% of crypto owners, compared with 14% of non-owners, reflecting stronger decentralization preferences among active users.

- Avoiding banking and transaction fees ranks lower overall, mentioned by just 10–11% of respondents, suggesting cost savings are a secondary motivation.

- A significant share of skepticism persists, as 22% of non-owners say they see no benefits, versus only 2% of crypto owners, underscoring a sharp perception gap between users and non-users.

Trading Volume Statistics

- Total spot and derivatives volume on centralized exchanges reached about $86 trillion in 2025, averaging roughly $265 billion per day.

- In Q1 2025, the top 10 centralized exchanges recorded around $5.4 trillion in spot trading volume, down 16.3% quarter‑on‑quarter.

- August 2025 saw combined spot and derivatives volume on centralized exchanges climb to a yearly high of $9.72 trillion, up 7.6% from July.

- Spot volumes in August reached about $2.36 trillion, while derivatives volumes hit roughly $7.36 trillion, both setting new yearly highs.

- By December 2025, trading activity on centralized exchanges fell to around $5.79 trillion in combined spot and derivatives volumes, down 26.4% month‑on‑month.

- Market concentration increased, with the top four exchanges processing about 68% of reported spot volume and roughly 72% of derivatives volume.

- Binance’s total trading volume in 2025 was nearly 5× higher than its closest rival, maintaining clear dominance into 2026.

- Across 2025, average daily centralized spot trading volume hovered near $146 billion, down 27.3% from late‑2024 levels.

Number of Active Users

- Global crypto users surpassed 580 million in 2025, up about 34% year over year.

- Ownership rates are estimated at around 12–15% of the global population, implying 800–1,000 million current or recent crypto users.

- Asia accounts for roughly 43% of all crypto users, North America 17%, and Europe 15%.

- India leads with about 93.5 million crypto owners, followed by China at 59.1 million and the USA at 52.9 million.

- There are an estimated 161 million stablecoin holders worldwide, reflecting the deep penetration of dollar‑linked tokens.

- Coinbase reported a Q1 2025 peak of 9.7 million monthly transacting users and around 10.8 million monthly active users.

- KuCoin has over 41 million registered users spanning more than 200 countries and regions as of mid‑2025.

- Traditional platforms like Börse Stuttgart Digital count roughly 1 million end‑users, signaling a crossover between legacy finance and crypto.

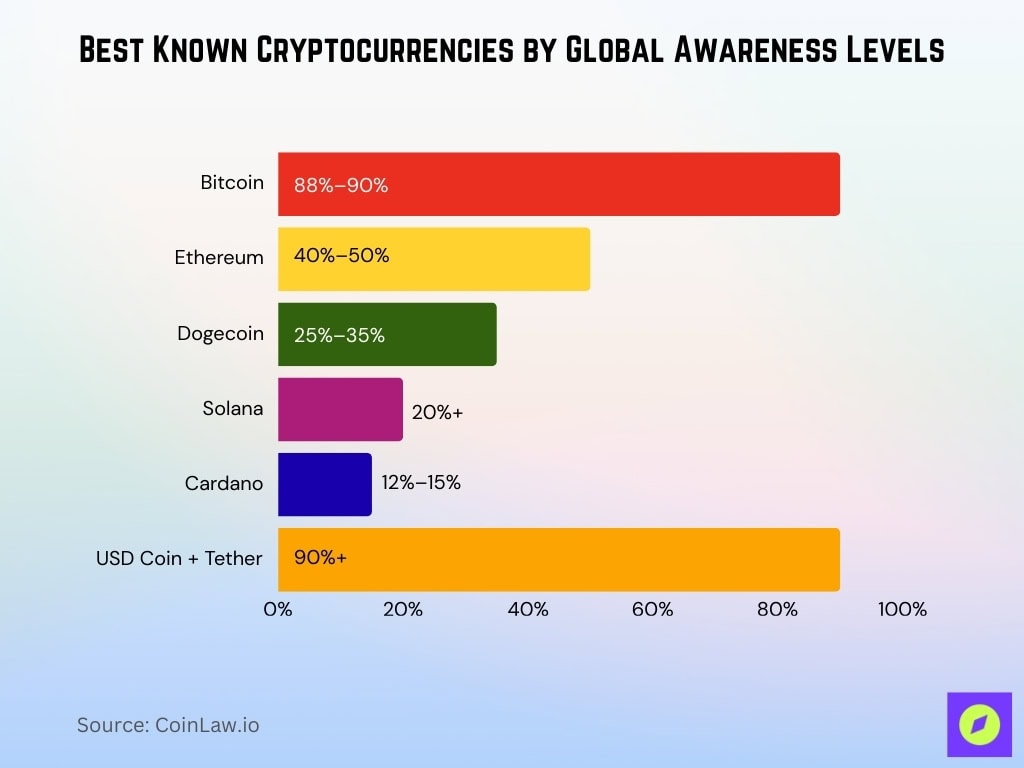

Best Known Cryptocurrencies

- Bitcoin remains the most recognized cryptocurrency globally, with awareness around 88%–90% among adults who have heard of crypto.

- Ethereum holds the second spot with awareness near 40%–50%, depending on region and survey sample.

- Dogecoin awareness generally ranges between 25%–35%, keeping it among the top meme coins by recognition.

- Solana’s awareness has climbed into the 20%+ range as its ecosystem and performance gains drive visibility.

- Cardano is recognized by roughly 12%–15% of respondents in recent awareness and ownership surveys.

- USD Coin and Tether together account for about 90%+ of the fiat‑backed stablecoin market cap, reflecting very high brand recognition in the stablecoin segment.

Global Number of Crypto Exchanges

- There are about 220–230 active centralized crypto exchanges worldwide, out of 250+ listed spot platforms.

- CoinMarketCap currently tracks roughly 250 spot exchanges with a combined 24‑hour spot volume of around $100–150 billion.

- The top 10 centralized exchanges regularly clear over $200 billion in combined daily trading volume.

- Centralized exchanges still process roughly 85–90% of total crypto trading volume, despite rapid DEX growth.

- Market share remains concentrated, with about 10 leading exchanges handling nearly 90% of global trading activity.

- Global exchange counts keep rising, but many of the newest platforms focus on niche or regional markets.

- Regulatory regimes in the U.S., EU, and Asia directly affect licensing for over 100 regionally active exchanges.

Market Capitalization Data

- Total crypto market cap ended 2025 at about $3.0 trillion, down roughly 23.7% in Q4.

- The global crypto market cap today is around $3.2 trillion, roughly 14% lower than a year ago.

- Late‑cycle peaks in 2025 briefly pushed total market cap above $4.0 trillion before the subsequent drawdown.

- From a 2017 baseline near $100 billion, market cap has expanded more than 30× to the current multi‑trillion‑dollar level.

- Bitcoin dominance recently hovered around 55–60%, with Bitcoin and Ethereum together accounting for roughly 70–75% of total market value.

- Forecasts see the total crypto market cap potentially reaching $5–10 trillion within the next few years if adoption and liquidity trends persist.

- Industry revenue from crypto trading and related services is projected to approach $100 billion by 2026, supported by the multi‑trillion‑dollar asset base.

- Global user counts are estimated to be around 560–860 million, implying hundreds of billions of dollars in market cap per 100 million users.

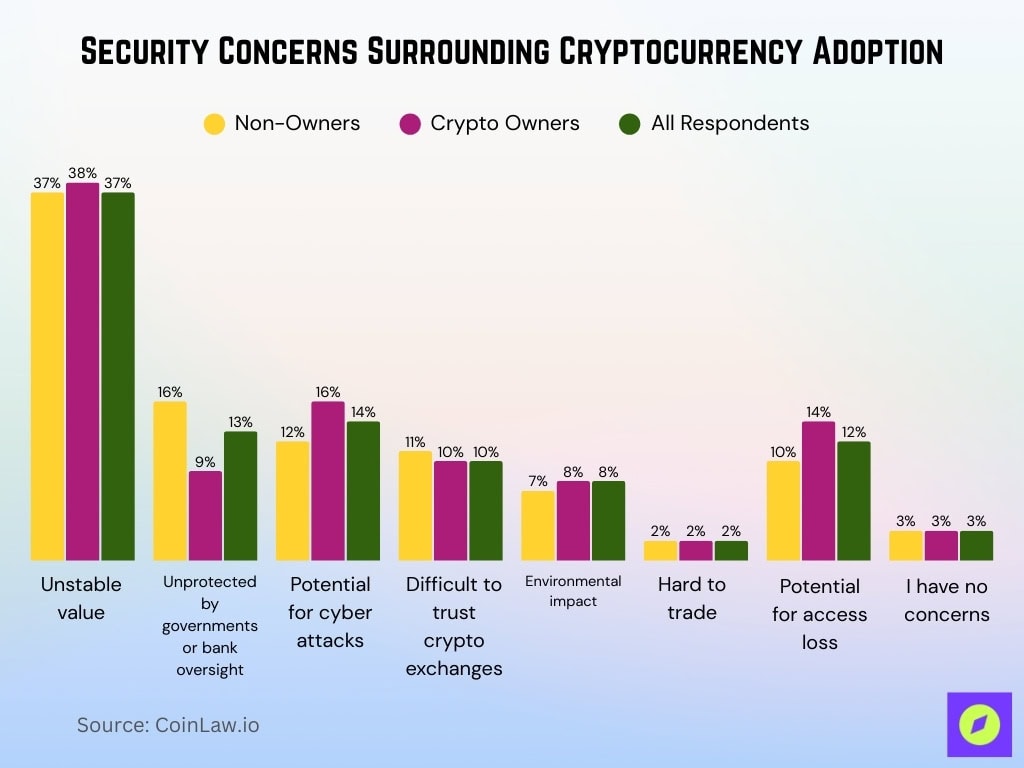

Security Concerns Surrounding Cryptocurrency Adoption

- Unstable value is the dominant concern, cited by 37% of all respondents, including 38% of crypto owners and 37% of non-owners, showing volatility remains a universal barrier.

- Lack of government or bank protection worries 16% of non-owners, nearly double the 9% of crypto owners, highlighting regulatory safety as a key adoption hurdle.

- Cybersecurity risks remain prominent, with 16% of crypto owners and 14% of all respondents concerned about potential cyber attacks on wallets and platforms.

- Trust in crypto exchanges continues to be fragile, as 10–11% of respondents say it is difficult to trust exchanges, reinforcing the impact of past failures and hacks.

- Environmental impact concerns persist but rank lower overall, mentioned by 8% of respondents, suggesting sustainability worries are secondary for most users.

- Loss of access to funds is a meaningful fear among active users, with 14% of crypto owners citing potential access loss, compared with 10% of non-owners.

- Very few respondents express confidence, as only 3% say they have no concerns, underscoring widespread caution across the market.

Exchange Rankings by Volume

- Binance leads with a median daily spot volume of about $18.0 billion, keeping it the largest crypto exchange by trading activity.

- MEXC ranks second with a median daily volume of $3.6billion across more than 2,000 listed coins.

- Bybit posts a median daily volume of roughly $3.5 billion, placing it firmly in the global top three.

- Gate.io handles around $3.4 billion in median daily volume, offering over 2,100 tradable assets.

- KCEX and CoinW see median daily volumes close to $3.0 billion each, making them key second‑tier liquidity venues.

- Crypto.com, HTX, OKX, and LBank each process between $2.7–2.9 billion in median daily volume, rounding out the current top 10.

- Across all tracked centralized exchanges, the combined 24‑hour spot volume typically ranges between $100–150 billion, depending on market conditions.

Revenue of Crypto Exchanges

- The global cryptocurrency exchange platform market is valued at about $63.38 billion in revenue and is projected to reach $150.1 billion by 2029.

- One research outlook estimates the broader crypto exchange market at roughly $85.75 billion in 2026 revenue.

- North America accounts for about 35.37% of global exchange revenue share, making it the largest regional market.

- Coinbase generated around $1.9 billion in total revenue in Q3 2025, up 54% year over year.

- Coinbase’s Q3 2025 net income was approximately $433 million, reflecting strong profitability versus many peers.

- Gemini reported H1 2025 revenue of $68.6 million against a net loss of $282.5 million, highlighting ongoing profitability challenges.

- Regional forecasts suggest North America’s exchange platform revenues could exceed $60 billion by 2029, led primarily by U.S. exchanges.

- Commercial (institutional and enterprise) clients are expected to represent about 72% of exchange platform market revenues by 2029.

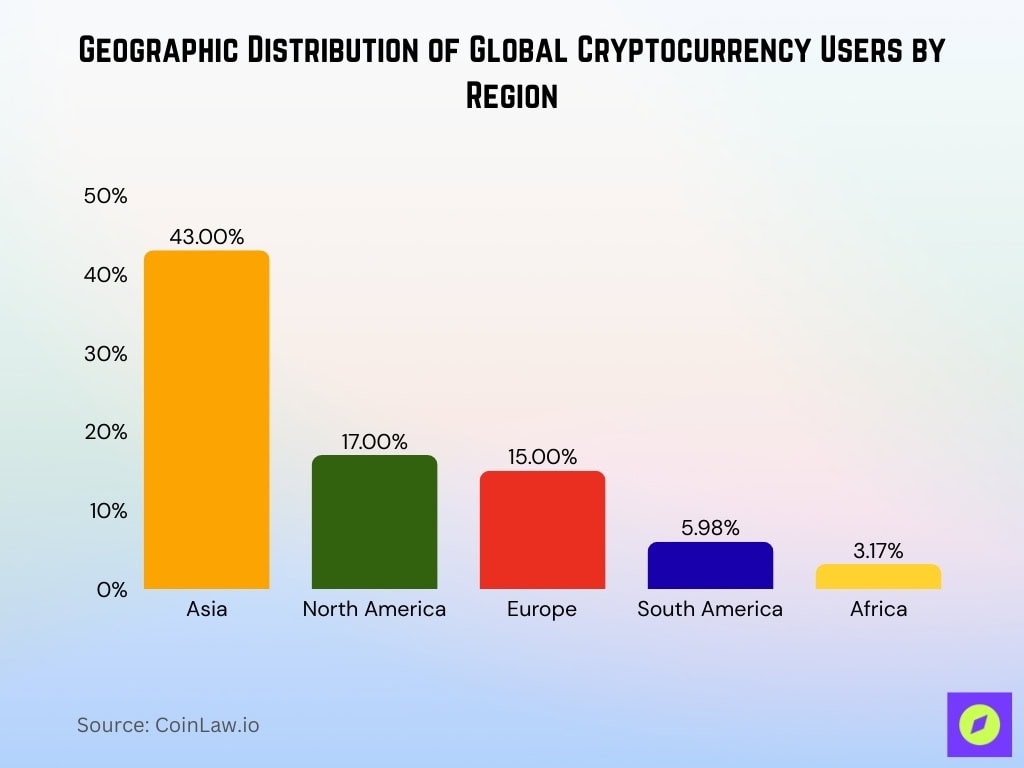

Geographic Distribution of Users

- Asia hosts about 43% of global crypto users, followed by North America at 17% and Europe at 15%.

- South America generates around 5.98% of exchange revenue, while Africa contributes roughly 3.17%.

- India leads with about 93.5 million crypto users, while the U.S. has around 52.9 million users.

- Vietnam, Pakistan, and the Philippines report 20.9 million, 15.9 million, and 15.8 million users, respectively, underscoring strong APAC grassroots adoption.

- Nigeria leads Africa with about 13.3 million crypto users, ahead of many developed markets.

- Coinbase’s user base exceeds 108 million across more than 100 countries, reflecting a broad global reach.

Total Value Locked (TVL) Concentration by Blockchain

- Ethereum controls about 68% of all DeFi TVL, with TVL above $99 billion, keeping a clear lead over every other chain.

- Solana holds roughly 9% of DeFi TVL, with around $9.2 billion locked across major protocols.

- Bitcoin has become the 3rd‑largest DeFi chain, with about 6.7% of cumulative TVL.

- BNB Chain captures around 6.5% of DeFi TVL, maintaining its role as a key DeFi ecosystem.

- Tron now accounts for roughly 4.3% of global DeFi TVL, down from an earlier double‑digit share.

- Ethereum L2s collectively secure over $40.5 billion in assets, with DeFi TVL on major L2s near $9.05 billion.

- Overall, DeFi TVL recently climbed to about $135.8 billion, up 8.53% in 24 hours on the back of Ethereum inflows.

Exchange Reserves and Security Metrics

- Bybit lost about $1.4–1.5 billion in a February 2025 hack but pledged to fully cover user losses from its reserves and emergency funding.

- KuCoin agreed to pay nearly $300 million in penalties and exit the U.S. market for 2 years after pleading guilty to unlicensed money transmission charges.

- Proof‑of‑reserves frameworks often require exchanges to hold an extra 6–14% above user balances as a buffer against volatility.

- Major CEXs such as Binance, Kraken, Bitget, BingX, and Bitfinex now publish recurring proof‑of‑reserves or real‑time reserve dashboards.

- Some PoR‑adopting exchanges report reserve ratios above 100%, indicating they hold more assets on‑chain than total customer liabilities.

- The Bybit incident is regarded as the largest single crypto exchange hack in history, surpassing prior records of about $615 million and $613 million.

- Regulators increasingly investigate exchanges that process billions in transactions without robust KYC/AML, with KuCoin accused of handling over $9 billion in illicit flows.

- Insurance coverage and third‑party security audits are becoming standard for top exchanges seeking institutional‑grade risk controls.

Stablecoin Flows

- Total stablecoin transaction volume reached about $33 trillion in 2025, up 72% year over year.

- USDC processed roughly $18.3 trillion in transactions in 2025, while USDT handled around $13.3 trillion.

- The combined stablecoin market cap climbed to over $305 billion, nearly a 50% increase during 2025.

- USDT’s market cap sits near $173–187 billion, versus USDC at around $74–75 billion.

- Stablecoins now represent roughly 30% of all on‑chain crypto transaction volume, with over $4 trillion settled between January and July 2025 alone.

- Stablecoin flows rose 81% year over year in 2025, with projections suggesting they could reach about $56.6 trillion annually by 2030.

- Stablecoins hold over $150 billion in U.S. Treasuries, ranking around 17th among sovereign holders.

- In Latin America, stablecoins are used for cross‑border payments and remittances in over 70% of surveyed institutions, far above the 49% global average.

Liquidity Metrics

- Top‑tier exchanges, representing about 19% of assessed platforms, now control over 60% of global spot trading volume.

- DEXs handled roughly 20% of global spot crypto volume in Q3 2025, up from about 10% in 2024.

- The DEX‑to‑CEX spot volume ratio climbed to around 0.23 by mid‑2025 as centralized spot volume fell nearly 28%.

- In Q2 2025, DEX spot volume reached roughly $876.3 billion, while CEX spot volume was about $3.9 trillion.

- PancakeSwap’s June 2025 trading volume hit a record near $325 billion, underscoring concentrated DEX liquidity.

- Stablecoin pairs provide approximately 60–70% of liquidity listings on major exchanges.

- Two leading exchanges together hold more than 50% of all reported reserves, with Binance alone at about $117 billion (31.8% increase year over year).

- The top 10 exchanges account for roughly 90% of stablecoin reserves, highlighting heavy liquidity concentration.

On‑Chain Metrics

- Global digital wallet users hit about 5.6 billion in 2025, with forecasts of 6.2 billion users by 2026.

- Crypto‑enabled mobile and digital wallets processed roughly $10.8 trillion in global crypto transaction volume in 2025.

- Dedicated crypto wallets like MetaMask and Trust Wallet together hold an estimated 5–7% share of the global digital wallet market.

- Crypto wallet markets are valued at nearly $12.20 billion in 2025, projected to reach around $98.57 billion by 2032.

- ETP net flows have reached about 515,000 BTC and 611,000 ETH, corresponding to on‑chain holdings of roughly $110 billion and $13 billion.

- U.S. Bitcoin ETFs recently saw a 7‑day net inflow of 15,511 BTC, while Ethereum ETFs added 93,878 ETH over the same period.

- Digital wallets are expected to account for over 50% of global e‑commerce transaction value by 2025, cementing on‑chain rails in payments.

- Around 45% of U.S. users aged 18–25 prioritize cryptocurrency integration when choosing a mobile or digital wallet.

Institutional vs. Retail Usage

- Institutional investors now hold about 24–28% of U.S. spot Bitcoin ETF assets, up from roughly 20% a year earlier.

- Institutional Bitcoin ETF holdings climbed to around $33.6 billion in Q2 2025, led by investment advisors with about $17.4 billion.

- Bitcoin ETF inflows reached roughly $25 billion in 2025, underscoring strong institutional allocation.

- Retail investors still own roughly 72–76% of Bitcoin ETF shares, keeping them the majority cohort.

- Corporate and public‑company holdings surpassed 1.1 million BTC (about 5% of total supply) by 2025.

- Institutional investors are estimated to control around 12.5% of the circulating Bitcoin supply, a share that continues to rise.

- Global crypto ETFs and ETPs held about $179.16 billion in assets at the end of November 2025.

- November 2025 saw net outflows of roughly $2.95 billion from crypto ETFs, after year‑to‑date inflows exceeding $39 billion.

Frequently Asked Questions (FAQs)

There are about 194 active cryptocurrency exchanges tracked globally.

Perpetual centralized crypto exchanges recorded $86.2 trillion in trading volume in 2025, a 47.4% increase year‑over‑year.

Coinbase has about 105 million global users, with 10.8 million monthly active traders reported.

Conclusion

Crypto exchanges today are at a crossroads, with security threats, stablecoin expansion, and institutional interest defining the landscape. Breaches are pushing platforms to invest heavily in protection. Meanwhile, stablecoins are facilitating trillions in flows and gaining legitimacy through regulatory clarity like the GENIUS Act.

Liquidity is consolidating in top platforms, while on-chain metrics and institutional tools shape evolving market transparency. Retail still leads in volume and engagement, but institutions are steadily growing. Together, these trends show a market maturing, complex yet actionable, volatile yet full of potential.