Wash trading remains one of the most controversial and closely watched forms of market manipulation in digital asset markets. This deceptive practice, where the same party buys and sells an asset to generate misleading volume, undermines price integrity, market confidence, and regulatory certainty. In traditional finance, wash trading is illegal under longstanding securities laws, but in crypto and NFT ecosystems, its prevalence still challenges regulators and platforms.

Real-world implications range from token listings that boost visibility to inflated NFT floor prices that lure unsuspecting buyers and distort secondary markets. Today’s article provides comprehensive statistics, trends, and insights into wash trading’s scope and impact.

Editor’s Choice

- One wash trading controller address managed an average of 183 wallets, highlighting coordinated scale.

- $516 million of Polygon’s NFT sales are attributed to wash trading.

- Wash trading comprised up to 24–25% of total volume in select NFT collections.

- U.S. authorities launched multiple enforcement actions targeting schemes.

- Hundreds of millions in wash trading by market-making firms on major exchanges.

- Bitcoin NFTs recorded $44,381 in wash trading volume this week.

- Ethereum NFTs showed $3.24 million in wash trading in the recent sales surge.

- NFT global sales hit $88.29 million with notable wash activity across chains.

Recent Developments

- In early 2025, U.S. prosecutors secured guilty pleas tied to wash trading and market manipulation, with penalties up to $428,059 and bans from major platforms for firms involved.

- Another prominent crypto market maker founder pleaded guilty in March 2025 for coordinating wash trading schemes valued at tens of millions of dollars.

- Regulatory scrutiny intensified with the SEC bringing multiple wash trading enforcement actions in the U.S. in the first half of 2025.

- Surveillance technologies for detecting anomalous trades have advanced, integrating behavioral and network analysis.

- Exchanges like Binance faced internal investigations in 2024 for alleged wash trading conduct tied to over $300 million in manipulative volume.

- Fragmented global regulation continues to complicate enforcement across borders.

- Market oversight bodies now issue guidance requiring improved monitoring systems to flag suspicious wash trading patterns.

- Despite enforcement pressure, wash trading tactics evolve with automated bots and layered account networks.

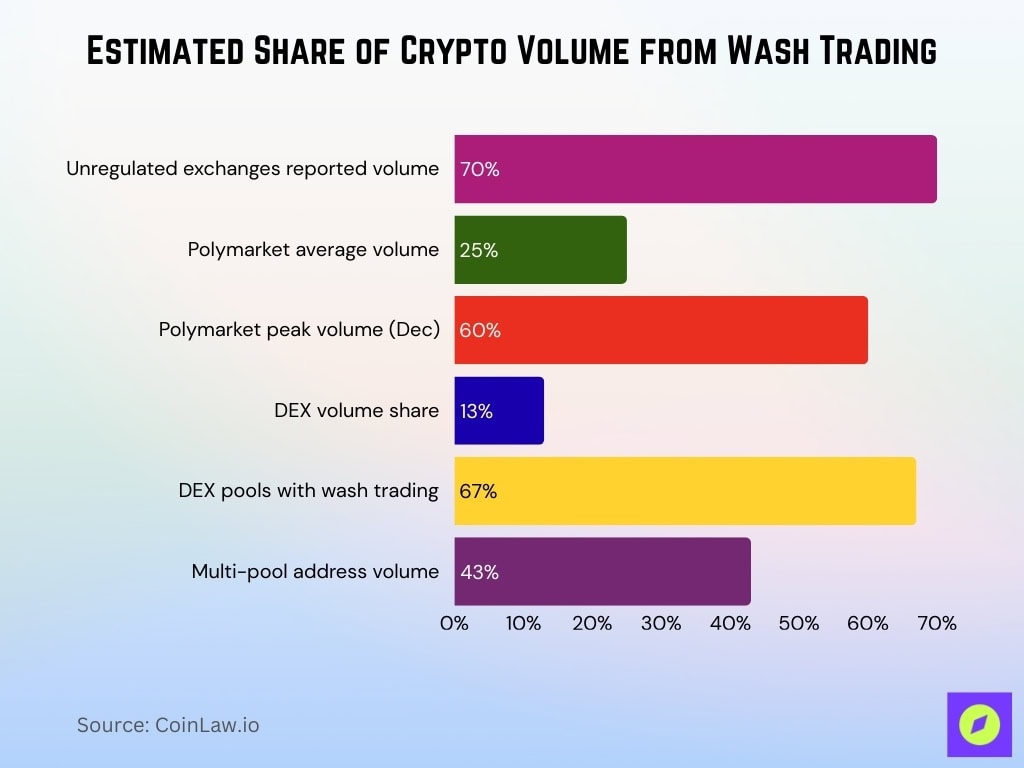

Estimated Share of Crypto Volume from Wash Trading

- Over 70% reported volume on unregulated crypto exchanges from wash trades.

- 25% average Polymarket volume from artificial wash trading.

- Wash trading peaked at 60% of Polymarket volume in December.

- 13% of DEX liquidity pools’ total trading volumes were wash trades.

- 67% of DEX liquidity pools exhibited wash trading activity.

- Wash trading drove 43% volume from multi-pool addresses.

What Is Wash Trading?

- Wash trading creates artificial volume, averaging 77.5% on unregulated crypto exchanges.

- Suspected wash trading reached $704 million on Ethereum, BNB, and Base DEXes.

- Alternatively, heuristics detect $1.87 billion in combined wash trade volume across chains.

- The top operator executed $313.6 million in suspected wash trading.

- Wash trading average per operator stands at $3.66 million.

- Solana NFTs recorded $588 million flagged as wash trades.

- Ethereum NFT wash trading exceeded $30 billion all-time.

- LooksRare NFT volume showed 95–99% wash trading activity, with one peer‑reviewed study finding 95.68% of trading value was wash trades and another Coindesk‑cited estimate putting it near 98%.

- 70% of crypto volumes on unregulated exchanges are from illegal wash trades.

- Profitable wash traders netted $8.9 million from NFT schemes

Wash Trading in Cryptocurrency Markets

- Suspected wash trading totaled $2.57 billion across select DEX blockchains.

- $704 million wash volume on Ethereum, BNB, and Base using primary heuristic.

- $1.87 billion wash trade volume detected by the alternative heuristic.

- $313.6 million maximum wash volume by a single operator.

- Average operator wash volume reached $3.66 million.

- 60% peak weekly volume from wash trading on Polymarket.

- 43,000 wallets in the largest detected wash trading cluster.

- 989 zero-risk position wash events affecting 72.82% tokens.

- 1,772% median volume spike during wash trading operations.

- 3.63 average wash trading operations per affected token.

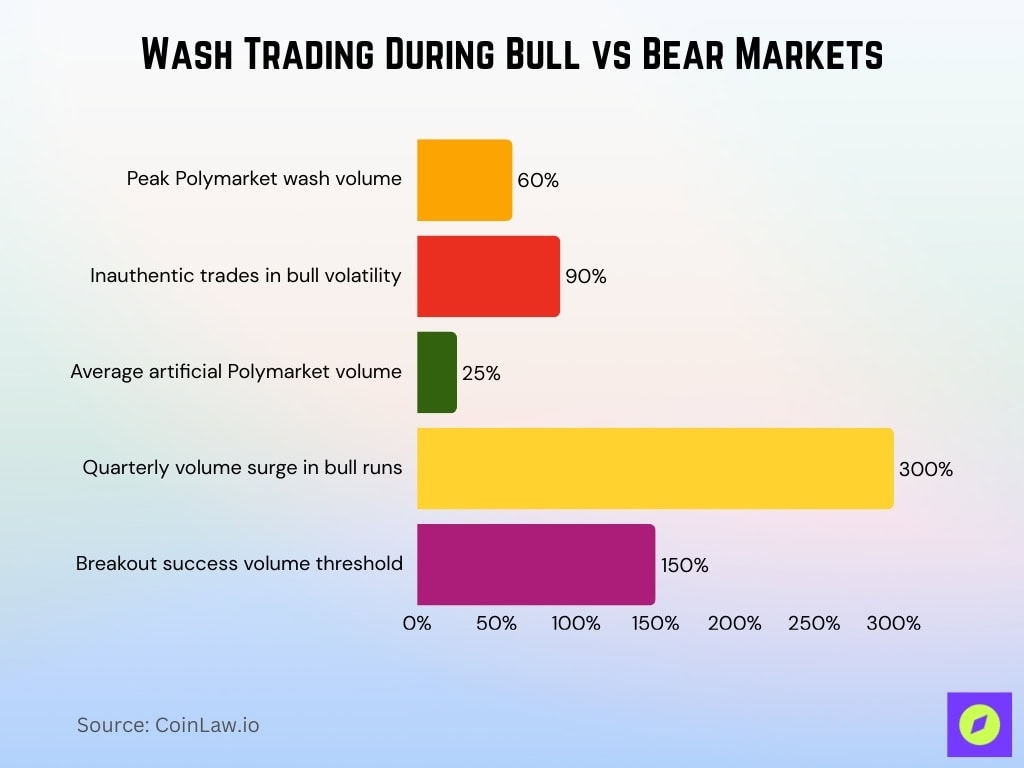

Wash Trading During Bull vs Bear Markets

- Wash trading peaked at 60% of Polymarket weekly volume.

- 90% of sports and election trades are inauthentic during peak bull volatility.

- 25% average Polymarket volume artificial across bull market highs.

- Volumes surged over 300% quarterly during strong bull runs.

- 43,000 wallet cluster generated $1 million wash volume in the bull phase.

- NUPL volatility is higher in bear markets versus bull price swings.

- Breakouts with 150%+ volume are more successful in bull surges.

- RVOL exceeded 2.0, signaling momentum in volatile bull/bear shifts.

NFT Market Wash Trading Statistics

- Bitcoin Ordinals NFTs recorded $44,381 in wash trading volume.

- Ethereum NFTs showed $3.24 million wash trading amid sales surge.

- Base chain NFTs hit $4.87 million in wash trading.

- BNB Chain NFTs logged $4,090 in wash trading activity.

- X2Y2 marketplace exhibited 84.2% volume from wash trades.

- Meebits collection had 78.22% of volume as wash trading.

- Terraform’s NFT collection showed a 58.88% wash trading share.

- Ethereum NFT wash trades totaled over $30 billion all-time.

- NFT sales volume climbed to $88.29 million with embedded wash activity.

Wash Trading by Asset Class (Spot, Derivatives, NFTs)

- Spot unregulated exchanges averaged 77.5% wash trading value.

- NFT LooksRare showed 95.68% trading value from wash trades.

- NFT Blur exhibited a 58.16% value as wash trading.

- NFT OpenSea had 31.22% trades flagged as wash trading.

- Ethereum NFTs recorded 45% all-time volume as wash trades.

- X2Y2 NFT marketplace showed about 85–90% wash trading volume, aligning with an 84.2% peer‑reviewed estimate with a Coindesk‑reported figure of roughly 87%.

- NFT wash trades totaled $8.86 million across 5,330 events.

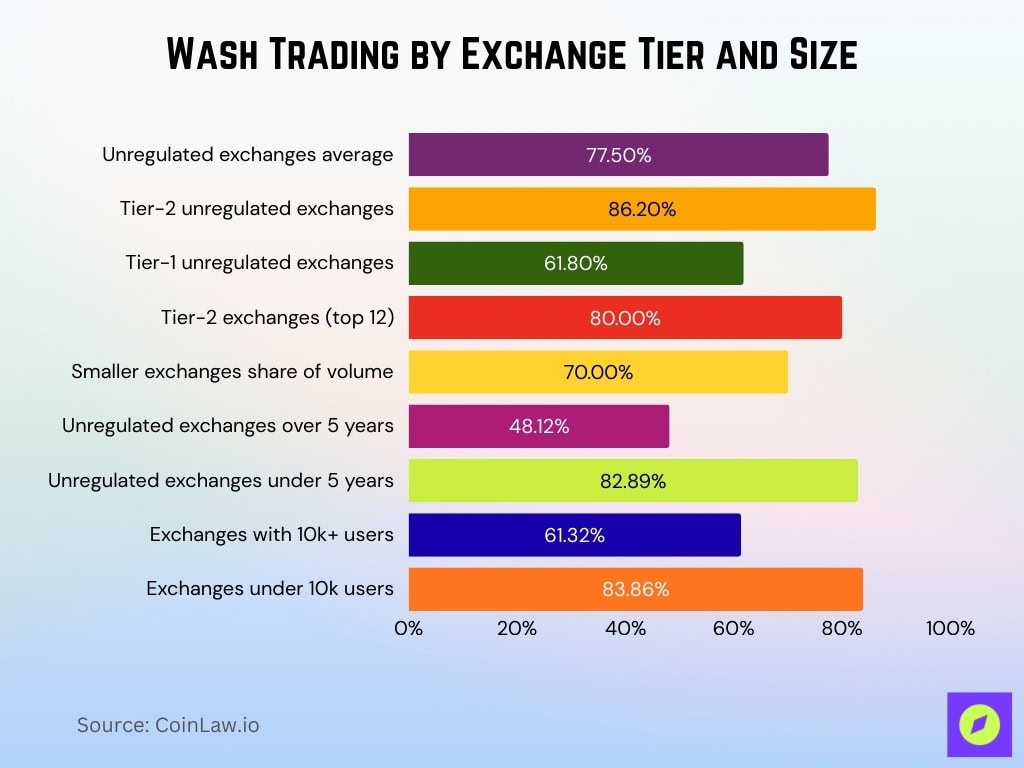

Wash Trading by Exchange Tier and Size

- 77.5% average wash trading volume on unregulated exchanges.

- 86.2% wash trades on Tier-2 unregulated exchanges.

- 61.8% wash trading proportion on Tier-1 unregulated exchanges.

- 80%+ wash trades on twelve Tier-2 unregulated exchanges.

- 70% of the total reported volume was traded on smaller exchanges.

- 48.12% wash trading on unregulated exchanges over five years old.

- 82.89% wash volume on newer unregulated exchanges under five years.

- 61.32% wash trading on exchanges with over 10,000 users.

- 83.86% wash volume on CEXs with fewer than 10,000 users.

Centralized Exchanges Wash Trading Statistics

- 70% average reported volume from wash trading on unregulated CEXs.

- Volumes inflated by factors up to 50× through artificial wash trades.

- 95% of all wash trading occurs on centralized trading platforms.

- Spot trading volume dropped 49% to $1.13 trillion in December.

- 77.5% average wash trading in value terms on unregulated spot exchanges.

- December spot volume hit a 15-month low at $1.13 trillion.

- 32% decline in CEX spot volume from November’s $1.66 trillion.

- Q2 2025 CEX volumes fell 27% to $3.9 trillion.

- Over 15% wash trade rate detected in ERC20 tokens on CEXs.

- Volumes exaggerated 1.25× to 50× on a subset of unregulated exchanges.

Decentralized Exchanges Wash Trading Statistics

- 0.035% of total DEX volume flagged as suspected wash trading.

- 67% of DEX liquidity pools showed wash trading activity.

- 13% of total trading volumes in DEX pools from wash trades.

- $2.57 billion suspected wash trading across DEX blockchains.

- 43% DEX volume from multi-pool wash trading addresses.

- 0.046% DEX volume detected via alternative wash heuristic.

- $67 billion perp DEX volume raised wash trading concerns.

- $20 billion daily PancakeSwap volume with 70% DEX share.

- 45% drop in DEX volumes matches CEX decline in December.

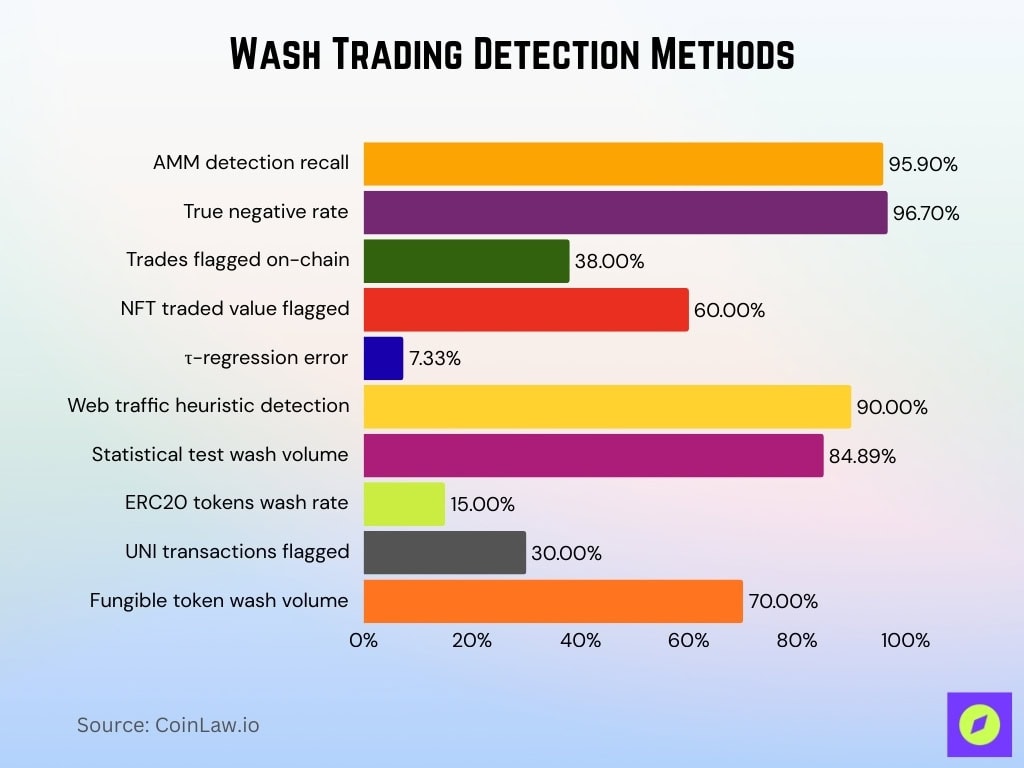

Detection Methods

- 95.9% recall rate for AMM pool wash trading detection.

- 96.7% true negative rate in wash trading pool identification.

- 38% trades (30–40%) are estimated as wash using direct on-chain filters.

- 60% traded value (25–95%) linked to manipulative NFT trades.

- 7.33% average error in τ-regression wash value estimation.

- >90% suspicious volume detected via web traffic heuristics.

- 84.89% reported volume from wash trades using statistical tests.

- >15% wash trade rate in most ERC20 tokens on-chain detection.

- >30% UNI token transactions flagged by WTEYE detection.

- 70% fungible token volume estimated wash aligns with NFT averages.

Volumes by Token or Trading Pair

- Donald J. Chump token saw 43% volume from Volume.li bot wash trades.

- BTC/USD pair averaged $490 million daily suspicious volume on wash exchanges.

- ETH/USD exhibited high wash trading levels, second to Bitcoin.

- XRP/USD showed elevated wash trading after Bitcoin and Ethereum.

- LTC/USD ranked among the top four pairs with major wash trading.

- >90% suspicious volume detected in BTC, ETH, XRP pairs.

- $39,723 fake volume generated in 10,341 trades for Chump token.

- 30% of tokens on EtherDelta are nearly exclusively wash traded.

- $42 million genuine daily BTC/USD vs $490 million wash group.

- $100,000 volume bot costs 0.212 ETH for 100 rapid trades.

Impact of Wash Trading on Prices and Volatility

- Wash trading boosts the exchange rank by 46 positions with 70% manipulated volume.

- 165% price volatility reduced to 9% after curbing wash trading.

- >90% suspicious volume distorts BTC/USD prices on wash exchanges.

- Wash trading positively correlates with short-term cryptocurrency price rises.

- Market volatility strongly predicts higher wash trading volumes.

- Wash trades cause rapid non-wash volume spikes during high media interest.

- Artificial volume misleads liquidity, widening bid-ask spreads.

- 70% trades inflate prices, misleading investors on small CEXs.

- Wash trading amplifies volatility in low legitimate volume conditions.

Regulatory Enforcement and Case Statistics

- 18 individuals and entities charged for crypto wash trading schemes.

- CLS Global fined $428,059 for cryptocurrency wash trading guilty plea.

- Founder faces $23 million forfeiture in market-making wash trading case.

- Shinhan Securities was penalized $212,500 by the CFTC for wash sales.

- Coinbase ordered to pay $6.5 million for wash trading violations.

- Raizen firms fined $750,000 for sugar futures wash sales.

- CFTC FY 2024 enforcement yielded $17.1 billion in monetary relief.

- Coinme Inc. settled $300,000 under the California Digital Financial Assets Law.

Frequently Asked Questions (FAQs)

Certain crypto exchanges were estimated to exaggerate actual trading volume by a factor of 25 to 50 times in wash trading studies.

Wash trading proportions reached as high as 94.5% on LooksRare and 84.2% on X2Y2 in some NFT markets.

The Meebits NFT collection had about 95-99% of its total trade volume identified as wash trading.

Conclusion

Wash trading remains a persistent challenge to transparency and fairness across digital asset markets. Manipulators exploit volatility, incentive structures, and low‑liquidity environments to generate misleading volume during both bull and bear cycles. Larger, well‑regulated exchanges generally perform better, while smaller venues and specific token pairs continue to attract higher levels of artificial activity.

Advances in detection methods, including machine learning and network analysis, have improved visibility, but enforcement still trails rapidly evolving tactics. Real‑world cases and expanding regulatory frameworks underscore the need for continuous monitoring, stronger compliance, and data‑driven oversight. As crypto markets mature, reducing wash trading will be essential to restoring trust and supporting sustainable growth.