Imagine standing at a coffee shop counter, waving your smartphone over a terminal to complete your purchase within seconds. This seamless experience, once futuristic, is now commonplace due to platforms like Samsung Pay. With its global reach and user-friendly interface, Samsung Pay has revolutionized how we transact. The platform continues to grow, adapting to advancements in mobile payment technologies and security standards. In this article, we dive into the latest 2025 statistics to explore the impact and trajectory of Samsung Pay in the evolving digital payment landscape.

Editor’s Choice: Key Usage Statistics

Here are some of the most significant statistics about Samsung Pay that showcase its influence in the mobile payment sector:

- Samsung Pay processes over 1.6 billion transactions annually in 2025, showing stronger global adoption.

- The platform now supports transactions in 31 countries, expanding its international footprint.

- In the US, Samsung Pay’s user base grew by 9% year-over-year, reaching 35 million active users in 2025.

- Users engage with Samsung Pay an average of 5.2 times per week, reinforcing its role in daily purchases.

- NFC-based payments now account for 85% of all Samsung Pay transactions, confirming the shift to contactless.

- 68% of Samsung Pay users in 2025 use it for retail purchases, while 32% use it for peer-to-peer transfers.

- Integration with loyalty programs led to a 22% boost in user engagement, underscoring Samsung Pay’s added value.

Global Adoption Rates

Samsung Pay has solidified its position as a leader in the mobile payment industry, achieving remarkable adoption rates worldwide. Here are the standout statistics:

- Samsung Pay is operational in 29 countries, with plans to expand into 5 more regions by 2025.

- Asia-Pacific leads adoption, accounting for 40% of global Samsung Pay users, followed by North America at 25%.

- In South Korea, Samsung Pay is used by 8 out of 10 smartphone owners, demonstrating its dominance in its home market.

- The European market grew by 15% year-over-year, fueled by increased adoption in countries like Germany, the UK, and France.

- Emerging markets like India and Brazil saw a 25% rise in active users, attributed to the growing penetration of Samsung smartphones.

- Over 70% of merchants in the US now accept Samsung Pay, thanks to its compatibility with both NFC and MST (Magnetic Secure Transmission) technologies.

- Samsung Pay’s user retention rate in regions with integrated public transport systems, such as Singapore and Australia, increased by 12%, driven by convenience in commuting.

These figures emphasize Samsung Pay’s strategic efforts to cater to diverse markets and bolster its presence in established and emerging economies alike.

Mobile Payment Transaction Volume

The rise of contactless payments continues to drive growth in Samsung Pay’s global transaction volume:

- Samsung Pay facilitated $342 billion in global transactions in 2025, reflecting a 17.9% increase from 2024.

- In the US, Samsung Pay transactions hit $76 billion, now comprising 22% of its total global volume.

- The average transaction value climbed to $45.10, showing consistent use for both everyday and premium purchases.

- Cross-border transactions made up 12% of total volume, underscoring its role in international payment convenience.

- Peer-to-peer payments grew by 28%, boosted by deeper integration with messaging and social platforms.

- Strategic partnerships fueled a 34% rise in online transactions, especially across major retail and e-commerce networks.

- Q4 2025 holiday sales saw a record $9.1 billion processed during Black Friday and Cyber Monday alone.

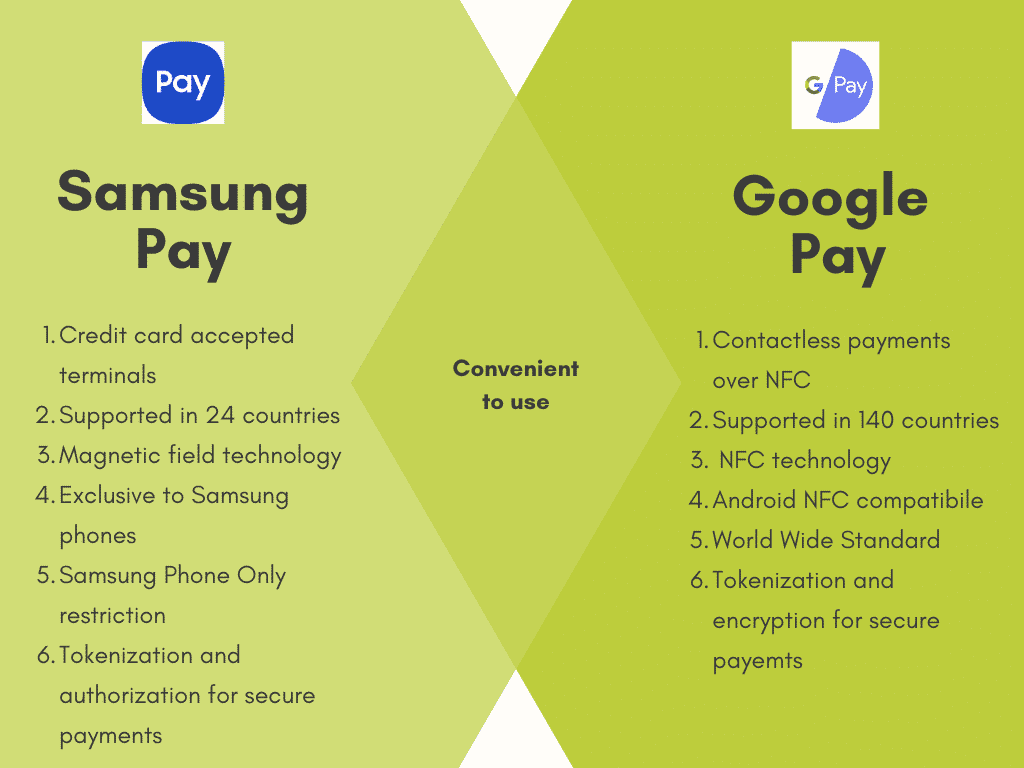

Samsung Pay vs Google Pay: A Quick Comparison

Samsung Pay

- Works with credit card terminals

- Available in 24 countries

- Uses magnetic field technology (MST)

- Exclusive to Samsung phones

- Has a Samsung-only restriction

- Offers tokenization & secure payment authorization

Google Pay

- Supports contactless payments via NFC

- Available in 140 countries

- Relies on NFC technology

- Compatible with all Android NFC devices

- Considered a worldwide standard

- Offers tokenization & encryption for secure payments

Digital Wallet User Statistics

Digital wallets, including Samsung Pay, are redefining how consumers manage and spend money. Here’s an in-depth look at Samsung Pay’s user statistics:

- Samsung Pay has surpassed 150 million global active users, achieving a 15% growth compared to 2023.

- 45% of Samsung Pay users are between the ages of 25 and 34, making millennials its largest user demographic.

- The platform boasts a 93% user satisfaction rate, emphasizing its intuitive design and reliability.

- Among users, 67% have linked multiple cards to their Samsung Pay accounts, leveraging its versatility.

- 85% of Samsung Pay users cite convenience as the primary reason for adopting the service, followed by security at 72%.

- The digital wallet saw 20% growth among small business owners, who increasingly use it for invoicing and receiving payments.

- Samsung Pay Rewards, the loyalty program, has engaged 40 million users, contributing to a 22% retention boost.

- Around 60% of new Samsung Pay users came from regions with growing mobile payment adoption, such as Southeast Asia and the Middle East.

- Samsung Pay has maintained a monthly active user rate (MAU) of over 80%, one of the highest in the digital wallet industry.

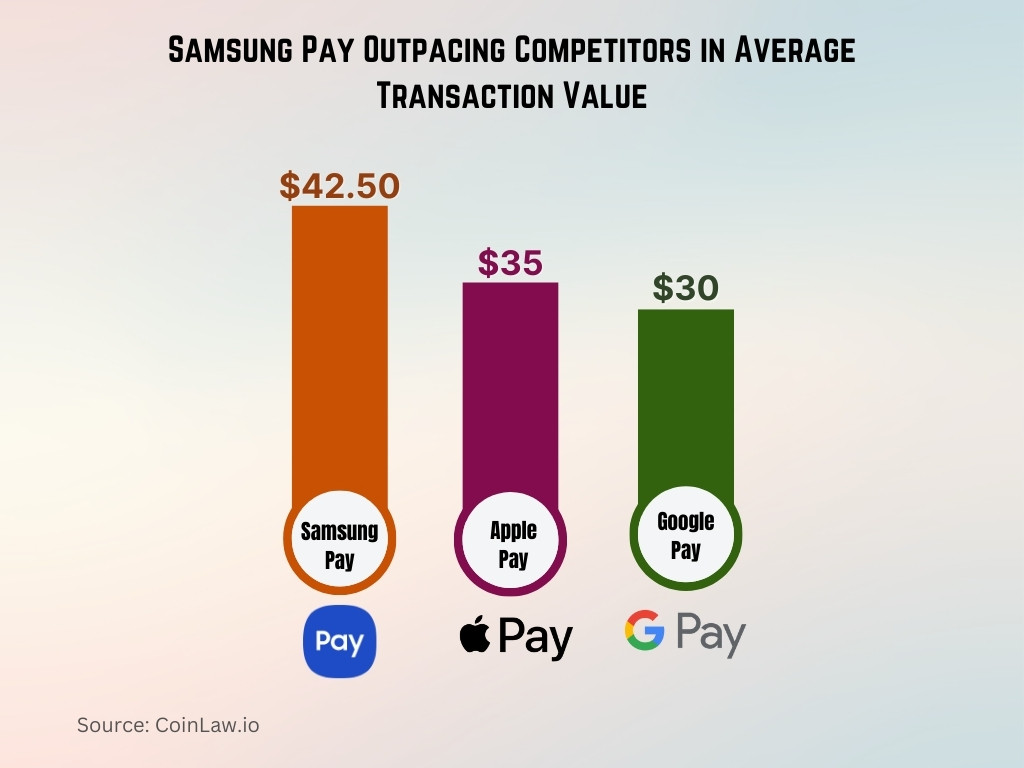

Market Share Comparison

Samsung Pay continues to compete strongly with other digital payment platforms. Here are key statistics:

- Samsung Pay holds a 14% share of the global mobile payment market, ranking third behind Apple Pay and Google Pay.

- In the Asia-Pacific region, Samsung Pay leads with a 25% market share, owing to strong adoption in South Korea and Southeast Asia.

- Samsung Pay captures 20% of the NFC payments market, benefiting from its dual compatibility with NFC and MST technologies.

- Among Android-based wallets, Samsung Pay dominates with a 35% share, surpassing competitors like Google Pay.

- Retail payments make up 75% of Samsung Pay’s total transactions, compared to 65% for Google Pay and 58% for Apple Pay.

- In the US market, Samsung Pay has a 10% penetration rate, reflecting steady growth amid increasing competition.

- The platform has a higher average transaction size compared to competitors, at $42.50 versus Apple Pay’s $35 and Google Pay’s $30.

Regional Usage Trends

Samsung Pay’s performance varies significantly across regions, reflecting differences in consumer behavior and market conditions. Here’s a detailed look at regional trends:

- South Korea remains Samsung Pay’s strongest market, with an 80% adoption rate among smartphone users, driven by high trust in its security features.

- India experienced a 25% increase in Samsung Pay users, boosted by the growing availability of Samsung devices in tier-two and tier-three cities.

- In the United States, Samsung Pay captured a 10% share of mobile payment transactions.

- Adoption in Western Europe rose by 15% year-over-year, particularly in countries like Germany, France, and Spain, where NFC adoption is surging.

- Brazil leads Samsung Pay’s growth in South America, with a 22% year-over-year increase in transactions due to rising smartphone penetration.

- Australia and Singapore have become key markets in the Asia-Pacific region, with 12% and 10% growth in active users, respectively.

- In the Middle East, Samsung Pay expanded its user base by 18%, driven by partnerships with local banks and retailers.

- Cross-border usage of Samsung Pay grew by 30%, with frequent travelers using the platform to make payments in countries that support the service.

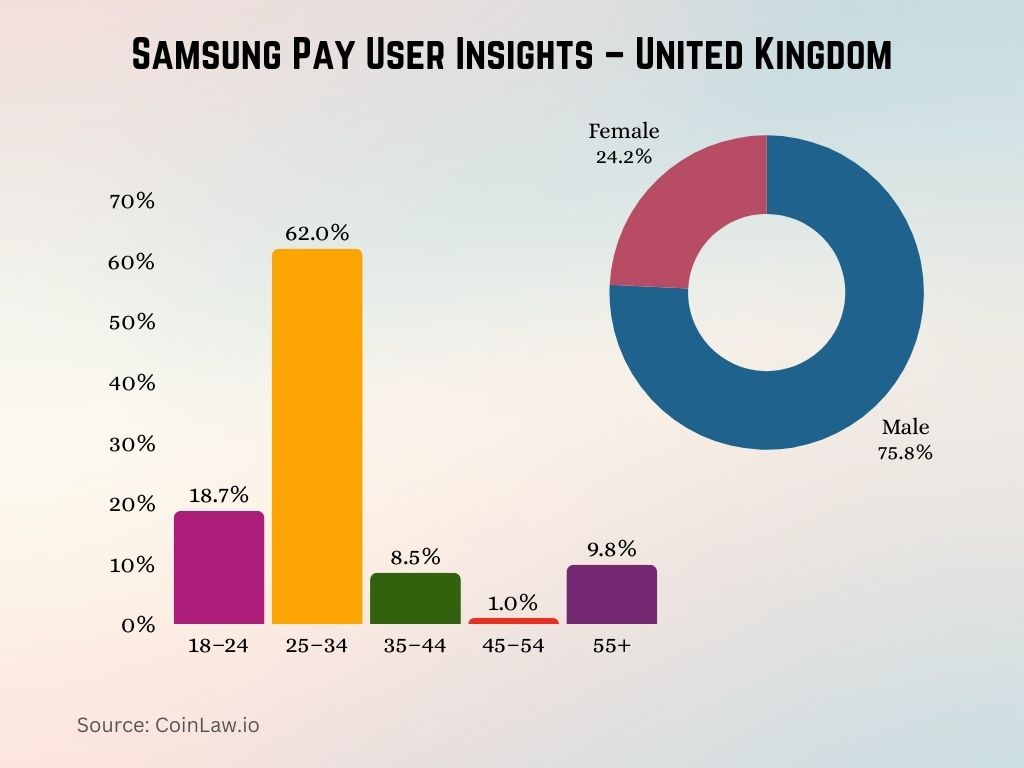

Samsung Pay User Insights – United Kingdom

- 62.1% of Samsung Pay users are aged 25–34 years.

- 18.7% of users fall in the 18–24 years age group.

- 8.5% of users are between 35–44 years.

- 1% of users are aged 45–54 years.

- 9.8% of users are 55 years and above.

- 75.8% of users are male.

- 24.2% of users are female.

- The most used device is the Samsung Galaxy S9.

- The second most used device is the Samsung Galaxy S8.

- The third most used device is the Samsung Galaxy S10.

- The fourth most used device is the Samsung Galaxy S9+.

- The fifth most used device is the Samsung Galaxy S10+.

Mobile Payment Growth

The mobile payment industry continues its rapid rise, with Samsung Pay maintaining strong momentum:

- The global mobile payment market is projected to reach $4.7 trillion in 2025, with Samsung Pay contributing $342 billion in transactions.

- Samsung Pay’s transaction volume rose by 17.9% year-over-year, surpassing the industry average of 13%.

- 85% of Samsung Pay users now regularly use NFC for contactless transactions, driving continued adoption.

- Peer-to-peer transactions via Samsung Pay surged by 28%, totaling $67 billion globally in 2025.

- Samsung Pay’s user base grew by 12%, bolstered by growth across Asia-Pacific, Europe, and Latin America.

- Integration with loyalty programs boosted user retention by 25%, as consumers sought value-added features.

- Retail partnerships powered a 34% jump in online transactions, proving Samsung Pay’s strength in e-commerce.

- Samsung Pay expanded into 6 new markets in 2025, cementing its role as a global mobile payment leader.

Mobile Payment Security Statistics

Security remains a cornerstone of Samsung Pay’s appeal, with advanced measures ensuring user trust. Here are the 2025 statistics reflecting its strong security posture:

- 98% of Samsung Pay users report high confidence in its security, thanks to tokenization and biometric authentication.

- Samsung Pay experienced a 25% decline in fraudulent transaction attempts, showcasing the effectiveness of its multi-layered security system.

- 85% of users cite security features, such as fingerprint and iris scanning, as a major reason for choosing Samsung Pay.

- Samsung Pay has zero reported major security breaches since its launch, maintaining its reputation for robust protection.

- 60% of users in the US and Europe prefer Samsung Pay over traditional payment methods due to enhanced encryption and data privacy.

- The integration of Samsung Knox has resulted in a 30% improvement in device-level security, reducing vulnerability to cyberattacks.

- 85% of merchants globally consider Samsung Pay one of the most secure mobile payment solutions for their customers.

- Security audits conducted by third-party firms confirmed a 99.9% compliance rate with global payment security standards.

- Samsung Pay’s fraud detection system flagged and prevented over $5 million in fraudulent activities globally.

Technological Innovations

Samsung Pay continues to evolve by integrating cutting-edge technologies. Key innovations include:

- The introduction of AI-driven fraud detection algorithms, which analyze transaction patterns in real-time, reducing fraud attempts by 40%.

- Voice-activated payment capabilities were launched in select markets, allowing users to authorize transactions hands-free.

- Samsung Pay now supports cryptocurrency payments, enabling 10 major cryptocurrencies for transactions in early-adopting regions.

- Integration with 5G networks improved transaction speeds by 30%, enhancing the overall user experience.

- The platform introduced smart budgeting tools, allowing users to set spending limits and receive alerts, which saw a 20% increase in engagement.

- A new feature enabling offline transactions using stored payment data was launched, catering to areas with unreliable internet connectivity.

- Samsung Pay extended its ecosystem to include wearable devices, with 15% of transactions initiated via Samsung smartwatches.

- Enhanced QR code payment functionality allows merchants in developing regions to accept payments without the need for NFC-enabled terminals.

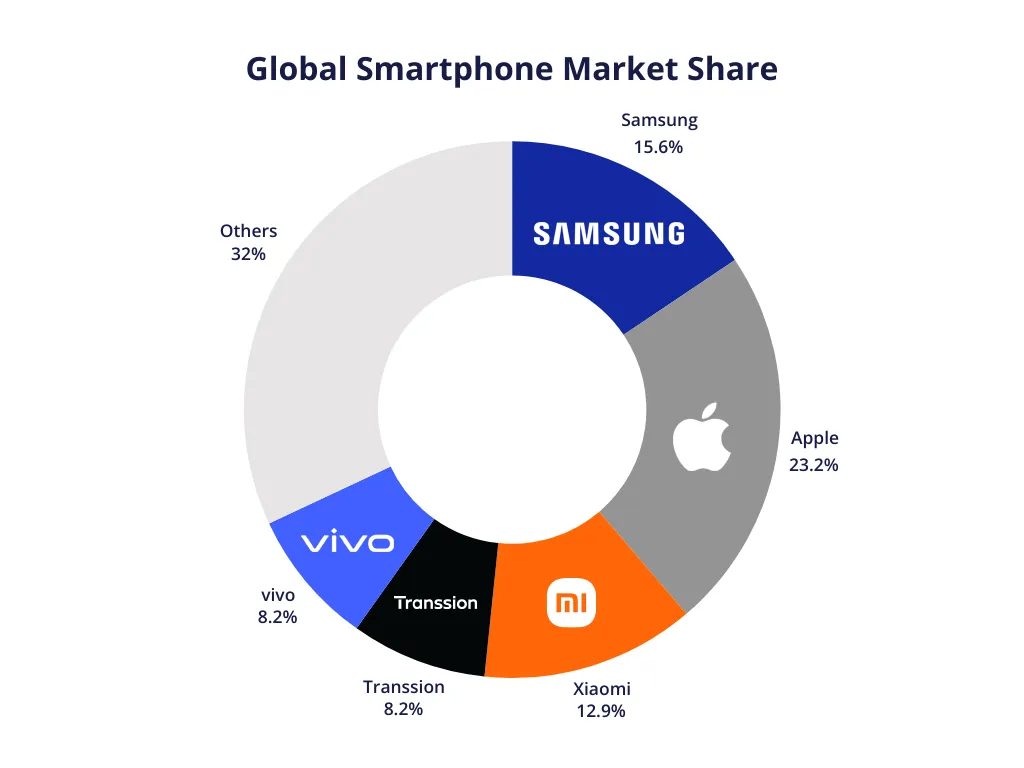

Global Smartphone Market Share

- Apple leads the market with a 23.2% share.

- Samsung holds the second spot at 15.6%.

- Xiaomi follows with a 12.9% market share.

- Vivo and Transsion are tied at 8.2% each.

- Others collectively account for 32% of the market.

Recent Developments

Samsung Pay has made significant strides in 2025, focusing on expansion, partnerships, and feature enhancements. Here are the most notable recent developments:

- Samsung Pay partnered with PayPal, allowing users to link their accounts for seamless online and in-store payments.

- The platform expanded to two new countries, South Africa and Turkey, broadening its global footprint.

- A collaboration with Amazon enabled one-click payments on the e-commerce giant’s platform, increasing user convenience.

- Samsung Pay is integrated with transport systems in 5 additional cities, enabling tap-to-pay functionality for public transportation.

- The launch of the Samsung Wallet, which consolidates payment cards, loyalty programs, and digital IDs, saw a 25% user adoption rate within the first three months.

- Samsung Pay for Business was unveiled, offering tools for small businesses to accept payments and track sales, increasing merchant adoption by 18%.

- A new rewards program tier for high-frequency users was introduced, enhancing customer retention by 15%.

- Samsung Pay announced its carbon neutrality goal, committing to sustainable digital payment solutions by 2030.

These developments highlight Samsung Pay’s commitment to innovation and expanding its ecosystem to cater to diverse user needs.

Conclusion

Samsung Pay continues to push boundaries in the digital payments arena, combining cutting-edge technology with a user-first approach. From its robust security measures to its seamless integration across devices, Samsung Pay not only meets consumer expectations but also exceeds them. Its global expansion, partnerships, and innovative features underscore its role as a leader in shaping the future of mobile payments.

As the digital economy evolves, Samsung Pay is well-positioned to remain a dominant force, offering a reliable, secure, and convenient payment solution for millions worldwide.