Ripple Labs has positioned itself as one of the most closely watched companies bridging blockchain technology and global payments. Its products and ecosystem, particularly RippleNet, On‑Demand Liquidity (ODL), and the XRP Ledger (XRPL), continue to shape how financial institutions approach cross‑border transfers, liquidity, and settlement. Real‑world applications span from banks using XRP to reduce foreign exchange friction to corporations integrating RippleNet APIs for global payouts. With ongoing regulatory developments and expanding network adoption, understanding Ripple’s current statistical landscape offers insight into the direction of digital finance. Explore the latest Ripple Labs statistics below.

Editor’s Choice

- Ripple’s valuation reached roughly $40 billion in 2025 after major funding rounds.

- More than 300 financial institutions now use RippleNet globally.

- Over $15 billion in cross‑border volume was processed via On‑Demand Liquidity in 2024.

- About 40% of RippleNet partners are actively using XRP for ODL.

- XRP Ledger’s latest protocol version (2.3.0) was released in late 2024.

- ODL adoption in the Asia‑Pacific region now accounts for 56% of global ODL volume.

- Ripple engages with 20+ central banks exploring CBDC infrastructure.

Recent Developments

- Major funding influx: Ripple led funding activity in crypto in late 2025, participating in a $666 million funding bonanza alongside other startups.

- Valuation boost: A $500 million funding round in 2025 lifted Ripple’s valuation to ~$40 billion.

- Cross‑chain expansion: Ripple integrated the XRP Ledger with Wormhole, enabling XRP interoperability with 35+ major chains as of mid‑2025.

- CBDC engagement: Ripple publicly reported engagements with 20+ central banks on digital currency platforms.

- Network upgrades: XRPL saw its 2.3.0 release in November 2024, improving performance and token standards.

- API growth: New enterprise APIs for multi‑chain payments and ISO 20022 compliance rolled out in 2025.

- Regulatory avenues: Ripple continues to pursue broader financial services charters to expand payment and custodial services.

- Institutional tooling: SDKs and integration tooling released to attract institutional developers to the XRPL ecosystem.

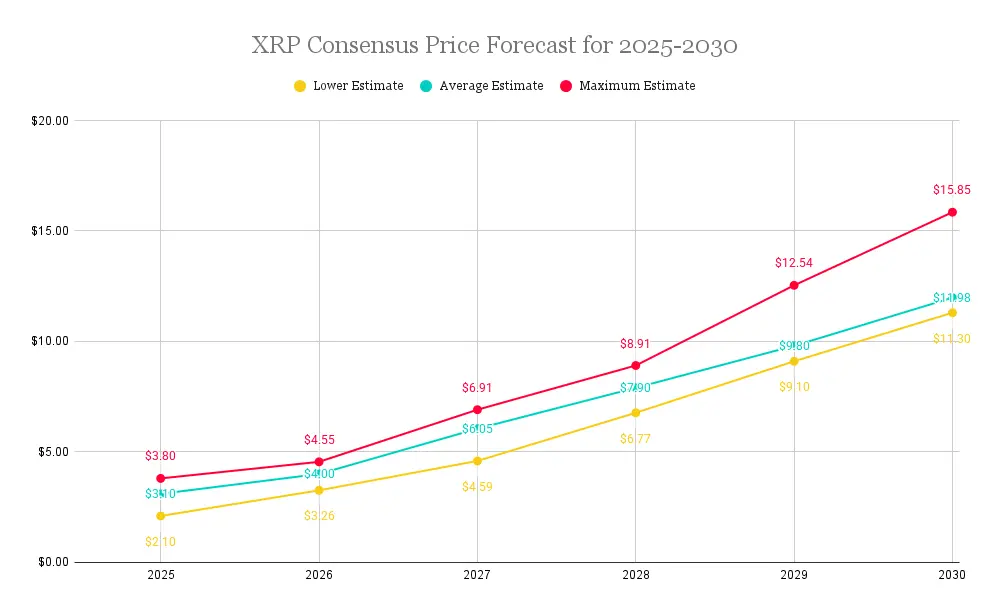

XRP Price Forecast

- XRP is forecasted to reach an average of $3.10 in 2025, with a maximum upside estimate of $3.80.

- By 2026, the average XRP price is expected to rise to $4.00, with a lower bound of $3.26 and an optimistic target of $4.55.

- In 2027, projections show XRP climbing to an average of $6.05, while the maximum estimate hits $6.91.

- 2028 forecasts put XRP’s average price at $7.90, with a potential high of $8.91 and a conservative low of $6.77.

- XRP may break the double-digit mark in 2029, with the average forecast at $9.80 and a bullish maximum of $12.54.

- By 2030, the XRP consensus forecast peaks at an average of $11.98, with a high-end estimate of $15.85, marking over a 4x increase from 2025 levels.

Ripple Labs Overview

- Founded: 2012 in San Francisco, CA, by Chris Larsen and others.

- Headquarters: San Francisco remains the central hub for corporate operations.

- Primary focus: Real‑time settlement infrastructure, liquidity optimization, and cross‑border payments.

- Core products: RippleNet, On‑Demand Liquidity, XRP Ledger services.

- Escrowed XRP: ~$24 billion worth of XRP held in escrow under management policies.

- Global footprint: Partnerships span 55+ countries with financial institutions.

- Strategic acquisitions: Gained custody service capabilities through the Metaco acquisition in 2023.

- Regulatory positioning: Holds an in‑principle payment license in Singapore and other regulated jurisdictions.

Funding and Valuation Statistics

- 2025 funding round: ~$500 million raised from investors, expanding growth runway.

- Company valuation: Estimated ~$40 billion in 2025 after the latest round.

- Total crypto funding growth: Ripple’s raise occurred amid a broader crypto sector raising ~$22 billion in 2025.

- Historical funding: Prior to 2025, Ripple had raised ~$293.8 million as of late 2024.

- Escrow XRP holdings: ~$24 billion worth of XRP in escrow scheduled for release over future years.

- Buyback initiatives: Ripple initiated a $285 million stock buyback to enhance shareholder value in 2024.

- Investor base breadth: Includes major venture and fintech backers from prior rounds.

- Funding doubling trend: Crypto funding activity doubled from 2024 to 2025, aiding Ripple’s prospects.

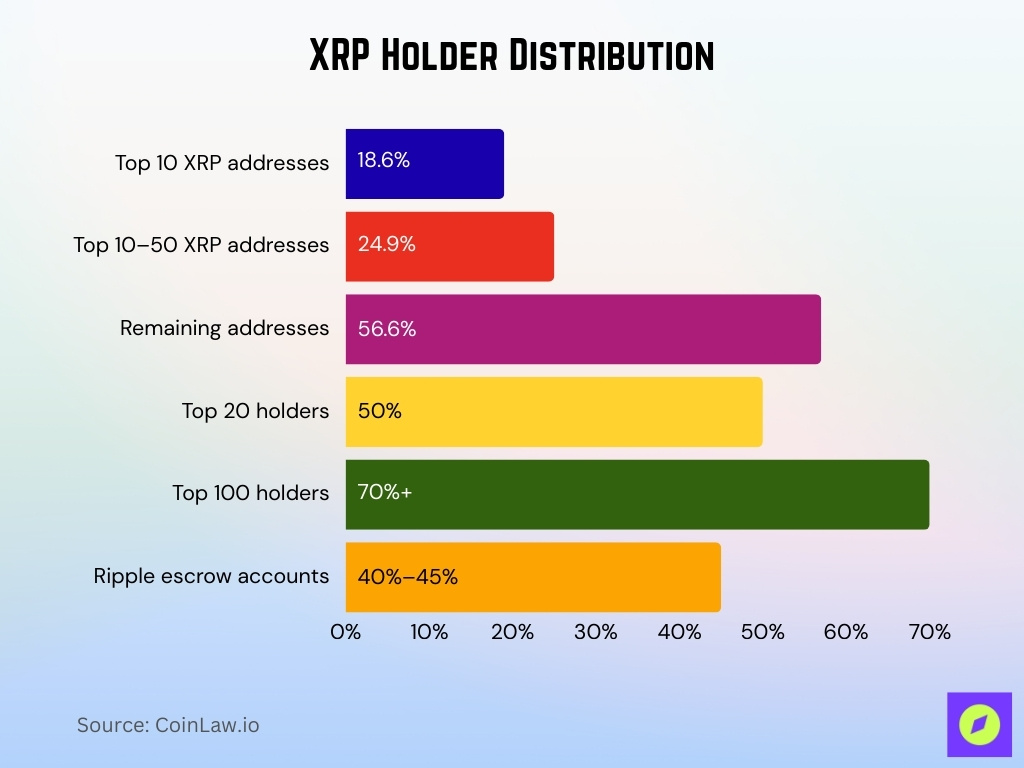

XRP Holder Distribution: Who Controls the Supply?

- The top 10 XRP addresses hold ≈18.6% of the circulating supply, according to CoinCodex 2025.

- Wallets ranked #11 to #50 control ≈24.9% of circulating XRP, indicating substantial mid-tier concentration.

- The remaining addresses (outside the top 50) account for ≈56.6% of circulating XRP, suggesting broad community distribution.

- The top 20 holders control approximately 50% of the total XRP supply, reinforcing centralization concerns.

- The top 100 holders own over 70% of the total supply, highlighting a highly concentrated ownership structure.

- Ripple’s escrow accounts still retain between ~40–45% of the 100 billion total XRP supply, based on CryptoRank 2025 data.

Profitability and Financial Performance

- Market size: The Ripple (XRP) market was valued at about $187.4 billion in 2024 and is projected to grow rapidly in the coming decade.

- 2025 industry funding climate: Ripple participated in a broader crypto funding acceleration, with total crypto investments estimated to reach $22 billion in 2025, doubling 2024’s figures.

- Strategic acquisitions: Ripple acquired treasury management and brokerage firms in 2025, investing more than $2 billion in traditional finance infrastructure.

- Product cost efficiency gains: Users of Ripple’s enterprise solutions reported ~$550 million in annual savings in 2025 versus traditional systems.

- Operational cost reduction: Financial firms leveraging XRP infrastructure reduced overall operational costs by ~45% compared with legacy rails.

- Remittance fee impact: XRP‑based remittance corridors cut pre‑funded capital requirements by ~65% for institutional users.

- Immediate settlement: XRP transactions settle within ≈3–5 seconds, driving faster financial throughput in cross‑border contexts.

- Savings versus SWIFT: RippleNet’s average transaction costs (~0.3%) remain significantly below traditional systems (often >7%).

Product and Service Overview

- Ripple partners with over 300 financial institutions globally through RippleNet.

- On-Demand Liquidity (ODL) processed $1.3 billion in payments during Q2.

- XRPL processes 2 million transactions daily, with 75% settling in under 5 seconds.

- XRPL handles 1,500 TPS natively, scalable to over 65,000 TPS with layer-2 solutions.

- XRP transactions average $0.0002–$0.0004 per operation.

- Weekly payments on XRPL surged 430% to over 8 million from 2023 levels.

- Over 60 banks utilize ODL for cross-border remittances.

- RippleNet spans customers across six continents with multi-chain Wormhole integration.

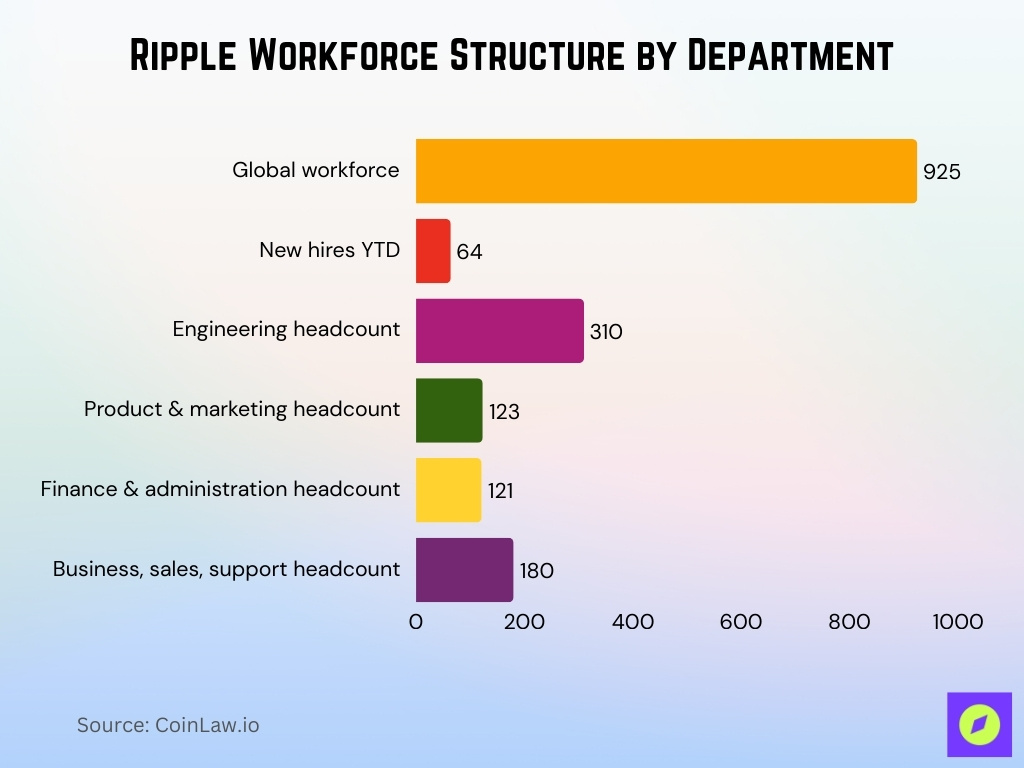

Employee and Office Statistics

- Global workforce: Ripple Lab’s headcount was approximately 925 employees in 2025, showing relative stability year‑over‑year.

- New hires: 64 new hires occurred year‑to‑date in 2025, indicating measured expansion.

- Engineering dominance: The largest department remains Engineering with ~310 staff members.

- Marketing and product teams: 123 employees focus on product and marketing functions.

- Finance and administration: 121 employees support core business operations.

- Business management and support: ~180 staff work in business, sales, support, and related areas.

- Global office spread: Ripple’s personnel span key hubs such as San Francisco, New York, London, and Singapore, reflecting its global operational footprint.

RippleNet Network Adoption Statistics

- Partner growth: RippleNet has expanded to include 300+ financial institutions globally as of 2025.

- Global reach: These partners span 55+ countries, strengthening Ripple’s international presence.

- Institution types: Members include banks, fintech firms, remittance platforms, and corporates.

- Annual savings: RippleNet users collectively reported ~$550 million in cost savings in 2025.

- Fintech vs bank growth: ~47% of RippleNet’s 2025 growth came from fintech partners versus traditional banks.

- API adoption: Hosted payment APIs via partnerships such as AWS integration help accelerate enrollment.

- Emerging corridors: RippleNet forged new corridors in South America and the Middle East regions in 2025.

- Sustainability integration: RippleNet’s networks increasingly integrate compliance (AML/KYC) features across jurisdictions.

Banking and Financial Institution Partnerships

- 300+ banks and financial institutions partner with RippleNet globally.

- Fortune 500 companies using RippleNet grew from 32 to 47.

- Ripple onboarded 38 new institutional partners in Q1, including Singapore and Canadian banks.

- Nigeria processed $92.1 billion in remittances via RippleNet infrastructure in Q2-Q3.

- Partners span 55+ countries across North America, Asia, Latin America, Europe, and Africa.

- Banks achieve average cross-border transaction costs of $0.0011 using Ripple rails.

- Institutional client retention rate reaches 92% with 98.4% uptime.

- Santander reported a 40% surge in cross-border volumes via ODL in Q3.

- SBI Holdings leverages XRP for remittances to the Philippines and Vietnam corridors.

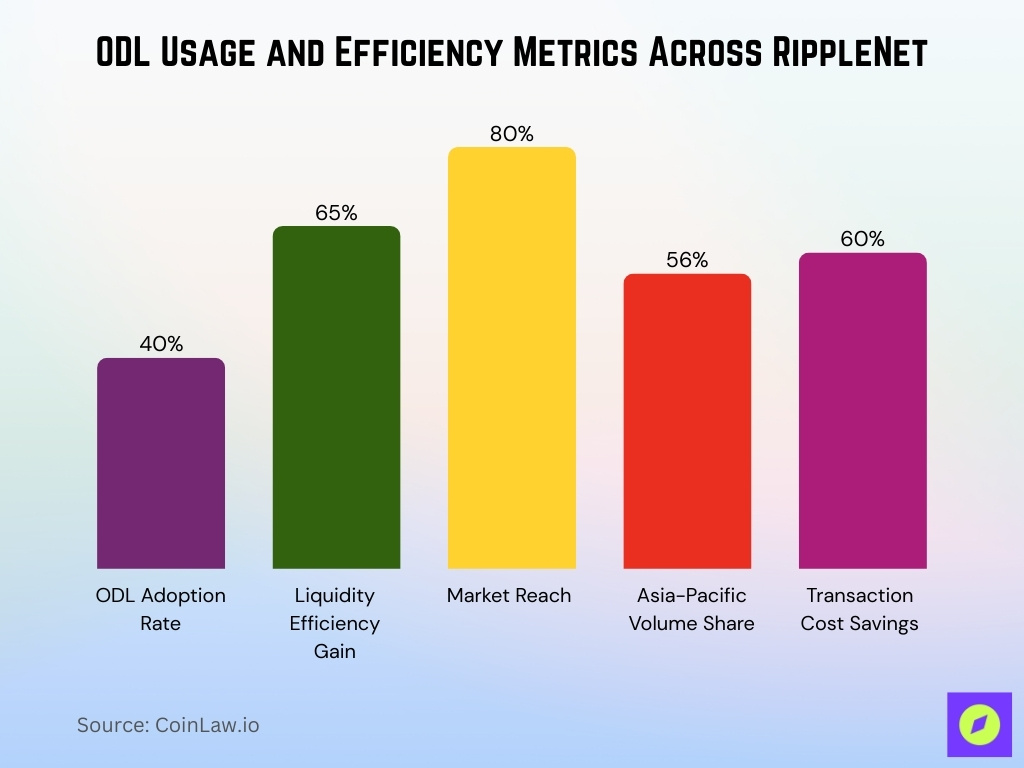

On‑Demand Liquidity (ODL) Usage Statistics

- ODL adoption rate: Around 40% of RippleNet partners actively employ ODL for liquidity.

- Liquidity efficiency: ODL reduces pre‑funding needs by ≈65% for institutional corridors.

- Market reach: ODL coverage now includes an estimated 80% of major remittance corridors globally.

- Regional concentration: About 56% of ODL volume originates from Asia‑Pacific corridors.

- Cost reductions: ODL users report 40–60% lower transaction costs versus traditional systems.

- RippleNet corridor expansion: ODL services now span 70+ corridor pairs worldwide.

- Settlement speeds: Most ODL‑enabled transactions settle in under 1 minute, even at scale.

Cross‑Border Payments Volume and Value

- RippleNet processes over $15 billion in cross‑border transaction volume monthly across its network of institutions.

- This volume reflects real‑world usage of blockchain‑enabled corridors for international transfers.

- Ripple’s cross‑border payments infrastructure significantly reduces settlement times versus legacy rails.

- Daily XRP transactions related to value transfers often top $1 billion in notional volume across exchanges, showing ongoing market engagement.

- The average daily trading volume of XRP was ~$1.73 billion in early 2025, a 22% increase year‑over‑year.

- Over 5.3 million active XRP wallets indicate broader participation in cross‑border transaction activity.

- Cross‑border remittances using XRP contribute to faster liquidity recycling, amplifying payment flows with lower token quantities.

- Regions such as Asia‑Pacific and Latin America see rising adoption for cross‑border corridors utilizing Ripple technology.

Transaction Speed and Cost Benchmarks

- XRP Ledger settles transactions in ≈3–5 seconds, far faster than many proof‑of‑work blockchains.

- Ledger consensus throughput can reach up to 1,500 transactions per second (TPS).

- Typical transaction fees on XRPL are a fraction of a cent, supporting high‑volume use cases.

- Faster settlement helps financial institutions reduce counterparty risk and capital lock‑up.

- Compared with traditional bank transfers, XRP‑powered rails can cut settlement time from days to seconds.

- Low cost per transaction positions XRP favorably for micropayments and global remittances.

- Speed and cost efficiencies help Ripple’s partners remain competitive in markets where customer expectations demand near‑real‑time transfers.

XRP Ledger Network Activity

- Average daily transactions reached 1.8 million in Q3, up 8.9% quarter-over-quarter.

- Weekly payments surged 430% to over 8 million from 2023 levels.

- Network hit a record 5.1 million transactions in a single day, driven by DEX and NFT utility.

- Added 447,200 new addresses in Q3, reaching a total of 6.9 million wallets.

- 60% of XRPL transactions consist of payments supporting enterprise use cases.

- Rippled version 2.5.0 introduced TokenEscrow, Batch, and PermissionedDEX amendments.

- DIA oracles now provide price feeds for 20,000+ assets, enabling DeFi protocols.

- Clio version 2.5.0 enhances the API with snapshot import and permission support.

- 190 active validators secure consensus with 35 on default UNL.

- XRPL processes transactions at ~1,500 TPS with 3-5 second finality.

Geographic Breakdown of XRP Adoption

- Partnerships span 55+ countries with financial institutions as of 2025, reflecting RippleNet’s expanded global reach across North America, Europe, Asia‑Pacific, Latin America, and Africa.

- Asia-Pacific region accounts for 56% of global ODL volume, led by Japan and the Philippines.

- Nearly 80% of Japanese banks integrate RippleNet for cross-border remittances.

- North America handles 26% of global crypto transaction activity with PNC Bank adoption.

- Europe features AMINA Bank as the first to deploy Ripple Payments for real-time transfers.

- Latin America sees pilots with Bradesco, Itaú Unibanco, and Banco Galicia in Brazil, Argentina.

- Africa expands via Chipper Cash and RedotPay partnerships for efficient remittances.

- Emerging markets like Nigeria process $92.1 billion in remittances using Ripple infrastructure.

Legal and Regulatory Milestones

- SEC and Ripple ended the lawsuit in August with $125 million civil penalty settlement.

- The court confirmed that XRP sold on exchanges is not a security for secondary market trades.

- Institutional sales were deemed securities violations with a permanent injunction imposed.

- Post-settlement XRP price surged above $3.30 with increased institutional trading volume.

- Ripple secured partnerships with 10 central banks for CBDC pilots on XRPL.

- Regulatory clarity triggered multiple XRP ETF filings by WisdomTree and Bitwise.

- Over 300 financial institutions accelerated adoption post-SEC resolution.

- Case closure reduced uncertainty, boosting institutional confidence by 65% in surveys.

Frequently Asked Questions (FAQs)

Ripple Labs controls about 42% of the total XRP supply through escrow reserves in 2025.

RippleNet has expanded to over 300 financial institutions globally using its cross‑border payment network.

Approximately 40% of RippleNet partners actively use XRP for ODL transactions.

Major exchanges like Binance, Bithumb, and Uphold held over 1.5 billion XRP each in custody.

Conclusion

The statistical snapshot of Ripple Labs and XRP reveals robust activity across payments volume, ledger performance, global adoption, and regulatory clarity. RippleNet’s cross‑border corridors demonstrate real‑world usage with volumes that rival legacy systems, while XRPL’s speed and low cost underpin its growing appeal. Geographic adoption patterns show momentum across diverse markets, from Asia‑Pacific remittances to institutional corridors in North America and Europe. Crucially, closure of major legal disputes has unlocked clearer regulatory pathways that now inform strategic growth plans.