Rabby Wallet has emerged as one of the fastest‑growing DeFi wallets, thanks to its seamless multi‑chain support and emphasis on security. Real‑world users in decentralized finance (e.g., liquidity providers, yield farmers) increasingly prefer Rabby for its risk alerts and gas-top-up features. Even institutional DeFi platforms are beginning to integrate Rabby for streamlined multi‑chain operations. Let’s dive into the current statistics and trends.

Editor’s Choice

- Over 4.2 million installs recorded globally this year.

- Quarterly fees for Q3 2025 reached $2.32 million.

- Supports 122 EVM chains as of mid‑2025.

- Weekly transaction volume recently surged to $320 million equivalent.

- Growth in transaction volume of 15% week over week in recent weeks.

- Over 240+ chain coverage quoted in some recent updates/promotional materials.

- A community poll is underway around a possible $RABBY token launch in late 2025.

Recent Developments

- Rabby now claims support for 240+ blockchains in its latest promotional update.

- The wallet introduced batch revoke to let users more efficiently manage token approvals.

- A mobile app version is under active improvement with ongoing security audits.

- Users now benefit from automatic network detection, avoiding manual chain switching.

- Rabby’s transaction parser and risk scanner have been integrated to flag vulnerabilities before signing.

- A community poll is underway regarding the native $RABBY token, including market cap estimates.

- Some reports also mention Solana and Cosmos integration coming in Q4 2025.

- Rabby added XRPL EVM integration and support for MEV guard features on BNB Chain.

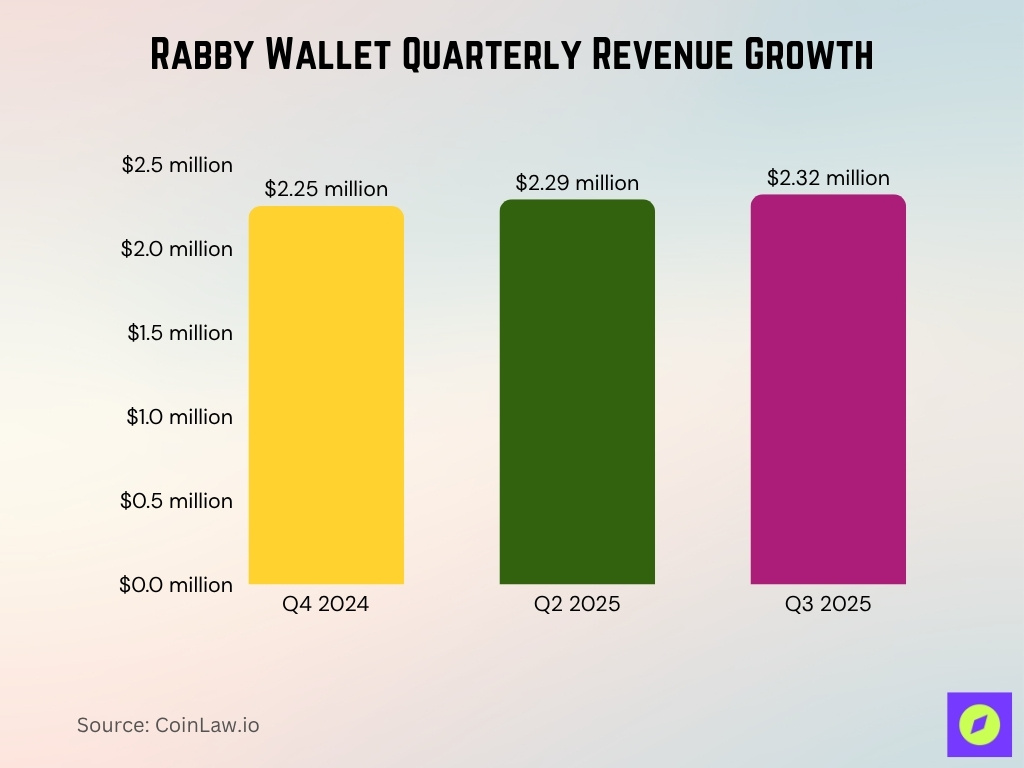

Key Metrics and Financial Statistics

- Q3 2025 fees: $2.32 million.

- In Q4 2024, revenues (fees) were approximately $2.25 million.

- Some sources also show Q3 2025 with $1.32 million in fees (discrepancy among data sources).

- Rabby’s DeFiLlama page lists its fee trajectory by quarter.

- Over the past weeks, transaction volume jumped to $320 million equivalent.

- Week‑to‑week growth in transaction activity is about 15%.

- User installs have crossed 4.2 million globally (2025 figure).

- In comparison, MetaMask holds ~143 million users globally in 2025.

- Trust Wallet reports ~115 million users in 2025.

- Rabby’s support for 122 chains is positioned aggressively in comparison to some peers.

Annualized Fees and Revenue

- Projecting Q3’s $2.32 million across four quarters suggests ~$9.28 million annualized.

- Based on Q4 2024’s $2.25 million quarter, full-year 2024 revenue likely hovered near $9 million.

- If the Q2 2025 number at $2.29 million holds, full‑year 2025 could exceed $9 million again.

- Fees currently represent revenue (no separate revenue sources noted).

- Comparison: Many DeFi wallets derive revenue via spreads, swap margins, or gas markups. Rabby’s clarity on fee capture is a strength.

- A potential token launch could introduce new revenue streams via staking or governance fees.

- Rabby’s revenue growth rate quarter‑over‑quarter has shown small gains (e.g., Q2 → Q3 2025).

- However, alternative data sources show inconsistencies in revenue reporting.

- Given the current scale, Rabby remains much smaller than wallets like MetaMask, but growth is accelerating.

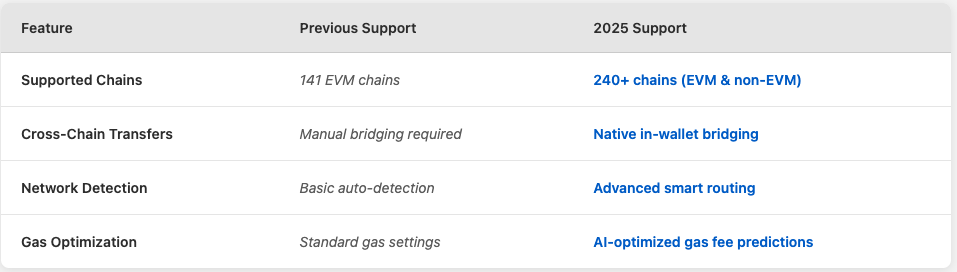

Supported Blockchains and Chain Coverage

- Rabby claims support for 122 EVM‑compatible chains.

- Some promotional material suggests 240+ chain coverage (perhaps counting future or non‑EVM chains).

- Early descriptions mention support for Ethereum, BNB Chain, Polygon, Avalanche, Fantom, and others.

- Rabby’s auto network detection leverages a chain database to choose the correct chain per dApp.

- Compared to MetaMask, which requires manual switching, Rabby’s chain support is a competitive differentiator.

- Some sources earlier quoted support for 88 chains, though that figure may now be outdated.

- Safeheron ranks Rabby among the top MPC/open wallets for chain coverage and auto switching.

- Continuous updates are adding chains over time, e.g., XRPL EVM announcements.

Multi‑Chain Experience and Auto Network Detection

- Rabby supports 122 EVM chains as of the latest comparisons vs. MetaMask.

- Some marketing updates suggest “240+ chain coverage” (perhaps including non‑EVM or planned chains).

- It supports integration with over 1,000 dApps via WalletConnect and other connectors.

- The auto network detection means that when you visit a dApp, Rabby picks the correct chain rather than making you switch manually.

- In comparison, Rabby is often praised for reducing “chain switching friction” relative to MetaMask.

- Some users report that Rabby “emulates” MetaMask in compatibility mode when a dApp doesn’t recognize it, enabling fallback.

- Chain support is dynamically updated; XRPL EVM is among the chain integrations being discussed.

- Rabby’s internal chain database is designed to support protocol upgrades and future chains without breaking UX.

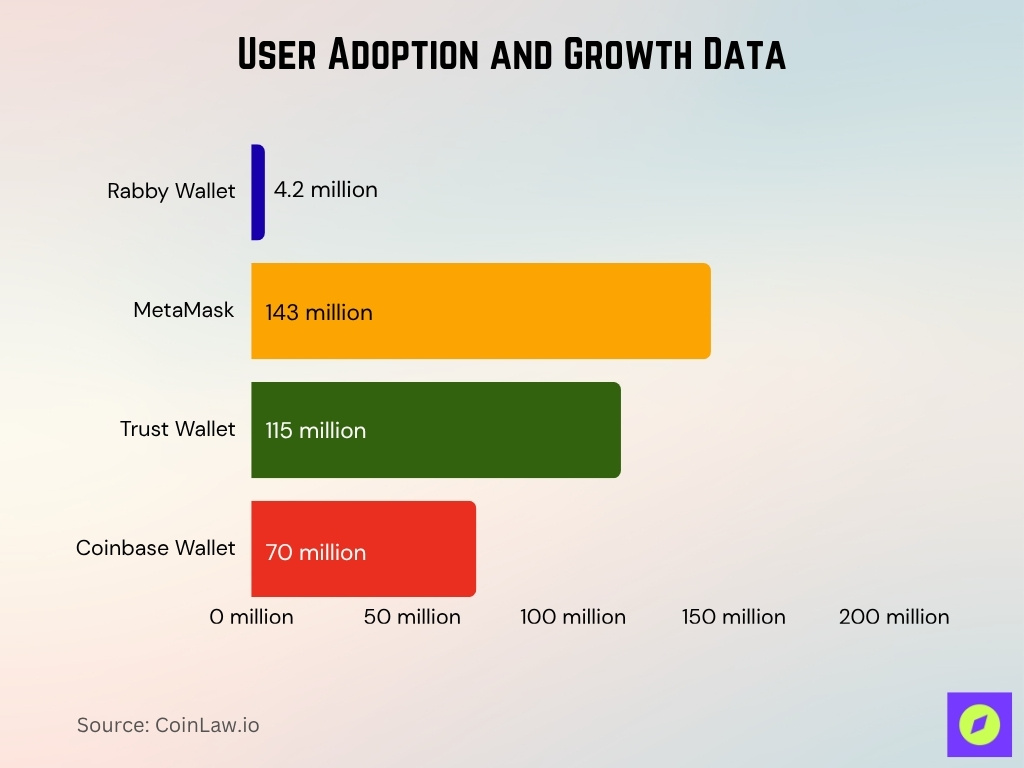

User Adoption and Growth Data

- In 2025, Rabby achieved 4.2 million installs globally.

- MetaMask remains the top wallet with ~143 million users in 2025.

- Trust Wallet reports ~115 million users in 2025.

- Coinbase Wallet, ~70 million users.

- Rabby’s adoption is still a fraction of top incumbents, but its growth rate is notable.

- Weekly transaction counts across EOA wallets surged to ~50 million weekly transfers as of mid‑2025 (general wallet trend).

- Among DeFi wallets, Rabby is seen as gaining traction in active user segments (liquidity providers, multi‑chain users).

- User feedback on Reddit notes that the UX feels superior compared to alternatives.

- Rabby’s presence on extension stores (Chrome) shows modest ratings (~3.7 out of 5).

Security Features and Audit Results

- Independent firms conduct regular security audits on Rabby to catch vulnerabilities.

- Least Authority completed a full audit of the browser extension on October 18, 2024.

- Auditors finalized a second mobile audit on September 2, 2025, for Rabby’s mobile applications.

- PeckShield audited the RabbyRouter smart contract, which powers swap functionality, and flagged a redundant ether transfer along with admin key risks.

- PeckShield identified the admin key privileges issue as a moderate concern.

- SlowMist audited various portions of Rabby’s smart contracts in 2023.

- In the extension audit, developers corrected a previously discovered infinite recursion risk (stack overflow in address resolution) by setting a retry limit of 20.

- CertiK rated Rabby’s security at 79.75 / BBB in its Skynet wallet listing.

Risk Alerts and Scam Prevention Results

- Rabby alerts users when a transaction poses suspicious logic or may lead to asset loss (via its risk scanner).

- It warns of risky approvals, encouraging users to revoke potentially dangerous approvals.

- The batch‑revoke feature lets a user revoke a set of contract approvals in one go, simplifying cleanup.

- In the 2025 mobile audit, synchronization between extension & mobile wallets was verified, ensuring risk features stay consistent across platforms.

- Rabby offers a “watcher mode”, letting users monitor an address without importing private keys, reducing risk exposure.

- For that exploit, ~114 ETH and 179 BNB were reportedly drained.

- Many users responded to the exploit by revoking all approvals across chains.

Rabby Cross-Chain Capabilities

- Supported Chains: Expanded from 141 EVM chains to 240+ chains, now covering both EVM & non-EVM networks.

- Cross-Chain Transfers: Upgraded from manual bridging to native in-wallet bridging for seamless movement of assets.

- Network Detection: Improved from basic auto-detection to advanced smart routing, reducing failed or misrouted transactions.

- Gas Optimization: Enhanced from standard gas settings to AI-optimized gas fee predictions, lowering costs and improving efficiency.

In‑Wallet Swap Volume and Performance

- Rabby’s annualized fees/revenue are around $14.68 million, implying significant swap/bridge activity.

- In Q3 2025, Rabby is reported to have generated ~$2.32 million in swap/fee revenue.

- Fees over 7 days at ~$357,603, and daily fees ~$9,243.

- The Rabby wallet bridge interface reports $322 million+ in volume and 127,000+ users, though a blockchain-based analytics dashboard would improve verification.

- The large bridge volume suggests that bridging + swapping is a key use segment.

- In some Reddit posts, users claim Rabby’s swap queries outperform MetaMask in terms of pricing quotes.

- Rabby’s smart routing across multiple liquidity sources or DEX aggregators helps optimize swap outcomes.

Points Reward System and User Activity

- Rabby has rolled out a Points System to incentivize user activity, ostensibly to seed future tokenomics.

- Rabby initiated a retrodrop farming campaign, tracking users who completed tasks in prior seasons.

- There is speculation that points earned will map to future $RABBY token allocations.

- A survey was launched to assess demand for $RABBY, using point system engagement metrics as input.

- Some announcements claim support for 141 EVM chains in 2025, tied to the Points system expansion.

- The Points mechanism helps Rabby gauge user activity and engagement depth before committing to formal tokenomics.

- As of now, no public breakdown exists of how many users have earned points or the volume of point-related transactions.

XRP Price Trends and Golden Cross Signal

- Current Price: XRP closed at $3.0483, showing a –2.34% decline.

- Daily High: XRP reached $3.1279 during the session.

- Daily Low: XRP dropped to $3.0117 at the intraday bottom.

- Golden Cross Event: A bullish crossover appeared around September 8.

- SMA 5: Short-term moving average stands at 3.0600.

- SMA 8: Medium moving average recorded at 3.0120.

- SMA 13: Longer-term moving average sits at 2.9402.

- Momentum (BBP 13): The Indicator shows a positive value of 0.1731.

- Rebound Trend: XRP rebounded from below $2.85 and climbed above $3.10 before pulling back.

Mobile App vs. Browser Extension Statistics

- Rabby is available in browser extension, desktop, and Android forms, with an iOS version under development.

- Rabby supports 240+ chains across platforms.

- The mobile audit, September 2025, ensured feature parity for security functions across extension and mobile.

- Some users report minor UI delays or sync lag between extension and mobile views, especially on less popular chains.

- As mobile adoption rises in the crypto space generally, Rabby’s mobile uptake will likely increase in 2026 and beyond.

- Planned roadmap features include improved mobile UX and cross‑platform consistency.

Competitor and Market Position Comparison

- MetaMask remains dominant, with ~30 million monthly users.

- Rabby supports 122+ chains vs. MetaMask’s more limited chain reach, requiring a manual switch.

- Trust Wallet had surpassed 200 million downloads by 2025.

- Rabby’s installs have crossed 4.2 million in 2025.

- Rabby’s annualized fees are at $14.68 million, putting it in active swap/bridge niche competition.

- Some competitor wallets offer fiat on‑ramps or staking, but Rabby currently does not.

Future Roadmap and Token Launch Statistics

- Rabby has publicly announced plans to launch a native $RABBY token and is surveying its community to estimate market cap demand.

- Rabby claims support for 141 EVM chains tied to the token incentives roadmap.

- Roadmap items include Solana / Cosmos integration in Q4 2025.

- Other proposed features, zk‑SNARK privacy layers in 2026 and advanced mobile UX in 2026.

- Rabby’s market survey indicates the token may help accelerate multi-chain integrations in DeFi.

- Rabby initiated a token poll to engage its community.

- Rabby has raised $25 million in funding in Q1 2024.

- No firm TGE, token generation event, date yet exists.

Frequently Asked Questions (FAQs)

Rabby Wallet has surpassed 4.2 million installs in 2025.

In Q3 2025, Rabby Wallet collected $2.32 million in fees.

Rabby’s annualized fee revenue is estimated at $23.95 million.

Rabby’s transaction volume rose 15% week over week, reaching $320 million.

Rabby supports 122 EVM-compatible chains.

Conclusion

Rabby Wallet has carved out a distinctive niche in the multi‑chain DeFi wallet landscape. Its strengths lie in security, auto chain detection, and its budding Points → token strategy. Relative to giants like MetaMask and Trust Wallet, Rabby is still small in scale, but its $14.68 million annualized fee revenue signals real traction.

Still, the success of its future depends heavily on the rollout of institutional features, developer adoption, and the realization of its $RABBY token roadmap. The coming year will likely be a pivotal period. If the token launch aligns well with utility and governance, it has the potential to shift Rabby from a high‑potential DeFi wallet into a core infrastructure layer.