Fireblocks has become one of the leading digital asset infrastructure platforms powering institutional crypto operations worldwide. It remains central to how banks, fintechs, and crypto-native firms move, secure, and manage assets at scale. Across payments, custody, and blockchain connectivity, its reach influences global digital finance, from stablecoin settlements to qualified custody for regulated institutions.

Real-world examples include banks integrating Fireblocks for digital asset services and payment providers deploying stablecoins on their network for cross‑border transactions. Explore below to understand the latest Fireblocks statistics that reveal its growing footprint and industry impact.

Editor’s Choice

- Over $10 trillion in assets are secured using the Fireblocks infrastructure across institutional clients.

- Fireblocks’ network supports more than 300 million wallets across global users.

- The Fireblocks Network for Payments covers 100+ countries and 60+ currencies.

- Fireblocks Trust has onboarded major institutional custody clients, including Bakkt, Galaxy, and FalconX.

- Stablecoin transaction volume has surged year‑over‑year, reflecting broader adoption trends.

Recent Developments

- Fireblocks launched the Network for Payments, uniting on/off‑ramps, liquidity providers, banks, and PSPs across 100+ countries.

- The Payments Network processes over $200 billion in stablecoin flows monthly.

- The Network embeds compliance and AML/KYT checks into transaction rails for regulated operations.

- SPARK 2025 emphasized the integration of tokenized real‑world assets (RWAs) onto Fireblocks’ stack.

- Fireblocks continues to expand its provider list, adding dozens of new members each quarter.

- Stablecoin ecosystem insights show 49% of payment providers actively use stablecoins, with another 41% planning deployment.

- Recent API expansions improve developer productivity, reducing complexity for blockchain app creation.

- Latest acquisition and integrations aim to unify institutional infrastructure with consumer‑grade experiences.

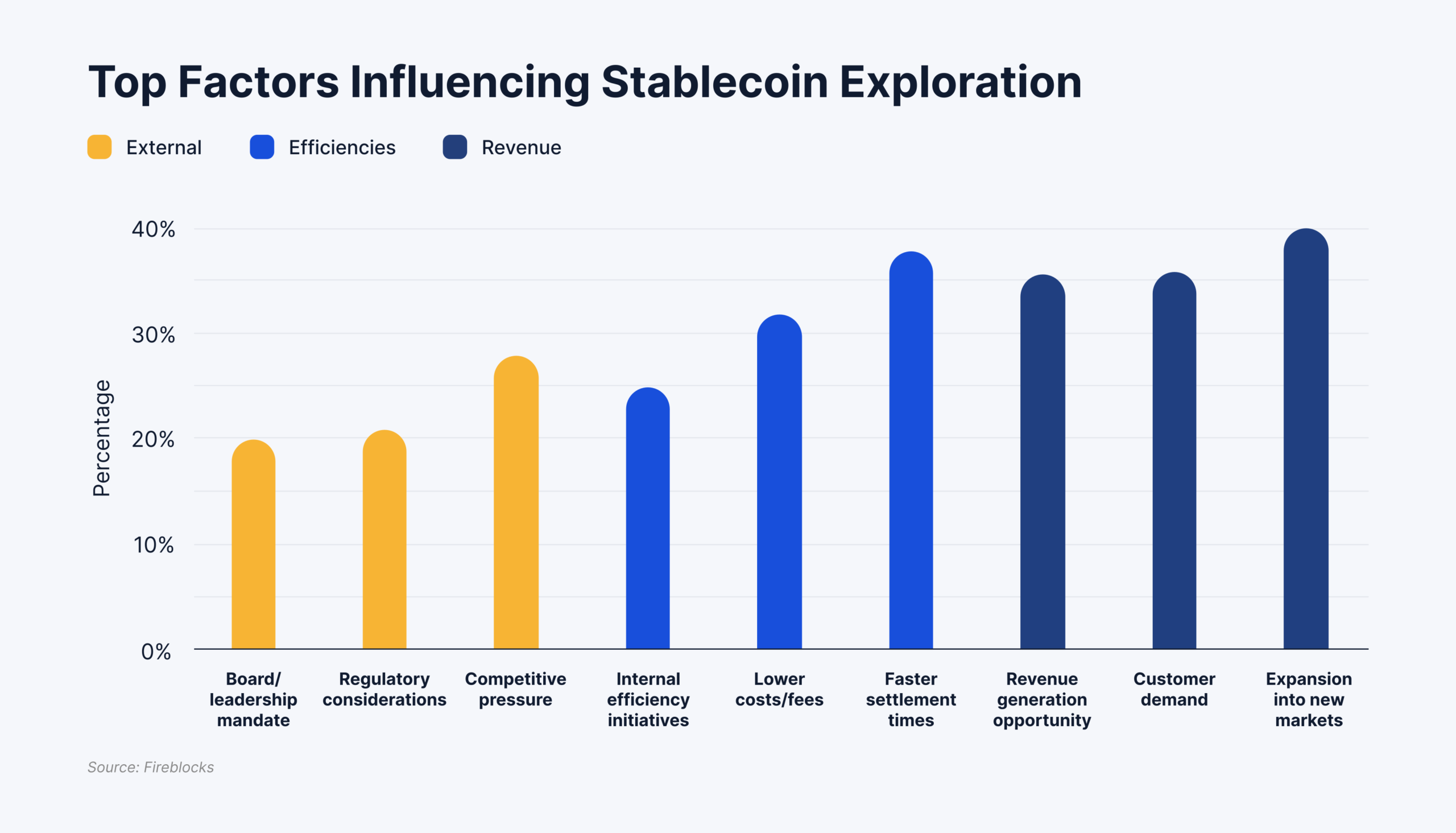

Top Factors Influencing Stablecoin Exploration

- Competitive pressure (27%) is the leading external trigger pushing institutions to evaluate stablecoin adoption.

- Regulatory considerations (20%) and board or leadership mandates (19%) show governance and compliance remain key decision drivers.

- Faster settlement times (36%) rank as the strongest efficiency benefit motivating stablecoin exploration.

- Lower costs and fees (31%) highlight the appeal of stablecoins for reducing transaction and operational expenses.

- Internal efficiency initiatives (24%) reflect efforts to modernize legacy payment and treasury systems.

- Expansion into new markets (39%) is the top revenue-related factor, signaling growth-driven adoption strategies.

- Revenue generation opportunities (35%) demonstrate increasing confidence in monetizing stablecoin-based services.

- Customer demand (35%) confirms rising market expectations for faster and more flexible digital payment options.

Fireblocks Company Background and History

- Fireblocks was founded in 2018 to provide secure MPC‑based custody and transfer infrastructure for digital assets.

- It pioneered MPC crypto wallets tailored for institutional security needs.

- The company’s valuation reached $8 billion after a $550 million Series E funding round.

- Fireblocks’ tech unifies custody, wallets, and transfer tools for enterprises and financial institutions.

- Over the years, it shifted from pure custody to broader infrastructure, including payments and network connectivity.

- Fireblocks now serves both crypto‑native and traditional finance clients, reflecting cross‑sector adoption.

- Ongoing development has broadened its product suite to include treasury and compliance services.

- Executive focus remains on security, compliance, and scalable digital finance solutions.

Customer and User Base Statistics

- Fireblocks claims 300+ banks and payments providers on its network.

- More than 300 million wallets are managed or secured through Fireblocks’ infrastructure.

- Over 2,200 organizations trust Fireblocks’ technology for custody and asset operations.

- Notable global clients include Worldpay, BNY Mellon, Galaxy, and Revolut.

- Fireblocks Trust counts major institutional custody clients like Bakkt, FalconX, Galaxy, and Castle Island.

- Around 300 payment companies and banks are actively building stablecoin capabilities on the Fireblocks Network.

- The platform supports users across multiple sectors, from fintech to asset management.

- Institutional adoption reflects both regulated entities and blockchain innovators.

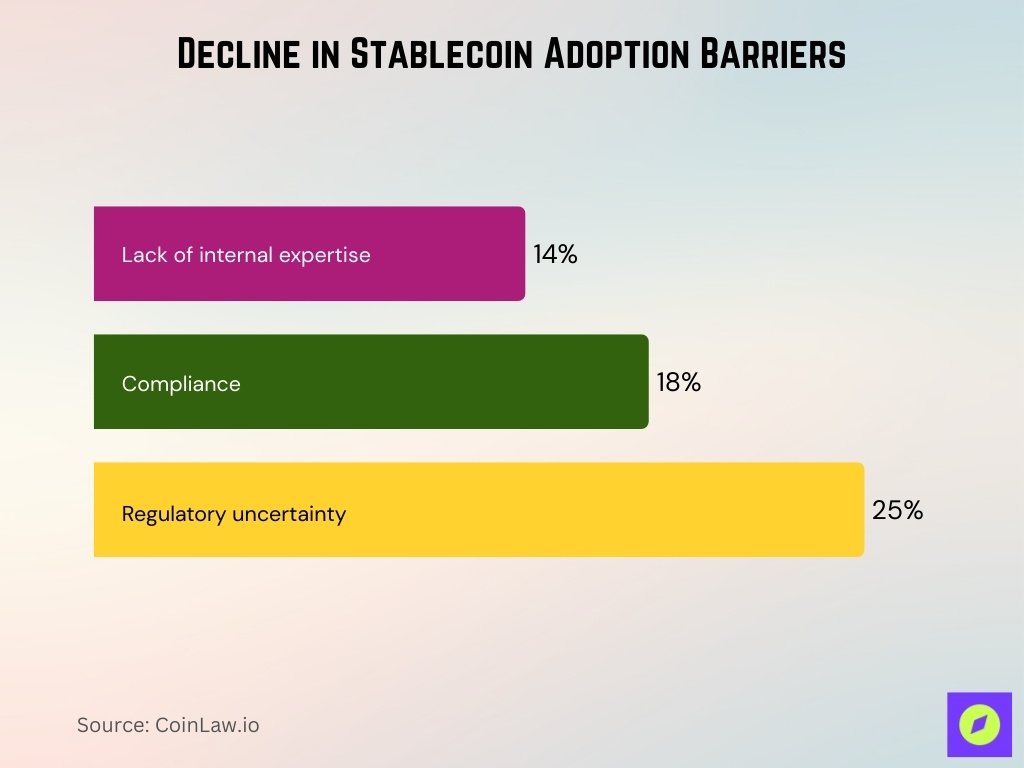

Decline in Stablecoin Adoption Barriers

- Regulatory uncertainty (25%) remains the most cited barrier, though it has fallen sharply compared to earlier years.

- Compliance concerns (18%) show significant improvement as regulatory frameworks and tooling mature.

- Lack of internal expertise (14%) is now a minor obstacle, signaling stronger institutional readiness.

Assets Under Custody and Transfer Volume

- Fireblocks’ infrastructure secures more than $10 trillion in digital assets.

- In 2024, Fireblocks processed a reported 15% of total global stablecoin volume.

- Stablecoins made up nearly 50% of all transaction volume on the platform in the same period.

- Monthly stablecoin transactions surged alongside industry growth, signaling strong throughput.

- Large transfers continue to occur on Fireblocks custody, for example, 22,300 SOL (~$3M) moved into custody in late 2025.

- Institutional transaction volume is underpinned by cross‑border payments and treasury operations.

- Fireblocks facilitates settlement and transfer workflows across hundreds of token types.

- Asset handling spans thousands of institutional counterparties.

Fireblocks Wallets and Custody Infrastructure Statistics

- Fireblocks Network supports 2,400+ institutions across 100+ countries.

- Platform secures more than $10 trillion in digital asset transactions.

- Processes 15% of global stablecoin volume with 35 million transactions monthly.

- Handles $40 billion in stablecoin transactions per quarter.

- Supports 1 billion+ wallet addresses in its ecosystem.

- Powers over 300 banks and payments providers worldwide.

- Stablecoins account for nearly 50% of total platform transaction volume.

- Network includes 40+ providers for stablecoin payments across 60+ currencies.

- Serves 2,000+ organizations, including major custodians and exchanges.

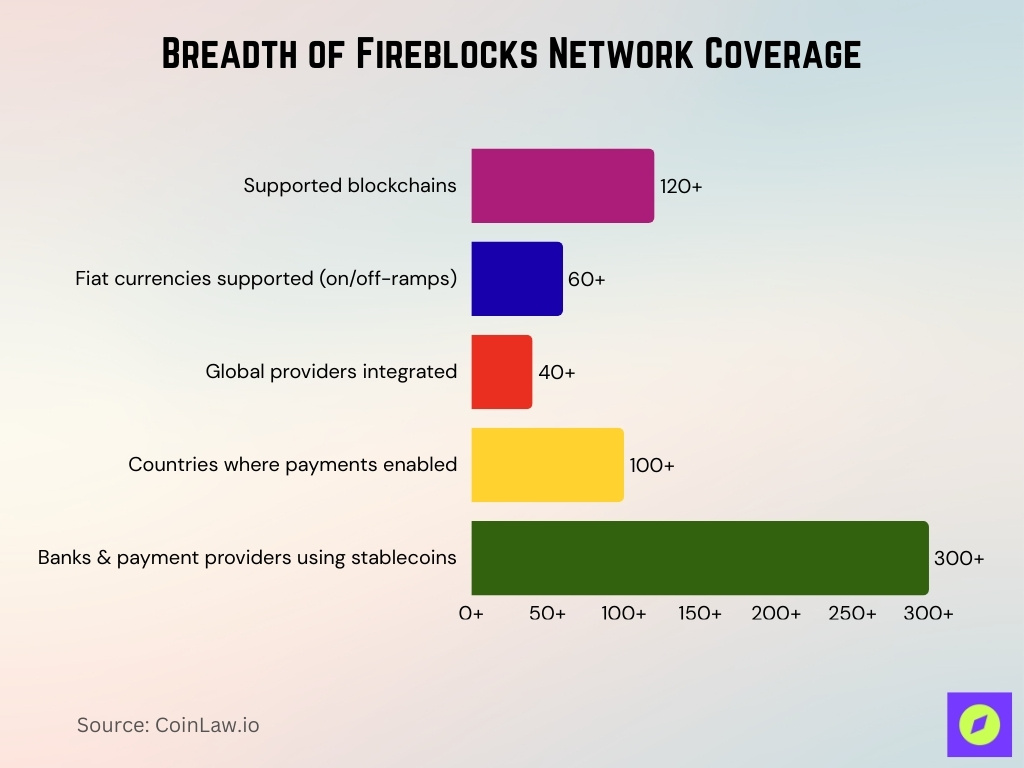

Network Coverage, Integrations, and Supported Assets

- Fireblocks Network operates across 120+ blockchains for asset interoperability.

- Supports on/off-ramps in 60+ fiat currencies and top stablecoins like USDC, USDT, PYUSD.

- Integrates with 40+ global providers, including liquidity and compliance partners.

- Features integrations with Chainalysis, Lynq for real-time AML/KYT monitoring.

- Enables payments across 100+ countries via unified APIs.

- Powers stablecoin operations for 300+ banks and payments providers.

- Supports broad cryptocurrencies, including BTC, ETH, XRP, alongside stablecoins.

- Onboards dozens of new providers quarterly for expanded coverage.

Performance, Scale, and Reliability Statistics

- Fireblocks processes 15% of global stablecoin volume with 35 million transactions monthly.

- Platform secures over $10 trillion in digital asset transfers without major incidents.

- Handles record $212 billion in stablecoin transactions in July alone.

- Processes combined $200 billion monthly stablecoin payments across network participants.

- Stablecoin transactions represent 55% of total platform volume at $1.5 trillion annually.

- Reaches $40 billion in stablecoin transactions per quarter for 300+ banks.

- Maintains high uptime supporting 2,000+ institutional clients without interruptions.

- Powers 3 billion monthly transactions on high-throughput chains like Solana.

- Delivers real-time monitoring for high-volume workflows across custody and payments.

Security, Compliance, and Risk Management Metrics

- Achieves NIST CSF 2.0 maturity score of 4.4, surpassing industry benchmark of 3.5.

- 86% of surveyed firms report infrastructure readiness for stablecoin operations.

- Holds SOC 2 Type 2, ISO 27001, 27017, 27018, and CCSS Level 3 certifications.

- Integrates Chainalysis and Elliptic for automated AML/KYT screening and risk scoring.

- Supports real-time transaction monitoring across 100+ blockchains and 300 million wallets.

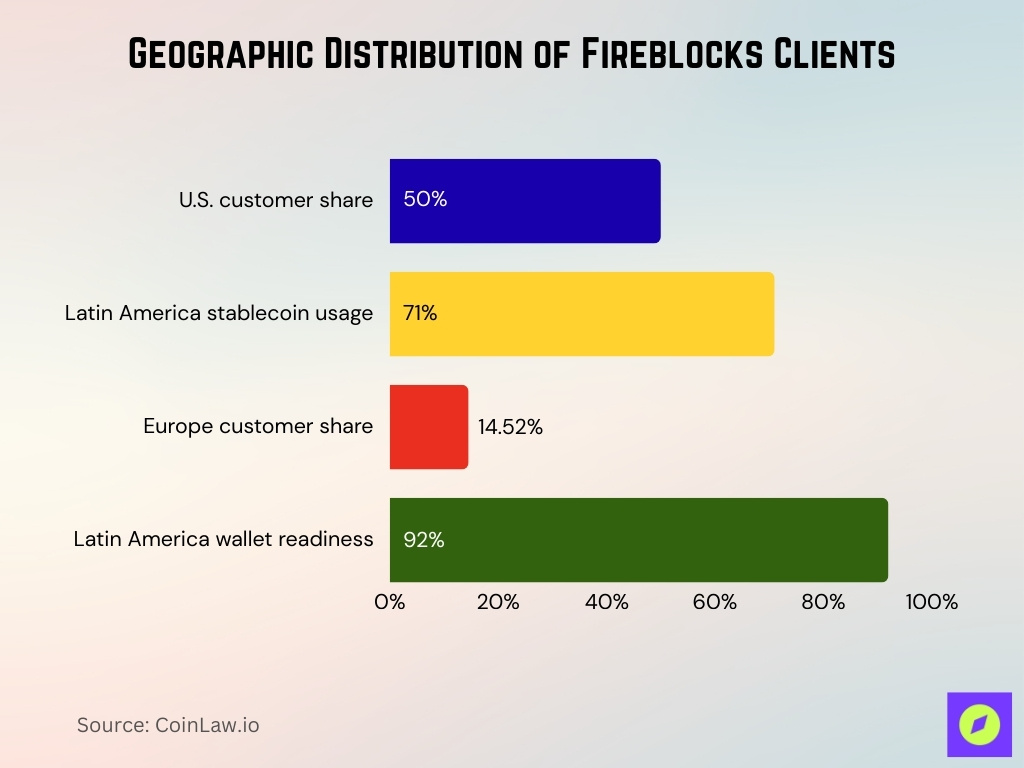

Geographic Distribution of Fireblocks Clients

- 50% of customers are located in the United States, dominating North American adoption.

- Latin America leads with 71% using stablecoins for cross-border payments.

- Europe features a strong presence with a 14.52% customer base, including ABN AMRO.

- 92% Latin American firms report wallet infrastructure readiness.

- Operates across 100+ countries, serving 2,400+ institutions globally.

- 37 companies in the United States, 28 in the United Kingdom, across 35 countries.

- Asia-Pacific drives market expansion via Singapore office and 43 employees.

- Africa corridors are active with Yellow Card and remittance flows from Europe/US.

DeFi, Web3, and dApp Connectivity Usage Statistics

- Enables DeFi access across 100+ blockchains, including Solana for institutional strategies.

- Powers staking integrations with Figment and Lido for regulated liquid staking.

- Supports 2,000+ entities accessing the BOB Bitcoin DeFi ecosystem with $250 million TVL.

- Facilitates DeFi operations on Solana with multi-step authorization workflows.

- Provides dApp Protection and Transaction Simulation for secure smart contract interactions.

- Automates NFT minting, airdrops, and transfers to millions of Web3 wallets via API.

- Secures DeFi treasury operations representing a significant share of $10 trillion transfers.

- Integrates WalletConnect for seamless dApp connectivity and yield generation.

- Expands Web3 tooling with SDKs supporting JavaScript, Python, and ethers.js frameworks.

Treasury Management and Payments Volume Statistics

- Secures over $10 trillion in digital asset transfers for global treasury operations.

- Processes $212 billion record stablecoin volume in a single month for payments.

- Network participants handle combined $200 billion monthly stablecoin payments.

- Stablecoin transactions reach $40 billion per quarter across 300+ banks.

- Powers treasury workflows for 2,400+ institutions in 100+ countries.

- Supports 60+ fiat currencies for multi-jurisdictional treasury settlements.

- Enables 25% of customer invoices to be settled via stablecoins internally.

- Facilitates real-time treasury monitoring across 120+ blockchains.

- Connects to liquidity pools via 40+ providers for treasury funding.

Institutional, Banking, and Enterprise Adoption Metrics

- Serves 2,400+ institutions, including major banks and fintechs globally.

- Trusted by 2,500+ financial institutions, banks, and payment providers.

- 15 of the 25 largest global banks announced stablecoin or tokenization initiatives.

- Powers 300+ banks processing 15% of global stablecoin volume.

- 80+ paying clients hold banking or trust licenses worldwide.

- Supports 1,500+ companies, including BNY, Worldpay, Visa, and BTG.

- 2,000+ organizations access staking via Galaxy integration.

- Thousands of firms, including Revolut, Galaxy, rely on platform security.

- Client base spans banking, payments, trading, and Web3 sectors.

Key Industry Verticals Using Fireblocks

- Serves 2,400+ enterprises across banking, payments, fintech, trading, and Web3 sectors.

- Powers 300+ banks, including ABN AMRO, for tokenized securities issuance.

- Supports 40+ payment service providers like Bridge for stablecoin settlements.

- Enables 1,500+ fintechs, including Oobit for crypto spending platforms.

- Facilitates 200+ exchanges like Bitso, Luno, and Gemini for trading liquidity.

- Trusted by 80+ asset managers for institutional custody and staking.

- Web3 firms, including Figment, Yellow Card, use it for secure operations.

- 15 of the top 25 global banks leverage digital asset infrastructure.

- 2,000+ organizations span diverse verticals with a unified platform.

Wallets-as-a-Service (WaaS) Adoption Metrics

- Enables creation and management of millions of wallets with MPC technology at scale.

- Supports 45+ blockchains natively for multi-chain wallet deployments.

- Powers Flipkart’s Web3 program serving 450M+ users across 80+ categories.

- Delivers 100-500ms signing latency for consumer-grade MPC performance.

- Processes millions of operations daily with a 99.9% uptime guarantee.

- Integrates with Moomoo Singapore, scaling digital assets by the end of the year.

- Supports iOS, Android, and web with customizable key backup and recovery.

- Enables 40+ blockchain node support, reducing development costs.

Developer and API Usage Statistics

- New Assets API delivers 4x faster data retrieval with pagination and filtering support.

- Unified Blockchain API provides real-time access across 120+ networks.

- Staking API automates flows supporting 30+ additional blockchains.

- Developers process 35 million transactions monthly via platform APIs.

- SDKs enable 100% first-attempt success during 200% traffic surges.

- APIs handle 100,000 TPS peaks with 23ms median broadcast time.

- Sandbox environments support testing for 2,400+ institutional clients.

- New APIs standardize asset metadata across fragmented blockchain sources.

- Developer tools reduce integration complexity by 50% for cross-chain apps.

M&A, Partnerships, and Ecosystem Growth Metrics

- Acquired Dynamic powering 50M+ on-chain accounts used by Kraken, Magic Eden.

- Dynamic’s 30-person team joins Fireblocks, enhancing developer wallet capabilities.

- Secures $4 trillion annual transfers post-Dynamic acquisition for institutional scale.

- SPARK 2025 announces 30+ new blockchain integrations via partnerships.

- Partners with Figment, Lido for regulated staking across institutional networks.

- Collaborates with Circle, expanding stablecoin access for 2,400+ institutions.

- Integrates Thales HSMs, FIS, and Temenos for enterprise compliance and finance.

- Station70, CoinCover partnerships extend security to consumer backup solutions.

- Ecosystem connects 40+ liquidity providers and compliance tools globally.

Frequently Asked Questions (FAQs)

The Fireblocks Network can process over 35 million monthly transactions.

49% of institutions were already using stablecoins for payments, according to the 2025 stablecoin industry survey.

The Fireblocks Network for Payments processes more than $200 billion per month in stablecoin payments.

More than 80 banks around the world are working with Fireblocks on custody infrastructure.

Conclusion

Fireblocks stands as a central pillar of digital asset infrastructure. Its global adoption spans diverse industries, geographies, and technical use cases, from banks and fintechs to Web3 developers and enterprise platforms. With Wallets‑as‑a‑Service, API ecosystems, strong partnerships, and recent acquisitions, Fireblocks not only secures trillions in assets but also fuels innovation in stablecoin payments, programmable finance, and cross‑border settlement. As adoption grows and markets evolve, Fireblocks’ data‑driven platform will continue shaping how digital finance operates in both institutional and consumer domains.