BitGo stands at the forefront of the digital asset infrastructure world, safeguarding cryptocurrency holdings for institutions, funds, and individual investors. The company is not only navigating explosive growth but also preparing for its first U.S. public offering, underscoring its growing influence in traditional finance. BitGo’s custody services, staking support, and API infrastructure power key functions across crypto markets and financial institutions alike. From institutional treasury asset protection to exchange integration and secure settlement, its impact is broad. Scroll through this detailed set of statistics to see why BitGo matters now more than ever.

Editor’s Choice

- BitGo’s U.S. IPO launched in January 2026, targeting up to $201 million raised and a near $1.96–$2 billion valuation.

- Assets under custody (AUC) surpassed $100 billion by late 2025.

- Over 1,550 digital assets will be supported on the platform by late 2025.

- More than 4,600 institutional clients globally as of mid‑2025.

- Platform end‑users exceeded 1 million across ~100 countries in 2025.

- National bank charter approval received from U.S. regulators in 2025.

Recent Developments

- BitGo filed confidentially for a U.S. IPO in mid‑2025 and publicly launched it in January 2026.

- The IPO offers 11.8 million Class A shares priced at $15–$17 per share.

- Institutional underwriters include Goldman Sachs and Citigroup.

- BitGo received federal bank charter approval from the U.S. Office of the Comptroller of the Currency.

- The company reported surging revenue growth, with early 2025 up nearly 4× compared with 2024.

- Headquarters officially changed from California to Sioux Falls, South Dakota, ahead of IPO.

- BitGo joins a broader crypto IPO wave that includes Circle, Bullish, and others.

BitGo User and Client Statistics

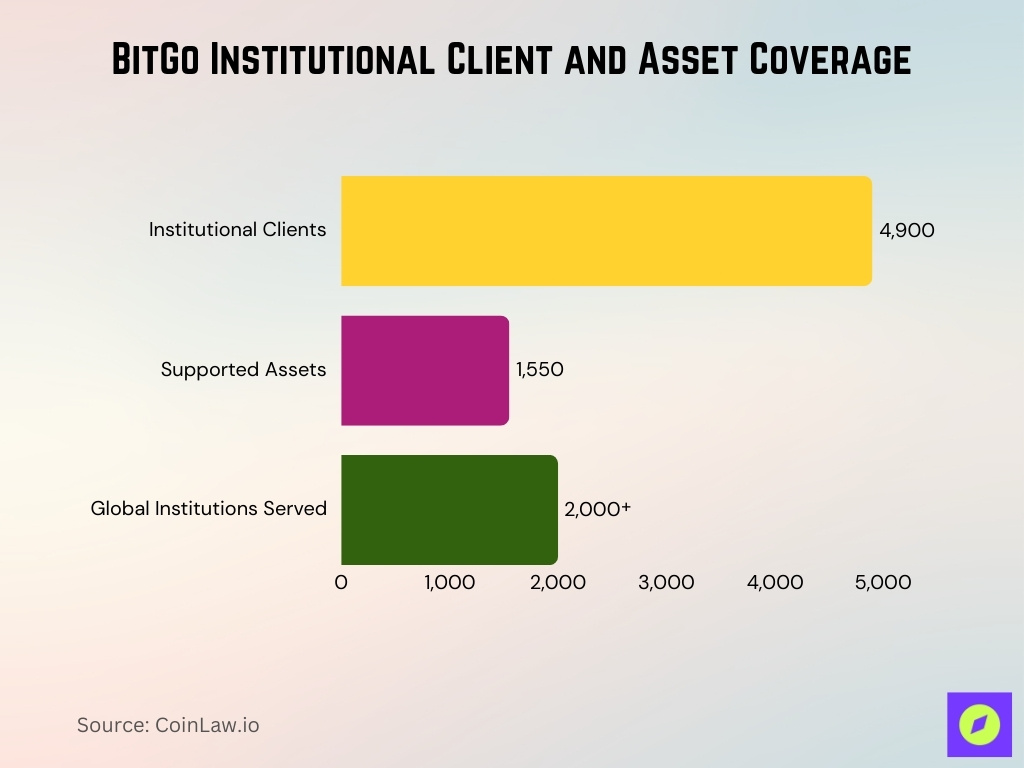

- Over 4,900 institutional clients at the 2026 IPO filing.

- Serves thousands of institutions, including top exchanges and platforms.

- Supports over 1,550 digital assets for millions of retail investors.

- Client base grew to 4,900 institutions by January 2026.

- Infrastructure serves 2,000+ institutional clients worldwide.

- Over 100 billion in assets for institutional and retail users.

What Is BitGo?

- Founded in 2013 as a digital asset custody provider.

- Provides secure multi-signature wallets for cryptocurrencies.

- Targets $1.96 billion valuation in first crypto IPO of 2026.

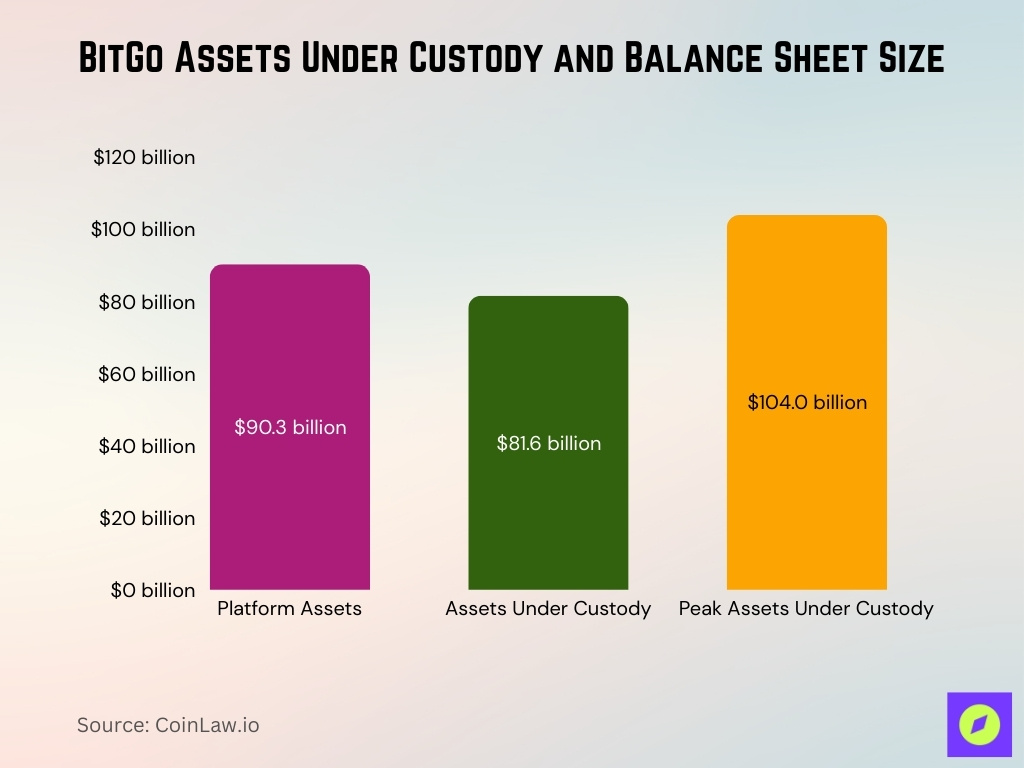

- Assets under custody dropped 22% to $81.6 billion in Q4 2025.

- Digital assets custodied grew 96% y/y to $104 billion as of Sep 2025.

- Trailing 9-month net revenues reached $140 million, up 65% y/y.

- Serves over 4,600 institutional clients across 100+ countries.

- Supports 80 of the top 100 digital assets in custody.

- Manages 90.3 billion platform assets as of June 2025.

BitGo Assets Under Custody (AUC)

- AUC climbed from approximately $60 billion to over $100 billion in H1 2025.

- By mid‑2025, BitGo held $90.3 billion in assets under custody.

- Asset growth reflects broad crypto adoption and institutional allocation.

- Growth rate exceeded 60% in the first half of 2025.

- AUC composition includes Bitcoin, Ethereum, and 1,550+ supported tokens.

- AUC increases are linked to both trading custody and staking engagements.

- Institutional clients contribute the bulk of high‑value custody holdings.

Profitability and Margin Metrics

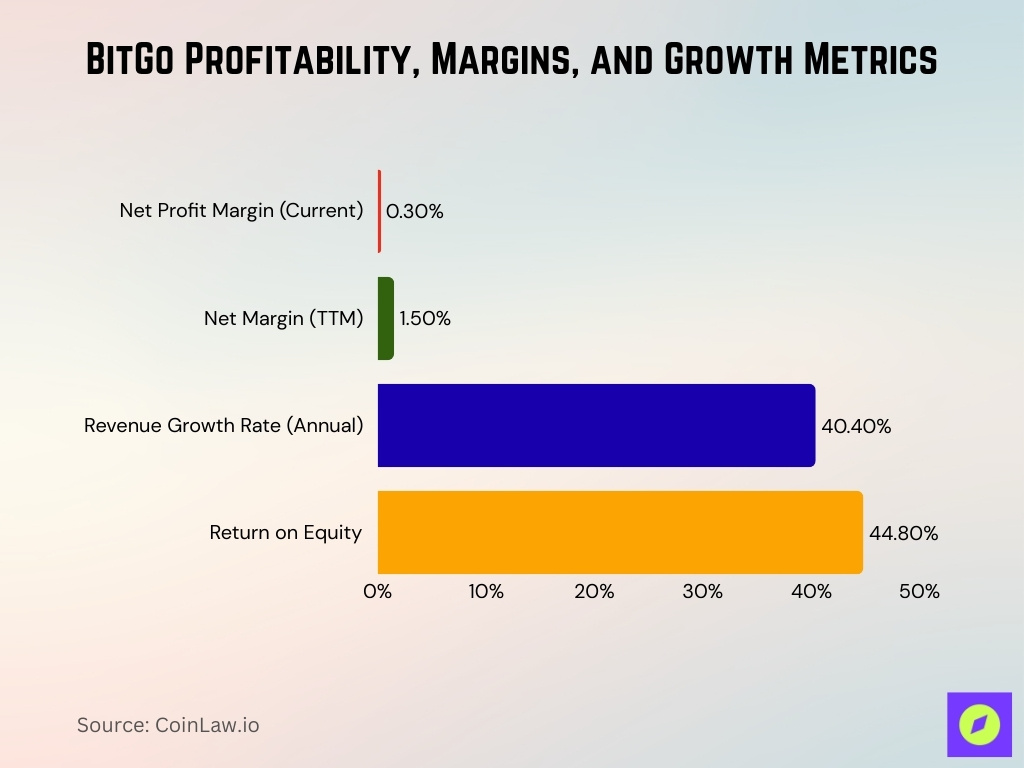

- Net profit margin compressed to 0.30% amid scaling challenges.

- Net margin is approximately 1.5% on a trailing 12-month basis.

- Revenue growth rate averages 40.4% per year.

- Return on equity stands at 44.8%.

- $156.6 million net income in 2024 on $3.08 billion revenue.

- $35.3 million net profit in the first nine months of 2025.

- Trailing 12-month revenue $11.14 billion with $164.65 million net income.

- H1 2025 revenue $4.19 billion, up 365% YoY, but net income $12.6 million.

Valuation and IPO Statistics

- Targets up to $1.96 billion valuation in the 2026 IPO.

- Offering 11.8 million Class A shares priced $15-$17 each.

- IPO proceeds up to $201 million at the upper price range.

- 11 million new shares from the company, 821,595 from existing stockholders.

- Underwriters’ option for an additional 1.77 million shares over 30 days.

- Listing onthe NYSE under ticker BTGO.

- Lead underwriters Goldman Sachs and Citigroup.

- The last private valuation was $1.75 billion in August 2023.

- Fiscal 2025 revenue is $6.1 billion with $90.3 billion AUM.

Trading and Transaction Volume

- H1 2025 trading revenue $4.19 billion, up 274% YoY.

- Supports trading across thousands of coins and tokens in spot, margin, and OTC.

- Stablecoins accounted for 78% of OTC trades in 2025.

- OTC desk launched Feb 2025, now supports derivatives trading.

- Aggregates liquidity from top exchanges and market makers.

- Custody-linked trading contributes to $140 million TTM revenue.

- No maker/taker fees with all-in institutional pricing.

Balance Sheet and Capital Structure

- $90.3 billion in platform assets as of June 2025.

- $81.6 billion assets under custody at Q4 2025 end.

- $104 billion peak assets under custody in Q3 2025.

- Dual-class structure with 106.7 million Class A shares post-IPO.

- 11.8 million Class A shares offered in IPO.

Staking and Restaking Statistics

- $48 billion in staked assets, the largest institutional staking platform.

- Clients earn up to 24% rewards on staked assets.

- Supports staking for 25+ assets, including BTC, ETH, SOL, AVAX.

- #1 staking platform by Total Value Locked (TVL).

- Expanded to native BTC staking on the Babylon protocol.

- Native Lido liquid staking for ETH, minting stETH.

- APT staking launched for institutional clients.

- Helius integration boosts Solana staking yields by 0.5-1.5% block rewards.

- Staking is integrated with $100+ billion in total assets under custody.

Geographic and Market Coverage

- Serves clients in 100+ countries with 4,600+ institutions.

- 2,000+ clients across 90 countries for staking services.

- Regulated entities in the U.S., Singapore, UAE, Germany, Denmark, and Switzerland.

- MiCA license from BaFin enables EU-wide custody and trading.

- VARA approval for custody and broker-dealer in the UAE MENA.

- MAS license in Singapore for digital tokens and payments.

- Official presence in Brazil for LatAm crypto custody.

- Supports World Chain for 160+ countries.

- 69 unique blockchain networks globally.

Token and Asset Concentration

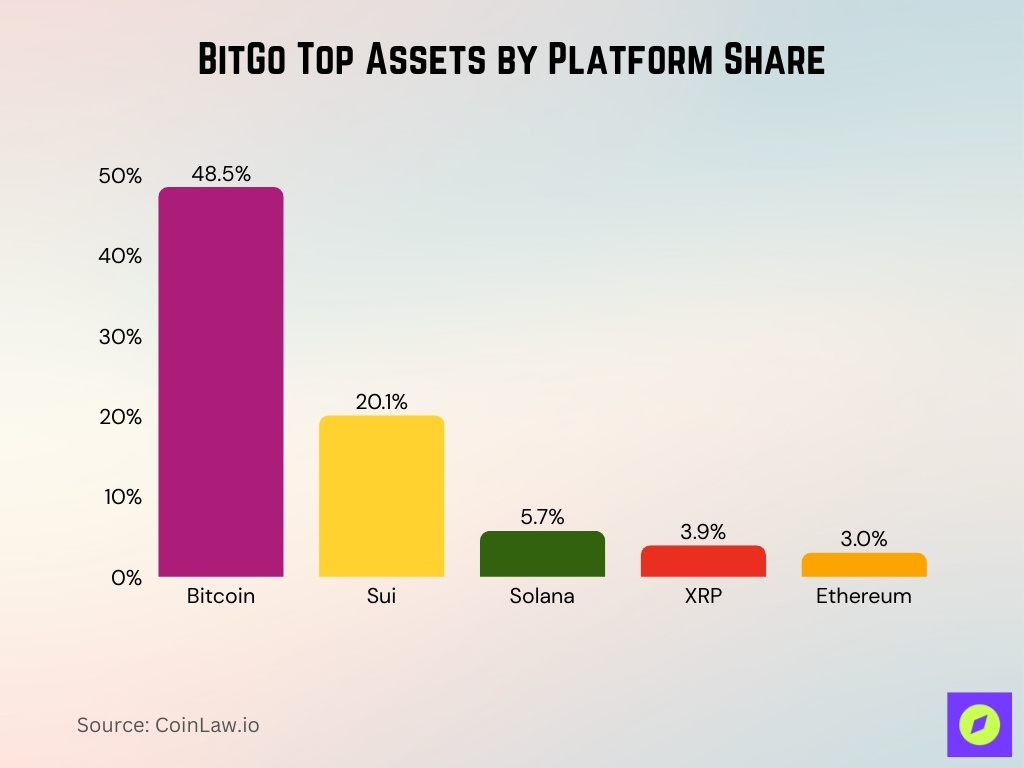

- 80% of assets are concentrated in the top 5 tokens as of late 2025.

- Bitcoin comprises 42.8% of total assets under custody.

- Supports 1,550+ digital assets despite top concentration.

- 79 of the top 100 digital assets are custodied.

- Bitcoin concentration heightens volatility exposure.

Enterprise and Institutional Adoption

- Supports 4,600+ institutional clients, including funds, banks, and exchanges.

- Infrastructure for 1,500+ institutions in 50+ countries.

- Serves 92 of the top 100 assets by market cap.

- Custodian for Fortune 100 companies, top exchanges, and blockchain projects.

- 1,550+ digital assets across 69 blockchain networks.

- Crypto-as-a-Service for thousands of fintechs and banks.

- Processes 8% of global Bitcoin transactions by value.

- 83% institutional investors plan to increase digital asset allocation.

Technology and Infrastructure Metrics

- Supports 1,550+ digital assets across 69 blockchain networks.

- 92 of the top 100 assets by market cap secured.

- Added 28 new blockchain networks in 2025.

- 80 of the top 100 digital assets are custodied.

- TSS wallets reduce gas fees vs multi-sig, 2-of-3 security model.

- Go Network OES integrates HTX, KuCoin, and Gate.io exchanges.

- Unified API for BTC, USDC, and tokenized U.S. equities.

- Cold custody insured up to $250 million per client.

- Processes trades in spot, margin, options, and futures.

Security and Risk Management Statistics

- $250 million insurance coverage for qualified cold custody assets.

- 9 million enterprise-grade multi-signature wallets in use, up 47% YoY.

- SOC 2 Type 2 certified for security, availability, and confidentiality.

- No single wallet exceeds $100 million in assets.

- 90% client assets are in cold storage for regulatory compliance.

- Assets are distributed across 7 global trust companies.

- Multi-sig eliminates single points of failure.

- Independent audits and continuous assessments.

- Segregated accounts ensure bankruptcy remoteness.

Partnerships and Ecosystem Statistics

- Brink’s strategic investment aligns physical and digital security.

- Serves 1,500+ clients in 50+ countries via partners.

- SOL Strategies validator partner for high-reward Solana staking.

- GlobalStake bare-metal staking for SOL, ETH, BNB, DOT, WALRUS.

- Voltage partnership enables Lightning Network services.

- Crossover Markets for Go Network off-exchange settlement.

- Matrixdock and Brink’s for secure gold custody integration.

- Distribution and technology partners earn referral rewards.

- 28 new blockchain networks were added in 2025 via the ecosystem.

Frequently Asked Questions (FAQs)

BitGo is targeting a valuation of up to $1.96 billion in its U.S. initial public offering.

BitGo plans to raise up to $201 million by offering shares in its public offering.

BitGo is offering about 11.8 million shares at a price range of $15–$17 per share.

BitGo supports more than 1,550 digital assets across its platform.

Conclusion

BitGo’s global infrastructure and regulatory footprint position it as a cornerstone of institutional crypto adoption. From wide geographic coverage and diverse licensing to security‑first technology and strategic partnerships, BitGo’s ecosystem supports a growing base of enterprise and institutional clients. These statistics underscore how compliance, risk management, and expansive integration contribute to BitGo’s scaling role in the digital finance landscape, a narrative that will continue evolving as the company enters public markets and fuels wider crypto infrastructure adoption.