Amazon Pay, launched in 2007, has steadily become a significant player in the global digital payment landscape. Initially designed to streamline transactions for Amazon’s marketplace, its reach now extends far beyond. Today, it is utilized by millions of businesses and consumers, offering a seamless and secure payment option for e-commerce and beyond.

As consumers increasingly opt for digital wallets and contactless payments, Amazon Pay is positioning itself as a key solution. Its influence continues to grow, particularly in e-commerce and retail, as more companies adopt this service to facilitate faster and safer payments.

Editor’s Choice

- Amazon Pay processed an estimated $95 billion in transactions, marking a 11.8% increase compared to 2025.

- Amazon Pay accounts for 6.5% of the global online payment market.

- Amazon Pay Later has over 14 million users globally.

- The platform recorded 3.6 billion transactions.

- More than 720,000 merchants worldwide now accept Amazon Pay, up from 600,000.

- Mobile usage of Amazon Pay surged by 22%, driven by smartphone payments.

- Amazon Pay added 70,000 new merchants to its ecosystem.

- Cross-border transaction volume increased by 28%.

Recent Developments

- Amazon Pay Later expanded to seven new countries, including Canada, Australia, and Brazil, enabling tens of millions of users to make flexible payments.

- Amazon Pay for Business in India boosted SME adoption by 28% with enhanced contactless payment tools.

- Amazon Pay advanced cryptocurrency integration for more merchants, supporting Bitcoin, Ethereum, and select stablecoins.

- Sustainability efforts expanded with carbon offset partnerships, adopted by 12% of users per transaction.

- Voice payments via Alexa rolled out to 20 new countries, comprising 10% of total transactions.

- Amazon Pay for In-Store Purchases grew to 150 major US and UK retail chains, lifting merchant adoption by 25%.

- Q1 partnership with Visa and Mastercard enhanced checkout speeds, boosting merchant conversions by 18%.

- Amazon infused Rs 600 crore into India operations, strengthening competition in UPI and digital wallets.

User Demographics and Usage Trends

- Males account for 54%, females 46% of users.

- 29.5% of users aged 25–34, the largest age group.

- 18–24 age group comprises 17.2% of the user base.

- Over 65% of transactions are via mobile devices.

- 78% of US Amazon Prime members used the service.

- The average US transaction size is $130, global $118.

- 70% cite ease of use and Amazon brand familiarity.

- Repeat usage rate reached 82% among active users.

Market Share of Amazon Pay in the Global Payment Industry

- Amazon Pay holds a 6.5% share of the global digital payment market.

- Amazon Pay’s market share increased to 6.5%, fueled by US and international adoption.

- In North America, Amazon Pay accounts for 7.5% of all e-commerce transactions.

- Amazon Pay’s Europe market share reached 5.5%, up from 5.0% prior year.

- Asia-Pacific share rose to 4.8%, driven by India’s and Japan’s digital payments.

- Cross-border transaction volume surged by 28%.

- Amazon Pay handled over $95 billion in global transactions.

- US contributed 52% of Amazon Pay’s global revenue.

Number and Share of Merchants Who Use Amazon Pay

- Over 720,000 merchants worldwide accept Amazon Pay.

- In the United States, 38% of e-commerce businesses offer Amazon Pay.

- SMEs comprise 70% of total Amazon Pay merchants.

- In Europe, 14% of online merchants have integrated Amazon Pay.

- Asia-Pacific merchants rose by 25%, led by India, Japan, and Australia.

- Latin America saw a 45% increase in Amazon Pay merchants.

- Amazon Pay onboarded an additional 70,000 merchants.

- Germany leads Europe with 2.1% merchant adoption share.

Amazon Pay’s Monthly Sales by Region

- Total monthly sales reached $62.5 billion globally.

- United States generated $30.8 billion, nearly half of the global total.

- Germany ranked second with $13.2 billion.

- Japan recorded $3.6 billion.

- Italy posted $2.1 billion.

- United Kingdom contributed $1.9 billion.

- Spain saw $880 million.

- France added $820 million.

- Saudi Arabia achieved $500 million.

- Others collectively brought $8.1 billion.

Competitive Position: Amazon Pay vs. Other Platforms

- Amazon Pay is the third-largest US digital wallet at 5.8% market share behind PayPal and Apple Pay.

- Processed $95 billion vs. PayPal’s $1.5 trillion and Apple Pay’s $170 billion.

- Customer satisfaction rated 4.75/5, below Apple Pay’s 4.85 but above PayPal’s 4.55.

- Merchant fees at 2.9% + $0.30, matching PayPal and Stripe.

- International payments growth 25%, trails PayPal’s 28% but beats Stripe’s 20%.

- 88% of merchants value fraud detection and buyer protection.

- Mobile transaction volume up 22% vs. Apple Pay’s 18%.

- Active US users: 45 million vs. PayPal: 220 million.

Adoption Across E-commerce and Retailers

- 38% of US e-commerce retailers integrated Amazon Pay.

- EU online retailers using Amazon Pay up 20%, Germany leading.

- Physical retailers’ adoption grew 25%.

- Luxury goods retailers 31% offer Amazon Pay.

- Grocery chains 23% of new integrations.

- 16% of transactions for digital goods.

- 48% of US e-commerce sites expected to offer Amazon Pay.

- Fashion sector adoption reached 29%.

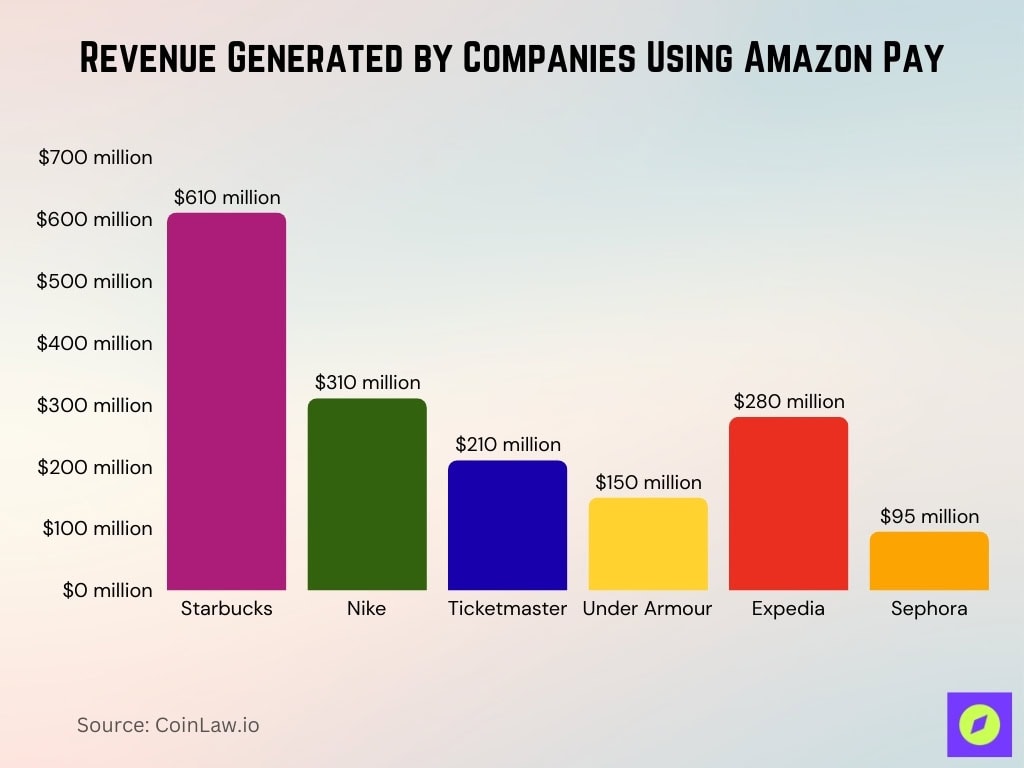

Companies Using Amazon Pay (Revenue)

- Starbucks processed $610 million through Amazon Pay, up 12%.

- Nike sales via Amazon Pay grew 14% to $310 million.

- Ticketmaster handled $210 million, 5% of global ticket sales.

- Under Armour reported $150 million, up 7%.

- Expedia bookings reached $280 million, 6% growth.

- Sephora added $95 million via Amazon Pay.

Technological Innovations and Features

- Biometric verification reached 55% user adoption for palm-based authentication.

- Voice payments via Alexa grew 38%, processing 3.1 million transactions.

- One-click checkout boosted merchant conversions by 32%.

- Fraud detection improved 22%, saving $135 million in chargebacks.

- Real-time tracking is used by 68% of active users.

- Cross-border enhancements drove 28% international transaction growth.

- Amazon Pay Later expanded 15.2%, aiding the BNPL market to $620 billion.

- Multi-factor authentication adoption hit 82% among merchants.

Amazon Pay Revenue Statistics

- Amazon Pay generated $2.0 billion in revenue.

- Transaction fees comprised 73% of revenue, with 27% from value-added services.

- US market represented 52% of global revenue.

- European revenue grew by 20%.

- Cross-border transactions contributed 30% of revenue.

- Revenue projected to reach $2.3 billion.

- Premium services like fraud prevention added $420 million.

- India operations revenue surged 35% year-over-year.

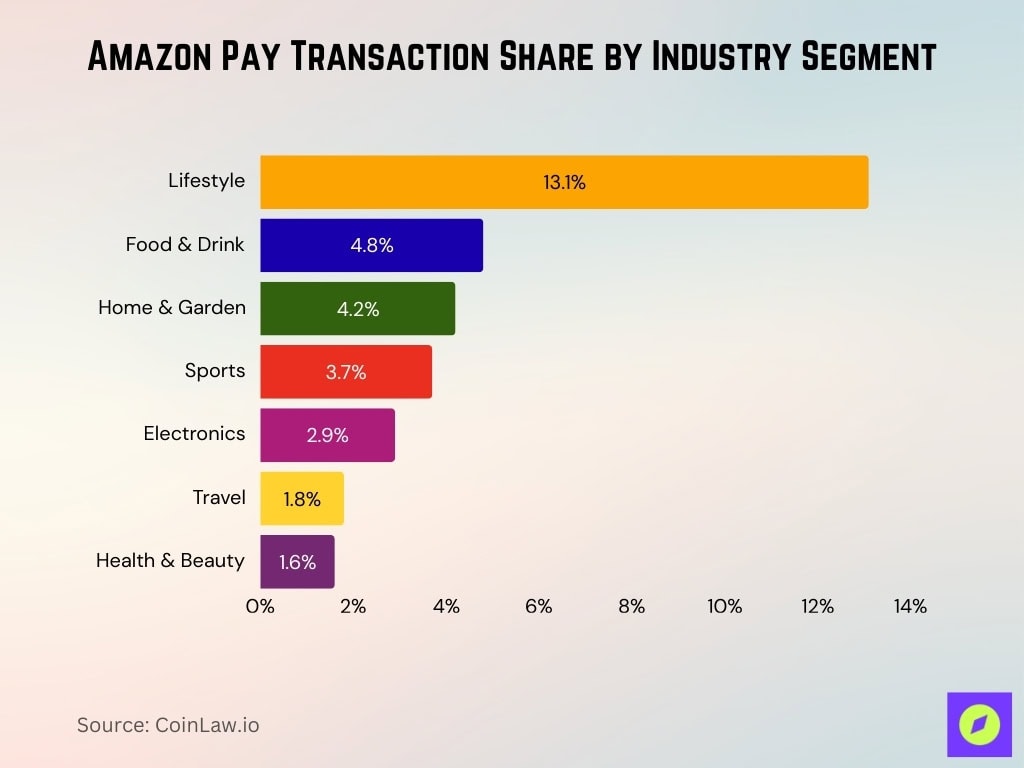

Industry Segments Using Amazon Pay

- “Other” category dominates at 67.9% of total Amazon Pay usage across diverse sectors.

- Lifestyle industries (fashion, wellness, personal care) account for 13.1%.

- Food & Drink businesses represent 4.8%, driven by online grocery and delivery services.

- The Home & Garden sector contributes 4.2%, including furniture and household goods.

- The sports industry accounts for 3.7% of transactions.

- The electronics category holds 2.9% share.

- Travel bookings comprise 1.8%.

- Health & Beauty reaches 1.6%.

Frequently Asked Questions (FAQs)

Net losses reduced by ₹46 crore year‑over‑year in FY25.

Amazon Pay held about 3.6% of the global payment processing market share in 2025.

Amazon Pay India reported ₹2,096 crore in revenue in FY25, down 9% year‑over‑year.

Conclusion

Amazon Pay has evolved from a simple digital wallet into a comprehensive global payment platform. With continuous innovations in biometric security, voice commerce, and blockchain integration, Amazon Pay is well-positioned to further dominate the digital payment landscape in the coming years. Its strategic expansion into new markets, combined with enhanced merchant services and AI-driven security, ensures that Amazon Pay will remain a vital tool for both consumers and businesses. As the payment industry becomes more interconnected and diverse, Amazon Pay is poised to leverage its brand trust, technical prowess, and expansive reach to set new benchmarks for digital payments worldwide.