In 2021, a pixelated image of a rock sold for over a million dollars. It was a moment that forced both Wall Street and Main Street to reckon with the idea that digital assets, known as NFTs (non-fungible tokens), might be more than a fad. Fast forward today, and the NFT market has evolved from speculative chaos into a multi-billion-dollar ecosystem interwoven with gaming, fashion, real estate, and even legal contracts. This article breaks down the latest stats and trends shaping the NFT space so you can understand where the market is today and where it’s heading.

Editor’s Choice

- The global NFT market size is projected to reach $60.82 billion by 2026, up from $43.08 billion in 2025.

- NFT market cap is estimated at $5.6 billion with total sales volume of $2.8 billion in H1 2025.

- Ethereum powers around 62% of all NFT contracts, maintaining its lead as the primary NFT blockchain.

- Gaming NFTs account for roughly 25% of total NFT trading volume in 2025, remaining one of the largest NFT use case segments.

- Utility and AI-powered NFTs are expected to drive growth, with AI-related projects representing about 30% of new developments.

- Asia leads globally with about 2.8 million NFT owners, while India records an NFT ownership rate of 13.5%.

- Weekly NFT sales recently jumped 37.41% to $88.29 million, with Ethereum sales up 39.08% to $27.57 million.

Recent Developments

- Major brands such as Disney, Spotify, and Netflix launched NFT integrations, offering token-gated and exclusive content access.

- Tokenized ticketing systems powered over 20 major global music and sports festivals using NFT-based passes.

- Dynamic NFTs with updatable metadata are now deployed in education and health tech for credentials and patient or learner records.

- Zora Protocol’s latest network upgrade focuses on near-zero fees and creator-first tooling for NFT minting and marketplaces.

- AI-generated NFTs in Europe are increasingly covered by creative authorship and copyright frameworks.

- Reddit’s collectible avatar NFTs surpassed 10 million holders and 32 million in sales volume, marking a mainstream adoption milestone.

- Cross-chain minting tools built on LayerZero and Axelar significantly reduced friction for multi-chain NFT deployments.

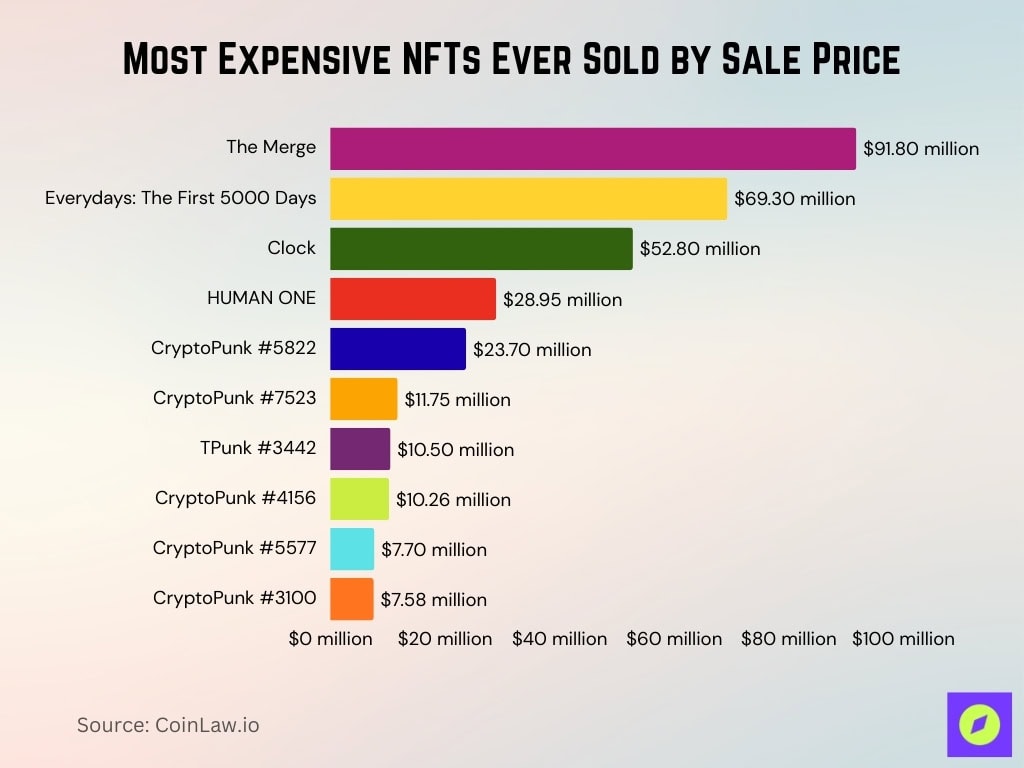

Most Expensive NFTs Ever Sold

- The Merge by Pak remains the most expensive NFT ever sold at $91.8 million.

- Beeple’s Everydays: The First 5000 Days holds second place with a sale price of $69.3 million.

- Clock by Pak and Julian Assange ranks third, selling for $52.8 million to support Assange’s legal defense.

- Beeple’s HUMAN ONE, a hybrid physical–digital artwork, sold for $28.95 million at Christie’s.

- CryptoPunk #5822 is the top-selling punk, purchased for $23.7 million.

- CryptoPunk #7523 “Covid Alien” was auctioned for $11.75 million at Sotheby’s.

- TPunk #3442, the priciest NFT on Tron, sold for $10.5 million.

- CryptoPunk #4156, one of 24 Ape Punks, changed hands for $10.26 million.

- CryptoPunk #5577, a cowboy-hat ape, sold for $7.7 million.

- CryptoPunk #3100, an Alien Punk with a headband, sold for $7.58 million.

Millennials and Men Lead in Collecting Physical Items and NFTs

- Men are more likely to collect, with 45% collecting physical items and 15% collecting NFTs.

- Only 22% of women collect physical items, and just 4% collect NFTs as a hobby or investment.

- Millennials lead collectors, with 42% collecting physical items and 23% collecting NFTs, the highest among age groups.

- Gen Z reports 20% physical collectors and 4% NFT collectors, showing lower NFT engagement than millennials.

- Gen X shows 37% collecting physical items and 8% collecting NFTs, indicating moderate adoption.

- Baby boomers remain the least engaged, with 29% collecting physical items and 2% collecting NFTs.

- Male NFT owners account for 63% of all NFT owners, while females represent 35%, and 2% prefer not to say.

Geographic Distribution of NFT Investments

- Asia now captures over 35% of the global NFT market share, led by China, Singapore, India, and the Philippines.

- The United States remains the single largest national market, with NFT revenue forecast at $80.5 million and user penetration of 0.61%.

- India records the highest NFT ownership rate globally at 13.5%, followed by Singapore at 9.2% and Nigeria at 8.6%.

- North America is projected to command over 45% of the NFT-as-a-service market share by 2035, driven by U.S. and Canadian platforms.

- Latin America’s key NFT markets include Brazil, with 4.6% owner share, and Mexico, with 2.3% owner share.

- African adoption is led by Ghana with 7.5% NFT ownership and Kenya with 2.8%, signaling a growing regional footprint.

- In Southeast Asia, Vietnam shows 6.4% NFT ownership and Indonesia 4.9%, supporting rising usage in remittances and microfinance pilots.

- Singapore hosts over 140 NFT-focused blockchain startups and is recognized as a leading hub for institutional NFT capital.

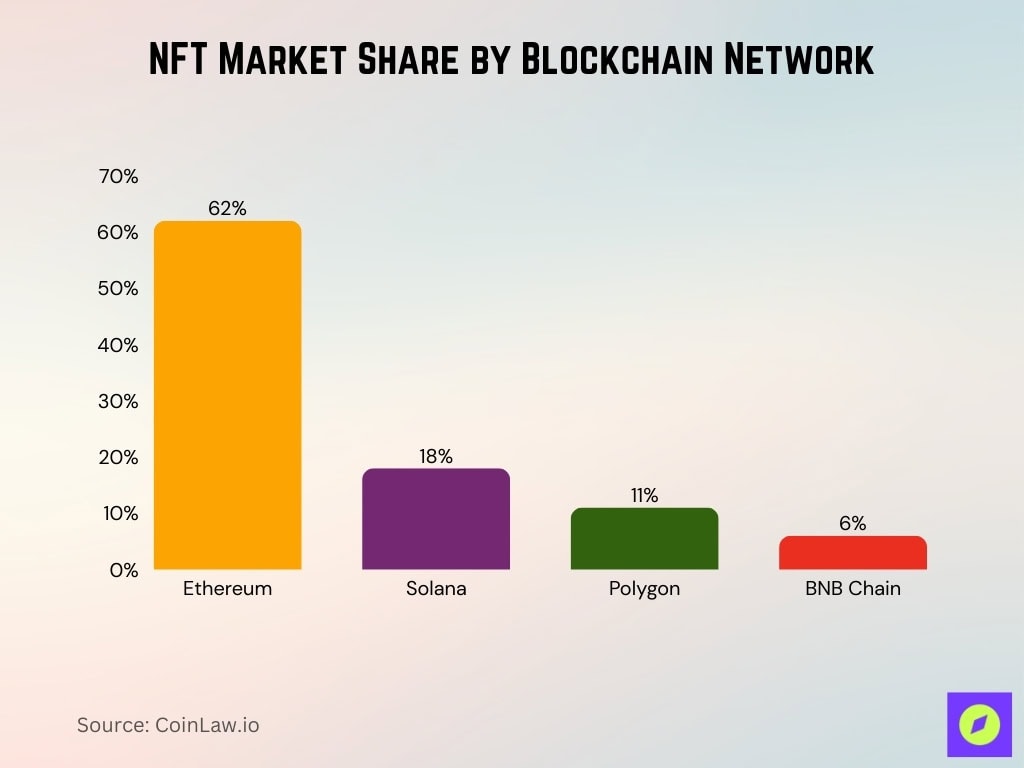

Blockchain Networks Powering the NFT Ecosystem

- Ethereum still leads with around 62% of NFT contracts and primary trading volume across major collections.

- Solana processes roughly 18% of NFT transactions, driven by high-throughput, low-fee mints and trades.

- Polygon powers about 11% of total NFT minting, including enterprise and brand drops from companies like Starbucks and Nike.

- BNB Chain accounts for approximately 6% of NFT market share, particularly in DeFi–NFT hybrid applications.

- Immutable-powered gaming ecosystems contribute to an NFT gaming market expected to reach $0.54 trillion in 2025 on the way to $1.08 trillion by 2030.

- Cross-chain NFT activity is expanding, with over 3 million NFTs bridged between networks over the last year.

- Ethereum Layer 2s such as Arbitrum, Optimism, and Base now concentrate nearly 90% of L2 transaction activity, including NFT traffic.

- Layer 2 ecosystems and sidechains together are projected to process millions of daily NFT-related transactions by 2026.

Game Developers Show Low Interest in NFTs

- Only 7% of game developers say they are very interested in using NFTs in their games.

- Around 21% report being somewhat interested in NFTs for future projects.

- A dominant 70% of developers state they are not interested in implementing NFTs at all.

- Just 2% of surveyed developers are currently using NFTs in their games.

Institutional Involvement and Venture Capital in NFTs

- Venture capital investment in NFT projects reached $4.2 billion in 2025, with institutional investors contributing around 15% of annual market revenue.

- Over 180 NFT-focused startups raised seed or Series A funding in H1 2025, signaling robust early-stage activity.

- Andreessen Horowitz (a16z) remains a top backer, allocating more than $600 million to NFT infrastructure and platform investments.

- Animoca Brands leads gaming-related NFT funding, having backed over 70 NFT gaming and metaverse projects worldwide.

- Three major NFT index funds and ETFs have been approved for trading in U.S. markets, giving institutional investors regulated exposure.

- More than 30% of institutional NFT deals now feature fractional ownership structures or embedded yield mechanisms.

- Financial giants such as Goldman Sachs and JPMorgan are piloting tokenized NFTs for digital asset collateralization use cases.

- NFT-dedicated accelerators and incubators now support over 200 teams globally, channeling capital and mentoring into the ecosystem.

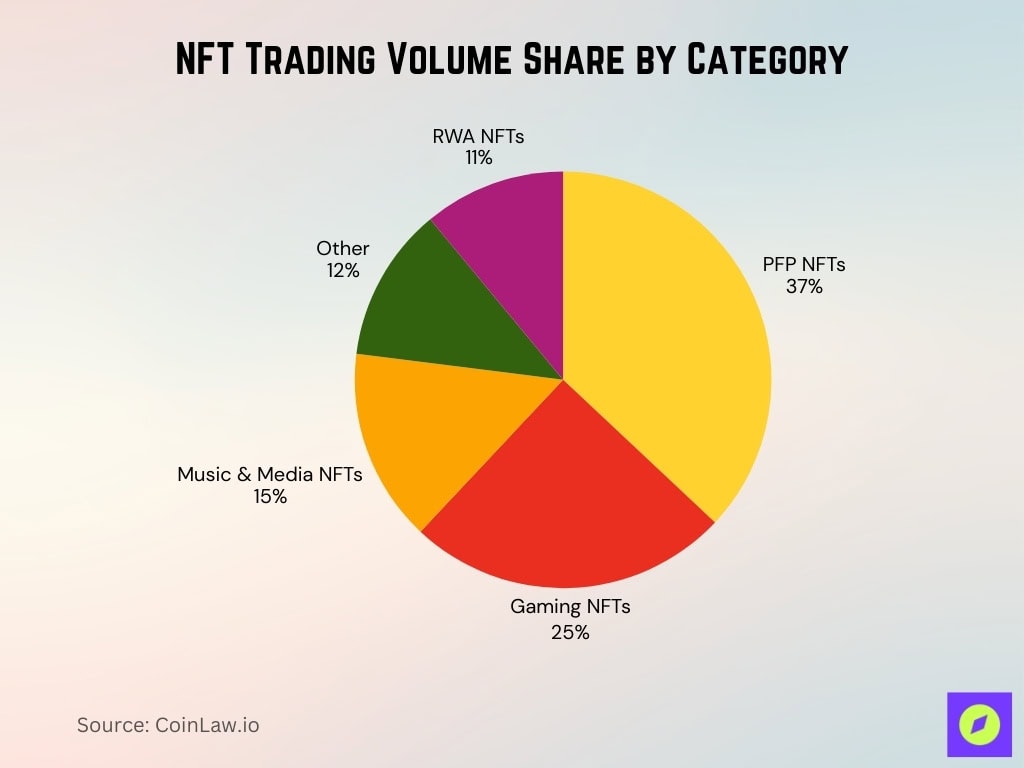

NFT Trading Volume Share by Category

- PFP NFTs dominate the market with 37% of total trading volume, remaining the most popular NFT category.

- Gaming NFTs account for 25% of trading volume, driven by play-to-earn economies and metaverse integrations.

- Music/Media NFTs represent 15% of total volume, reflecting strong growth in creator-led digital assets.

- The Other category makes up 12% of NFT trading volume, covering experimental and niche use cases.

- RWA NFTs (Real-World Asset NFTs) hold 11% of market volume, signaling rising tokenization of physical assets.

Top NFT Marketplaces by Volume, Traders, and Price

- OpenSea captured about 29.7% of the NFT market share in May 2025 with $69 million in monthly volume and 283,000 users.

- Blur recorded roughly $135 million in 30-day trading volume in August 2025, targeting pro traders with advanced tools.

- Across 2022–2024, OpenSea facilitated a cumulative $23.14 billion in NFT trading volume, the highest among all marketplaces.

- Blur followed with $8.54 billion in cumulative trading volume over the same period, cementing its role as a pro-trader hub.

- Magic Eden amassed $6.39 billion in cumulative trading volume and held a 37% market share at its 2024 peak.

- On Ethereum, Blur commanded 68.8% market share from $2.43 billion YTD trading volume versus OpenSea’s $0.64 billion.

- A 2025 snapshot shows Blur at $520 million 30-day volume with 220,000 active users, and OpenSea at $340 million with 280,000 users.

Impact of Royalties and Creator Earnings on Market Dynamics

- Over 80% of NFT smart contracts now include automated royalty enforcement, with Ethereum creators having earned more than $1.8 billion in cumulative royalties.

- The average royalty fee across leading marketplaces is about 6.1%, with most collections setting rates between 5% and 10% of resale value.

- Ethereum-based platforms generated over $920 million in royalties for creators in 2025 alone.

- Optional royalty structures on Blur and OpenSea drove a 12% increase in buyer activity but cut creator royalty revenues by around 18%.

- Over 63% of NFT creators report earning more from secondary sale royalties than from initial mint sales.

- Around 428 top NFT collections account for roughly 80% of all royalty revenue paid out to creators.

- Dynamic royalty models can increase creator earnings by up to 40% through tiered or performance-based adjustments.

- Co-creator royalty splits and influencer shares have expanded revenue participation by approximately 30% in supported collections.

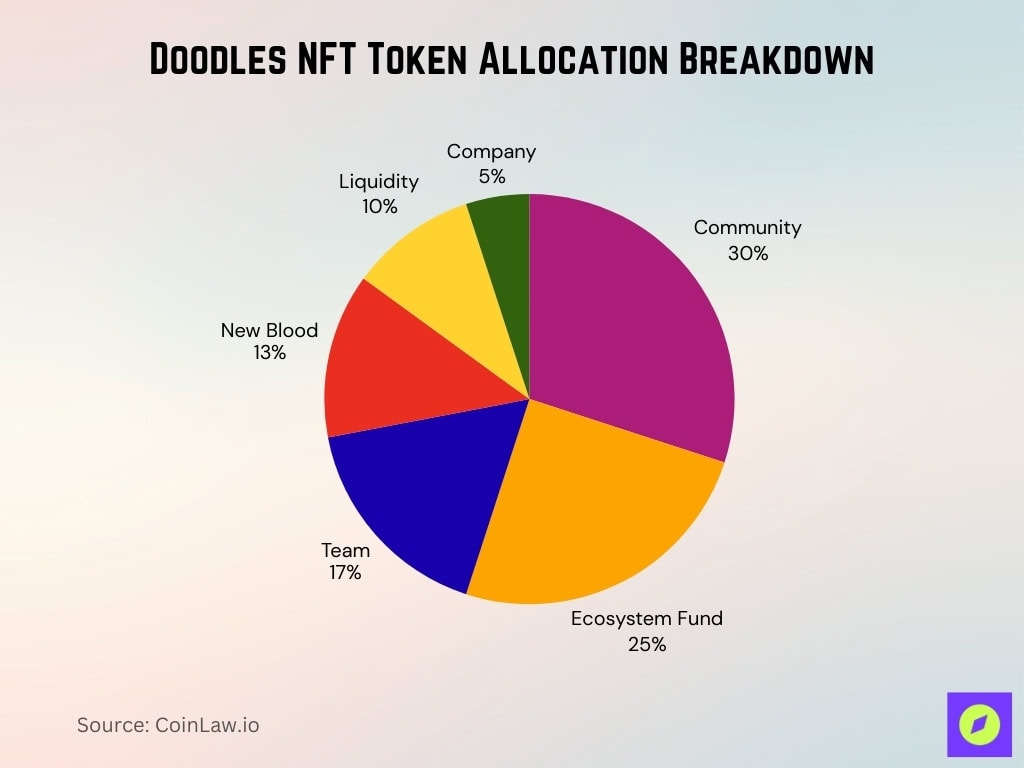

Doodles NFT Token Allocation Breakdown

- 30% is allocated to the Doodles Community, highlighting a strong focus on decentralized ownership and engagement.

- 25% goes to the Ecosystem Fund, supporting long-term growth and innovation within the Doodles ecosystem.

- 17% is set aside for the Team (subject to a 1-year cliff and 3-year vest), ensuring team alignment with project success.

- 13% is allocated to New Blood, likely aimed at onboarding new contributors or talent.

- 10% is reserved for Liquidity, supporting token trading and market stability.

- 5% is assigned to the Company, also under a vesting schedule.

Integration of NFTs in Web3 and Metaverse Platforms

- Over 72% of metaverse platforms now support NFT-based assets like avatars, wearables, and land as core in-world items.

- NFT sales within metaverse environments surpassed $42 billion in 2025, with avatar customization assets alone making up 31% of transactions.

- Decentralized identity (DID) and wallet-based NFT IDs are used by around 22 million metaverse users to verify identity and access.

- The virtual land NFT market is projected to grow from $1.1 billion in 2025 to $20.9 billion by 2035 at a 34.5% CAGR.

- Over 80% of Gen Z metaverse users have bought or traded at least one NFT, showing strong youth adoption.

- Gen Z makes up 45% of global metaverse users, and Millennials 34%, forming the primary NFT-owning cohorts.

- Corporate NFT launches, including branded metaverse wearables, now account for 18% of total NFT market share.

Top-Selling Meme NFTs and Their Earnings

- Doge remains the top meme NFT, selling for about $4.2 million.

- Charlie Bit My Finger sold at auction for $760,999.

- Nyan Cat’s iconic GIF NFT sold for roughly $600,000 (around 300 ETH at the time).

- Disaster Girl’s original photo NFT sold for about $500,000 (around 180 ETH).

- Overly Attached Girlfriend brought in approximately $411,000–$460,000 from its NFT sale.

- Bad Luck Brian’s NFT sold for around $36,000–$45,500, reflecting strong nostalgia value despite a lower price tier.

Challenges Slowing Down NFT Market Adoption

- Price volatility remains the top concern, with 48% of NFT buyers reporting hesitation due to unpredictable valuations.

- Scams and rug pulls have caused nearly $6 billion in Web3 losses in 2025, with NFT rug pulls alone accounting for about $450 million.

- Average losses per rug-pull victim reached around $9,800, and the average amount stolen per rug pull climbed to roughly $510,000.

- High Ethereum gas fees still range from $50–$150 to mint NFTs under normal congestion, spiking higher during peak periods.

- Roughly 69% of illiquid NFT collections fall to a 0 ETH floor price within six months, fueling fears of saturation and low liquidity.

- Only about 4% of U.S. adults own NFTs, and many non-owners cite security, scams, and complexity as key barriers.

- NFT fraud events can average around $300,000 in losses per incident, severely impacting individual investors.

Frequently Asked Questions (FAQs)

Total NFT supply grew to ~1.34 billion tokens in 2025.

Secondary market sales represented ~52% of total NFT transactions.

The NFT market could expand to approximately $347.46 billion by 2030.

In October 2025, the market saw 10.1 million sales, with trading volume up ~30% month‑over‑month.

Conclusion

The NFT landscape today is no longer defined by pixel art speculation; it is a multi-faceted, revenue-generating digital economy touching finance, culture, and identity. From institutional capital to Gen Z creators, the ecosystem is becoming more inclusive, compliant, and creative. However, challenges such as royalty disputes, security concerns, and regulatory lag remain roadblocks to seamless adoption. As NFTs integrate deeper into Web3 infrastructures, real-world asset tokenization, and creator economies, the coming years are poised for refinement rather than revolution.