SIM swapping has emerged as one of the most financially damaging forms of identity theft in recent years. In this crime, attackers take control of a victim’s mobile number to bypass SMS-based security, access personal accounts, and steal funds. The rise of mobile authentication and the ongoing reliance on text‑message verification have made this threat particularly potent. From retail banking to digital wallets, companies and consumers are coping with sharper losses and more frequent attacks. Read on for a data‑driven look at how SIM swapping is evolving and why it matters.

Editor’s Choice

- $33 million arbitration award against T-Mobile for a single SIM swap crypto theft case.

- Telecom consumer fraud losses reached $12.5 billion amid the SIM swap explosion.

- 982 SIM swap complaints led to $26 million losses per the FBI 2024 IC3 report.

- Crypto-related SIM swap losses totaled $28.4 million in documented U.S. cases.

- 1,055% surge in SIM swaps confirmed by Cifas Fraudscape 2025 report.

- Exetel fined $695,000 after 73 SIM swaps enabled $412,000 in fraud.

- 90% of Australian SIM swaps occurred without victim interaction

Recent Developments

- 1,055% surge in unauthorised SIM swaps reported by Cifas Fraudscape.

- 421,000 total fraud cases filed with the National Fraud Database.

- 3,000 SIM swap incidents in the UK, doubling from the prior year.

- T-Mobile ordered to pay $33 million in SIM swap arbitration case.

- Exetel fined $695,000 for enabling 73 SIM swaps and $412,000 fraud losses.

- eSIM technology compresses SIM swap attack timelines to under 5 minutes.

- 90% of Australian SIM swaps occur without victim interaction.

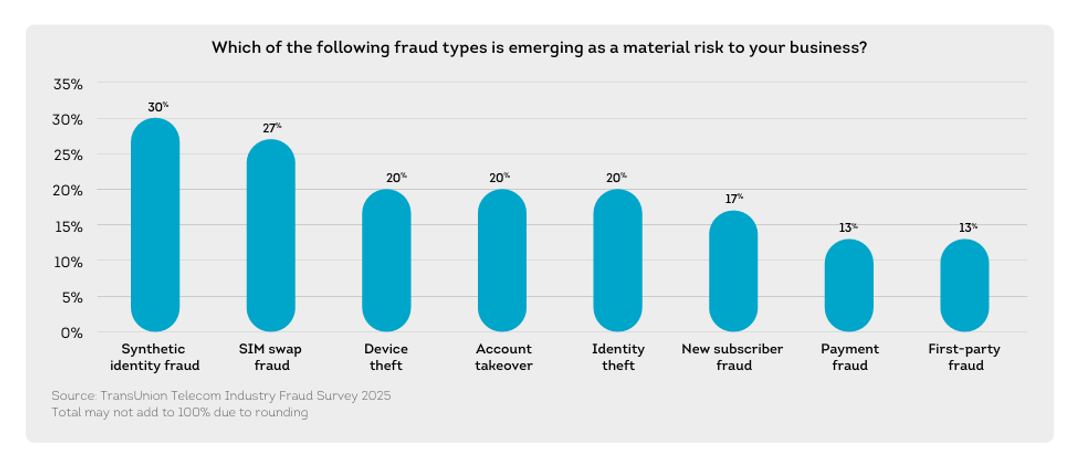

Emerging Fraud Risks Impacting Businesses

- Synthetic identity fraud leads all threats at 30%, making it the most cited material risk for businesses.

- SIM swap fraud ranks second at 27%, highlighting growing exposure tied to mobile account control.

- Device theft accounts for 20% of reported emerging fraud risks across organizations.

- Account takeover fraud also stands at 20%, reflecting persistent credential and access abuse.

- Identity theft represents 20%, showing continued misuse of personal data at scale.

- New subscriber fraud impacts 17% of businesses, driven by abuse during account onboarding.

- Payment fraud remains a concern at 13%, affecting transaction integrity and revenue.

- First-party fraud is cited by 13%, indicating losses caused by customers themselves.

What Is SIM Swapping?

- SIM swapping is a form of cell phone account takeover that exploits SMS/voice authentication weaknesses.

- 96% of SIM swap cases involve social engineering tactics.

- 29% of account takeover victims are adults aged 61+.

- 90% of Australian SIM swaps occur without victim contact.

- $33 million T-Mobile arbitration award from single SIM swap theft.

- eSIM attacks compress timelines to under 5 minutes.

- 1,055% UK SIM swap surge from 289 to nearly 3,000 cases.

- $300 bribes were offered to carrier insiders per fraudulent swap.

Global SIM Swap Trends

- The UK saw a 1,055% increase in SIM swap cases from 2023 to 2024.

- Nearly 3,000 unauthorized SIM swap incidents were reported in the UK in 2024.

- SIM swap fraud rose over 1,000% year‑over‑year globally in recent industry tracking.

- Australia reported a 240% rise in SIM porting and related fraud cases in 2024.

- More advanced fraud schemes now blend automation and human tactics.

- Telecom fraud overall remains in the multi‑billion‑dollar range worldwide.

- Attackers use global data breaches to fuel port‑out scams across regions.

- As digital identity reliance increases, SIM swap becomes more attractive to thieves.

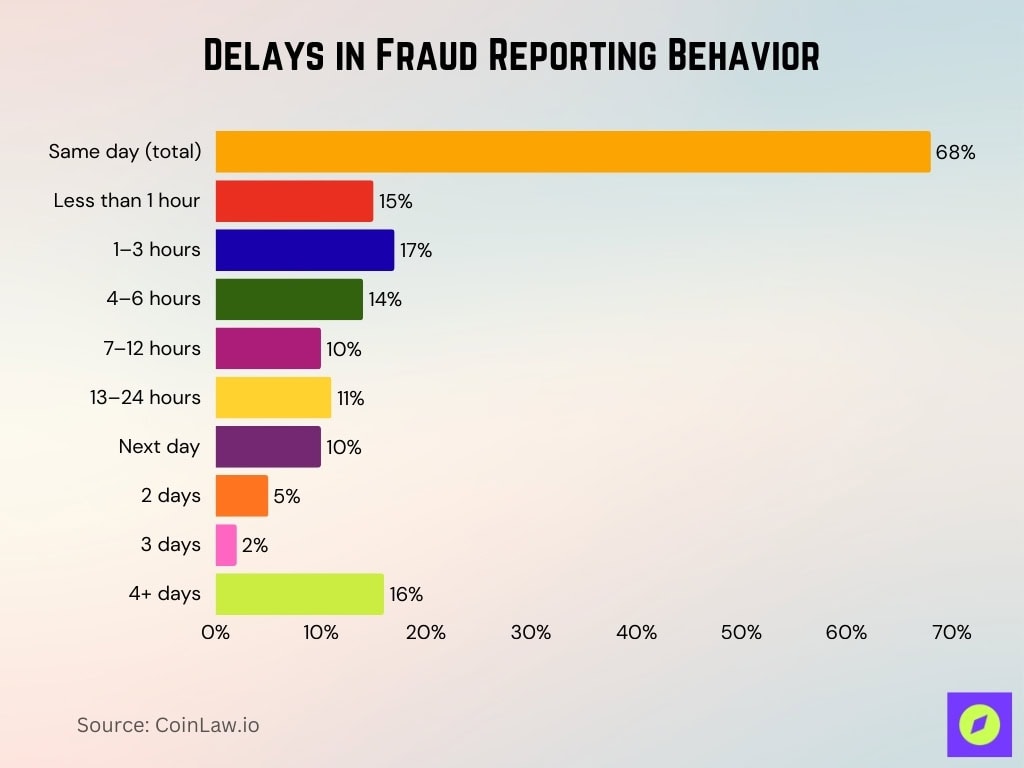

Delays in Fraud Reporting Behavior

- 68% of fraud incidents are reported on the same day, indicating rapid initial awareness among most victims.

- Within same-day reporting, 15% report fraud in under one hour, showing immediate recognition in critical cases.

- 17% of reports occur within 1–3 hours, reflecting early detection after initial account compromise.

- 14% are reported within 4–6 hours, often after secondary account checks or alerts.

- 10% take 7–12 hours to report, increasing the window for fraud escalation.

- 11% are reported after 13–24 hours, allowing attackers extended time to exploit accounts.

- 10% of victims delay reporting until the next day, significantly raising potential losses.

- Multi-day delays remain common, with 5% reporting after 2 days and 2% after 3 days.

- A concerning 16% report fraud only after 4 or more days, creating the highest risk of unrecoverable losses.

U.S. SIM Swap Losses

- $26 million in losses reported to the FBI IC3 in 2024.

- FBI records show 982 SIM swap complaints tied to these losses.

- Loss figures exclude unreported recoveries, wages lost, and resolution costs.

- U.S. carriers have increased fraud detection investments, but gaps remain.

- Loss reporting may be underrepresenting the total U.S. financial impact.

- SIM swaps contribute to a broader U.S. fraud trend that includes $12.5 billion in various phone‑related scams.

- Regulatory pressure mounts for carriers to strengthen authentication layers.

UK SIM Swap Surge

- More than 2,900 unauthorised SIM swaps were reported in the UK in 2024, a staggering 1,055% increase from just 289 cases the year before.

- Identity fraud linked to mobile products rose 87% year‑over‑year, underscoring broader vulnerability in telecom services.

- Consumers aged 61 and older now represent 29% of all takeover victims in the UK, up 90% year‑on‑year.

- Nearly 421,000 total fraud cases were filed with the UK’s National Fraud Database in 2024, with SIM swaps a major driver.

- UK telecom fraud cases increasingly involve social engineering rather than technical exploits.

- The telecom industry is now one of the leading sectors targeted by fraudsters.

- SIM swap incidents in the UK have brought renewed regulatory and insurer focus on telecom‑level protections.

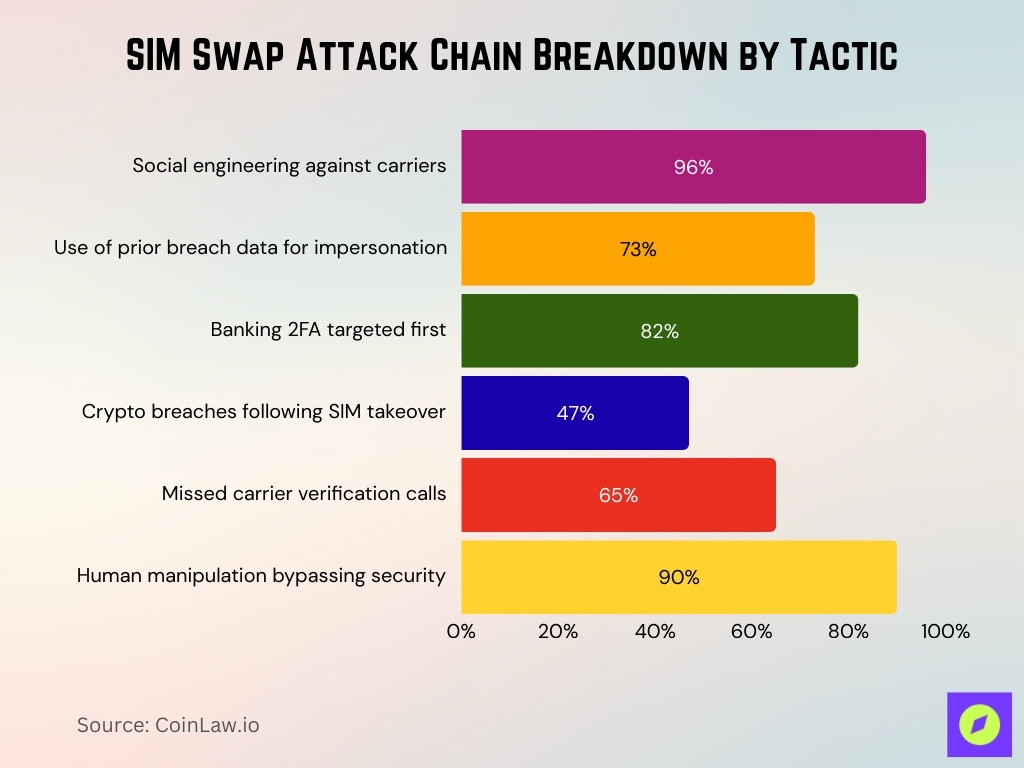

Attack Chain Breakdown

- 96% of SIM swaps start with social engineering against carriers.

- 73% of attacks use data from prior breaches for victim impersonation.

- Average successful swap completes in under 15 minutes.

- 82% of hijacked numbers target banking 2FA codes first.

- 47% of crypto platform breaches follow an immediate SIM takeover.

- Attackers sell compromised accounts for $300-$1,000 on dark web markets.

- 65% of victims fail to answer carrier verification calls during swaps.

- Automated scripts enable 10x scaling of SIM swap operations.

- 90% of swaps bypass technical security via human manipulation.

Victim Demographics

- Adults aged 61+ comprise 29% of UK SIM swap account takeover victims.

- Victims over 60 suffer average losses of $45,000 per SIM swap incident.

- 73% of SIM swap victims fell for social engineering phone calls.

- 42% of victims had credentials exposed in prior data breaches.

- Crypto holders represent 35% of high-value SIM swap targets.

- 18-34 year-olds account for 22% of reported SIM swap cases.

- High net worth individuals face 4x higher SIM swap attack rates.

- 65% of victims ignored carrier verification calls during attacks.

- Females comprise 52% of documented SIM swap victims

Cryptocurrency SIM Swap Impact

- $33 million in cryptocurrency was stolen via a T-Mobile SIM swap, leading to an arbitration award.

- $24 million BTC theft by a teen using SIM swap on the entrepreneur’s accounts.

- Crypto-related SIM swaps account for 35% of high-value U.S. thefts.

- $28.4 million total documented crypto losses from SIM swap attacks.

- $2.17 billion stolen from crypto services by mid-year, SIM swaps enabling 15%.

- 47% of crypto exchange breaches involved prior SIM takeover.

- DOJ recovered $5.4 million BTC from the 2019 SIM swap crypto heist.

- Blockchain irreversibility prevents 92% of SIM swap crypto recovery.

- Crypto holders face 6x higher SIM swap targeting than average users.

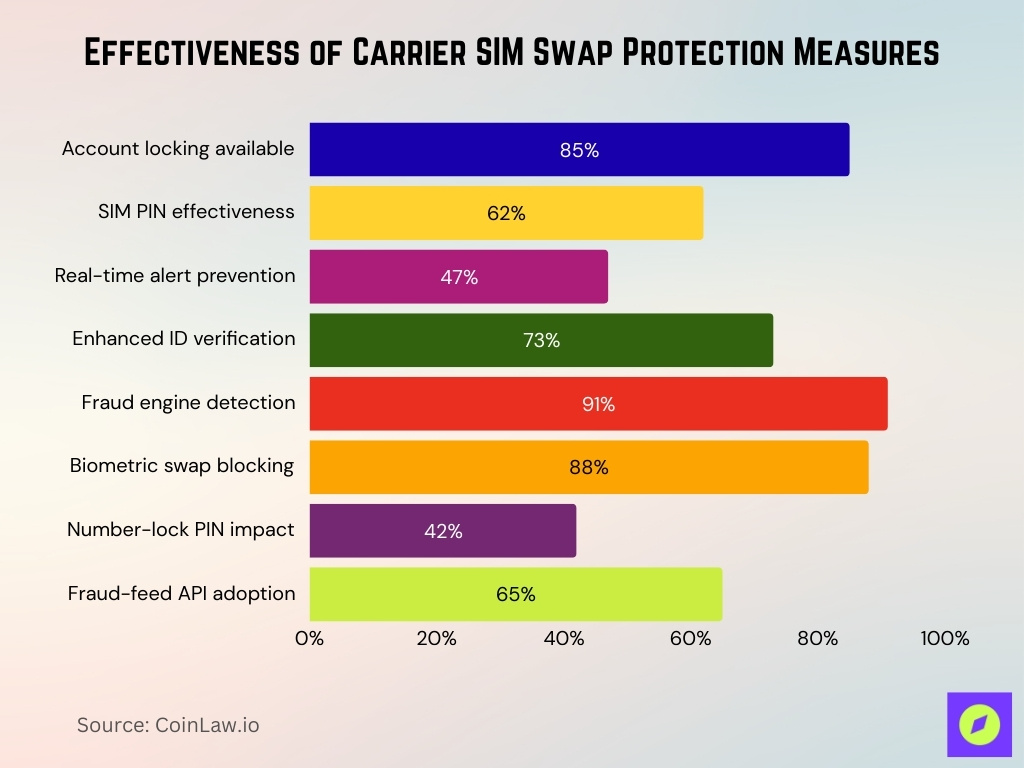

Carrier Protection Features

- 85% of major U.S. carriers now offer account locking features.

- 62% reduction in unauthorized swaps after SIM PIN activation.

- Real-time alerts prevent 47% of attempted SIM changes.

- 73% of carriers require enhanced ID verification for port requests.

- Fraud detection engines flag 91% of suspicious SIM activities.

- Biometric pilots block 88% of social engineering swap attempts.

- 42% drop in mobile takeovers after number-lock PIN rollout.

- Fraud-feed APIs are integrated by 65% of enterprise carriers.

- Verizon’s protections stopped 3,200 swap attempts quarterly.

Financial Losses Overview

- Telecom fraud losses reached $12.5 billion, including SIM swap incidents.

- The average SIM swap victim loss totals $39,000 per the FBI data.

- $33 million T-Mobile liability from a single high-value SIM swap case.

- 982 U.S. SIM swap complaints generated $26 million in losses.

- Global SIM swap fraud constitutes 2.3% of $546 billion cybercrime total.

- Corporate SIM swap incidents average $1.2 million in damages.

- 73% of victims face additional $5,000+ recovery costs.

- High-value attacks exceed $100,000 in 28% of cases.

High-Profile Case Studies

- T-Mobile ordered to pay $33 million in arbitration after SIM swap enabled $43 million crypto theft.

- 15-year-old NY student stole $24 million in BTC via SIM swap on an entrepreneur’s accounts.

- Exetel was fined $695,000 after 73 SIM swaps caused $412,000 in customer fraud losses.

- M&S Retail suffered a major SIM swap attack, compromising executive accounts and customer data.

- DOJ seeks forfeiture of $5.4 million BTC from 2019 SIM swap crypto heist perpetrators.

- 289 to 3,000 UK SIM swaps linked to organized identity theft rings per Cifas.

- Australian telco Medion fined $260,000 for enabling SIM swap scams affecting thousands.

- $28.4 million total crypto losses documented across 12 major U.S. SIM swap cases.

- Palo Alto Unit 42 report details 47% crypto exchange breaches preceded by SIM takeovers.

Why SIM Swaps Are Rising

- 1,055% surge driven by weak telecom identity verification gaps.

- 73% of attacks leverage data from 2.6 billion personal records exposed in breaches.

- 96% success rate from social engineering on carrier support agents.

- Digital banking growth increases SIM swap value by 4x for financial access.

- Automated tools enable 10x scaling of attacks across thousands of targets.

- Remote service reduces ID checks, contributing to a 240% porting fraud.

- eSIM adoption compresses attack windows to under 5 minutes.

- Crypto adoption elevates SIM swaps as 35% of high-value theft enablers.

Business and Compliance Risks

- GDPR fines averaged €2.1 million for SIM swap data breaches.

- 47% customer churn follows SIM-related corporate breaches.

- Insurance premiums rose 35% for firms using SMS 2FA post-SIM incidents.

- 73% compliance audits now mandate SIM swap monitoring.

- Third-party vendor breaches triggered $1.8 million average penalties.

- 62% of class actions stem from unaddressed SIM swap alerts.

- 91% risk frameworks include real-time telecom identity checks.

- Brand value drops 22% after publicized SIM swap incidents.

SIM Swap Prevention

- Authenticator apps block 98% of SMS-dependent SIM swap attacks.

- Number locks reduce unauthorized swaps by 62% across major carriers.

- Real-time SIM detection APIs prevent 85% of high-value fraud attempts.

- Social engineering training cuts victim susceptibility by 73%.

- Signal loss monitoring enables 91% faster incident response.

- Password hygiene programs lower data exposure risks by 47%.

- Incident response plans recover 68% more assets post-SIM swap.

- Telecom risk assessments identify 82% of vulnerabilities preemptively.

- FIDO2 adoption eliminates 96% of phone-based 2FA compromises.

Red Flags and Response

- 87% of victims notice sudden signal loss as the first SIM swap indicator.

- 76% receive unauthorized password reset emails post-SIM takeover.

- Carrier port alerts rejected by 91% of vigilant customers prevent swaps.

- Unusual login alerts follow 68% of successful SIM hijackings.

- Immediate carrier contact recovers 73% of numbers within 1 hour.

- Authenticator resets block 94% of secondary account compromises.

- Financial freezes halt 82% of transactions during SIM swap response.

- Law enforcement reports aid 59% of asset recovery cases.

- 42% faster response via automated fraud monitoring tools.

Frequently Asked Questions (FAQs)

29% of account takeover cases involving SIM swap fraud in the UK in 2024 targeted individuals aged 61 or older.

In reported global data, 90% of SIM swap incidents occurred without victim interaction.

A notable arbitration award stemming from a SIM swap incident in the U.S. involved $33 million tied to cryptocurrency theft.

Conclusion

SIM swapping remains one of the most significant and growing vectors of identity and financial fraud. The rapid rise in incidents reflects both evolving attacker tactics and ongoing dependency on SMS‑based authentication. While carriers, regulators, and businesses are strengthening protections, individuals and organizations must adopt layered defenses and proactive responses. Awareness of risks, coupled with modern authentication and swift reaction to red flags, can limit damage and reduce the threat’s impact. Stay informed, stay vigilant, and treat mobile identity as a fundamental part of your cybersecurity strategy.