Rug pulls have cemented themselves as one of the most damaging scams in cryptocurrency, costing investors billions and shaking confidence in digital assets. Rug pull schemes have direct consequences for retail investors and institutional players alike, especially in DeFi and memecoins, where trust and rapid capital flows are central. This article presents the most current rug pull statistics, offering insight into their frequency, financial impact, and role within the broader crypto crime landscape.

Editor’s Choice

- $500 million was estimated to be lost to rug pull scams in the previous year alone.

- The average amount stolen per rug pull rose to ~$510,000 in 2025.

- NFT rug pulls made up around 14% of scam cases in 2025, reflecting their growth.

- Social media drove 80% of rug pull traffic, with platforms like Telegram and Discord dominating promotion.

- Binance Smart Chain (BSC) hosted ~71% of all rug pull scams in 2024 due to lower fees and ease of deployment.

Recent Developments

- In early 2025, rug pull incidents reportedly fell by 66% year-over-year in some trackers, though losses surged to nearly $6 billion.

- Crypto scams overall set new records in 2024, partly due to AI-enabled attacks and highly automated fraud operations.

- Reports indicate that over 62% of meme coins launched in 2025 were flagged as potential rug pulls within 30 days.

- High-profile political rumors around tokens like $LIBRA caused market spillovers, showing how rug pull-like events can affect mainstream sentiment.

- Research shows thousands of tokens exhibiting suspicious patterns that could indicate rug pull behavior, including 22,195 tokens on Solana alone.

- Smart contract detection tools are being developed with 95.3% precision to identify rug pull schemes before they occur.

- Rug pull research has broadened to encompass 34 root causes, suggesting more diverse scam mechanisms than previously understood.

Scam Tokens Deployed by Exploit Type

- Honeypots dominate scam deployments, with 98,442 tokens, showing that trapping users into non-sellable tokens remains the most common exploit tactic.

- Hidden mint functions account for 60,985 scam tokens, enabling developers to inflate supply after launch and dilute investor holdings.

- Fake ownership renunciations appear in 48,974 tokens, misleading users into believing contracts are immutable while control is secretly retained.

- Hidden balance modifiers affect 8,340 tokens, allowing scammers to arbitrarily change user balances without visible contract changes.

- Hidden transfer logic is found in 2,026 tokens, restricting or selectively blocking token movements after investors buy in.

- Hidden fee modifiers, used in 823 tokens, silently increase transaction taxes to drain value during trades.

- Hidden max amount modifiers are the least common, with just 40 tokens, but still pose a high risk by covertly limiting sell sizes.

Key Rug Pull Statistics at a Glance

- ~2,100 investors are typically involved in a rug pull project before it collapses.

- 75% of rug pull projects lacked audited smart contracts.

- NFT rug pulls accounted for 14% of incidents in 2025.

- Social media promotions contributed to 80%+ of investor traffic to rug pull schemes.

- Binance Smart Chain hosted 71% of rug pull scams in 2024.

- Younger investors dominated victim demographics, especially those under 35, making up 63% of victims.

- Over 60% of new meme coins in 2025 were flagged as potential rug pulls within 30 days.

Number of Rug Pull Incidents per Year

- Rug pull reports suggest fewer incidents in early 2025 compared with the same period of 2024, dropping from 21 to 7 incidents in one tracker.

- Despite fewer incidents, financial losses increased sharply, illustrating that scams became more impactful.

- Historic comparisons show rug pulls grew from a negligible fraction of scams in 2020 to a significant threat by 2021.

- Rug pulls constituted 37% of all crypto scam revenue in 2021, indicating how early they became widespread.

- The creation of scam tokens surged alongside DeFi growth between 2021 and 2024.

- On some blockchains, hundreds of thousands of suspicious pools or tokens exhibit characteristics common to rug pulls.

- Short-lived projects (active < 6 months) make up a large share of documented rug pull scams.

- Rug pull frequency often spikes during crypto bull markets, as speculative capital flows increase.

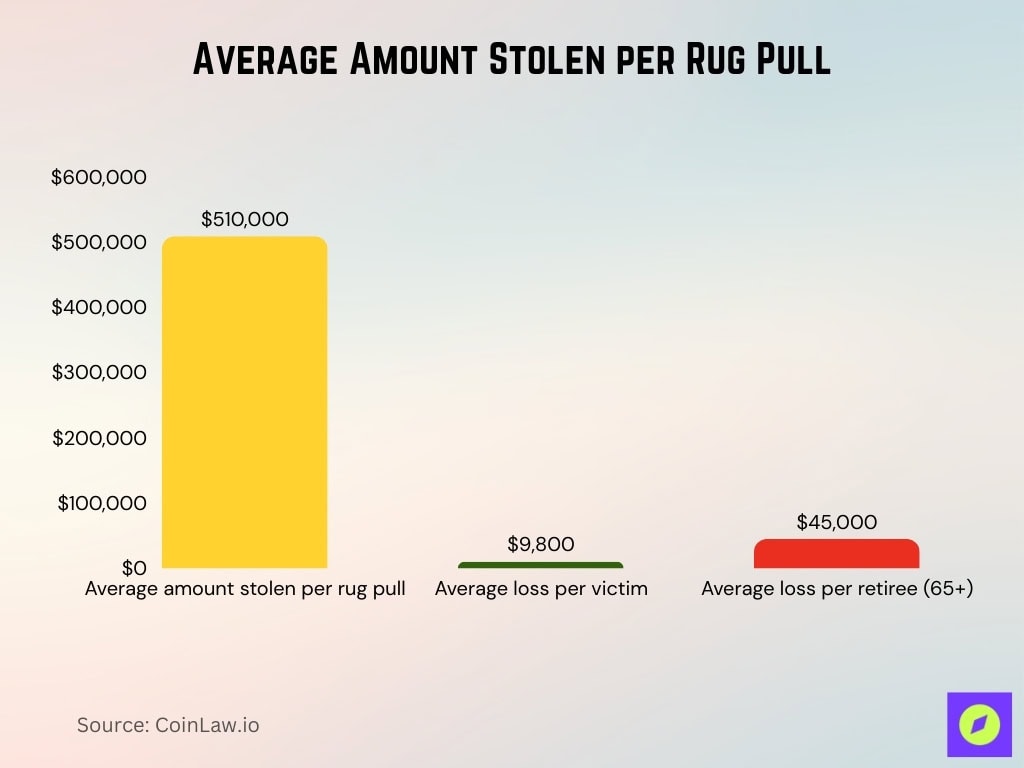

Average Amount Stolen per Rug Pull

- The average stolen per rug pull reached $510,000.

- Victims lost an average $9,800 in rug-pull scams.

- 65% of victims lost over $10,000 each.

- Retirees over 65 lost an average $45,000 each.

- The largest single rug pull drained $290 million.

- Corporate investors lost over $500 million in one case.

- 95% of financial losses remain unrecoverable.

- Average per incident across DeFi crimes hit $29.9 million.

- Exchange hacks averaged $50 million each.

Share of Rug Pulls in Overall Crypto Crime

- Rug pulls drained $900 million from new tokens amid rising scams.

- Memecoins comprised 80% of all rug pulls in DeFi fraud.

- DeFi rug pulls caused $6 billion in losses early in the year.

- Rug pulls accounted for 35% of the DeFi platform’s stolen funds.

- Total projected crypto theft exceeded $5 billion, with scams dominant

Average Loss per Victim

- Individuals lost an average $9,800 in rug pulls.

- 65% of victims lost over $10,000 each.

- Retirees over 65 lost an average $45,000 each.

- 22% of victims were scammed multiple times.

- Median crypto fraud loss reached $5,400.

- Phishing victims averaged $790 loss.

- 150,000 Americans lost $5.2 billion total.

- 10,000 victims hit by ATM scams lost $333 million.

- The average per incident $20,717 in scams.

Rug Pull Losses by Blockchain or Network

- BSC hosted 72% of rug pull incidents.

- Ethereum accounted for 19% of rug pulls.

- Solana rug pulls showed a 37% increase.

- Polygon saw a 15% rise in Ponzi rugs.

- Solana pools exhibited 93% soft rug pulls.

- Ethereum lost $183 million to attacks.

- Solana suffered $17 million in losses.

- BSC dominated due to low fees and ease.

DeFi vs CeFi Rug Pull Statistics

- DeFi platforms bore $1.39 billion in losses vs CeFi $408.9 million.

- 82% of rug pulls targeted DeFi tokens.

- Rug pulls made 65% of all DeFi scams.

- DeFi took 25% of scam platforms, rising to 30%.

- CeFi suffered $1.809 billion from 22 incidents.

- DeFi had 126 incidents, losing $649 million.

- 52% DeFi crime events targeted protocols, causing 83% damages.

- 41% DeFi events are caused by malicious actors like rug pulls, at 17% damage.

- The crypto industry lost $30 billion, with 2/3 CeFi and 1/3 DeFi.

- DeFi Q1 rug pulls reached $6 billion.

Rug Pulls by Crypto Sector (DeFi, NFTs, Memecoins, Metaverse)

- DeFi rug pulls drove nearly $6 billion in losses, up 6,500% year over year.

- Memecoin scams alone wiped out over $500 million from investors.

- Rug pulls drained $900 million from new token launches across sectors.

- NFT rug pulls have contributed more than $1.1 million in single-collection exits like Frosties.

- Overall, crypto and NFT rug pulls and scams have cost over $27 billion to date.

- Pump.fun-style memecoins saw 98.6% of 7 million tokens as rugs or pumps, with only 97,000 retaining $1,000+ liquidity.

- One DeFi-focused Mantra rug pull alone erased $5.52 billion in investor value.

- Meme-focused rug pulls now account for the majority of recorded rug incidents in recent data.

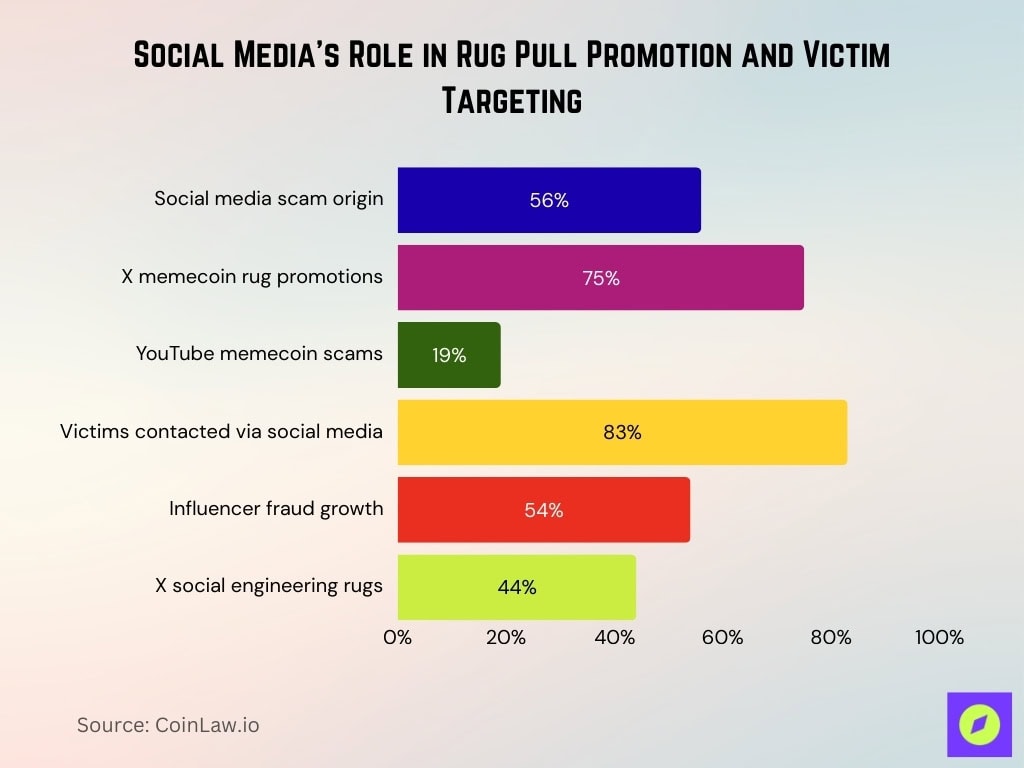

Rug Pulls and Social Media Promotion Statistics

- 56% of all cryptocurrency scams originate from social media platforms like Telegram and X (Twitter).

- 75% of memecoin rug pulls used compromised social accounts on X for promotion.

- 19% of memecoin scam attacks occurred on YouTube, amplifying rug pull hype.

- 83% of victims were first contacted via social media, led by Telegram channels.

- 1,500 active scam Telegram channels promoted fake airdrops and rug pulls.

- Influencer-driven fraud campaigns surged 54% on YouTube, Telegram, and TikTok.

- 44% of social engineering scams on X resulted in direct rug pulls.

Project Type (DEX, Yield Farms, Tokens, NFTs)

- About 60% of tokens on major DEXs are active for less than one day, signaling high rug-pull risk.

- On BSC, 65.6% of analyzed liquidity pools showed exit-scam rug pull patterns.

- On Ethereum, 81.1% of examined 1-day token pools exhibited rug pull behavior.

- Researchers flagged 272,349 potential rug pulls on BSC liquidity pools alone.

- Ethereum DEXs showed 21,742 suspected rug-pull pools tied to short-lived tokens.

- MetaYield Farm, a DeFi yield project, stole $290 million from over 14,000 investors.

- NFT rug pulls made up 14% of all rug pulls, with losses totaling $450 million.

- Roughly 72% of crypto Ponzi schemes promoted fake staking or yield-farming opportunities.

- About 82% of all rug pulls targeted DeFi tokens tradable on DEXs.

Geographic Distribution of Rug Pulls and Victims

- Nearly 150,000 Americans filed crypto scam complaints, many tied to rug pulls.

- About 1 in 20 US adults were hit by crypto scams involving rugs and other fraud.

- Asia accounted for roughly 60% of global crypto theft volume, including rug pulls.

- Europe reported around $800 million in NFT and crypto scam losses.

- Africa’s crypto losses jumped by approximately 150% year over year.

- Global scams cost victims $5.2 billion in reported US-linked theft alone.

- Rug pulls and related scams helped drive a 7,192% surge in exit-scheme volumes from 2022 to 2024.

Demographics of Rug Pull Victims

- Retail investors suffered 74% of total crypto fraud losses, over $12.7 billion.

- Victims aged 25-40 made up 64% of crypto fraud reports.

- Men accounted for 71% of reported crypto scam victims.

- Older people over 60 lost $3.2 billion, more than all younger groups combined.

- Gen Z (18-24) faced 2.8× higher risk from social media crypto scams.

- Novice investors with no prior experience formed 52% of scam cases.

- 83% of victims were first contacted via social media, led by Telegram.

- Quick-return seekers were 3.4× more likely to fall for rug pulls and Ponzi schemes.

- In the US, nearly 150,000 people filed crypto scam complaints, including many rug pull victims.

Soft vs Hard Rug Pull Statistics

- Soft rug pulls rose by 35%, outpacing hard rug pulls in growth.

- Hard rug pulls made up 55% of rug pull cases, soft rugs 45%.

- Average soft rug pull duration is 8 months, versus <24 hours for hard rugs.

- Soft rug pulls between 2024–2025 increased by a further 33%.

- Soft rug pulls caused about $1.2 billion in losses in a single year.

- In 38% of hard rug pulls, the scam occurred within 7 days of launch.

- Deceptive tokenomics or hidden mint functions appeared in 36% of hard rugs.

- On Solana’s Raydium, 93% of pools showed soft rug pull characteristics.

- Median loss in Solana soft rug pulls was $2,832, with a max of $1.9 million.

Rug Pull Frequency vs Market Cycles (Bull vs Bear Markets)

- Rug pull frequency historically surges during bull markets, with speculative activity rising.

- Phishing losses, correlated with rug scams, hit $31 million in Q3 2025 Ethereum bull rally.

- Phishing losses jumped 29% of the yearly total during the market’s strongest rally.

- Attacks intensify in bull phases when trading volumes and optimism peak.

- Scam activity drops in bear corrections but shifts to higher-impact incidents.

- Flash loan attacks in rug pulls rose to 18% during volatile 2025 periods.

- Soft rug pulls grew 35% as bull conditions fueled more launches.

Law Enforcement and Regulatory Actions on Rug Pulls

- SEC charged blockchain engineer Eric Zhu with $1.7 million “Game Coin” rug pull fraud.

- FCA banned 87 crypto firms for suspected fraud, including rug pulls.

- Indian ED froze $240 million in Ponzi-linked crypto assets.

- Interpol issued 18 red notices for rug pull and Ponzi masterminds.

- DOJ, FBI, and Secret Service formed Scam Center Strike Force targeting crypto scams.

- SEC filed charges against 3 fake crypto platforms misappropriating $14 million.

- Only 6% of stolen crypto funds have been recovered through legal actions.

Frequently Asked Questions (FAQs)

At least $500 million was reportedly lost to rug pull scams in the past year.

About 92% of rug pulls in 2025 involved developers using anonymous identities.

In a certain rug pull detection study, about 70% of addresses created just one token.

A detection model identified around 4,801 rug pull tokens in real‑world scenarios.

Conclusion

Rug pulls remain a persistent and evolving threat in the crypto ecosystem heading. While reported incident counts have declined in some periods, the financial impact per scam continues to grow, driven by memecoin hype, social media amplification, and increasingly sophisticated tactics. Data across project types, demographics, and regions shows that both retail and institutional participants face real exposure. As regulatory oversight expands and detection tools improve, investor awareness and due diligence remain the most effective defenses against rug pull losses.