Optimism remains one of the top Ethereum Layer‑2 (L2) scaling solutions, offering lower fees and faster transactions for decentralized finance (DeFi), NFTs, and smart contracts. Its adoption influences how users interact with Ethereum, helping retail traders execute cheaper trades and enabling developers to build scalable applications. From financial product launches to on‑chain games leveraging Optimism’s reduced gas fees, the network’s growth reflects broader trends in blockchain efficiency and usability. Scroll down to explore detailed Optimism statistics across key metrics like market cap, user activity, TVL, and more.

Editor’s Choice

- Optimism handles 1.57 billion transactions across Superchain in H1.

- Superchain TVL reaches $6.3 billion, representing 42.8% of Ethereum L2 TVL.

- OP Mainnet processes an average of 800,000 daily transactions.

- Flashblocks reduce block times to 250 milliseconds from 2 seconds.

- Optimism’s Superchain spans 34 OP Chains and drives over 50% of all L2 activity and 10%+ of overall crypto activity in H1 2025.

- 1,452 developers contributed to Optimism GitHub repos in the past year.

- Superchain drives 50% of all L2 activity across 34 OP Chains.

Recent Developments

- Superchain Upgrade 16a was deployed on October 2, enhancing interoperability and gas limits.

- Flashblocks launched in September 2025, reducing block times to 250ms from 2 seconds.

- CCTP V2 integration enables fast USDC cross-chain transfers in seconds.

- OKX migrates XLayer to OP Stack, helping the Optimism Superchain power over 50% of Ethereum L2 activity and 10%+ of total crypto activity in H1 2025.

- Season 8 governance launches with 4 stakeholder voting groups on August 1.

- 31.34 million OP tokens unlocked on November 29, representing 1.74% circulating supply.

- Interop Layer roadmap targets mainnet early 2026, unifying 29 OP Stack chains.

- OP Stack adoption reaches dozens of chains, including Base and World Chain.

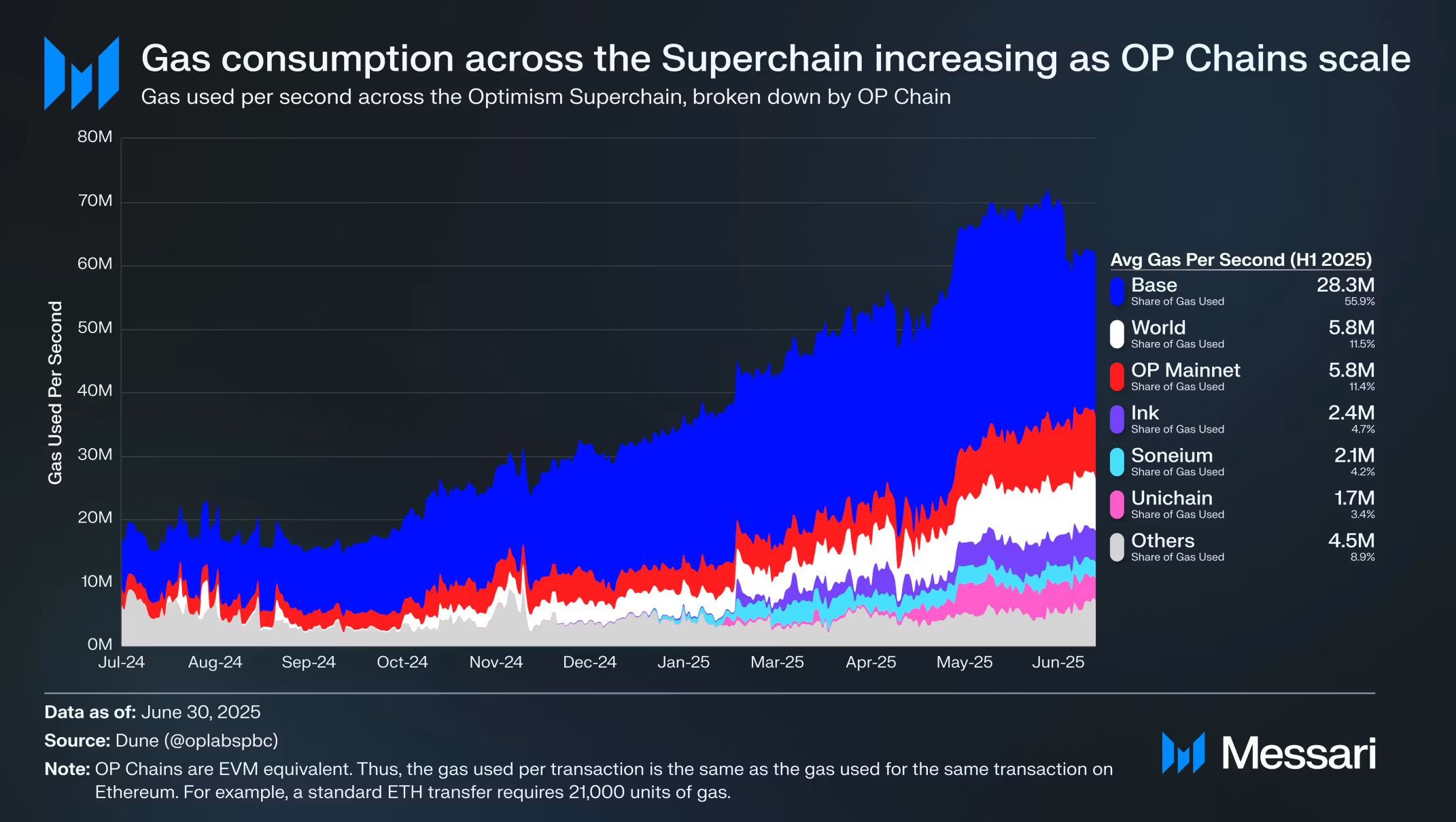

Optimism Superchain Gas Usage Breakdown

- Base dominates gas consumption, averaging 28.3 million gas per second, accounting for 55.9% of total Superchain activity.

- World and OP Mainnet each consume about 5.8 million gas per second, representing ~11.5% and 11.4% shares respectively.

- Mid-tier OP Chains like Ink (2.4 million) and Soneium (2.1 million) together contribute nearly 9% of total gas usage.

- Unichain averages 1.7 million gas per second, holding a 3.4% share despite lower transaction volume.

- Other OP Chains combined generate 4.5 million gas per second, equal to 8.9% of network demand.

- Total Superchain gas consumption exceeds 50 million gas per second, highlighting rapid scaling across OP-based networks in H1 2025.

Optimism Market Capitalization Statistics

- As of late December 2025, OP’s market cap fluctuated around $520 million–$840 million on major trackers.

- Latest rankings placed OP in the top ~80–120 crypto assets by market cap.

- OP’s circulating supply was ~1.94 billion tokens, out of a max around 4.29 B.

- Some aggregators reported Optimism valuations near $1.08 billion earlier in 2025.

- Fully diluted market cap (FDV) has hovered near $1.1 billion in parts of the year.

- Daily trading volumes often exceeded tens of millions USD, indicating market liquidity.

- Price volatility persisted, with short‑term declines tied to token unlocks and L2 competition.

- Market cap changes tracked broader crypto cycles and rival L2 performance patterns.

Total Value Locked (TVL) On Optimism

- As of late 2025, aggregated TVL across the Optimism Superchain was around $6.3 billion.

- Optimism’s share of Layer‑2 TVL trails larger competitors like Arbitrum but remains among the top scaling networks by locked assets.

- Across all Layer‑2s, total TVL in 2025 peaked above $16 billion, illustrating broader scaling adoption.

- Bridged TVL for OP Mainnet alone has exceeded $1.8 billion in locked assets at recent 2025 peaks.

- TVL performance signals how liquidity responds to incentives, upgrades, and competitive offerings.

- Stablecoin dominance within TVL metrics indicates a preference for low‑volatility assets in liquidity pools.

- Changes in TVL reflect shifting protocol priorities as builders experiment with cross‑chain capital deployment.

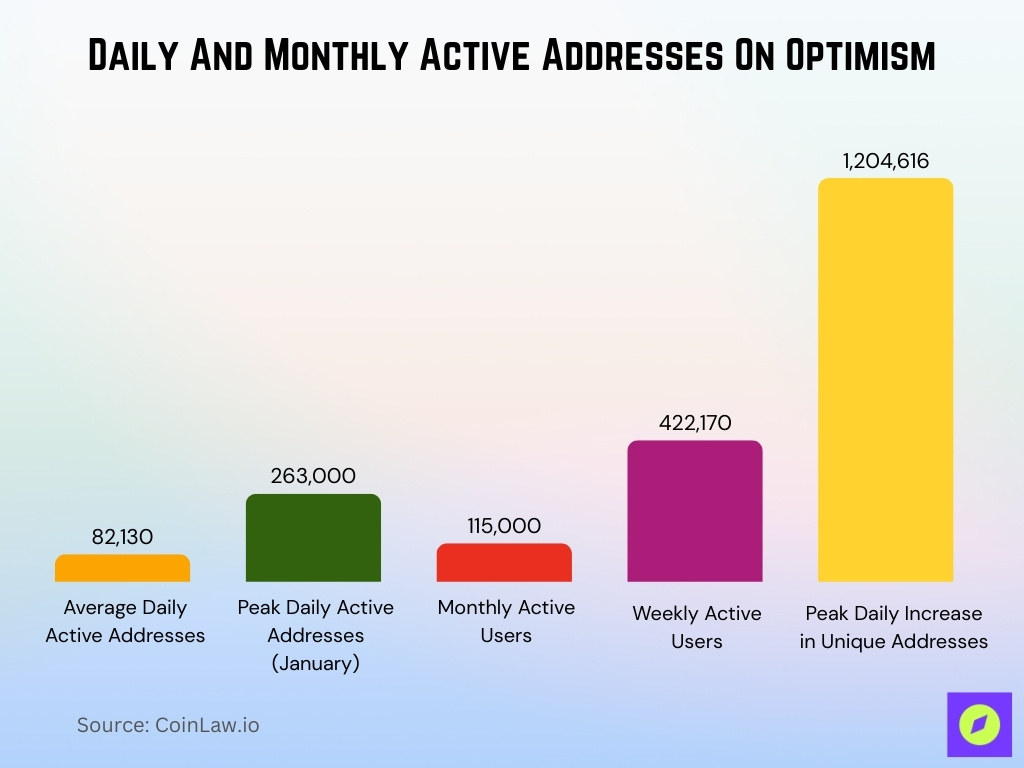

Daily And Monthly Active Addresses On Optimism

- Daily active addresses average 82,130 across OP Mainnet.

- January daily active addresses reach 263,000, ranking top 15 chains.

- Monthly active users exceed 115,000 on the Optimism network.

- Superchain handles 36.4% of all Layer 2 transactions via active addresses.

- Daily active addresses trail Arbitrum by 30-50% post-Dencun upgrade.

- Weekly active users hit 422,170, reflecting 38.2% growth.

- Unique addresses grow by 1,204,616 in the peak daily increase.

Transaction Volume And Throughput On Optimism

- Throughout 2025, Optimism and its Superchain ecosystem collectively processed hundreds of millions of transactions, reflecting ongoing use across DeFi and dApps.

- Optimism’s Superchain now spans 34 OP Chains, contributing over 50% of all Layer‑2 activity on Ethereum scaling networks.

- That same network expansion also accounts for 10%+ of total crypto activity, showing cross‑sector uptake.

- OP Mainnet alone has seen DEX trading volumes in the tens of millions per day, indicating steady throughput.

- Bridged TVL figures near $1.24 billion point to substantial asset movement activity on-chain.

- Active transaction throughput grows as sequencer optimizations like Flashblocks improve block speeds.

- CCTP V2 integration in mid‑2025 enabled faster cross‑chain USDC settlements, indirectly boosting throughput metrics.

- Competing Layer‑2s like Arbitrum and Base show larger volumes, but Optimism maintains consistent throughput within its ecosystem.

- Total transactions recorded on Optimism’s Superchain networks contribute meaningfully to Ethereum’s scaling capacity.

Leading DeFi Protocols On Optimism

- OP Mainnet DeFi TVL typically ranges around $700–800 million in 2025, fluctuating with incentives and market cycles.

- DEXs record $67.64 million 24h trading volume.

- Perps volume hits $12.53 million daily across protocols.

- Stablecoins market cap stands at $640.99 million.

- Velodrome leads Optimism DEXs with top TVL dominance.

- 42 DeFi projects operate natively on the Optimism ecosystem.

- Weekly DEX volume totals $513.41 million with 6.43% growth.

- Aave holds a significant lending TVL share on OP Mainnet.

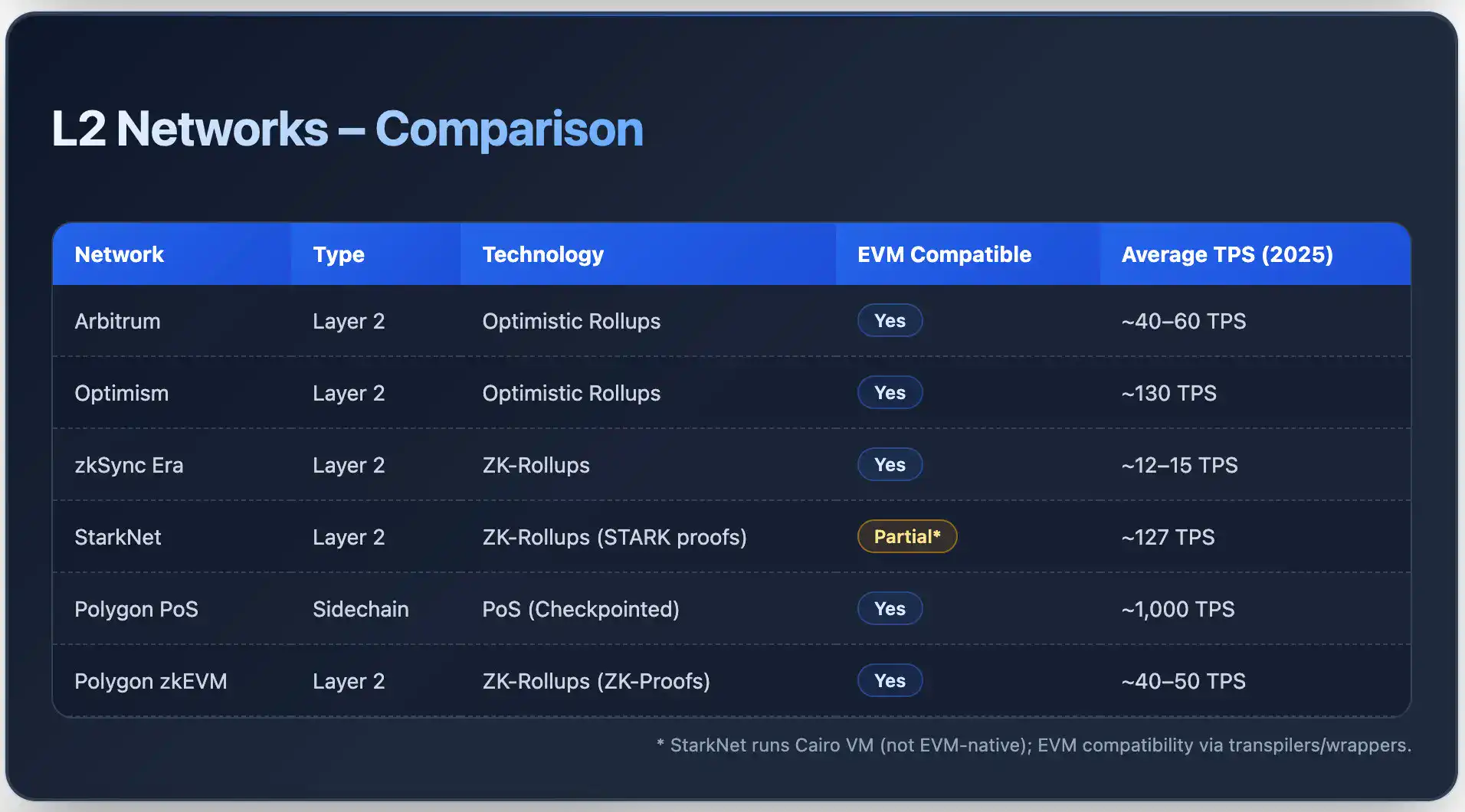

Layer 2 Networks Performance Comparison

- Optimism leads major L2s in throughput, averaging 130 TPS, outperforming Arbitrum (40–60 TPS) and zkSync Era (12–15 TPS).

- StarkNet approaches Optimism’s performance with 127 TPS, despite partial EVM compatibility.

- Polygon PoS delivers the highest throughput overall at 1,000 TPS, though it operates as a sidechain.

- Polygon zkEVM processes around 40–50 TPS, aligning closely with Arbitrum’s lower range.

- Most leading networks maintain full EVM compatibility, while StarkNet relies on wrappers despite reaching 127 TPS.

NFT Trading Volume And Collections On Optimism

- Optimism NFT 24h trading volume reaches $768 across collections.

- Optimism Quests leads with $1.037 million market cap and 13 sales.

- CryptoTesters collection floor price at 0.074 ETH with 51% 24h change.

- 14 active NFT collections operate exclusively on Optimism.

- Optimism Ape Yacht Club records $82,205 market cap.

- OptiChads NFT floor stands at 0.002 ETH with 24.8% 30d growth.

- Total Optimism NFT market cap exceeds $2.7 million.

- Bored Town Optimism achieves $72,530 market cap with 3 sales.

- Uniswap V3 Positions NFT holds $495,845 market cap.

Number Of Users And Wallets On Optimism

- OP Mainnet cumulative unique addresses have surpassed 450 million all‑time, reflecting sustained onboarding since 2023.

- OP Mainnet records over 450 million total unique addresses according to on‑chain explorers.

- Active addresses surge to 1.23 million across the network.

- Daily active addresses average 82,130 on OP Mainnet.

- Peak daily active addresses hit 170,000 before settling at 80,000.

- Single-day address increase peaks at 1,204,616 new wallets.

- Layer 2 user growth achieves 42% year-over-year expansion.

- Active addresses spike to 38,000 during network airdrops.

- Monthly active addresses exceed 115,000 unique wallets.

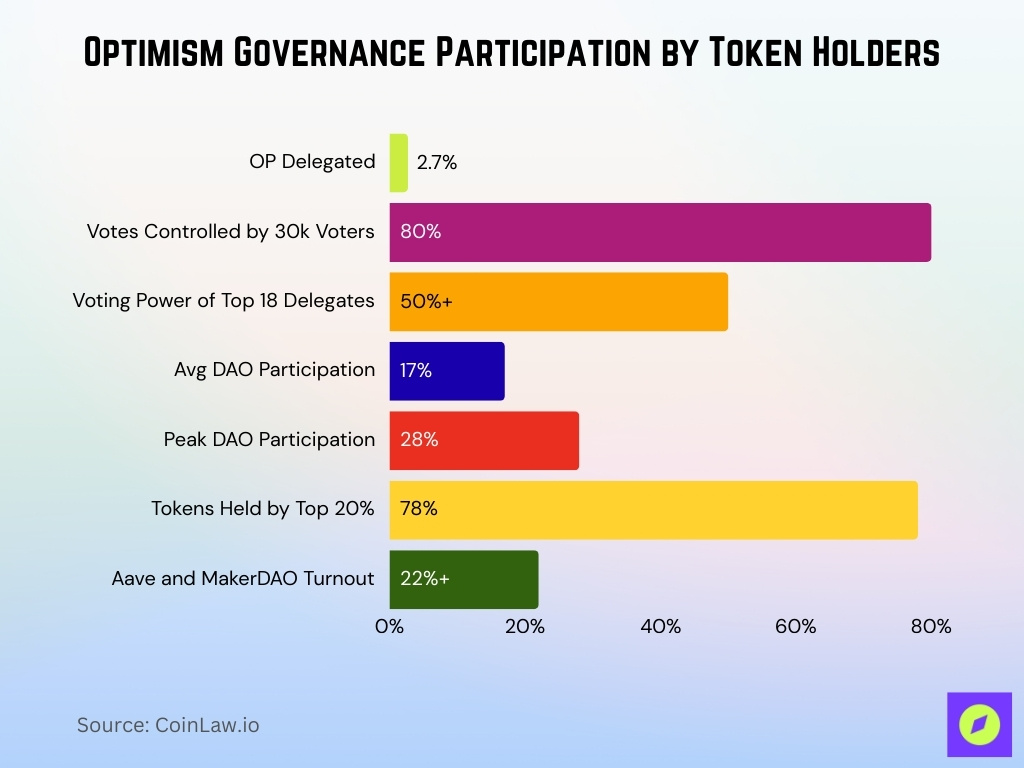

OP Token Holder Participation In Governance

- Total OP supply fixed at 4.29 billion tokens with 1.25 billion circulating.

- 116 million OP (~2.7%) delegated for Token House governance voting.

- 30,000 voters control 80% total votes despite minimal individual power.

- 18 delegates control over 50% delegated voting rights record.

- DAO voter participation averages 17% with top projects reaching 28%.

- There are roughly 1.37–1.38 million unique OP token holders recorded on‑chain as of late 2025.

- 78% governance tokens held by top 20% stakeholders.

- Quorum met by fewer than 8 representatives consistently.

- Aave and MakerDAO achieve 22%+ turnout on critical Optimism votes.

Developer Activity and GitHub Statistics for Optimism

- ethereum-optimism/optimism repo garners 6,000 stars and 4,000 forks.

- 1,452 developers contributed to Optimism repositories past year.

- Optimism outpaces peers with developer growth since 2023, per Electric Capital.

- ethereum-optimism/developers repo attracts 95 stars and 58 forks.

- OP Stack ecosystem spans 1.7 million analyzed repositories.

- Monthly active blockchain developers hit 23,615 with Ethereum L2 spillover.

- Optimism smart contract deployments surge 5x year-over-year.

- Superchain registry tracks dozens of OP Stack chain deployments.

Security Incidents And Exploit Statistics On Optimism

- Optimism bug bounty program offers up to $2,000,042 for critical vulnerabilities.

- DeFi contract exploits drop 38% YOY amid improved Layer-2 auditing practices.

- Crypto hacks surge to $2.2 billion with 21% increase versus prior year.

- OP Stack undergoes dozens of comprehensive security audits.

- Moonwell exploit on Optimism risks over $1 million via price feed vulnerability.

- Access control flaws drive 59% of DeFi losses exceeding $1.6 billion.

- Bedrock upgrade implements two-step withdrawals, enhancing bridge security.

- October DeFi exploits total $38.6 million across 9 incidents.

- Ethereum L2 developers conduct 8.7 million smart contract audits ecosystem-wide.

Frequently Asked Questions (FAQs)

There are about 1.94 billion OP tokens circulating, which is ~45% of the 4.29 billion maximum token supply.

Optimism has secured around $6 billion in total value locked (TVL), compared with Arbitrum at approximately $16.63 billion and Base at $10 billion (2025 figures).

The Optimism Superchain spans 34 OP Chains and accounts for over 50% of all Layer‑2 (L2) activity and more than 10% of total crypto activity.

Some sources estimate OP’s market cap near $888 million, showing variation depending on price feeds and data platforms.

Conclusion

Optimism stands as a mature Ethereum Layer‑2 ecosystem, marked by millions of wallet addresses and active users, thousands of developers engaging with its open‑source repositories, and nuanced governance participation by OP token holders. Security remains a core focus, supported by audits and bounty programs, even as broader crypto incident trends improve. Wallet adoption, developer tooling, and governance evolution underscore Optimism’s role in scaling Ethereum while offering insights into the shifting dynamics of Layer‑2 solutions.