NEAR Protocol stands tall as a scalable, AI-native Layer‑1 blockchain with real-world influence in decentralized finance and cross-chain interaction. It fuels efficient DeFi platforms, serving millions in transaction volume, while its developer grants and sharding upgrades support sophisticated Web3 applications. NEAR supports cost-efficient token bridges such as Rainbow Bridge and powers AI-enhanced dApps like NEAR-Chat and NEAR.Cognition, reflecting growing AI integration in blockchain ecosystems.

Editor’s Choice

- $2.47 – Current NEAR price (as of August 22, 2025).

- $3.1 billion – Market capitalization via circulating supply (1.25 bn NEAR).

- 600 ms blocks / 1.2 s finality achieved with Nightshade 2.0 upgrade (May 2025).

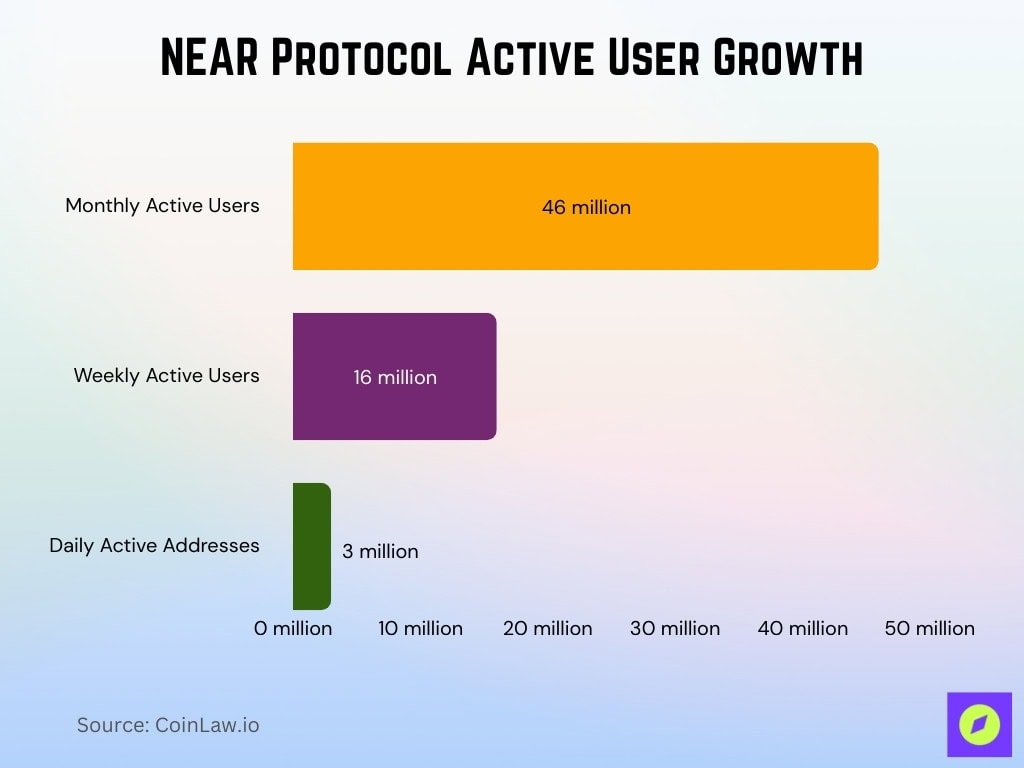

- 46 million – Monthly active users as of May 2025.

- 254 validators, with 44.9% of supply staked by the end of Q1 2025.

- $240 million – DeFi Total Value Locked at close of Q4 2024.

- 15.8% QoQ growth in daily returning addresses in Q4 2024.

Recent Developments

- Launch of NEAR Dev incubator for dApp teams (February 3, 2025).

- NIGHTSHADE 2.0 upgrade in May 2025 reduced block time to 600 ms, finality 1.2 s.

- Inflation cut proposal, halving from 5% to 2.5%, aligning tokenomics with usage (mid‑2025 governance).

- NEAR Intents integrates direct swaps into Sui, expanding cross‑chain utility (July 2025).

- Ecosystem agreements, validator tooling with OpenMesh/DappNode, funding for Nuffle Labs (mid‑2025).

- Co‑founders spoke at TOKEN2049 Dubai, promoting AI and telecom partnerships (May 2025).

- Public RPC endpoint deprecation announced, shift toward more sustainable node options (summer 2025).

Real‑Time Price

- $2.47 – live NEAR price (as of August 22, 2025).

- –3.5% change over the past 24 hours.

- 24‑hour low/high, $2.43 / $2.56.

- Year‑to‑date price drop, –42.2%, ranging between $1.80–$8.24.

- All‑time high, $20.42 (January 16, 2022), currently –88% from that peak.

- All‑time low, $0.526 (November 4, 2020), current level is +370% above that floor.

- Forecast NEAR to average around $2.50 in 2025, with a possible peak of $3.04 by September, assuming neutral macroeconomic trends and continued ecosystem growth

- Price leveled at $2.50, stable through the rest of 2025.

Developer & Ecosystem Activity

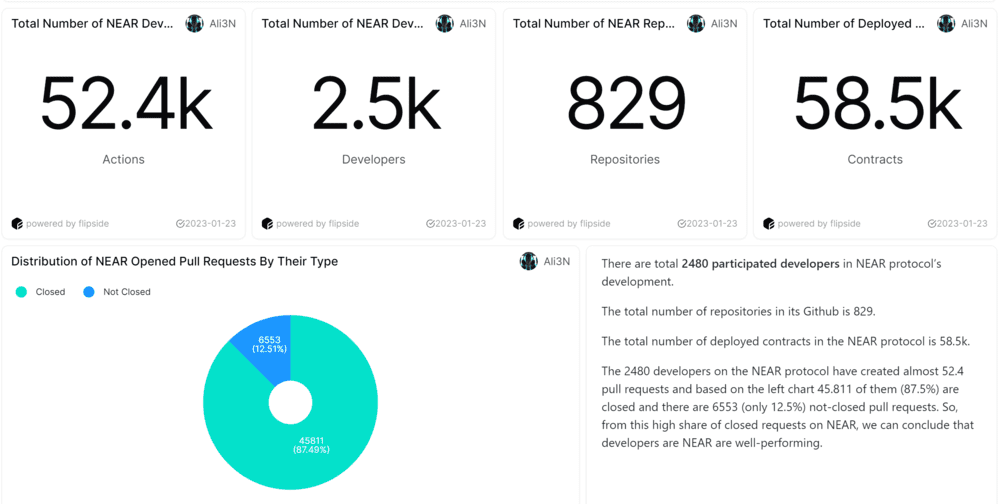

- NEAR recorded over 52.4k developer actions, reflecting strong engagement in its ecosystem.

- The network is supported by around 2.5k developers, with 2,480 actively participating in protocol development.

- Developers contribute across 829 repositories, showcasing consistent open-source activity.

- More than 58.5k contracts have been deployed on the NEAR blockchain, underscoring real-world usage.

- Out of total pull requests, 45,811 (87.5%) are closed, while 6,553 (12.5%) remain open, indicating high efficiency and strong follow-through from NEAR’s developer base.

Market Capitalization & Fully Diluted Valuation

- Estimated market cap, $3.09B based on current price ×1.25B circulating supply.

- Figure, $3.045B.

- FDV roughly mirrors market cap due to the close alignment of circulating and total supply.

- Liquidity and demand fluctuations influence market ranking (#36).

Circulating Supply vs. Total Supply

- Circulating supply 1.25B NEAR tokens.

- 1,248,510,000 NEAR, giving a similar figure.

- Total/maximum supply not clearly disclosed, FDV aligns with circulating cap.

- No significant unlocked token cliffs reported for 2025, aiding supply stability.

Trading Volume

- 24‑hour trading volume, $136M.

- Volume reported at $128.6M, down 23% day-over-day.

- Active trading across NEAR pairs.

- Volume dips linked to short-term bearish sentiment.

- Higher volumes aligned with institutional pulses, e.g., early August rallies.

Ecosystem Growth and Funded Projects

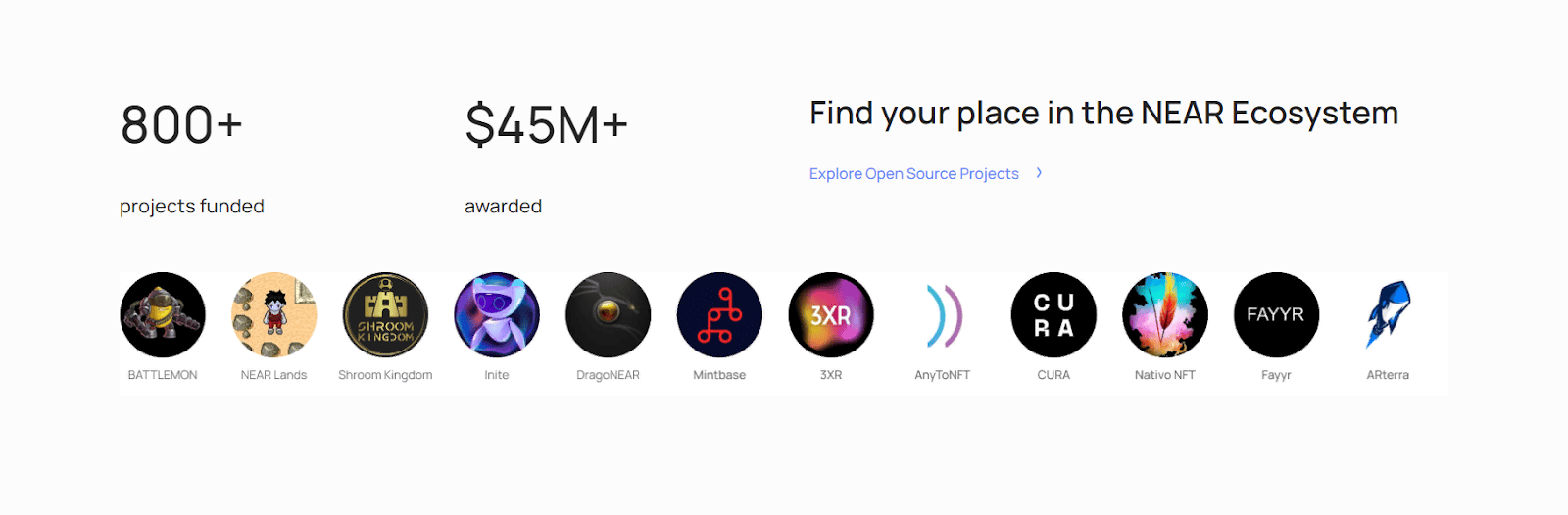

- NEAR has supported over 800 projects through its funding initiatives.

- More than $45 million has been awarded to builders and innovators across the ecosystem.

- Notable funded projects include Battlemon, NEAR Lands, Shroom Kingdom, Inite, DragoNEAR, Mintbase, 3XR, AnyToNFT, CURA, Nativo NFT, Fayyr, and ARterra.

All‑Time High vs. All‑Time Low

- $20.42, all‑time high reached on January 16, 2022, current price sits –88% below that peak.

- $0.526, an all‑time low on November 4, 2020, the current price is +370% above that floor.

- Intraday price swings in August 2025 ranged over 6–7%, reflecting high volatility around both ATH and ATL levels.

- Institutional selling on August 14 caused a 6.9% price drop, underscoring sensitivity near these extremes.

- Support at $2.75–$2.80 proved resilient during sell‑offs, while resistance near $2.90–$3.00 remains unbroken.

- Despite massive selling, NEAR rebounded to $2.82 within hours, demonstrating recovery strength.

- Institutional flows continue to drive volatility, but long‑term price anchors remain intact.

- Patterns suggest ATH and ATL are increasingly distant references; current action centers instead on mid‑range support and resistance zones.

Institutional Activity

- $10.1 million of inflows from institutional investors in mid‑August sparked a 6% rally from $2.57 to $2.73.

- Global crypto investment products captured $572 million in inflows, with NEAR among the top beneficiaries.

- Weekly active users hit 16 million, up 18.4%, surpassing Solana’s 14.8 million, drawing institutional interest.

- On August 14, institutional selling of 32.2 million tokens triggered a swift 6.9% drop, with volume 3,500% above average.

- Heavy selling occurred in concentrated bursts, two trades of 19.99M and 12.22M tokens within hours.

- On August 8, institutional flows drove trading of 18.9 million units, with algorithmic selling of 120,000 units in just four minutes.

- Analysts flagged these patterns as signs of corporate sophistication but also market fragility.

- Institutional activity remains a key driver of NEAR’s mid‑term price action, both upside and downside.

NEAR Protocol Price Predictions

- In 2025, NEAR’s price is projected between $2.21 (min) and $5.40 (max), with an average around $4.01.

- By 2026, estimates rise to $5.26–$6.29, averaging $6.11.

- In 2027, forecasts suggest growth to $7.24–$8.57, with an average near $8.35.

- By 2028, NEAR could trade between $9.45 (min) and $11.09 (max), averaging $10.28.

- For 2029, projections show prices in the $11.63–$13.44 range, with an average of $12.89.

- In 2030, NEAR is expected to climb higher, ranging from $16.54 (min) to $18.37 (max), averaging $17.58.

- By 2031, bullish forecasts place NEAR between $23.90–$25.74, with an average prediction of $25.34.

Network Performance

- NEAR’s protocol achieves an average of 80 transactions per second (TPS), with observed testnet peaks hitting 4,135 TPS during load testing scenarios, as per Pagoda’s engineering blog and blockchain explorer data.

- Measured average 63.73 TPS via sharding.

- Nightshade 2.0 upgrades parallel sharding, boosting real-world throughput significantly.

- 600-millisecond block times, with 1.2-second finality, are among the fastest in the blockchain space.

- NEAR’s Nightshade roadmap aims for a theoretical throughput of up to 1 million TPS in testnet environments, a benchmark detailed in technical proposals outlining long-term scaling potential rather than present-day reality.

- Compared to major networks, NEAR’s performance supports real-time AI and DeFi apps.

- Following the Nightshade 2.0 and Protocol 79 upgrades, NEAR reduced end-to-end latency by up to 30% in selected workloads, enhancing user experience and dApp responsiveness according to developer benchmark reports.

- Validators remain decentralized and responsive, reflected in competitive TPS and block times.

Tokenomics & Staking

- NEAR’s static inflation rate stands around 4.5% annually, distributed as staking rewards.

- Governance discussions are underway to halve inflation to 2.5%, aiming to boost token scarcity.

- 11.6 million NEAR are already staked under the current inflation model.

- Reduction to 2.5% inflation prompted a comment, “Cut inflation to 2.5% and we’ll buy 10M NEAR.”

- The inflation cut could spark supply shock dynamics, possibly tightening markets.

- Reward distributions scale with actual stake share across validators; staking remains attractive.

- All key upgrades, e.g., stateless validation, increase participation, indirectly reinforcing staking incentives.

Active Addresses and User Growth

- MAUs reached 46 million by May 2025, placing NEAR just behind Solana in network scale.

- Weekly active users also climbed to 16 million, highlighting sustained growth momentum.

- Daily activity peaked at 3 million unique addresses, eclipsing Tron and Solana.

DeFi & Ecosystem

- Rhea Finance introduced $rNEAR, a multi‑chain liquid staking token, enhancing liquidity and cross‑chain options.

- NEAR Intents integrated with Stellar and Sui, smoothing intent-driven DeFi and reducing friction.

- Partnership with Everclear in July 2025 aims at $1B+ cross‑chain stablecoin clearing.

- DeFi TVL stands near $218 million.

- Electric Capital’s 2025 Developer Report lists NEAR among the top Layer‑1s with over 2,500 monthly active developers contributing to smart contract infrastructure and AI-native app tooling.

- Sharding advances (Protocol 77, 79) reduce fees and boost DeFi usability.

- Ecosystem diversification continues via gaming, AI apps, and tooling grants.

Network Security & Vulnerabilities

- No major hacks or fund losses have occurred in recent years.

- In October 2024, a “Web3 Ping of Death” vulnerability was discovered and patched before exploitation, with no downtime or loss.

- Protocol upgrades, stateless validation, and sharding aim to reduce attack surfaces and improve resilience.

- Shift to stateless validation also strengthens decentralization by lowering hardware requirements.

- Developer oversight of sharding and chain abstractions bolsters audit capabilities.

- Upgrade pipeline follows rigorous testnet/mainnet cycles to avoid rollout disruptions.

- Protocol has demonstrated a robust security posture despite rapid expansion.

Total Value Locked (TVL)

- NEAR Protocol’s TVL stands at approximately $160 million, a slight 2.4% increase in the past 24 hours.

- DeFi items like Burrow, LiNEAR, and Meta Pool Near have fueled recent TVL growth.

- As of April 15, 2025, NEAR’s market cap–to–TVL ratio reached 22.2, indicating the token may be overvalued relative to DeFi usage.

- Analysts caution that TVL can be misleading; it may reflect inflated capital figures rather than real value.

- TVL remains a useful barometer of ecosystem activity and protocol confidence.

Network Activity and Transactions

- Q4 2024 saw 7.9% QoQ growth in daily transactions, driven by expanding ecosystem demand.

- Nightshade sharding and cross-chain tools continue to support a rising trend in transaction activity.

- By May 2025, NEAR’s monthly active users (MAUs) surged to 46 million, making it the second-largest Layer‑1 blockchain.

- NEAR led all blockchains in weekly active users, 16 million active users, up 18.4% week‑over‑week.

- In Q3 2024, the network catered to around 3 million daily active users, surpassing other high-traffic chains.

- Growth reflects higher engagement from both retail users and AI‑powered dApps.

Validator and Staking Statistics

- Q1 2025 data shows average daily DEX volume jumped 101.1% QoQ, signaling rising validator demand.

- Stablecoin market cap rose 2.0% QoQ to $697.2 million, adding depth to staking-related activity.

- Although detailed figures on validator counts and staking ratios are not available, this corresponds with broader staking trends.

Token Supply and Distribution

- As of April 15, 2025, NEAR’s total supply stood at 1.245 billion, with 1.2175 billion (97.7%) circulating.

- The top 10 holders control 25.55% of the supply, suggesting moderate centralization.

- No large token unlock cliffs reported for 2025, in line with earlier supply observations.

Sharding and Scalability Metrics

- NEAR’s Nightshade sharding delivers 600‑ms block times and 1.2‑second finality, among the fastest in crypto.

- Scalability developments target millions of TPS in test-net environments, signaling high throughput potential.

Energy Consumption and Sustainability

- Current sources do not provide specific data on NEAR’s energy use or sustainability.

- Its sharded PoS consensus is inherently more energy-efficient than older proof-of-work chains.

Conclusion

NEAR Protocol continues to expand across multiple dimensions. Its TVL reflects growing DeFi engagement, while network activity, with tens of millions of active users, signals real adoption. Active addresses and transactions continue rising, supported by sharding, AI integration, and staking. The token supply and distribution remain balanced, even as scalability promises future growth. That said, metrics like TVL can be misleading without context, and energy data needs more visibility. Overall, NEAR shows strong fundamentals and upward momentum. Readers curious about validator trends, ecosystem breakdowns, or long-term forecasts, stay tuned for deep dives in upcoming analyses.