From Bitcoin’s digital gold dominance to Tether’s record-breaking market cap, today’s most valuable cryptocurrencies define the shape of global finance. Today, over $3.8 trillion in total market capitalization is spread across coins serving vastly different purposes: store of value, decentralized computing, stable settlement, and meme-fueled speculation. This guide breaks down the top cryptocurrencies by market value, exploring what makes them dominant and what investors need to know about their real-world utility and long-term potential.

Key Takeaways

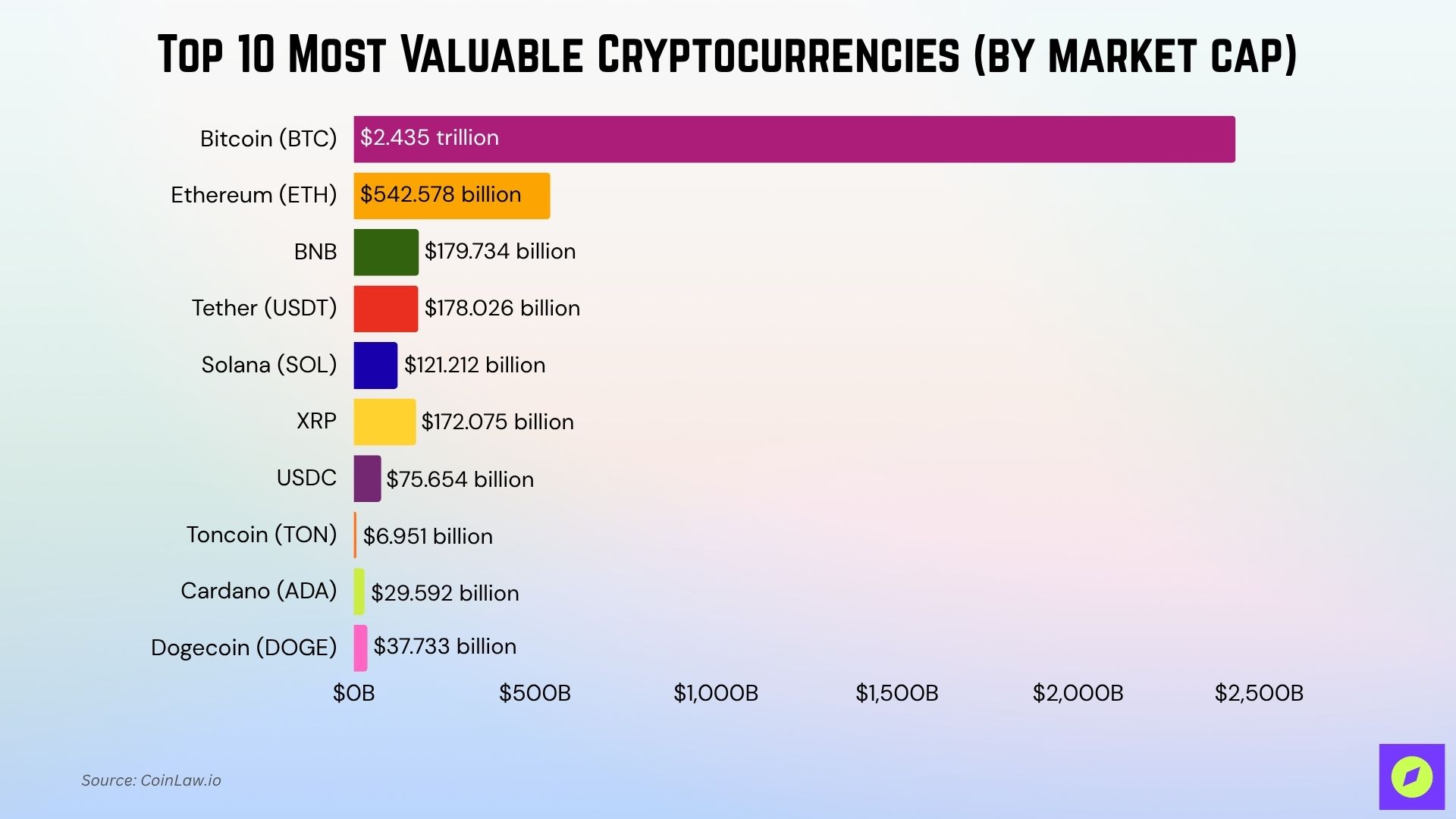

- Bitcoin dominates the market with a $2.435 trillion valuation and a price of $122,120 per coin.

- Ethereum ranks #2 with a $542.6 billion market cap, powering DeFi and smart contracts.

- Tether (USDT) and BNB are neck-and-neck around the $178–179 billion mark.

- XRP climbs to #6, now worth over $172 billion, with a price surge to $2.87.

- Toncoin’s market cap remains relatively low at $6.95 billion, despite strong ecosystem momentum.

What Makes a Cryptocurrency Valuable?

While price alone grabs headlines, true value is measured by market capitalization, calculated as:

Market Cap = Token Price × Circulating Supply

However, crypto investors also evaluate:

- Utility & Ecosystem Reach (DeFi, NFTs, payments, etc.)

- Adoption Metrics (wallets, users, institutions)

- Tokenomics (supply limits, burn rates, issuance schedules)

- Security & Network Strength (decentralization, uptime, validators)

- Liquidity & Integration (exchange listings, trading volume, fiat access)

Top 10 Most Valuable Cryptocurrencies

The top-ranked cryptocurrencies represent the most dominant forces in the digital asset landscape, combining scale, liquidity, and widespread adoption. These assets often set the tone for market sentiment and innovation across the broader blockchain ecosystem.

| Rank | Cryptocurrency | Market Cap | Price | Circulating Supply |

| 1 | Bitcoin (BTC) | $2.435 trillion | $122,120 | 19.93 million |

| 2 | Ethereum (ETH) | $542.578 billion | $4,488 | 120.70 million |

| 3 | BNB | $179.734 billion | $1,290.00 | 139.18 million |

| 4 | Tether (USDT) | $178.026 billion | $1 | 177.91 billion |

| 5 | Solana (SOL) | $121.212 billion | $221 | 546.08 million |

| 6 | XRP | $172.075 billion | $2.87 | 59.87 billion |

| 7 | USDC | $75.654 billion | $1.00 | 75.66 billion |

| 8 | Toncoin (TON) | $6.951 billion | $2.75 | 2.52 billion |

| 9 | Cardano (ADA) | $29.592 billion | $0.82 | 35.83 billion |

| 10 | Dogecoin (DOGE) | $37.733 billion | $0.25 | 151.26 billion |

1. Bitcoin (BTC) – Digital Gold at an All-Time High

As the original cryptocurrency, Bitcoin continues to influence investor sentiment and global digital asset policy. Its role in portfolio diversification and inflation hedging keeps it firmly in the spotlight across economic cycles.

- Market Cap: $2.435 trillion

- Price: $122,120

- Circulating Supply: 19.93 million

- Why It’s Valuable: Bitcoin is often referred to as “digital gold” due to its fixed supply and decentralized architecture, and it has seen increased institutional adoption, though it still significantly trails gold in total market value.

2. Ethereum (ETH) – DeFi Infrastructure & Web3 Engine

Ethereum’s programmable blockchain has become foundational for decentralized economies, enabling innovation across sectors from finance to digital identity. Its ability to evolve through upgrades ensures continued relevance in the Web3 era.

- Market Cap: $542.6 billion

- Price: $4,488

- Circulating Supply: 120.70 million

- Why It’s Valuable: Ethereum dominates the smart contract economy, with a flourishing Layer 2 ecosystem and deflationary tokenomics. It anchors DeFi, NFTs, and stablecoins.

3. BNB (Binance Coin) – Ecosystem Utility & Exchange Powerhouse

BNB fuels a growing ecosystem of decentralized apps, token launches, and on-chain governance tied to one of the most active exchange networks in the world. Its integration across multiple blockchain services strengthens its staying power.

- Market Cap: $179.7 billion

- Price: $1,290

- Circulating Supply: 139.18 million

- Why It’s Valuable: BNB powers Binance’s trading, gas fees on BNB Chain, and token burns. Despite regulatory scrutiny, its use across DEXs and launchpads keeps value rising.

4. Tether (USDT) – The Liquidity Backbone

Tether offers a stable, dollar-pegged gateway for crypto users in both developed and emerging markets. Its widespread adoption makes it a vital layer in global crypto liquidity and settlement infrastructure.

- Market Cap: $178.0 billion

- Price: $1.00

- Circulating Supply: 177.91 billion

- Why It’s Valuable: As the most-used stablecoin, USDT anchors trading pairs across exchanges. It’s essential for cross-border settlements and DeFi liquidity pools.

5. Solana (SOL) – High-Speed, High-Utility Layer-1

Solana’s architecture prioritizes performance, attracting developers seeking scalability without compromising user experience. Its expanding developer ecosystem supports diverse use cases in gaming, finance, and digital collectibles.

- Market Cap: $121.2 billion

- Price: $221

- Circulating Supply: 546.08 million

- Why It’s Valuable: Solana’s speed and low fees make it the preferred chain for NFTs, gaming, and mobile wallets. With growing institutional adoption, it cements its place as an Ethereum alternative.

6. XRP – Banking Rail & Global Settlement Layer

XRP is engineered for high-speed transfers across financial networks, with appeal for institutions looking to modernize global payment rails. Its focus on interoperability positions it for utility beyond speculation.

- Market Cap: $172.1 billion

- Price: $2.87

- Circulating Supply: 59.87 billion

- Why It’s Valuable: XRP is promoted by Ripple for use in cross-border settlements, and some banks have explored pilots, but mainstream banking adoption remains limited and regionalized.

7. USD Coin (USDC) – The Compliant Stablecoin

USDC combines price stability with transparent reserve backing, offering businesses and protocols a trusted digital dollar. Its expanding use in fintech, payroll, and tokenized assets signals growing real-world relevance.

- Market Cap: $75.65 billion

- Price: $1.00

- Circulating Supply: 75.66 billion

- Why It’s Valuable: Known for transparency and regulatory alignment, USDC is preferred by fintechs and institutions for DeFi, payments, and tokenized real-world assets.

8. Toncoin (TON) – Telegram’s Ecosystem Engine

Toncoin powers a native Web3 experience inside messaging platforms, unlocking crypto access for non-technical users. Its convergence of social media and blockchain technology represents a unique value proposition.

- Market Cap: $6.95 billion

- Price: $2.75

- Circulating Supply: 2.52 billion

- Why It’s Valuable: Toncoin is integrated with Telegram’s in-app wallet and mini-apps, and has seen increasing activity, though full ecosystem adoption is still in early stages.

9. Cardano (ADA) – Academic Blockchain with PoS Governance

Cardano emphasizes scientific research and formal verification to guide its development roadmap. Its measured approach appeals to long-term builders focused on sustainable blockchain adoption.

- Market Cap: $29.6 billion

- Price: $0.82

- Circulating Supply: 35.83 billion

- Why It’s Valuable: ADA continues to focus on peer-reviewed upgrades, staking security, and decentralized governance. While slower to deploy dApps, it maintains long-term ecosystem loyalty.

10. Dogecoin (DOGE) – Memecoin with Real Volume

Dogecoin‘s origins as a meme evolved into a community-driven movement with surprising staying power. Its cultural influence and transactional simplicity keep it actively used despite its unconventional beginnings.

- Market Cap: $37.7 billion

- Price: $0.25

- Circulating Supply: 151.26 billion

- Why It’s Valuable: Dogecoin is frequently used for tipping on social platforms like Reddit and Twitter, with some merchants accepting DOGE, though broader commercial usage remains limited.

Honorable Mentions: Rising Stars Outside the Top 10

Beyond the top rankings lies a dynamic field of emerging projects gaining traction through unique technologies and real-world applications. These rising stars often signal where the next wave of growth, disruption, or investor interest may unfold.

- Avalanche (AVAX): Expanding subnet architecture for enterprise and gaming.

- NEAR Protocol (NEAR): Known for seamless UX and developer onboarding.

- Arbitrum (ARB): Dominates Ethereum L2 activity and TVL.

- Render (RNDR): Gaining traction in AI, 3D rendering, and metaverse integrations.

- Chainlink (LINK): Powers decentralized oracles with growing RWA and DeFi use.

These tokens may climb into the top ranks based on ecosystem traction, use-case expansion, or regulatory tailwinds.

Risks That Could Reshape Value Rankings

The crypto market is highly sensitive to macro trends, regulatory shifts, and technological vulnerabilities. Even well-established projects must adapt quickly to maintain their position in an ecosystem defined by rapid change.

- Regulatory Shocks: Global crackdowns on stablecoins, centralized exchanges, or privacy coins, and U.S. and EU decisions could disrupt valuations overnight.

- Security Incidents: Smart contract hacks, bridge exploits, or chain halts (e.g., Solana in prior years).

- Technological Obsolescence: Failure to scale, upgrade, or attract developers (risk for L1s like Cardano).

- Tokenomics Pressure: Inflationary supply increases, token unlock cliffs, or poor burn economics.

- Sentiment Swings: Meme coins like DOGE and SHIB are most vulnerable to hype cycles and celebrity influence.

Frequently Asked Questions (FAQs)

Bitcoin’s dominance has recently dropped below 60 % of the total market’s capitalization.

The forecast CAGR is 13.1 % for that period.

Saros surged by 1,379 % in H1 2025.

The global crypto market cap was over $3.9 trillion.

Conclusion

The most valuable cryptocurrencies aren’t just defined by price or market cap; they reflect deeper trends in innovation, adoption, and global financial transformation. From Bitcoin’s institutional maturity to emerging ecosystems like Solana and Toncoin, each project holds a different place in the evolving Web3 landscape.

As the industry matures, utility, governance, and scalability are becoming just as important as speculation. For investors, builders, and observers alike, staying informed about how and why value shifts is key to navigating the future of digital assets with confidence.