LBank has rapidly emerged as a major centralized cryptocurrency exchange, shaping global digital‑asset trading with millions of users and multi‑billion‑dollar daily volumes. Founded in 2015, the platform supports an expanding roster of coins, embraces diverse markets, and competes with long‑standing players in the exchange ecosystem.

Across industries, institutions use LBank for liquidity sourcing and automated market making, while retail traders rely on it for access to fast listings and speculative memecoins. This article offers a data‑rich look at LBank statistics, helping you understand its scale, reach, and performance metrics. Explore deeper to gauge where LBank stands in today’s crypto landscape.

Editor’s Choice

- 20M+ registered users globally as of late 2025, marking a meaningful milestone in user adoption.

- $8.5 billion+ peak daily trading volume reported in 2025, up sharply from prior periods.

- 800+ supported cryptocurrencies with 900+ tokens and 1,100+ trading pairs.

- Ranked among the Top 10 global crypto exchanges by volume and market influence.

- 160+ countries with active users across LBank’s platform footprint.

- 4%+ share of global spot trading volume reported in late 2025.

- 8/10 trust score on CoinGecko’s exchange metrics, signaling solid operational credibility.

Recent Developments

- LBank reported a 71% quarter‑over‑quarter increase in trading volume, underscoring rapid growth momentum heading into 2026.

- Daily trading volume records peaked at $10.5 billion in late 2025, signaling strong market engagement.

- The exchange launched a $1 billion global talent program to attract developers and ecosystem builders.

- Strategic partnerships, including regional sponsorship of the Argentina National Team, drove brand awareness with 100M+ impressions.

- LBank introduced stablecoin USDT/USDC EARN programs with yields up to 500% APY for users.

- Expansion of reward campaigns with WLFI token distributions for global users enhanced engagement.

- Traffic surged after the exchange’s 10th anniversary campaign, boosting sign‑ups and platform activity.

- CoinGecko and Crypto.News awarded LBank with Top Exchange accolades for performance and growth.

Derivatives Trading Volume Statistics

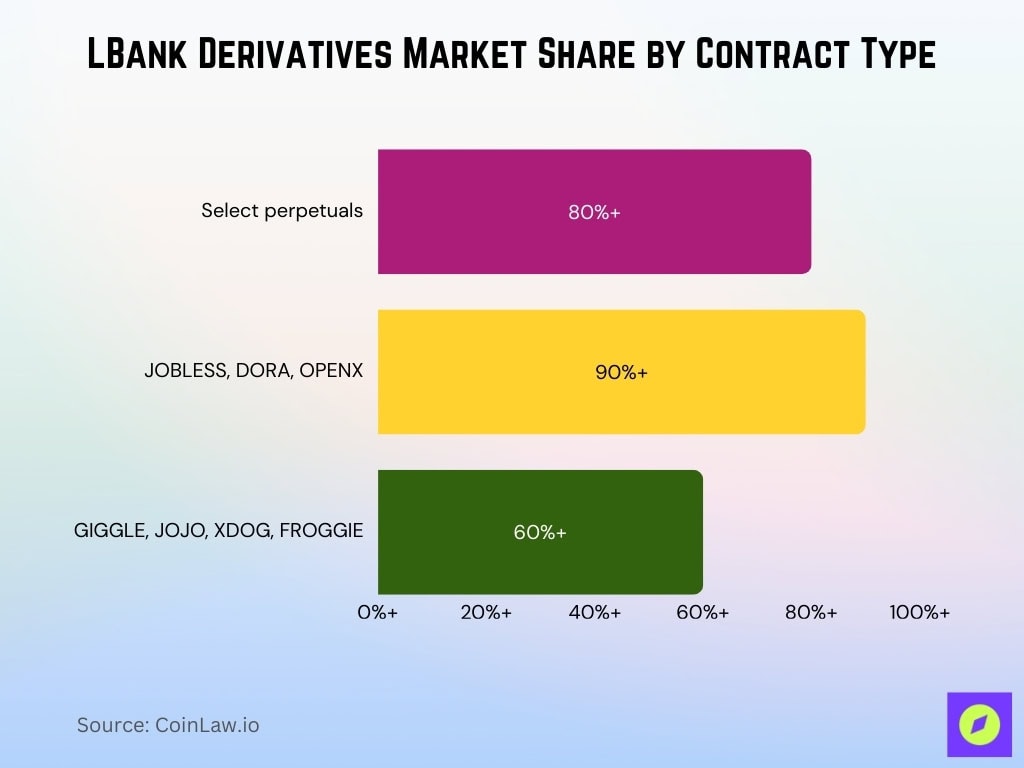

- Captures over 80% market share in select perpetual pairs.

- Dominates 90%+ share in JOBLESS, DORA, and OPENX futures.

- Exceeds 60% share in GIGGLE, JOJO, XDOG, FROGGIE contracts.

- Ranked 8th globally by futures volume as of November 2025.

- Holds top-10 position among derivatives exchanges worldwide.

- Exceptional $190 million depth in SOL futures, leading peers.

- Offers up to 125x leverage on select perpetual futures pairs.

- Daily futures volumes range $4–5 billion amid deep liquidity.

What Is LBank?

- Launched in 2015, LBank operates as a centralized crypto exchange headquartered in the British Virgin Islands.

- The platform supports diverse crypto services, including spot, futures, derivatives, copy trading, and staking.

- It has established a zero‑incident security record over a decade of operation.

- Users can trade in 131+ fiat currencies via over 55 payment methods.

- It offers advanced order types and leverages up to 125× on compatible products.

- LBank aims to provide fast token listings, often within hours of creation.

- The exchange features risk control systems and multi‑region compliance safeguards.

- Its services extend from beginner’s spot trading to advanced derivative instruments.

LBank Exchange Overview

- Supports 917+ coins and 1,104+ trading pairs, projected to reach 1,000 coins and 1,150 pairs.

- 24-hour trading volume averages $3.2 billion, peaking over $4 billion on volatile days.

- BTC/USDT dominates with 14–16% of volume, exceeding $450 million daily.

- Spot fees at 0.10% maker/taker; futures 0.02% maker, 0.06% taker.

- Perpetual futures up to 125x leverage; leveraged ETFs at 3x.

- Trust score 7/10; liquidity spread 0.77%.

- Reserves hold $16.2 million in on-chain assets.

- Fiat ramps for USD, EUR, HKD, BRL, CAD.

- REST/WebSocket APIs for 1,100+ markets

Listed Coins And Trading Pairs

- Lists 917 coins across all markets.

- Supports 1,104 spot trading pairs.

- Added 366 new tokens in Q1 2025 alone.

- Features 800+ cryptocurrencies in total.

- Over 1,000 trading pairs, including futures.

- 185 memecoins listed in Q1, 51% of new assets.

- 288 premium assets added in Q3 across sectors.

- 135 exclusive listings in Q3, 46.88% of total.

- Rapid listings yield a 1.39% 100x token ratio.

Geographic Reach

- Serves users from 160+ countries and regions worldwide while claiming accessibility in over 210 jurisdictions through its global platform reach as of 2025.

- Maintains 20 million+ registered users globally as of 2025.

- Holds licenses in Canada, the US (multiple states), Australia, and Italy for compliance.

- Emerging markets drive 33% YoY user growth amid strong adoption.

- Significant traffic from the US (licensed states) and the EU user bases.

- Supports fiat ramps in USD, EUR, HKD, BRL, and CAD for regional access.

- Sponsors the Argentina national team to boost visibility in Latin America.

- Provides multilingual support in 10+ languages for global traders.

Registration And Compliance Metrics

- Surpassed 20 million registered users in 2025 with 33% YoY growth.

- Draws active users from 160+ countries and regions worldwide, even though the platform’s services are marketed as accessible in over 210 jurisdictions.

- Holds MSB registrations in the US and Canada.

- Maintains AUSTRAC DCE registration in Australia.

- Requires KYC for fiat on-ramps and high withdrawal limits.

- Limits full services in the US and UK due to licensing.

- Provides 24/7 support for compliance queries.

Fee Structure Statistics

- Spot maker/taker fees at 0.10% base rate.

- Futures maker 0.02%, taker 0.06%.

- VIP Level 8 spot fees drop to 0.033% maker.

- Futures VIP Level 8 taker at 0.0405%.

- Referral program offers up to 50% trading fee discount.

- 90% fee rebate for qualified referrers.

- Listing fees reportedly $20,000–$40,000.

- Copy trading features 0% platform fee.

Spot Trading Volume Statistics

- Average daily volume hit $10.5 billion in 2025, up 209% YoY.

- Spot volumes rank among the global top five CEX consistently.

- BTC/USDT leads as the top spot pair by far.

- Memecoin spot share surged from 11.2% to 28.9%.

- Ranked top three for memecoin spot volumes.

- Q3 average daily volume reached $8.5 billion, up 71% QoQ.

- Q1 average daily volume exceeded $4 billion, up 17.5% QoQ.

- Supports hundreds of high-velocity spot token listings.

- Altcoin spot liquidity deepened amid market cycles.

Market Share Among Exchanges

- Secured top-10 global ranking by adjusted spot volume.

- Ranked 8th by futures trading volume worldwide.

- Memecoin market share reached 28.9%, up 100% YoY.

- Dominates 90%+ share in JOBLESS, DORA, OPENX derivatives.

- Leads 80% share in ZENT, EDEL perpetual segments.

- Holds 60%+ in GIGGLE, JOJO, XDOG futures niches.

- $190 million SOL futures depth surpasses peer averages.

- Top 3rd among CEX for memecoin spot volumes.

Traffic And Website Analytics

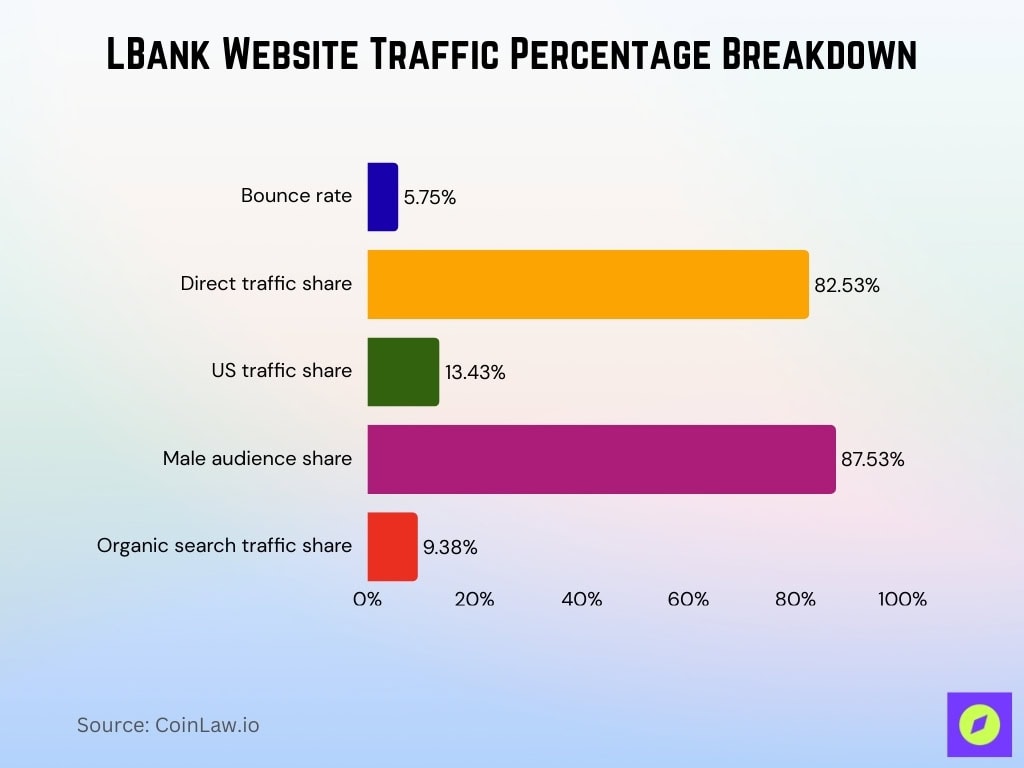

- 14.6 million total monthly visits.

- Global website ranking improved to #801.

- 5.75% bounce rate with 44.30 pages per visit.

- Average visit duration is 11:25 minutes.

- 82.53% direct traffic share.

- US contributes 13.43% of visits.

- 87.53% male audience, 25-34 age dominant.

- 9.38% organic search traffic.

New Listings And Launchpad Performance

- 40.47% of new tokens were premier listings.

- 16 assets hit 100x+ gains post-listing.

- Top 10 new listings averaged 762x returns.

- LBANK EDGE tokens averaged 800% peak gains.

- Meme Launch tokens peaked at over 3,800% average.

- 1.39% of new listings achieved 100x returns.

- LAUNCHCOIN debuted with 152x peak gain.

- BLUM recorded a 123x return on listing.

- 288 premium assets listed in Q3.

Revenue And Profitability Indicators

- Average daily volume $10.5 billion in 2025, up 209% YoY.

- Ranked top-5 CEX multiple times for spot and derivatives.

- Spot fees generate revenue at 0.10% average rate.

- Futures fees range from 0.02%–0.06% maker/taker.

- 20 million+ users drive recurring fee revenue.

- Listing fees contribute $20,000–$40,000 per project.

- Referral discounts of up to 90% off trading fees.

- Q3 daily volume $8.5 billion, 71% QoQ growth.

Security And Risk Management Metrics

- 10 years of operation with zero reported security incidents.

- Intercepted 1,800+ threats in Q1 2025, blocking $200 million in losses.

- Maintains $100 million Futures Risk Protection Fund.

- Partners with Elliptic for real-time AML/KYT screening.

- Serves 20 million+ users across 210+ countries securely.

- Employs a 24/7 AI-driven threat monitoring system.

- The majority of assets are stored in cold wallets offline.

- Supports 2FA, anti-phishing, and device binding.

Proof Of Reserves And Asset Transparency

- Exchange reserves exceed $16.2 million verifiable on-chain.

- Trust score stands at 7/10 on major aggregators.

- Liquidity spread measures 0.77% average.

- 917 coins are listed with full transparency data.

- 1,104 trading pairs are tracked publicly.

- API provides real-time order book depth.

- Annual reports confirm zero major breaches over 10 years.

- Cold storage secures the majority of user assets.

- Public volume metrics audited by third parties.

Partnerships And Ecosystem Growth

- Sponsors the Argentina national football team regionally.

- Partnered with Elliptic for AML/KYT compliance.

- Hosted 1001 Crypto Nights events globally.

- 10 million+ impressions from marketing campaigns.

- $1 billion talent incubation fund launched.

- Sponsored Bitcoin 2025 conference activities.

- Regional meetups in Asia and LATAM held.

- Partnerships with 135+ exclusive token projects.

Mobile App Usage Statistics

- Over 10 million global downloads reported.

- Android app holds a 4.3 rating from 22,200 reviews.

- iOS app rated 3.7 out of 5 from 675 ratings.

- Serves 20 million+ registered users via app access.

- 24/7 customer support is integrated into the app.

- Supports 1,000+ spot pairs on mobile.

- 600+ derivative pairs available.

- Copy trading with 3,500+ lead traders.

- $5 billion+ copy trading capital on the app.

Frequently Asked Questions (FAQs)

LBank supports 962+ cryptocurrencies and 1,141+ trading pairs.

LBank’s platform cites a daily trading volume of around $4+ billion.

LBank’s exchange reserves are reported at approximately $14,045,029 to $16,690,885.

Conclusion

LBank continues to solidify its role as a major centralized crypto exchange with robust traffic growth, expanding mobile engagement, and tangible ecosystem partnerships. Data today, consistent trading volume gains, and strong user participation across markets. While some transparency areas like public proof‑of‑reserves audits remain limited compared with peers, overall platform performance underscores resilient security structures and diverse revenue drivers. LBank’s trajectory through strategic alliances and technology adoption suggests its competitiveness in the evolving global crypto exchange landscape will persist into the future.