Kaspa (KAS) has emerged as one of the most talked‑about layer‑1 cryptocurrencies, driven by its high throughput, unique blockDAG design, and ever‑growing ecosystem. Its performance has captured interest from traders and developers alike, with real‑world usage in fast payments and potential decentralized applications. In finance, Kaspa’s speed has made it a candidate for micro‑transaction networks, while exchanges test new futures and margin markets around KAS activity. Read on to explore the latest Kaspa statistics, from price action and volatility to network growth and developer momentum.

Editor’s Choice

- Market cap around $1.18 billion with a circulating supply of 27.06 B KAS in late 2025.

- Kaspa processed over 158 million transactions in a single day (October 5, 2025), nearly matching Bitcoin’s yearly total.

- Network throughput hit 5,705 TPS at a record point in 2025.

- Average block time remains extremely fast at about ~1 s.

- Max supply capped at 28.7 billion KAS with scheduled halving of emissions.

- Kaspa ranked within the Top 80 cryptocurrencies by market cap in 2025.

Recent Developments

- October 2025 saw Kaspa processing 158 M+ transactions in one day, setting a throughput benchmark.

- In September 2025, the network reached 3,210 TPS, showcasing scaling improvements.

- Protocol updates, including the DagKnight consensus upgrade, are on the roadmap for early 2026.

- Kaspathon hackathon announced for Jan–Feb 2026 with 200,000 KAS in prizes to foster dApp development.

- Node management upgrades rolled out in November 2025 for easier deployment and notifications.

- Expansion of developer tooling to support upcoming smart contract layers.

- Growth in exchange listings and trading pairs has improved global accessibility.

- Social engagement around protocol milestones has spiked on community channels.

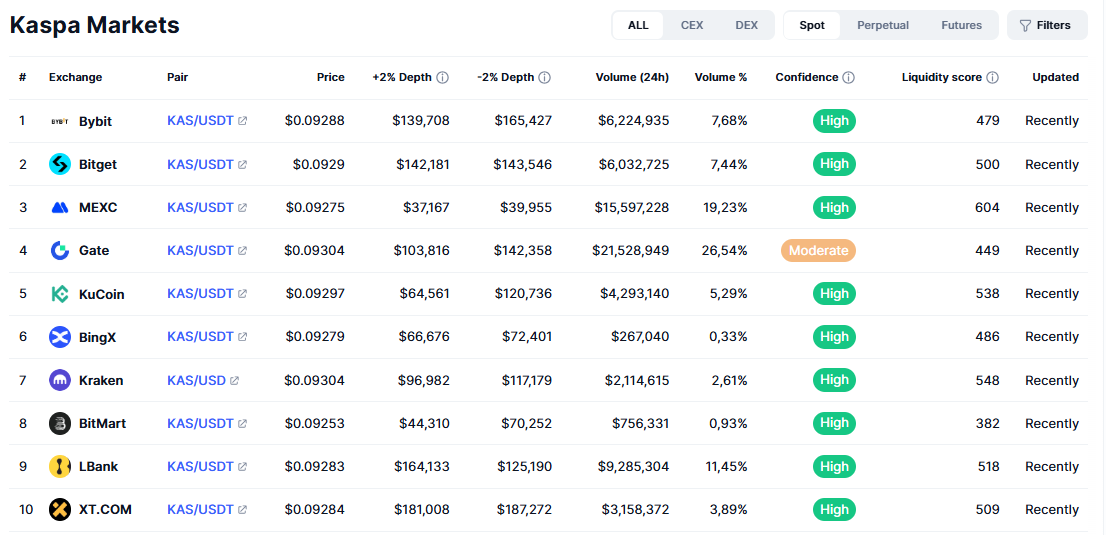

Kaspa Spot Market Liquidity and Order Book Depth

- Gate dominates spot activity with 26.54% of total volume share, reflecting strong trader engagement and consistent order flow.

- MEXC follows with a sizable 19.23% volume share and the highest liquidity score at 604, signaling deep and efficient markets.

- LBank captures 11.45% of trading activity, supported by solid bid and ask depth around current price levels.

- Bybit and Bitget each contribute over 7% of volume share, reinforcing Kaspa’s liquidity across multiple top-tier exchanges.

- Order book depth is strongest on XT.COM, showing $181,008 (+2%) and $187,272 (-2%), indicating tight spreads near market price.

- LBank and Bitget also maintain robust depth, each exceeding $160,000 within the ±2% price range.

- Liquidity quality remains high, with most exchanges posting liquidity scores above 500, led by Kraken at 548 and KuCoin at 538.

- Price alignment across venues is tight, with KAS trading consistently between $0.0925 and $0.0930, reducing arbitrage friction.

- Smaller exchanges still support resilience, as even lower-share platforms maintain meaningful depth and stable pricing.

Kaspa Volatility Indicators

- Short‑term price volatility remains elevated compared to major coins, with ~5.1% daily variance noted on TradingView.

- Weekly declines of ~6.7% observed in late December 2025.

- Price swings have ranged between $0.042 and $0.060 over recent months.

- Technical patterns show Bollinger Band compression, signaling reduced volatility phases.

- Support levels around $0.048–$0.050 are key to maintaining stability.

- Resistance pressure forms near $0.060–$0.070 zones.

- Macroeconomic effects (BTC dominance) influence Kaspa’s swings.

- Volatility correlates with broader crypto trends and liquidity shifts.

Derivatives Metrics (Futures, Perpetuals, Options)

- Futures markets for Kaspa see gradual uptake as institutional interest rises, with open interest climbing to $44.7 million.

- Perpetual swap volumes are increasing on margin platforms, recording 14.24% 24-hour OI growth.

- Funding rates fluctuate with market sentiment shifts, turning positive at 0.0013% amid bullish reversal.

- Open interest figures grow in correlation with volatility spikes, exceeding $70 million during whale surges.

- Bid-ask differences in derivatives inform risk premiums, supported by $80 million daily trading peaks.

- Options markets remain nascent with limited strikes, while futures dominate at $0.06 OI threshold.

- Roll costs reflect trader hedging activity, with positive rates signaling buyer dominance post-correction.

- Significant derivative flows often align with macro crypto events, showing 7% futures OI uptick.

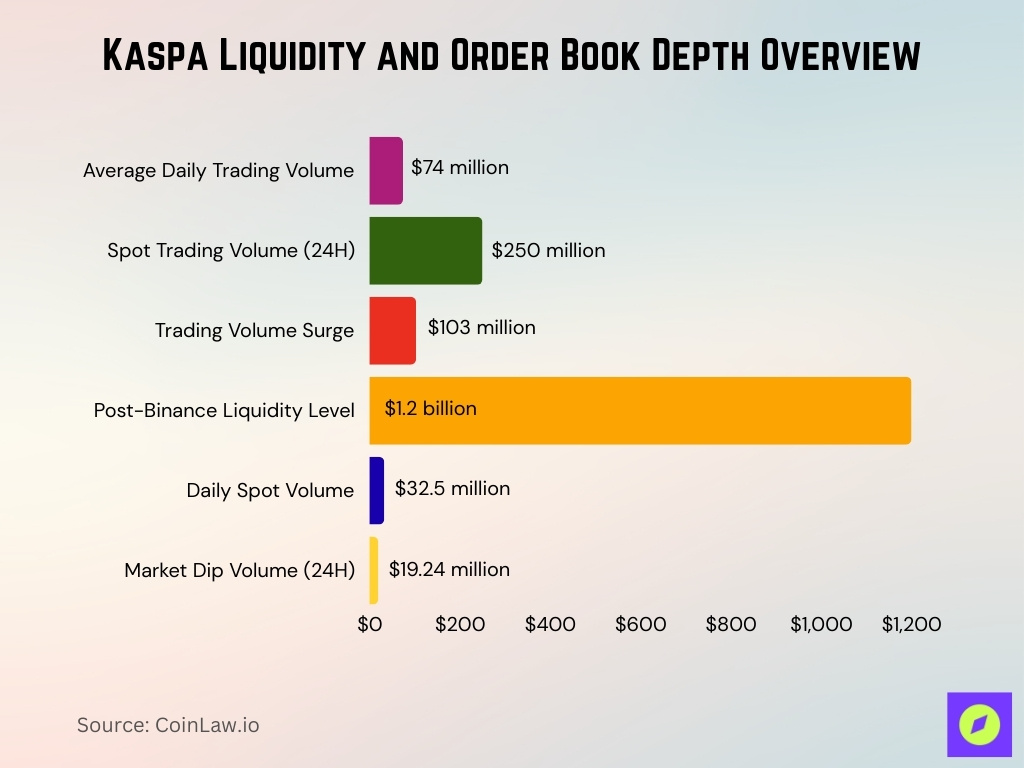

Liquidity and Order Book Depth

- Kaspa trading volume maintains multi-million dollar daily figures across exchanges, averaging $74 million daily with a 6.70% uptick.

- Major exchanges like Kraken and Coinbase report consistent order flow amid $250 million spot trading volume in 24 hours.

- Bid-ask spreads tighten during high-activity sessions, supported by $103 million trading volume surge with a 144% increase.

- Liquidity concentrated on spot markets with rising participation, reaching $1.2 billion post-Binance event.

- Depth improvements are seen as exchange listings expand, with $32.5 million daily spot volumes ensuring robust order books.

- Increased whale activity can momentarily shift depth around key levels, as whales accumulated 35 million KAS near $0.050.

- Order book resilience tested during broader market dips, maintaining $19.24 million 24-hour volume.

Open Interest and Funding Rates

- Open interest for Kaspa futures has been increasing in tandem with volatility spikes, reaching $79.2 million with a 25% daily jump.

- Funding rates on perpetual swaps vary widely, standing at positive 0.0013% during bullish reversals.

- Whale activity preceding the HTX listing accounted for the accumulation of 114 million KAS over 30 days.

- Exchange reserves of KAS dropped 3% ahead of HTX listing, indicating position adjustments affecting open interest.

- Funding rate deviations widened around major news catalysts, with 14.24% OI growth on perpetuals.

- Short- and long-term interest divergences have influenced funding cost differentials, showing a 10% average OI rise.

- Market reactions to macro fear and greed indicators have translated into fluctuating open interest signals, hitting $44.7 million.

On-Chain Activity Overview

- Kaspa processed 158 million transactions in one day in October, reflecting peak network throughput.

- Daily transaction volumes have routinely exceeded tens of millions, hitting 1.92 million on September 14.

- Public node discovery shows 1,000 nodes active on the Kaspa network, contributing to consensus resilience.

- Average transaction size and frequency rises correlate with ecosystem events, reaching 5,705 TPS peak.

- Kaspa’s block confirmation latencies remain sub-second, producing 10 blocks per second post-Crescendo.

- Kaspa explorer tools offer live metrics on blocks and transactions, with 90,000+ daily active addresses.

- On-chain decentralized activity adds diverse transaction types, processing $10 billion daily volume in October.

- Network active addresses surged 150% year-over-year to 545,600.

- Kaspa achieved a 5,584 TPS record, redefining Proof-of-Work scalability.

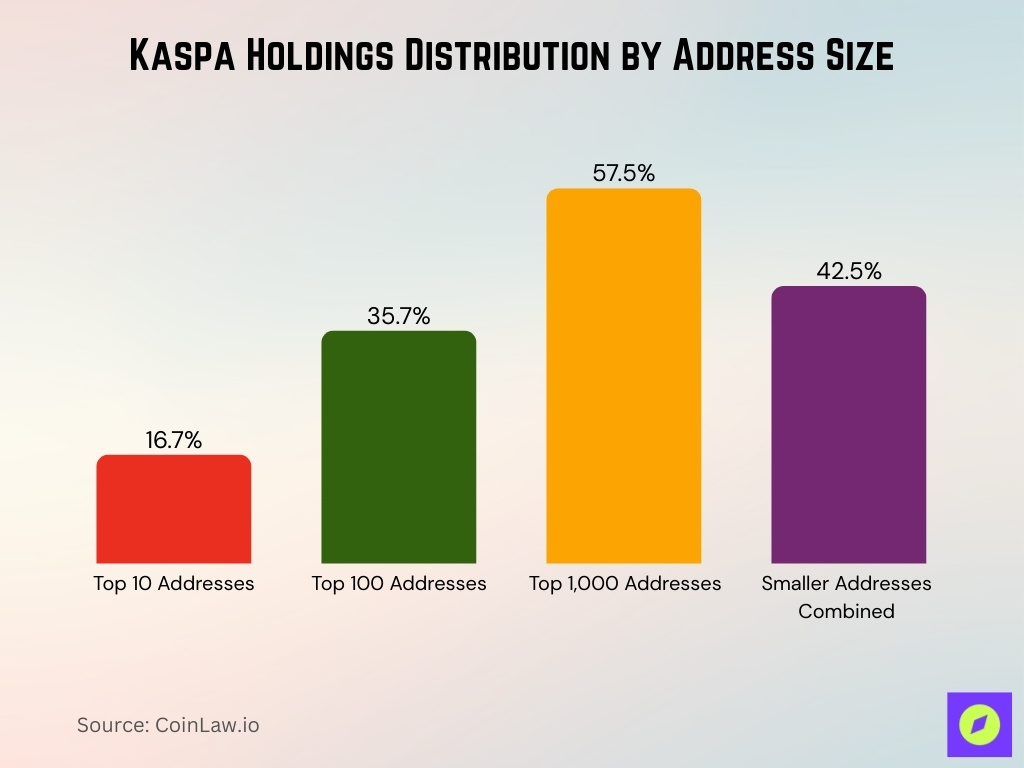

Holdings Distribution by Address Size

- Data shows ~16.7% of KAS supply held by top 10 addresses.

- Next tier (top 100) holds ~35.7%, indicating distribution beyond the largest holders.

- The top 1,000 accounts control around 57.5% of the total supply.

- Remaining ~42.5% is distributed among smaller addresses and active trading accounts.

- Mining pools contribute significantly to medium-sized holdings due to ASIC and GPU miner activity.

- Distribution trends trend toward decentralization relative to initial miner concentration.

- Whales occasionally redistribute to smart custody or exchange flows, altering supply patterns.

- Lower‑tier wallets (<100 KAS) represent a substantial number of unique holders, indicating grassroots participation.

Large Holders and Whales

- Top 10 KAS‑holding wallets control about 16.7% of the circulating supply, showing moderate concentration typical of PoW coins.

- Top 100 addresses hold roughly 35.7% of supply, suggesting broader accumulation beyond early miners.

- The top 1,000 addresses account for nearly 57.5% of KAS tokens, illustrating diverse ownership.

- Whale movements often precede liquidity shifts around exchange listings, as evidenced by HTX trading data.

- Large transfers into cold wallets increase during perceived undervaluation periods.

- “Whale accumulation” narratives have been correlated with speculative forecasts higher than current trading prices.

- Large holders’ behavior often informs futures positioning and open interest dynamics.

- Address clustering around major addresses continues to be analyzed for market influence signals.

Mining Difficulty and Block Statistics

- Kaspa mining difficulty and hashrate have climbed to levels uncommon among alternative PoW networks.

- Reported difficulty near ~61.6 P (petas) suggests rising competition among miners.

- Network hashrate reportedly peaked around 1.6 EH/s in early 2025 before easing toward 0.60 EH/s, reflecting shifting miner participation.

- Block reward is tapering, already under ~60 KAS per block as mining progresses.

- Difficulty adjustments help maintain rapid consensus despite miner influx.

- Block times persist at roughly ~1 s post‑Crescendo.

- Mining pool diversity supports decentralized hash distribution.

- GPU mining remains viable, though profitability hinges on electricity costs and difficulty trends.

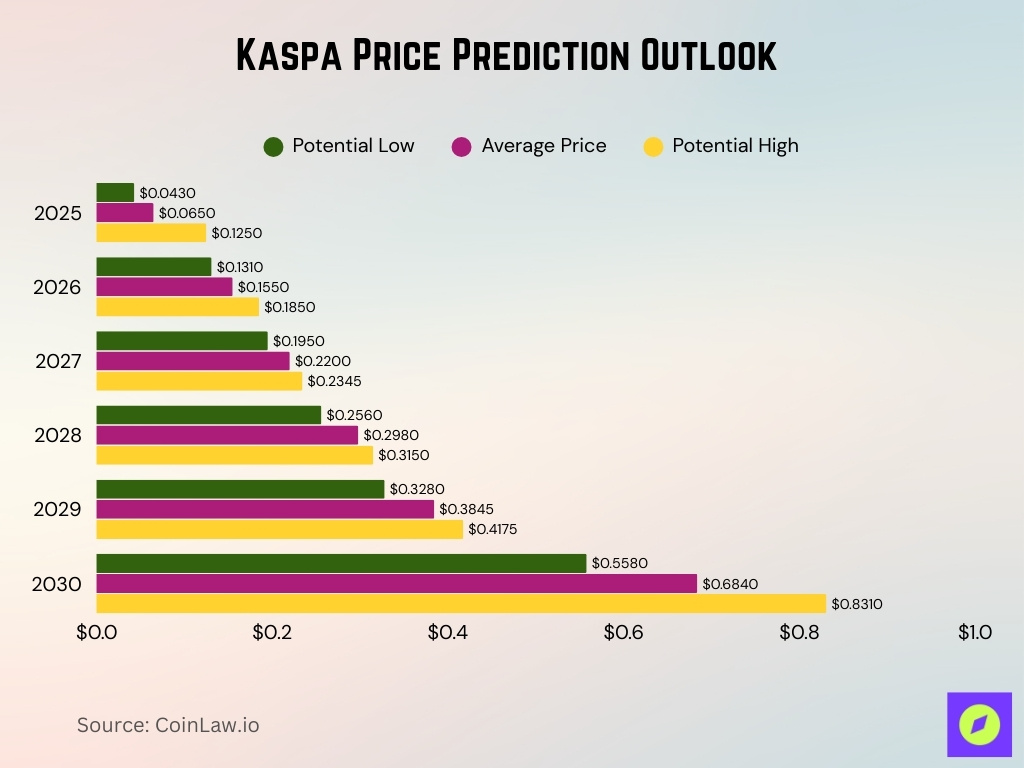

Kaspa Price Prediction Outlook

- 2025 projects a cautious range, with a potential low of $0.043, an average price of $0.065, and a potential high of $0.125, reflecting early growth volatility.

- 2026 shows stronger momentum, as the average price rises to $0.155 with an upside target of $0.185.

- 2027 continues the upward trend, pushing the average forecast to $0.220 and narrowing the range toward $0.2345 on the high end.

- 2028 signals a mid-cycle expansion phase, with prices averaging $0.298 and a projected high of $0.315.

- 2029 strengthens long-term confidence, delivering an average price of $0.3845 and a potential high of $0.4175.

- 2030 represents the most bullish scenario, with a potential low of $0.558, an average price of $0.684, and a peak projection of $0.831.

- Overall, the data implies a steady multi-year uptrend, with projected averages increasing by more than 10× from 2025 to 2030.

Emission Schedule and Inflation Rate

- Kaspa’s maximum supply remains capped at 28.7 billion KAS.

- Emission rate decreases over time, mimicking long-term supply scarcity through monthly halvings.

- Mid-2025 inflation is estimated to be around 10-15% and falling with smooth reductions.

- Block rewards are decreasing monthly by a factor of (1/2)^(1/12), controlling token issuance.

- No vesting unlocks or team allocations, leaving mining as the sole supply source with 93.29% circulating.

- Fully diluted valuation reflects potential future supply impact on market cap at $1.22 billion current.

- The token release schedule spans decades, with emission tapering into the 2040s.

- Circulating supply reaches 26.90 billion KAS, leaving 1.80 billion remaining.

- Emission controls support long-term inflation decline to near-zero post-2030.

Energy Efficiency and Mining Profitability

- Kaspa uses the kHeavyHash PoW algorithm with 77 J/TH efficiency on Antminer KS7, minimizing orphaned block energy waste.

- Antminer KS5 Pro delivers 25 GH/s hashrate at 3100 W, achieving $8–$10 daily profitability at $0.12/kWh.

- Miner profitability correlates with electricity costs below $0.06/kWh, yielding $20.46 net daily on the base case.

- GPU miners remain viable, but ASIC dominance pushes the network hashrate beyond 1.5 EH/s.

- Estimated block rewards decline with a 5.94% monthly emission reduction, pressuring short-term revenue.

- Faster ~1-second block times spread fixed energy costs across 2,200 TPS average throughput.

- Profitability indices show high reward density with Antminer KS5 electricity at 40.5% of expenses at $0.05/kWh.

- Mining difficulty rise compresses margins unless price exceeds $0.075 KAS, enabling 180-220 day ROI.

Developer Activity and GitHub Stats

- Kaspa’s core repositories show 64 developers actively contributing over the past year.

- The flagship repository rusty-kaspa has 735 stars and frequent commits signaling sustained interest.

- Rusty-kaspa recorded 72 commits average past year across tracked repositories.

- Several sub-projects, like kaspad, receive ongoing updates with 20 releases in rusty-kaspa.

- Developer discussions through KIPs number at least 4 proposals refining network capabilities.

- Growth in open-source participation shows a 50% year-over-year increase in engineering engagement.

- New repositories for bridges and SDKs emerge alongside 10 BPS Crescendo hardfork commits.

- Repository activity includes 684+ pull requests merged in rusty-kaspa.

- Kaspa tracks 20 GitHub repos with top developers like someone235 leading contributions.

Ecosystem Growth (dApps, Integrations, Partnerships)

- Kaspa ecosystem expands to 100+ dApps, including DeFi, NFTs, and gaming applications.

- Kaspa’s social media following reaches 500,000 across Twitter and Telegram platforms.

- Kaspathon hackathon launches with a 200,000 KAS prize pool, attracting 28+ participants.

- 2,066 KRC-20 tokens were deployed, generating $1.64 million in fees within 24 hours.

- KaspaCom DeFi platform integrates DEX, lending, NFTs, and wallet services in a single ecosystem.

- Layer 2 zkEVM rollup enables EVM compatibility for smart contract development.

- Kaspawave Explorer provides free wallet tracking for KAS and KRC-20 tokens.

- Kaspa targets 10,000 daily active users through community engagement initiatives.

- Simply Kaspa Indexer offers high-performance PostgreSQL transaction indexing.

Community and Social Media Metrics

- Kaspa’s social following across major platforms reached 500,000 combined on Twitter and Telegram.

- Daily active community participants increased 40-50% year-over-year on forums and chats.

- Twitter account surpassed 240,000 followers by early year with an organic growth rate.

- Telegram shows 42,377 members with 1,105 online in the official Kaspa channel.

- LunarCrush analytics track heightened social activity with 7,993 #Kaspa posts during peaks.

- Daily interactions exceed 500 across social platforms with 150% engagement growth.

- Social sentiment ranks Kaspa in CMC bullishness at 93% despite macro conditions.

- Community engagement targets 10,000 daily active users through real-time interactions.

- Hashtag trends show 8-10% active users on Telegram/Discord relative to total followers.

Risk Indicators and Drawdown Statistics

- Macro sentiment indicators like the fear/greed index hover around neutral levels at 72 (Greed).

- Kaspa’s beta relative to Bitcoin stands at 0.82, suggesting elevated volatility during swings.

- Drawdowns from local highs reached 80% from peaks amid broader crypto cycle impacts.

- Correlation with Bitcoin’s price over 90 days remains elevated at high systemic influence levels.

- Derivative funding rate swings stabilized at neutral 0.01%, preceding volatility shifts.

- Exchange net flows show +20.3% inflows in July, signaling accumulation amid selling pressure.

- Liquidity-at-Risk metric indicates High risk at 1.85 for top whale liquidations.

Forecasts and Analyst Expectations

- Some models forecast a moderate price increase to around $0.06 – $0.07 by 2026 under steady growth assumptions.

- AI‑driven projections show possible higher targets up to $0.10 – $0.11 in 2025 in favorable conditions.

- Long‑term forecasts vary widely, with some predicting multi‑year KAS appreciation tied to adoption.

- Analyst emphasis remains on balancing tech upgrades (e.g., Crescendo scaling) with market sentiment.

- Resistance and support levels are key in price models anticipating trend continuation or reversal.

- Beta and volatility forecasts suggest sharper moves than many large‑cap crypto assets.

- Integration of network usage metrics improves forecast precision.

- Overall expectations hinge on adoption, liquidity depth, and macro risk sentiment.

Frequently Asked Questions (FAQs)

Kaspa’s circulating supply is about 27 billion KAS tokens currently tradable in the market.

The market cap of Kaspa has been reported to be near $1.2 billion to $1.3 billion.

Kaspa processed over 158 million transactions in one day on October 5, 2025.

Kaspa’s network maintains an average block time of roughly ~1 s.

Conclusion

Kaspa’s trajectory demonstrates a blend of rapid technical evolution and community adoption. Growth in developer activity, ecosystem integrations, and social engagement highlights a maturing network. Risk factors like volatility and macro sentiment still sway price dynamics. Analyst forecasts remain mixed but generally optimistic when factoring in infrastructure upgrades and expanding participation. Trackers like social metrics and fear/greed indices should continue guiding both short‑term traders and long‑term investors as Kaspa navigates the broader crypto landscape.