Institutional players have come a long way. Risk management in crypto investing has transformed from an afterthought into a sophisticated discipline. With digital assets becoming mainstream in institutional portfolios, understanding crypto risk management isn’t optional; it’s essential. In this article, we’ll explore the statistics and trends shaping how institutions approach risk in the fast-evolving crypto landscape.

Editor’s Choice

- 72% of institutional investors report enhanced risk management frameworks specifically designed for crypto assets.

- 84% of institutional investors consider regulatory compliance their top priority in crypto risk management.

- 60% of institutions have integrated AI-driven risk assessment tools into their crypto investment strategies by Q1.

- 9 out of 10 institutional crypto investors cite counterparty risk as their most significant concern.

- 67% of institutional funds now perform real-time blockchain auditing to reduce fraud exposure.

- 41% of firms allocate more than 10% of their total compliance budget to crypto risk oversight.

Key Drivers Behind Institutional Crypto Mitigation Strategies

- Volatility management is the leading driver, with 82% of institutions employing derivatives like options and futures for hedging crypto exposure.

- 81% of institutional investors cite regulatory uncertainty as a core reason for tightening crypto risk controls.

- Cybersecurity threats drive 74% of institutional risk mitigation strategies, with increased spending on penetration testing and zero-trust architectures.

- 62% of surveyed firms employ multi-signature wallets and cold storage solutions to reduce custodial risks.

- 55% of institutional investors cite counterparty default as the main reason for integrating real-time credit risk monitoring tools.

- DeFi smart contract risks have driven 49% of institutional DeFi users to adopt third-party auditing services before engaging with DeFi protocols.

- Liquidity risks in thinly traded assets have led 53% of institutions to implement liquidity stress testing frameworks.

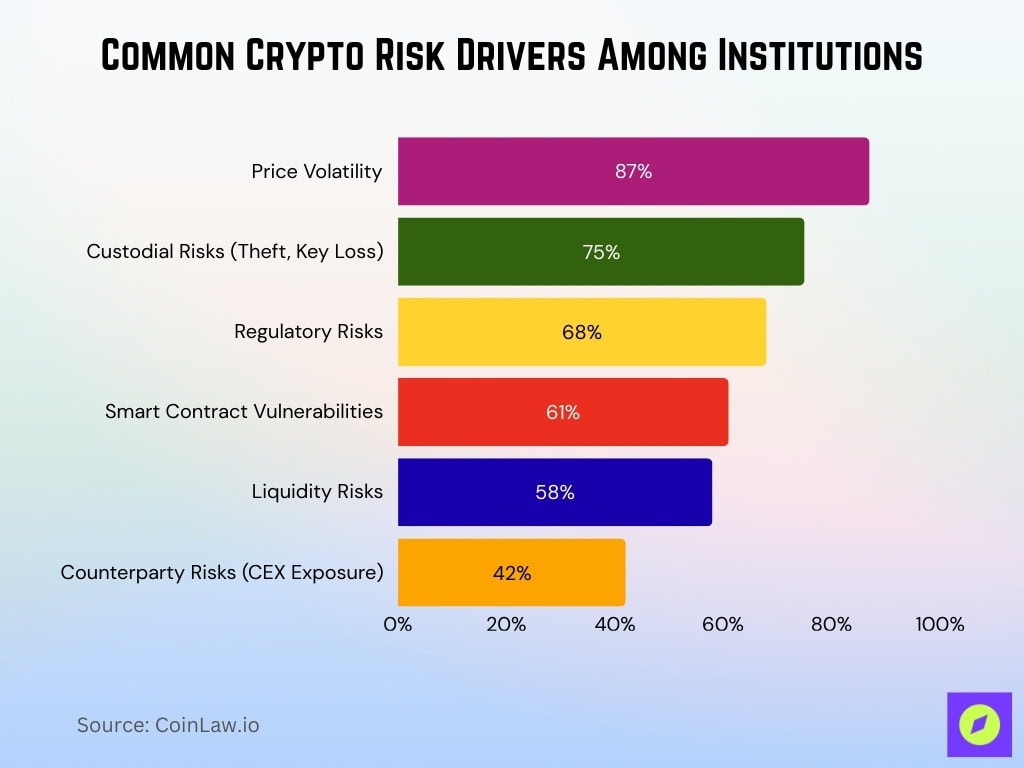

Common Risk Drivers Across Crypto Assets

- Price volatility remains the #1 concern for 87% of institutional crypto investors.

- Smart contract vulnerabilities are considered a critical risk by 61% of institutions engaging with DeFi protocols.

- Custodial risks, including theft and loss of private keys, are flagged by 75% of institutional investors as a top concern.

- Regulatory risks are ranked among the top three concerns by 68% of institutions, especially in emerging markets.

- Counterparty risks associated with centralized exchanges have caused 42% of institutions to limit exposure to tier-2 and tier-3 exchanges.

- Liquidity risks are cited by 58% of surveyed funds, particularly in altcoins with low daily trading volumes.

Institutional Exposure to Crypto-Related Risks

- 65% of institutional investors report direct exposure to cryptocurrencies.

- 32% of institutional portfolios now allocate between 5% to 10% to crypto assets, signaling growing confidence in the asset class.

- 54% of institutional investors experienced losses exceeding 10% on crypto holdings during market downturns.

- Liquidity constraints in altcoin markets affected 38% of institutional investors, leading to forced liquidations in high-stress scenarios.

- 48% of institutions report cross-border regulatory risks, particularly those investing in Asia-Pacific and Latin America.

Market Data on Crypto Custodial Risk Management Solutions

- Cold storage adoption among institutions reached 81%, with multi-signature wallets used by 67% of custodians.

- 58% of institutional investors use insured custodial services, with coverage often extending to $150 million per wallet.

- Fireblocks, Anchorage Digital, and BitGo remain the top three preferred custodians for institutional crypto assets.

- 43% of surveyed institutions employ dual custodial solutions to mitigate single-point-of-failure risks.

- 65% of institutional investors reported conducting annual security audits of their custodial service providers.

- 74% of institutional custodial services now offer automated compliance reporting, aligning with global regulatory standards.

- Digital asset custody platforms integrated with decentralized key management systems (DKMS) increased by 39%.

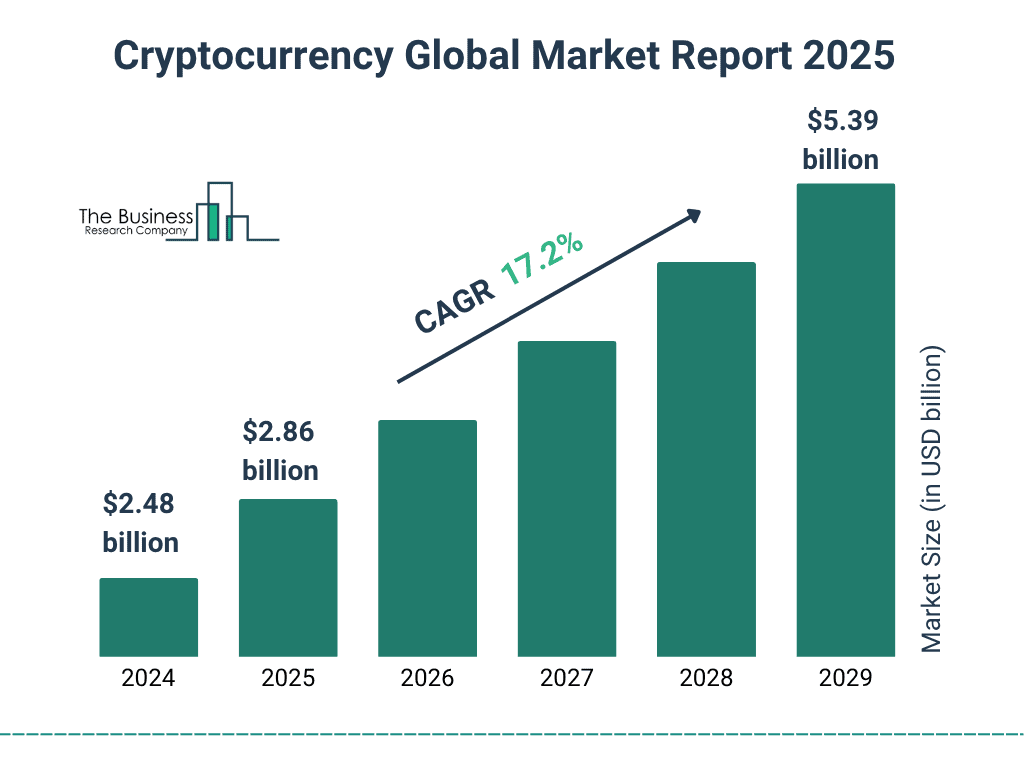

Cryptocurrency Global Market Growth Outlook

- The global cryptocurrency market is projected to grow from $2.48 billion in 2024 to $5.39 billion by 2029, more than doubling in five years.

- Market value is expected to reach $2.86 billion in 2025, signaling continued post-cycle recovery and institutional re-entry.

- Growth accelerates through 2026 at $3.29 billion, reflecting rising adoption of crypto infrastructure and compliance-ready platforms.

- By 2027, the market is forecast to expand to $3.80 billion, driven by broader enterprise and financial services integration.

- Market size is projected to hit $4.38 billion in 2028, supported by increasing use of blockchain in payments, custody, and risk management.

- Overall expansion reflects a strong 17.2% CAGR, highlighting sustained long-term growth momentum in the global crypto ecosystem.

Regulatory Compliance and Risk Management in Institutional Crypto Investments

- 84% of institutional investors rank regulatory compliance as their top concern.

- 63% of institutions report investing in automated compliance tools that streamline AML/KYC processes for crypto transactions.

- 71% of institutional investors are fully compliant with MiCA regulations in Europe as of Q2.

- FINRA and SEC regulations prompted 57% of US-based institutions to restructure their crypto operations to enhance compliance.

- 41% of surveyed institutions cite licensing requirements as a barrier to expanding their crypto asset offerings.

- 52% of institutional investors perform continuous transaction monitoring to ensure compliance with FATF guidelines.

- Regulatory sandboxes in Singapore, Switzerland, and the UAE attracted 37% of global institutional investors.

- 29% of surveyed institutions developed proprietary compliance frameworks, integrating AI tools to manage dynamic regulatory landscapes.

Correlations Among Crypto Assets

- Bitcoin (BTC) and Ethereum (ETH) maintain a correlation coefficient of 0.89, reflecting their close market behavior.

- Stablecoins show a negative correlation with altcoins in 47% of institutional portfolios, aiding risk diversification.

- Correlations between crypto assets and traditional equity markets (S&P 500) remain at 0.36, indicating limited co-movement.

- 28% of institutional investors report utilizing correlation analysis to structure multi-asset crypto portfolios.

- DeFi tokens have a higher correlation (0.72) among themselves but show weak correlations with Bitcoin and Ethereum (< 0.4).

- Tokenized assets backed by real-world commodities (e.g., gold) exhibit a correlation of 0.18 with volatile crypto assets like altcoins.

- 60% of surveyed institutions use correlation matrices as part of their portfolio risk assessment and optimization processes.

- The correlation between Bitcoin and major fiat currencies (USD, EUR) remains below 0.2, underscoring its non-correlated asset status.

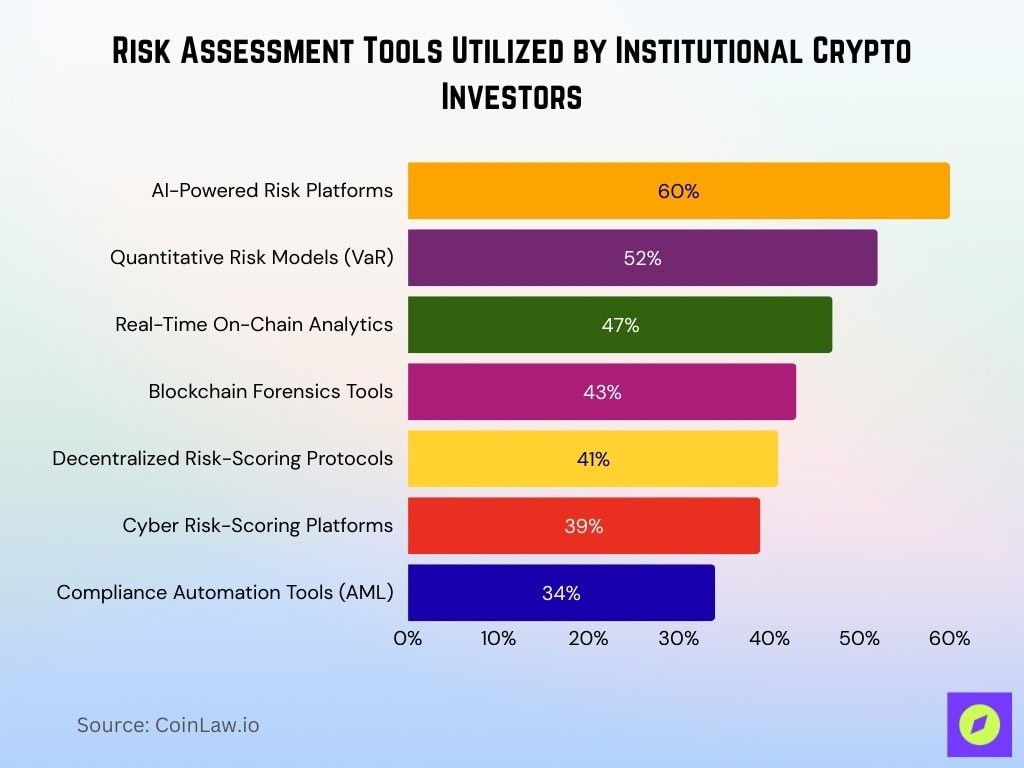

Risk Assessment Tools Utilized by Institutional Crypto Investors

- 60% of institutional investors have integrated AI-powered risk assessment platforms like Elliptic and Chainalysis.

- 47% of surveyed institutions use real-time on-chain analytics to monitor transaction risks and counterparty behaviors.

- 43% of institutional investors rely on blockchain forensics tools to trace fund flows and detect illicit activities.

- 52% of institutions deploy quantitative risk models that incorporate VaR (Value at Risk) metrics tailored for crypto asset classes.

- Compliance automation tools like TRM Labs have seen a 34% increase in institutional adoption for AML risk management.

- 39% of institutional investors use cyber risk-scoring platforms to assess third-party vendors in the crypto ecosystem.

- 41% of surveyed institutional traders rely on decentralized risk-scoring protocols for DeFi investments.

Data Breaches and Cybersecurity Threats Impacting Institutional Crypto Portfolios

- Institutions experienced $2.9 billion in losses due to cybersecurity breaches targeting crypto portfolios.

- 43% of institutional investors reported at least one attempted cyberattack on their crypto holdings in the past 12 months.

- Phishing attacks remain the most common threat vector, accounting for 32% of successful breaches among institutional investors.

- 72% of firms have implemented multi-factor authentication (MFA) and hardware security modules (HSMs) to counter unauthorized access.

- 58% of institutional investors now partner with cybersecurity firms specializing in blockchain threat intelligence.

- 45% of surveyed institutions conduct penetration testing and red teaming exercises on their custodial and exchange platforms.

Counterparty and Liquidity Risks in Institutional Crypto Trading

- Counterparty risk was cited by 79% of institutional traders as the greatest concern in over-the-counter (OTC) crypto trading.

- 48% of institutions experienced delayed settlements due to counterparty creditworthiness issues.

- Liquidity risk in thinly traded crypto assets resulted in 42% of institutions facing higher-than-expected slippage during exit strategies.

- 54% of institutional investors now use centralized clearing solutions to mitigate counterparty risks in crypto derivatives markets.

- 39% of institutions demand pre-funding of collateral in OTC transactions to manage default risk.

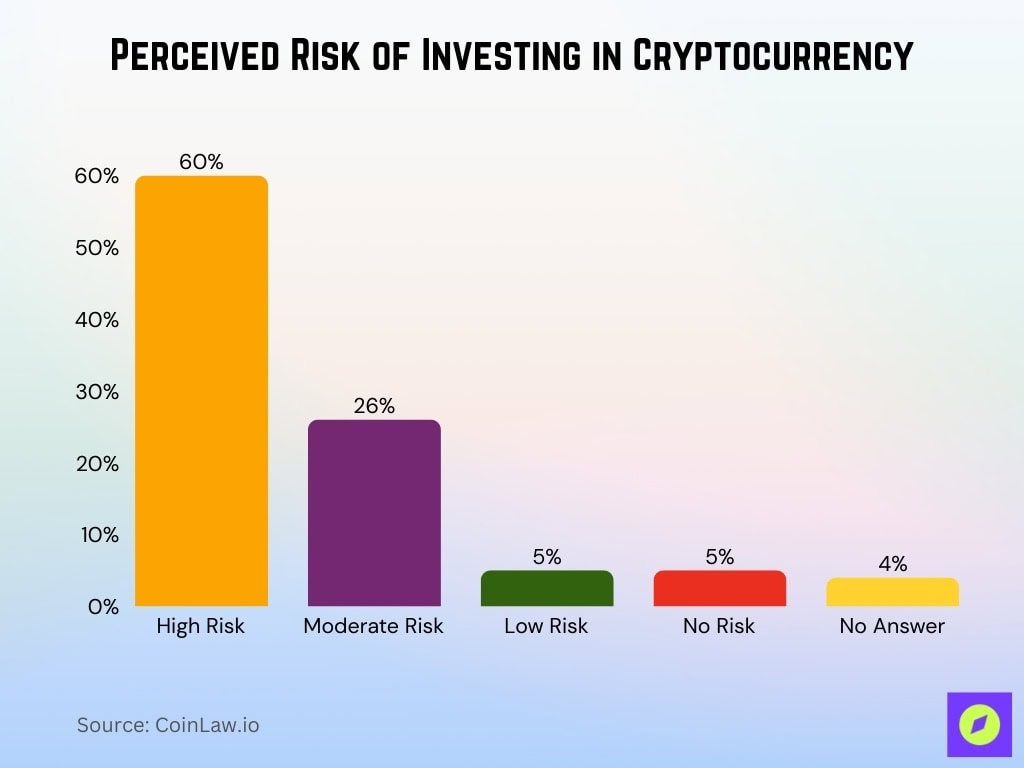

Perceived Risk of Investing in Cryptocurrency

- A clear majority of respondents, 60%, classify cryptocurrency investing as high risk, underscoring widespread concern over volatility and market uncertainty.

- 26% of participants view crypto as a moderate risk investment, suggesting cautious interest rather than outright rejection.

- Only 5% consider cryptocurrency a low-risk asset, highlighting limited confidence in its stability.

- Another 5% believe crypto carries no risk, representing a small but confident minority of investors.

- Just 4% of respondents provided no answer, indicating high overall engagement with the risk assessment question.

Risk Management Practices in Crypto Lending and Staking by Institutions

- 52% of institutional investors participated in crypto lending markets.

- Staking participation by institutions has grown to 46%, with a focus on Ethereum (ETH) and Cardano (ADA) networks.

- Collateralization ratios in institutional crypto loans average 160% as lenders prioritize overcollateralization to mitigate default risks.

- 56% of institutions employ third-party custodians for staked assets to enhance security and control.

- Smart contract auditing is mandatory for 73% of institutions before participating in DeFi lending and staking protocols.

- 47% of institutional lenders conduct continuous risk monitoring of borrower wallets to detect early warning signs of liquidity stress.

Impact of Stablecoins and DeFi Protocols on Institutional Risk Management

- 48% of institutional investors actively use stablecoins for settlement and liquidity management.

- USDC remains the most preferred stablecoin, used by 62% of institutions for transaction settlements.

- 41% of institutions express concerns over stablecoin issuer transparency, particularly regarding reserve audits.

- DeFi protocol exposure accounts for 28% of total crypto assets managed by institutional investors.

- Smart contract risks in DeFi platforms have led 35% of institutions to require third-party audits before allocating capital.

- Flash loan attacks are cited as a key concern by 29% of institutions engaging in DeFi lending protocols.

- Liquidity mining programs are utilized by 31% of institutions to maximize DeFi yields despite increased risk profiles.

- Governance token holdings have increased among institutions, with 22% of investors participating in DeFi governance decisions to influence protocol risks.

- Cross-chain bridges, used by 18% of institutions, present new risk vectors, prompting additional due diligence and security audits.

Insurance and Hedging Solutions Adoption in Institutional Crypto Portfolios

- $6.7 billion in crypto-specific insurance policies have been underwritten for institutional portfolios, up 52% year-over-year.

- 41% of institutions purchase crime insurance policies covering theft, fraud, and cyberattacks on digital assets.

- Parametric insurance models are adopted by 29% of institutions to cover smart contract exploits and protocol failures.

- Hedging with crypto derivatives (futures, options, swaps) is standard practice for 63% of institutional investors to manage price volatility.

- Over-the-counter (OTC) options desks report a 38% increase in institutional demand for Bitcoin and Ethereum hedging strategies.

- Credit default swaps (CDS) for crypto counterparties are utilized by 17% of institutions to manage lending risks.

- Insurance premiums for institutional crypto policies have risen 15% on average due to increased claims and market volatility.

Recent Developments

- AI and machine learning tools for predictive risk modeling are integrated by 57% of institutions managing crypto portfolios.

- Tokenization of insurance products is gaining traction, with 12% of institutions using on-chain insurance solutions for DeFi and CeFi investments.

- Partnerships with RegTech providers have increased by 38%, enabling institutions to navigate complex global regulatory frameworks.

- Green crypto investing strategies are adopted by 24% of institutions, focusing on ESG-aligned blockchain projects.

- Integration of quantum-resistant encryption protocols is underway at 14% of custodial service providers, anticipating future cybersecurity risks.

Frequently Asked Questions (FAQs)

65% of institutional investors report direct exposure to crypto assets in 2025.

32% of institutions allocate 5%–10% of their portfolio to crypto assets.

54% of institutions experienced losses greater than 10% during crypto market downturns.

Conclusion

Institutional crypto risk management has evolved into a multi-layered discipline, integrating advanced technologies, regulatory frameworks, and innovative insurance solutions. Institutions are not just investing in crypto, they’re investing in robust systems that ensure security, compliance, and operational resilience. The rising complexity of digital asset portfolios makes proactive risk management a cornerstone for institutional success in the crypto market.

For forward-thinking investors, the takeaway is clear: crypto risk management isn’t a niche process anymore. It’s a critical driver of long-term sustainability and trust in the institutional digital asset ecosystem.