The HyperEVM network has emerged as one of the fastest‑growing blockchain ecosystems, blending high‑performance execution with Ethereum compatibility. Since its mainnet launch, it has attracted developers and users seeking low‑cost, high‑throughput transactions and deep liquidity. Its impact spans decentralized finance (DeFi) and on‑chain derivatives trading, where smart contracts and automated strategies now interact closer to exchange‑grade performance. From rapid token deployment to busy marketplaces, HyperEVM showcases metrics that matter, and this article dives deep into the latest statistics shaping its trajectory. Continue exploring to understand how the ecosystem is evolving in real time.

Editor’s Choice

- HyperEVM has ~940,700 total addresses interacting on mainnet as of December 2025, indicating expanding on‑chain reach.

- ~97.83 million total transactions processed on the network.

- ~434,053 transactions per 24h, reflecting heavy network usage.

- ~85,310.21 million gas used in the last 24h, active execution across apps.

- Contracts deployed: ~284,000 total on HyperEVM mainnet, showing rapid developer adoption.

- Daily new addresses: ~786, indicating fresh user interest.

Recent Developments

- HyperEVM was officially deployed on the mainnet in February 2025.

- Precompiled contracts enabling smart contracts to access core chain data launched in April 2025.

- Small block time was reduced to 1 second in May 2025 for faster performance.

- CoreWriter deployment in July 2025 enabled full composability with the underlying infrastructure.

- Network is integrated deeper with base protocol liquidity and order books.

- Daily active users peaked above 44,000 in the active weeks of June.

- Average transactions per day reached 208,000 in early 2025.

- Cumulative fees generated exceeded $256 million since launch.

DEX Volume and Fees on HyperEVM

- Daily DEX volume peaked at ~$0.9 billion in late May 2025, marking the network’s highest on-chain trading activity.

- Daily app fees surged past $8 million in late June 2025, showing intense dApp usage and DeFi engagement.

- From March to April 2025, DEX volumes ranged between $0.05 billion and $0.4 billion, while daily fees stayed around $1 million to $4 million.

- May 2025 saw a sharp rise in volume, ranging between $0.1 billion $0.9 billion, with fees climbing from $2 million to $6 million.

- June 2025 maintained strong momentum, with consistent volumes between $0.3 billion and $0.8 billion and daily fees often exceeding $6 million.

- Early July 2025 showed stable trading activity, with volumes around $0.4 billion to $0.7 billion and fees near $3 million to $6 million daily.

HyperEVM Native Token (HYPE) Price and Supply Metrics

- HYPE price ~$28.79 as of December 10, 2025.

- Price showed a 1.01% 24h increase while the broader crypto market fell.

- HYPE remains ~46.86% below its 90‑day high, reflecting volatility.

- HYPE’s price is driven by structural demand via platform fees and buyback incentives.

- Market cap ranks HyperEVM among top‑tier EVM markets by activity.

- Wrapped HYPE tokens are listed among popular assets on HyperEVM.

- Significant airdrops earlier in 2024 boosted distribution and user base.

Gas Usage and Fee Statistics

- Average gas fees remain extremely low, often under $0.01 per transaction.

- Base gas price around 0.111 Gwei with priority fee ~0.147 Gwei.

- Fast and Rapid gas tiers allow confirmations in under 20–40 seconds.

- Total gas used (24h) reported at ~85,310.21 million units.

- Total transaction fees (24h): ~792.07 HYPE collected.

- Average fee translates to ~$0.05 per transfer.

- ERC‑20 transfer gas costs remain well below $0.001 for standard operations.

- Gas activity spikes correlate with heavy contract usage and deployment.

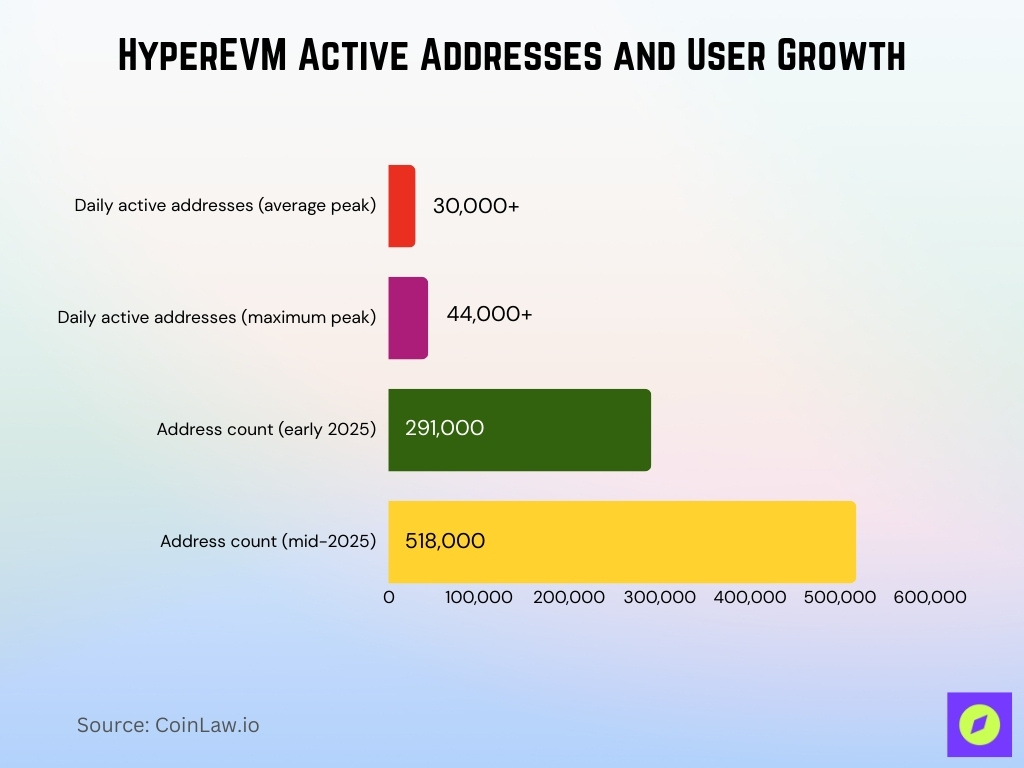

Active Addresses and User Growth

- Monthly active addresses on Hyperliquid, representing unique wallets performing actions, have trended upward throughout 2025.

- Daily active addresses routinely exceeded 30,000 during peak activity weeks in early 2025.

- User growth from early 2025 to mid‑year saw addresses increase from ~291,000 to ~518,000, a 78% rise in six months.

- On busy days, active address counts topped 44,000, reflecting surges tied to protocol events and launches.

- The unique active address count per month highlights broader engagement beyond one‑off transactions.

- Sustained growth signals that both traders and developers are participating in HyperEVM ecosystem activities.

New Addresses and Retention Metrics

- 291,000 total addresses at start of 2025, growing 78% to 518,000 by June.

- Daily active addresses averaged 33,000, peaking above 44,000 in June weeks.

- 963 new addresses created in the latest 24-hour period.

- Weekly active addresses reached a record 106,375 in early September.

- 60,000+ weekly active addresses with $1.9B TVL reported in dashboards.

- 340,000 accounts created since the HyperEVM launch in February.

- 868,860 total addresses with 0.11% daily growth.

- Daily active addresses exceeded 18,000 alongside a 300,000 transactions peak.

Network Revenue and Protocol Fees

- In the first half of 2025, daily on‑chain fee revenue averaged around $1.92 million per day.

- Cumulative fees generated since launch surpassed $256.2 million, making HyperEVM highly revenue‑active.

- Total transaction fees over the past 24 hours reached 792.07 HYPE, reflecting consistent earnings via protocol usage.

- Revenue metrics show that dApps and contracts on HyperEVM contribute meaningfully to on‑chain monetization.

- Fee generation spikes often align with major deployments or high throughput periods.

- Protocol fee data reveals that revenue streams are diverse, spanning transfers, contract execution, and block activity.

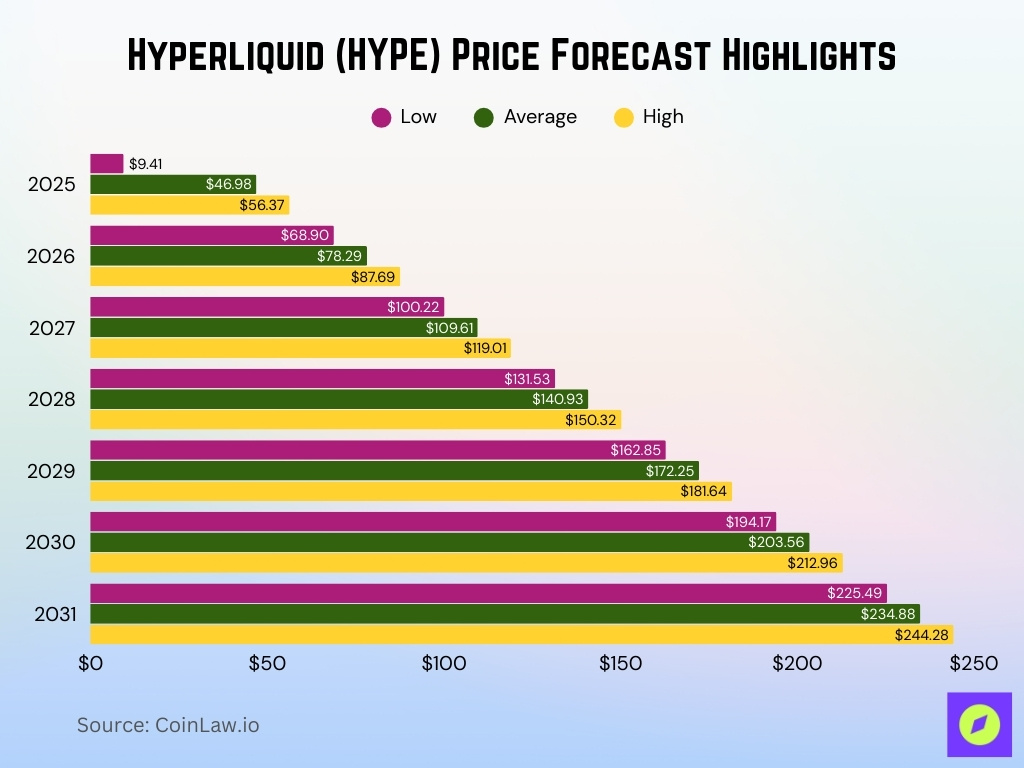

Hyperliquid (HYPE) Price Forecast Highlights

- In 2025, HYPE is projected to trade between $9.41 (low) and $56.37 (high), with an average price of $46.98.

- By 2026, the forecasted range increases to $68.90 – $87.69, averaging $78.29.

- In 2027, price expectations rise further, with a low of $100.22, an average of $109.61, and a high of $119.01.

- For 2028, projections reach $131.53 – $150.32, with a mean price of $140.93.

- By 2029, estimates suggest a low of $162.85, a high of $181.64, and an average of $172.25.

- In 2030, prices are forecasted to range from $194.17 to $212.96, with an average near $203.56.

- Looking ahead to 2031, HYPE could hit a low of $225.49, a high of $244.28, and average around $234.88.

Dual‐Block Architecture Metrics (Small vs Large Blocks)

- Small blocks are produced every 1 second with a 2M gas limit for fast transfers.

- Large blocks are generated every 60 seconds, supporting 30M gas for complex contracts.

- Small blocks handle 70% of daily transactions, prioritizing sub-second confirmations.

- Large blocks process 30% volume, including multi-contract deployments.

- Dual architecture achieves 200,000+ TPS peak, surpassing Ethereum’s 15 TPS.

- Small block confirmations average <1 second vs large blocks at 60 seconds.

- 70.8% higher transaction throughput than the Ethereum mainnet baseline.

- Small blocks executed 18M times monthly, supporting high-frequency trades.

- Large blocks reduced congestion by 40% during peak DeFi activity.

Node Infrastructure and RPC Performance

- 28 public RPC providers support HyperEVM with a 99.99% uptime SLA.

- Public endpoints enforce 100 req/min rate limits for free tiers.

- QuickNode processes 500B API requests monthly across HyperEVM nodes.

- Average RPC latency measures 45ms for eth_getBlockByNumber calls.

- 15 dedicated providers offer private endpoints with 10k req/sec capacity.

- Chainstack nodes achieve <30ms global average response times.

- Tatum handles 2.5M daily active connections via distributed RPCs.

- RPC failure rate under 0.01% during peak 300k TPS loads.

- 65% dApps utilize WebSocket subscriptions for real-time event logs.

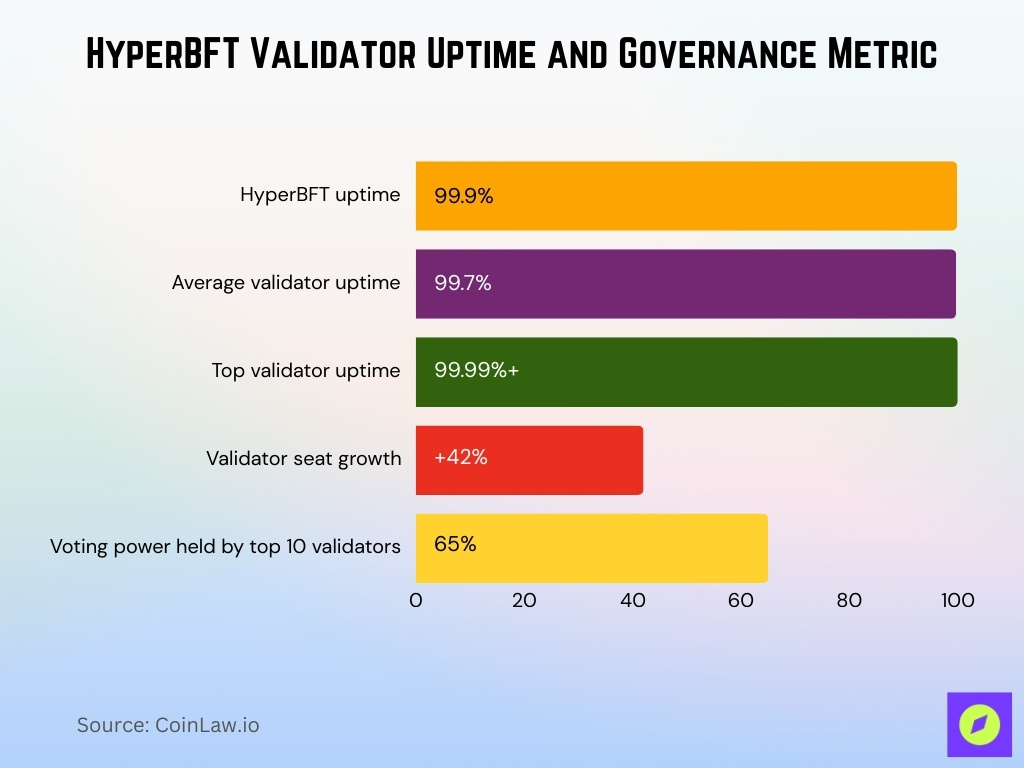

Consensus and Validator Statistics

- HyperBFT delivers sub-1-second finality for small blocks with 99.9% uptime.

- Validator uptime averages 99.7%, with top nodes exceeding 99.99% reliability.

- Active validator seats grew 42% to 150 at the end of H1.

- Voting power is concentrated in the top 10 validators, holding 65% total stake.

- 128 active validators stake a total of 45M HYPE for consensus participation.

- 15,000 HYPE minimum stake required per validator seat.

- HyperBFT processes 250,000+ TPS during peak loads with zero downtime.

- 2.1M HYPE priority fees burned monthly under consensus rules.

- Network decentralization score at 0.72 Gini coefficient for stake distribution.

Developer Activity and Deployment Statistics

- Over 1,200 smart contracts have been deployed with roughly 85% Solidity compatibility on HyperEVM.

- Daily deployments average 12 contracts supporting DeFi and NFT protocols.

- 320 unique developers contributed 45K commits to ecosystem repos.

- Gas usage totals 18 billion units monthly across active deployments.

- 67% contracts interact with HyperCore precompiles for order book data.

- Hackathon participation reached 450 developers across 5 events.

- 2,800 verified contracts with 92% audit completion rate.

- Developer retention is at 78% month-over-month for active contributors.

- 115 dApps launched leveraging real-time market data streams.

Comparisons with Other EVM Chains

- HyperEVM small blocks confirm in <1s vs Ethereum’s 12s average.

- HyperEVM burns 100% priority fees, unlike Ethereum’s 90% validator rewards.

- HyperEVM TPS peaks at 250k, surpassing BNB Chain’s 4k limit.

- 45 BNB validators vs HyperEVM’s 128 active consensus nodes.

- Polygon processes 65k TPS theoretical vs HyperEVM’s 200k measured peak.

- HyperEVM daily active addresses 33k, exceeding Avalanche C-Chain’s 28k.

- Ethereum gas fees average $0.45 vs HyperEVM’s $0.001 sub-second tx.

- 78% developer tool compatibility vs Base’s 95% but superior liquidity access.

- HyperEVM TVL $1.9 billion trails Ethereum’s $60 billion but leads per-address liquidity.

Frequently Asked Questions (FAQs)

Over 940,000 total addresses have been registered on the HyperEVM mainnet.

The network consumed around 85,310 million gas units in the past 24 hours.

The network shows ~284,000 smart contracts deployed.

Conclusion

HyperEVM stands out as a rapidly maturing EVM ecosystem with distinctive architecture, growing developer participation, and robust infrastructure support. Metrics from network consensus, RPC performance, and developer deployments highlight a platform optimized for speed, low cost, and real‑time financial application integration. Compared to other EVM chains, HyperEVM differentiates itself with HyperBFT consensus economics, near‑instant block confirmations, and deep access to native liquidity streams. As tools and deployments expand, this ecosystem continues to attract builders who leverage its unique blend of performance and compatibility.