EY (Ernst & Young) remains one of the Big Four professional services firms, shaping global business through audit, tax, consulting, and advisory functions. EY posted steady growth amid economic turbulence, highlighting its emphasis on AI-driven solutions and client transformation. EY’s impact stretches from helping Fortune 500 companies refine governance frameworks to supporting governments with tax and sustainability strategies. Through this article, readers will explore the latest EY statistics that illuminate its performance, strategy, workforce, and market relevance.

Editor’s Choice

- $53.2 billion in global revenue for FY25, a 4% increase from the prior year.

- EY’s AI-related revenue up ~30% year‑on‑year, reflecting tech‑driven demand.

- EY operates in 150+ countries and territories with 700+ office locations worldwide.

- Assurance remains EY’s largest service revenue contributor.

- Tax services saw a ~5.5% increase in revenue in FY25.

- Consulting services grew ~5.2% in revenue during the same period.

- EY reported deepening AI adoption, with over 15,000 staff engaged in AI‑led projects.

Recent Developments

- EY announced global revenue growth to $53.2 billion for FY25.

- AI and digital transformation services were key growth vectors in 2024, 25.

- EY deployed technology investments via its “All In” strategy to support clients.

- The firm expanded strategic alliances with technology partners to scale solutions.

- EY expanded EY‑Parthenon, its strategy and transactions arm, to 25,000+ professionals globally.

- Recent leadership changes included new U.S. managing partner nominations tied to audit modernization.

- Press releases highlighted EY’s focus on risk resilience and generational workplace culture.

- EY’s U.S. survey revealed culture and respect were top retention factors among professionals.

- Growing emphasis on Responsible AI frameworks to support clients adopting new technology.

Top Marketing Priorities of High-Growth Consulting Firms

- Content creation leads marketing strategy, with 39.8% of high-growth consulting firms prioritizing it to drive visibility, authority, and inbound demand.

- Brand differentiation ranks second, cited by 27.4% of firms aiming to stand out in an increasingly crowded consulting market.

- Social media marketing matches brand differentiation at 27.4%, highlighting its role in client engagement, thought leadership, and lead generation.

- Over two-thirds of marketing focus among high-growth firms centers on content, branding, and social channels, underscoring a shift toward digital-first growth strategies.

- High-growth consulting firms prioritize long-term brand equity, favoring scalable marketing initiatives over short-term promotional tactics.

EY Overview Statistics

- EY is part of the Big Four accounting and consulting networks.

- FY25 revenue reached $53.2 billion, up ~4% in local currency from FY24.

- FY24 revenue was roughly $51.2 billion, representing solid baseline growth.

- The firm covers audit, tax, consulting, advisory, and strategy services.

- EY‑Parthenon accounts for a growing share of strategy and transactions advisory.

- EY ranks among the largest professional services firms globally by revenue.

- Its global brand prioritizes trust, quality, and innovation-led transformation.

Global Revenue and Growth

- Global revenue: $53.2 billion in FY25, up 4% from FY24.

- Revenue marked a 3.9% increase in U.S. dollar terms year‑over‑year.

- Five‑year CAGR (FY20–25) sits at approximately 8.2%.

- OECD and technology service lines drove consistent demand.

- Tax services revenue grew ~5.5% in local currency to $12.7 billion.

- Consulting services revenue grew ~5.2% to $16.4 billion.

- Assurance services revenue increased ~3.5% to $17.9 billion.

- EY’s strategy and transactions services were flat at ~$6.2 billion.

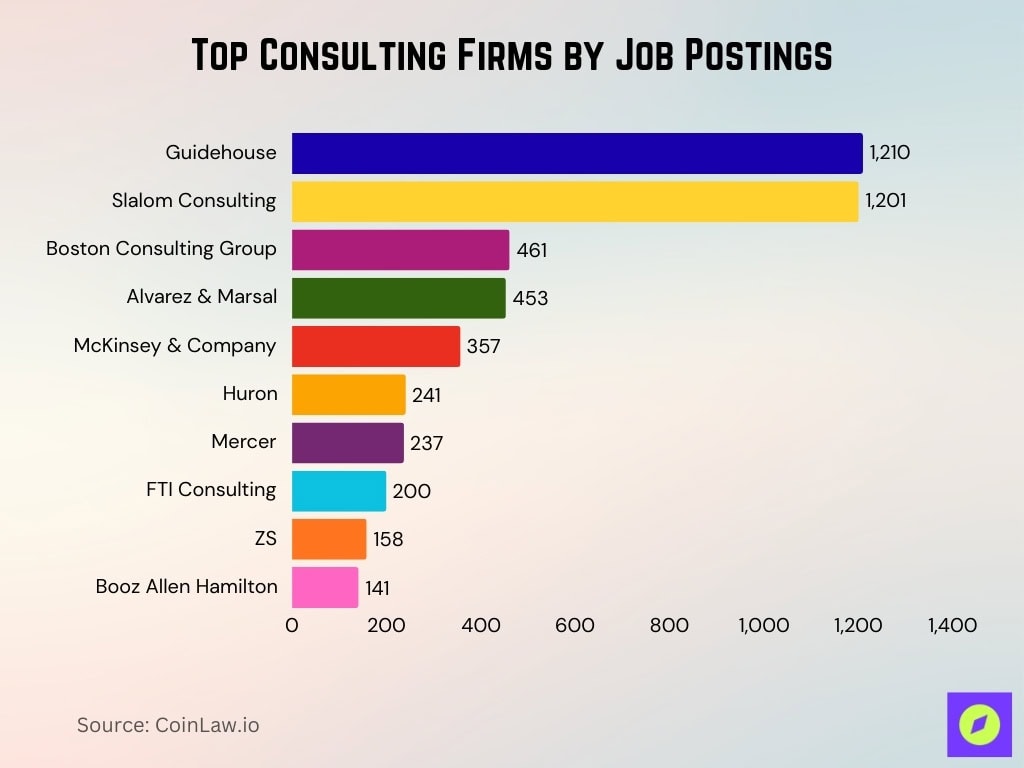

Top Consulting Firms by Job Postings

- Guidehouse leads consulting hiring activity, posting 1,210 open roles, signaling strong demand for transformation, risk, and public sector expertise.

- Slalom Consulting closely follows, with 1,201 job postings, reflecting sustained growth in digital, cloud, and customer experience services.

- Boston Consulting Group ranks third, advertising 461 positions, highlighting steady demand for strategy, analytics, and operations talent.

- Alvarez & Marsal reports 453 openings, underscoring continued hiring in restructuring, performance improvement, and corporate turnaround services.

- McKinsey & Company lists 357 roles, indicating selective but ongoing recruitment for high-impact consulting engagements.

- Mid-tier firms show active expansion, with Huron (241 roles) and Mercer (237 roles) maintaining a strong presence in healthcare, human capital, and advisory hiring.

- FTI Consulting posts 200 jobs, reflecting consistent demand in forensic, economic, and strategic communications practices.

- ZS records 158 openings, pointing to focused hiring in analytics-driven and life sciences consulting roles.

- Booz Allen Hamilton rounds out the top 10, with 141 job postings, emphasizing stable demand in government and defense consulting.

- Hiring concentration is heavily skewed toward the top two firms, which together account for over 2,400 job postings, far exceeding the rest of the market.

Revenue by Service Line

- Assurance remains the largest revenue stream at $17.9 billion.

- Tax services reached $12.7 billion, up 5.5% in local currency.

- Consulting generated $16.4 billion, increasing 5.2% year-over-year.

- Strategy & Transactions (EY-Parthenon) held steady at $6.2 billion.

- AI-related revenue across consulting grew 30%.

- Over 15,000 professionals worked on AI-led projects in consulting and EY-Parthenon.

- Global revenue totaled $53.2 billion, up 4.0% in local currency.

- Assurance supported over 160,000 audit engagements with AI.

- EY invests over $1 billion annually in AI platforms and products.

Global Workforce and Headcount

- EY’s global workforce exceeded 400,000 professionals in 2025.

- The number includes staff across audit, tax, consulting, and support functions.

- Headcount grew by ~13,000 in FY25 (from ~393,000).

- Growth in consulting and AI project teams outpaced some legacy functions.

- Talent acquisition in sustainability and digital risk advisory has increased significantly.

- EY’s mobility survey shows global talent demand rising amid cost pressures.

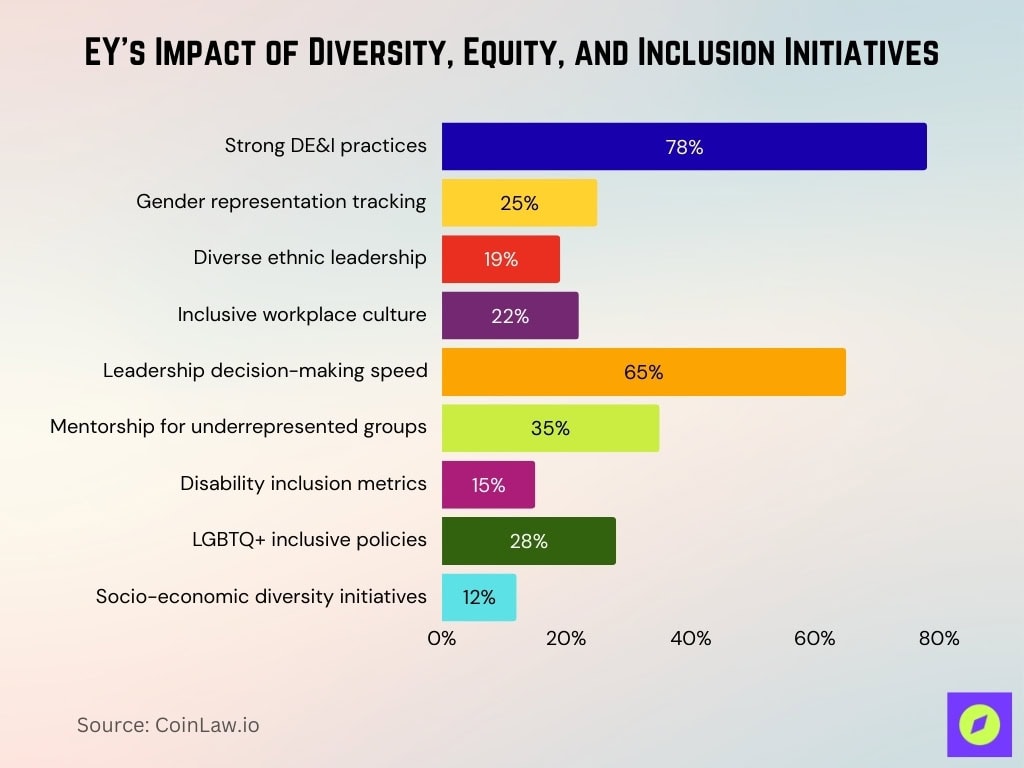

Diversity, Equity, and Inclusion Metrics

- 78% of organizations with strong DE&I practices report higher innovation levels.

- Companies tracking gender representation achieve 25% greater productivity gains.

- Firms with diverse ethnic leadership see 19% increased revenue.

- Inclusive cultures boost employee retention by 22% annually.

- 65% of surveyed leaders link DE&I to faster decision-making.

- Mentorship programs for underrepresented groups improve promotion rates by 35%.

- Organizations with disability inclusion metrics report 15% lower turnover.

- LGBTQ+ inclusive policies correlate with 28% higher engagement scores.

- Socio-economic diversity initiatives yield 12% better talent attraction.

Client Base and Sectors Served

- EY serves 76% of Denmark’s top 100 companies as auditors or advisors.

- EY-Parthenon comprises 25,000 professionals across 150 countries.

- EY operates in 150+ countries and territories, serving diverse clients.

- Financial services represent a core industry cluster with major multinational clients.

- EY audits 29% of Denmark’s top 100 companies in assurance services.

- Client base spans six core clusters, including technology, energy, and health.

- EY Luxury Client Index surveyed 1,672 clients across 10 markets.

- Strategic alliances supported 55% of overall EY revenue from clients.

Office Locations and Footprint

- EY maintains 700+ office locations across 150+ countries.

- Network spans 22 regions grouped into three geographic areas.

- America region hosts 40% of the global office footprint.

- The MEIA area includes 350 offices serving diverse markets.

- Asia-Pacific operates 200+ locations with rapid expansion.

- 85 wavespace™ innovation hubs support client collaborations.

- Local offices employ over 400,000 professionals worldwide.

- Regional hubs deliver 60% of cross-border client engagements.

- Sustainability consulting centers operate in 120 countries.

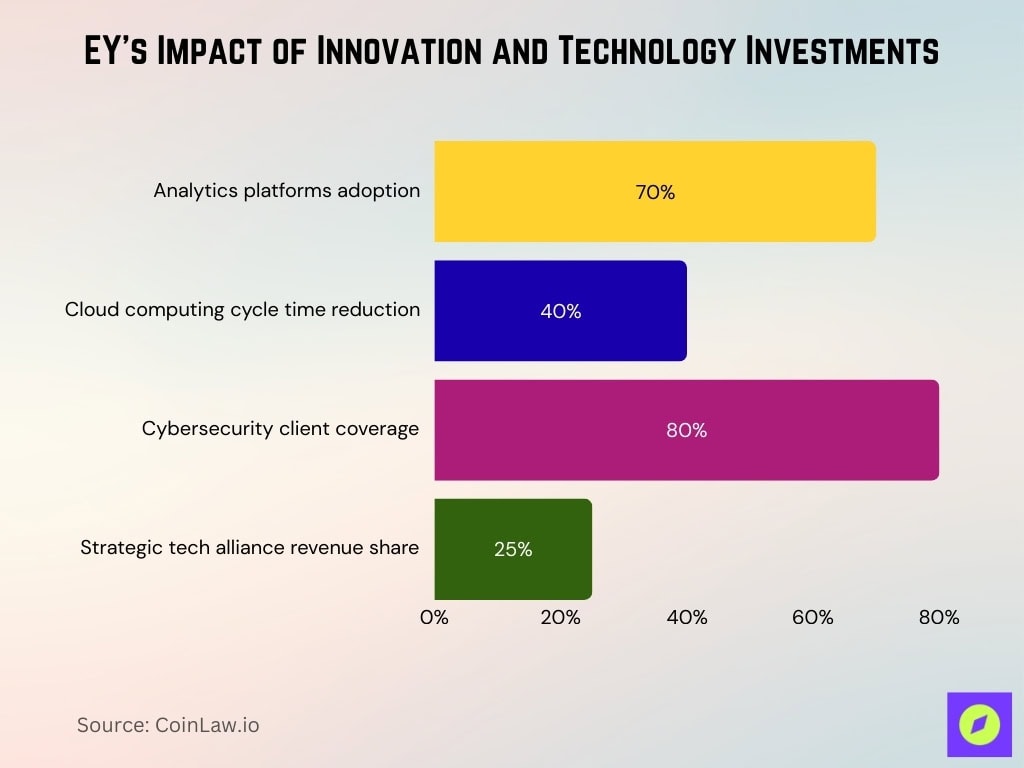

Innovation and Technology Investments

- Analytics platforms support data visualization for 70% of consulting clients.

- Cloud computing integration reduces project cycle times by 40%.

- Cybersecurity services protect operations for 80% of enterprise clients.

- Strategic tech alliances contribute to 25% of innovation revenue.

- EY invests $1 billion annually in AI-first platforms and analytics.

- 85 wavespace™ innovation hubs facilitate client co-creation globally.

- Digital audit tools deployed across 160,000 engagements improve efficiency.

- AI labs enable rapid prototyping for 2,500 complex client challenges.

- Automation tools enhance delivery speed in 15,000 AI projects.

AI and Data Analytics Adoption

- AI-related revenue increased 30% year-over-year.

- Over 15,000 professionals engaged in AI-led client projects.

- 160,000+ audit engagements supported by AI tools.

- EY invests over $1 billion annually in AI platforms.

- 85 wavespace™ hubs focus on AI and data analytics.

- Predictive analytics adoption grew 45% in client finance functions.

- AI governance frameworks are deployed for 70% of enterprise clients.

- Risk modeling solutions enhanced decision-making for 2,500 clients.

- Ethical AI training has been completed by 80% of consulting staff.

Sustainability and ESG Metrics

- Nearly 30,000 professionals worked on over 25,000 client sustainability engagements.

- 300,000 sustainability courses delivered to EY people.

- Emissions intensity per revenue dollar reduced by 54% from the 2019 baseline.

- Emissions per person decreased 52% from 2019 baseline.

- 64% of surveyed companies have climate transition plans.

- 53% of companies set Scope 3 emissions targets.

- 80% link executive incentives to climate performance.

- 68% conduct quantitative climate risk assessments.

- Third consecutive year of emissions reductions across core operations.

Assurance Services Statistics

- EY’s assurance services generated approximately $17.9 billion in revenue in FY25, marking a 3.5% increase year‑over‑year.

- Assurance revenue has remained the largest single service line for EY globally.

- Over the five‑year period (FY20–FY25), assurance services grew at an estimated 6.5% CAGR, illustrating steady long‑term demand for audit and related assurance work.

- EY’s assurance business expanded its client reporting capabilities by integrating AI‑assisted audit tools that enhance data accuracy and completeness.

- The U.S. market has seen improvements in audit quality metrics, with EY aiming for its lowest auditing deficiency rate in over a decade (expected ~9% in 2025) following major quality reforms.

- EY audit professionals globally numbered in the ~140,000 range within the broader assurance workforce involved in digital transformation and regulatory compliance tasks.

- Assurance teams increasingly use predictive analytics to identify emerging risks and prioritize high‑impact audit areas.

- In FY24 (prior year), EY’s assurance segment also recorded growth (6.3% in local currency), setting a strong baseline for FY25 performance.

Tax Services Statistics

- EY’s global tax services revenue grew by ~5.5% to $12.7 billion in FY25, outpacing the overall firm growth rate.

- Tax consulting demand surged amid ongoing global tax reforms, helping guide multinational companies and cross‑border investors.

- Over the five years through FY25, tax services at EY achieved approximately a 6.8% CAGR, reflecting sustained client needs for strategic tax planning.

- In the UK, EY reported a ~5% increase in tax business revenue for FY25, highlighting strong performance in one of its major international markets.

- EY’s Worldwide Corporate Tax Guide 2025 covers tax systems in about 150 jurisdictions, demonstrating EY’s global reach in tax advisory.

- Tax service offerings include direct tax advisory, transfer pricing, digital tax strategy, and tax compliance services tailored to complex global operations.

- EY’s tax teams increasingly support clients with AI‑enabled tax planning tools that automate reporting and model changes in tax legislation.

- EY’s tax revenue growth in FY25 contributed meaningfully to the firm’s overall performance, reinforcing tax services as a critical revenue driver.

Frequently Asked Questions (FAQs)

EY’s tax division grew by 5.5 % in local currency in FY25.

Over 15,000 EY professionals were engaged in AI‑led projects in FY25.

EY reported £3.78 billion in UK fee income for FY25, marking 2 % growth in that market.

EY’s consulting services saw approximately 5.2% revenue growth in FY25.

Conclusion

EY demonstrated resilience and strategic growth across core service lines, with assurance and tax services posting noteworthy gains in a complex global business environment. Assurance services maintained their role as the firm’s largest revenue contributor, while tax services benefited from expanding advisory needs tied to shifting global tax landscapes.

EY’s growth trends show sustained momentum, supported by digital transformation and responsible technology adoption. As EY continues to refine its data‑driven solutions and strengthen audit quality, its performance underscores a balance between innovation and trusted service delivery. Overall, these statistics reveal a firm navigating change while continuing to forge value for clients worldwide.