Electronic Know‑Your‑Customer (eKYC) has rapidly shifted from a compliance nicety to a global necessity. As digital onboarding becomes the norm in banking, fintech, and telecom, eKYC enables institutions to verify identities remotely while reducing friction and fraud risk. In sectors ranging from retail banking to mobile payments, eKYC streamlines user onboarding and strengthens trust in digital interactions. Read on for a detailed look at the latest numbers underlining this shift.

Editor’s Choice

- More than 70% of KYC onboarding in 2025 is expected to be automated via digital identity verification and biometrics.

- Over 82% of global financial institutions had adopted at least one form of biometric authentication by 2024.

- The global digital identity verification market (broader than eKYC) is estimated at $13.78 billion in 2025, indicating rising demand for verification solutions.

- The Asia‑Pacific region executed over 1.8 billion digital verifications in 2024, marking it as the fastest-growing eKYC region.

- In 2024, North America controlled more than 40% of the global eKYC market revenue.

Recent Developments

- Banks and financial institutions account for over 40% of e-KYC usage globally.

- Cloud-based e-KYC solutions represent around 60% of deployments worldwide.

- Identity authentication holds about 50% market share within e-KYC technologies.

- Top vendor LIQUID commands 66% market share in banking and 96% in telecommunications sectors.

- India registered 44.63 crore e-KYC transactions by March 2025, a 6% increase YoY.

- Enhanced due diligence features increased by 35% in recent e-KYC system upgrades.

- Europe is projected to hold around 30%–32% of the global eKYC market in 2025, consistent with forecasts that value the global eKYC market at about $1.1 billion in 2025 and Europe’s share at roughly one‑third.

- The video KYC services market is expected to reach €323.7 million in 2026.

- More than 70% of global KYC onboarding is automated in 2025, replacing manual processes.

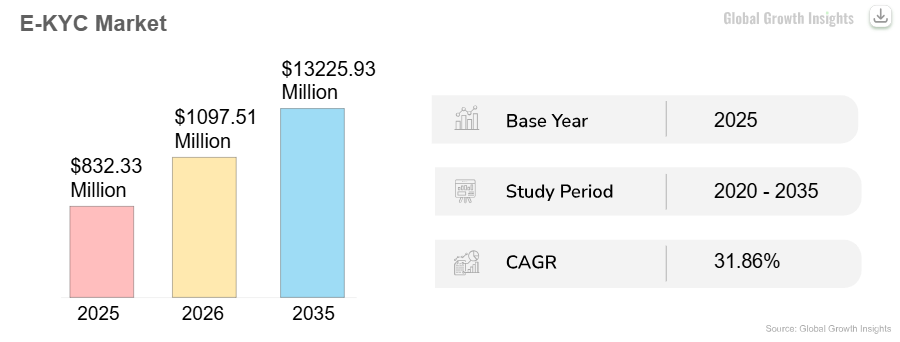

eKYC Market Growth Highlights

- The E-KYC market is projected to reach $13.23 billion by 2035, up from $832.33 million in 2025.

- Between 2025 and 2035, the market is expected to grow at a CAGR of 31.86%.

- By 2026, the market is estimated to rise to $1.10 billion, reflecting strong early-stage momentum.

- The base year for this projection is 2025, with data studied across a 15-year period (2020–2035).

- This surge reflects increasing global demand for remote identity verification, digital onboarding, and regulatory compliance technologies.

North America eKYC Adoption

- Under one market report, the North American eKYC segment’s value reached $271.28 million in 2024.

- The high adoption in North America reflects strict regulatory requirements, widespread digital banking, and consumer demand for streamlined verification.

- Integration of biometric methods (fingerprint, facial recognition) is common among U.S. and Canadian banks, aligning with the global trend of over 82% of institutions using biometrics by 2024.

- The region leads the broader digital identity verification market in 2025, with an estimated share of 38.4%.

- North America’s fintech sector, a major user of eKYC, is projected to contribute significantly to growth, as fintech adoption continues rising.

- Demand for secure, remote customer onboarding (digital banking, mobile wallets, online insurance) in North America is driving eKYC investments.

Asia Pacific eKYC Statistics

- Asia-Pacific registered over 1.8 billion digital verifications in 2024, making it the fastest-growing eKYC region.

- In 2024, the Asia‑Pacific share of global eKYC revenue was estimated at approximately 23%.

- Market size for India’s eKYC segment reached $26.3 million in 2024, with strong growth expected through 2033.

- The broader fingerprint biometrics market in the Asia Pacific is projected to reach $11.0 billion in 2025, highlighting rising demand for biometric verification.

- Rapid smartphone penetration and mobile-first solutions drive high volumes of eKYC in Southeast Asia, often via mobile‑based verification tools.

- Fintech, payment platforms, and mobile wallet providers in countries like India, Indonesia, and Vietnam are leading eKYC adoption in the region.

- Regulatory pressures and government-led digital ID initiatives (such as national identity systems) support widespread eKYC use across the Asia Pacific.

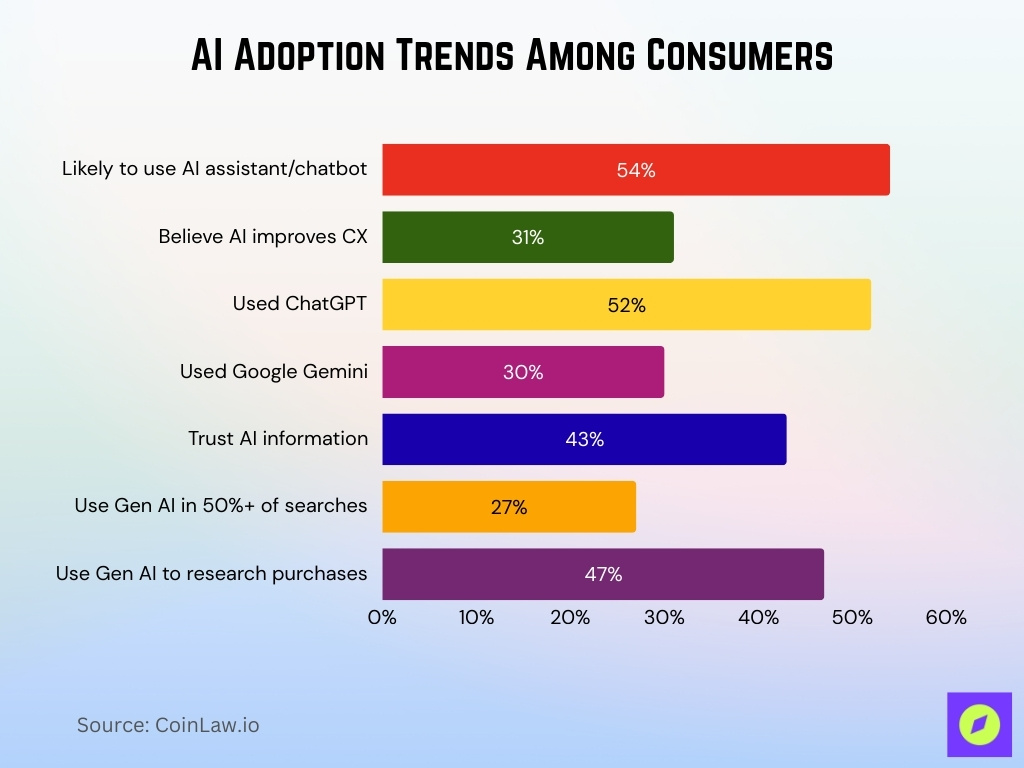

AI Adoption Trends Among Consumers

- 54% are likely to use an AI assistant or chatbot.

- 31% believe AI can improve the customer experience.

- 52% of consumers have used ChatGPT.

- 30% have used Google Gemini.

- 43% trust information from an AI tool.

- 27% use Generative AI at least half the time they perform an internet search.

- 47% are likely to use Gen AI tools to research purchases.

Europe eKYC Market Share

- Europe’s eKYC market was valued at $480 million in 2024.

- The same source projects Europe’s eKYC market to grow to $2.02 billion by 2033, implying a CAGR of around 19.7% over the forecast period.

- Europe accounted for over 30% of the global eKYC market revenue in 2024, amounting to about $203.5 million.

- The UK’s eKYC market reportedly stood at $34.2 million in 2024.

- Germany’s share was about $40.3 million in 2024, indicating significant uptake among large economies.

- France’s eKYC market was estimated to be $18.7 million in 2024.

- Analysts expect Europe’s eKYC adoption to accelerate further as firms adopt real-time identity verification.

Latin America eKYC Growth

- Latin America accounted for more than 5% of global eKYC revenue in 2024, with a market size of roughly $33.9 million.

- A CAGR of about 21.4% is forecasted for Latin America’s eKYC market over 2024–2031.

- Brazil alone had an eKYC market size of approximately $14.5 million in 2024.

- Argentina’s estimated 2024 eKYC market size was $5.7 million.

- Colombia, Peru, Chile and other countries add to regional demand as firms modernize KYC procedures.

- The growth triggers include rising digital payments, increased financial inclusion efforts, and regulatory pressure.

- Demand for eKYC is expected to keep rising, especially in underbanked populations.

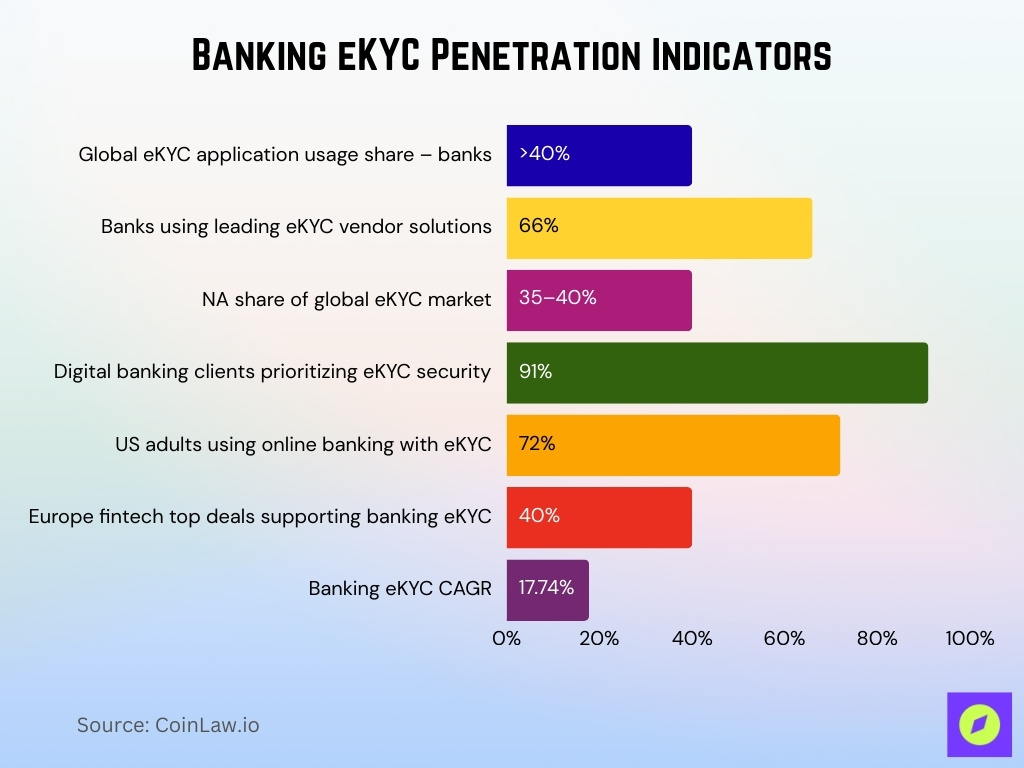

Banking Sector eKYC Usage

- Banks hold over 40% of global e-KYC application usage.

- 66% of banks implementing eKYC use leading vendor solutions.

- North America holds roughly 35%–40% of the global eKYC market in 2025, with the region’s market estimated at about $0.4 billion–$0.45 billion out of a global eKYC market near $1.1 billion.

- 91% of digital banking clients prioritize security via eKYC.

- Banks dominate the e-KYC end-user segment due to AML compliance.

- 72% of US adults used online banking with eKYC in 2023; the trend continues in 2025.

- Europe fintech leads with 40% of top deals supporting banking eKYC.

- Banking e-KYC drives 17.74% CAGR through 2025-2033.

Middle East and Africa Trends

- The MEA region accounted for about $13.56 million in eKYC revenue in 2024, roughly 2% of the global total.

- A CAGR of about 21.7% is projected between 2024 and 2031.

- GCC countries had an estimated eKYC market size of $5.81 million in 2024.

- South Africa’s eKYC market was valued at around $2.14 million in 2024.

- MEA markets leverage eKYC as part of digital transformation and mobile banking expansion.

- Regulatory push for AML and know‑your-customer compliance encourages adoption of digital identity verification.

- Governments and private players are expected to invest more in cloud-based identity infrastructure post‑2025.

Fintech eKYC Adoption Rates

- Over 65% of leading fintechs require biometric liveness checks in eKYC by 2025.

- Fintech holds a 28.80% share in the digital identity market, driven by eKYC in 2025.

- 78% of internet users adopt fintech services monthly, boosting eKYC demand in 2025.

- 32% of fintech KYC processes are powered by blockchain-based ID verification globally.

- Asia-Pacific fintech eKYC grows at 24.50% CAGR through 2025, led by digital inclusion.

- Financial institutions, including fintechs fastest-growing eKYC end-user segment.

- MEA e-KYC market surges with fintech adoption for financial inclusion in 2025.

Fraud Prevention Benefits

- Identity verification transactions double globally from 86 billion in 2025 to 170 billion by 2030.

- Biometric eKYC reduces identity fraud by 85% compared to document checks.

- Multi-modal verification lowers fraud rates by 62% in financial onboarding in 2025.

- Deepfake detection blocks 95% synthetic identity attacks in real-time verification.

- 90% organizations report reduced fraud post biometric verification implementation.

- Video KYC liveness detects 98% impersonation attempts successfully in 2025.

- Global fraud prevention investments reach $48 billion, supporting identity verification by 2025.

Telecom eKYC Implementation

- 96% of telecom operators use leading LIQUID eKYC solutions globally.

- 90% adoption rate is expected among telecom operators by 2025 for SIM verification.

- More than 58% of global telecom operators implemented eKYC by 2025.

- Telecom sector drives 17.74% CAGR in e-KYC market through 2025.

- 155 countries mandate SIM registration with identity verification, fueling telecom eKYC.

- India telecom eKYC transactions reached 44.63 crore in March 2025.

- Biometric eKYC reduces telecom identity fraud by significant margins post-adoption.

- Telecom eKYC enables SIM registration compliance across Asia, African markets in 2025.

Insurance Industry Statistics

- Insurance holds a 35.7% share in identity verification digital services.

- Digital KYC insurance is projected to reach $5.3 billion by 2033.

- Identity verification for insurance stands at $2.18 billion in 2024.

- USA identity verification valued at $4.3 billion in 2025, insurance key driver.

- Asia-Pacific leads e-KYC insurance adoption with regulatory frameworks in 2025.

- Insurance e-KYC reduces onboarding time significantly via AI-biometrics.

Biometric Verification Data

- Fingerprint biometrics are valued at $26.33 billion entering 2025.

- Biometric systems grow from $53.22 billion in 2025 at a 12.3% CAGR.

- Biometrics account for a dominant share of the identity verification market in 2025.

- The biometric ID verification market hits $15 billion in 2025.

- Over 70% consumers use fingerprint biometrics globally in 2025.

- Facial biometrics will be adopted by 43% for payments and verification in 2025.

- Biometric authentication secures $2.5 trillion in mobile payments by 2025.

- North America holds a 32% biometrics market share in 2025.

Video Verification Adoption

- Video KYC adoption increased 41% in the telecom and BFSI sectors in 2025.

- 86 billion digital ID verifications expected worldwide in 2025.

- Video verification will be integrated into 75% multi-factor onboarding workflows in 2025.

- Liveness detection combats deepfakes in 88% video verification platforms.

- Video KYC market is projected $382.5 million in 2024, growing in 2025.

- 15.29% CAGR drives video KYC from 2026-2035 post 2025 surge.

- Mainstream video KYC standard in India, European banks by 2025.

- Identity verification reaches $14.34 billion, including video, in 2025.

Regulatory Compliance Impact

- eKYC market growth accelerated by AML regulations across 155 countries in 2025.

- Non-compliance fines reached $4.3 billion in the banking sector 2024-2025.

- 90% financial institutions cite regulatory pressure as the primary eKYC driver in 2025.

- MiCA regulations mandate eKYC for 80% EU crypto platforms by 2025.

- Automated eKYC reduces compliance costs by 65% for global banks.

- Real-time verification meets KYC/AML requirements in 72% digital onboarding in 2025.

- Regulatory technology investments hit $15 billion, supporting eKYC 2025.

Frequently Asked Questions (FAQs)

The global digital identity verification market is estimated to be worth $13.78 billion in 2025.

North America is expected to lead, holding a 38.4% share in 2025.

The single-factor authentication segment is estimated to hold 68.5% of the market in 2025.

Conclusion

The data show clearly, eKYC and digital identity verification are no longer niche tools. They play a central role across telecom, insurance, banking, fintech, and other industries, serving as the foundation for compliance, onboarding efficiency, and fraud prevention. Biometric and video verification are increasingly preferred for their reliability and speed. Regulators worldwide continue to push firms toward automated identity verification. As identity fraud and cyber threats rise, the growth of the global identity verification market, forecast to reach tens of billions of dollars within the decade, reflects organizations’ urgent need to safeguard trust and security in digital interactions.