Cryptocurrency fraud is evolving fast, and scammers are becoming more sophisticated. As the crypto market matures, understanding fraud trends is crucial for investors, regulators, and the broader public. This article breaks down the latest cryptocurrency fraud statistics and insights to help you stay informed and protected.

Editor’s Choice

- 41% of all crypto-related scams involved phishing and social engineering tactics.

- DeFi exploits totaled ~$2 billion in Q1 2025 alone, with full-year hacks suppressed but significant.

- Crypto investment scams made up 38% of all recorded digital asset fraud incidents.

- AI-generated deepfake scams rose by 700%, impersonating major exchange executives and YouTube influencers.

- Social media fraud channels contributed to 56% of all crypto scam cases, led by Telegram, X (Twitter), and Instagram.

- Stablecoin-related scams surged 47%, driven by fake USDT and USDC investment platforms.

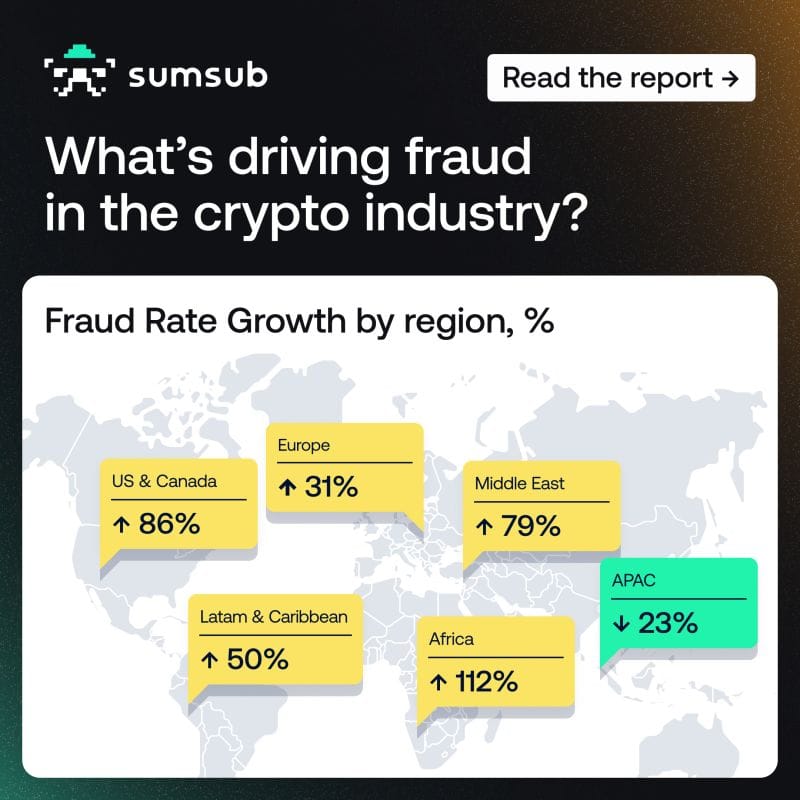

Fraud Rate Growth by Region

- Africa recorded the fastest rise, with fraud rates surging 112%, signaling the rapid expansion of crypto-related scams.

- US and Canada saw a sharp increase of 86%, highlighting escalating fraud pressure in mature crypto markets.

- The Middle East experienced a 79% jump, driven by growing adoption and cross-border crypto activity.

- Latin America and the Caribbean reported a 50% increase, reflecting rising exposure among retail users.

- Europe posted a more moderate growth of 31%, suggesting stronger controls relative to other regions.

- APAC stood out with a 23% decline, indicating improved fraud prevention and enforcement effectiveness.

Cryptocurrencies Present an Attractive Opportunity for Fraudsters

- Over 92% of crypto fraud cases involved privacy-enhancing tools such as mixers and tumblers.

- DeFi protocols accounted for 61% of total stolen crypto assets across major fraud incidents.

- Unregulated exchanges facilitated more than $8.6 billion in illicit transactions, a 17% year-over-year increase.

- Exploited smart contract flaws led to losses exceeding $2.3 billion across multiple DeFi platforms.

- Ponzi and HYIP schemes offered unrealistic monthly returns averaging 27%, targeting novice investors.

- Ransomware-related crypto payments surpassed $1.8 billion, with 68% processed through non-KYC exchanges.

- AI deepfakes in fraud surged ~700% in 2025 per industry reports.

- Pump and dump schemes on low-market-cap tokens resulted in investor losses totaling $740 million.

- Influencer-driven fraud campaigns surged 54%, primarily on YouTube, Telegram, and TikTok.

- Reported fraudulent ICOs and token presales increased 71%, reflecting a rebound in scam coin launches.

Scammers Increasingly Rely on Social Media to Reach Targets

- 56% of cryptocurrency scams originated from social media platforms, including Instagram, Telegram, and X (Twitter).

- Meta platforms like Facebook and Instagram drove 38% of reported crypto scam leads.

- Telegram operated over 1,500 active scam channels promoting fake airdrops and investments.

- Fraudulent YouTube livestreams mimicking Bitcoin giveaways defrauded viewers of $120 million.

- TikTok scams targeting Gen Z surged 145%, featuring fake influencer testimonials.

- WhatsApp groups facilitated $310 million in crypto theft via bogus trading signals.

- LinkedIn recruitment scams for crypto jobs rose 67%, leading to widespread fraud.

- Fake endorsements impersonating Elon Musk comprised 32% of social media scam attempts.

- Deepfake videos of influencers on Instagram caused $450 million in losses.

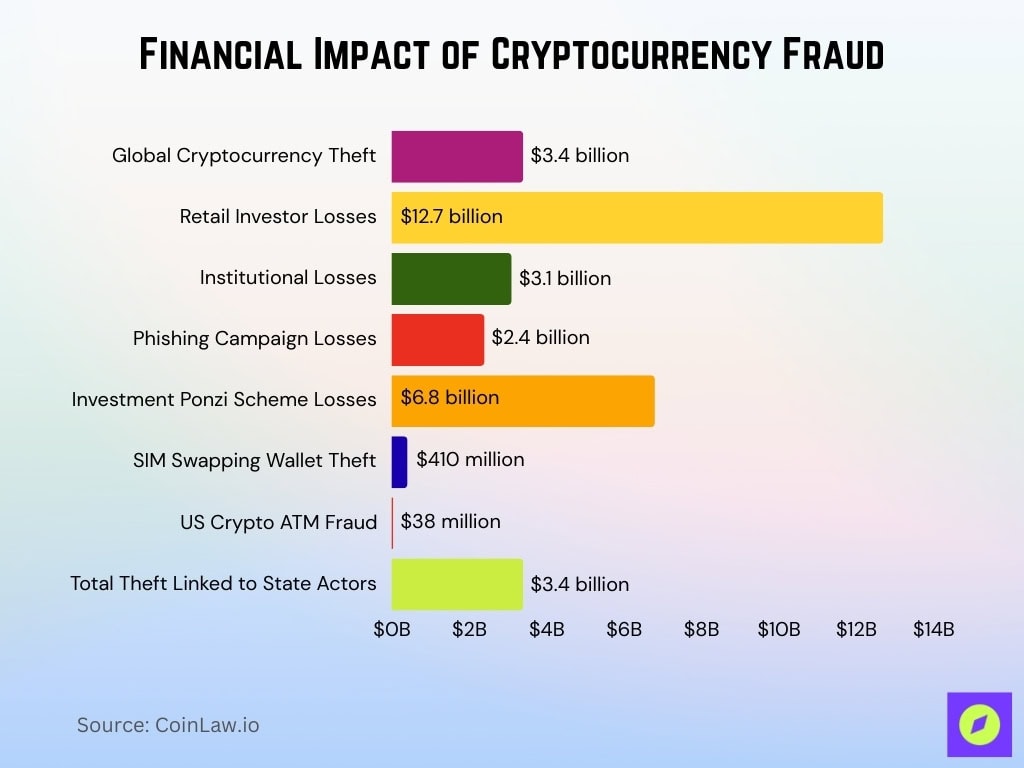

Financial Impact of Cryptocurrency Fraud

- Global cryptocurrency theft reached $3.4 billion in 2025.

- Retail investors suffered 74% of total losses, amounting to over $12.7 billion.

- Institutional entities incurred $3.1 billion in damages from advanced hacks and fraud schemes.

- Phishing campaigns extracted $2.4 billion worldwide through email and SMS deception.

- Investment Ponzi schemes drained $6.8 billion, heavily targeting older people over 55.

- FTC data showed crypto scams comprising 47% of all payment fraud reports.

- SIM-swapping exploits on wallets caused $410 million in thefts among affluent users.

- US crypto ATM fraud tallied $38 million, fueled by impersonation of authorities.

- Law enforcement recoveries remain limited; total theft hit $3.4 billion, with a focus on North Korean actors.

Regulatory Measures Addressing Cryptocurrency Fraud

- The SEC initiated 33 enforcement actions against fraudulent crypto projects, down 30% from prior levels.

- MiCA regulation mandated 100% identity verification for crypto transactions over €1,000.

- Japan’s FSA revoked 4 VASP licenses for KYC non-compliance, the highest on record.

- The UK FCA noted a 28% drop in reported crypto scams due to enhanced KYC enforcement.

- 85 jurisdictions implemented FATF Travel Rule legislation, covering 73% globally.

- VARA in Dubai advanced fraud prevention through expanded licensing under crypto rules.

- South Korea reduced onboarding fraud by 39% via centralized crypto ID systems.

- FATF reported 79% of VASPs were KYC-compliant worldwide as of Q3.

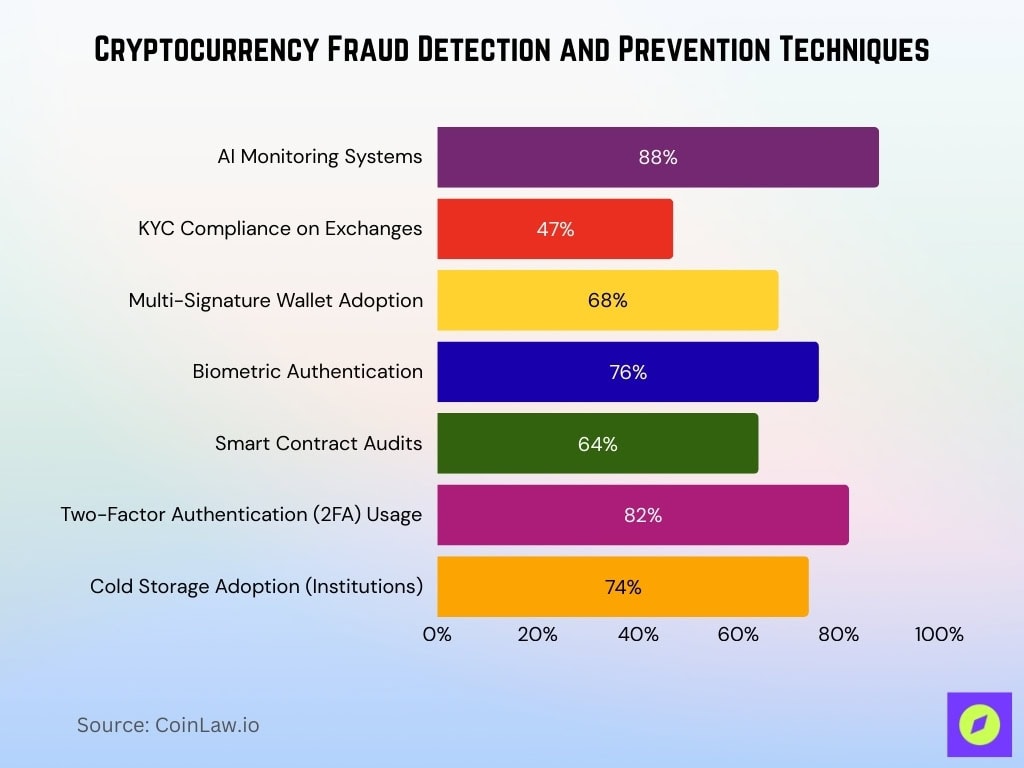

Cryptocurrency Fraud Detection and Prevention Techniques

- Blockchain analytics firms uncovered over $4.8 billion in illicit crypto transactions through advanced tracing.

- AI monitoring systems flagged 88% of suspicious activities prior to major financial damage.

- KYC compliance on exchanges rose 47%, blocking anonymous fund movements by scammers.

- Multi-signature wallets saw 68% adoption growth across DeFi ecosystems for added security.

- Biometric authentication cut fake account registrations by 76% on leading platforms.

- Smart contract audits climbed 64%, averting exploits linked to prior massive DeFi losses.

- 2FA usage among traders increased 82%, slashing account compromises by 59%.

- Cold storage adoption hit 74% for institutions, minimizing online hacking vulnerabilities.

Role of Blockchain Technology in Combating Fraud

- Immutable blockchain records enabled tracing of $5.7 billion in stolen cryptocurrency funds.

- Decentralized identity solutions reduced fraudulent DeFi account creation by 52%.

- Zero-knowledge proofs (ZKPs) reached 18% adoption among crypto exchanges for privacy.

- Blockchain analytics boosted fraud detection accuracy by 78% via pattern algorithms.

- Token provenance tracking in NFT markets decreased counterfeit scams by 38%.

- Smart contracts with audit trails blocked over $950 million in fraudulent transactions.

- DAOs using voting-based detection cut fraudulent proposals by 55%.

- Cross-chain monitoring identified $1.1 billion in suspicious asset movements.

- Open-source forensic tools like GraphSense achieved 65% adoption by investigators.

- 85% of US law enforcement agencies deployed blockchain analytics tools.

Impact of AI and Deepfake Technology on Cryptocurrency Fraud

- AI-generated deepfakes drove $4.6 billion in crypto scams, comprising 40% of high-value cases.

- 87 deepfake scam rings dismantled across Asia in Q1, targeting public figures and executives.

- Deepfake impersonations ranked as the fourth leading crypto fraud method by volume.

- AI voice cloning featured in 210 reported incidents, causing $110 million in losses.

- AI phishing emails evaded filters in 68% of attempts, heightening crypto vulnerabilities.

- Synthetic identities via AI made up 34% of fake exchange account registrations.

- Generative AI content powered 48% of social media crypto scam promotions.

- Fake AI trading bots defrauded investors of $680 million with false return promises.

- AI-automated pump-and-dump operations led to $610 million in altcoin investor losses.

- Deepfake video calls tricked firms into $35 million fake token investments.

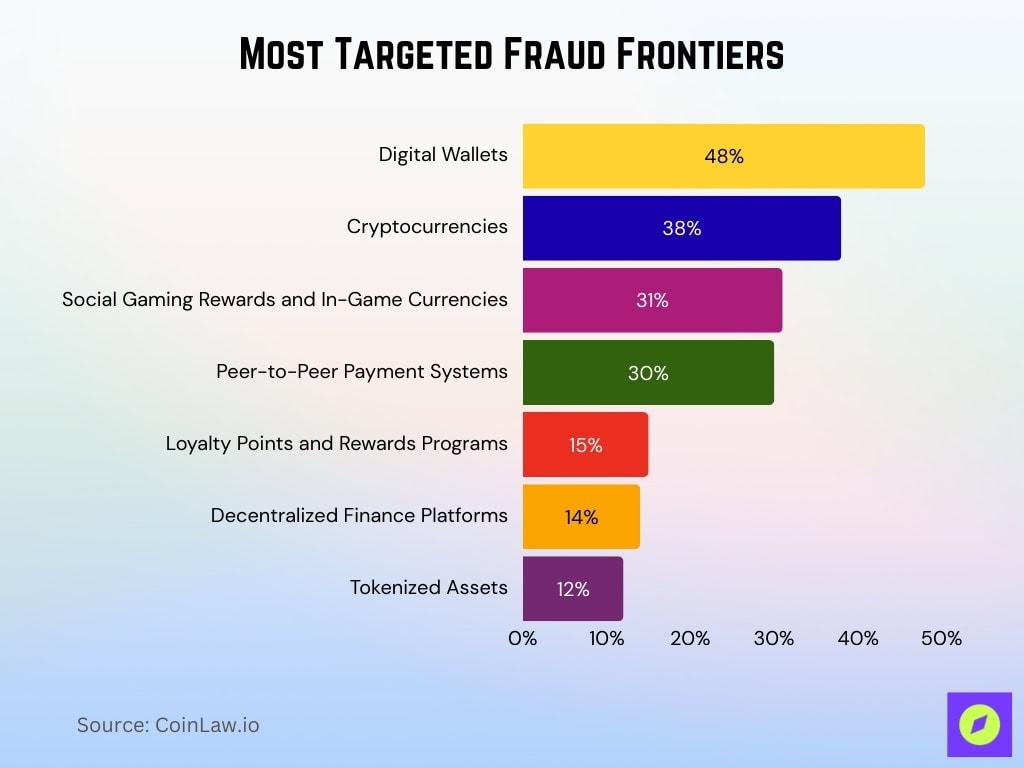

Most Targeted Fraud Frontiers

- Digital wallets lead fraud targeting at 48%, making them the primary entry point for crypto-related scams and account takeovers.

- Cryptocurrencies rank second at 38%, reflecting persistent exploitation of exchanges, wallets, and on-chain transfers.

- Social gaming rewards and in-game currencies account for 31%, as fraudsters exploit virtual economies and younger user bases.

- Peer-to-peer payment systems represent 30%, driven by instant transfers and limited transaction reversibility.

- Loyalty points and rewards programs attract 15%, highlighting growing abuse of non-cash digital value systems.

- Decentralized finance platforms face 14% of targeting, largely tied to smart contract exploits and protocol vulnerabilities.

- Tokenized assets account for 12%, indicating rising fraud exposure as real-world assets move on-chain.

Victim Demographics and Behavior Patterns

- Victims aged 25-40 comprised 64% of cryptocurrency fraud reports.

- Men represented 71% of reported crypto scam victims.

- Older people over 60 suffered $3.2 billion in losses, exceeding all younger groups combined.

- Gen Z (18-24) faced 2.8 times higher risk from social media crypto scams.

- Novice investors without prior experience accounted for 52% of scam cases.

- 78% of victims skipped due diligence before fraudulent crypto investments.

- 83% were initially contacted via social media, led by Instagram and Telegram.

- Quick-return seekers were 3.4 times more susceptible to rug pulls and Ponzi schemes.

- 80,000 unique victims reported personal wallet compromises amid rising incidents.

- 40s age group filed the highest number of crypto fraud complaints.

Recent Developments

- Interpol arrested 1,800 suspects in global crypto fraud operations, recovering $1.1 billion in assets.

- FBI dismantled four major Ponzi schemes totaling $1.5 billion through specialized units.

- Europol Operation Borrelli led to 5 arrests and the seizure of $540 million from 5,000 victims.

- China shut down 3,200 crypto fraud networks, reclaiming $2.1 billion in stolen funds.

- India ED froze $350 million linked to illegal loan apps and investment fraud rings.

- UK NCA Crypto Unit secured 18 arrests for schemes causing $450 million losses.

- DOJ seized $225 million in crypto confidence scams via blockchain tracing.

- Australia’s ASIC pursued cases against exchanges failing to halt $520 million fraud.

- Eurojust operation busted €600 million laundering network with 9 arrests across Europe.

- Interpol HAECHI VI recovered $439 million and blocked 68,000 bank accounts.

Frequently Asked Questions (FAQs)

Private key compromises accounted for 43.8% of all stolen cryptocurrency.

The Bybit exchange hack resulted in $1.5 billion stolen by DPRK-linked hackers.

Stolen funds rose 21% to $2.2 billion.

Wallet compromises affected 80,000 unique victims, nearly double from 2022.

Conclusion

Cryptocurrency fraud is no longer an emerging threat; it’s an evolving and sophisticated global challenge. As this year progresses, fraudsters are leveraging AI, deepfakes, and the anonymity of DeFi to target both individuals and institutions on an unprecedented scale. However, advances in blockchain forensics, global regulation, and user education are steadily closing the gap. The key to mitigating risk lies in awareness, vigilance, and leveraging robust security protocols.