Cronos has emerged as a key Layer‑1 blockchain, aimed at powering decentralized finance (DeFi), NFTs, and scalable smart contracts with high throughput and low fees. Its integration with the Crypto.com ecosystem gives it access to millions of users and real utility across payments and digital asset markets. In real‑world finance, companies leverage Cronos for cost‑efficient settlement rails, and developers deploy DeFi protocols that compete with traditional finance alternatives. Explore the full article below to understand how Cronos is performing across metrics that matter in crypto today.

Editor’s Choice

- Cronos’ circulating supply stands at roughly 38.6 B CRO in late 2025, in line with a 100 B CRO max supply following the strategic reserve governance change.

- Market cap is around $3.5 billion as of late 2025, reflecting Cronos’ status as a mid‑cap Layer‑1 asset.

- Total Value Locked (TVL) is near $520 million in DeFi, with roughly $410–420 million in bridged TVL and $168 million in stablecoins.

- Maximum theoretical TPS capacity reaches about 60,000 TPS with ~0.5–0.6 s block times after BlockSTM optimizations.

- Average transaction fee ≈ $0.0033 per transfer.

- Over 105 million total transactions have been processed historically.

- Protocol hosts hundreds of active smart contracts and dApps.

Recent Developments

- Cronos 2025 roadmap emphasizes on‑chain asset tokenization and institutional adoption, with targets of $10 billion in tokenized assets by 2026.

- Cronos partnered with Crypto.com and Morpho to launch DeFi lending vaults accessible to 150 million users starting Q4 2025.

- Network upgrades, including BlockSTM, achieved up to 60,000 TPS and 500ms block times for Ethereum interoperability via IBC.

- Strategic integration with Crypto.com wallets boosted daily transactions by 400% and reduced gas fees 10x.

- Cronos Labs allocated $100 million ecosystem fund for dApps, infrastructure, and $42,000 PayTech Hackathon prizes.

- Expanded global compliance via Crypto.com’s 120+ licenses and MiCA approval supports institutional infrastructure.

- Increased focus on AI‑native DeFi primitives through Cronos AI SDK for LLMs and Proof of Identity standards.

- Cronos maintained $710 million TVL and ranked top 30-40 chain by market cap among cryptocurrencies.

CRO Technical Snapshot: RSI, MACD, and Price Action

- Current CRO Price is $0.09303, showing a 1.94% decline in the last session.

- RSI (14) stands at 49.43, signaling neutral momentum near the 50 mark.

- RSI Signal Line is slightly higher at 49.99, indicating flat trend strength.

- MACD Line is at 0.00007, while the Signal Line is -0.00009, suggesting a mild bullish crossover.

- MACD Histogram shows a reading of -0.00016, implying weak momentum divergence.

- Recent High reached $0.09537, while the recent low dropped to $0.09282 within the same candle.

- Buy/Sell Spread is minimal, with Buy at $0.09305 and Sell at $0.09303 on Coinbase.

Inflation, Emissions, and Burn Statistics

- Token burns totaled 183 million CRO worth $49.5 million in September, reducing the circulating supply.

- Crypto.com executed a 50 million CRO burn in late 2025 following governance approval with 94% yes votes.

- Yearly staking emissions are fixed at 500 million CRO from a 5 billion allocation over the next decade.

- Monthly unlocks from the strategic reserve added 1.16 billion CRO starting in April through 2030.

- 15% of transaction fees are automatically burned, creating deflationary pressure on supply.

- Third major 50 million CRO burn scheduled for late 2025 to enhance scarcity.

- Inflation rate from block rewards is estimated to be lower than many PoS peers at under 10% annually.

- Burn programs offset emissions, reducing net supply pressure by 20% year-over-year.

Liquidity, Exchange Listings, and Pairs

- CRO traded on 20+ major exchanges, including Crypto.com, OKX, Kraken, and Coinbase.

- Daily trading volume averaged $18.41 million with a 44.22% increase on key pairs.

- CRO/USDT pair showed 917,391 CRO large trades worth $235,953 on Coinbase.

- DEXs’ volume reached $5.82 million daily across Cronos protocols.

- CRO/USD liquidity supported $38.96 million in 24-hour Kraken trades.

- Order book depth provided low slippage with stable $100k-$1 million daily volumes.

- Paired with ETH, USDC stablecoins across CEX and DEX venues.

- 7-day DEX volume totaled $34.9 million with 0.03% CEX dominance.

- Liquidity pools stabilized spreads, reducing price impact on deeper pairs.

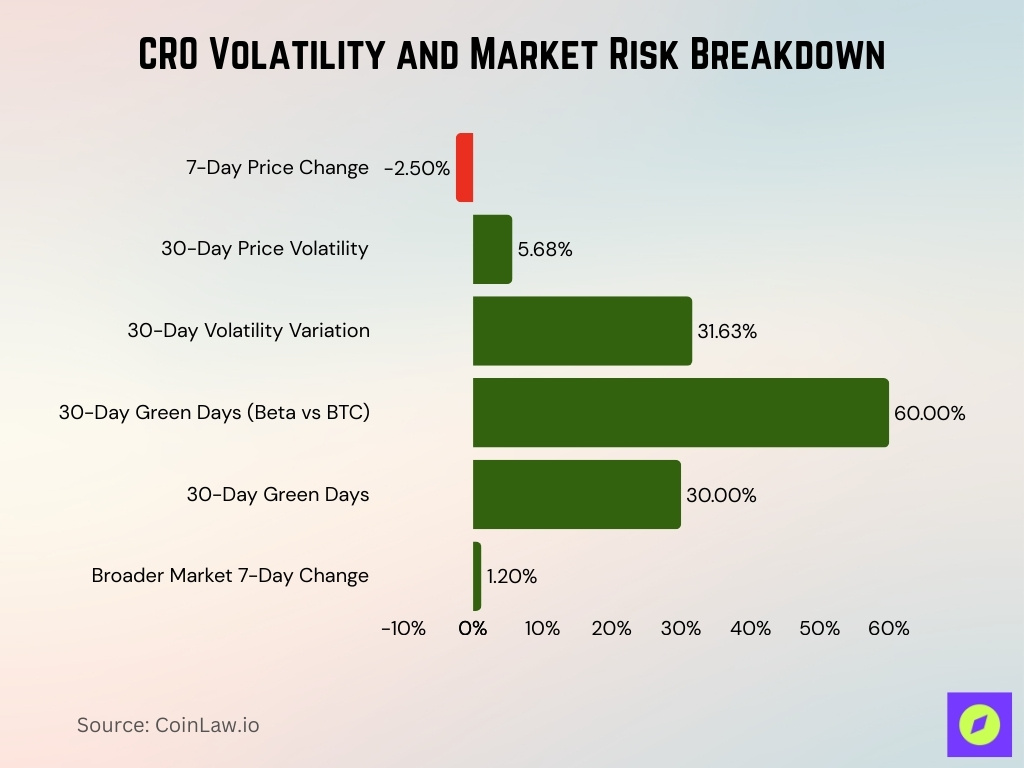

Volatility and Risk Metrics

- CRO 7-day performance fell ~2.5% while broader crypto markets rose 1.2%.

- 30-day price volatility measured 5.68% with 9/30 green days.

- 30-day volatility variation reached 31.63% amid neutral sentiment.

- CRO exhibited high beta patterns relative to Bitcoin, with 60% green days in the recent 30 days.

- Daily trading volume averages around $18–20 million in late 2025, with short‑term spikes frequently pushing volume above $30 million.

- Price predictions ranged from $0.09 to $0.35 across analysts.

- Order book depth on Crypto.com provided $10-12 million liquidity at ±2% price levels.

- Average 30-day trading volume hit $34.94 million, supporting moderate liquidity.

- 14-day RSI stood at 61.82, indicating neutral-to-bullish momentum.

On-Chain Activity Overview

- Theoretical TPS capacity reached 60,000 with 500ms block times via BlockSTM.

- Daily transactions surged 400% after block time was reduced from 6s to 0.5s.

- Daily active users grew 150% following gas fee reductions and upgrades.

- Real-time TPS averaged 1.08 with a max of 141.7 TPS over 100 blocks.

- Cross-chain IBC traffic connected to 115+ blockchains via LayerZero.

- Average block time achieved 0.6s with instant finality and sub-$0.01 fees.

- The average transaction fee stood at $0.003294, supporting DeFi and NFT activity.

Transactions, TPS, and Throughput

- Theoretical maximum TPS reached 60,000 via BlockSTM optimizations.

- Average block time reduced to 0.6 seconds with instant finality.

- Real-time TPS averaged 1.08, peaking at 141.7 TPS over 100 blocks.

- Daily transactions processed 40 million during peak October activity.

- Average transaction fee maintained at $0.003294, enabling high throughput.

- Confirmation latency dropped below 500ms for DeFi settlement.

- Throughput scaled 400% post-block time reduction from 6s to 0.5s.

- SDK optimizations handled demand spikes without exceeding 0.01s lag.

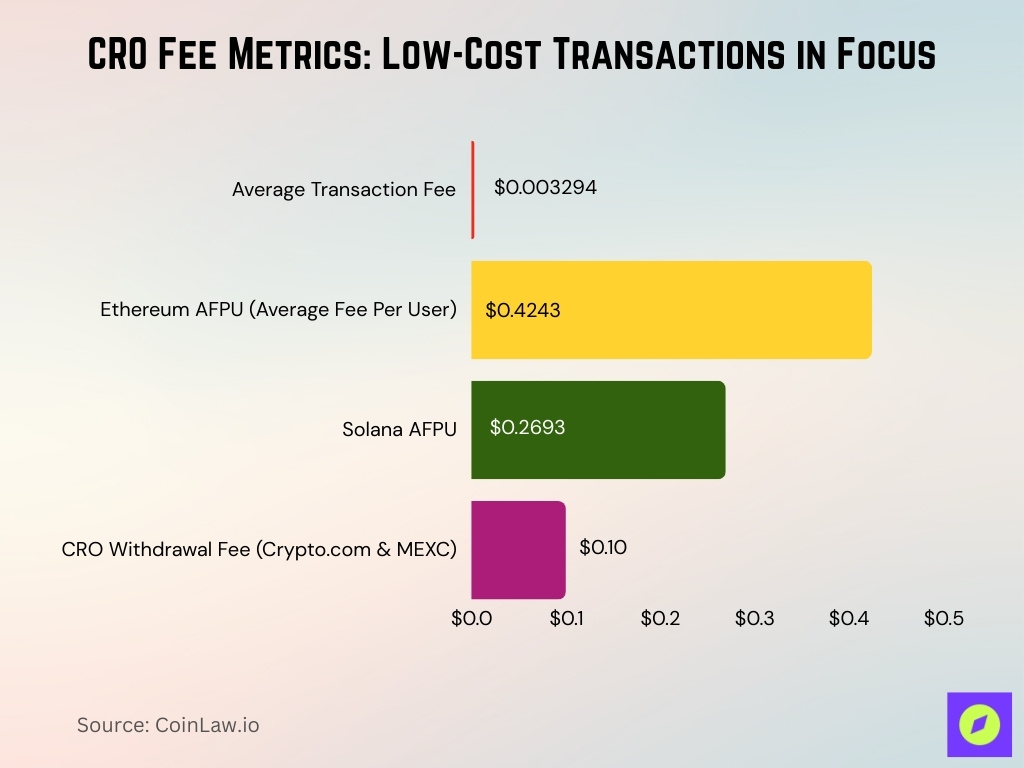

Transaction Fees and Cost Metrics

- The average transaction fee remained $0.003294 during high throughput periods.

- Sub-$0.01 fees achieved across 60,000 TPS capacity with instant finality.

- Fees ranked lower than Ethereum’s $0.4243 AFPU and Solana’s $0.2693.

- CRO withdrawal fees averaged $0.10 across Crypto.com and MEXC exchanges.

- Gas prices stabilized at 431 Gwei fast and 379 Gwei normal on EIP-1559.

- 15% of transaction fees are automatically burned, creating deflationary pressure.

- Validator fee revenues generated from 40 million daily transactions.

- The dynamic base fee adjusted predictably during 400% transaction growth.

- Cost efficiency supported microtransactions at sub-cent levels consistently.

Block Time, Finality, and Network Performance

- Processed over 150 million transactions across Cronos chains using CRO gas.

- Achieved 60,000 TPS maximum with 500ms block times via BlockSTM.

- Average block time maintained at 0.6 seconds with instant finality.

- Real-time TPS averaged 1.08, peaking at 141.7 TPS over 100 blocks.

- Daily transactions reached 40 million during peak demand periods.

- Validator sync times were reduced, supporting 400% transaction growth.

- EVM compatibility handled congestion at sub-$0.01 fees consistently.

- Network uptime exceeded 99.99% across high-throughput conditions.

- Snapshot restore optimized cutting deployment times by 75%.

Total Value Locked (TVL) on Cronos

- Cronos TVL is near ~$520 million across DeFi protocols, supported by roughly $168 million in stablecoins.

- Stablecoins within TVL exceed $181 million market cap, anchoring liquidity.

- Pools and bridged value account for roughly $410–420 million in bridged TVL, including native and third‑party assets, within a broader ~$520 million DeFi TVL footprint.

- DEX volume on Cronos contributes yearly TVL uplifts via user activity.

- TVL fluctuations reflect broader market conditions and DeFi adoption cycles.

- Cronos’s TVL remains competitive among mid‑tier EVM chains.

- TVL metrics help gauge smart contract value secured and locked.

- A portion of TVL originates from DEXs and yield protocols native to Cronos.

- Monitoring TVL over time highlights ecosystem momentum and capital flows.

- Bridged TVL indicates cross‑chain asset inflows.

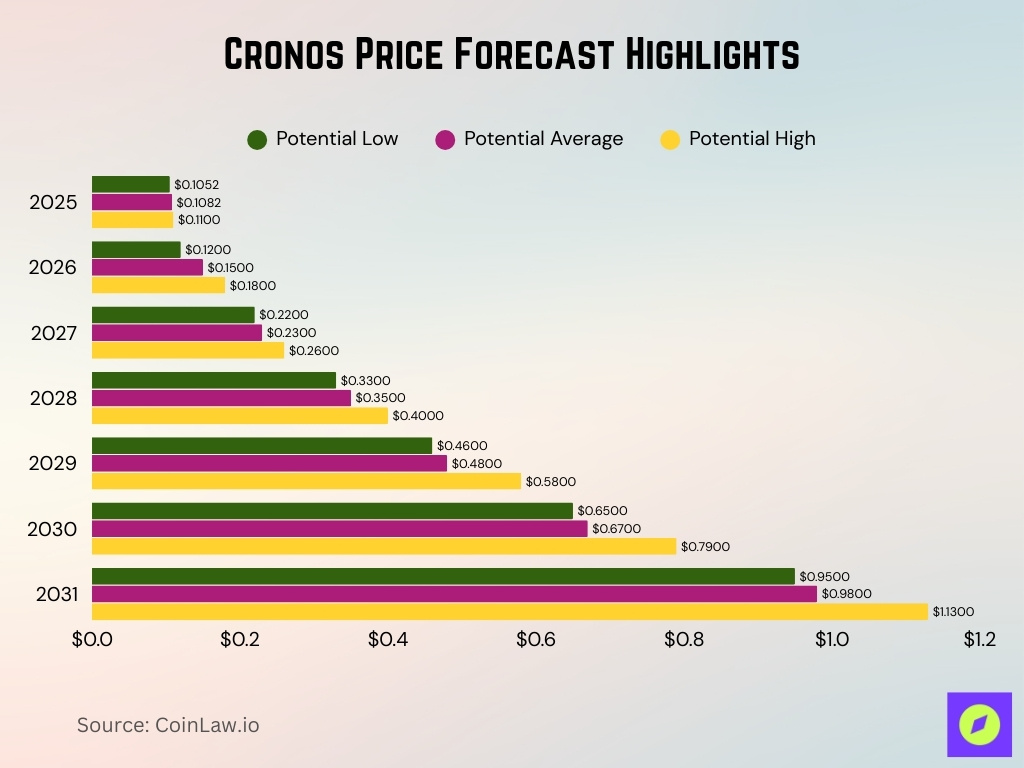

Cronos Price Forecast Highlights

- 2025 forecast shows a low of $0.1052, with a potential average of $0.1082, and a maximum price of $0.110.

- 2026 prediction rises to a low of $0.12, with an average of $0.15 and a high of $0.18.

- 2027 projection jumps to a minimum of $0.22, with an average price of $0.23 and a maximum target of $0.26.

- 2028 estimate continues upward with a low of $0.33, an average of $0.35, and a peak price of $0.40.

- 2029 outlook places the minimum at $0.46, average at $0.48, and high at $0.58.

- 2030 range shows $0.65 (low), $0.67 (average), and $0.79 (high).

- 2031 target peaks with a low of $0.95, an average of $0.98, and a maximum forecast of $1.13.

Wallets, Addresses, and Holder Distribution

- Total unique addresses reached 2,236,404 across the Cronos network.

- Active addresses surpassed 350,000 in the final three months, with 32,000 peak daily.

- Daily active addresses averaged 487, indicating steady engagement.

- The top 10 holders controlled roughly 8% of Cronos’ mainnet supply.

- ERC-20 CRO holders numbered 339,177 with a neutral token reputation.

- Crypto.com integration provided access to 150 million+ potential users.

- Address growth reflected a 150% rise in active users post-upgrades.

- Whale concentration showed top addresses holding 92% wrapped CRO on Ethereum.

dApps, DeFi, and NFT Ecosystem Statistics

- Hosted 500+ dApps across DeFi, payments, and NFTs, securing $500 million TVL.

- 8 major DeFi dApps are active, including VVS Finance and CroSwap protocols.

- Total DeFi TVL is around $520 million, with stablecoins still near $168 million and DeFi activity gradually lifting overall TVL.

- VVS Finance captured $219.67 million TVL, generating $16,516 daily fees.

- DEXs’ volume hit $5.82 million daily across Cronos protocols.

- Ebisu’s Bay led as the top NFT marketplace with diverse collections.

- VVS V3 processed $230,599 24h volume across 40 pairs.

- Cumulative DEX volume exceeded $13 billion, led by VVS Finance.

- 15+ self-custodial wallets support dApp interactions.

Frequently Asked Questions (FAQs)

Cronos claims access to 150 million+ users through its strategic partner, Crypto.com.

Following strategic announcements, CRO surged ~11% during market stabilization post a large liquidation event.

Cronos zkEVM saw ~59.8% TVL growth in August 2025 on selected protocols.

Conclusion

Cronos’s statistics reflect a blockchain that continues to grow in user base, network performance, and ecosystem breadth. TVL and on‑chain metrics indicate solid DeFi engagement, while staking and validator participation underscore robust security foundations. Wallet growth and holder diversification point to real adoption beyond exchange flows, and the expanding suite of DeFi and NFT dApps highlights a dynamic developer community. As performance metrics like TPS and finality improve, Cronos strengthens its competitive stance among EVM‑compatible and Cosmos‑linked Layer‑1s. These trends suggest that Cronos may play a pivotal role in the evolving decentralized finance and Web3 landscape.