Consensys, the blockchain software company founded by Ethereum co‑founder Joseph Lubin, remains one of the most influential players in Web3 infrastructure and applications. Its products, especially MetaMask and Infura, serve millions of users and developers worldwide, shaping real‑world use cases from decentralized finance (DeFi) to digital identity tooling.

From powering decentralized apps (dApps) to enabling seamless wallet integration for retail and institutional users, Consensys’ impact is felt across crypto wallets, developer infrastructure, and blockchain adoption. Explore this article to understand the latest Consensys statistics, including user adoption, market dynamics, and recent developments driving growth.

Editor’s Choice

- ~30 million monthly active users (MAUs) on MetaMask in mid‑2025.

- MetaMask supports 11 distinct blockchains as of 2025.

- ~55% growth in MetaMask MAUs from late 2023 to early 2024.

- MetaMask’s Social Login feature cut onboarding friction by ~30%.

- Consensys’ Web3Auth acquisition aimed to simplify wallet onboarding and security.

- MetaMask trading and perpetual futures volume trends exceeded $765 billion total DEX volume by August 2025.

- Consensys was valued at $7 billion in its 2022 Series D funding round.

Recent Developments

- MetaMask recently integrated support for the Monad network to expand user access to EVM ecosystems.

- Consensys acquired Web3Auth to simplify wallet management and improve user security in 2025.

- The company launched a $30 million rewards program tied to MetaMask and Linea activity to boost engagement.

- Rumors and hints around an imminent MetaMask token have circulated through 2025.

- Consensys is considered a potential candidate to pursue a public listing (IPO) in 2025.

- Expansion of the MetaMask ecosystem includes perpetual futures trading features within the wallet app.

- Partnerships and ecosystem expansion continue to increase cross‑chain and dApp integration opportunities.

- Enhanced security measures and developer‑related updates were highlighted in mid‑2025 MetaMask security reporting.

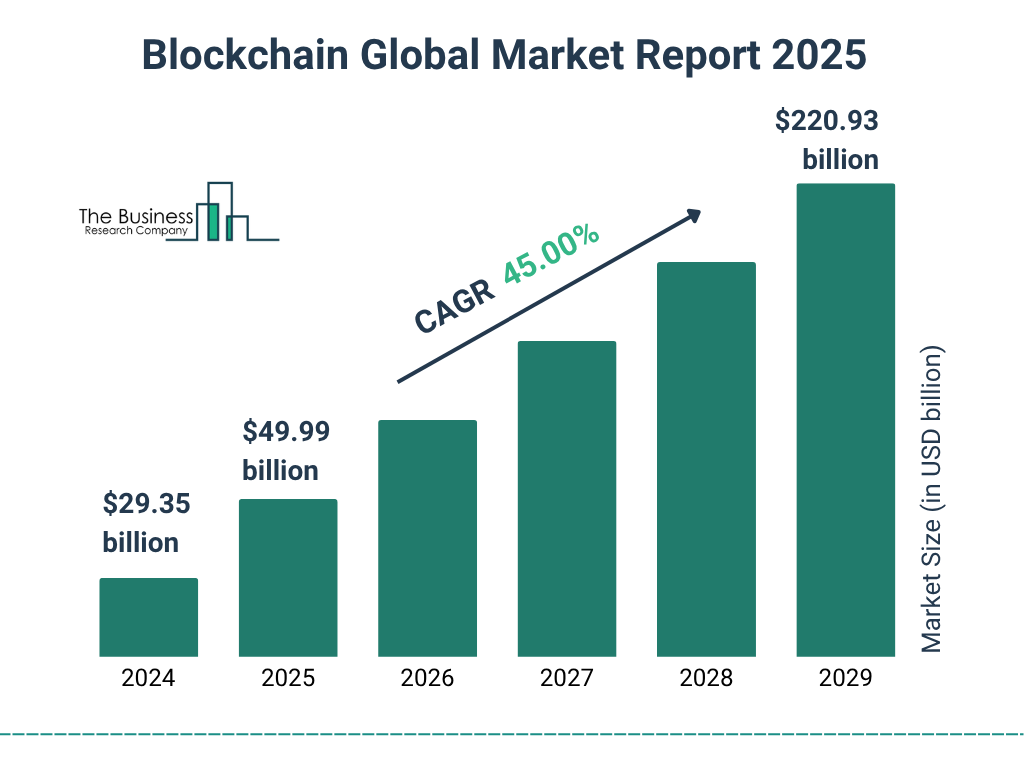

Blockchain Global Market Growth Outlook

- The global blockchain market is projected to grow from $29.35 billion in 2024 to $220.93 billion by 2029, highlighting rapid long-term expansion.

- Market size is expected to reach $49.99 billion in 2025, reflecting accelerating enterprise and government adoption.

- Continued momentum pushes the market to approximately $74.5 billion in 2026, driven by DeFi, Web3, and infrastructure investments.

- By 2027, the blockchain market value is forecast to surpass $111 billion, signaling mainstream commercial use.

- Growth intensifies in 2028, with the market estimated at $165 billion as scaling solutions and regulation mature.

- Overall growth represents a strong 45.0% CAGR, positioning blockchain as one of the fastest-growing global technology sectors.

Consensys Overview

- Founded in 2014 by Ethereum co-founder Joseph Lubin.

- Headquartered in Fort Worth, Texas, with a global workforce expanding year over year.

- 30 million MetaMask monthly active users drive global Web3 adoption.

- MetaMask supports 143 million total users worldwide.

- Linea network DeFi TVL surpasses $1.2 billion.

- Company valuation exceeds $7 billion post-funding.

- Total funding raised reaches $715 million across rounds.

- The workforce comprises 501-1,000 employees globally.

- Linea Ignition program distributes 1 billion LINEA tokens.

- MetaMask website garners 5.64 million monthly visits.

Key Consensys Products and Services

- 30 million MetaMask monthly active users globally.

- MetaMask supports 11 blockchains, including Sei network.

- MetaMask Social Login reduces onboarding friction by 30%.

- Linea DeFi TVL reaches $1.214 billion record high.

- Linea’s daily DEX volumes exceed $100 million.

- Linea fees paid total $370K in 24 hours.

- MetaMask cumulative swap revenue hits $325 million.

- Metamask.io records 5.64 million monthly visits.

- Infura serves over 400,000 Web3 developers globally.

Blockchain Marketing Budget Allocation Trends

- Influencer collaborations receive the largest share at 22%, highlighting the importance of trusted voices in crypto adoption.

- Content creation accounts for 20% of total spend, reflecting strong demand for educational and thought leadership assets.

- Community management captures 18%, showing continued investment in Discord, Telegram, and DAO engagement.

- Airdrops and giveaways represent 16%, emphasizing user acquisition and token-driven growth strategies.

- Paid advertising makes up 10%, indicating a cautious approach due to regulatory and platform restrictions.

- Events and activations receive 9%, supporting conferences, meetups, and ecosystem networking.

- Analytics and tools account for 5%, underscoring a smaller but critical focus on performance tracking and optimization.

MetaMask Usage Statistics

- ~30 million MAUs reported in early‑to‑mid 2025.

- Growth from ~19 million MAUs in late 2023 to ~30 million in early 2024 (~55% increase).

- MetaMask is used across major platforms as a default wallet for DeFi and NFT activities.

- The wallet supports 11 blockchains as of 2025.

- The global wallet adoption trend shows ~861 million crypto wallet users projected worldwide by 2025.

- MetaMask’s onboarding improvements reportedly reduced friction by ~30%.

- Web traffic to metamask.io remained strong, with millions of visits monthly in 2025.

- ~17.4% of all MetaMask site visitors originate from the United States.

MetaMask Market Share and Adoption

- MetaMask holds an estimated 80–90% share of Web3 wallet usage among decentralized app users.

- Among self‑custodial wallets, MetaMask leads with over 22 million users compared to other wallets.

- Competing wallets like Coinbase Wallet (~11 million) and Trust Wallet (~10.4 million) trail MetaMask.

- Retail users account for ~82% of crypto wallet holders in broader adoption figures.

- Institutional wallet adoption shows ~51% year‑over‑year growth as of 2025.

- MetaMask’s global adoption markedly outpaces many competitors in DeFi activity.

- U.S. adoption contributes significantly to wallet growth, with ~27% of internet users owning wallets.

- The broader wallet market is projected to reach $43.66 billion by 2028 at ~31.7% CAGR.

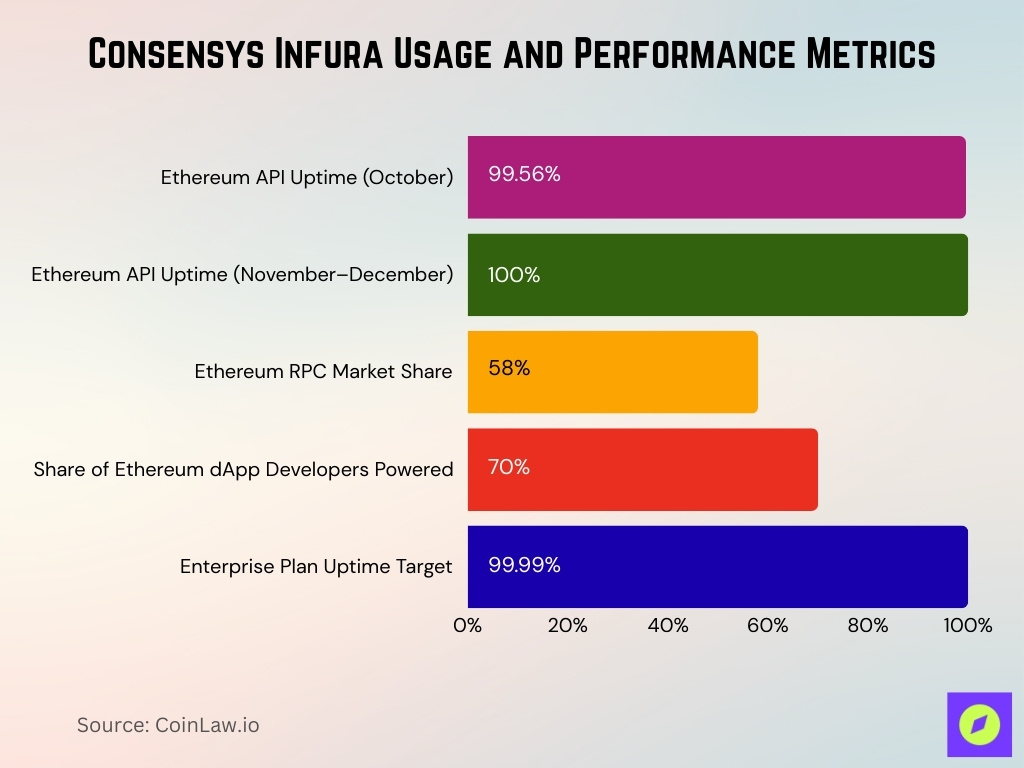

Infura Usage and Performance Metrics

- 400,000 developers trust the Infura platform globally.

- 99.56% uptime for Ethereum API in October.

- 100% uptime achieved in November and December.

- Supports $4.8 trillion on-chain transaction volume annually.

- 58% market share of Ethereum RPC requests.

- Powers 70% of dApp developers on Ethereum.

- 10x faster request speeds than self-hosted nodes.

- 99.99% uptime target on enterprise paid plans.

Consensys Revenue and Financial Highlights

- Consensys reported a $7 billion post‑money valuation following its Series D funding round in 2022.

- Across its funding lifecycle, the company has raised $715 million–$725 million in venture capital.

- The 2022 Series D round of $450 million was the largest to date, led by ParaFi Capital.

- Consensys’ revenue was previously reported to be around $250 million annually in some industry analyses.

- Revenue streams include MetaMask swap fees, developer subscriptions (Infura), enterprise tooling, and staking services.

- Infura’s developer subscription model provides recurring SaaS‑like revenue tied to usage.

- MetaMask fees from token swaps and trading integrations contribute a major share of operating revenue.

- Consensys continues expanding revenue diversification via enterprise APIs and institutional services.

Consensys Valuation and Funding Rounds

- Consensys reached a $7 billion valuation with its Series D round in March 2022.

- Prior to Series D: Series C was $200 million in 2021 at a ~$3.2 B valuation; Series B was ~$65 million in 2021; Series A was $10 million in 2019.

- Total funding across all rounds is estimated between $715 million and $725 million.

- Consensys has engaged major institutional investors, including Microsoft, Temasek, SoftBank Vision Fund, and Mastercard.

- Secondary market interest in pre‑IPO shares has grown with accredited investors trading stakes privately.

- Reports in 2025 suggest Consensys is preparing for an IPO with JPMorgan & Goldman Sachs as lead underwriters.

- The potential IPO could occur as early as 2026, with expectations of raising “several hundred million dollars”.

- A public listing would mark a key milestone for crypto infrastructure firms entering traditional markets.

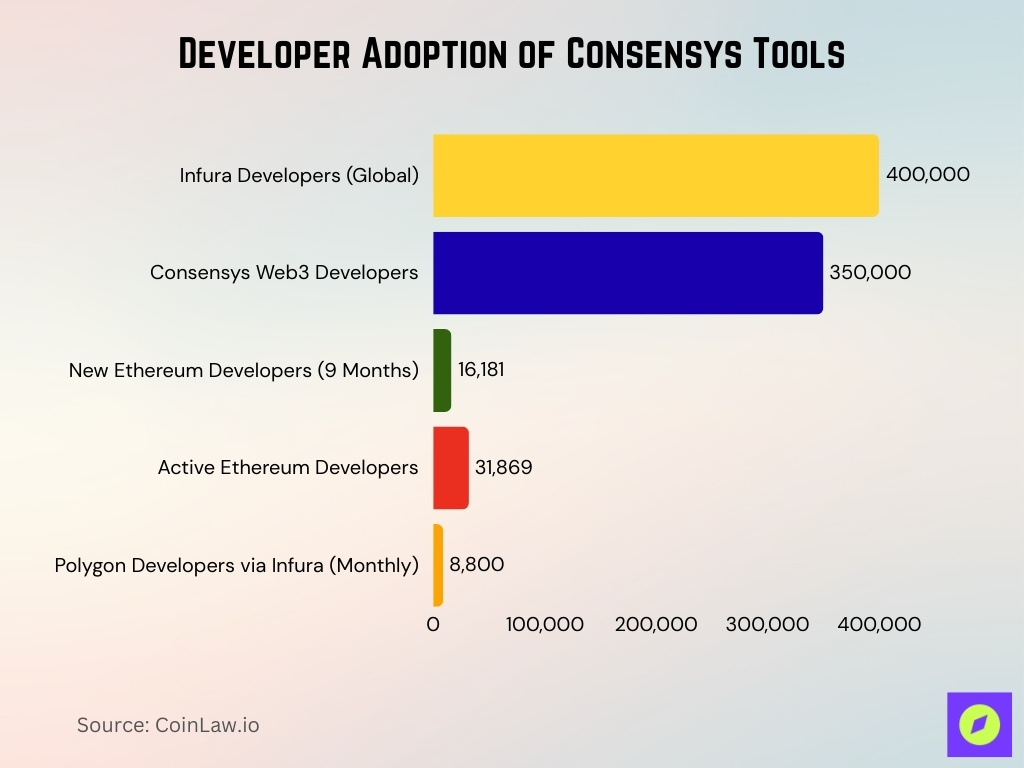

Developer Adoption of Consensys Tools

- 400,000 developers trust the Infura platform worldwide.

- 350,000 Web3 developers use Consensys blockchain tools.

- 16,181 new Ethereum developers onboarded in nine months.

- 31,869 total active Ethereum developers leveraging the ecosystem.

- Infura powers 8,800 Polygon developers monthly.

- MetaMask SDK enables cross-platform dApp connections.

- 72% developers use Hardhat with Consensys testing tools.

- 55% adoption of Truffle and Ganache for local environments.

- 85% rise in AI-assisted tools among Ethereum developers.

Employee and Organizational Growth at Consensys

- 600-700 employees operate across global hubs.

- 501-1,000 total staff per company profile.

- 1,093 employees reported in business analytics.

- 7% workforce reduction eliminates 47 positions.

- 20% staff cut affects 162 employees previously.

- Roughly $715 million in total funding supports expansion.

- 727 active job openings signal hiring momentum.

- 38% overall workforce reduction over two years.

User Retention, Engagement, and Activity Levels

- 30 million monthly active users worldwide.

- 143 million total users globally.

- Social Login reduces onboarding friction by 30%.

- 55% MAU growth since 2023 baseline.

- 35% of users fail to back up seed phrases.

- $325 million cumulative swap revenue generated.

- 1.1 to 3.8 engagement actions in the first week.

- 13% to 30% retention improvement via features.

- 5.64 million monthly visits to metamask.io.

Consensys Ecosystem and Partner Integrations

- 30+ venture firms in the Linea Ecosystem Investment Alliance.

- Linea integrates with 150+ dApps across DeFi and NFTs.

- Partnerships with OKX, Swift, and Sei networks.

- Infura connects Uniswap for MetaMask queries and swaps.

- 11,500 financial institutions via Swift blockchain settlement.

- MetaMask SDK supports Wagmi, React Native, and Web3Auth.

- Collaborations with Microsoft, Hitachi, and AMD cloud providers.

- Linea builds for Mastercard, Visa, and JP Morgan finance.

Geographic Distribution of Consensys Users

- According to global crypto adoption data, 43% of respondents in the U.S. report owning a crypto wallet, with adoption strong in the Americas overall.

- Emerging markets, notably Nigeria (84%), South Africa (66%), Vietnam (60%), and the Philippines (54%), show higher wallet ownership rates than many developed markets.

- India also exhibits significant adoption, with 50% reporting crypto wallet ownership.

- In Europe, countries like Turkey report 44% wallet ownership, while nations such as France, Italy, and the U.K. lag below the global average.

- Wallet penetration in Japan and Canada remains comparatively lower than in Asian and African markets.

- Geographic wallet distribution data suggests the U.S. and India lead Web3 usage among developed markets, with rising interest across Latin America.

- Broader regional adoption data places North America and Europe around ~43–44% crypto wallet ownership, indicating that traditional markets are catching up with emerging ones.

Web3 and Crypto Survey Data by Consensys

- A 2024 Consensys‑YouGov survey shows 93% global awareness of cryptocurrencies among respondents.

- Of those aware, 51% claim they understand what cryptocurrencies are, marking a modest increase in comprehension.

- 42% of global respondents currently own or have bought cryptocurrencies, with increases seen in markets like the Philippines, Mexico, and South Africa.

- Participation in 10 of 11 Web3 activities increased year over year, including NFTs, DeFi, and wallet use.

- A significant portion (58%) of people in key markets, including the United States and India, reported familiarity with decentralization concepts.

- The survey highlighted concerns about trust and privacy, with 54% believing blockchain can mitigate AI‑generated fake data risks.

- Emerging markets exhibit a stronger intent to invest in cryptocurrencies over the next 12 months compared to developed regions.

- Regions like Europe and Japan showed comparatively lower future investment intent, indicating varied global sentiment.

Consensys Role in DeFi and NFT Ecosystems

- Ethereum DeFi TVL reaches $166 billion.

- Linea DeFi TVL surges to $2 billion.

- Ethereum captures 51% DeFi market share.

- Ethereum TVL totals $119 billion, representing 49% sector value.

- Linea DEX daily volumes hit $159 million.

- MetaMask swap revenue accumulates $325 million.

- Linea’s daily transactions grow to 1.6 million.

- Linea active wallets expand to 1.12 million.

- Total DeFi TVL surpasses $150 billion.

Security, Compliance, and Risk Metrics at Consensys

- Web3 losses reach $3.1 billion in H1 from exploits.

- $2.5 billion in security incidents in the first half.

- $1.6 billion stolen across 197 Q1 incidents.

- Phishing attacks cause $600 million in damages.

- 158,000 individual wallet compromises affect 80,000 victims.

- 23.35% stolen funds from personal wallet breaches.

- 61.4% Ethereum losses totaling $1.9 billion.

- Access control failures account for $1.83 billion.

- 37% decrease in Q3 hack losses despite wallet risks.

Network Activity Powered by Consensys Infrastructure

- Ethereum averages 1.65 million daily transactions.

- Peak daily transactions hit 1.92 million on February 17.

- Linea TVL surges to $1.64 billion.

- Linea’s daily DEX volumes exceed $100 million.

- Ethereum DeFi TVL dominates at $119 billion.

- Linea processes 1.6 million daily transactions.

- Ethereum’s daily transaction value averages $11.7 billion.

- 127 million active Ethereum wallets.

- Total DeFi TVL reaches $237 billion record high.

Frequently Asked Questions (FAQs)

MetaMask reports around 30–35 million monthly active users as of 2025.

MetaMask supports 11 distinct blockchains as of 2025.

Consensys was valued at $7 billion following its Series D funding.

Infura’s API services were used by over 430,000 developers, according to earlier reports.

Conclusion

Consensys continues to shape the Web3 landscape through global user adoption, developer tooling, DeFi and NFT engagement, and secure infrastructure services. Geographic distribution data show growing participation worldwide, with emerging markets driving much of the growth. Survey insights from Consensys and YouGov reveal expanding familiarity with crypto and rising intent to engage in Web3 services.

In the DeFi and NFT ecosystems, Consensys tools enable high activity levels and help drive innovation across applications. Security and compliance issues remain a central concern, with industry‑wide risk metrics pushing providers to strengthen protections. Network activity powered by Consensys infrastructure underscores the company’s pivotal role in modern blockchain ecosystems. Together, these statistics demonstrate both the advances and challenges facing Consensys and the broader Web3 sector.