Circle Internet Group continues to shape the global digital finance landscape as the issuer of USD Coin (USDC), the world’s second‑largest stablecoin. With strong growth in circulation, transaction volume, and broader market adoption, USDC is influencing how businesses and financial institutions move digital dollars across borders. From retail payments to institutional settlement rails, USDC’s expanding role highlights the growing intersection between traditional finance and blockchain‑based money. Explore the detailed statistics below to understand how Circle and USDC are performing today.

Editor’s Choice

- USDC in circulation reached ~$73.7 billion by the end of Q3 2025, up sharply from early‑year levels, reflecting stronger institutional and payments demand.

- Circle reported $740 million in revenue in Q3 2025, a 66% year‑over‑year increase.

- Net income reached $214 million in Q3 2025, more than double the prior year.

- On‑chain USDC transaction volume in Q3 2025 hit ~$9.6 trillion, up over 580% YoY.

- Meaningful USDC wallets grew ~77% year‑over‑year to ~6.3 million.

- Circle’s IPO valuation reached billions, signaling strong investor confidence.

Recent Developments

- Circle went public on the NYSE at $31 per share, selling 34 million shares and raising about $1.1 billion, valuing the company at roughly $6.9 billion under the ticker CRCL.

- USDC’s circulating supply grew to around $61 billion, passing its previous high of $56 billion and pushing Circle’s fully diluted valuation close to $8 billion.

- Visa’s USDC settlement pilot handled about $3.5 billion in stablecoin transactions before expanding to U.S. banks, with usage peaking at nearly 1 billion API calls in February.

- Visa has now rolled out USDC settlement for U.S. banks on Solana, allowing 24/7 settlement and faster on-chain fund transfers.

- The GENIUS Act requires state-regulated stablecoin issuers with over $10 billion in market cap to move to federal oversight or stop issuing new stablecoins within 360 days.

- Under the law, only approved stablecoin issuers can serve U.S. users, limiting issuance to regulated banks and compliant non-bank firms.

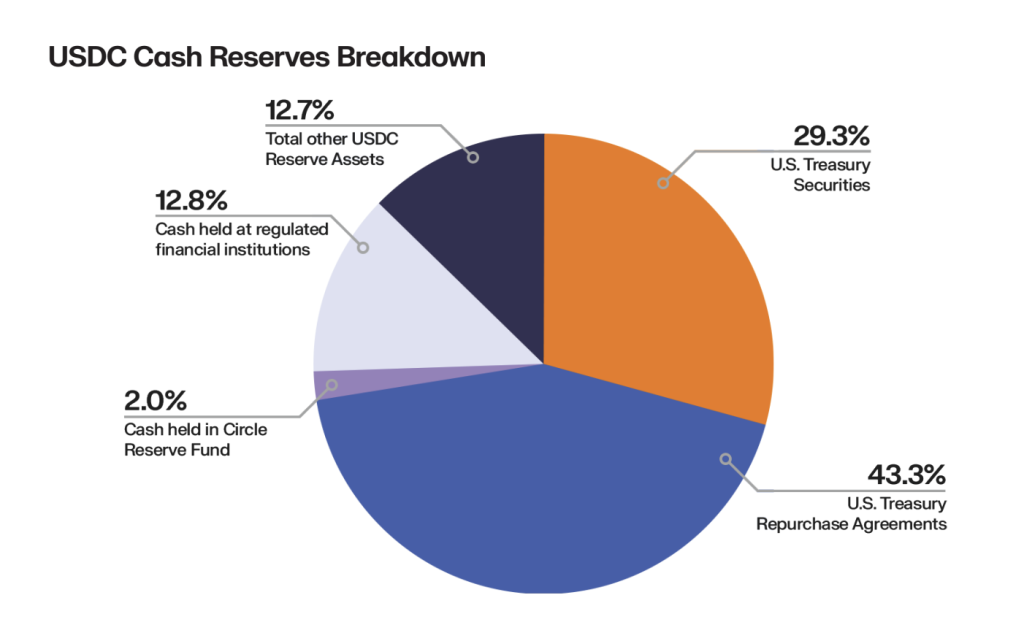

USDC Cash Reserves Breakdown Insights

- U.S. Treasury repurchase agreements dominate reserves at 43.3%, highlighting a strong focus on short-term, highly liquid instruments.

- U.S. Treasury securities account for 29.3% of reserves, reinforcing USDC’s reliance on government-backed assets.

- Cash held at regulated financial institutions represents 12.8%, providing immediate liquidity and operational flexibility.

- Other USDC reserve assets make up 12.7%, indicating limited exposure to non-core reserve categories.

- Only 2.0% is held in the Circle Reserve Fund, showing minimal dependence on internal fund structures.

- Overall, more than 70% of reserves are tied to U.S. government instruments, supporting stability, transparency, and low-risk backing.

Circle Key Facts Overview

- Circle is the issuer of USDC, a stablecoin pegged 1:1 to the U.S. dollar.

- USDC launched in 2018 and has grown into a foundational digital dollar asset.

- Circle discontinued USDC support on the TRON blockchain in early 2024.

- As of March 31, 2025, USDC had been used for over $25 trillion of on‑chain transactions since its inception.

- The token competes closely with Tether (USDT) as the #2 stablecoin by market cap.

- USDC attained regulatory clarity and state/federal licensing across U.S. jurisdictions.

- Circle’s governance over USDC became fully centralized after the Centre Consortium dissolved in 2023.

- Wallet statistics indicate rapid adoption growth among individual and institutional holders.

Circle Revenue and Profitability

- Circle achieved $740 million in total revenue and reserve income in Q3 2025.

- That represents a 66% year‑over‑year jump compared to Q3 2024.

- Net income of $214 million marked a 202% increase YoY.

- Adjusted EBITDA grew 78% YoY, reflecting efficiency gains.

- In Q2 2025, revenue reached $658 million with 53% growth over 2024.

- Analysts project full‑year 2025 revenue could top ~$2.6 billion.

- Circle’s revenue is largely driven by interest earned on USDC reserves.

- Some revenue is shared with partners such as Coinbase under reserve‑holding arrangements.

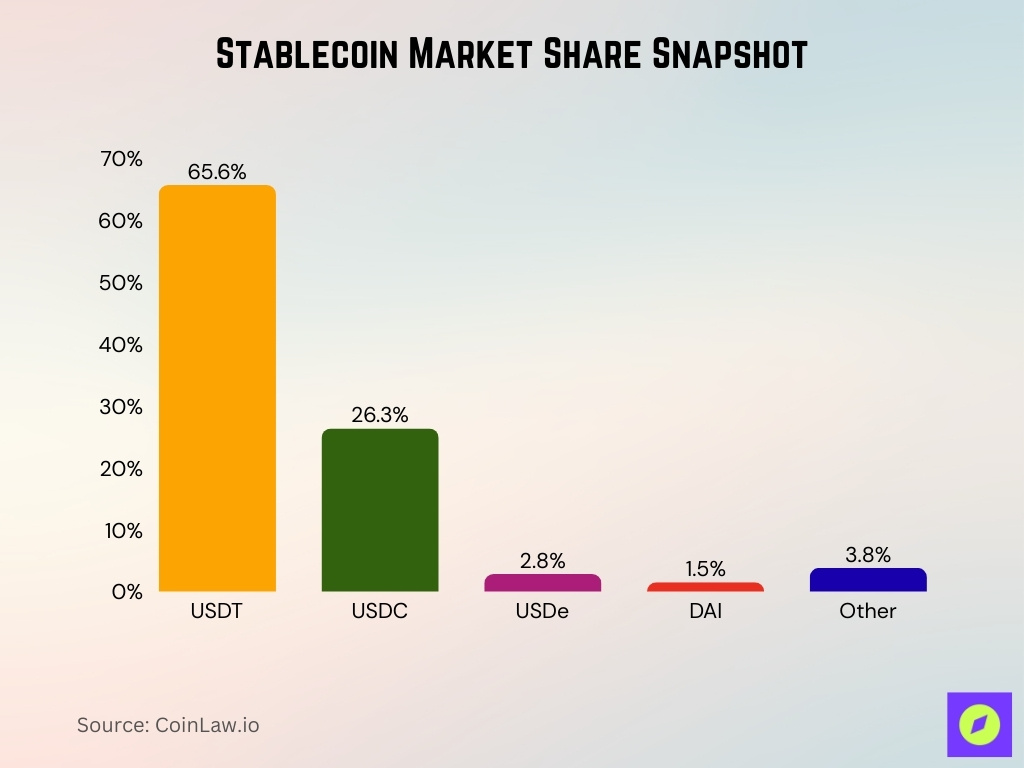

Stablecoin Market Share Snapshot

- USDT dominates the stablecoin market with a 65.6% share, controlling nearly two-thirds of the total stablecoin supply.

- USDC holds 26.3% market share, positioning it as the second-largest stablecoin with strong institutional and enterprise usage.

- USDe accounts for 2.8%, reflecting early-stage but growing adoption among alternative stablecoin models.

- DAI represents 1.5% of the market, highlighting its more limited role compared with centralized fiat-backed stablecoins.

- Other stablecoins collectively make up 3.8%, indicating a highly concentrated market led by two primary issuers.

- Overall, USDT and USDC together control 91.9% of the stablecoin market, underscoring strong consolidation at the top.

On‑Chain Transaction Volume

- Q3 2025 on‑chain USDC transaction volume reached ~$9.6 trillion, up ~586% YoY.

- Previously, USDC had processed $5.9 trillion in Q2 and ~$1.4 trillion in last year’s Q3.

- Since 2018, cumulative on‑chain usage has surpassed $25 trillion by March 2025.

- USDC is consistently one of the top stablecoins by transaction volume globally.

- Stablecoin sector transaction volumes continued to grow in 2025 with broader market expansion.

- USDC’s share of total stablecoin volume has risen alongside its market cap gains.

- USDC activity has increased across DEX and CEX venues.

Users and Network Adoption

- Meaningful USDC wallets holding at least $10 rose to ~6.3 million globally.

- Wallet count represents roughly 77% YoY growth.

- Circle’s network touches hundreds of millions of users via partners and integrations.

- USDC active wallets surpassed ~5.2 million in 2025.

- Adoption increased sharply among institutional and developer constituencies.

- Integration with global exchanges expanded access to trading and custody.

- Retail users in key regions hold growing USDC wallets tied to payments.

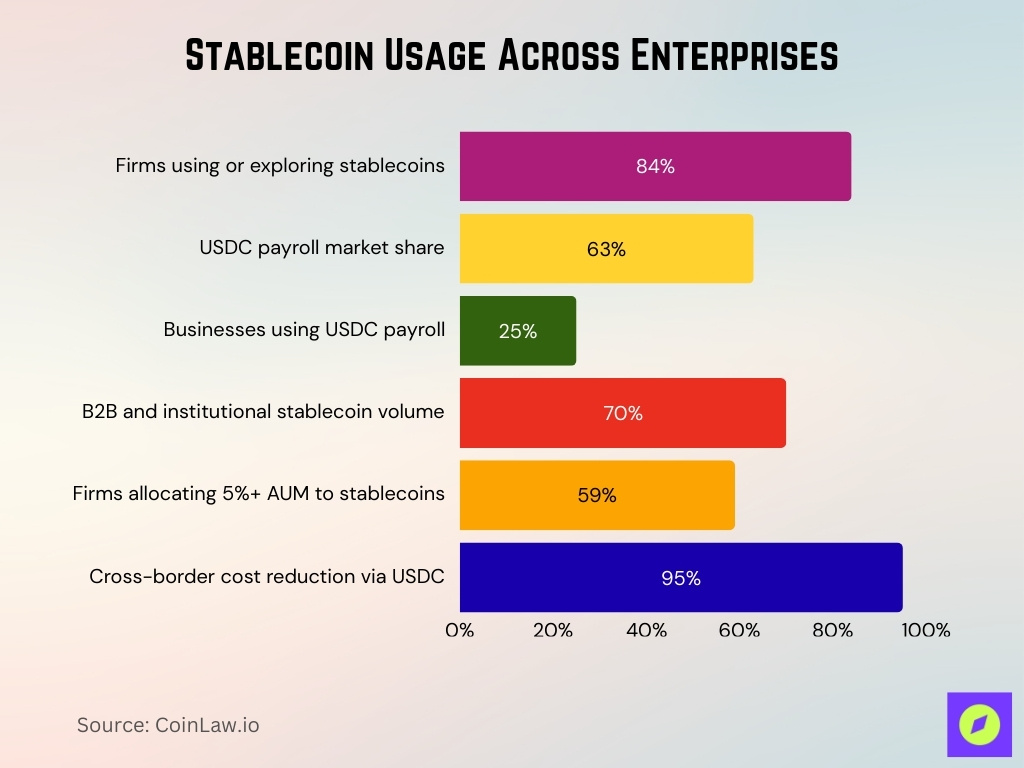

Institutional and Enterprise Usage

- 84% of financial firms are using or are interested in stablecoins for enterprise operations.

- USDC holds a 63% market share in crypto payroll processing $8.9 trillion in H1.

- 25% of global businesses adopted crypto payroll solutions featuring USDC integration.

- B2B payments and institutions account for over 70% of stablecoin transaction volume.

- 59% of firms plan to allocate over 5% of AUM to stablecoins by 2026.

- GENIUS Act enabled 95% cheaper cross-border payments via USDC partnerships with Visa and Deutsche Börse.

Chain Distribution of USDC

- USDC is natively supported across 28 blockchain networks, including Ethereum, Solana, Polygon PoS, Avalanche, and XRP Ledger.

- CCTP cross-chain transfer volume surged 640% YoY to $31.3 billion in Q3.

- Ethereum hosts the largest USDC supply at ~$39.7 billion, up from $34.5 billion earlier in the year.

- USDC processed over 500 million transactions on Ethereum alone.

- Circle’s CCTP represented 47% of all bridged volume across major providers in Q3, rising above 50% in October.

- Stablecoin on-chain transfers exceeded $15.6 trillion in Q3 across public blockchains.

- DeFi TVL reached $123.6 billion with stablecoins comprising ~40%.

- USDC wallets grew to 87 million unique addresses globally.

- 2.1 million new USDC wallets created in February across Ethereum, Solana, and Avalanche.

- Over 450 DeFi protocols accept USDC for liquidity and staking.

Geographic Adoption

- The United States represents 38% of global USDC transactions, underscoring its central role in stablecoin activity.

- Latin America recorded a 31% year-over-year increase in USDC usage for cross-border payments, reflecting accelerating regional uptake.

- Across APAC, crypto transaction volume climbed 69% YoY to $2.36 trillion, supported by strong USDC stablecoin flows.

- In South Asia, crypto adoption expanded 80%, reaching $300 billion in transaction volume.

- Meanwhile, Nigeria, Kenya, and South Africa collectively account for 12% of global USDC peer-to-peer usage.

- Europe contributes 18% of worldwide USDC on-chain activity, driven largely by the UK and Germany.

- India alone reports 5.7 million wallet addresses interacting with USDC.

- At the same time, Latin America added 2.3 million new USDC-holding wallets as of March.

- Canada and Australia together expanded the USDC user base by 28%.

- Within the U.S., crypto activity surged 50% between January and July.

- By the end of Q3 2025, USDC circulation reached approximately $73.7 billion, supported by institutional adoption across major chains.

- Alongside this growth, the Circle Payments Network now supports 29 financial institutions, processing $3.4 billion in annualized transaction volume.

- As a result, corporate treasuries shortened cross-border settlement times from 24 hours to near-instant using USDC.

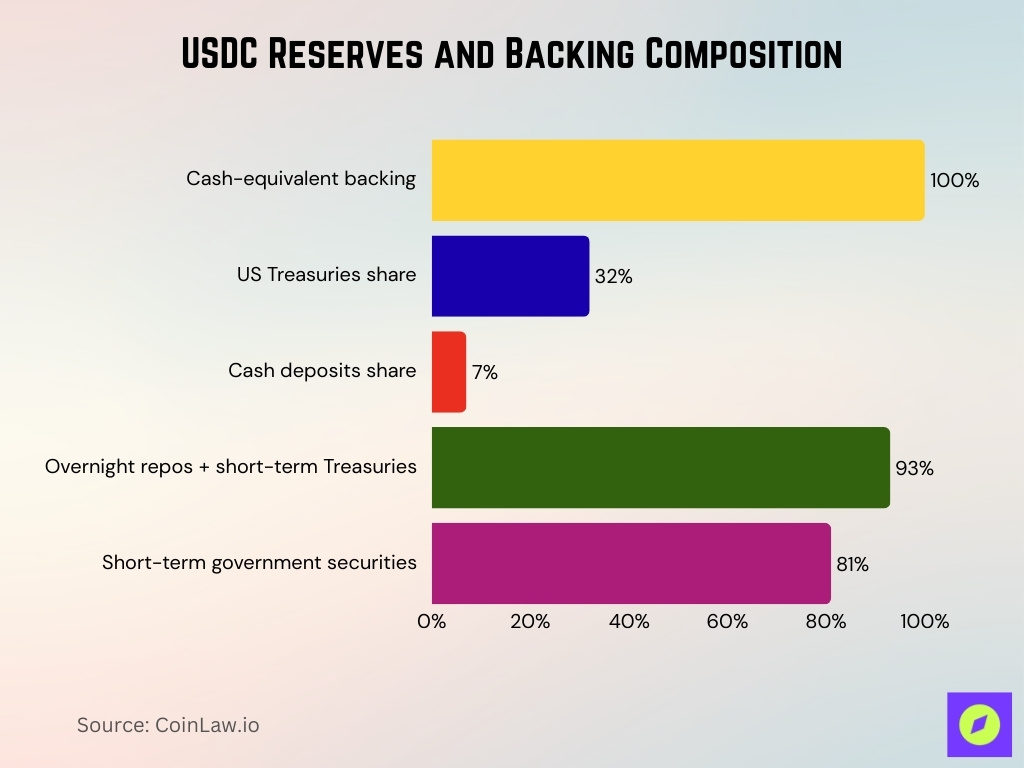

Reserves and Backing Composition

- USDC reserves totaled $76.5 billion as of December 2025, fully backing circulating supply with 100% cash equivalents.

- Circle Reserve Fund (USDXX) held $40.6 billion in US Treasury reverse repurchase agreements.

- US Treasuries comprised $24.5 billion or 32% of total USDC reserve assets.

- Cash deposits represented 7% of USDC backing.

- Overnight repos and short-term US Treasuries accounted for 93% of reserve composition.

- Short-term government securities formed 81% of holdings, avoiding long-term or illiquid assets.

- Total reserves exceeded USDC circulation by $1.2 billion in the latest monthly attestation.

Payment and Commerce Use Cases

- Shopify Payments processed $47.5 billion in Q1 via 1.89 million merchants, now supporting USDC checkout.

- B2B stablecoin payments surged 30x to $3 billion monthly volume across 20 fintech providers.

- Shopify USDC payments are available to global merchants with a 0.5% rebate offsetting fees.

- Global remittance fees averaged 6.49% while USDC remittances cost under 1%.

- 73% of merchants plan crypto acceptance within 2 years, prioritizing stablecoins.

- Stablecoins facilitate $20-30 billion daily on-chain payments for remittances and settlements.

- USDC on Shopify enables 24/7 settlement from hundreds of wallets, including guest checkout.

- 64% of Shopify GMV processed via native payments, boosted by USDC integration.

- Stablecoins captured 3% of $200 trillion global cross-border payments volume.

DeFi and Trading Activity

- USDC drives liquidity pools across decentralized exchanges like Uniswap and Curve.

- 34%+ of DEX liquidity pools include USDC, underscoring deep DeFi engagement.

- Algorithmic and bot‑driven trading accounts for ~58% of USDC trading volume.

- Centralized exchanges process 40%+ of USDC trading volume.

- USDC is widely used as collateral in lending and borrowing protocols in DeFi ecosystems.

- On-chain derivatives and perpetual futures platforms settle in USDC for risk management.

- Stablecoin pools boost price stability and efficiency in automated market makers.

- USDC’s velocity in active markets signals frequent usage and re‑deployment across protocols.

- Integration with institutional trading desks enhances volume depth and order book strength.

Interest Rate Sensitivity

- Q2 reserve yields dropped to 4.85% from 5.88% year prior, compressing revenue margins.

- Distribution costs rose 68.2% to $106 million, offsetting lower reserve earnings.

- Short-term rates projected at 3.75%-4.00% through 2026 impact USDXX fund returns.

- USDC circulation growth of 25% partially offset 15% reserve yield decline.

- Analysts forecast Circle revenue at $1.2 billion, assuming stable 4.5% average yields.

- Non-interest revenue streams grew 45% to $15 million via API and services.

- Treasury bill yields fell from a 5.3% peak to 4.1% by Q4, pressuring margins.

- Circle’s fully diluted valuation hit $8 billion despite rate sensitivity concerns.

Operating Expenses and Efficiency

- In Q2 2025, operating expenses totaled roughly $577 million, reflecting investments in growth and stock‑based compensation.

- Distribution, transaction, and related costs increased ~64% YoY in Q2 2025 due to higher USDC circulation.

- Stock‑based compensation formed a significant portion of Q2 2025 operating costs.

- Circle has reported Adjusted EBITDA growing 78% YoY, suggesting improved scale efficiency.

- Efficient reserve income generation helps offset a rising cost base tied to platform expansion.

- In Q3 2025, Circle’s revenue still significantly exceeded expenses, showing strong operating leverage.

- Operating expenses may rise further as Circle pushes into new markets and builds institutional integration.

- Analysts have noted elevated expense forecasts in late 2025, pressuring near‑term profit margins.

- Continued expansion of network services and support for additional chains contributes to cost growth.

Funding, Valuation, and Stock Performance

- Circle completed its IPO on the NYSE in June 2025 under the ticker CRCL, drawing significant investor interest.

- Early trading saw Circle’s shares spike roughly 168% above the initial $31 IPO price, signaling high demand.

- As of late 2025, Circle’s market cap stands around $20–$21 billion on NYSE data.

- Shares have exhibited volatility, reflecting rate‑sensitive reserve income and broader market trends.

- A recent JPMorgan upgrade highlighted “solid” fundamentals while acknowledging competitive pressures.

- Analyst targets vary, with some forecasting long‑term upside while others emphasize uncertainty in stablecoin economics.

- Consensus forecasts project Circle’s 2025 revenue climbing toward ~$2.6 billion, largely through reserve income.

- Relative performance metrics show CRCL up ~20% year‑over‑year, though far below early 2025 highs.

- Investor debates revolve around sustainable valuation given dependency on interest rate cycles.

Frequently Asked Questions (FAQs)

Approximately $73.7 billion in USDC was in circulation at the end of Q3 2025.

USDC circulation grew 108% year‑over‑year by the end of Q3 2025.

Circle reported $740 million in total revenue and reserve income in Q3 2025.

Conclusion

Circle Internet Group has firmly positioned USDC as a foundational digital dollar, supported by conservative reserves and reinforced by rising usage across payments, trading, and institutional rails. Notably, record double-digit growth in circulation, on-chain activity, and enterprise adoption highlights why stablecoins are reshaping key parts of the global financial system.

Meanwhile, operational performance reflects both strength in revenue generation and pressure from expanding costs, while interest-rate sensitivity remains a key factor for future profitability. At the same time, Circle’s stock performance mirrors these dynamics, balancing optimism around stablecoin integration with broader market volatility. Ultimately, as the ecosystem continues to evolve, USDC’s stability, transparency, and expanding footprint will play a central role in how digital money integrates with traditional finance.