Chainalysis has become one of the most cited sources for blockchain intelligence and crypto crime data as digital assets embed themselves deeper into global finance. The firm’s reports shape how regulators, law enforcement, and financial institutions understand trends like illicit transactions, adoption patterns, and evolving threats. Chainalysis data has a real‑world impact, from guiding bank compliance programs to helping prosecutors trace stolen crypto. Explore the core metrics and key figures shaping today’s blockchain ecosystem.

Editor’s Choice

- Global Crypto Adoption Index ranks countries such as India and the United States as leaders in crypto adoption in 2025.

- Chainalysis is trusted by over 1,500 customers, including exchanges and financial institutions.

- Illicit crypto transaction estimates for 2024 reached $40.9 billion, with projections above $50 billion.

- North Korean hackers stole $2.02 billion in crypto in 2025, a 51% increase from 2024.

- Chainalysis tools have helped law enforcement and regulators seize and recover over $34 billion in illicit and stolen crypto assets to date.

- Individual wallet compromises surged to 158,000 incidents in 2025.

- Stablecoins comprised 63% of illicit crypto transfers by 2024.

- Crypto crime represents 0.14% of total on‑chain transaction volume in 2024.

Recent Developments

- Chainalysis reports that 2024’s illicit crypto totals may be closer to $51 billion once additional data is incorporated.

- Growth in illicit volumes is projected to surpass 2023’s revised figures of $46.1 billion.

- North Korean threat actors drove the majority of 2025’s largest hacks.

- Evolving laundering techniques now favor additional layering and mixers over direct exchange transfers.

- Sub‑Saharan Africa’s crypto on‑chain activity reached $25 billion in a single month in 2025.

- The MENA region observed over $60 billion in monthly transaction volume at peaks in late 2024.

- Scam revenue, such as pig butchering, was on track for a record year in 2024.

- APAC saw the monthly on‑chain value received rise to $244 billion in late 2024.

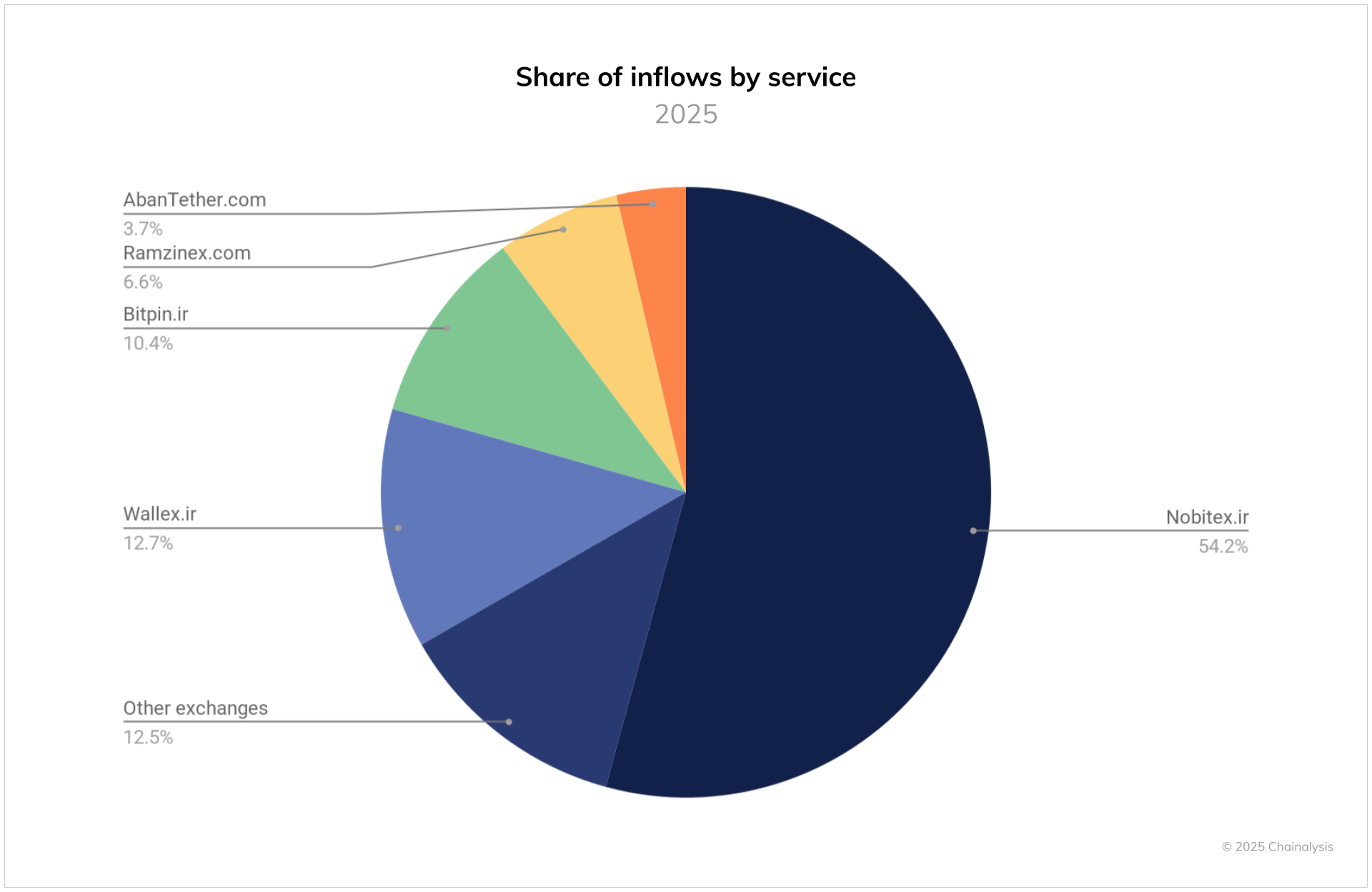

Share of Inflows by Service

- Nobitex.ir dominated inflows with 54.2%, accounting for more than half of all tracked service-level inflows.

- Wallex.ir captured 12.7% of inflows, positioning it as the second-largest individual exchange.

- Other exchanges collectively represented 12.5%, highlighting a fragmented long-tail of smaller platforms.

- Bitpin.ir contributed 10.4%, reflecting a strong mid-tier presence in the market.

- Ramzinex.com accounted for 6.6%, indicating moderate but consistent inflow activity.

- AbanTether.com recorded 3.7%, making it the smallest contributor among the major services tracked.

Chainalysis Revenue and Growth Metrics

- Chainalysis’s annual recurring revenue (ARR) was estimated at $190 million in 2023.

- That represented growth of roughly 35% year‑over‑year from 2022.

- The estimated ARR for 2024 reached around $250 million with continued growth.

- The company’s valuation was about $2.5 billion in 2024.

- Chainalysis has raised more than $500 million in funding across rounds.

- Government contract revenue has become a major share of sales.

- The firm has maintained a substantial cash position even during market downturns.

- Revenue growth has historically accelerated with institutional demand for compliance tools.

Customer and User Base Statistics

- Chainalysis is trusted by 1,500+ organizations worldwide.

- Customers include financial institutions, exchanges, and regulators.

- Surveys indicate a 97% customer satisfaction score.

- Nine out of the top ten crypto exchanges reportedly use Chainalysis services.

- The platform’s training programs have certified 20,000+ professionals globally.

- Chainalysis’s data covers over 107,000+ unique entities and 1B+ addresses.

- Over 1,000 government and private sector organizations are supported across 70+ countries.

- End users include compliance teams, investigators, and analysts across sectors.

Biggest Cryptocurrency Exchanges by 24h Spot Volume

- Binance leads global spot trading with $15–$17.5 billion daily, commanding roughly 30–40% of total market share.

- Bybit processes $7.0–$7.3 billion in 24-hour spot volume, reinforcing its rise from a derivatives-focused platform to a top spot exchange.

- Gate.io records approximately $3.8–$4.5 billion daily, supported by an estimated $113.7 billion in monthly spot volume and about 9% market share.

- Bitget handles around $3.0–$3.5 billion per day, ranking among the top exchanges by spot market share in some 2025 listings.

- OKX consistently posts about $3.0 billion in daily spot trades, keeping it firmly within the global top tier.

- Crypto.com averages roughly $3.5 billion in daily volume, based on median 2025 trading activity.

- MEXC sees $2.7–$3.0 billion in daily spot volume, reflecting strong participation from high-frequency and emerging-market traders.

- Coinbase reports a wide $2.4–$4.0 billion daily range, underscoring volume volatility tied to U.S. market conditions and institutional flows.

Government and Law Enforcement Clients of Chainalysis

- Chainalysis works with 330 government agencies worldwide.

- Platform connects 1,500+ law enforcement and regulatory organizations.

- 85% of U.S. law enforcement agencies use Chainalysis blockchain tools.

- Chainalysis Reactor is adopted by over 150 government agencies globally.

- Tools supported the recovery and seizure of $34 billion in illicit crypto assets.

- Operation Spincaster generated 7,000+ leads across 19 agencies.

- FBI leveraged Chainalysis to freeze $11.8 million in Caesars ransomware funds.

- 120+ Chainalysis experts with 500+ years assist global cybercrime units.

Financial Institutions Using Chainalysis

- Chainalysis serves over 1,000 institutional clients, including financial institutions.

- Nine of the top ten crypto exchanges use Chainalysis products.

- KYT screens over $4 trillion in transactions annually for financial institutions.

- Products helped top exchanges decrease fraud by 60%.

- Chainalysis detected 98% of known hacks before their occurrence for clients.

- BitMEX reduced on-chain risk exposure by 88% using Chainalysis.

- Platform used by hundreds of financial institutions for AML monitoring.

- KYT has been adopted by 110 cryptocurrency businesses and banks across 35 countries.

- Financial institutions leverage tools to screen $250 million+ in transfers yearly.

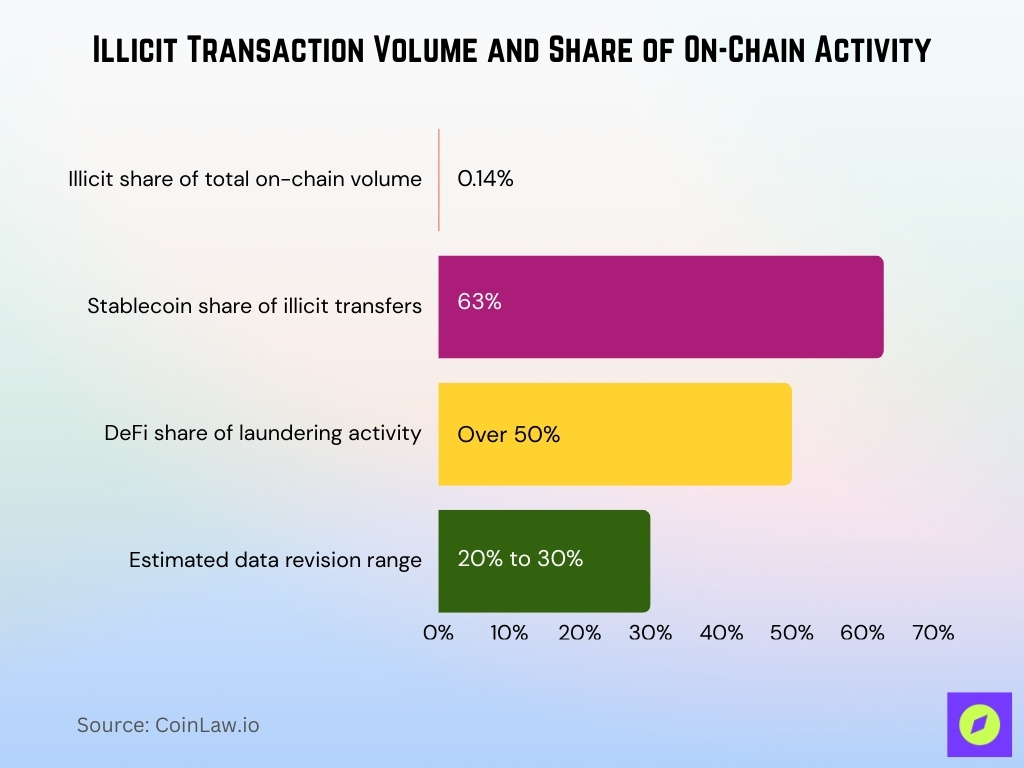

Illicit Transaction Volume and Share of On‑Chain Activity

- Illicit crypto transaction volume reached $40.9 billion in 2024, a new nominal high.

- Chainalysis estimates that figure could rise above $50 billion as more illicit addresses are identified.

- Despite the headline number, illicit activity accounted for only 0.14% of total on‑chain volume.

- Stablecoins represented 63% of all illicit crypto transfers, overtaking Bitcoin.

- DeFi protocols were involved in over 50% of stolen‑fund laundering flows.

- Illicit volumes tend to be revised 20–30% as attribution improves over time.

Reactor Usage and Performance Statistics

- Chainalysis Reactor is used by 1,500+ organizations worldwide for blockchain investigations.

- The platform enables tracing across 27+ blockchains, supporting complex investigations across major public networks.

- Reactor’s intelligence graph incorporates 134,000+ unique real‑world counterparties and services.

- Investigators can follow funds through 40 M+ assets and 325 M+ swaps using Reactor tools.

- Over $34 billion in stolen funds have been frozen or recovered using Chainalysis Reactor.

- Reactor’s analytics cover 300+ bridges and DEXs, enhancing investigative coverage over decentralized finance.

- Its workflow integrates KYT alerts, enabling rapid escalation from compliance flags to deep forensic tracing.

- Performance metrics show Reactor aids law enforcement in linking on‑chain activity to real‑world entities more efficiently than manual methods.

KYT Adoption and Compliance Metrics

- Chainalysis KYT (Know Your Transaction) underpins real‑time monitoring for suspicious blockchain transfers.

- 1,500+ organizations share KYT‑derived intelligence daily to pre‑empt illicit activity on crypto platforms.

- KYT tools monitor on‑chain activity against 107,000+ unique entities and 1 billion+ addresses.

- Adoption by centralized exchanges remains high as part of AML regimes.

- KYT compliance alerts help platforms detect risk with customizable risk rule sets in real time.

- KYT is integral to financial institution compliance strategies, especially in U.S. and EU jurisdictions.

- Continuous transaction scanning by KYT reduces manual review workloads for compliance teams.

- Alerts tied to transfers with high‑risk counterparty tags enable quicker SAR filings and regulator reporting.

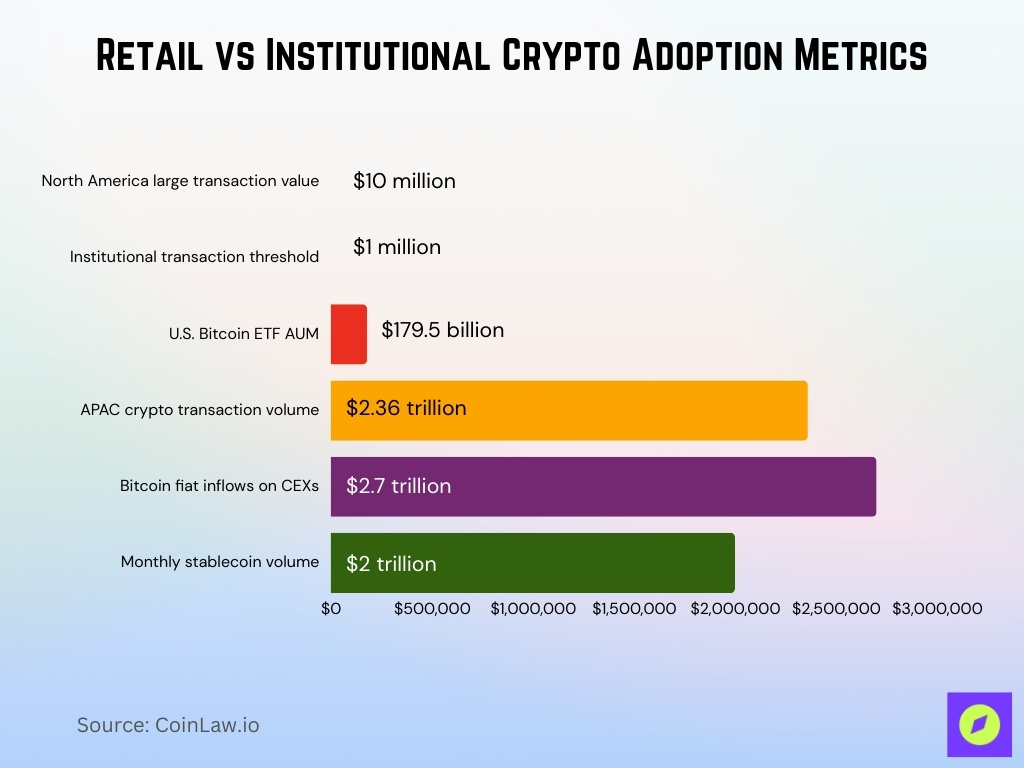

Retail vs Institutional Crypto Adoption Metrics

- North America leads with 45% of global transaction value in transfers over $10 million.

- Institutional transactions defined as over $1 million are now captured in the Chainalysis Adoption Index.

- U.S. bitcoin ETFs reached $179.5 billion AUM by mid-2025, driving institutional inflows.

- APAC grew 69% year-over-year to $2.36 trillion with retail dominance in emerging markets.

- Bitcoin fiat inflows hit $2.7 trillion on centralized exchanges, mostly retail purchases.

- Stablecoin volumes exceeded $2 trillion monthly, reinforcing retail payment usage globally.

Kryptos Platform Coverage and Usage

- Kryptos maps 6,500+ unique services and blockchain activity they control.

- Services account for hundreds of millions of addresses and $6 trillion+ transferred value.

- The platform covers over 100 blockchains with instant compatibility for new tokens.

- Kryptos profiles enable risk assessment across thousands of crypto services daily.

- Institutional clients use Kryptos for due diligence on 1,000+ counterparties.

- Service profiles track historical trends for millions of on-chain entities.

- Broad coverage identifies threats in $34 billion illicit funds landscape.

- Outputs support compliance workflows for 1,500+ organizations.

Geographic Distribution of Chainalysis Customers

- Chainalysis customers span over 70 countries, reflecting global market penetration.

- Adoption in North America and Europe remains strong, with both regions accounting for substantial institutional engagement.

- APAC drives rapid growth, posting a 69% year‑over‑year rise in on‑chain transaction value.

- Latin America also grew adoption by 63%, with strong retail and institutional usage patterns.

- Sub‑Saharan Africa saw a 52% increase in on‑chain value received, supporting developing market usage.

- Turkey’s crypto inflows approached $878 billion by mid‑2025, highlighting regional adoption despite economic turbulence.

- MENA recorded monthly transaction flows above $60 billion in late 2024.

- Europe’s crypto ecosystem shows maturation with diverse retail and institutional profiles.

Layoffs and Restructuring at Chainalysis

- Chainalysis reduced its workforce by approximately 15% in early 2023, impacting about 75 employees as part of a cost‑realignment strategy.

- A second restructuring round followed later in 2023, bringing total layoffs close to 20% of staff within the year.

- Despite layoffs, Chainalysis maintained a headcount of 500+ employees globally entering 2024.

- Leadership stated the cuts aimed to extend the cash runway, amid slower crypto market growth.

- Government and law‑enforcement contracts were not materially reduced during restructuring.

- Chainalysis continued hiring selectively in public sector and compliance engineering roles post‑layoffs.

- Workforce optimization coincided with a broader downturn in crypto venture funding across 2022–2023.

- By 2025, the company signaled a return to measured hiring aligned with revenue growth.

Ransomware, Scams, and Fraud Metrics in Chainalysis Data

- Crypto scams generated over $10 billion in revenue in 2024, with pig‑butchering scams leading losses.

- Ransomware payments rebounded to $1.1 billion in 2023, reversing a prior decline.

- Average ransomware payment size increased by over 50% year over year.

- North Korean hacking groups stole $2.02 billion in crypto in 2025, a 51% increase from 2024.

- Individual wallet compromises exceeded 158,000 incidents in 2025.

- Romance and investment scams accounted for nearly two‑thirds of scam revenue.

- AI‑assisted scam techniques accelerated victim targeting and scale.

- Chainalysis data shows victims aged 30–49 incurred the highest median losses.

Global Crypto Adoption Index Statistics

- India ranked No. 1 in the 2024–2025 Global Crypto Adoption Index.

- Nigeria and Vietnam consistently placed in the top five for grassroots adoption.

- The United States ranked highest among institution‑driven crypto markets.

- Lower‑middle‑income countries drove the fastest adoption growth rates.

- Stablecoins dominated usage in regions facing currency volatility.

- Sub‑Saharan Africa saw 52% growth in on‑chain value received year over year.

- Latin America adoption grew 63%, driven by remittances and inflation hedging.

- Adoption metrics weigh retail activity, DeFi usage, and purchasing power parity.

Frequently Asked Questions (FAQs)

By mid‑2025, more than $2.17 billion was stolen from cryptocurrency services, already exceeding the total for all of 2024.

Following the 2025 activity, North Korea’s crypto thefts pushed their all‑time total to approximately $6.75 billion.

Over 70% of jurisdictions worldwide made progress on stablecoin regulation in 2025.

Conclusion

Chainalysis statistics show a crypto ecosystem that is larger, more institutional, and more transparent than ever before. While illicit activity and scams continue to evolve, their share of overall blockchain usage remains small and increasingly traceable. For regulators, banks, and enterprises, these data points highlight why blockchain intelligence now sits at the center of compliance, risk management, and market analysis, and why digging deeper into the numbers matters.