Blockchain has become a buzzword for all things technology in the past decade. You might have come across at least a couple of ideas on how the blockchain and crypto infrastructure can innovate almost every industry out there. But where does blockchain stand today? Here are some latest statistics about the past, present, and future of blockchain.

Editor’s Choice

- Estimates place the global blockchain market at roughly $300–400 billion by 2030, with CAGRs in the 50–70% range.

- The global blockchain IoT segment alone is projected to $5,802.7 million with a 91.5% CAGR from 2018 to 2026.

- Crypto user base forecast to approach 800 million globally, with more than 1.3 billion unique wallet addresses in use.

- Institutional adoption is rising as 86% of surveyed institutions have or plan digital asset exposure, and 85% increased allocations through 2026.

- Crypto asset management market projected to grow from $1.66 billion to $4.68 billion by 2030 as tokenization and DeFi expand.

- Core blockchain market size is estimated to be around $10.4 billion in 2025, rising to $13.7 billion in 2026 with strong enterprise deployment momentum.

- Asia-Pacific blockchain IoT market expected to hit $1,459.8 million by 2026 with a 94.8% regional growth rate.

Market Adoption Stats of Blockchain

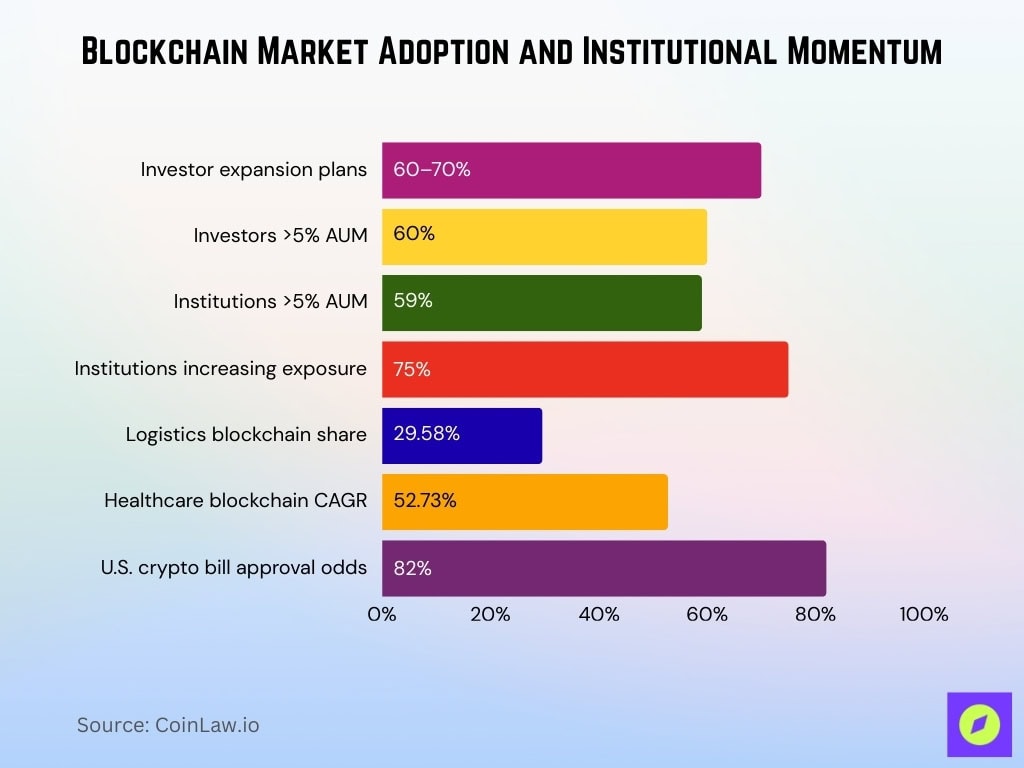

- 60-70% global investors plan to expand digital asset exposure, with 60% allocating over 5% AUM.

- 59% institutions plan to allocate over 5% AUM to cryptocurrencies amid maturing infrastructure.

- 75% institutions expect to increase digital asset allocations overall in the coming year.

- Logistics & transportation captures 29.58% blockchain supply chain share with healthcare at a 52.73% CAGR.

- 82% chance of key U.S. crypto bill passing, boosting institutional and regulatory adoption.

- While over 170 public companies hold Bitcoin, combined corporate holdings are closer to 300,000–400,000 BTC.

- U.S. blockchain supply chain market grows from $1.23 billion to $26.86 billion at 47.06% CAGR.

- Blockchain IoT market reaches $5.8 billion at 91.5% CAGR driven by secure data sharing.

- Enterprise adoption led by financial services, with cloud BaaS and interoperability frameworks maturing.

Technology Applications on Blockchain

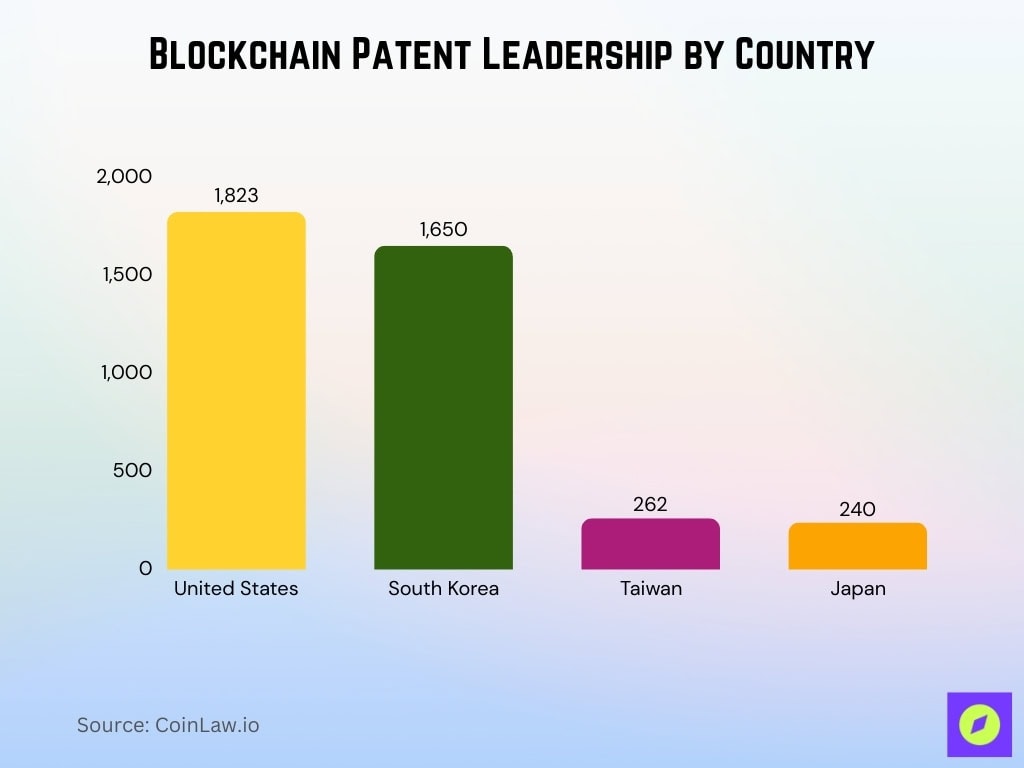

- U.S. holds 1,823 blockchain patents granted, followed by South Korea’s 1,650.

- Japan ranks with 240 blockchain patents granted alongside Taiwan’s 262.

- China dominates with 90% blockchain patent filings and 68% granted patents since 2009.

- Asia leads with 50,360 filings and 11,634 grants at a 23.1% grant rate.

- Smart contracts power over 85% blockchain-based deals and transactions.

- Global smart contracts market projected to hit $73.8 billion at 82.2% CAGR.

- U.S. smart contracts on blockchain are valued at $0.7 billion, growing to $4 billion.

- Provenance & supply chain top use cases valued at $962 billion business opportunity.

Blockchain Market Statistics

- Global blockchain market valued at $10.4 billion in 2025, projected to surpass $13.7 billion with a 31.66% CAGR.

- Blockchain market forecasted to reach $67.4 billion by 2026 at 68.4% CAGR from $4.9 billion base.

- North America commands 35.4–37.8% global blockchain market share, led by U.S. adoption.

- BFSI sector holds a 24–30% blockchain spending share, driven by payments and tokenization.

- Roughly 60–70% of institutional investors plan to increase digital asset allocations within the next few years, underscoring strong institutional confidence in blockchain and tokenization

- Blockchain in the healthcare market grows at 34–63.3% CAGR, reaching $11.33–25.52 billion.

- Blockchain in the government market surpasses $10 billion with over 30% CAGR and 50+ nations deploying.

- Asia-Pacific is the fastest-growing region, with the blockchain technology market projected to reach around $150 billion by 2032, driven by rapid adoption in finance, supply chain, and identity solutions.

Age Demographics of Crypto Owners in the U.S.

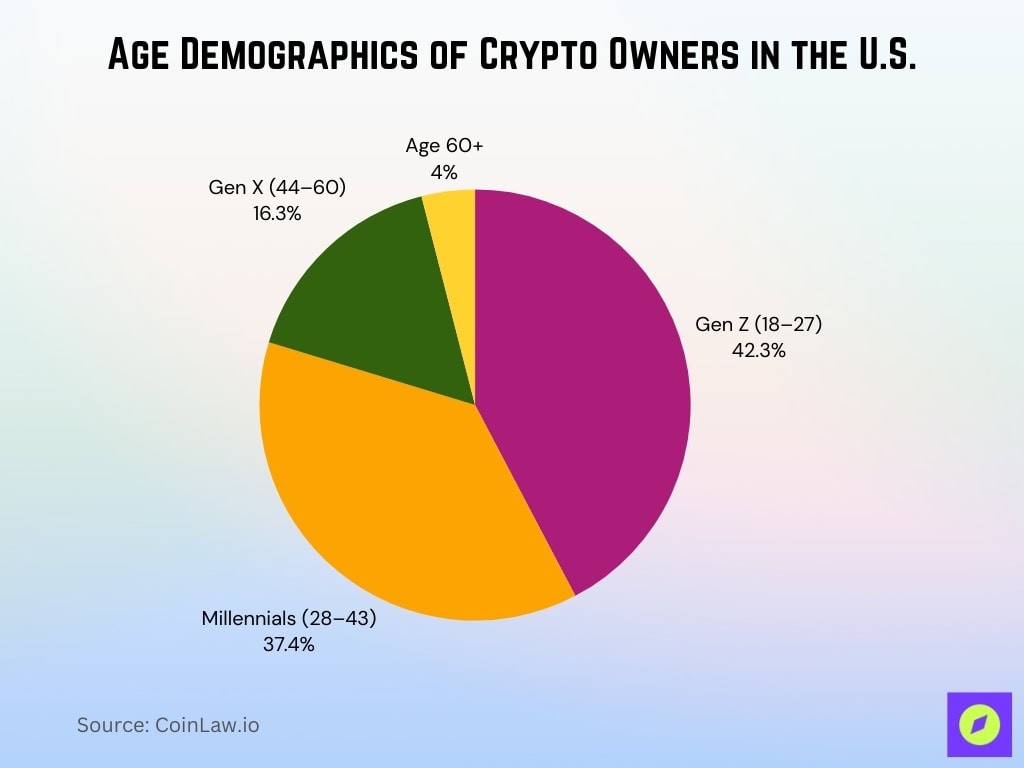

- Gen Z (18-27) leads at 42.3% ownership, followed by Millennials (28-43) at 37.4%.

- Gen X (44-60) accounts for 16.3% while those over 60 represent 4% of owners.

- 35% investors aged 25-34 and 26% aged 35-44, comprising 60%+ young cohort.

- Men under 30 own at a 20% rate vs 6% women; 30-44 men at 26% vs 13% women.

Stats on Security and Confidence in Blockchain

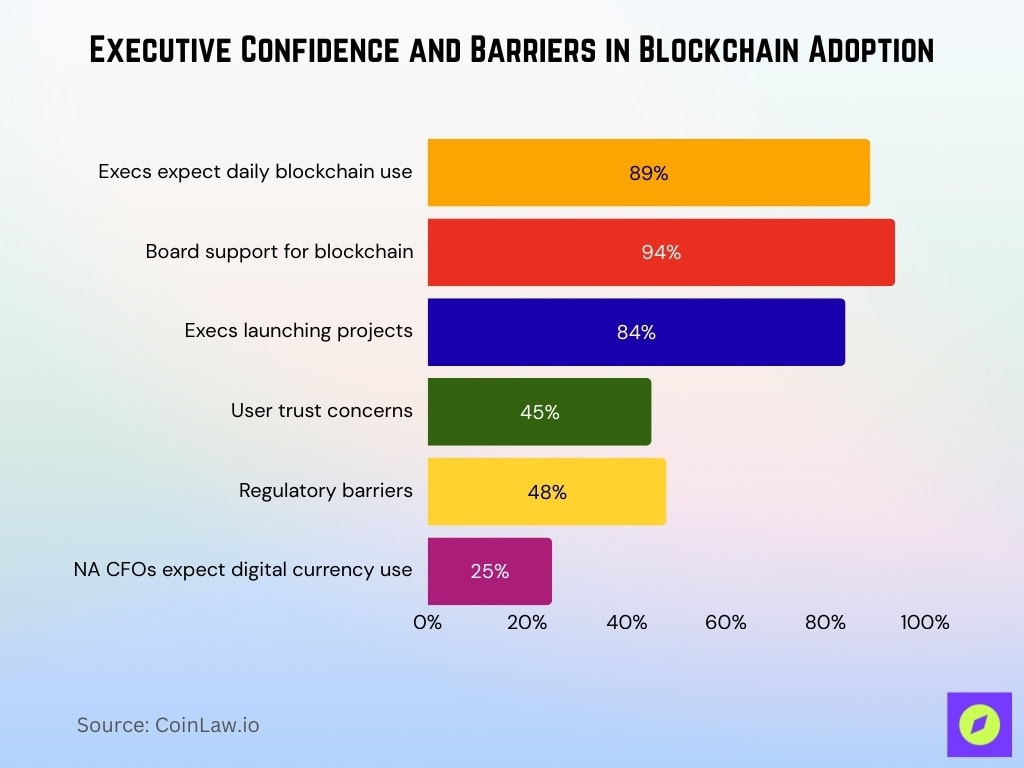

- 89% financial executives believe blockchain will enter everyday use, with 94% boards supporting projects.

- 84% executives initiated blockchain projects, though 45% cite user trust and 48% regulatory barriers.

- 25% North American CFOs expect digital currency use within two years, signaling rising confidence.

- Blockchain incidents hit 200, causing $2.935 billion losses, up 46% year-over-year.

- DeFi suffered 126 attacks with $649 million losses, while CeFi platforms lost $1.809 billion.

- 137 countries representing 98% global GDP explore CBDCs, with 72 in advanced stages.

- 69 countries are in pilot/development phases, and only 4 fully launched live CBDCs.

- Bitcoin blockchain size has surpassed 700 GB, reflecting double-digit percentage growth year-over-year as blocks and historical transaction data steadily accumulate.

Recent Developments

- Global crypto market cap surges to $3.22 trillion in early 2026, with Bitcoin clearing legacy positions.

- U.S. spot Bitcoin ETFs record $697 million inflows on January 5, led by BlackRock’s $287 million.

- Ethereum stablecoin transfers exceeded $8 trillion in Q4 2025, doubling the prior quarter volumes.

- 80% Fortune 500 companies now use blockchain, processing $10 trillion in on-chain transactions annually.

- Stablecoin supply hits $305 billion with $47.6 trillion transaction volume across major chains.

- Venture capital pours $11.5 billion into blockchain startups across 2,150 deals focused on early-stage.

- GENIUS Act implementation advances, drawing new entrants amid U.S. market structure legislation.

- Ethereum active addresses peak at 10 million monthly, with daily transactions hitting 2.23 million.

Frequently Asked Questions (FAQs)

Blockchain market surges to USD 248.9 billion by 2029 at 65.5% CAGR or USD 1.43 trillion by 2030 at 90.1% CAGR.

Active blockchain wallets hit 83 million in 2025, with cryptocurrency users reaching 861 million globally.

59% institutions plan over 5% AUM to cryptocurrencies, while 75% expect increases.

137 countries (98% global GDP) explore CBDCs, with 72 in advanced stages.

Conclusion

These statistics on blockchain technology make a few things clear. First, despite concerns regarding security and feasibility, blockchain is being seen as a gold mine. While only a few sectors are actively developing blockchain solutions, this trend will soon change.

Better options will emerge as Blockchain-as-a-Service (BaaS) providers expand globally.

This development must be viewed alongside the increasing popularity of cryptocurrencies, which have significantly changed the way people think about money. However, it’s essential to find a balance between the decentralized nature of blockchain and the critical need for fundamental governance.