BitMine Immersion Technologies has added another 23,823 ETH worth about $103.7 million to its treasury, pushing its total holdings beyond 2.87 million ETH.

Key Takeaways

- BitMine added 23,823 ETH, valued at $103.7 million, on October 10, marking its second large Ethereum buy in one week.

- The company’s Ethereum stash now exceeds 2.87 million ETH, worth roughly $12.6 billion, solidifying its position as the largest corporate ETH holder.

- BMNR stock declined 1.5 percent, closing at $59.10, amid criticism from short seller Kerrisdale Capital targeting the firm’s treasury model.

- BitMine remains committed to its goal of acquiring 5 percent of Ethereum’s total supply, showing continued confidence in ETH’s future utility.

What Happened?

BitMine Immersion Technologies made another massive Ethereum purchase, acquiring 23,823 ETH worth approximately $103.7 million. This follows an earlier acquisition of 20,020 ETH just two days prior, bringing the company’s October Ethereum buys to more than $193 million. Despite the market reacting with skepticism and a short position from Kerrisdale Capital, BitMine continues to expand its crypto holdings aggressively.

Bitmine keeps accumulating $ETH — 5 hours ago, they received another 23,823 $ETH($103.68M) from BitGo.https://t.co/DLOO6fgc7Khttps://t.co/w5uTBr9jZg pic.twitter.com/nScuFMDf5X

— Lookonchain (@lookonchain) October 10, 2025

BitMine’s Aggressive ETH Strategy

BitMine’s ETH accumulation strategy is playing out in full view of the market. The company’s latest acquisition was identified via on-chain data from Arkham, shared by Lookonchain, showing the transaction came from a BitGo wallet into an address associated with BitMine.

- BitMine has not officially confirmed the new transfer, but data confirms the wallet is tied to its operations.

- The firm now holds 2.87 million ETH, representing a market value of around $12.6 billion at current prices.

- Earlier this week, BitMine also bought 20,020 ETH worth about $89.7 million via FalconX.

These purchases are part of BitMine’s broader aim of accumulating 5 percent of Ethereum’s total supply, a goal the company has reiterated multiple times.

Stock Pressure and Short Seller Criticism

Despite the bold ETH purchases, BitMine’s stock has been under pressure. Shares of BMNR dropped 1.5 percent on October 9 and slid another 0.78 percent in pre-market trading the next day.

The dip comes amid mounting scrutiny from Kerrisdale Capital, which publicly disclosed a short position against BMNR. Kerrisdale argues that BitMine’s Digital Asset Treasury (DAT) model is outdated, claiming that investors would be better served by direct ETH exposure or ETFs rather than a stock trading at a premium.

According to Kerrisdale, BitMine’s current valuation does not align with the value of its crypto holdings, and it criticized the DAT model as lacking long-term viability. BitMine has not responded publicly to these accusations.

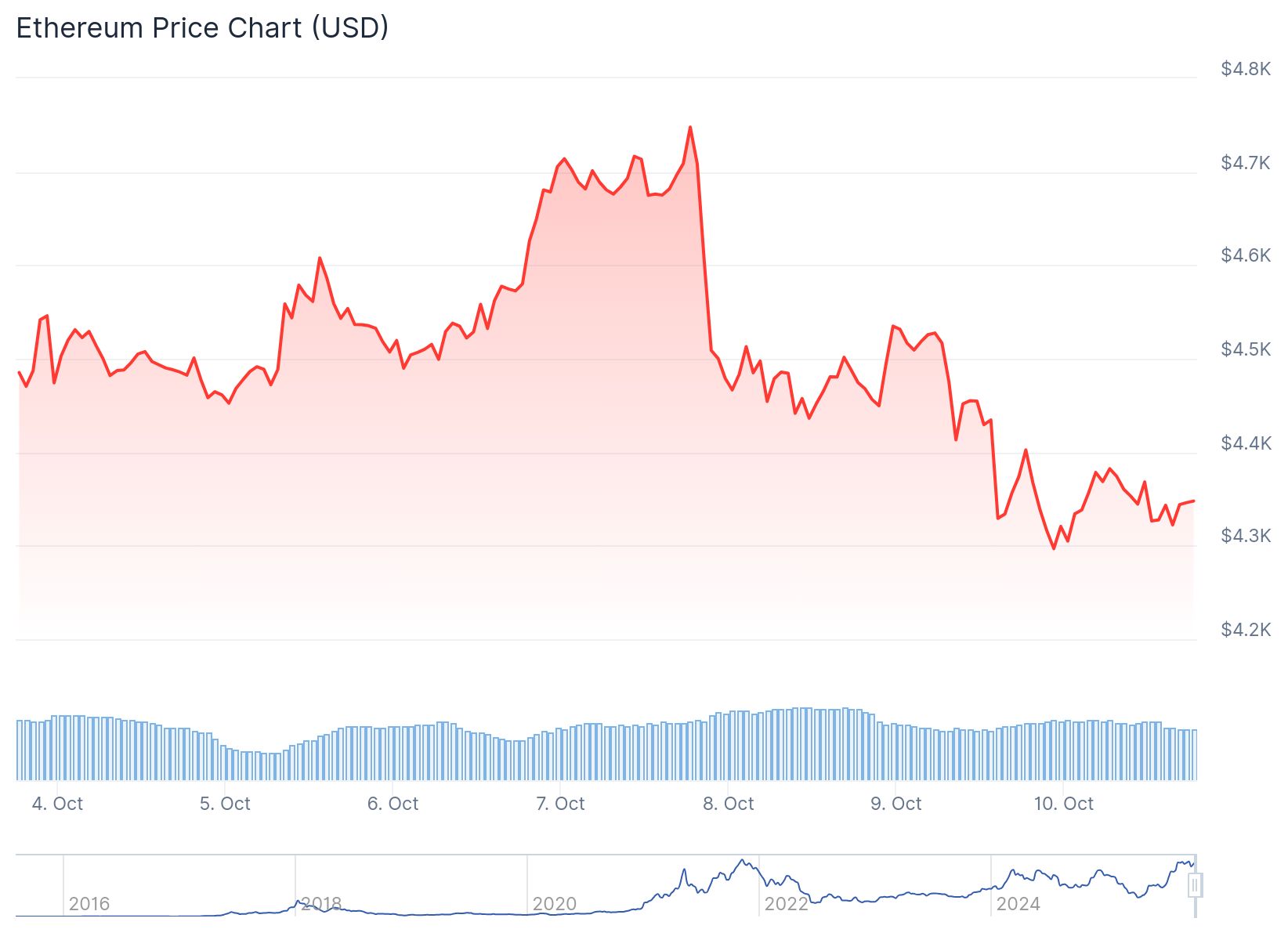

Market Context: ETH Price Dips, Volume Drops

BitMine’s purchases coincided with a pullback in Ethereum’s price, which dropped to a low of $4,273 amid macroeconomic concerns and a lack of rate cut signals from Fed Chair Jerome Powell.

- ETH is currently trading at $4,342, down roughly 3 percent over the past 24 hours.

- Trading volume has increased slightly by 2 percent, but analysts suggest market interest is cooling.

- Futures open interest has declined on key exchanges including CME, Binance, and OKX.

Despite these bearish signals, BitMine has stayed on course, showing no signs of slowing down its Ethereum acquisition strategy.

CoinLaw’s Takeaway

I find BitMine’s unwavering commitment to Ethereum fascinating. In my experience, most firms would hesitate to double down when stock prices fall and a short seller comes after them. But BitMine is doing the opposite. It’s stacking ETH aggressively, clearly signaling long-term belief in Ethereum’s role in the future of finance. Whether investors agree or not, this kind of conviction is rare. While critics argue the DAT model is outdated, BitMine is betting that the value of Ethereum will far outweigh any temporary criticism or volatility.