The ATM landscape is shifting rapidly as digital payments grow, and cash usage falls. Global data shows a continuing slide in ATM transactions and installations, driven largely by mobile wallets and contactless payments replacing routine cash withdrawals. This transition affects banking operations, financial access in underserved regions, and consumer behavior across demographics. Real-world impacts include fewer bank branch ATMs in urban U.S. centers and changing consumer patterns where everyday payments favor apps such as Apple Pay and Venmo. Read on to explore the latest data and trends shaping this evolving ATM ecosystem.

Editor’s Choice

- Global ATM numbers declined to about 2.91 million in 2025, down 1.4% from 2024.

- ATM usage dropped ~5.7% across major economies, including the U.S., UK, and Germany.

- Mobile payment adoption contributed to a ~10.8% reduction in cash withdrawals in developed countries.

- Peer‑to‑peer apps cut ATM visits by ~22% among Gen Z.

- Global ATM transactions in 2025 were ~86.7 billion, slightly lower than the previous year.

- Average withdrawal per transaction increased ~3.3% to $157, indicating fewer but larger withdrawals.

- Average ATM fees for out‑of‑network use in the U.S. hit $4.86 in 2025.

Recent Developments

- Global ATM installations declined by 1.8% from 3 million to 2.95 million units.

- Worldwide ATM transaction volume reached 86.7 billion, down slightly from the prior year.

- Average withdrawal amount per transaction rose to $157, up 4.2% year-over-year.

- Contactless ATM transactions surged by 19%, driven by tap-and-go adoption.

- Cardless ATM withdrawals increased by 17.8%, fueled by mobile app integrations.

- Total ATM visits dropped by 11.2%, reflecting a shift to digital payments.

- Out-of-network ATM fees hit a record average of $4.86 per transaction.

- ATM usage in major economies declined by 5.7%, led by younger demographics.

- Banks expanded ATMs with non-cash functions like deposits and bill payments.

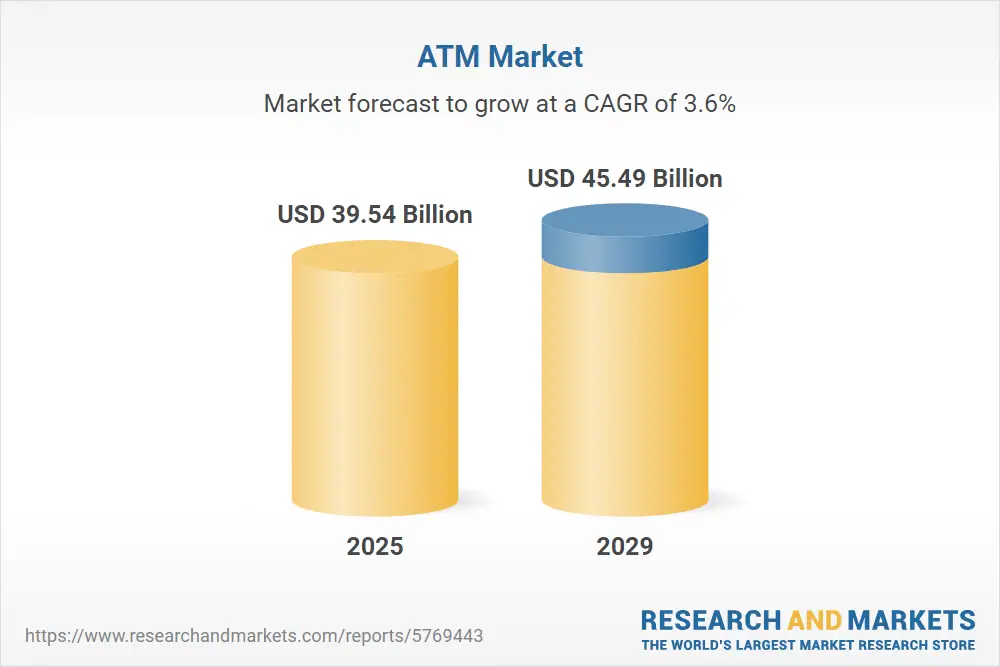

ATM Market Growth Outlook

- The ATM market is forecast to grow at a CAGR of 3.6% over the next four years.

- Market size is projected to increase from $39.54 billion in 2025 to $45.49 billion by 2029.

- Despite digital payment growth, the ATM industry shows steady expansion driven by emerging markets and banking infrastructure upgrades.

Regional Differences in ATM Usage Decline

- North America ATM installations declined by 5%.

- Western Europe experienced a 7.5% drop in ATM usage.

- Asia-Pacific ATM installations comprise 50% of the global total.

- Latin America saw a 7% increase in ATM transactions.

- South Africa ATM numbers fell 23.1% from 34,405 to 26,454.

- Africa retains 89% cash in consumer transactions.

- Developing economies show 84% reliance on physical cash.

- Developed countries’ ATM usage declined 5.7%.

Decline in Number of ATMs Installed

- Global ATM count reached 2.91 million units.

- Total ATMs fell to 2.95 million worldwide.

- ATM installations declined by 1.8% year-over-year.

- Annual decline marked 1.4% from the prior year.

- Cryptocurrency ATMs exceeded 39,000 installations.

- Crypto ATMs grew 6% year-over-year.

- On-site ATMs account for 50% of the global total.

- Off-site ATMs dropped from 97,319 to 82,526.

- New deployments outpaced by exits in developed economies.

- Basic ATMs declined sharply than high-functionality terminals.

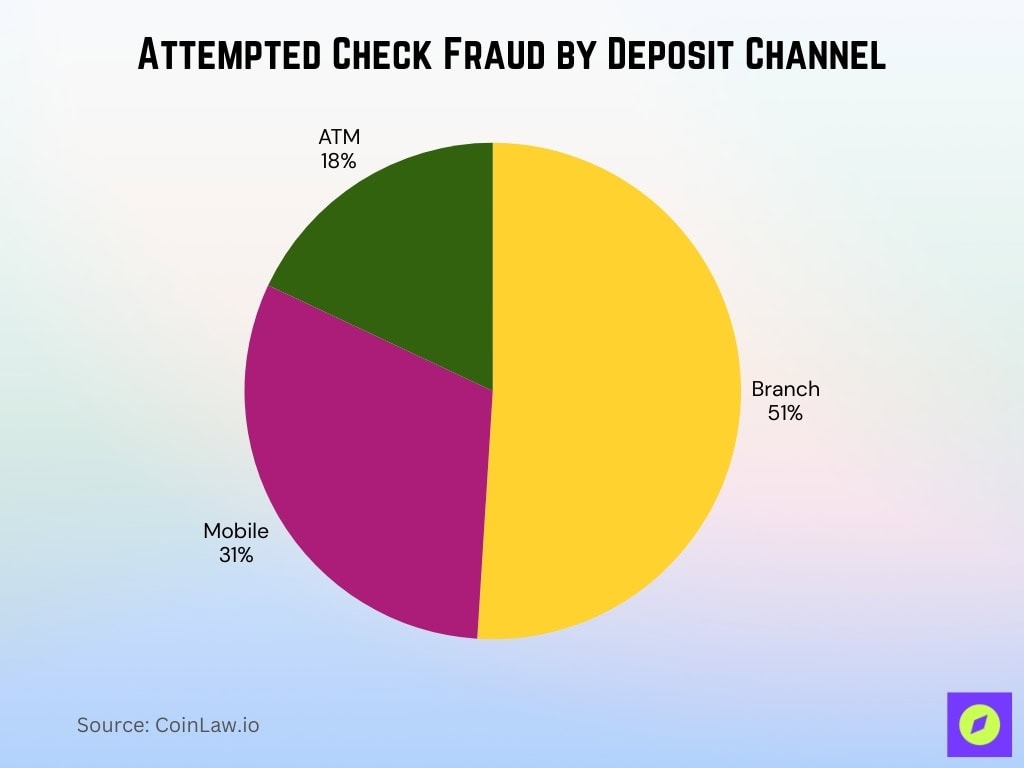

Attempted Check Fraud by Deposit Channel

- Branches account for 51% of all attempted check fraud by deposit value, making them the highest-risk channel.

- Mobile deposits represent 31% of attempted fraud, reflecting increased risks tied to remote banking.

- ATMs account for 18% of fraud attempts, the lowest among deposit channels.

Cash Usage Decline and Payment Mix Shift

- In 2025, ATM usage fell about 5.7% in major markets like the U.S., UK, and Germany due to increased adoption of mobile wallets and contactless payment methods.

- Contactless payments contributed to a 10.8% drop in routine cash withdrawals in developed economies as consumers favored digital options like Apple Pay and Google Wallet.

- QR–based payments surged ~19.5% globally in 2025, further reducing reliance on cash and ATM visits.

- Peer‑to‑peer platforms such as Venmo and Zelle decreased ATM usage by an estimated 22% among Gen Z users this year.

- Despite the global trend, some markets still rely heavily on cash; in parts of Africa, ~89% of consumer transactions in 2025 continued to be cash‑based.

Urban vs Rural ATM Usage Patterns

- Urban ATM use is twice as high as in rural areas.

- 10% of urban transactions are linked to digital banking cards.

- 70%+ of rural ATM transactions remain cash withdrawals.

- Rural India hosts only 20% of the total ATMs despite 65% population.

- 94% of RCBC ATM Go transactions are outside Metro Manila.

- 64% of rural ATM Go users are women.

- Urban cash withdrawals surged 37.49% versus rural 12.50%.

- 85% of global ATM transactions are cash withdrawals.

- Rural ATMs are vital, where 45% lack nearby bank branches.

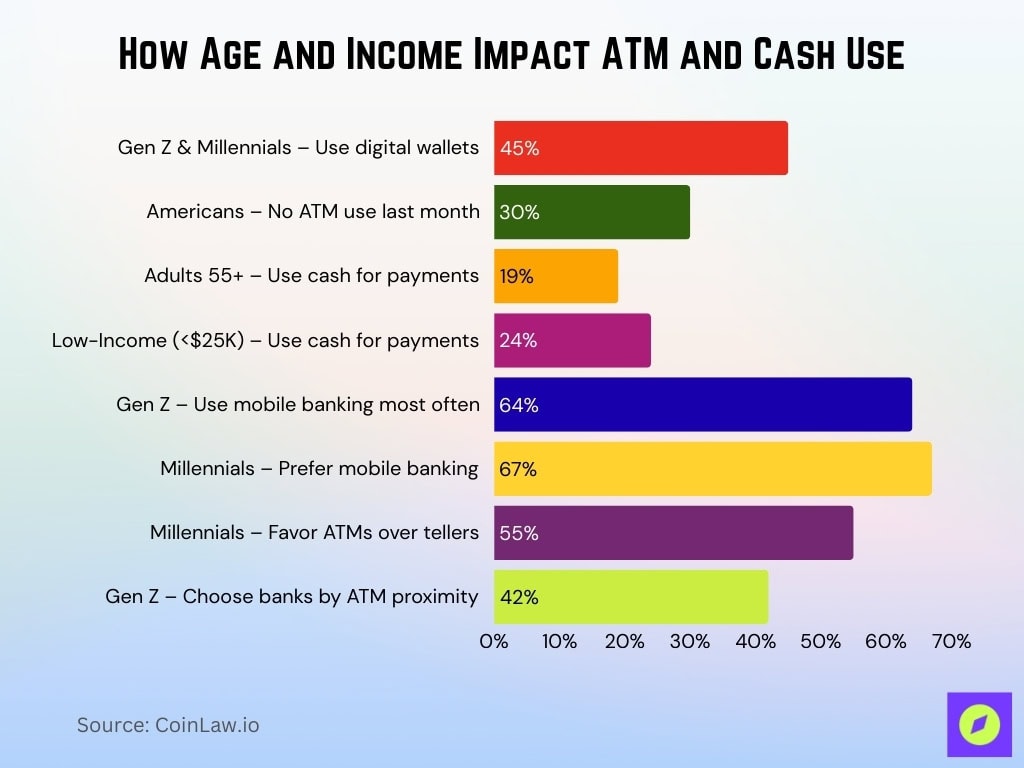

Demographic Differences in ATM Usage Decline

- Gen Z and Millennials use digital wallets for ~45% of payments.

- 30% of Americans reported no ATM cash withdrawal last month.

- Adults 55+ used cash for 19% of payments.

- Households under $25,000 used cash for 24% of payments.

- 64% of Gen Z use mobile banking apps most often.

- 67% of Millennials prefer mobile banking apps.

- 55% of Millennials favor ATMs over bank tellers.

- 42% of Gen Z consider ATM proximity when choosing banks.

ATM Withdrawal Frequency vs Amount Per Visit

- Global ATM transaction totals reached 86.7 billion.

- Average cash withdrawal per trip rose 3.3% to $157.

- ATM visits dropped by 11.2% while amounts per visit increased.

- 58% of global consumer transactions involved cash.

- Monthly ATM usage averaged about 350 transactions per ATM in select markets.

- 87% of ATM transactions occurred outside banking hours.

- Out-of-network ATM fees hit a record average of $4.86.

- 64% of banks adopted cash recycling ATMs for efficiency.

- Contactless ATM transactions surged by 19%.

- Cardless mobile withdrawals are available at 30% of global ATMs.

Branch Closures and ATM Network Rationalization

- Over 8,000 bank branches worldwide are projected to shut down.

- US projected 900 to 1,400 branch closures, the highest globally.

- Global ATM numbers declined to 2.91 million, down 1.4%.

- US active bank branches dropped below 65,000 as of Q2.

- Australia lost 333 bank ATMs, 155 branches in a year.

- Bank of America reduced its footprint by 18% via closures.

- 1 in 4 rural US branches closed in low-population areas.

- Over 320 US branches slated for closure in Q1.

- Asia-Pacific saw a 16% reduction in bank branches Jan-May.

- Germany and France combined for 1,100 branch closures.

Cash‑Dependent Segments Despite Overall Decline

- 84% of consumer transactions in developing economies relied on physical cash.

- 88% of US households used ATMs.

- 58% of global consumer transactions involved cash.

- 98% of daily transactions in Myanmar are made in cash.

- 95% of payments in Ethiopia remained cash-based.

- 73% of the population in India and Brazil used ATMs monthly.

- 89% of consumer transactions in Africa used cash.

Security, Fraud, and Their Effect on ATM Usage

- Global ATM fraud losses reached $2.05 billion.

- Skimming attacks accounted for 77% of ATM fraud cases.

- End-to-end encryption is implemented in 68% of new ATM installations.

- Biometric authentication is deployed in 18% of ATMs worldwide.

- Europe saw a 32% rise in ATM fraud incidents.

- Skimming devices caused $1.58 billion in global losses.

- EMV chip technology reduced ATM fraud by 30% in developed countries.

- AI-driven fraud detection cut ATM fraud by 16.1% globally.

- Remote monitoring systems reduced fraud losses by 11.3%.

Differences Between Advanced and Emerging Economies

- ATM usage declined by 5.7% in advanced economies like the US, UK, and Germany.

- Western Europe experienced a 7.5% drop in ATM usage.

- Asia-Pacific held 51.2% of global ATM deployments, led by India, Indonesia.

- 84% of consumer transactions in emerging economies used physical cash.

- Global ATM installations fell 1.8% overall, with emerging market stability.

- US accounted for 80.1% of worldwide crypto ATMs.

- Latin America saw 7% increase in ATM transactions.

- 89% of consumer transactions in Africa used cash.

- North America ATM installations are expected to decline 5%.

Technology Upgrades and Smart ATM Adoption

- About 30% of global ATMs supported cardless mobile withdrawals in 2025, up from ~20% the previous year, showing rising digital integration.

- Contactless ATM transactions rose by ~19% in 2025, reflecting hygiene and convenience preferences post‑pandemic.

- Cash recycling ATMs, capable of reusing deposited funds for withdrawals, now account for about 64% of the installed base, improving efficiency.

- Many ATM operators are replacing legacy units with touchscreen and biometric‑enabled terminals to attract users.

Frequently Asked Questions (FAQs)

Approximately 2.91 million ATMs globally in 2025, marking a 1.4% decline from the previous year.

Global ATM transaction volume reached ~86.7 billion transactions in 2025.

The average withdrawal per ATM transaction rose to $157 in 2025.

~64% of banks worldwide adopted cash recycling ATMs in 2025.

Conclusion

The decline in ATM usage reflects broader shifts toward digital payment ecosystems and changing consumer behaviors. Developed economies see faster drops in cash withdrawals, while emerging markets and cash‑dependent segments maintain higher ATM relevance. Security and fraud trends continue shaping how and where machines are deployed, prompting innovation in authentication and smart terminal technology. Even as transaction volumes fall, ATMs remain a crucial financial access point, particularly in underserved regions and among older or cash‑oriented demographics. Ongoing technology upgrades and evolving payment mixes will dictate the future role of ATMs in global finance.