Aptos has quickly emerged as a notable Layer 1 blockchain, combining high throughput with scalable infrastructure to support decentralized finance (DeFi), NFTs, and enterprise use cases. Aptos continues to attract developer interest and user engagement due to its Move programming language and parallel transaction processing design, which sets it apart from many contemporaries.

Real-world applications include high‑speed DeFi platforms relying on low-latency execution and gaming ecosystems where speed and cost directly impact user experience. This article unpacks the latest Aptos statistics today and sheds light on what they mean for the broader crypto landscape. Continue reading to explore key metrics shaping Aptos’s performance.

Editor’s Choice

- Aptos’s market capitalization is about $1.18 billion in early 2026.

- Circulating supply is ~764.9 million APT tokens.

- Aptos recorded 24‑hour trading volume above $100 million.

- The all‑time high price of APT is around $20 +.

- Price change over 7 days shows mild negative momentum (~‑4% to ‑5%).

- Token unlocks continue according to the vesting schedule.

- A significant share of wallets (~20 million) are active monthly.

Recent Developments

- Partnership with Reliance Jio enhanced Aptos’s presence in India and reportedly drove over half of 20 million active monthly wallets from that market.

- Aptos’s on‑chain token unlocks scheduled in February 2026 highlight the development toward long‑term supply release.

- The community expansion continues through ecosystem incentives for builders and users.

- Aptos continues integrating the Echo Protocol to bridge BTC into its DeFi ecosystem.

- Developer activity around Move and DApps has grown, with more weekly commits across open protocols.

- Growth of staking yields continues to attract long‑term token holders.

- Cross‑chain integrations with stablecoin markets show increased interoperability.

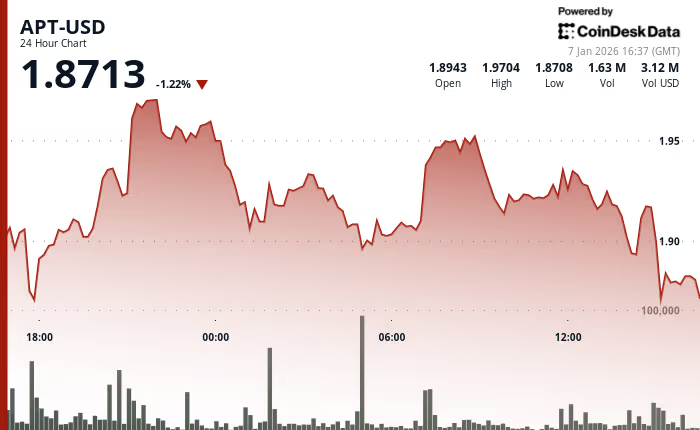

Aptos Price Snapshot

- Aptos (APT) traded at $1.8713, reflecting short-term market pressure.

- The token recorded a -1.22% price change over the last 24 hours.

- APT opened the session at $1.8943, indicating a mild intraday decline.

- The 24-hour high reached $1.9704, showing brief upside momentum.

- The 24-hour low dipped to $1.8708, marking a tight downside range.

- Trading activity totaled 1.63 million APT, highlighting steady market participation.

- Total 24-hour trading volume stood at $3.12 million, signaling moderate liquidity.

Aptos Key Facts Overview

- Aptos operates as a Proof-of-Stake blockchain emphasizing safety and scalability.

- Move language stems from Meta’s Diem project.

- Network supports high throughput at 45.85 real-time TPS, scaling to 160,000 TPS theoretically.

- Achieved a $1.75 million record on-chain revenue for the week ending Jan 4.

- Mainnet has been live since late 2022 with a $1.18 billion market cap.

- Ranks #89 by market cap among crypto assets.

- 484 developers contributed over the past year.

Trading Volume and Liquidity Metrics

- 24-hour trading volume reaches $98.35 million across exchanges.

- DEX spot volume totals $80–100 million daily.

- Perps trading volume hits $14 million over 24 hours.

- 7-day price change shows +5.82% gain.

- Volume-to-market-cap ratio stands at 8.37%.

- Ranks #85 by relative market popularity.

- Stablecoin trading volume surpassed $30 billion early this year.

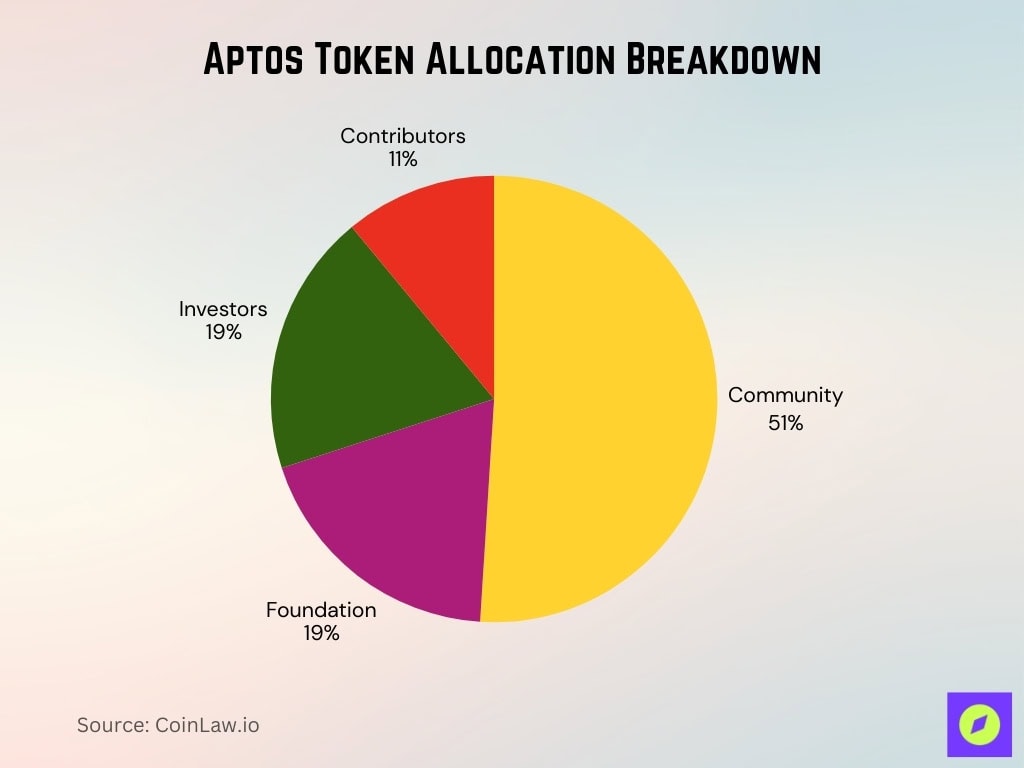

Supply and Tokenomics

- Allocation covers foundation (19%), community (51%), investors (19%), and contributors (11%).

- Circulating supply stands at 765 million APT.

- Total supply reported at 1.19 billion APT.

- Theoretical maximum supply remains infinite due to vesting unlocks.

- Next unlock scheduled for early February releases 11.30 million APT.

- Stake rewards drive ongoing inflationary token issuance.

- FDV calculated at $1.83 billion.

Volatility and Risk Metrics

- Price trades 91% below the all-time high of $19.92.

- 30-day volatility measures 6.93%.

- The current staking reward rate stands at 7% annually.

- RSI indicator reads 49.10, signaling neutral momentum.

- 43% green days over the past 30 days.

- Starting annual inflation rate set at 7%, declining to 3.25% minimum.

Staking and Rewards Statistics

- 494.5 million APT delegated, representing 76.15% staking ratio.

- Annual staking reward rate fixed at 7% APY.

- Proposal circulated to reduce rewards from 6.8% to 3.79%.

- Average validator commission rate holds at 9%.

- Minimum delegation threshold remains 11 APT per validator.

- 75 active validators maintain network consensus.

- Rewards auto-compound every 2-hour epoch cycle.

- Undelegation period spans 30 days maximum.

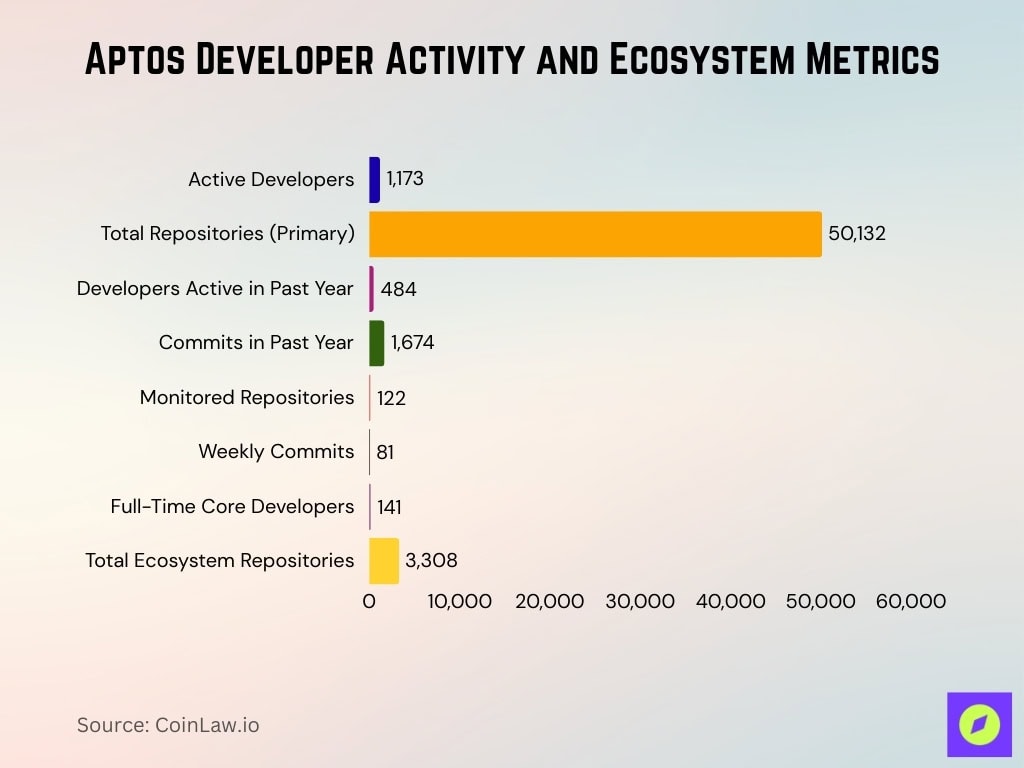

Developer Activity and Ecosystem Growth

- 1,173 active developers contribute across 50,132 repos.

- 484 developers worked on Aptos in the past year.

- The past year has committed a total of 1,674.

- 122 repos monitored with recent 81 weekly commits.

- 141 full-time developers are committed to the core.

- 3,308 repositories support ecosystem development.

Transaction Fees and On-Chain Activity

- Daily fee revenue peaked at $1.07 million on Dec 31.

- Weekly on-chain revenue reached $1.75 million ending Jan 4.

- Network processes tens of millions of transactions daily.

- DEX volume exceeds $99 million in 24 hours.

- 1.8 million daily active addresses were reported recently.

- $90 million transactions processed by Rhuna in 2025.

- Gas price denominated in Octas at 100 Octas per unit.

- Stablecoin supply supports $1.68 billion transfers.

Addresses and Holder Distribution

- Aptos network hosts millions of holders, with metrics showing over 6.3 million unique holders on the mainnet.

- The top 100 holders control ~13.77% of supply, demonstrating some concentration at large addresses.

- The top 10 holders account for ~9.68% of the total supply, providing insight into distribution density.

- Daily active addresses track substantial user engagement, with fluctuations indicating periods of market activity.

- Aptos’s address activity surged to 1.5 million active wallets in recent months, up over 100% in 30 days.

- Monthly active addresses reportedly reached ~20 million globally, with notable regional participation in India.

- Holder numbers expand alongside ecosystem growth, reflecting broader adoption of DeFi and gaming applications.

- New address creation often correlates with spikes in stablecoin minting or DeFi deposit events.

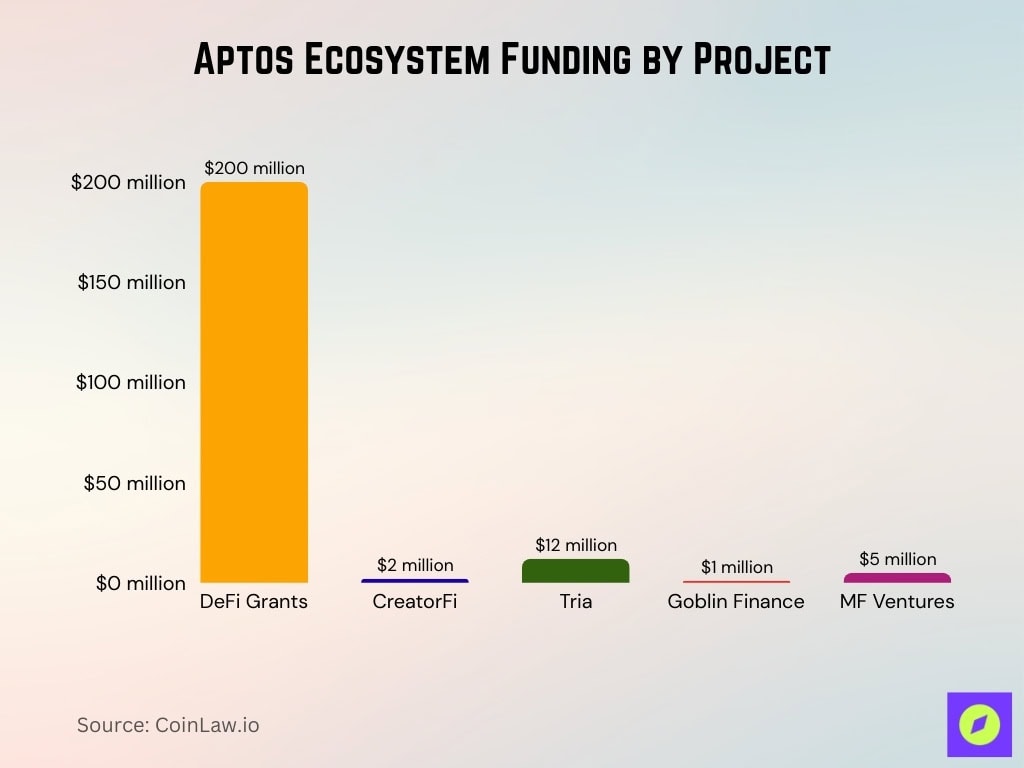

Ecosystem Funding and Investments

- Ecosystem hosts 370 projects across categories.

- Foundation distributed 200 grants for DeFi, NFTs, and infrastructure.

- $200 million committed to DeFi grants and liquidity initiatives.

- CreatorFi secured $2 million in strategic funding.

- Tria raised $12 million pre-seed for infrastructure.

- Goblin Finance completes $1 million strategic financing.

- MF Ventures deploys $5 million across six startups.

- 330+ projects span DeFi, NFTs, gaming, and payments.

Network Security and Validator Statistics

- Network maintains 100 active validator nodes.

- Validators grew from 41 to 75 by mid-2025.

- Delegated stake ratio reached 47.1% of the total.

- Average validator uptime exceeds 99%.

- Leaderboard tracks proposal success rates for rewards.

- Geographic distribution spans 20+ countries globally.

- Byzantine fault tolerance secured with 67% honest stake.

- Minimum stake requirement set at 10 million APT.

DeFi, TVL, and Stablecoin Activity

- Stablecoins market cap reaches $1.364 billion [-4.65% weekly].

- USDT dominance in stables is at 70.38%.

- DEX’s volume hits $160.36 million over 24 hours.

- Perps volume records $48.9 million daily.

- App revenue generates $54,701 in 24 hours.

- Bridged TVL contributes $515.49 million.

- Stablecoin supply peaked at $1.8 billion in 2025.

NFT and Gaming Ecosystem Statistics

- The global NFT gaming market is valued at $0.62 trillion.

- Sector projected to grow at 14.35% CAGR through 2031.

- Gaming NFTs represent 38% of blockchain NFT transactions.

- Blockchain gaming averages 4.66 million daily active wallets.

- NFT market is forecasted at $60.82 billion overall.

- Asia-Pacific holds 28.7% blockchain gaming market share.

- Ethereum captures 62% NFT contract dominance.

- Play-to-earn models boost revenue 40% in blockchain games.

- 25% higher player willingness to pay for blockchain assets.

Adoption, Community, and Global Reach

- 20 million monthly active wallets globally.

- 1.5 million active wallets in October 2025 peak.

- India accounts for over 50% of active wallets.

- 1 million unique active wallets on Hyperion DEX in 2025.

- Daily transactions stabilize at 5.7 million.

- 114% growth in active addresses over 30 days.

- $545.7 million stablecoin inflows in a single day.

- 181% monthly active wallet growth in Q1 2025.

Comparisons With Other Layer 1 Blockchains

- Aptos market cap is $1.23 billion, Sui is higher with a superior TVL ratio.

- Solana’s market cap exceeds $100 billion, versus Aptos’ $3 billion.

- Aptos TVL $0.462 billion trails Solana‘s leading $69 billion Ethereum.

- Sui DeFi TVL $1.6 billion surpasses Aptos $930 million.

- Aptos Market Cap/TVL ratio is the lowest at 2.7.

- Solana DEX volumes triple Sui and Aptos combined recently.

- Sui has weekly active developers of 280, Aptos has 272.

- Solana fees generated $1.1 million in October versus Aptos $196k.

Frequently Asked Questions (FAQs)

$1.609 billion.

$99.15 million.

~20 million wallets, with over half from India.

~86% increase.

Conclusion

Aptos today stands as a rapidly evolving Layer‑1 blockchain, distinguished by its developer focus, growing NFT and gaming ecosystem, and expanding global community. Metrics show significant engagement, from millions of wallets to consistent developer activity, and a diversified suite of applications ranging from DeFi to immersive digital assets.

While Aptos competes with established ecosystems like Ethereum and Solana, it carves its niche with a Move‑optimized stack and community momentum. As staking, funding, and real‑world use cases deepen, Aptos’s trajectory signals a blockchain ecosystem that continues to adapt and expand across sectors.