In 2014, Apple Pay entered the payment landscape, changing how consumers interact with their wallets. With a single tap, it promises a more secure, seamless, and convenient payment experience. Over the years, Apple Pay has transformed into one of the most popular mobile payment systems globally, bridging users and merchants in a cashless economy. As 2025 unfolds, this article explores the latest Apple Pay statistics, highlighting its growth trajectory, adoption trends, and market dynamics.

Editor’s Choice: Key Apple Pay Milestones

- Launch Year Apple Pay launched in October 2014 in the US, partnering with major banks like Wells Fargo, Chase, and Citibank.

- Global Reach As of 2025, Apple Pay is available in over 85 countries, offering seamless payments to hundreds of millions globally.

- Transaction Volume Growth In 2025, Apple Pay is projected to process over $7.6 trillion annually, maintaining its lead in digital wallet transactions.

- User Base Expansion Apple Pay now has 580 million+ active users worldwide, reflecting a growth of 16% year-over-year.

- E-commerce Integration In the US, 51% of online purchases in 2025 were made via mobile wallets, with Apple Pay holding the top share.

- POS Adoption 94% of US retailers now accept Apple Pay at checkout, reinforcing its widespread in-store acceptance.

- Security Innovations Apple Pay continues to lead with biometric verification, tokenization, and on-device encryption, enhancing secure transactions.

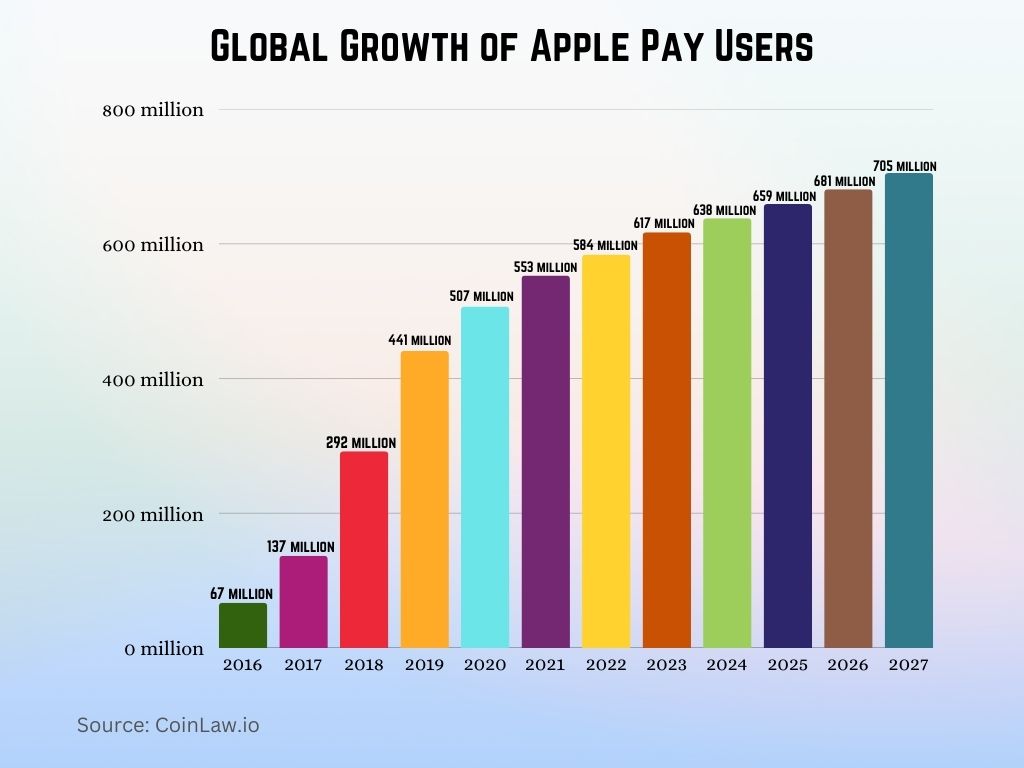

Global Growth of Apple Pay Users

- 2016: Apple Pay had 67 million users globally. This marked the early adoption phase of the service, just two years after its launch.

- 2017: The user base more than doubled to 137 million. This rapid growth reflected increasing consumer trust in mobile payments.

- 2018: Apple Pay reached 292 million users. The service saw strong global expansion, especially in developed markets.

- 2019: Users jumped to 441 million worldwide. This surge was driven by more banks and retailers supporting the platform.

- 2020: The platform crossed 500 million users, reaching 507 million. The COVID-19 pandemic accelerated the demand for contactless payments.

- 2021: An estimated 553 million people used Apple Pay. Growth continued steadily as Apple Pay expanded into new regions.

- 2022: User count was projected at 584 million. Continued smartphone penetration and digital wallet adoption fueled the increase.

- 2023: Apple Pay was expected to have 617 million users. This reflected the growing trend toward mobile-first financial habits.

- 2024: The user base is projected to hit 638 million. Market confidence in Apple Pay’s security and ease of use supports this growth.

- 2025: Estimated users will rise to 659 million. Wider merchant acceptance and integration with other Apple services aid adoption.

- 2026: Projections show 681 million users globally. Apple Pay continues to benefit from broader fintech ecosystem developments.

- 2027: The platform is expected to reach 705 million users. This milestone reflects Apple Pay’s position as a dominant force in digital payments.

User Adoption and Demographics

Understanding who uses Apple Pay provides insights into its adoption success.

- Age Demographics: 70% of users fall between 18 and 34 years old, making it a preferred payment method among millennials and Gen Z.

- Gender Usage: Adoption is slightly skewed, with 55% of users being male compared to 45% female users globally.

- Income Group Preference: Households earning above $100,000 annually are more likely to use Apple Pay, accounting for 62% of users.

- Digital Wallet Penetration: In the US, over 85% of iPhone users have set up Apple Pay, showcasing its growing integration with Apple devices.

- Daily Usage: Around 30% of active users use Apple Pay daily, and 60% use it at least once a week.

- Geographic Trends: The highest adoption rates are in North America (45%) and Europe (35%), with Asia-Pacific regions catching up rapidly.

- Merchant Type Popularity: Grocery stores, coffee shops, and transportation services are among the top categories where Apple Pay is most frequently used.

Market Share and Competitive Analysis

Apple Pay dominates the digital wallet ecosystem but faces increasing competition.

- Market Leadership: Apple Pay held a 45% share in the US mobile payment market, maintaining its lead over competitors like Google Pay and Samsung Pay.

- Competitor Comparison: While Apple Pay leads in the US, Google Pay dominates in India and other Android-heavy markets.

- Cross-Device Integration: Apple Pay’s ecosystem, spanning iPhones, Apple Watches, and iPads, creates a seamless experience unmatched by competitors.

- Ecosystem Lock-In: 76% of users cite Apple’s ecosystem as a key reason for using Apple Pay, ensuring loyalty among iOS users.

- Global Transactions: Apple Pay accounted for 35% of global mobile wallet transactions, reflecting its increasing international footprint.

- Merchant Partnerships: Apple Pay collaborates with over 10 million merchants worldwide, outpacing most other mobile wallets.

- Future Threats: Emerging technologies like Buy Now, Pay Later (BNPL) and blockchain wallets could challenge Apple Pay’s dominance in specific demographics.

Revenue and Transaction Volume

- Annual Transaction Volume: Apple Pay processed over $7.6 trillion in transactions in 2025, reflecting a 21% year-over-year increase.

- Revenue Contribution: Apple Pay generated $9.4 billion in revenue in 2025, contributing 3.4% of Apple’s total revenue.

- Per-Transaction Fee: Apple earns a 0.15% fee on each credit card transaction made through Apple Pay, fueling consistent growth.

- In-App Purchases: In-app purchase transactions via Apple Pay rose by 26% in 2025, showcasing continued dominance in digital commerce.

- E-commerce Market Share: Apple Pay captured 14.3% of global e-commerce sales in 2025.

- Average Transaction Size: The average Apple Pay transaction hit $29.70 in 2025.

- Recurring Transactions: 44% of subscription services now offer Apple Pay as the preferred payment method among users in 2025.

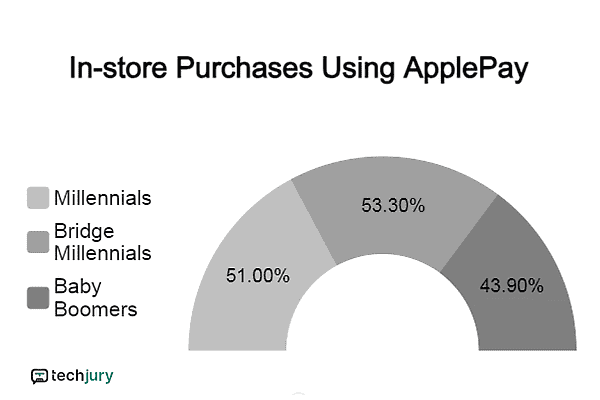

In-Store Purchases Using Apple Pay by Generation

- Bridge Millennials lead in Apple Pay usage for in-store purchases, with 53.3% adoption.

- Millennials follow closely, with 51.0% of them using Apple Pay in physical stores.

- Baby Boomers show the lowest usage, with only 43.9% making in-store purchases via Apple Pay.

Merchant Acceptance and Partnerships

Apple Pay’s growth is closely tied to its widespread acceptance and strategic partnerships.

- Global Merchant Base: Over 10 million merchants worldwide now accept Apple Pay, including 90% of US retailers.

- Partnerships with Banks: Apple Pay is supported by 5,000+ banking institutions, ensuring wide accessibility for consumers.

- E-commerce Integration: Platforms like Shopify, BigCommerce, and WooCommerce offer seamless Apple Pay integration, driving adoption among online retailers.

- Retail Giants on Board: Brands like Walmart, Target, and Starbucks have integrated Apple Pay, expanding its reach among everyday consumers.

- Transport Networks: Apple Pay is integrated with 40+ major transit systems globally, including New York’s MTA and London’s TfL.

- Small Business Adoption: 70% of small businesses in the US now accept Apple Pay, thanks to accessible POS system integrations like Square and Clover.

- Charity Support: Apple Pay enables donations to 200+ charitable organizations, including the Red Cross and UNICEF, driving philanthropic contributions.

Apple Card: On Cards, Wallets, and Savings

- Active Users: Apple Card reached 18.2 million users by the end of 2025, reflecting a 21% growth from the previous year.

- Daily Cash Rewards: Users earned over $2.4 billion in cashback in 2025, with 2% for Apple Pay and 3% with select partners.

- High Approval Rates: Apple Card maintains a 57% approval rate, outpacing many traditional credit card issuers in 2025.

- Savings Accounts: Apple’s Savings Account surpassed $16.5 billion in deposits in 2025, still offering a competitive 4.15% APY.

- Interest-Free Financing: 0% financing on Apple products drove a 36% increase in Apple hardware purchases through Apple Card.

- Integration with Wallet: 96.5% of Apple Card users have it linked to Apple Pay in 2025, ensuring a unified digital wallet experience.

- Credit Score Improvements: Responsible usage of the Apple Card led to an average credit score boost of 22 points in one year.

Apple Wallet vs. Google Wallet: US User Forecast

- In 2024, Apple Wallet is projected to have 79.3 million users in the US, compared to 48.6 million for Google Wallet.

- By 2025, Apple Wallet will have 83.5 million users, 63.8% more than Google Wallet’s 50.9 million users.

- The gap continues to widen, with Apple Wallet reaching 87.5M (2026), 91.3M (2027), and 95.0M (2028).

- Meanwhile, Google Wallet grows steadily but more slowly: 53.1M (2026), 55.1M (2027), and 57.0M (2028).

This trend shows Apple Wallet’s dominant lead in US digital wallet adoption through 2028.

Apple Pay Later: Apple’s Foray into BNPL

- BNPL User Base: Apple Pay Later surpassed 3.5 million users by 2025, showing rapid adoption since its launch

- Transaction Volume: In 2025, Apple Pay Later processed $2.1 billion in BNPL transactions, securing 7.8% of the US BNPL market

- Average Loan Size: The typical loan size through Apple Pay Later in 2025 is $165, mainly for electronics and lifestyle items

- Interest-Free Terms: Apple Pay Later continues to offer six-week interest-free payment plans, keeping it highly competitive

- Retailer Partnerships: Major brands, including Nike, Sephora, Best Buy, and now Target, support Apple Pay Later at checkout

- Consumer Feedback: 82% of users reported high satisfaction in 2025, praising its clarity and seamless Apple Wallet integration

- Demographic Trends: Millennials and Gen Z make up 68% of Apple Pay Later users, confirming its youth-driven appeal

Global Adoption and Usage

Apple Pay has established a significant presence across the globe, continually expanding its user base and geographic reach.

- Countries Supported: Apple Pay is available in over 70 countries, including recent expansions into Colombia and Bahrain.

- Top Regions by Usage: North America leads with 45% of Apple Pay transactions, followed by Europe at 30% and Asia-Pacific at 20%.

- Emerging Markets: Apple Pay adoption in India and Brazil increased by 35% due to local partnerships with major banks.

- Cross-Border Payments: Apple Pay supports seamless cross-border transactions in 50+ currencies, making it ideal for international travelers.

- Adoption in the EU: In France, 60% of iPhone users actively use Apple Pay, compared to 40% in Germany.

- Mobile Wallet Rankings: Apple Pay ranks as the #1 digital wallet in 25 countries, including the United States, the UK, and Japan.

- Transit Integration: Countries like China and Singapore report that 80% of transit payments are made via Apple Pay.

Apple Pay Usage: Online and POS Adoption

Apple Pay continues to thrive in both online and in-store environments.

- Online Transactions: 45% of Apple Pay transactions were online purchases, particularly in e-commerce and app stores.

- POS Transactions: In the US, 85% of retail POS systems are compatible with Apple Pay, ensuring widespread accessibility.

- Average Checkout Time: Apple Pay reduces checkout times by 50% compared to traditional card payments.

- Recurring Payments: 25% of Apple Pay users use the service for recurring payments like subscriptions and utility bills.

- Tap-and-Go Trend: In Australia, 90% of in-store Apple Pay transactions occur via tap-and-go NFC terminals.

- Popular Online Merchants: Major platforms like Amazon, Etsy, and eBay report a 20% increase in checkout completion rates when using Apple Pay.

- Restaurant Usage: Over 60% of fast-food chains globally now accept Apple Pay, simplifying contactless payments.

Security and Technology

Apple Pay prioritizes advanced security features, setting industry standards in mobile payments.

- Tokenization: Apple Pay uses dynamic security tokens to ensure that card numbers are never shared with merchants.

- Biometric Authentication: Face ID and Touch ID provide an extra layer of security, used in 99% of transactions.

- Fraud Protection: Fraud rates for Apple Pay are 0.01%, significantly lower than traditional credit card transactions.

- Device Safety: Lost iPhones can be deactivated remotely, ensuring that Apple Pay accounts remain secure.

- Two-Factor Authentication: Apple mandates 2FA to set up Apple Pay, enhancing user account protection.

- PCI DSS Compliance: Apple Pay complies with Payment Card Industry Data Security Standards, ensuring secure data handling.

- Encrypted Transactions: Every Apple Pay transaction is encrypted, providing end-to-end data security.

Benefits of Accepting Apple Pay

Merchants who accept Apple Pay enjoy a range of advantages, from increased sales to customer satisfaction.

- Faster Checkout: Apple Pay speeds up checkout processes, reducing customer wait times by 30%.

- Increased Sales: Businesses that accept Apple Pay report a 15% increase in sales, driven by convenience.

- Higher Cart Conversion Rates: Online merchants see an 18% improvement in cart conversion when Apple Pay is enabled.

- Global Acceptance: Merchants gain access to Apple Pay’s 500 million user base, ensuring wider reach.

- Customer Satisfaction: 80% of customers rate their Apple Pay experience as highly satisfying, making it a preferred choice.

- Contactless Payments: Apple Pay’s emphasis on contactless solutions appeals to post-pandemic consumer preferences.

- Improved Security: Merchants benefit from reduced fraud liability due to Apple Pay’s robust security features.

Recent Developments

- Integration with BNPL: Apple Pay Later expanded rapidly in 2025, offering flexible financing across thousands of retailers globally

- Enhanced Savings: Apple’s Savings Account reached $16.5 billion in deposits by 2025, still offering a competitive 4.15% APY

- Transit Expansion: Apple Pay integrated with 12 additional transit systems in 2025, including Sydney’s Opal and Mexico City Metro

- Improved Accessibility: Voice-activated payment features were upgraded in 2025, improving accessibility for 1.2 million visually impaired users

- E-commerce Growth: Apple Pay’s Shopify integration helped drive a 28% increase in SMB transactions in 2025

- Increased Focus on SMEs: Tailored Apple Pay solutions for SMEs led to a 32% adoption boost among small-to-medium businesses in 2025

- AI-Driven Fraud Detection: AI-powered fraud tools in 2025, cut suspicious activity by 42%, enhancing user trust and security

Conclusion

Apple Pay’s journey from a novel payment method to a global leader in mobile transactions highlights its innovative approach and customer-centric focus. With continuous advancements in technology, security, and global reach, Apple Pay is set to remain a cornerstone of digital payments for years to come. As businesses and consumers alike increasingly adopt mobile-first solutions, Apple Pay’s integration across devices, markets, and payment categories positions it as a critical player in shaping the future of commerce.