Zerion has solidified its role as a cross‑chain crypto dashboard, blending wallet, portfolio tracker, DeFi access, and NFT analytics. The platform now powers real‑time visibility into on‑chain behavior for users, developers, and institutions alike. In practice, crypto funds may use Zerion’s API to monitor large wallets across Ethereum and Solana, while DeFi aggregators embed Zerion’s tracking to surface yield across chains for users. Let’s dive into the key numbers driving Zerion’s traction today.

Editor’s Choice

- Zerion reported over 300,000 monthly active users across its platforms (web, mobile, extension) in early 2025.

- Over $1 billion in cumulative transaction volume processed.

- 341,000 “active funded wallets” recorded in 2023 by Zerion itself.

- 199,755 unique Zerion DNA owners by end‑2023.

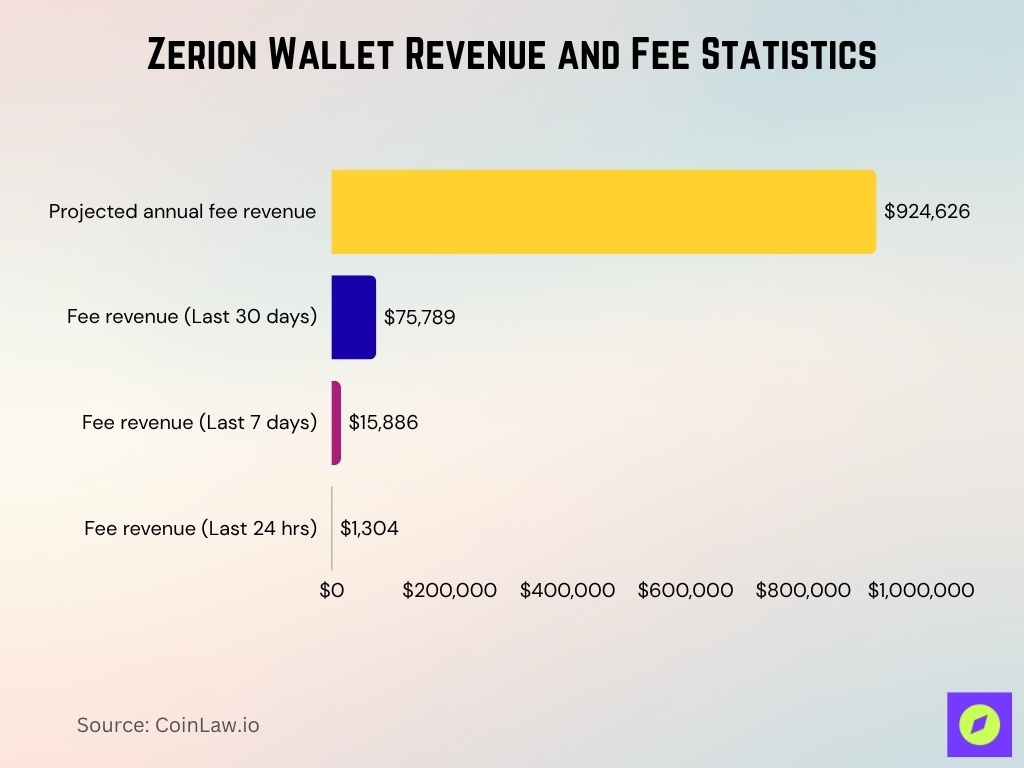

- Zerion estimates $924,626 in annualized revenue from transaction and bridge fees based on a 0.5% fee model and current user/transaction growth as of 2025.

- Over 10 million wallets are eligible for Zerion XP rewards as of late 2024.

- Zerion Android climbed to 3rd place in Coinspect’s 2025 wallet security ranking.

Recent Developments

- The Zerion browser extension, built from scratch, launched publicly in December 2023 after an early access phase with ~30,000 users.

- In late 2024, Zerion announced the XP Rewards program, making over 10 million wallet addresses eligible for retroactive XP drops.

- Zerion rolled out Premium features: lower fees (50% less), advanced P&L analytics, exportable CSVs, early access, and priority support.

- The platform also began pushing ZERO, a layer‑2 solution meant to eliminate gas fees for Zerion users.

- The API infrastructure continued expansion, as of 2025, Zerion API supports 24+ chains, real-time updates, and webhook alerts.

- Coinspect’s 2025 security ranking highlighted Zerion’s improvements in phishing protection and dApp connection transparency.

- RivalSense reports that Zerion crossed $1 billion in transaction volume and surpassed 300K users in early 2025.

Zerion Portfolio and Asset Statistics

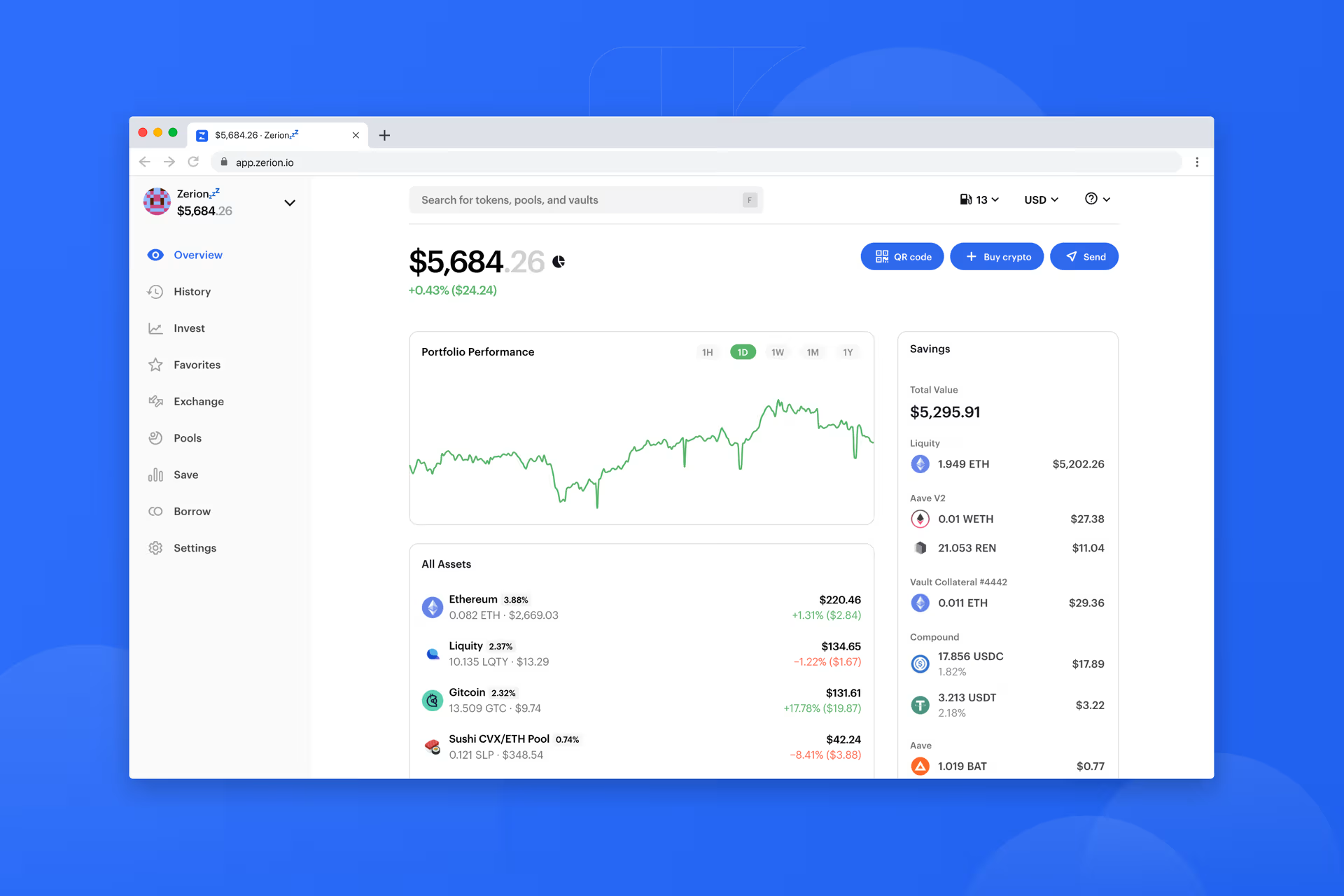

- The total portfolio value is $5,684.26, reflecting a daily gain of +0.43% (+$24.24). This shows a stable upward performance in the short term.

- Ethereum dominates the portfolio with 0.082 ETH worth $2,669.03, recording a +1.31% increase. This makes ETH the single largest holding in the account.

- Liquity (LQTY) holdings amount to 10.135 tokens valued at $13.29, showing a -1.22% drop. The slight decline indicates short-term volatility in this asset.

- Gitcoin (GTC) stands at 13.509 tokens worth $9.74, posting a strong +17.78% growth (+$19.87). This makes it the fastest-growing asset in the portfolio.

- Sushi CVX/ETH Pool (SLP) allocation totals 0.121 SLP valued at $348.54, with an -8.41% decline (-$3.88). This marks the steepest drop among the tracked assets.

Savings Breakdown

- The total savings balance is $5,295.91, almost matching the overall portfolio value. This highlights the significant weight of savings in the user’s assets.

- 1.949 ETH in Liquity accounts for $5,202.26, making it the largest single savings position. This alone represents the majority of the savings portfolio.

- Aave V2 holdings include 0.01 WETH worth $27.38 and 21.053 REN worth $11.04. These represent smaller but diversified positions.

- Vault collateral adds 0.011 ETH, worth $29.36, to the balance. While minor, it contributes to the stability of the savings mix.

- Compound assets include 17.856 USDC worth $17.89 and 3.213 USDT worth $3.22. These stablecoins provide liquidity and reduce volatility exposure.

- Aave BAT holdings stand at 1.019 BAT, valued at $0.77. This is the smallest position in the savings account.

Key User Statistics

- Monthly active users (MAU) exceeded 300,000 by early 2025.

- In 2023, Zerion reported 341,000 active funded wallets.

- Unique owners of Zerion DNA NFT reached 199,755 by year‑end 2023.

- Over 10 million wallets became eligible for Zerion XP in 2024.

- Rated 4.7/5 in Chrome Web Store with 715 ratings for the extension.

- Android app security ranking rose 12.2 points to reach 3rd place among wallets in 2025.

- In 2025, Zerion reportedly supported 300K+ users across its wallet/web platforms.

- Hundreds of developers, wallets, and consumer tools integrate the Zerion API, enhancing its reach.

Transaction Volume and Activity

- Over $1 billion in total transaction volume processed by Zerion to date.

- In 2023, Zerion disclosed $595 million in transaction volume.

- Zerion has processed $4.58 trillion in transaction volume historically.

- ~280,000 transactions and ~57,000 users recorded in Dune Analytics data.

- Zerion charges a trading/bridge fee of 0.5% per transaction.

- Cumulative revenue from fees totals approximately $3.18 million.

- In the 30-day window, Zerion’s fees were ~$75,789.

- Daily fee revenue is approximately $1,304.

Revenue and Fee Statistics

- Zerion’s projected annual revenue from fees is ~$924,626 (2025).

- In the past 30 days, fees generated ~$75,789.

- In the past 7 days: ~$15,886 in fees.

- In the last 24 hours: ~$1,304 in fees.

- Zerion’s revenue mirrors its fee model (0.5% on trading/bridging).

- Release of the Premium plan offers a 50% discount on fees for subscribers.

- As adoption grows, fee revenue may scale with transaction volume and Premium uptake.

NFT and DeFi Integration Stats

- Zerion supports 40+ EVM-compatible chains for DeFi + token tracking.

- The platform aggregates DeFi positions, LP tokens, staking rewards, debts, and yields in one view.

- Zerion’s API covers DeFi positions for 8,000+ protocols across chains.

- Users can track NFT collections, metadata, and floor price via API endpoints.

- Zerion now supports Solana NFTs and assets in addition to EVM chains.

- The wallet automatically finds and surfaces DeFi “gems” by tracking wallet activity.

- In cross‑chain stablecoin swaps, Zerion selects optimal bridge + DEX routes to reduce slippage and cost.

- Zerion wallet tracks full multichain transaction history across 50+ blockchains, including swaps, NFTs, and bridges.

- The DeFi portfolio tracker is free, with Premium adding deeper analytics across chains.

Zerion DNA NFT Metrics

- As of the end of 2023, there were 199,755 unique Zerion DNA NFT owners.

- Zerion DNA is designed as a soulbound NFT that evolves with on‑chain activity.

- Owning a Zerion DNA can grant Premium perks or unlock features.

- The DNA NFT is tied to wallet behavior and reflects user history on Zerion.

- Transferability is limited; if DNA is on Ethereum, transfers may be allowed, but if on the ZERO network, DNA is non‑transferable.

- The DNA count offers a proxy for truly engaged users.

- DNA burn or upgrade events may influence the dynamics of engagement.

- The growth trend of DNA holders lags general wallet adoption.

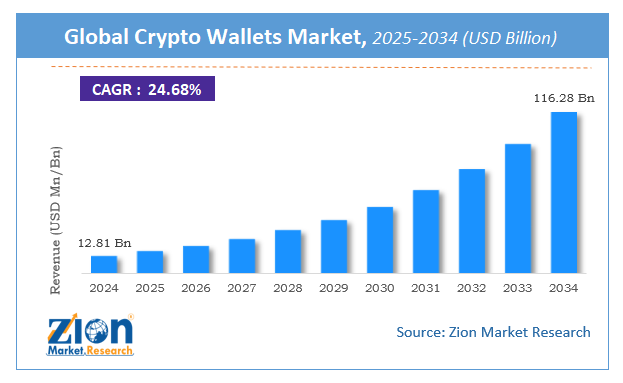

Global Crypto Wallets Market Statistics

- In 2025, the market is expected to reach around $15 billion. This marks the start of a strong upward trend fueled by the adoption of digital assets.

- By 2026, revenues are projected to hit approximately $18 billion. The steady increase reflects growing demand for secure wallet solutions.

- In 2027, the market size is forecast to expand to $21 billion. This continues the consistent year-on-year growth momentum.

- The 2028 estimate shows the market reaching $25 billion. This milestone highlights the widening usage of wallets in retail and institutional finance.

- By 2029, the industry is projected to be worth $29 billion. This growth indicates an accelerating pace of adoption across regions.

- Entering the next decade, 2030 figures suggest the market will climb to $34 billion. This shows crypto wallets moving closer to mainstream financial infrastructure.

- In 2031, revenues are forecast at $40 billion. This illustrates the increasing reliance on digital wallets for both payments and asset storage.

- By 2032, the market is projected to $47 billion. The rise reflects heightened global participation in crypto ecosystems.

- The 2033 forecast shows the market reaching $56 billion. This significant jump demonstrates the scale of institutional and retail adoption.

- By 2034, the industry is expected to soar to $116.28 billion. This represents nearly a tenfold increase from 2024, underscoring a 24.68% CAGR across the forecast period.

Portfolio Tracking Features

- Zerion provides real-time updates on portfolio value, token balances, and P&L summaries.

- It automatically tracks DeFi positions, LPs, staked assets, debts, and rewards across all connected chains.

- Users can import any wallet address and view positions via “watch mode.”

- Portfolio tracking supports 40+ chains by default.

- Exporting transaction history (CSV) is unlocked in the Premium tier.

- Zerion supports multi-account aggregation, and users see the full portfolio across all their addresses.

- The API enables automated P&L computation and enrichment for third-party apps.

- Historical performance charts let users assess growth and token allocations over time.

- Zerion’s UX includes a “By Protocol” view to break down assets per DeFi protocol category.

Supported Chains and Assets

- Zerion supports 50+ EVM blockchains and adds new chains weekly.

- Support includes Ethereum, Polygon, BNB Smart Chain, Base, Optimism, Arbitrum, zkSync, Scroll, Blast, Zora, etc.

- Solana support is now integrated.

- On BNB Smart Chain, users can see tokens, NFTs, and DeFi positions.

- On Polygon, Zerion tracks tokens, DeFi, and NFTs seamlessly and bridges from other chains.

- The API provides a unified schema for assets and metadata across all chains.

- Users can add custom nets, testnets, and RPC endpoints to extend support.

- Asset types include fungible tokens, NFTs, LP tokens, synthetic assets, and debt tokens.

- Zerion also handles bridges/swaps, so cross‑chain movement is integrated as an asset event.

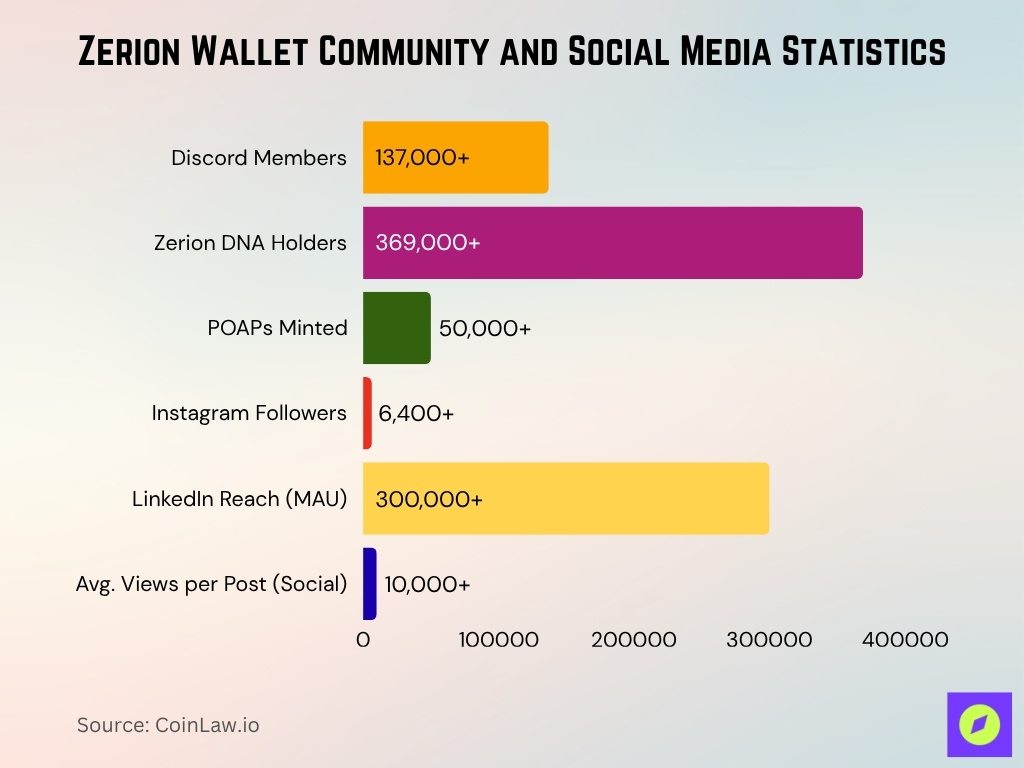

Community and Social Media Statistics

- Discord membership exceeds 137,000+, reflecting nearly 4× growth in 12 months.

- Zerion reports 369,000+ Zerion DNA holders in its community metrics.

- Over 50,000 POAPs minted for community events, drops, and milestones.

- Zerion’s Instagram shows 6,400+ followers.

- On LinkedIn, Zerion advertises serving 300K+ monthly active users across 150+ countries.

- Social media content and short‑form videos reportedly garner 10K+ organic views per post.

- Zerion’s blog integration with Lens enables users to follow wallet‑based identities.

- The “Zerion Ambassador Program” exists to deepen community engagement.

- Community outreach spans Discord, X, Lens, and Farcaster.

Multichain and Cross‑Platform Usage

- Zerion aggregates wallet data from multiple chains into a single unified view.

- Cross‑chain swaps, bridging, and optimal routing happen within the wallet interface.

- In a multichain view, users can trace transaction flow and evaluate their cross‑chain P&L.

- The API enables third parties to fetch cross‑chain portfolio and transaction data in one call.

- Zerion supports syncing across devices.

- The wallet detects route inefficiencies and offers better swap/bridge paths across chains.

- Mobile, web, and browser extensions share feature parity for multichain capabilities.

- The extension interacts with dApps on multiple chains via wallet injection.

- Cross-platform synchronization helps users switch between devices without losing state.

Zerion Wallet Mobile vs Desktop Stats

- In the Chrome Web Store, the Zerion extension has 4.7 / 5 stars from 715 ratings.

- The extension reaches thousands of users across desktop environments.

- The mobile app listing notes “Join 300k+ people” in its App Store description.

- The Android version lists advanced on-chain security and multichain support.

- The iOS app supports portfolio, trading, NFT views, and cross‑chain interaction.

- As of September 2025, the extension version is 1.29.0.

- The macOS app was slated for deprecation in 2025.

- Premium benefits apply across mobile, web, and extension.

- For desktop, the extension connects directly with dApps and auto‑inserts into Web3-enabled sites.

- Mobile usage often dominates for quick portfolio checks, and the desktop is preferred for deeper analytics.

Funding and Investor Statistics

- Zerion has raised a total of $22.5 million across multiple rounds.

- A notable Series B round of $12.3 million was raised.

- Investors include Coinbase Ventures, Alchemy Ventures, Wintermute, Mosaic Ventures, Placeholder, and DCG.

- Earlier seed rounds totaled smaller sums such as $2 million.

- Zerion now serves 200K+ monthly active users from 150+ countries.

- PitchBook confirms the $22.5M total raise and key backers.

- CoinRank tracks fundraising rounds and investor activity.

- Some sources estimate valuations at ~$147.3 million.

Privacy and Data Practices

- Zerion is non‑custodial; it never holds users’ private keys or funds.

- Zerion uses a bug bounty program to reward white‑hat vulnerabilities.

- The platform aggregates on‑chain data but does not collect KYC from users.

- Zerion integrates Lens Protocol for decentralized social identity.

- No signs that Zerion sells personal off‑chain data.

- Wallet metadata may be logged under standard analytics terms.

- Zerion supports hardware wallet integration.

Roadmap and Future Plans

- Zerion is developing ZERO, a layer‑2 network to reduce gas fees.

- Continued chain expansion is expected.

- Enhancements to Premium analytics are planned.

- Further integration into Web3 social networks is underway.

- Upgrades to bridging, liquidity routing, and swap optimization are projected.

- Potential NFT / DNA evolution features may be introduced.

- On‑chain modules may be built for DNA utility and rewards.

- More third‑party API partnerships are planned.

- Community expansion remains a strategic pillar.

Frequently Asked Questions (FAQs)

Zerion’s fees are projected to generate $924,626 in annual revenue.

Over 10 million wallets are eligible for the Zerion XP retrodrop.

There are 416,439 Zerion DNA NFTs minted and 350,869 unique owners.

Zerion reported 341,000 active funded wallets in 2023.

Conclusion

Zerion Wallet sits at the intersection of portfolio analytics, multichain DeFi access, and evolving Web3 social layers. Its million in funding, Discord members, and robust audit programs underscore its ambition and credibility. While competitors abound, Zerion’s strength lies in integrating wallet, DeFi, and NFT tracking under a unified experience. Looking ahead, ZERO, deeper analytics, and social identity features will shape whether it becomes a dominant player. If you’re curious about how Zerion stacks up today vs. a year ago, or want granular metric trends, read the full article to get every compelling statistic and trend explained.