Malaysia-based tech firm VCI Global is making a bold move into crypto payments with a $100 million investment in OOB tokens and a strategic partnership with Tether-backed platform OOBIT.

Key Takeaways

- VCI Global is acquiring $100 million worth of OOB tokens, the native token of crypto payments firm OOBIT.

- Tether is expected to become the largest shareholder of VCI Global as a result of the deal.

- VCI Global will manage OOBIT’s digital treasury and integrate OOB tokens into its fintech and AI platforms.

- OOBIT offers tap-to-pay crypto transactions and is expanding stablecoin payment capabilities.

What Happened?

VCI Global announced its plan to purchase $100 million in OOB tokens and take on the role of treasury manager for OOBIT, a Singapore-based crypto payments platform. The strategic deal links VCI with major crypto players, including Tether, which will become VCI Global’s largest shareholder through its OOBIT stake. This positions VCI at the heart of a growing digital asset ecosystem.

🚨 Breaking:

— VCI Global Limited (@VCIGMY) November 11, 2025

Tether, the world’s largest stablecoin issuer, has emerged as the largest shareholder of NASDAQ-listed $VCIG following a $100M digital asset treasury deal involving the OOB token.

Bridging #Tether #Solana #AI #Fintech #Nasdaq

A landmark moment for Web3 meets Wall…

VCI Global’s Crypto Expansion

VCI Global, a Nasdaq-listed firm known for developing AI and fintech platforms, is diving deeper into the digital asset world with this latest initiative. The company acquired the first $50 million in OOB tokens from the OOB Foundation at a valuation of $0.20 per token, or $200 million market capitalization, by issuing restricted shares. The remaining $50 million in OOB tokens will be purchased on the secondary market after the token’s public launch.

Following this deal, VCI Global will oversee the OOB digital treasury and plans to integrate OOB token utility into its AI, digital finance, and sovereign data products. It is also creating a Digital Treasury Division to lead its crypto asset initiatives.

Company CEO Dato’ Victor Hoo called the move a commitment to “building a cross-sector platform that advances technology, AI, digital assets, and industry applications through the capital markets.”

OOB Token Rebrand and Launch

The OOB token is being rebranded from its previous name OBT and migrated from Ethereum to Solana, with a public launch scheduled for November 12. OOB is the utility token of OOBIT, which enables merchants to accept crypto payments through point-of-sale systems and cash out in fiat.

OOBIT has also integrated with The Open Network (TON) since May 2024, allowing retail payments using Tether’s USDt and Tether Gold (XAUt). Backers of the platform include Tether, Solana co-founder Anatoly Yakovenko, CMCC Global, and 468 Capital.

The platform is competing in an increasingly crowded space, with Visa and Stripe also pushing into stablecoin payments. OOBIT’s March report found that 70% of crypto purchases in the EU were used for food, drinks, and retail items, with an average spend of $8.36.

Market Response and Financial Moves

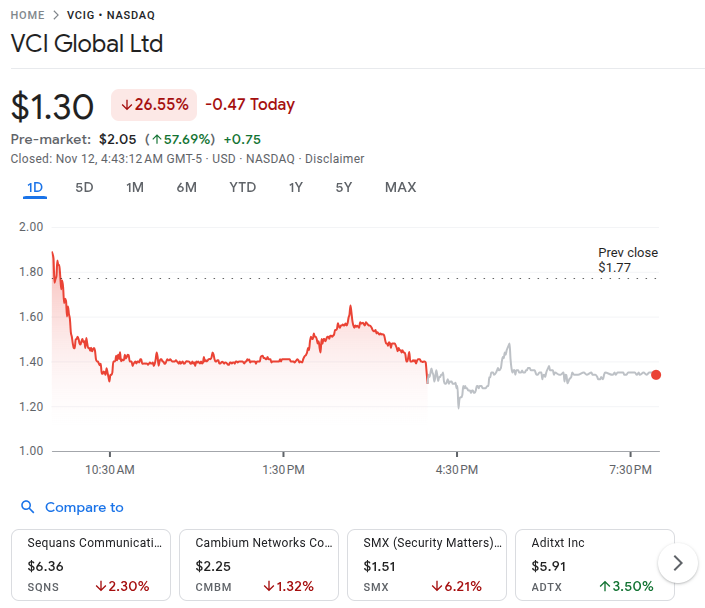

While the deal signals strategic ambition, the market reacted with caution. VCI Global’s stock dropped more than 20% in early trading on the day of the announcement, and it has fallen over 65% in the past month, closing at $1.30.

This move follows a $5 million capital raise by VCI Global in October 2025 and a $25 million Series A round in February 2024 aimed at expanding its crypto payments capabilities.

CoinLaw’s Takeaway

I see this as a massive credibility boost for OOBIT, thanks to VCI Global’s capital injection and strategic backing. The involvement of Tether and other industry veterans makes this much more than a routine investment. In my experience, deals of this scale often signal an intention to reshape the payment rails, especially when paired with treasury management roles. The rebrand and Solana move suggest they’re chasing speed, cost efficiency, and scale. That said, the stock market’s cold reaction shows that investors still need convincing. But for those tracking the future of crypto payments, this partnership is worth watching closely.