Vanguard remains a pillar of the global investment landscape, known for low‑cost investing, broad fund offerings, and scale that few rivals can match. Vanguard’s products power millions of retirement accounts and index‑based portfolios across the United States, while financial advisors regularly use its ETFs to build diversified client portfolios. With shifts in market trends and investor focus toward ETFs and low fees, Vanguard’s data reveals how investing behaviors and firm strategy are evolving. Explore the latest statistics in this detailed, data‑driven analysis.

Editor’s Choice

- Vanguard’s global AUM is about $11.6 trillion as of September 2025, placing it firmly among the world’s largest asset managers.

- More than 50 million investors hold Vanguard funds globally.

- Vanguard provides 458+ funds worldwide (U.S. & international).

- Average asset‑weighted expense ratio of 0.07% in U.S. funds (2024).

- Vanguard ETFs have 77% lower expense ratios than industry averages.

- Record ETF inflows industrywide in 2025 exceeded $1.5 trillion.

- Vanguard continues expanding its ETF lineup to meet investor demand.

Recent Developments

- Vanguard’s fee reductions in early 2025 are the largest in its history, saving investors over $350 million.

- Expense ratios were cut across 168 share classes of mutual funds and ETFs.

- The reductions impacted core broad market, international, and fixed‑income products.

- Competitive fee pressure continues as Vanguard responds to industry cost dynamics.

- Vanguard launched new ETFs, including VGVT, VTG, and VTP, to enhance fixed‑income exposure.

- ETF investors in 2025 poured more than $1.5 trillion into U.S.‑listed ETFs.

- Actively managed ETF strategies drew $518 billion in inflows, up sharply from 2024.

- Market trends show ETFs gaining share relative to mutual funds due to tax efficiency and tradability.

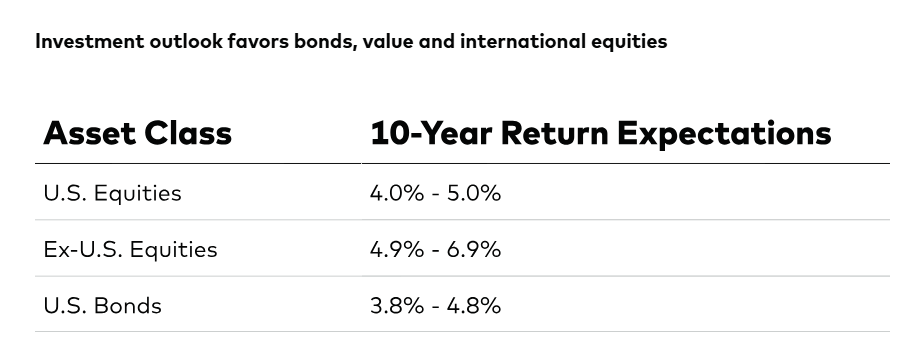

Investment Outlook and 10-Year Return Expectations

- U.S. Equities are projected to deliver 4.0% to 5.0% annual returns over the next 10 years, reflecting more moderate growth expectations for domestic stocks.

- Ex-U.S. Equities show stronger long-term potential, with expected returns of 4.9% to 6.9%, highlighting improved valuations and diversification benefits outside the U.S.

- U.S. Bonds are expected to generate 3.8% to 4.8% annual returns, making fixed income more competitive compared with recent low-yield periods.

- The outlook favors international equities over U.S. equities on a return basis, driven by higher projected returns.

Vanguard Key Facts and Figures

- Founded in 1975 by John C. Bogle with a mission to serve investors’ interests.

- As of 30 Nov 2025, Vanguard offers 227 funds in the U.S. and 231 international funds.

- More than 50 million individual investors hold Vanguard products.

- Approximately 20,000 employees support Vanguard’s global operations.

- Vanguard’s asset‑weighted U.S. expense ratio was around 0.07% in 2024.

- Vanguard’s unique ownership structure means the funds’ investors own Vanguard.

- Vanguard is the largest mutual fund provider and the second‑largest ETF provider globally.

- The firm’s core philosophy emphasizes low cost, broad diversification, and long‑term investing.

Assets Under Management

- Vanguard’s total AUM is approximately $11.6 trillion as of late 2025.

- Roughly $10.4–10.5 trillion in AUM was reported as of late 2024–early 2025.

- Vanguard ranks as one of the top two global asset managers, alongside BlackRock.

- Vanguard’s AUM reflects broad investor adoption of low‑cost index strategies.

- Equity funds constitute a large portion of managed assets.

- Fixed‑income and bond funds are also significant subsets of Vanguard’s total AUM.

- Industry comparisons show Vanguard alongside BlackRock and Fidelity controlling about 50% of U.S. fund assets.

- Vanguard funds help drive lower industry average expense ratios.

Fund Lineup Overview

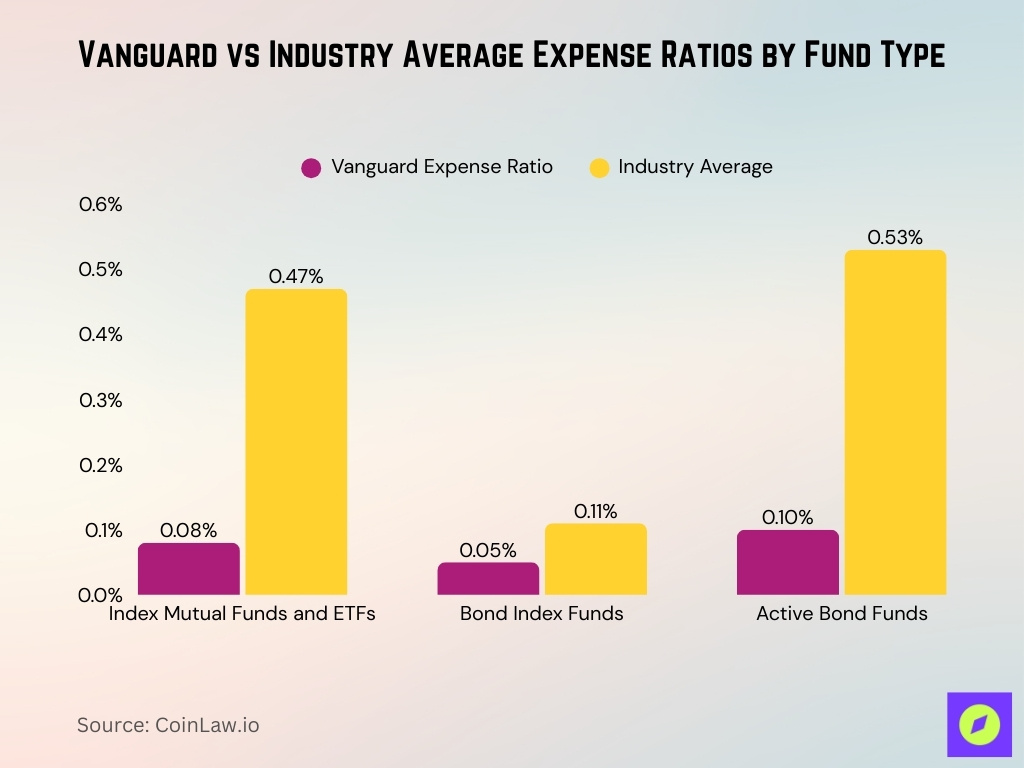

- Vanguard’s average asset-weighted expense ratio across index mutual funds and ETFs is about 0.08%, versus an industry average near 0.47% for comparable products.

- In fixed income, Vanguard bond index funds carry a weighted-average expense ratio of 0.05% and active bond funds about 0.10%, compared to 0.11% and 0.53% industry averages.

- Vanguard manages 220+ U.S. funds and 450+ funds globally as of late 2025, serving more than 50 million investors worldwide.

- Vanguard ETFs collectively hold about $3.8 trillion in assets across more than 100 products covering U.S., international, fixed income, and factor exposures.

- Vanguard mutual funds span more than 190 index funds and 160+ actively managed and specialized strategies, representing over $4 trillion in assets.

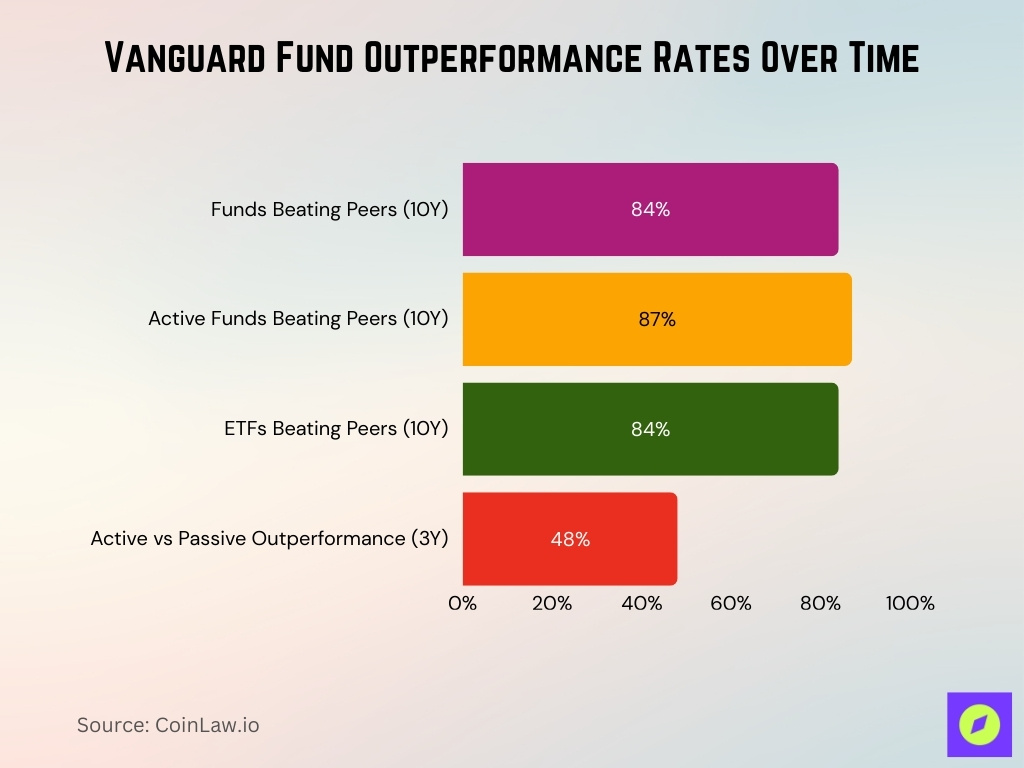

- About 84% of Vanguard mutual funds and ETFs have outperformed their peer‑group averages over the past 10 years, net of fees.

- The Vanguard Total Stock Market ETF alone holds around 3,500+ U.S. stocks, while the Vanguard Total World Stock ETF holds nearly 10,000 stocks across 50+ markets.

- Vanguard Investor Choice expansion in 2026 lifts eligible investors to roughly 20 million and increases eligible assets from $1 trillion to over $3 trillion for proxy voting choice.

Vanguard ETF Statistics

- Vanguard offers 100+ U.S.-listed ETFs with combined assets of about $3.8 trillion and an average expense ratio of 0.09%.

- Approximately 80–85% of Vanguard ETFs and active funds have outperformed peer group averages over the past 10 years, based on LSEG Lipper data.

- Vanguard’s ETF family spans more than 3 major asset classes (equity, fixed income, and multi-asset) and covers over 50 countries through global and international mandates.

- Flagship core ETFs like VOO, VTI, and BND collectively manage over $700 billion and serve as primary building blocks in many model portfolios.

- Vanguard Total World Stock ETF (VT) alone holds almost 10,000 stocks across more than 20 countries, charging an expense ratio of just 0.06%.

- VXUS and related international ETFs provide exposure to roughly 8,700+ non-U.S. stocks spanning developed and emerging markets worldwide.

- Vanguard Information Technology ETF (VGT) holds about 320+ tech stocks and delivered an average annual return of 22% over the last 10 years.

- The largest Vanguard equity ETFs, including VUG and VTV, each hold over $200 billion in assets, ranking among the biggest stock index funds globally.

Mutual Funds Statistics

- Vanguard manages 350+ mutual funds with combined assets exceeding $4 trillion across equity, fixed income, and balanced categories.

- Vanguard’s average mutual fund expense ratio stands at 0.08%, far below the industry average of 0.47% for comparable funds.

- 84% of Vanguard mutual funds outperformed their Lipper peer-group averages over the past 10 years through December 2024.

- Index mutual funds comprise the majority of Vanguard’s lineup, tracking benchmarks like the S&P 500 or total market indices with fees around 0.05%.

- Actively managed fixed income mutual funds average a 0.10% expense ratio versus a 0.53% industry norm, with 91% outperforming peers over 10 years.

- 50+ million investors worldwide hold Vanguard mutual funds, primarily in retirement accounts and taxable brokerage setups.

- Vanguard equity mutual funds span large-cap value (VTV), growth (VUG), and total market categories, holding trillions in U.S. stocks.

- Bond mutual funds from Vanguard hold weighted-average expense ratios of 0.05% for index and 0.10% for active, beating competitors by over 50%.

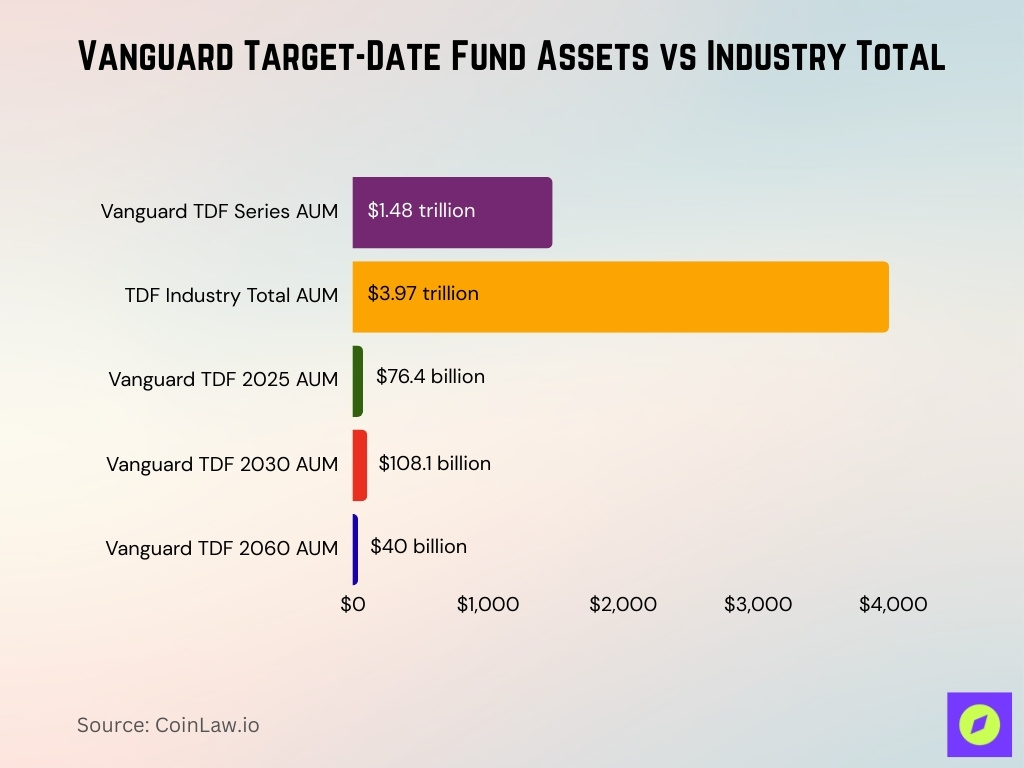

Target-Date Funds Statistics

- Vanguard Target Retirement Funds series manages $1.48 trillion in assets, representing about 37% of the $3.97 trillion target-date fund industry total.

- Vanguard Target Retirement 2025 Fund (VTTVX) holds $76.4 billion in net assets with 8% portfolio turnover.

- Vanguard Target Retirement 2030 Fund carries $108.1 billion in net assets as of late 2025 with 60.39% stock allocation.

- Vanguard Target Retirement 2060 Fund (VTTSX) manages $40 billion in assets and yields 2.06% TTM.

- 65–75% of Vanguard TDF vintages outperformed peers over 10 years through early 2025, topping 75% over 3 years.

- Vanguard TDF 2025 Fund delivered a 7.13% annualized return over 5 years, placing in the middle third of category peers.

- Vanguard TDF series ranks highly among peers: 2025 Fund 24th/115, 2030 30th/137, Income Fund 40th/102.

Fixed Income Funds Statistics

- Vanguard fixed income ETFs hold $512 billion in AUM as of June 2025, part of over $3.1 trillion total ETF assets.

- Vanguard’s average expense ratio for index fixed income ETFs is 0.037%, while active fixed income ETFs average 0.105%.

- 86% of Vanguard mutual fund and ETF assets sit in the lowest-cost deciles of their peer groups.

- 44 of 48 Vanguard active bond funds outperformed peer group averages over the past 10 years.

- Bloomberg U.S. Aggregate Bond Index returned 2.78% in Q1 2025 and 4.88% over the prior 12 months.

- Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) manages $63.1 billion with a 0.03% expense ratio.

- Vanguard Intermediate-Term Corporate Bond ETF annualized 8.0% over 3 years, ranking 9th percentile in the category.

- Vanguard High-Yield Active ETF yields 5.06% with a 0.22% expense ratio, half the category average of 0.59%.

Equity Funds Statistics

- Vanguard equity mutual funds and ETFs hold over $5 trillion in AUM, representing the largest portion of $11.6 trillion total firm assets.

- 88% of Vanguard equity funds outperformed their Lipper peer-group averages over the past 10 years.

- Vanguard Total Stock Market Index Fund manages $88.9 billion with a 0.01% expense ratio, tracking nearly 100% of the U.S. investable market.

- Vanguard 500 Index Fund ETF (VOO) holds $1.5 trillion in assets, ranking as one of the world’s largest equity funds.

- Vanguard Large-Cap Index ETF (VV) operates with $42.7 billion in median total assets across recent fiscal years.

- Vanguard equity index funds average a 0.08% expense ratio, versus the industry peer average of 0.47%.

- 86% of Vanguard mutual fund and ETF assets reside in the lowest-cost deciles of their respective peer groups.

- Vanguard Total Stock Market ETF (VTI) and mutual fund counterpart track CRSP US Total Market Index covering large-, mid-, small-, and micro-cap stocks.

Performance Statistics

- 84% of Vanguard funds outperformed peer-group averages over the past 10 years.

- 87% of Vanguard actively managed funds beat peer-group averages over the past 10 years.

- 84% of Vanguard ETFs outperformed peer-group averages over the past 10 years.

- 48% of active Vanguard funds outperformed passive Vanguard peers over 3 years ended June 2025.

- Vanguard ESG US Stock ETF (ESGV) holds $12.0 billion in assets with a 0.09% expense ratio.

International Funds Statistics

- Vanguard Total International Stock Index Fund Admiral Shares (VTIAX) manages $558.2 billion with a 0.09% net expense ratio.

- Vanguard Total International Stock ETF (VXUS) delivered a 6.80% annualized return over the past 10 years with a 0.07% expense ratio.

- Vanguard international equity funds track the FTSE Global All Cap ex US Index, covering 8,500+ stocks across 50+ countries.

- Vanguard international equity index funds average a 0.08% expense ratio versus the industry average of 0.51%.

- Vanguard Total International Bond ETF (BNDX) packages broad investment-grade international bonds with low costs and diversified holdings.

- 84% of Vanguard international funds outperformed peer group averages over the past 10 years.

- VTIAX and VXUS showed 20.87% and 21.03% YTD returns, respectively, in the recent 2025 data.

- Vanguard international funds hold exposure to developed (MSCI EAFE) and emerging markets for global diversification.

Vanguard Sector and Thematic Funds Statistics

- Vanguard Information Technology ETF (VGT) manages $86.3 billion in assets, tracking 320+ tech stocks with a 0.10% expense ratio.

- Vanguard Health Care ETF (VHT) holds $19.89 billion in net assets, yielding 1.61% and returning 1.78% YTD.

- Vanguard Real Estate Index Fund ETF (VNQ) oversees $62.2 billion in net assets with a 6.36% average annual return over 10 years.

- Vanguard sector ETFs include 11 funds targeting industries like energy, financials, health care, industrials, and utilities.

- 86% of Vanguard funds, including sector offerings, reside in the lowest-cost deciles versus peers.

- Vanguard Energy ETF (VDE) provides exposure to 100+ energy stocks with a 0.10% expense ratio for sector overweighting.

- Vanguard Financials ETF ranks among the top performers in its category with a strong 10-year outperformance record.

Expense Ratio Statistics

- Vanguard’s asset‑weighted average expense ratio sits at approximately 0.07%, well below the industry average of 0.44%.

- In February 2025, Vanguard implemented the largest expense ratio reduction in the firm’s history, cutting costs on 168 share classes across 87 funds.

- The 2025 fee reductions are expected to save investors more than $350 million in fund expenses.

- Actively managed fixed‑income funds at Vanguard now average around 0.10% in expense ratios, significantly lower than many peers.

- Index bond funds have an average expense ratio close to 0.05%, under half of competitor averages.

- Broad market passive index funds (e.g., popular S&P 500 trackers) can have expense ratios as low as 0.03%.

- Lower fees have driven investor inflows toward Vanguard’s lowest‑cost products; the cheapest 20% saw net inflows of $930 billion in 2024.

- Vanguard’s push to reduce costs has been an ongoing trend, with over 2,000 fee cuts since its founding.

- Expense ratio reductions span U.S., international, equity, bond, and money market funds, impacting a wide range of investor portfolios.

Vanguard Investor Demographics

- Vanguard serves 50 million clients worldwide with $11.6 trillion in global AUM as of December 2024.

- The average Vanguard retirement account balance reached $148,153 in 2024, up 10.5% year-over-year.

- Median Vanguard retirement account balance stood at $38,176 in 2024, up 8.2% from 2023.

- 30% of Vanguard accounts hold under $10,000, while 30% exceed $100,000.

- 16% of Vanguard retirement participants maintain balances of $250,000 or more.

- 34% of Vanguard UK Personal Investor clients are aged 30 or younger, attracting millennial and Gen Z savers.

- 75% of investors under age 35 at Vanguard express low risk tolerance for substantial returns.

- The media, entertainment, and leisure sector shows the highest median Vanguard account balance at $102,681.

Flows and Fund Inflows/Outflows

- U.S. ETF industry recorded $1.5 trillion in net inflows during 2025, shattering previous records.

- Fixed income ETFs captured a record $448 billion in net inflows amid demand for income generation.

- Active ETFs drew $518 billion in net inflows, signaling rising interest in managed strategies.

- Vanguard and iShares seized 54% of all U.S. ETF net flows in 2025.

- Vanguard S&P 500 ETF (VOO) set an ETF inflow record with $143 billion net new assets.

- Vanguard UCITS ETF range attracted $2.8 billion net inflows in December 2025 alone.

- Core equity ETFs gathered $182.4 billion in net inflows for the full year 2025.

- Developed-market equity ETFs topped flows with $65.2 billion net inflows over 2025.

Retirement Investing Statistics

- Vanguard manages $1.48 trillion in target-date fund assets, holding 37% market share in $3.97 trillion TDF industry.

- Average Vanguard 401(k) participant balance reached $148,153 in 2024, up 10% year-over-year.

- Median Vanguard 401(k) participant balance hit $38,176 in 2024, rising 8% from the prior year.

- 42% of U.S. Vanguard 401(k) participants are on track to maintain their preretirement lifestyle in retirement.

- 80% of Vanguard 401(k) participants use target-date funds, with 66% of contributions allocated there.

- 70% of Vanguard target-date fund investors hold entire accounts in a single fund.

- 45% of Vanguard plan participants increased deferral rates in 2024, setting a record participation.

ESG and Sustainable Investing Statistics

- Vanguard ESG U.S. Stock ETF (ESGV) manages $11.16 billion in assets with a 0.09% net expense ratio.

- The global ESG investing market reached $39.08 trillion in 2025, projected to hit $125.17 trillion by 2032 at 18.1% CAGR.

- ESGV holds $43.87 million in fossil fuel investments, equating to 0.38% of fund assets.

- Vanguard ranks among the top U.S. sustainable asset managers alongside BlackRock, UBS, Amundi, and Fidelity.

- European sustainable funds managed $2.7 trillion as of March 2025, facing $1.2 billion Q1 outflows.

- Vanguard ESG U.S. Corporate Bond ETF (VCEB) expense ratio stands at 0.12%, tracking the Bloomberg Barclays MSCI U.S. Corporate SRI Select Index.

Frequently Asked Questions (FAQs)

Vanguard serves more than 50 million investors globally.

Expense ratio cuts are expected to save investors more than $350 million in 2025.

Vanguard’s asset‑weighted average expense ratio in the U.S. is about 0.07%.

Vanguard, BlackRock, and Fidelity together manage roughly 50% of U.S. fund assets.

Conclusion

Vanguard’s statistics underscore its continued influence on global investing through extremely low fees, strong fund performance, and robust inflows, particularly into ETF and retirement strategies. Its investor base trends toward long‑term planning and cost awareness, while flows highlight a persistent preference for diversified, tax‑efficient vehicles. As ESG and sustainable investing gain traction, Vanguard’s suite evolves to meet changing investor priorities without sacrificing its core philosophy of low‑cost, broad market exposure. Together, these figures paint a clear picture: Vanguard remains a leading choice in the evolving landscape of global asset management.