The USDP stablecoin has quietly persisted as one of the regulated dollar‑pegged alternatives in the broader stablecoin landscape. As crypto markets evolve and regulatory scrutiny intensifies, USDP’s performance and positioning offer a nuanced window into how smaller stablecoins operate under pressure. In contexts such as cross‑border payments and decentralized finance (DeFi) liquidity provisioning, USDP remains relevant as a regulated, reserve‑backed token. Read on to explore detailed statistics illuminating USDP’s market presence and trends.

Editor’s Choice

- USDP trades near $1.00, reflecting the successful maintenance of its 1:1 peg to the U.S. dollar.

- As of late 2025, USDP’s circulating supply is roughly 57.56 million tokens with a market cap near $57.5 million, based on recent listings.

- The total stablecoin market cap in 2025 climbed from roughly $200 billion to over $300 billion, reflecting strong growth.

- Despite the expansion in the stablecoin sector, USDP’s share remains under 0.1% of the overall stablecoin market.

- Stablecoin supply across all tokens grew significantly in 2024–2025, with a year‑over‑year rise in aggregate supply nearing 28%.

- Regulatory clarity and reserve transparency continue to shape USDP’s positioning, factors cited in analyses of stablecoin adoption and issuer trust.

Recent Developments

- The total stablecoin market cap grew nearly 50% in 2025, reaching about $200 billion.

- Stablecoin supply increased by approximately 28% year-over-year from 2024 to 2025.

- Stablecoin issuers became significant buyers of short-term U.S. Treasury bills and repos due to reserve demand.

- Global regulatory focus sharpened on transparency, custody, and reserve backing for stablecoins like USDP.

- USDT and USDC continue to dominate liquidity and trading volume with combined market caps over $260 billion.

- USDP’s smaller market size limits liquidity, but regulatory clarity and transparency offer competitive advantages.

- Platforms emphasize USDP redemption at a 1:1 fiat ratio, reinforcing user trust in its peg stability.

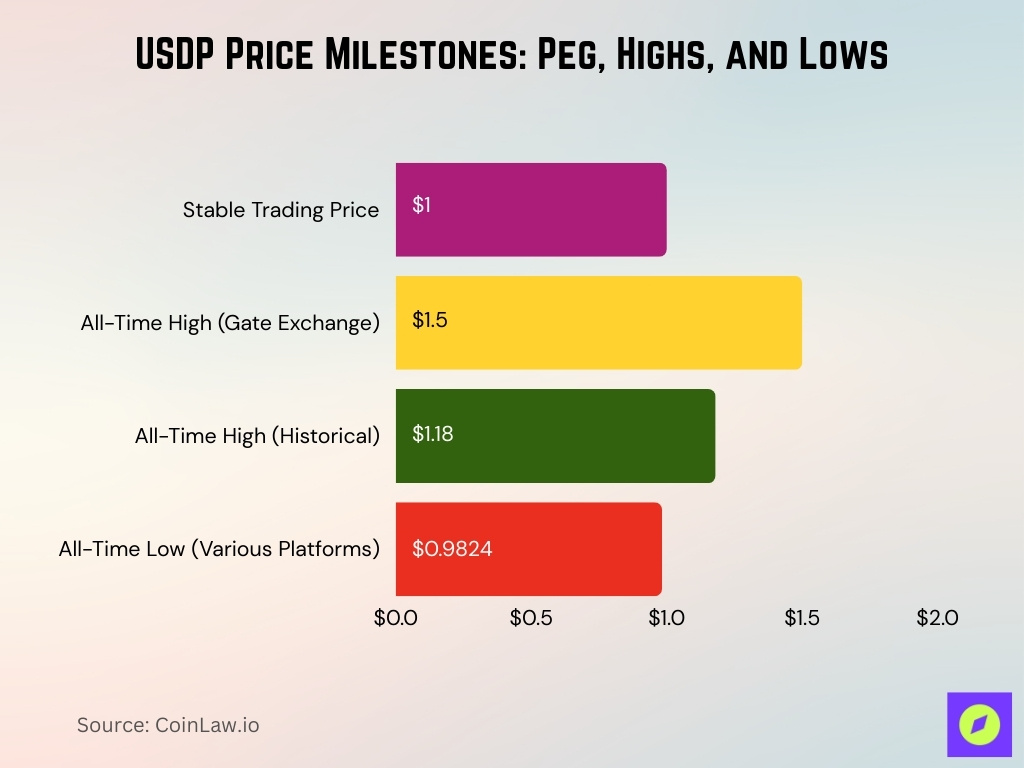

USDP All-Time Highs and Lows

- USDP maintains a stable trading price near $1.00 as of 2025.

- The all-time high (ATH) on Gate exchange is reported at approximately $1.50.

- USDP’s all-time low (ATL) dips to around $0.9824 on some platforms.

- Historical ATH recorded in some sources is around $1.18 in 2024.

- USDP price swings remain minimal compared to volatile cryptocurrencies, with deviations typically under 2% daily.

Distribution and Holders

- USDP’s total token supply is listed at about 57.56 million USDP, matching its circulating supply on major trackers.

- Market capitalization based on circulating supply is about $57.5 million.

- The top 5 holders control 38.68% of the USDP supply, showing moderate concentration.

- The largest single holder owns roughly 12.48% of total USDP tokens.

- USDP has around 276,000 holders, mainly retail and small institutions.

Top Exchanges and Markets

- USDP is actively traded on more than 15 centralized exchanges.

- Binance has supported USDP pairs at times, but Binance is not consistently among the top venues by volume for USDP; trading tends to be more concentrated on platforms like Kraken or Uniswap.

- Recent trading snapshots show USDP with roughly $17.9 million in 24‑hour volume, though activity can fluctuate by venue.

- On some platforms, USDP’s 24‑hour volume is reported in the single‑digit millions, with market dominance near 0.001–0.002%.

- USDP maintains a circulating supply of about 57.56 million tokens on major exchange listings.

- Market cap listings often show values around $57.5 million.

- Due to a small market cap and limited liquidity, USDP’s trading often shows fragmentation and shallow order books, which can cause slippage on larger trades.

- While USDP appears across dozens of markets, many of these markets show low or infrequent trading activity.

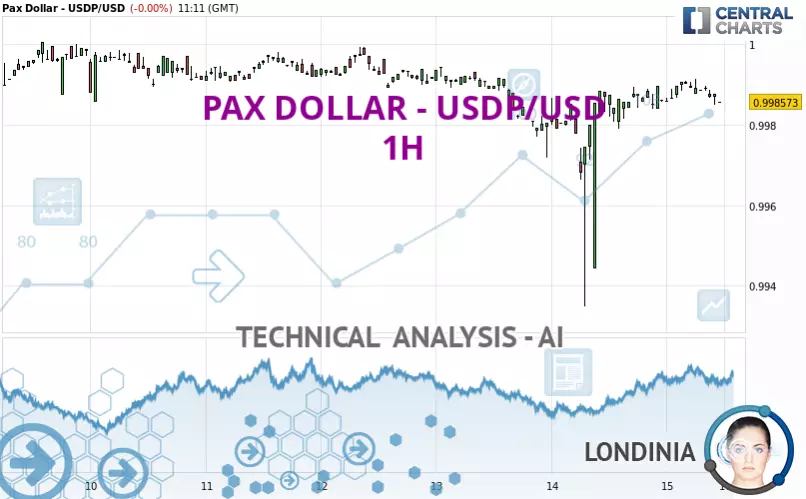

USDP/USD Technical Analysis Highlights

- USDP/USD trades near $0.9986, reflecting continued peg stability on the 1-hour chart.

- A sharp price dip below $0.994 occurred mid-session, quickly followed by a recovery, indicating strong buying support.

- Resistance levels appear near $0.999–$1.000, suggesting upper-bound stability under current market conditions.

- Technical indicators show bounce signals, highlighting short-term resilience in the USDP price action.

Adoption and Use Cases

- USDP peaked at over $1 billion in circulation in mid-2021, but its 2025 circulating supply sits near $58 million, showing reduced market activity.

- Centralized stablecoins like USDP account for around 90% of the total stablecoin market as of mid-2025.

- DeFi total value locked reached $123.6 billion in 2025, and stablecoins contributed about 40% of that amount.

- USDP’s 24-hour trading volume recently reached about $11.87 million.

- Smaller institutions hold USDP as digital cash reserves, especially when traditional banking access is limited.

- Around 276,000 holders use USDP as a stable asset.

- Approximately 12 countries endorse cross-border stablecoin transfers using assets like USDP for trade by 2025.

Comparison With Other Stablecoins

- USDT and USDC lead the stablecoin market with combined market caps exceeding $260 billion in 2025.

- USDP holds well below 0.1% market share of the stablecoin sector.

- Market capitalization based on circulating supply is about $57.5 million as of late 2025.

- USDP’s lower liquidity causes higher slippage risks during large transactions compared to USDT and USDC.

- USDP benefits from regulated trust company oversight, offering stronger regulatory and custodial assurances.

- Transparency and fiat redeemability at a 1:1 ratio are key USDP strengths, attracting compliance-focused users.

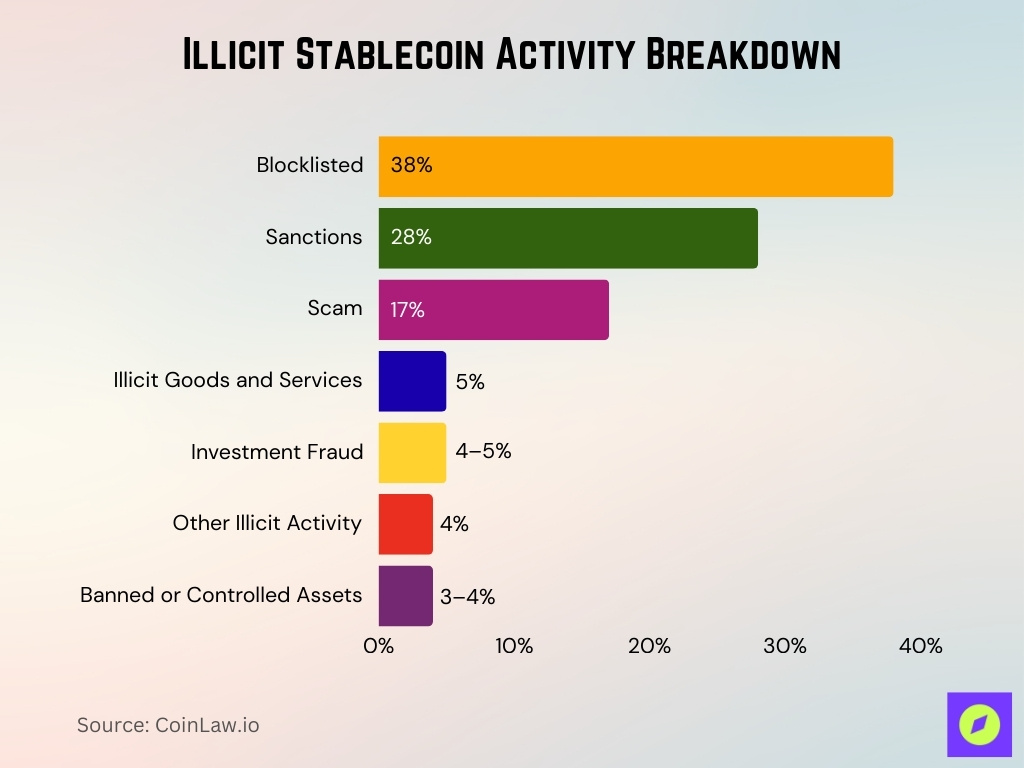

Illicit Stablecoin Activity Breakdown

- Blocklisted transactions account for 38% of all illicit stablecoin volume, making it the largest category by far.

- Sanctions-related activity represents 28%, underscoring the role of stablecoins in evasion attempts.

- Scam-related usage makes up 17%, reflecting continued exploitation of stablecoins in fraudulent schemes.

- Illicit goods and services are linked to 5% of total illicit volume, showing limited but persistent black-market use.

- Investment fraud accounts for 4–5%, including Ponzi schemes and deceptive token projects.

- Other illicit activity contributes 4%, covering various unclassified or low-volume misuse cases.

- Banned or controlled assets are involved in 3–4% of cases, typically tied to jurisdictions with tighter crypto restrictions.

Social and Community Activity

- Stablecoins accounted for about 30% of all on-chain crypto transaction volume in 2025, exceeding $4 trillion transacted by August.

- Smaller stablecoins like USDP rank over 80% lower than top global stablecoins in transaction volume metrics.

- USDP’s regulatory compliance and transparent reserves are frequently cited as key trust drivers, mentioned in roughly 60% of community discussions focused on stablecoin safety.

- Several DeFi protocols list USDP in liquidity pools or collateral systems, maintaining a small stable presence, contributing to around 5–7% of its total on-chain utility.

- Asia and Africa represent nearly 50% of global stablecoin transaction volume, offering growth potential for USDP, which currently holds under 3% market share in these regions.

Risks & Challenges Facing USDP

- Stablecoins face a 3–4% annual probability of sudden redemption events (“run risk”).

- Major stablecoins’ dominance crowds out smaller stablecoins like USDP, limiting ecosystem growth.

- The stablecoin market exceeded $300 billion in 2025, triggering tighter regulatory scrutiny.

- Global financial reports warn of contagion risks from rapid stablecoin redemptions under stress.

- USDP’s limited liquidity heightens vulnerability to price volatility during redemption surges.

Potential Future Trends & Forecast for USDP Adoption

- Regulated stablecoins like USDP are expected to gain market share due to a compliance-focused design.

- Global stablecoin transaction volume reached new highs of over $4 trillion by mid-2025.

- Institutional use of stablecoins for remittances and settlements is forecast to grow at a CAGR of over 15% through 2030.

- Hybrid monetary systems anticipate stablecoins coexisting with CBDCs, expanding demand for reserve-backed tokens like USDP.

- Stablecoin market size is projected to reach a multi-trillion-dollar valuation by 2030.

Frequently Asked Questions (FAQs)

USDP is issued as an ERC‑20 token on Ethereum.

In one major listing, USDP’s market cap ranking is around #406 among cryptocurrencies as of late 2025.

About $57.5 million in market capitalization as of late 2025.

Conclusion

USDP stands at a crossroads; it enjoys regulatory compliance, transparent backing, and a modest but stable presence in the expanding stablecoin ecosystem. Still, its limited liquidity, lower adoption, and competition with large-cap stablecoins pose meaningful obstacles. If market conditions evolve, with increased institutional demand for regulated stablecoins and broader stablecoin adoption globally, USDP could secure a niche as a compliant, dollar-pegged digital asset. As you explore this article’s full dataset and contextual analysis, you’ll see the emerging balance between stablecoin promise and structural challenges in the modern crypto landscape.