Uniswap has redefined the way we trade digital assets, offering a seamless, permissionless exchange powered by liquidity pools. In practice, protocols like retail traders efficiently swapping tokens on Ethereum and institutional firms leveraging deeper liquidity across layer 2 solutions showcase Uniswap’s real-world impact. Dive into the data ahead to uncover how Uniswap is shaping decentralized finance.

Editor’s Choice

- As of mid-2025, Uniswap’s total TVL fluctuates around $4.5 billion, reflecting active participation across L1 and L2 networks.

- Uniswap remains a dominant DEX, processing between 50% and 65% of weekly DEX volume depending on chain activity and competition.

- Since its early 2025 launch, Uniswap v4 has reportedly processed over $100 billion in cumulative trading volume, based on third-party analytics.

- $1 billion TVL achieved by v4 within 177 days, faster than v3.

- 67.5 % of daily volume occurs on layer 2 networks.

- Uniswap’s average daily trading volume in 2025 ranges between $1–2 billion across all supported chains, depending on market volatility.

- Over 2,500 custom liquidity pools created using Hooks.

Recent Developments

- The launch of Uniswap v4 in early 2025 introduced Hooks, singleton design, and significant gas optimizations.

- Direct $ETH support reduced gas fees by about 15 % by eliminating the need for WETH.

- Hooks enable developers to build limit orders, dynamic fees, and custom oracles.

- Developer activity on Uniswap v4 in July 2025 suggests an average of ~100 Hooks created daily, based on GitHub and ecosystem dashboards.

- A $95.4 million grants pool and $25.1 million budget allocated under the “Uniswap Unleashed” governance program.

- Unichain, Uniswap’s L2, now handles nearly 50 % of v4 transaction volume.

- Uniswap’s governance model is evolving with strategic accountability structures via the Uniswap Foundation.

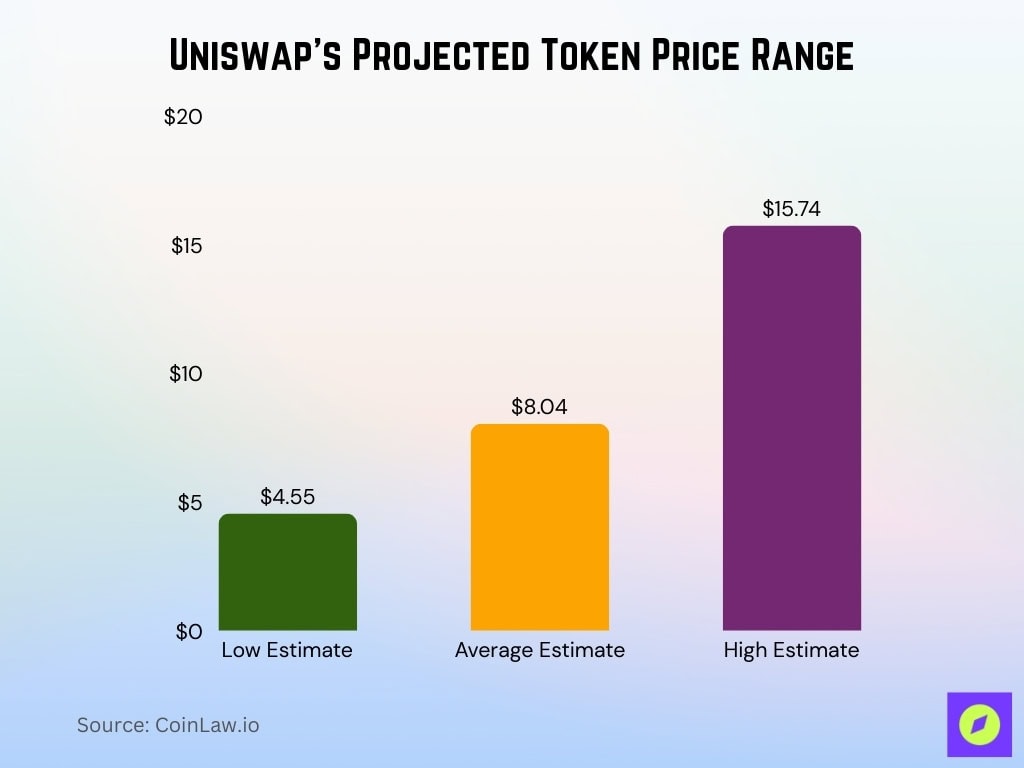

Token Statistics

- A conservative model points to a range of $4.55 (low), $8.04 (average), and $15.74 (high) in 2025.

- Total trading fees over Uniswap’s lifetime now exceed $4.94 billion.

- Current UNI price stands at $9.93 as of August 29, 2025.

- UNI’s all-time high reached $44.92, while its all-time low was $1.03.

- Price models from third-party sources forecast UNI could trade between $4 and $28 in 2025, but these are speculative and not consensus projections.

- Another projection sets a potential high of $28.5 by year’s end.

- In June 2025, UNI hovered near $7.60, with analysts eyeing a move toward $10.

Total Value Locked (TVL)

- Uniswap’s 2025 TVL stands at roughly $4.5 billion.

- v4 alone surpassed $1 billion in TVL by July 27, 2025.

- The TVL growth rate for v4 reached this milestone in 177 days, faster than v3’s 45-day climb.

- Overall, DeFi TVL hit $123.6 billion in 2025, marking a 41 % year-over-year increase.

- $62.4 billion of that growth occurred on Ethereum in Q2 2025, representing a 33 % quarter-over-quarter jump.

- Uniswap’s total across versions registers at $1.07 billion of TVL, with v3 holding 46 % market share and v4 growing at 14 %.

- Strong layer 2 adoption, 72 % of TVL now sits on L2 chains.

Transaction Count Statistics

- Researchers analyzed over 50 million transactions across L1 and L2 Uniswap networks to gauge adoption and scalability.

- An Ethereum Q2 2025 snapshot shows 1.43 million daily transactions, an 8 % QoQ increase.

- Active addresses grew 7 % to 431,200, indicating rising participation.

- NFT-related addresses surged 31 % QoQ to 11,400, showing diverse use on-chain.

- Uniswap v4 captured ~30 % of all trades, while v3 still handled 60 %.

- Layer 2 networks account for 67 % of v4 transaction volume, reflecting a clear shift toward scalability.

- Total trading volume since v4 went live exceeds $110 billion.

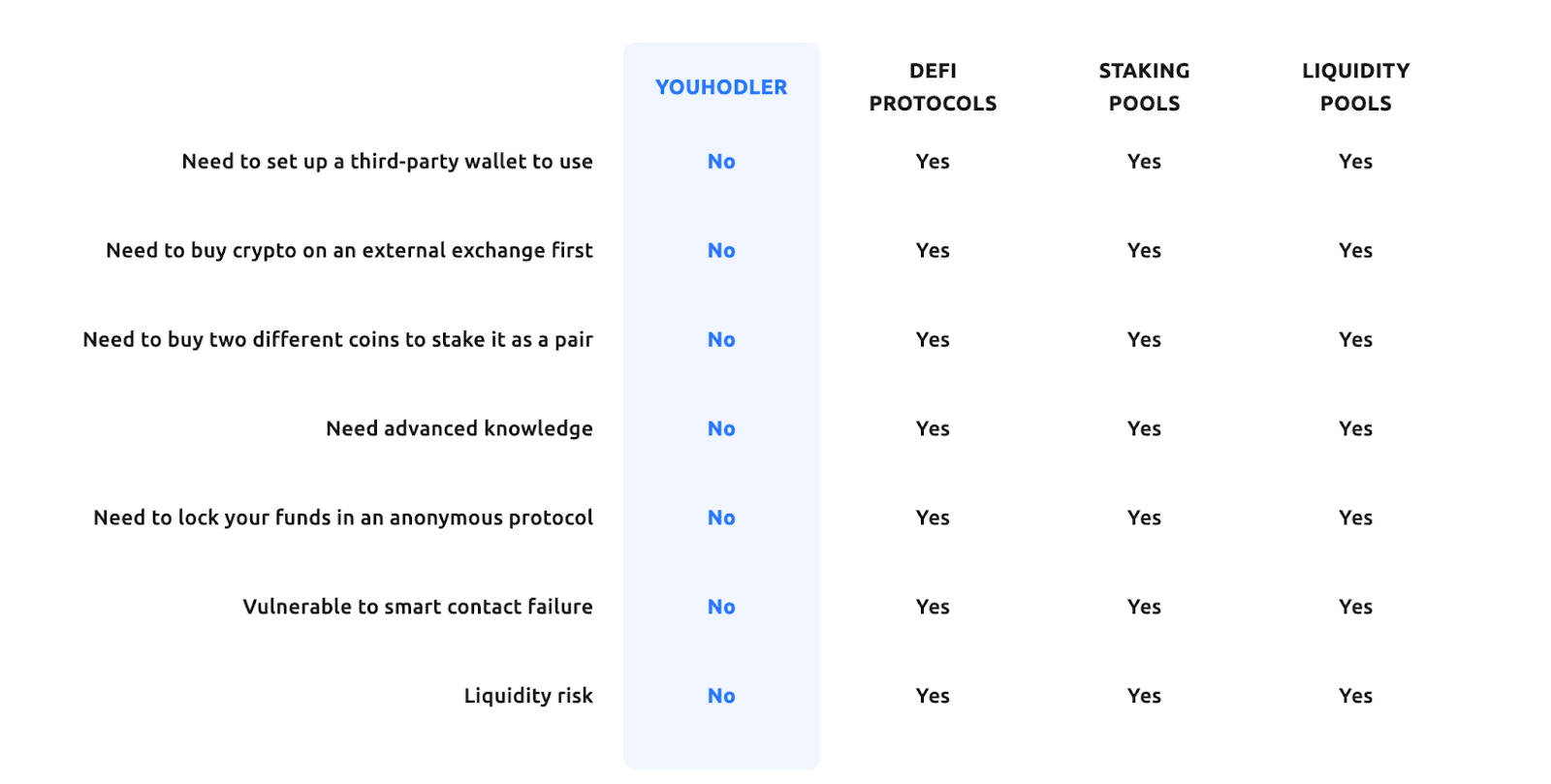

Uniswap vs Centralized Alternatives: Risk & Complexity Breakdown

- YouHodler requires no third-party wallet setup, while Uniswap (via DeFi protocols, staking pools, or liquidity pools) does.

- To use Uniswap, users must first buy crypto on an external exchange. YouHodler streamlines onboarding.

- Uniswap liquidity pools require pairing two different tokens, adding complexity. YouHodler avoids this step.

- Using Uniswap demands advanced DeFi knowledge, whereas YouHodler is beginner-friendly.

- Funds on Uniswap are often locked in anonymous protocols. YouHodler uses a centralized, regulated setup.

- Uniswap protocols are vulnerable to smart contract failure. YouHodler is not.

- Liquidity risk is present in Uniswap pools. YouHodler minimizes this exposure.

Liquidity Pool Statistics

- Developers launched over 2,500 custom liquidity pools using Hooks on Uniswap v4.

- v4’s modular architecture enables highly customizable pools for diverse use cases.

- A complex network study shows Uniswap’s market exhibits scale-free, core-periphery, and fragile connectivity traits.

- As of October 2023, Uniswap V2 had 260,544 pairs and V3 had 15,350.

- Pools paired with stablecoins or top tokens (WETH, USDC, etc.) dominate liquidity, covering 262,402 of 266,826 total pools.

- The model suggests that removing highly central tokens could severely disrupt liquidity connectivity.

- Liquidity supply reflects fragmentation; high-fee pools attract 58 % of liquidity but only 21 % of trading volume.

Fee Revenue Statistics

- Annualized fee projections for Uniswap in 2025 estimate around $1.8–$1.9 billion, based on recent volume trends and fee schedules.

- About $155.6 million in fees earned over the past 30 days.

- Trading activity brought in $36 million in fees just in the last week.

- Daily trading fees average around $540,000.

- As of June 29, 2025, front-end trading fees alone surpassed $157.2 million.

- From April to September 2024, Uniswap garnered $52.75 million in fee revenue following a fee increase.

- Uniswap activity on Base contributes significantly to revenue, approaching 40–50%, though exact proportions vary over time.

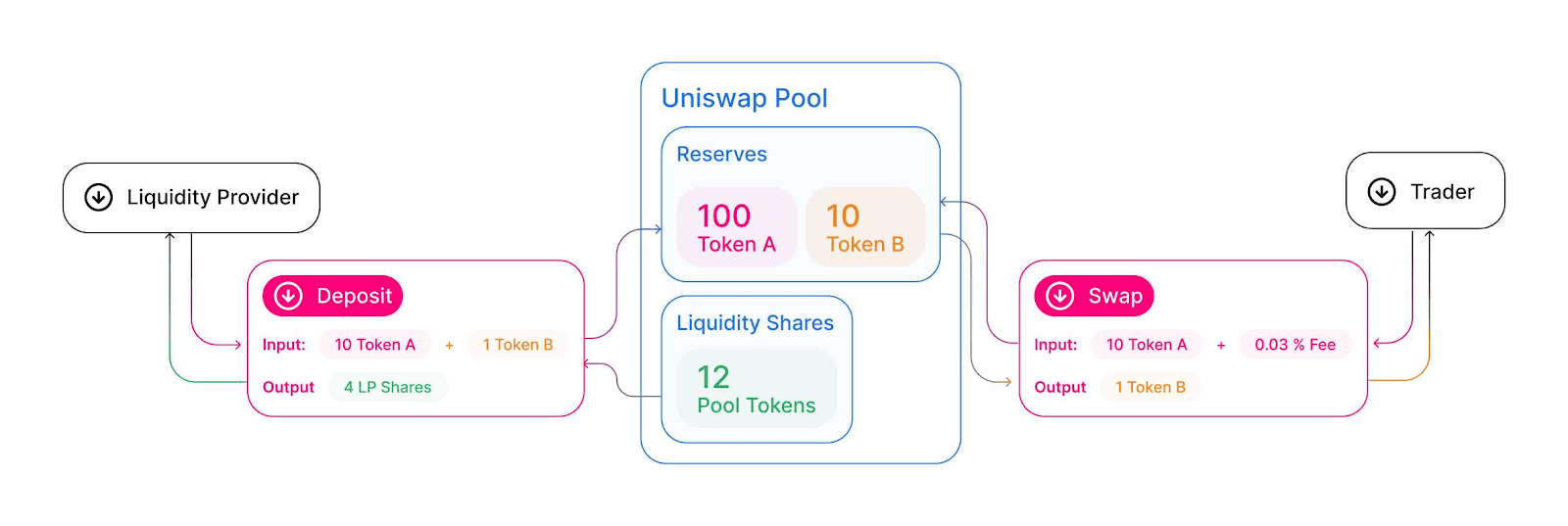

How a Uniswap Pool Operates: Liquidity and Swap Flow

- A liquidity provider deposits 10 Token A and 1 Token B, supplying a trading pair to the pool.

- In exchange, they receive 4 LP Shares, representing their ownership stake in the pool’s reserves and future fee earnings.

- The Uniswap pool holds 100 Token A and 10 Token B as total reserves before the swap occurs.

- There are 12 Pool Tokens in circulation, indicating how much liquidity has been provided by all users.

- A trader initiates a swap by providing 10 Token A plus a 0.03% fee, and receives 1 Token B in return.

- All swaps follow Uniswap’s automated market maker (AMM) model, ensuring price balance through the constant product formula.

Price Trends and Volatility

- Swap volumes in 2025 already exceed the total for 2024, driven by growing adoption.

- UNI spiked nearly 20% in a day when it briefly surpassed $10, before retracing slightly.

- While user count surged, especially via Base, this didn’t translate directly into higher TVL or revenue.

- Price models anticipate a potential breakout toward $30, yet fundamentals remain below previous peaks.

- The volatile swings, now ranging from under $5 to toward $30, reflect speculative pressure and on-chain dynamics.

- Multiple projections reinforce the theme, a high ceiling near $16–$28, with midpoints near $8–$11.

- Persistent fluctuation around $7–$10 suggests a key psychological and technical level to watch.

User and Wallet Statistics

- As of 2025, over 6.3 million wallets have interacted with Uniswap, though “active” status may vary based on 30/90-day usage metrics.

- More than 50% of users now transact via Base, highlighting L2-driven engagement.

- The rise in wallets doesn’t necessarily equate to higher capital; TVL remains moderate.

- The surge in new wallets suggests growth across geographies and chain support.

- While daily transaction counts weren’t specified here, the overall wallet growth suggests rising participation.

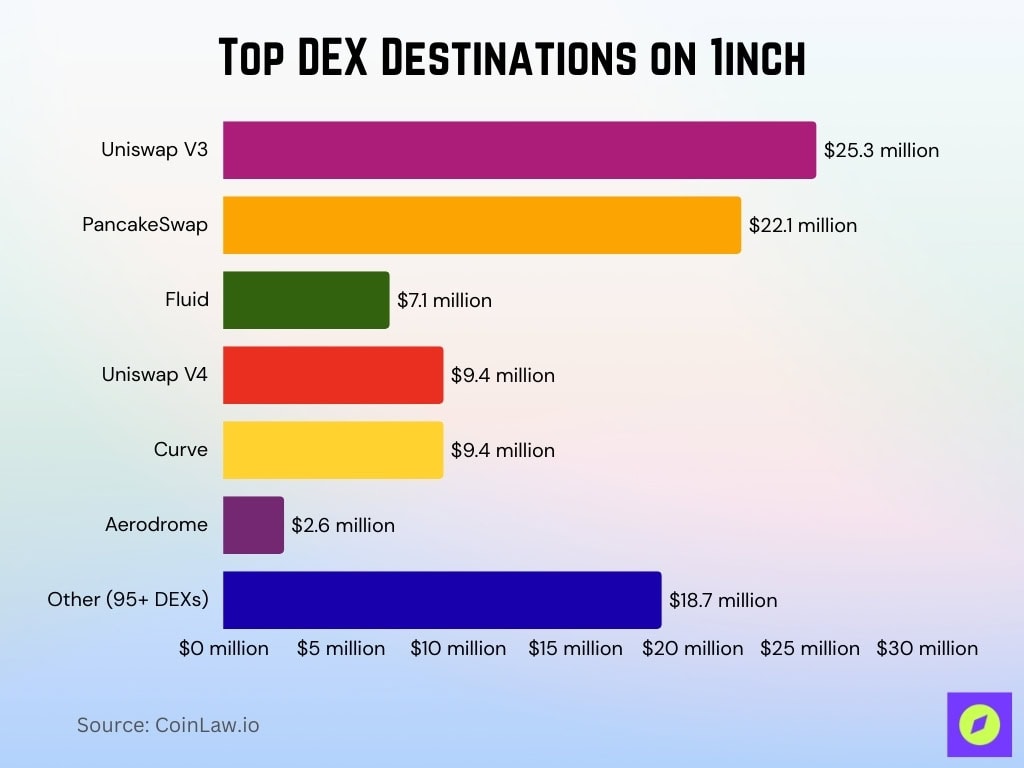

Top DEX Destinations on 1inch

- Uniswap V3 led all decentralized exchanges, handling $25.3 million in daily average volume via 1inch, accounting for 35.7% of total routed volume.

- PancakeSwap followed with $22.1 million in daily average volume, showing strong cross-chain adoption.

- Uniswap V4 recorded a daily average of $9.4 million, reflecting growing adoption despite being newly launched.

- Curve matched Uniswap V4 with $9.4 million in daily volume, maintaining relevance in stable asset swaps.

- Fluid saw a daily average of $7.1 million, briefly spiking to 14.6% share during its peak performance window.

- Aerodrome remained a minor destination with $2.6 million in daily average volume.

- A diverse group of 95+ other DEXs collectively captured $18.7 million in daily routed volume via 1inch.

Network Activity Metrics

- Swap volume in 2025 has already overtaken 2024’s total in under seven months.

- Base not only drives user growth but also contributes about 50% of revenue, given fragmentation.

- Despite that activity, TVL and fees remain below historic peaks, marking a balance between engagement and capital retention.

- Frequent Layer 2 interactions suggest a lean usage model, favoring smaller, active trades over larger value locks.

- Wallet count has ramped up sharply; 6.3 million users now engage with the protocol.

- Network activity is increasingly decentralized across chains like Base, Arbitrum, and others.

- High frequency of swaps may continue boosting engagement even if TVL lags.

Swap Count and Frequency

- Total swap volume has already outpaced the previous year by mid‑2025.

- A near 20% daily jump in volume and price reflects heightened swap activity.

- High user presence from Base suggests rapid swap rates and repeated interactions.

- Although precise counts aren’t logged in these sources, early wallet and revenue data suggest frequent small trades.

- The pattern reflects active swapping rather than fewer, high-value liquidity movements.

Liquidity Provider Data

- Over 90 % of the largest liquidity providers (LPs) change positions within a month, showing a dynamic reallocation trend.

- While some pools have influential LPs, Uniswap liquidity inflows are typically more distributed across hundreds of participants.

- Uniswap v3 enables ~54 % higher returns than v2, thanks to concentrated liquidity, though it demands more active management.

- Liquidity positions in v3 are represented as NFTs (ERC 721), adding complexity and flexibility.

- High fee pools capture 58 % of liquidity supply, but only execute 21 % of trade volume, showing imbalanced fragmentation.

- Arbitrageurs often erode LP earnings; v2 pools can be more profitable for passive LPs than v3 counterparts.

- In a sample covering 43 % of TVL, LPs earned $199.3 million in fees but suffered $260.1 million in impermanent loss, a net deficit of $60.8 million versus simply HODLing.

Layer 2 Statistics

- Uniswap operates across Ethereum and multiple Layer 2 networks, including Arbitrum, Base, Optimism, and Polygon, widening its reach.

- A community analytics tool, the Uniswap Incentive Analysis Terminal, tracks TVL and incentive efficiency across L2 chains like Base and Arbitrum.

- Incentive programs boosted TVL significantly. Base saw average daily TVL surges of $6 million during campaigns.

- However, liquidity often dropped sharply post-incentive, especially on smaller chains like Scroll and Blast.

- Uniswap v4’s Hooks and singleton architecture run on multiple chains, reducing gas by over 99 %.

- The layered support allows both retail traders and institutions to engage across chains with streamlined access.

- Operating across such chains helps diversify liquidity sources and user participation.

Top Trading Pairs

- As of August 2025, WOJAK/WETH briefly topped Base pair volumes with $5.3 million in 24h trading, though active pairs change frequently.

- Stablecoin and wrapped token pairs, such as WETH/USDC, dominate total pool volume and usage.

- Uniswap remains a top liquidity pool provider for most ERC-20 token pairs, due to its open‑source, fee‑sharing model.

- Its deep liquidity makes Uniswap pools popular for on-chain insurance, yield farming, synthetic assets, and lending protocols.

- Market depth modeling shows Uniswap v3’s wETH-wBTC pools offer 3–6× more liquidity than CEXes like Binance near mid price levels.

- However, for wETH USDT, Binance remains deeper near mid price, and Uniswap depth increases further from mid price.

- Uniswap’s custom property of concentrated liquidity allows pools to better withstand slippage and large trades.

Market Share Analysis

- Uniswap remains a leading DEX by volume and liquidity, though competitors like Curve and Fluid have carved significant niches, especially in stablecoins.

- That status makes it the go-to venue for high-volume traders, institutions, and DeFi protocols.

- Yet, Dune data shows that on stablecoins, Fluid recently surpassed Uniswap, capturing 55 % market share across Ethereum, Base, Arbitrum, and Polygon.

- Fluid’s total deposits grew 40 % year‑to‑date, reaching over $1.4 billion, emphasizing growing competition.

- Uniswap nevertheless leads the overall DEX market, commanding broad token pairing and liquidity breadth.

- Its institutional adoption and cross-chain strength give it resilience versus narrower competitors.

- While competition rises, Uniswap’s liquidity, UX, and tooling maintain its top-tier position.

Protocol Growth Over Time

- Since its 2018 launch, Uniswap has grown from zero to a multi-chain protocol with billions in TVL, daily volume in the billions, and multi-million of wallet users.

- The launch of v3 introduced concentrated liquidity, NFT-based LP positions, and custom fee tiers, improving capital efficiency.

- In 2025, v4 added Hooks and gas-reducing architecture across chains, significantly enhancing developer flexibility and cost efficiency.

- TVL and transaction volume continue to climb through targeted incentives, especially on Base and Arbitrum.

- Adoption by institutions and developers also grows via deep liquidity, extensible pools, and analytical tools.

- Overall, Uniswap’s trajectory reflects steady innovation, expanding reach, and Layer 2 scalability.

Network Robustness Metrics

- Uniswap’s multi-chain presence across Ethereum, Arbitrum, Base, Polygon, and more enhances network reliability.

- Hooks and modular architecture in v4 offer adaptive responses to changing conditions, strengthening resilience.

- High liquidity depth on key pools (e.g., wETH-wBTC) ensures smoother price execution even under market pressure.

- Yet, LP concentration, where top providers dominate, could pose a risk in case of mass withdrawal.

- Impermanent loss and arbitrage risks mean that LP participation requires active management and risk awareness.

- The Incentive Terminal helps monitor liquidity strength over time and across chains, aiding strategic oversight.

- Despite emerging competitors, Uniswap’s architecture, liquidity, and analytics foster infrastructural trust.

Conclusion

Uniswap remains the dominant decentralized exchange, backed by billions in trading volume, deep liquidity across chains, and continuous protocol innovation. From LP dynamics and fee efficiency to Layer 2 expansion and cutting-edge tooling like Hooks and incentive tracking, the statistics show a mature, evolving protocol. It still faces challenges, impermanent loss, LP concentration, and emerging rivals like Fluid, but its infrastructure strength and developer-friendly design keep it at the heart of DeFi. Explore the full article to discover how each data point adds to Uniswap’s narrative.