Uniswap has officially entered a new era with a massive $596 million UNI token burn and the launch of its long-awaited fee switch.

Key Takeaways

- 100 million UNI tokens worth $596 million were burned on December 28, 2025, as part of a major governance decision.

- The move followed the overwhelming approval of the “UNIfication” proposal, with 99.9% community support.

- Uniswap has now activated protocol fees on v2 and select v3 pools, while eliminating interface fees.

- A Growth Budget of 20 million UNI will fund continued development in the Uniswap ecosystem.

What Happened?

Uniswap carried out one of the largest token burns in DeFi history, destroying 100 million UNI tokens worth nearly $596 million. This milestone followed the “UNIfication” governance proposal, which passed with 99.9% support and over 125 million UNI votes in favor. The burn is part of a broader strategy to make UNI deflationary and more value-driven.

UNIfication has officially been executed onchain

— Uniswap Labs 🦄 (@Uniswap) December 27, 2025

✓ Labs interface fees are set to zero

✓ 100M UNI has been burned from the treasury

✓ Fees are on for v2 and a set of v3 pools on mainnet

✓ Unichain fees flow to UNI burn (after OP & L1 data costs)

Let the burn begin pic.twitter.com/fcr3WY3gPc

Uniswap’s Economic Shift Begins

Uniswap’s recent token burn was not just symbolic. It marked the beginning of a structural economic transformation within the protocol.

- The burned tokens were taken from Uniswap’s treasury, permanently reducing the circulating supply.

- The “fee switch” is a feature debated in the DeFi space for years and has finally gone live.

- Protocol fees are now enabled on Uniswap v2 and selected v3 pools on Ethereum.

- Interface fees were set to zero, removing user-facing charges on the Uniswap front end.

This means Uniswap is now channeling protocol-generated revenue toward burning UNI tokens, after paying for necessary blockchain infrastructure costs like Optimism and Layer-1 data. The goal is to maintain a deflationary supply model, potentially boosting UNI’s long-term value.

Broad Community Backing

The UNIfication proposal received near-unanimous support from the community, with just 742 votes against it out of over 125 million votes. High-profile backers included:

- Jesse Walden, Variant Fund founder.

- Kain Warwick, creator of Infinex and Synthetix.

- Ian Lapham, former engineer at Uniswap Labs.

Following the burn, Uniswap Labs confirmed the execution in a post on X, stating that “UNIfication has officially been executed onchain.”

Price and Market Impact

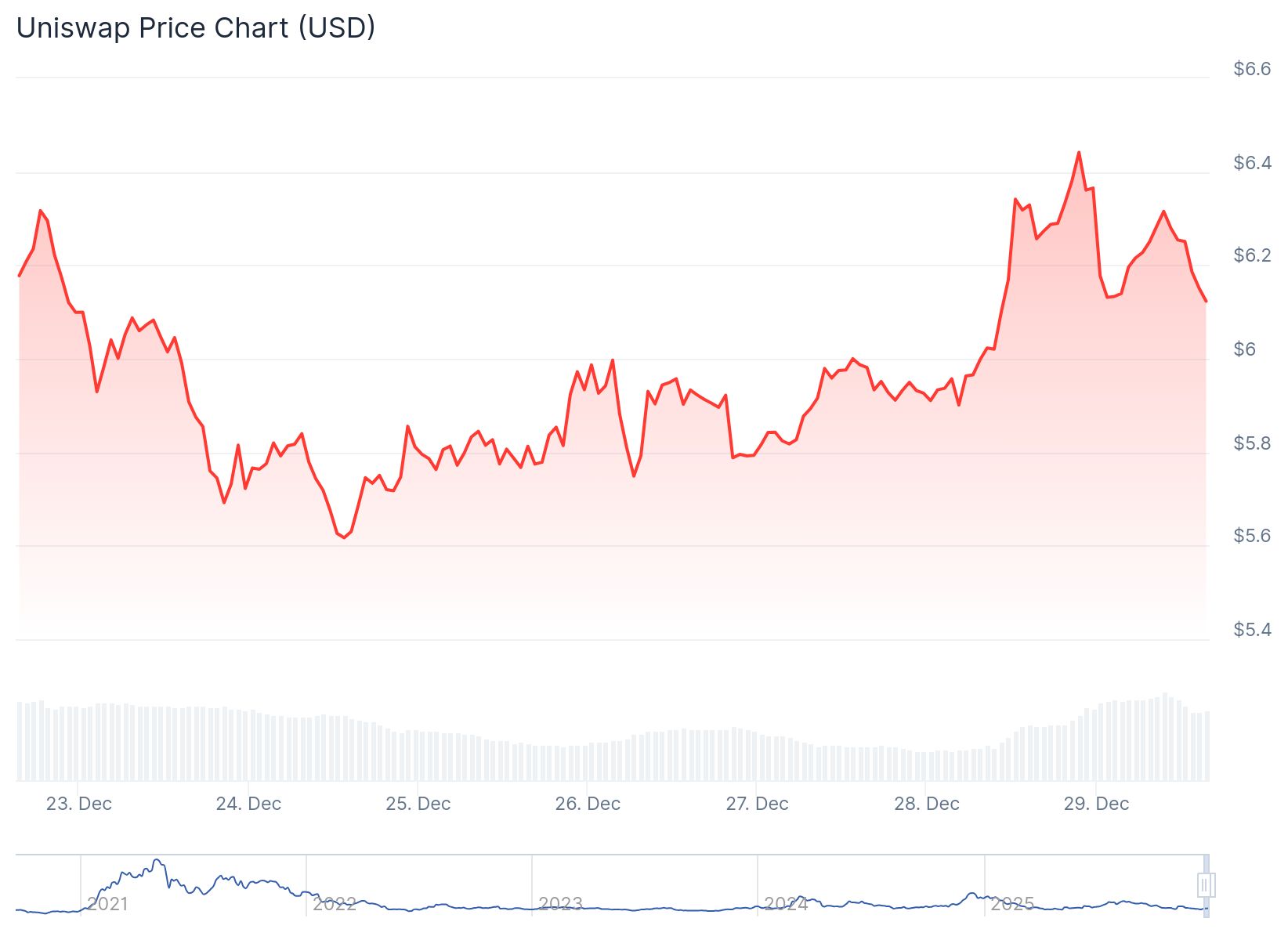

The UNI token responded positively to the news, climbing over 5% in the following 24 hours, with both trading volume and market capitalization rising. The circulating supply of UNI is now approximately 730 million, down from 830 million, with a capped total supply of 1 billion.

Growth Budget for Developer Support

Uniswap is not just burning tokens. The Uniswap Foundation has committed to continuing its developer funding and grant programs. As part of this plan, a Growth Budget of 20 million UNI has been allocated to support protocol development and ecosystem expansion. This shows Uniswap’s balanced approach to reducing supply while still investing in innovation.

CoinLaw’s Takeaway

I’ve seen many protocols talk about sustainability, but few execute like this. Burning 100 million tokens while kicking off a revenue-sharing model is bold and refreshing. In my experience, when DeFi platforms align incentives between protocol health and token holders, real value gets created. What Uniswap just did is not only historic, it sets a serious precedent. They’re no longer just the OG DEX, they’re evolving into a mature, revenue-aware ecosystem. I’ll be watching how this deflationary trend plays out because it could reshape how DeFi protocols manage governance and growth.