In recent years, the UK insurance industry has experienced remarkable shifts due to digital innovation, regulatory changes, and evolving consumer demands. From life insurance premiums to car insurance affordability, each segment has its own set of challenges and growth opportunities. Understanding the latest trends in 2025 is essential, as this industry continues to shape both household finances and the broader economy. This article provides a comprehensive look at the key statistics, industry dynamics, and regulatory updates that define the UK insurance market in 2025.

Key Takeaways

- 1The total UK insurance market grew by 6.8% in 2025, driven by a 7.1% increase in life insurance and a 5.6% rise in personal insurance.

- 2The UK financial services sector faced the highest data breach costs in 2025, averaging £6.42 million per breach.

- 3The UK insurance industry remains the 4th largest globally, managing £1.91 trillion in investments as of 2025.

- 4Cybercrime hit 60% of large firms and 46% of mid-sized companies in 2025.

- 5The UK home insurance market reached £5.45 billion in 2025, with the average home insurance premium rising to £412 in Q2.

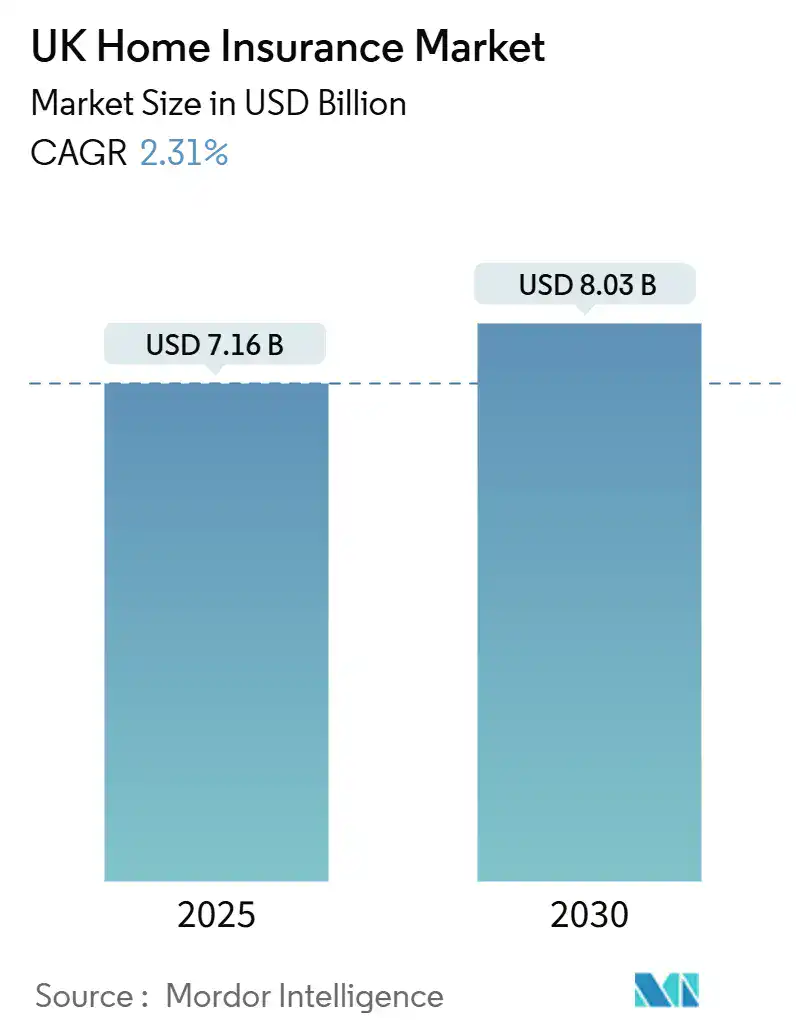

UK Home Insurance Market Forecast

- The UK home insurance market is expected to grow at a CAGR of 2.31% from 2025 to 2030.

- The market size is projected to rise from USD 7.16 billion in 2025 to USD 8.03 billion by 2030.

- This reflects a steady upward trend, indicating increased demand and premium growth in the coming years.

- Insights suggest modest yet stable growth, making it a resilient segment within the insurance industry.

Household Spending on Insurance in the UK

- UK households spend an average of £2,460 annually on insurance premiums, covering health, car, home, and life.

- The average home insurance expenditure rose by 5.2% in 2025 due to inflation and higher building material costs.

- Car insurance premiums reached an average of £495 per vehicle in 2025, maintaining their place as a major household cost.

- Health insurance costs increased by 9.3% year-on-year in 2025 as private care demand remained high.

- Travel insurance spending rose by 11.4% in 2025, fueled by global travel recovery and risk awareness.

- About 48% of UK households boosted their life insurance coverage in 2025 for better financial protection.

- Bundled insurance policies grew by 13.5% in 2025 as more families prioritized savings and simplicity.

Life Insurance Premiums and Policies

- Average annual life insurance premiums in the UK reached £318 in 2025, influenced by age, health status, and coverage.

- Premiums for whole-life policies averaged £628 annually in 2025, reflecting their value in long-term financial planning.

- Term life insurance premiums ranged between £162 and £215 annually in 2025 for basic coverage.

- Policies with critical illness add-ons made up 33% of total life insurance policies in 2025 as demand for broader protection grew.

- The over-50s life insurance market expanded by 5.1% in 2025 amid rising interest in affordable end-of-life plans.

- Over 63% of policies now offer flexible premium options, including monthly, quarterly, or annual payments in 2025.

- Joint life insurance policies saw an uptake growth of 8.2% in 2025 among married and cohabiting couples.

Types and Adoption of Life Insurance

- Term life insurance remains the top choice, making up 57% of all policies in 2025 due to its affordability and simplicity.

- Whole life insurance adoption grew by 3.6% in 2025 as more policyholders prioritize lifelong coverage and estate planning.

- Over-50s insurance policies accounted for 21.5% of new life insurance sales in 2025, driven by demand for low-barrier coverage.

- The critical illness insurance market rose by 8.9% in 2025 amid rising health concerns and income protection needs.

- Policies for children’s education funding increased by 6.8% in 2025, highlighting stronger financial planning among parents.

- Universal life insurance held 5.3% of the total market in 2025, remaining a niche due to cost and complexity.

- Group life insurance policies provided by employers rose by 10.7% in 2025 as businesses expanded employee benefit offerings.

General Insurance Market Trends and Segmentation

- Property insurance in the UK contributed £53.2 billion in 2025, driven by higher real estate and renovation expenses.

- Home insurance premiums rose by 5.6% in 2025 due to inflation and elevated construction costs.

- The motor insurance market was valued at £31.4 billion in 2025, with EV coverage gaining momentum.

- Cyber insurance led growth with a 19.7% rise in premiums in 2025 amid increasing digital threats.

- The pet insurance market reached £1.63 billion in 2025 as veterinary costs and adoption rates climbed.

- Health insurance saw 10.8% growth in individual policies in 2025 due to pressure on public healthcare systems.

- Commercial insurance for SMEs made up 41.3% of the general insurance market in 2025, with property, liability, and cyber risks prioritized.

Car Insurance Costs and Affordability Issues

- The average annual car insurance premium in the UK was £498 in 2025, marking a 3.6% increase amid ongoing cost pressures.

- Young drivers under 25 paid an average of £1,362 annually in 2025 due to high-risk classification.

- EV insurance premiums were typically 18.5% lower than conventional vehicles in 2025, supported by safer driving trends.

- Telematics-based insurance grew by 13.4% in 2025 as more drivers embraced behavior-linked premium models.

- The UK government’s insurance premium tax remained at 12% in 2025, continuing to affect affordability.

- Urban regions like London saw premiums up to 21.2% higher in 2025 due to elevated accident and claim rates.

- Pay-per-mile insurance adoption rose by 11.1% in 2025 as more low-mileage drivers sought flexible coverage options.

Fraud and Risk Management

- Insurance fraud cases rose by 5.8% in 2025, leading to £1.28 billion in estimated fraudulent claims across the industry.

- Car insurance fraud remained the top issue, making up 56.7% of all fraudulent claims in 2025 through staged and exaggerated incidents.

- Over 77% of insurers used AI-powered digital identity tools in 2025 to combat fraud more effectively.

- Anti-fraud training initiatives grew by 16.3% in 2025, helping insurers strengthen internal detection capabilities.

- Blockchain adoption in risk management reached 37.2% in 2025 as insurers focused on transparency and security.

- Predictive analytics reduced claim processing time by 21.5% in 2025, improving high-risk claim identification.

- The Insurance Fraud Bureau recorded an 8.9% rise in awareness campaigns in 2025, encouraging public fraud reporting.

Employers’ Liability Insurance Costs in the UK

- The average annual cost for one office worker is £61, reflecting minimal liability risk in non-physical roles.

- For one employee doing physical work, the cost increases significantly to £213 due to higher exposure to injury risks.

- When the number increases to two employees performing physical work, the cost rises to £354.

- The highest cost is observed for five employees in physical roles, reaching £753 annually, showing a direct correlation between employee count, nature of work, and insurance cost.

- Businesses should factor in employee type and number when budgeting for liability insurance.

Digital Transformation and InsurTech Adoption

- Over 73% of UK insurers invested in digital platforms in 2025 to streamline operations and improve customer experiences.

- The UK InsurTech sector grew by 16.8% in 2025, fueled by AI-driven automation and hyper-personalized policy offerings.

- Mobile app adoption by policyholders rose by 21.4% in 2025 as self-service and digital-first strategies advanced.

- AI integration in claims processing boosted efficiency, cutting processing time by 31.2% in 2025.

- Blockchain use in policy verification and underwriting increased by 11.6% in 2025, strengthening data trust and security.

- Chatbot usage for customer service grew by 26.5% in 2025, supporting faster responses to routine queries.

- Data analytics in underwriting was used by 67.3% of insurers in 2025 to drive precision in pricing and risk models.

Environmental, Social, and Governance (ESG) Initiatives

- Over 68% of UK insurers implemented ESG frameworks in 2025, prioritizing sustainability and responsible investment.

- Climate-related risk insurance rose by 21.6% in 2025 as demand surged for natural disaster and weather event coverage.

- Renewable energy insurance products saw a 16.4% increase in 2025, supporting the green infrastructure boom.

- The industry reaffirmed its net-zero carbon goal by 2050, with major insurers cutting emissions and boosting clean energy portfolios.

- Social impact initiatives rose by 11.2% in 2025 as insurers expanded charitable and community-based programs.

- ESG reporting transparency improved, with 77% of insurers releasing detailed disclosures in 2025.

- The green insurance market for EVs and eco-friendly homes expanded by 19.3% in 2025, reflecting rising consumer demand.

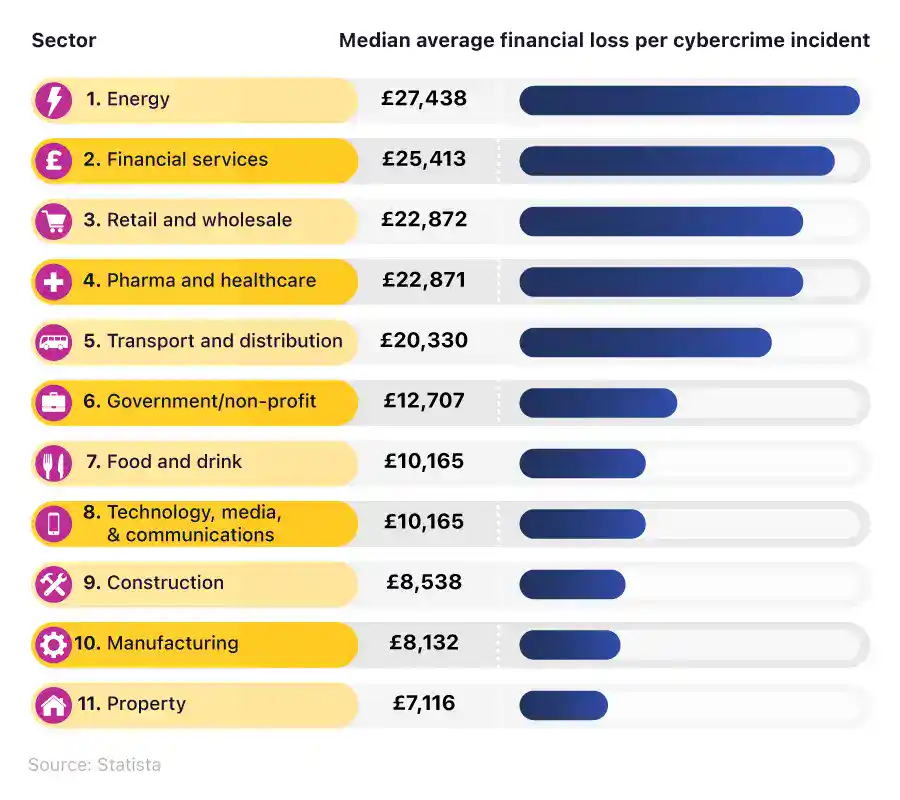

Cybercrime Financial Impact by Industry (UK)

- The Energy sector faces the highest losses, with a median average of £27,438 per cybercrime incident.

- Financial services follow closely with £25,413, reflecting high-value data and transaction risks.

- Retail and wholesale see an average loss of £22,872, just slightly higher than Pharma and healthcare at £22,871.

- The Transport and distribution sector incurs £20,330 per incident, highlighting supply chain vulnerabilities.

- Government and non-profits experience a moderate loss of £12,707, while Food and drink and Tech/media/communications both report £10,165.

- Construction suffers £8,538, and Manufacturing faces losses of £8,132 per incident.

- The Property sector has the lowest average loss at £7,116, but remains a target nonetheless.

Recent Developments

- With inheritance tax (IHT) law changes set for April 2027, there’s a growing uptake of life insurance policies in 2025 to manage future tax burdens without asset liquidation.

- Domestic & General strengthened its fraud defenses in 2025 following a High Court win, reinforcing legal protection against impersonation scams targeting warranty holders.

- Vitality announced in 2025 that it will offer weight-loss injections like Wegovy and Mounjaro to members with a BMI over 35, aiming to combat severe obesity and boost health outcomes.

- The Bank of England confirmed in 2025 that stricter liquidity reporting rules for large life insurers will take effect by December 2025, under new PRA oversight measures.

- The UK insurance market continued shifting into a soft phase in 2025, forcing insurers and brokers to seek genuine growth beyond pricing strategies.

Conclusion

The UK insurance industry in 2025 presents a dynamic blend of technological innovation, evolving consumer expectations, and stringent regulatory standards. The industry’s robust growth across life, general, and health insurance sectors demonstrates its adaptability and essential role in supporting the UK economy. With a strong focus on digital transformation and ESG initiatives, UK insurers are setting a global standard for modernization and sustainability. As new trends and challenges emerge, the industry’s commitment to innovation and compliance will continue shaping its future, ensuring a more secure, efficient, and sustainable insurance landscape for years to come.