BitMine Immersion Technologies has expanded its Ethereum holdings again, taking advantage of the market dip to bolster its crypto treasury.

Key Takeaways

- BitMine acquired 110,288 ETH last week, growing its total Ethereum stack to over 3.5 million tokens

- The company now controls 2.9% of all ETH, positioning itself as the largest Ethereum treasury globally

- BitMine’s total crypto and cash holdings stand at $13.2 billion, including $398 million in unencumbered cash

- Chairman Tom Lee cites increasing institutional interest and strategic OTC purchases as key to their aggressive growth

What Happened?

BitMine Immersion Technologies (BMNR), a publicly traded Ethereum-focused treasury firm led by Wall Street veteran Tom Lee, purchased over 110,000 ETH during last week’s dip. This marks a 34% increase from its previous week’s Ethereum acquisitions. The move brings BitMine’s total ETH holdings to more than 3.5 million tokens, representing 2.9% of Ethereum’s total supply.

Alongside its crypto assets, BitMine holds nearly $398 million in cash reserves, giving it ample firepower for future acquisitions. Its total crypto and cash portfolio now values at $13.2 billion, making it one of the largest digital asset treasuries globally.

🧵

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) November 10, 2025

BitMine provided its latest holdings update for Nov 10th, 2025:

$13.2 billion in total crypto + “moonshots”:

-3,505,723 ETH at $3,639 per ETH (Bloomberg)

– 192 Bitcoin (BTC)

– $61 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and

– unencumbered…

BitMine Doubles Down on Ethereum Strategy

BitMine has been executing over-the-counter (OTC) ETH purchases, a strategy aimed at acquiring large volumes of Ethereum without impacting market prices. The company’s goal is clear: build a massive, long-term stake in Ethereum, potentially reaching up to 5% of the total circulating supply.

- BitMine currently holds over 3.5 million ETH, valued at about $12.4 billion.

- The company also owns 192 Bitcoin, worth approximately $20.2 million.

- Unencumbered cash stands at $398 million, up $9 million from the prior week.

While other digital asset treasuries have scaled back purchases due to falling stock prices and market volatility, BitMine has stayed aggressive, signaling strong conviction in Ethereum’s long-term value.

Market Reaction and Institutional Backing

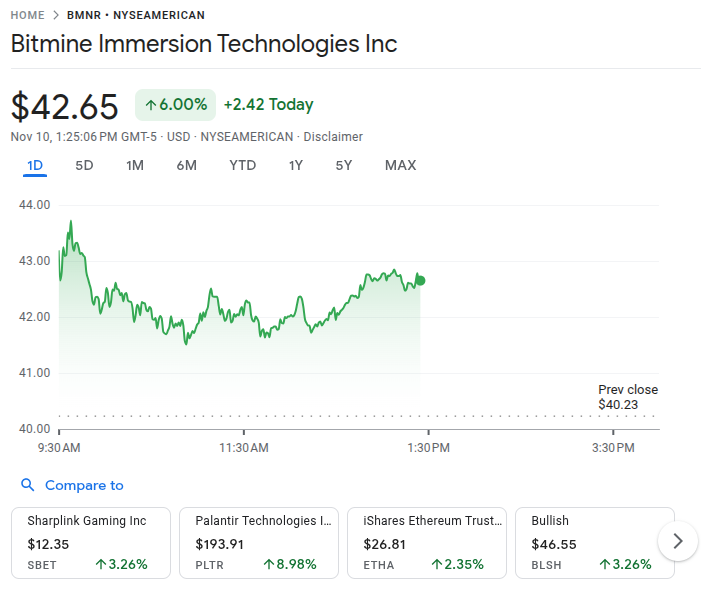

Following the announcement, BitMine’s shares rose over 5%, trading at around $42.20. Despite a recent 20% drop over the last month due to broader crypto market weakness, investor sentiment showed signs of recovery.

Chairman Tom Lee attributed the purchase surge to the attractive price levels of Ethereum during the dip. He stated:

Lee also noted growing institutional appetite for blockchain technology and Ethereum in particular. At a recent summit co-hosted with the Ethereum Foundation at the NYSE, he observed:

CoinLaw’s Takeaway

In my experience, moves like BitMine’s are more than just market plays. They reflect a deep strategic shift where major firms begin treating Ethereum as a core asset class, not just a speculative instrument. I found BitMine’s OTC strategy particularly smart. It avoids spooking the markets while allowing them to build a serious position. If they reach their 5% goal, it could transform how institutional players think about Ethereum exposure. This could be the blueprint for future corporate crypto treasuries.