TaxBit has become a leading platform in crypto tax compliance and digital asset reporting, helping individuals and enterprises navigate the complexities of cryptocurrency taxation today. As digital assets grow in popularity and regulation tightens, TaxBit’s tools support millions of users in automating calculations, generating compliance reports, and integrating real‑time transaction data with tax obligations.

Across industries like fintech and institutional investing, real‑world applications range from exchanges using TaxBit to produce accurate 1099 forms to enterprises automating global tax reporting processes. Explore this article for a comprehensive statistical snapshot of TaxBit’s evolution and market impact.

Editor’s Choice

- 100 million+ tax forms generated by TaxBit for end users and businesses.

- $500 billion+ in digital asset transactions reconciled through the TaxBit platform.

- North America holds about 60% market share in crypto tax software demand.

- TaxBit has raised ~$237 million in total funding over multiple rounds.

- TaxBit supports tax compliance across 140+ countries and currencies.

- On track for crypto tax software market CAGR of 10.8%, 2026-2033.

Recent Developments

- Partnerships like Bybit integration for CARF compliance across 70+ jurisdictions highlight global reach.

- New Global Digital Platform Reporting tools were launched in 2025, enhancing international tax navigation.

- TaxBit maintains close collaboration with the IRS and industry regulators for compliance data support.

- AWS infrastructure modernization provided 82% cost savings and a 5× processing speed increase.

- TaxBit continues to expand its suite of enterprise offerings, including automated tax form generation.

- Integration with major platforms and exchanges accelerates adoption among institutional clients.

- Growing demand from digital asset brokers has led to more tailored compliance solutions.

What Is TaxBit?

- TaxBit was founded in 2018 by CPAs and tax attorneys to automate crypto tax reporting.

- Platform connects to 100+ crypto exchanges for data ingestion.

- Raised $130 million Series B at $1.33 billion valuation in 2021.

- Current valuation stands at $1.5 billion.

- Supports compliance with global standards, including CARF and DAC7.

TaxBit Funding and Valuation Statistics

- Total funding raised $237–$240 million over 7 rounds as of 2026.

- Series B round secured $130 million at a $1.33 billion valuation.

- 2025 valuation is estimated at $1.5 billion for a private company.

- 7 funding rounds completed since inception in 2018.

- Key investors include Paradigm, Tiger Global, and Insight Partners.

- Additional backers include IVP, Sapphire Ventures, and Coinbase Ventures.

User and Customer Growth Statistics

- Supports tax reporting for millions of individual and enterprise users worldwide.

- Generated over 100 million tax forms for users.

- Reconciles more than $500 billion in digital asset transactions.

- Integrates with 100+ crypto exchanges for seamless onboarding.

- Serves customers across 70+ jurisdictions globally.

- North America holds 60% market share, driving the US user base.

- Enterprise clients include the IRS and major exchanges like Coinbase.

- Partnerships with Bybit and others expand user adoption.

- Reconciled trillions in transaction volume historically.

TaxBit Network Coverage and Partnerships

- Network spans 70+ jurisdictions via integrations.

- Supports 500+ platforms in the partner ecosystem.

- Covers 140+ countries through alliances.

- Partners with Bybit for CARF/DAC8 global compliance.

- Integrates with Fireblocks for institutional workflows.

- Collaborates with Gemini for automated tax reporting.

- Alliances with Blockpit expand European capabilities.

- Works with Coinbase, Kraken, and IRS enterprises.

- AWS partnership boosts data processing scalability.

TaxBit Employee and Headcount Statistics

- 25% employee growth rate annually.

- Locations include Salt Lake City (HQ), Seattle, NYC, and Singapore.

- The engineering team drives 100+ exchange integrations.

- Sales personnel support enterprise and government clients.

- Deloitte Fast 500 recognition for rapid headcount scaling.

- The hybrid work model spans 70+ jurisdictions.

Geographic Footprint and Office Locations

- Supports compliance in 140+ countries and currencies worldwide.

- Offices located in Salt Lake City (HQ), Seattle, New York City, and Singapore.

- Expansion covers European markets under MiCA and DAC8 regulations.

- Partnerships with Blockpit for European ecosystem integration.

- Bybit integration aids 70+ jurisdictions globally.

- The remote-hybrid model spans multiple time zones.

- Collaborates with AWS for international tech infrastructure.

- Multi-currency reporting for diverse global markets.

- Serves North America with 60% market share dominance.

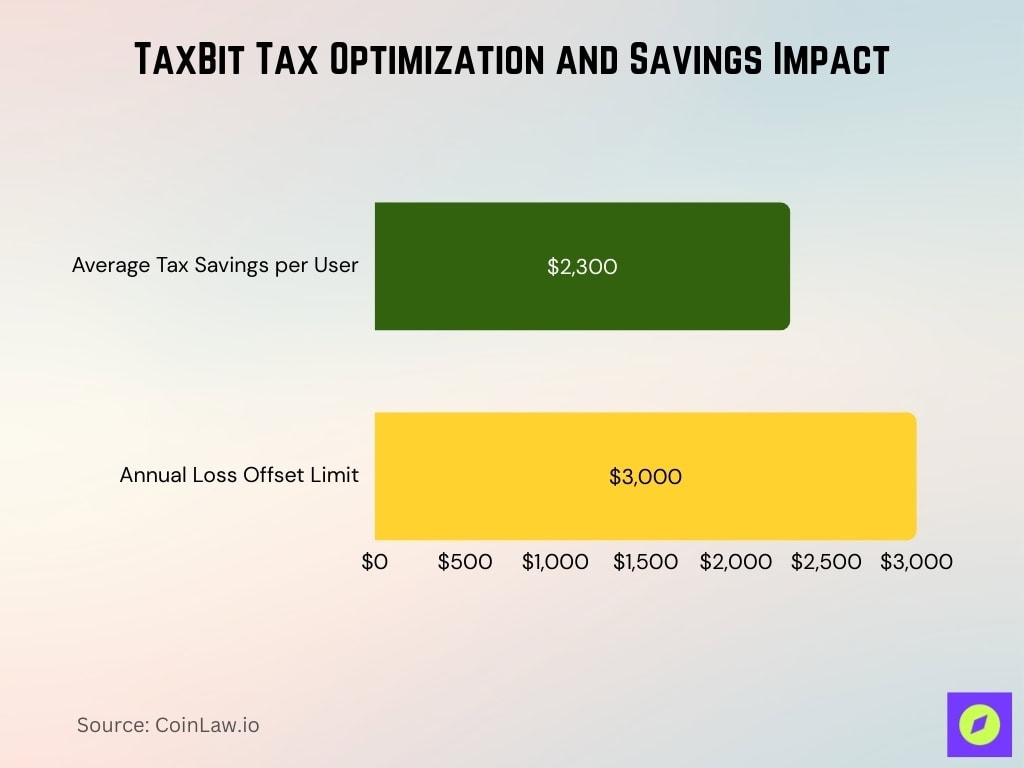

Tax Optimization and Tax Loss Harvesting Metrics

- Users saved an average of $2,300 in tax liabilities during the 2025 tax season.

- Offsets up to $3,000 net losses against ordinary income annually.

- Available to Plus and Pro plan subscribers.

- Supports harvesting for crypto and NFT losses.

- 22% tax bracket users gain an extra $220 per $1,000 harvested.

- Monitors portfolios with 100+ monthly transactions optimally.

- Provides pre-trade tax impact analysis via Tax Optimizer.

- Generates end-of-year savings reports in audit logs.

TaxBit Product and Platform Overview

- Unified platform automates 100M+ tax forms annually.

- Enterprise Tax solution handles trillions in transaction volume.

- Integrates with 100+ crypto exchanges for data ingestion.

- Reconciles $500 billion+ digital asset transactions.

- Supports compliance across 140+ countries and currencies.

- Generates IRS Form 8949 and 1099 series automatically.

- Real-time portfolio tracking with tax liability calculators.

- Audit-ready reports meet CARF, DAC7, and MiCA standards.

- Secure API connections ensure accurate multi-platform data.

- Scalable workflow from ingestion through regulatory filing.

Supported Exchanges, Wallets, and Platforms

- Integrates with 500+ exchanges and crypto services via APIs.

- Supports 100+ leading exchanges, including Coinbase, Kraken, and Gemini.

- Connectivity covers centralized and decentralized exchanges.

- Wallet integrations for major on-chain networks like Ethereum and Bitcoin.

- Partners with custody providers such as Fireblocks for institutions.

- API real-time data exchange with the core tax engine.

- DeFi and NFT support for non-traditional asset reporting.

- Covers 140+ countries’ transaction types comprehensively.

- Handles $500 billion+ transactions across platforms.

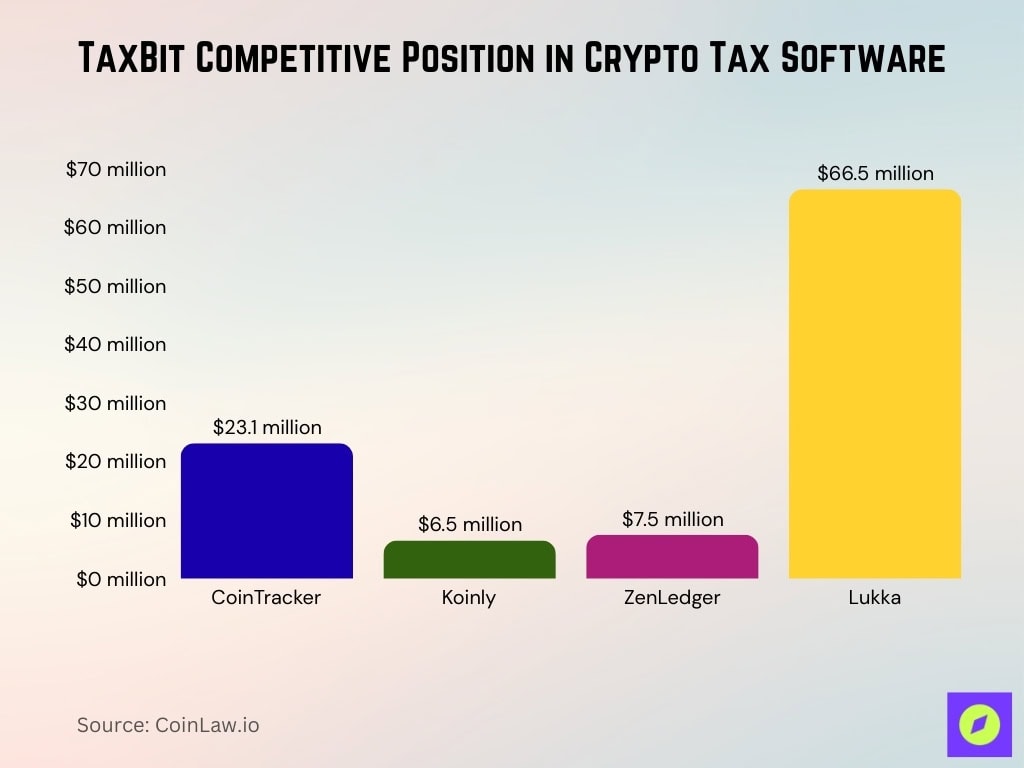

Competitors and Market Positioning

- Key rivals include CoinTracker ($23.1 million revenue), Koinly ($6.5 million), ZenLedger ($7.5 million), and Lukka ($66.5 million).

- Enterprise focus differentiates from consumer platforms like CoinTracker.

- Supports 500+ integrations vs Koinly (800+) wallets.

- Holds unicorn status at $1.33 billion valuation.

- Global coverage in 140+ countries exceeds many rivals.

- Partnerships with IRS, Big Four boost positioning.

- 16.5% CAGR crypto tax market through 2029.

- Strong in institutional vs retail-focused competitors.

Blockchain, Asset, and Network Coverage

- Ingests data from 29 major exchanges covering 10,000+ digital assets.

- Supports Bitcoin, Ethereum, Solana, Avalanche, Polygon, and Base blockchains.

- Covers thousands of crypto assets across multiple networks.

- Achieves 99.99% data accuracy for supported assets.

- Real-time feeds track taxable events instantly.

- Rapidly adds emerging tokens with market growth.

- Handles $500 billion+ transaction volume across assets.

- Integrates DeFi and NFT protocols for full coverage.

- Spans 140+ countries’ asset reporting needs.

Transaction Volume and Forms Processed

- Generated 100 million+ tax forms for users worldwide.

- Reconciled over $500 billion in digital asset transactions.

- Automates 1099 and international tax forms for exchanges.

- Processes data from 500+ exchanges and wallets.

- Supports trillions of cumulative transaction volume historically.

- Audit-ready summaries for enterprise regulatory compliance.

- Scales for peak periods across 140+ countries.

- 99.99% accuracy in transaction reconciliation.

- Flags discrepancies in high-volume processing.

Tax Forms and Reporting Output Statistics

- TaxBit auto-generates IRS forms, including 1099-B, 1099-MISC, 8949, and 1099-K.

- Over 100M+ tax forms have been generated for users across the globe.

- The platform supports both U.S. and OECD CARF/DAC7 international reporting standards.

- Form delivery can be done electronically or securely mailed to recipients.

- Enterprise clients utilize bulk processing for 10,000+ tax forms per cycle.

- Form accuracy rates exceed 99.8%, reducing manual corrections and compliance risks.

- Support includes corrections, updates, and amended returns throughout the filing season.

- Audit trails and downloadable archives provide transparency and data retention compliance.

Security, Compliance, and Regulatory Credentials

- SOC 1 Type II and SOC 2 Type II certified for data security.

- Complies with ISO/IEC 27001 information security standards.

- Uses AES-256 encryption for data in transit and at rest.

- Meets GDPR, CCPA, HIPAA privacy requirements.

- Supports CARF, DAC8, and MiCA regulatory frameworks.

- Conducts regular third-party security audits.

- Enforces multi-factor authentication and access controls.

- Hosted on secure AWS infrastructure globally.

- Maintains incident response for 99.99% uptime.

Industry Recognition, Awards, and Rankings

- Ranked on the 2025 Deloitte Technology Fast 500 with 214% growth.

- Won 2025 Digital Banker’s Award for Best Digital Assets Tech Provider.

- Named to CB Insights Blockchain 50 for innovative startups.

- Featured in Forbes Fintech 50 for three consecutive years.

- Recognized by Fast Company for fintech product excellence.

- Top crypto compliance solution per FinTech Futures.

- Partners with EY, Kraken, Gemini, and Bybit leaders.

- Holds ISO and SOC certifications for enterprise standards.

- CB Insights highlights it as a 2026 blockchain leader.

Frequently Asked Questions (FAQs)

TaxBit has generated 100M+ tax forms for users and businesses worldwide.

TaxBit has reconciled $500 billion+ in digital asset transactions across its platform.

TaxBit is valued at approximately $1.5 billion as a private company.

TaxBit’s latest employee count is around 150 people.

Conclusion

As crypto assets become a core part of modern finance, TaxBit stands out by simplifying the complexity of digital asset taxation. The platform’s ability to reconcile transactions, support, and operate jurisdictions highlights its unmatched scale. With a diverse user base, cutting-edge automation, and partnerships across regulators and enterprises, TaxBit has firmly established itself as a foundational tool for compliant digital finance. As regulations evolve, its agile platform and strategic roadmap ensure continued relevance and leadership in the crypto tax space.