Stellar (XLM) plays a pivotal role in enabling fast, low-cost cross-border payments and efficient smart contract operations via its Soroban integration. Stellar underscores its relevance through real-world deployments, such as remittance corridors and stablecoin issuance for global cash-to-crypto access. This article breaks down current and year-over-year statistics in a reader-friendly way and invites you to explore deeper insights below.

Editor’s Choice

- $0.3646, XLM’s current trading price as of September 3, 2025.

- $11.6 billion, Market capitalization.

- 31.7 billion XLM, Circulating supply.

- 50 billion XLM, Maximum supply (fully diluted).

- ~$329 million, 24‑hour trading volume.

- $0.94, All‑time high (January 2018).

- –7% weekly change, Recent 7‑day price decline.

Recent Developments

- Stellar’s blockchain has been leveraged through partnerships such as MoneyGram’s cash-to-crypto services and IBM’s World Wire project, though IBM’s involvement has significantly declined since 2020. PayPal’s engagement is indirect, mostly via stablecoins like USDC that are interoperable with Stellar

- The partial ruling in the SEC v. Ripple Labs case in July 2023, which found that XRP is not inherently a security, has contributed to market optimism and a temporary increase in institutional interest across several digital assets, including Stellar, due to its similarities with Ripple.

- Total value locked (TVL) in Stellar‑based DeFi has exceeded $145 million, accompanied by rising stablecoin issuance (~$200 million), boosting XLM liquidity demand.

- A few machine learning-based price aggregators suggest that Stellar may reach an average of $0.47–$0.49 by mid-2025, although these models rely heavily on historical technical patterns and are not endorsed by financial institutions.

- Some independent technical analysts have identified a potential bullish flag pattern forming on XLM charts, with short-term support near $0.3786 and speculative upside toward $0.80, though these predictions are interpretive and not based on fundamentals.

- Analysts propose bullish year-end targets ranging up to $1.29, with bearish lows near $0.65, averaging $0.97.

- Aggregate forecasts for 2025 vary; CoinGape estimates $0.45–$0.50, Benzinga $0.26–$0.40, and Changelly around $0.41.

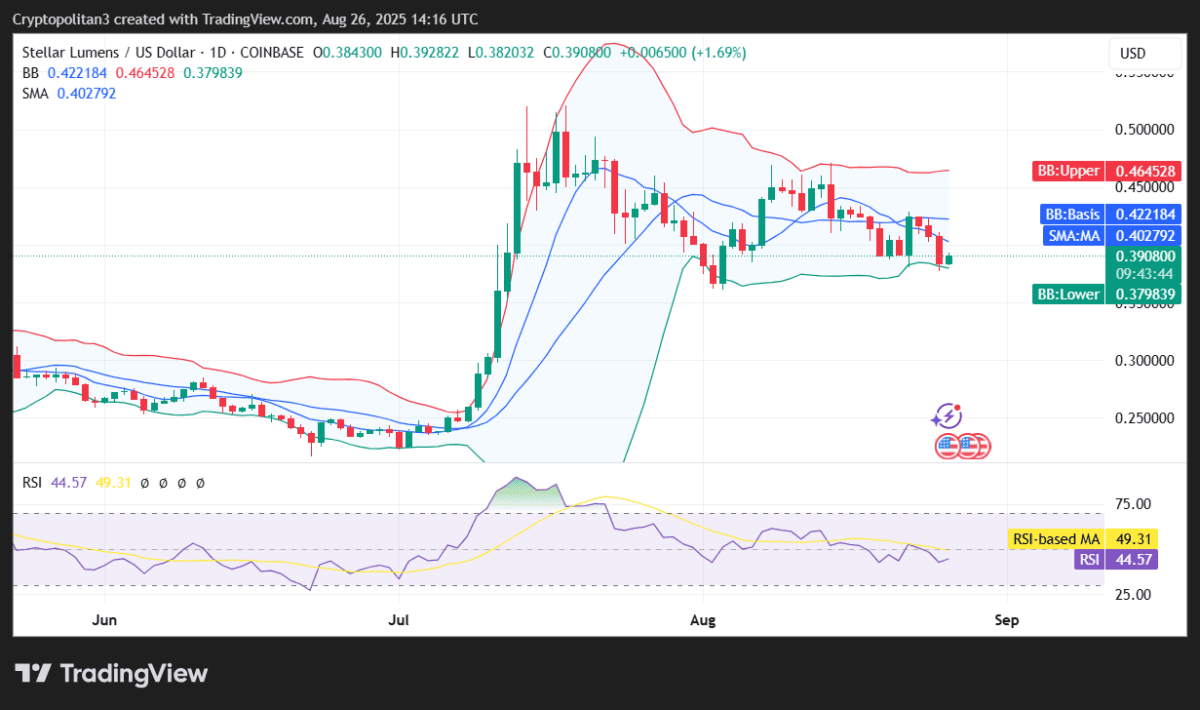

Stellar (XLM) Technical Snapshot

- XLM closed at $0.3908, gaining +1.69% on the day.

- The daily range showed a high of $0.3928 and a low of $0.3820.

- The Simple Moving Average (SMA) stood at $0.4028, slightly above the closing price.

- Bollinger Bands indicated volatility, with an upper band at $0.4645, a middle band at $0.4222, and a lower band at $0.3798.

- The Relative Strength Index (RSI) was 44.57, suggesting neutral momentum.

- The RSI-based Moving Average registered at 49.31, pointing to a balanced trend.

Historical Price Performance

- All‑Time High, $0.94 in January 2018.

- Since then, XLM trades roughly –60% below that peak.

- All‑Time Low, approximately $0.00112 in November 2014.

- Year‑to‑date movement (March – September 2025), upward trend from ~$0.27 to ~$0.36.

Market Capitalization

- Current market cap is about $11.6 billion.

- Volume‑to‑market‑cap ratio, 0.0269 (indicating liquidity relative to size).

- Ranking, generally within the top 20–21 cryptocurrencies by market cap.

Fully Diluted Valuation

- Using max supply (50 billion XLM), FDV is approximately $18.3–$18.4 billion.

- Compared to the current market cap (~$11.6 billion), this implies about 35–40% upside if all tokens become liquid.

Circulating Supply

- 31.73 billion XLM are currently in circulation, approximately 63% of the maximum supply.

- Another source reports 31.39 billion XLM, reinforcing the ~63% figure.

- CoinGecko lists 32 billion XLM, slightly higher but within a comparable range.

- These figures reflect a steady increase in supply as Stellar’s inflation and distribution mechanisms continue.

- Supply metrics remain stable across major trackers, suggesting consistency in issuance and reporting.

- The supply growth is gradual, up from roughly 30.77 billion XLM around mid-2025.

- Circulating supply remains a critical gauge of liquidity and investor access.

Stellar Ecosystem Highlights

- 255+ grants were issued between Nov 2022 and Dec 2023, supporting innovation and growth across the network.

- Stellar now has 81,000+ onramp locations globally, expanding accessibility for users worldwide.

- The network achieves an average ledger closing time of 5.8 seconds, ensuring fast and efficient transaction processing.

Total and Maximum Supply

- Maximum supply stands fixed at 50 billion XLM, with no new tokens to be created past that cap.

- Total supply aligns exactly with the maximum, 50,001,806,812 XLM.

- Changelly reports a nearly identical number, 31.39 billion in circulation, versus 50 billion maximum.

- Stellar’s supply protocol halted its earlier inflation, whereas at launch, total supply reached 100 billion; it was reduced after 2019 to a fixed 50 billion.

- The fixed supply provides predictability and limits dilution.

- Fixed maximum means market cap and FDV calculations remain stable unless tokens are unlocked.

- The difference between circulating and maximum supply highlights room for future issuance or reserve release.

24‑Hour Trading Volume

- Around $308 million in trading occurred in the past 24 hours.

- TradingView reports a similar $329 million figure, confirming high activity.

- The Block lists $314.8 million, another close match.

- Coinbase shows a 24‑hour figure of approximately $315 million.

- Seven‑day trading volume averages around $319 million/day.

- Monthly volume sums to $11.35 billion, averaging nearly $378 million/day.

- Small day‑to‑day fluctuations suggest consistent liquidity and steady demand.

All‑Time High and Low Values

- All‑time high remains around $0.94, reached in January 2018.

- TradingView provides precision at $0.9309 on January 4, 2018.

- All‑time low is about $0.00123, seen in November 2014.

- FastBull confirms the low of $0.0011227 on November 19, 2014.

- Price today hovers roughly 60% below its peak.

- The long-term range underscores significant volatility and recovery potential.

- These historical extremes offer context for current valuations and market sentiment shifts.

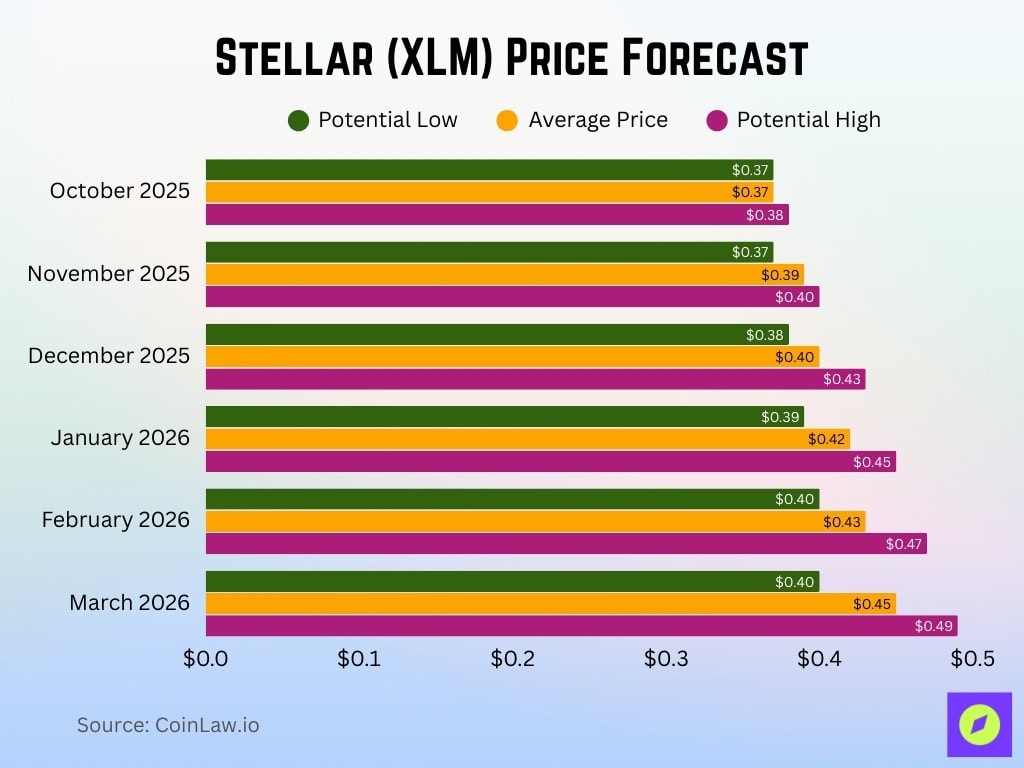

Stellar (XLM) Price Forecast

- In October 2025, XLM is expected to trade between $0.37 and $0.38, averaging $0.37.

- In November 2025, the price could range from $0.37 to $0.40, with an average of $0.39.

- By December 2025, XLM may climb to $0.43, averaging $0.40 with a low of $0.38.

- Entering January 2026, forecasts suggest a range of $0.39 to $0.45, with an average of $0.42.

- In February 2026, XLM could rise further, averaging $0.43, with highs of $0.47.

- By March 2026, projections indicate growth to $0.49, averaging $0.45 and holding a low of $0.40.

Market Rank and Position

- Stellar is ranked #16 on CoinMarketCap.

- CoinGecko places it lower, around #21.

- Price predictions imply it remains within the top 20–25 by market cap.

- As of July 2025, Stellar was the 18th largest crypto by market cap, valued at $9.04 billion.

- Current market cap is approximately $11.55 billion.

- Ranking has remained relatively stable, reflecting steady investor interest and capitalization.

- Its position affirms its role as a mid-tier, well-established altcoin.

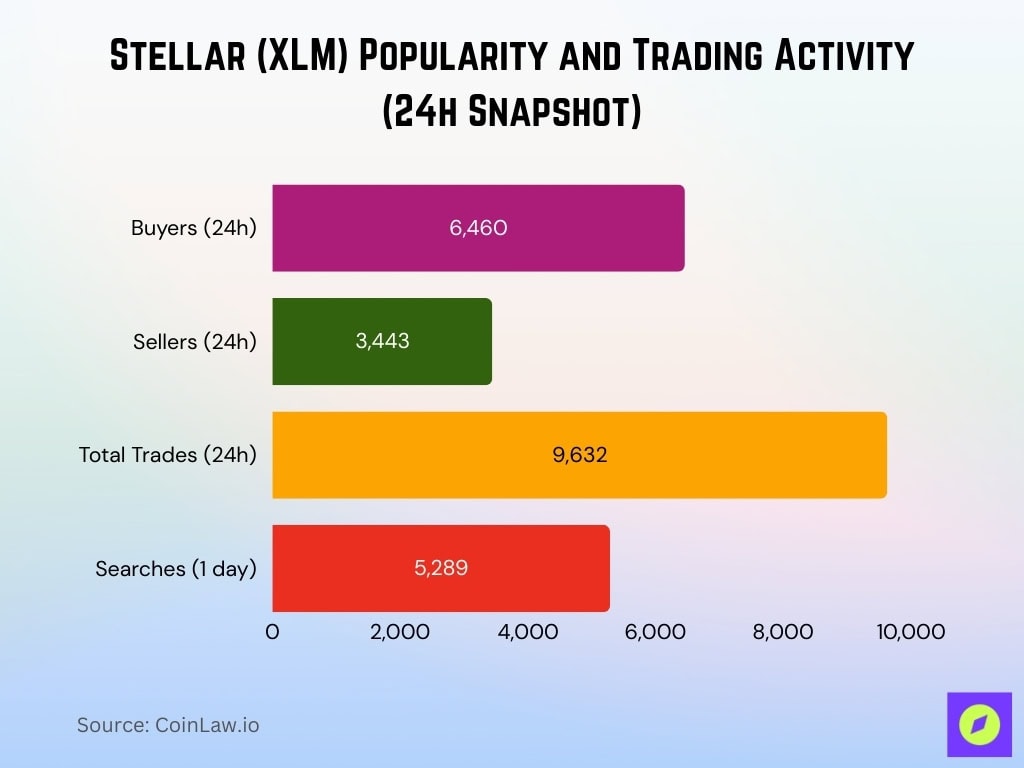

Popularity and Trading Activity

- In the last 24 hours, 6,460 buyers and 3,443 sellers, totaling 9,632 trades.

- It was searched 5,289 times in a single day on the platform.

- Coinbase lists XLM as the #5 most popular asset among its tradable offerings.

- On Coinbase, 98% of users are buying, a sign of bullish sentiment.

- Trading activity reflects active engagement and investor confidence on major exchanges.

- High search and trade volume signals both awareness and demand.

- These metrics highlight robust participation across institutional and retail segments.

Exchange Listings and Trading Pairs

- Stellar trades on 99 cryptocurrency exchanges and supports around 235 trading pairs.

- Binance Futures leads with the most active pair (XLM/USDT) and a 24-hour volume exceeding $121 million.

- MEXC Futures and Bybit Futures follow, with respective daily volumes of approximately $50 million and $39 million.

- HTX (formerly Huobi) also ranks high, handling about $32 million in daily trade activity.

- Stellar supports diverse fiat pairs on exchanges like Binance (USD, EUR, JPY, GBP, TRY, ETH) and others, such as Gate and HTX.

- Payment via stablecoins dominates, with USDT accounting for 76.5 % of trading volume, stablecoins overall at 82.7 %, and fiat at around 11.3 %.

- On Stellar’s own decentralized exchange, StellarTerm offers 39 coins and 99 trading pairs, with USDC/XLM as the most traded pair at roughly $4.8 million in 24-hour volume.

Global Price Comparison (USD, EUR, GBP, etc.)

- In USD, XLM trades around $0.3646.

- In GBP, the price is approximately £0.2726, reflecting real-time conversion variations.

- In CAD, XLM is about CA$0.5029.

- In AUD, it stands at A$0.5597.

- In INR, the token is trading at ₹32.09 per XLM.

- For PHP, the value is around ₱20.94 per XLM.

- In SGD, it’s S$0.4702, in ZAR, about R6.46.

On‑Chain and Network Statistics

- The Stellar network hosts approximately 9.75 million accounts, reflecting ongoing adoption.

- Daily ledger activity includes around 7.9 million operations, including 3.85 million payments and over 747,000 DEX trades.

- The U.S. Department of Commerce now posts quarterly GDP data on-chain via Stellar.

- As of April 2025, Stellar ranks second in supporting tokenized treasuries, holding over $470 million in assets.

- The Stellar Development Foundation projects up to $3 billion in real-world assets (RWA) on-chain by year-end.

- Earlier in 2025, Q1 reports confirmed total RWA issuance hitting $757 million.

- This growth underscores Stellar’s positioning as a hub for asset tokenization and decentralized financial infrastructure.

Social Media and Community Stats

- Globally, as of 2025, around 5.45 billion people use social media, about 67.1% of the global population, up from 4.72 billion in 2023.

- Average daily social media use is 2 hours 24 minutes, totaling roughly 17 hours weekly.

- On average, users engage across seven different platforms per month.

- Instagram’s worldwide audience grew by 25.3%, Pinterest by 23.2%, LinkedIn by 13.9%, and X (formerly Twitter) by 11.3% year-over-year.

- Social users increasingly favor video content, with 78% preferring short videos to learn about new products, and 93% of marketers planning to increase social engagement.

- While exact numbers for Stellar’s channels weren’t available, these trends suggest strong opportunities for crypto brands in community growth and outreach.

Notable Partnerships and Ecosystem Integrations

- Stellar aims to support $3 billion in tokenized real-world assets by the end of 2025 via partners like Paxos, Ondo, Etherfuse, SG Forge, alongside Franklin Templeton and WisdomTree.

- Institutional adoption is growing, Visa expanded its settlement platform to include Stellar, and Archax partnered to tokenize a money market fund from Aberdeen Asset Management on-chain.

- Cheesecake Labs, marking five years as a Stellar integration partner, has been named an official ambassador at Blockchain Rio 2025 and Meridian 2025.

- Strategic collaborations like these reinforce Stellar’s role in bridging traditional finance and blockchain ecosystems.

Conclusion

Stellar (XLM) continues to solidify its role as a practical, asset-focused blockchain. It operates across a broad network of exchanges with diverse trading pairs, offers competitive access globally, and supports robust on-chain activity with millions of daily operations. Social media trends suggest ripe opportunities for community growth, while Stellar’s partnerships, especially in tokenizing assets and integrating with financial institutions, signal strong institutional confidence. Stellar captures both the technical infrastructure and strategic relationships needed to drive adoption. Explore the full article for deeper insights into each statistic and ecosystem dynamics.