Stacks (STX) has emerged as a key Bitcoin‑layer protocol driving smart contracts and decentralized finance (DeFi) activity directly atop the Bitcoin base layer. Today, Stacks experienced notable growth across supply metrics, network usage, and DeFi engagement, while broader crypto markets shaped price trends and liquidity conditions.

Real‑world applications of Stacks include enabling Bitcoin‑native DeFi products and powering digital identity and apps secured by Bitcoin’s hash power. For builders and investors alike, understanding the latest statistical landscape of Stacks can reveal meaningful trends and risks in this evolving ecosystem. Below, explore detailed data across supply, volume, and recent developments shaping Stacks.

Editor’s Choice

- Circulating supply: ~1.82 billion STX tokens available in the market.

- Trading volume (24h): ~$9.7 million across exchanges.

- Total Value Locked (TVL): ~$119 million in DeFi contracts.

- All‑time high price: $3.86 per STX.

- All‑time low price: $0.0456 per STX.

- DeFi TVL growth H1 2025: +97.6 % in Q1 alone.

- Total STX stacked: Increased from ~452.8 M to ~511.9 M.

Recent Developments

- Chainhooks 2.0 alpha testing supported 2,400 chainhooks with stable performance.

- Chainhooks 2.0 beta featured scalable services handling high worker counts efficiently.

- Dual Stacking live enabled boosted BTC yields for holders staking both BTC and STX.

- sBTC withdrawal functionality launched on the Bitcoin mainnet on April 30 with a permissionless process.

- sBTC deposit caps filled rapidly: third cap with 2,000 BTC in three hours.

- BitGo launched institutional custody support for sBTC and STX, expanding Bitcoin DeFi access.

- Hex Trust integrated STX and sBTC custody, serving over $5 billion in assets.

Top Chains by Stablecoins Market Cap Change

- Morph led all chains with a +756% surge in stablecoin market cap, reaching $22.2 million despite its smaller base.

- Cronos followed closely, posting a +686% increase and expanding its stablecoin market to $144 million.

- Stacks recorded a strong +437% growth rate, bringing its stablecoin market cap to $5.93 million in Q1.

- Bob saw rapid expansion with a +378% rise, although its total stablecoin value remained modest at $1.04 million.

- Solana combined scale and growth, adding +146% while holding a dominant $12.5 billion in stablecoin market cap.

- Algorand achieved a +118% quarterly increase, lifting its stablecoin market to $136 million.

- zkSync posted a solid +91.9% gain, reaching $121 million in stablecoin market capitalization.

- Hedera rounded out the list with a +90.5% increase, growing its stablecoin market cap to $84.1 million.

Supply, Circulating Supply, and Inflation Metrics

- Circulating supply: ~1.82 billion STX tradable tokens.

- Total supply: ~1.82 billion STX, broadly matching circulating supply.

- Max supply: Ongoing issuance model, with no fixed hard cap.

- Approximately 1,818 M STX projected by 2050 under current issuance assumptions.

- Distribution design limits outsized influence by preventing extreme concentration among early holders.

- Stacked STX growth: Increased from ~452.8 M to ~511.9 M in H1 2025, a gain of about 13.1%.

- Inflation dynamics are moderated by stacking participation and sBTC incentives.

- Supply availability remains relatively high compared with networks that lock most tokens.

Trading Volume and Liquidity Statistics

- 24‑hour trading volume: Approximately ~$9.7 million in recent periods.

- Short‑term volume showed declines of roughly 15% during quieter trading sessions.

- STX trades actively across major centralized exchanges, including Binance, Coinbase, and KuCoin.

- Binance frequently leads STX/USDT liquidity pairs.

- Weekly volume fluctuates as traders respond to Bitcoin price movements.

- Liquidity depth supports fast execution on large exchanges, though it varies by pair.

- DeFi‑native trading volumes remain smaller compared with centralized venues.

- Lower on‑chain liquidity highlights potential upside as DeFi usage expands.

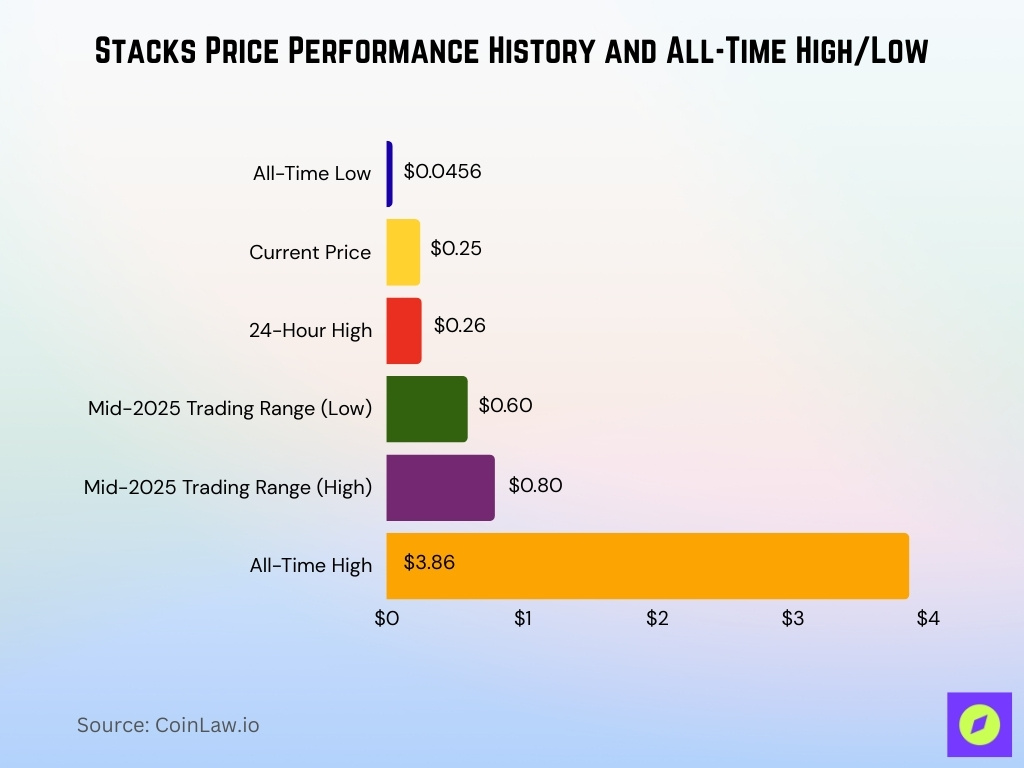

Price Performance History and All‑Time High/Low

- Current price: Roughly $0.25–$0.26 per STX toward late 2025.

- All‑time high (ATH): About $3.86 per STX during previous market cycles.

- All‑time low (ATL): Near $0.0456 per STX at historical bottoms.

- STX traded approximately 82–83% lower year over year, reflecting broader altcoin pressure.

- 24‑hour price range: Typically fluctuated between $0.25 and $0.26 in recent sessions.

- Mid‑2025 price action included periods where STX traded closer to $0.60–$0.80.

- Price movements often tracked sentiment around Bitcoin DeFi narratives.

- Market capitalization hovered near $460 million–$470 million during late‑year trading.

- Price resilience occasionally followed ecosystem upgrades and network announcements.

On-Chain Activity and Network Usage Statistics

- Total transactions increased 9.4% in Q1 and 68.4% in Q2.

- Active accounts exceeded 225,000 with 1.4 million cumulative unique wallets.

- Transaction volume surpassed 5.4 billion STX across the network.

- Bitcoin inflows reached over 5,000 BTC worth $600 million via sBTC.

- sBTC first deposit cap of 1,000 BTC filled in 72 hours.

- sBTC second cap of 3,000 BTC fully subscribed shortly after opening.

- sBTC third cap filled with 2,000 BTC in just 3 hours.

- Daily active addresses showed a 25% rise amid heightened on-chain activity.

- Network TVL hit a peak of $160 million before stabilizing at $115 million.

Stacks DeFi and TVL (Total Value Locked) Statistics

- Total Value Locked: Generally ranged between $100 million and $119 million across trackers.

- TVL surged nearly 97.6% in Q1 2025, reflecting renewed DeFi interest.

- Q2 2025 TVL growth: About 9.2%, indicating continued but slower expansion.

- Stablecoin market capitalization on Stacks remained modest, near $5.6 million.

- DeFi fee generation tracked closely with TVL trends.

- NFTs and other applications contributed a smaller share of network value.

- Cross‑chain liquidity incentives supported incremental TVL growth.

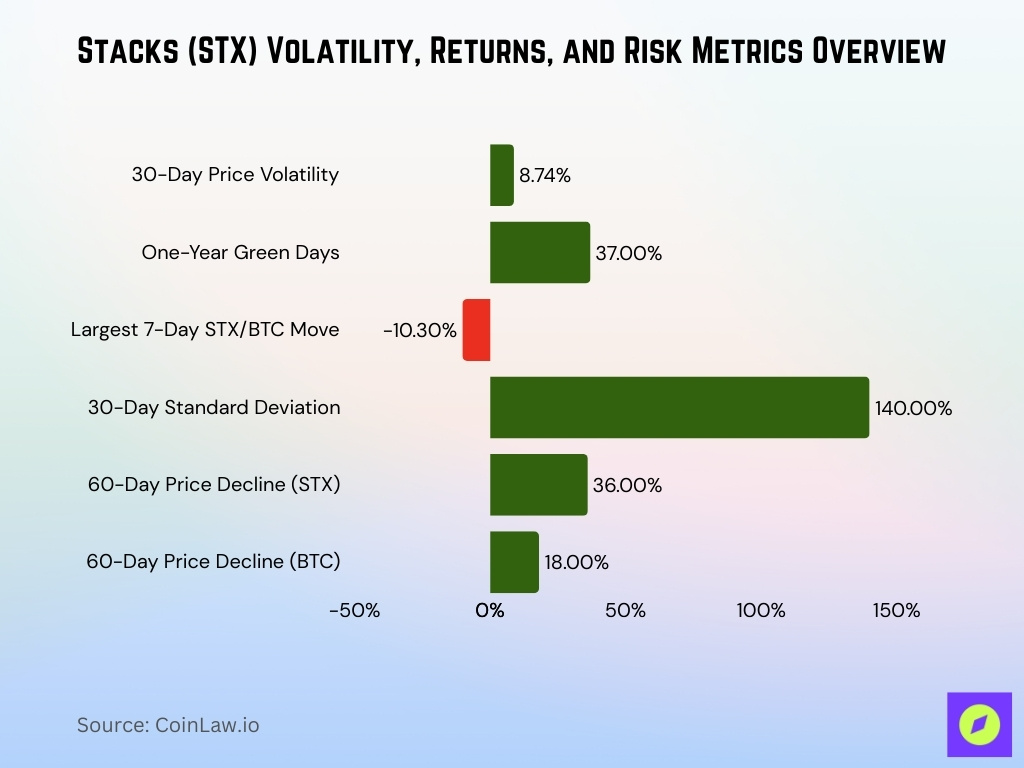

Volatility, Returns, and Risk Metrics

- STX recorded 8.74% price volatility over the last 30 days.

- STX’s one-year performance showed 37% green days amid high fluctuations.

- Seven-day STX/BTC price movement hit a 10.3% drop on the largest swing.

- STX exhibited a 140% 30-day standard deviation, reflecting elevated volatility.

- STX beta stood at 1.85 times more volatile than the Bitcoin benchmark.

- STX correlation coefficient to BTC measured 0.86, amplifying market swings.

- STX’s 60-day decline reached 36% underperforming BTC’s 18% drop.

- STX 24-hour trading volume hit $7.72 million amid liquidity shifts.

Staking, Stacking, and Yield Metrics

- Liquid stacking users earned an average of 9.29% APY on STX positions.

- StackingDAO protocol TVL surpassed 105 million STX in participation.

- Standard STX stacking delivered ~9% APY denominated in BTC rewards.

- Dual Stacking enabled up to 10x BTC yield boost with STX pairing.

- sBTC rewards program distributed BTC yields at a 7.41% APY baseline.

- PoX mechanism paid stackers approximately 10% APY over two-week cycles.

- Dual Stacking cycles began November 5 with rewards every 2 weeks.

- STX borrowing utilization hit 91.26% reflecting strong staking demand.

- STX debt ceiling increased from 2.5 million to 5 million STX.

User Adoption and Wallet/Address Statistics

- Daily active addresses declined 21.4% in Q1 and 38.1% in Q2.

- Active addresses increased 62.47% QoQ amid network recovery signals.

- Cumulative unique wallets reached 1.4 million across the ecosystem.

- WalletConnect facilitated 55.5 million unique users connecting in 2025.

- 59% of crypto wallet users preferred non-custodial self-custody options.

- Institutional wallet usage grew 51% year-over-year for STX assets.

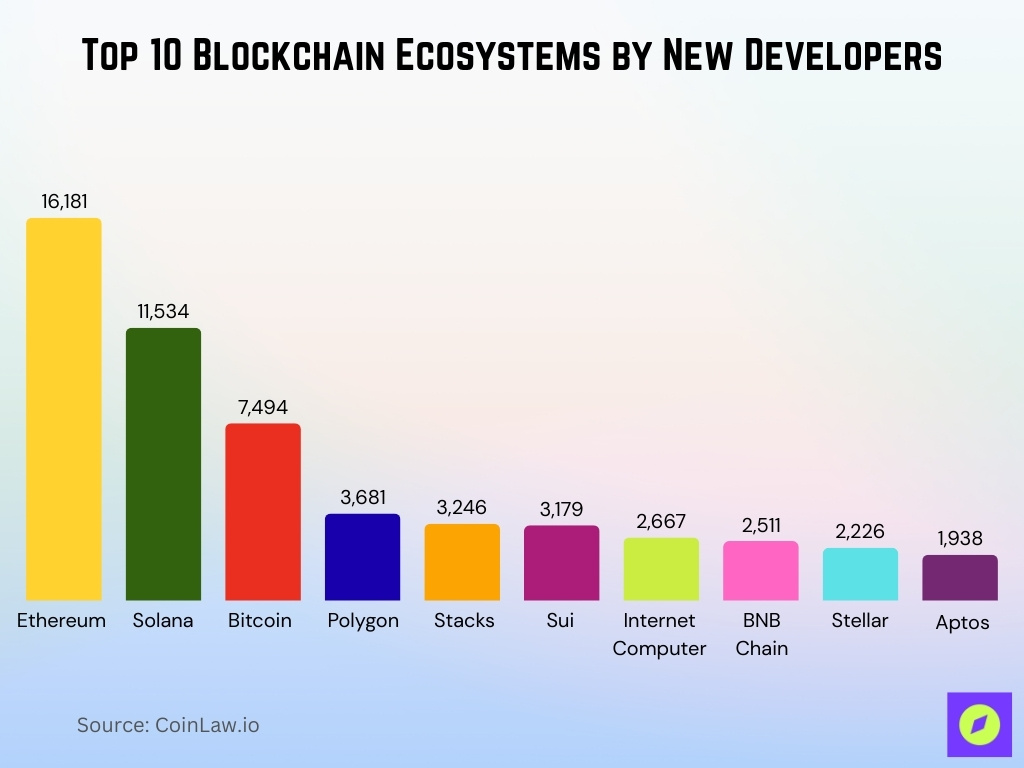

- Stacks ranked 5th in the Electric Capital 2025 Developer Report.

- Monthly transactions surpassed 1 million in peak August activity.

Top 10 Blockchain Ecosystems by New Developers

- Ethereum led all ecosystems with 16,181 new developers, reinforcing its position as the most attractive platform for builders.

- Solana ranked second, onboarding 11,534 new developers, reflecting strong momentum in high-performance blockchain development.

- Bitcoin placed third with 7,494 new developers, highlighting growing interest beyond its traditional store-of-value narrative.

- Polygon added 3,681 new developers, driven by continued adoption of scaling and Layer-2 solutions.

- Stacks attracted 3,246 new developers, showing rising demand for Bitcoin-native smart contract development.

- Sui closely followed with 3,179 new developers, indicating rapid ecosystem expansion.

- Internet Computer recorded 2,667 new developers, supported by its full-stack decentralized application model.

- BNB Chain welcomed 2,511 new developers, maintaining relevance through broad DeFi and Web3 tooling.

- Stellar onboarded 2,226 new developers, benefiting from its focus on payments and financial infrastructure.

- Aptos rounded out the top ten with 1,938 new developers, reflecting steady growth in its Move-based ecosystem.

Stacks Mining and Proof‑of‑Transfer Metrics

- Stacks relies on Proof‑of‑Transfer (PoX), where miners commit BTC to earn STX.

- PoX anchors Stacks blocks directly to the Bitcoin blockchain.

- Miner and stacker incentives are closely aligned through BTC transfers.

- STX locked for stacking grew from ~452.8 M to ~555.7 M by mid‑2025.

- Average daily stackers: Roughly 38–39 participants in stacking pools.

- Average daily miners: Around 7.8–8.1, reflecting steady block production.

- Economic incentives fluctuated alongside Bitcoin price movements.

- PoX remained central to Stacks’ security and economic design.

Token Distribution, Holdings, and Concentration Metrics

- Circulating supply reached 1.812 billion STX across markets.

- Stacking locked approximately 20% of the circulating supply, reducing float.

- Total supply capped at 1.818 billion STX with a fixed emission schedule.

- Stacks Endowment allocated 500 million STX for a five-year development fund.

- SIP-031 governance saw a 303 million STX voting participation rate.

- Exchange wallets held a notable share of 1.8 billion circulating STX supply.

- Miners received 500 STX per block post-January halving reduction.

- US whales controlled 27% of the global large holder STX concentration.

- Market cap measured $620 million at $0.3425 per STX price.

Correlation With Bitcoin and Crypto Market Benchmarks

- STX correlation coefficient to BTC measured 0.86, mirroring price movements.

- STX exhibited a 0.89 beta, amplifying Bitcoin market volatility.

- STX showed a 0.737 positive correlation with the top 10 coins by market cap.

- STX is 1.85x more volatile than the Bitcoin benchmark during swings.

- STX 0.565 correlation with top 100 coins excluding stablecoins.

- Bitcoin dominance at 58-59% influenced STX capital inflows.

- STX rose 2.39% in 24h, outperforming the broader crypto market’s 0.65%.

- STX is up 400% since Q1, tied to the Bitcoin Layer 2 narrative strength.

Analyst Ratings, Forecasts, and Price Prediction Statistics

- CoinCodex forecasts STX rising 13.84% to $0.2879 by January 2026.

- Coinfomania projects $0.634 low and $0.885 high for the year.

- InvestingHaven targets $2-3 range after $0.91 Fibonacci breakout.

- Changelly predicts $4.52 potential by 2026 with $5.64 in 2028.

- Finst bullish scenario sees STX reaching €0.2121 (+2.60%).

- Coincheckup estimates 13.75% upside to $0.3036 short-term.

- Kraken models blend technicals projecting higher late-2020s targets.

- CoinLore machine learning forecasts weekly and multi-year STX ranges.

Frequently Asked Questions (FAQs)

Stablecoins on Stacks have a market cap of around $5.56 million.

Stacks DeFi TVL fell to $96.6 million in Q1 2025, then recovered to about $108.3 million in Q2 2025.

Certain models suggest STX could reach up to about $1.72 in 2025.

Stacks DEX volume has been around $1.38 million in 24 hours.

Conclusion

Stacks (STX) reflects a maturing Bitcoin‑layer ecosystem, combining smart contract functionality with Bitcoin‑anchored security. While active address counts fluctuated, transaction growth and DeFi expansion signaled deeper engagement from committed users. Proof‑of‑Transfer continued to align miner and stacker incentives, reinforcing network security.

Token distribution remained balanced across markets, staking, and operational use, while correlation with Bitcoin shaped overall performance. Analyst forecasts pointed to potential upside driven by DeFi adoption and sBTC integration, tempered by broader crypto market cycles. As Stacks advances through its roadmap, sustained usage, liquidity growth, and Bitcoin alignment will define its long‑term trajectory.