Banking behaviors among senior citizens are shifting noticeably today. As more older adults engage with digital and traditional banking services, their habits reflect both long-standing preferences and evolving demand for convenience. In real-world terms, this trend influences how banks design retirement account tools and affects how community banks allocate resources for branch vs. online services. Dive into the statistics below to see how seniors manage deposits, choose channels, and carry out everyday banking, and what that means for institutions and policymakers alike.

Editor’s Choice

- 48.3% of U.S. banked households used mobile banking as their primary method to access accounts.

- People aged 65 and older represent 27% of online banking users in the U.S.

- Nearly 70% of adults over age 50 now use financial technology tools, including mobile banking and peer-to-peer payment apps.

- Among older adults, those aged 66+ overwhelmingly support maintaining physical bank branches (88% say banks “should be mandated” to keep more branches).

- A field experiment found that individuals aged 55+ own 55% of all U.S. households’ financial assets, highlighting the significance of seniors to overall banking wealth.

- Despite the rise of digital banking, more than half of people aged 45 and older still prefer conducting transactions at a bank or credit union.

- Among older adults, technology familiarity strongly predicts whether they continue using mobile banking, whereas technology anxiety reduces that likelihood, especially in those 70+.

Recent Developments

- In 2024, mobile finance app downloads in the U.S. rose by 3.9%, bringing total downloads to 583 million.

- A 2025 survey showed that for the first time, a majority of Baby Boomer respondents said they use mobile banking apps most often; their reliance on website-based online banking dropped (from 41% in 2024 to 35% in 2025).

- Over 2 in 5 Americans now use fintech platforms in 2025.

- Roughly 83% of consumers report a traditional bank as their primary financial institution.

- Digital banking overall, including online and mobile, remains the preferred method for many Americans.

- Older adults often face age-linked obstacles in digital banking, prompting increased research into inclusive service design.

- As digital finance expands, seniors face new exposure to cybersecurity and fraud risks, encouraging a focus on education and security habits.

Senior Citizens’ Share of Deposits and Wealth

- Individuals aged 55+ hold 73% of all U.S. wealth in 2025.

- Americans aged 70+ control a record 32% of total household wealth.

- Households aged 55-64 have a median net worth of $364,260, rising to $410,000 for 65-74.

- 70% of those aged 55-64 own tax-preferred retirement accounts like 401(k)s or IRAs.

- 57% of 55-64 households hold retirement savings averaging $185,000.

- 62% of adults 50-64 maintain retirement savings accounts.

- 79% of households 65+ own homes, often 50%+ of their net worth.

- Baby Boomers (61-79) show 72% prioritizing retirement savings in 2025.

- Households 75+ average $1.62 million net worth, 55% above the national average.

Preferred Banking Channels for Seniors

- Around 48.3% of U.S. banked households use mobile banking as their primary access method, including a growing share of older adults.

- Among Baby Boomers, 38% now say mobile banking apps are their most used channel.

- Website-based banking declined to 35% among Baby Boomers in 2025.

- About 1 in 8 Baby Boomers say visiting a branch remains their most frequent method.

- More than half of adults 55+ say they prefer in-person or branch-based banking, even though only about 16–20% actually use branches as their most frequent channel.

- Most adults 65+ believe banks should retain more physical branches.

- Fintech usage, now over 40% nationally, may shift future channel preference trends.

- Tech-savvy seniors are gradually shifting toward mobile-first banking experiences.

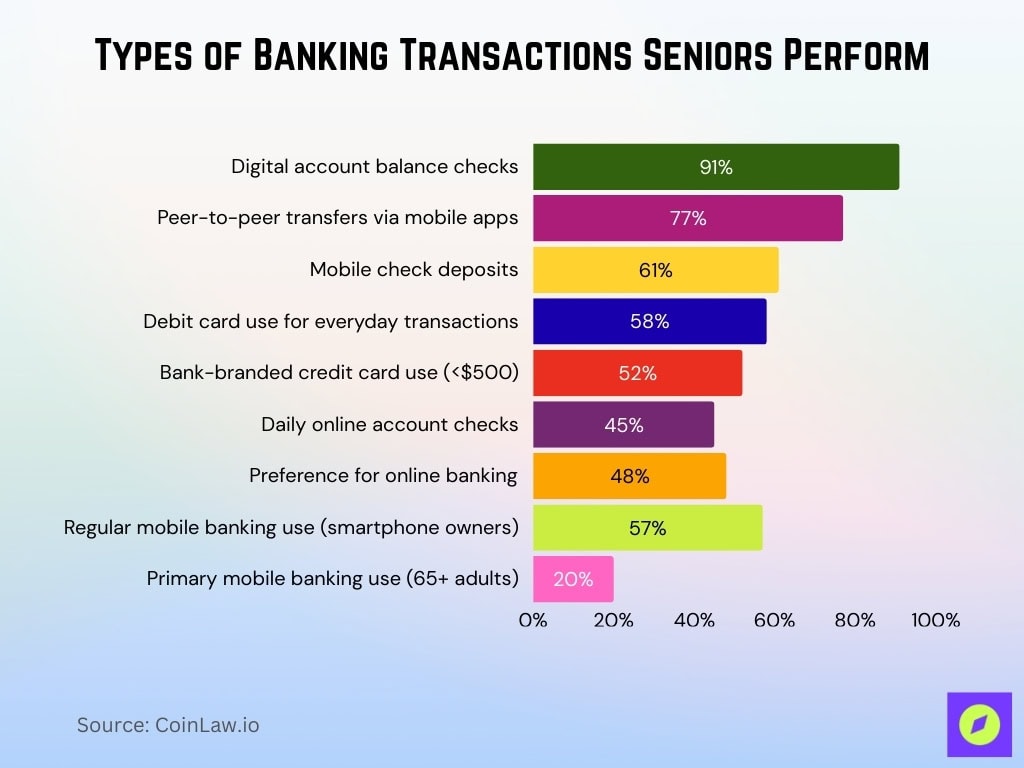

Types of Banking Transactions Seniors Perform

- 91% of seniors perform account balance checks digitally.

- 77% of older adults complete peer-to-peer transfers via mobile apps.

- 61% use mobile check deposits for routine banking in 2025.

- 58% of Baby Boomers prefer debit cards for everyday transactions.

- 52% of Boomers use bank-branded credit cards for purchases under $500.

- 45% of Baby Boomers check their financial accounts daily online.

- 48% of Boomers favor online banking over in-person visits.

- 57% of smartphone-owning seniors access mobile banking regularly.

- 20% primary mobile banking usage among adults 65+ in 2025.

Adoption of Digital and Mobile Banking by Seniors

- 77% of adults 50+ use fintech for bank balance checks.

- 70% of adults 50+ report using fintech services in 2025.

- 28.2% of adults 65+ primarily use online banking.

- 15.3% of seniors 65+ rely mainly on mobile banking.

- 42% of Baby Boomers adopt fintech regularly in 2025.

- 30% of Baby Boomers primarily use mobile banking apps.

- 79% of Baby Boomers engage with online banking platforms.

- 43% of adults 55+ use online banking as their primary method.

- 22% growth in fintech use among retirees 65+ YoY.

Barriers to Digital Banking Adoption for Seniors

- 51% of older adults cite hacking fears as the primary barrier.

- 49% of seniors express malware concerns hindering adoption.

- 26% of adults 65+ are aware of two-factor authentication.

- 74% 2FA awareness gap exists between seniors and youth.

- Technological complexity ranks top barrier for digital banking.

- Security concerns deter 63% of older adults from using apps.

- Physical decline affects digital interface navigation for seniors.

- Technology anxiety is strongest among adults 70+.

- 42% lower security readiness in the 65+ cohort vs. the young.

Motivations and Enablers for Seniors Using Digital Banking

- Convenience ranks as the top motivator for seniors’ digital banking adoption.

- Accessibility drives user-friendly interfaces, boosting older adults’ engagement.

- Social influence from family increases digital banking willingness by 45%.

- Desire for independence motivates 65% of mobility-limited seniors.

- Time saving is cited by 68% as a key enabler for elderly fintech use.

- Ease of use enables 72% of seniors to adopt mobile services.

- Family support boosts adoption rates by 35% among older adults.

- Peer recommendations enhance perceived usefulness for 65+ users.

- The pandemic experience increased digital tool adoption by 52% in seniors.

Trust and Security Perceptions Among Senior Banking Customers

- 51% of seniors cite hacking fears as the top security concern.

- 49% of older adults worry about malware in digital banking.

- 10% of senior bankers view online transactions as insecure.

- 26% of adults 65+ know 2FA security features.

- 74% security awareness gap separates seniors from younger users.

- 63% deterred by perceived online risks in banking apps.

- 61% of threat-exposed seniors resolve issues independently.

- 72% of senior management prioritize cybersecurity highly.

- 85% of online seniors spend 6+ hours daily on devices.

Frequency of Banking Activities Among Older Adults

- 91% of U.S. consumers use mobile banking apps to check balances.

- 62% use mobile apps to transfer money between accounts, 54% deposit checks, and 46% complete other transfers.

- About 70% of adults over 50 now use fintech tools, indicating rising engagement with digital banking.

- Adults 65+ show regular digital usage, though many 70+ report technology anxiety that limits frequency.

- Seniors with strong technology familiarity use mobile banking more consistently.

- Digital banking adoption continues to surge across age groups.

- Many older adults still rely on in-person services, maintaining meaningful in-branch transaction frequency.

- Seniors, who hold a large share of assets, may complete fewer but higher-value transactions.

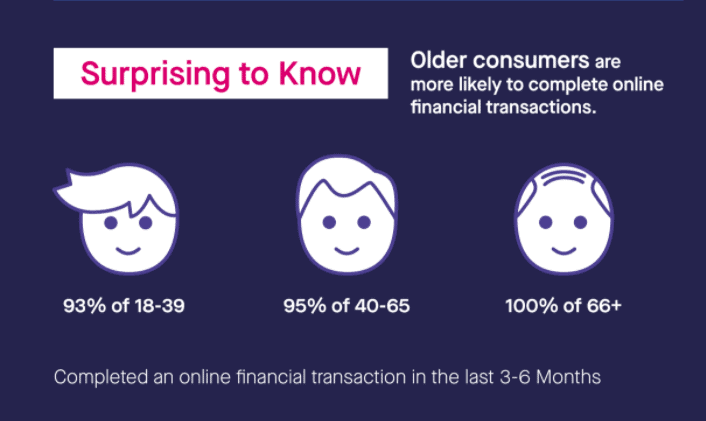

Older Adults Are Leading in Online Financial Transactions

- 100% of adults aged 66+ completed an online financial transaction in the past 3–6 months, making them the most active age group digitally.

- 95% of individuals aged 40–65 also reported completing online transactions, showing strong adoption among middle-aged users.

- 93% of adults aged 18–39 completed online financial transactions, slightly lower than older groups, defying typical digital-native assumptions.

- Contrary to common belief, older consumers are more likely to perform online banking activities than younger users.

- This trend highlights a significant shift in senior digital engagement, suggesting banks should not underestimate tech-savvy behavior in the 66+ age group.

Fraud, Scams, and Financial Exploitation Targeting Seniors

- Adults 65+ lost $12.5 billion to scams in 2024, up 25% YoY.

- Seniors 60+ suffered $3.4 billion in identity theft losses in 2023.

- 101,000+ seniors victimized by financial fraud, $3.4 billion total losses.

- Imposter scams cost older adults $700 million in 2024.

- Adults 60+ represent 24% of identity theft claims but 41% losses.

- 1 in 10 seniors falls victim to fraud annually.

- Median loss for 80+ hit $1,450 from scams in 2023.

- $27 billion annual elder financial abuse losses estimated.

- 362% rise in $10K+ imposter scam reports from seniors since 2020.

In Branch Banking Behavior and Service Expectations

- 48% of adults 55-64 prefer in-person banking over digital channels.

- 48% of seniors 65+ choose branch visits for banking needs.

- 85% of adults 50+ favor physical banks for deposits and withdrawals.

- 26% of older adults visit branches for known teller interactions.

- 24% of seniors value social interaction at bank branches.

- 16% of Baby Boomers regularly visit physical branches.

- 18% of consumers still prefer face-to-face branch banking.

- 64% of Boomers 55+ rate human interaction as very important.

- 53% of Baby Boomers prefer bank tellers over ATMs.

How Consumers Want Banks to Serve Them in the Future

- 79% of consumers want their banks to offer more all-digital processes, making this the top future service preference.

- 47% prefer drive-thru and touchless banking options for safer, more convenient access to banking services.

- Only 26% still prefer in-person banking, even with enhanced safety measures in place.

- These figures highlight a clear shift toward digital-first banking, with physical branches taking a backseat in consumer expectations.

Seniors’ Loyalty to Primary Banks and Switching Behavior

- Baby Boomers show 70.9% trust in the primary bank brand reputation.

- 75% of seniors 60+ are unlikely to switch banks next year.

- 50% of Baby Boomers maintain accounts for over 15 years.

- 83.1% retention rate at community banks serving seniors.

- 17% overall consumers are likely to change banks in 2025.

- 89.2% retention among Japanese seniors at traditional banks.

- 64% of Boomers 55+ value human interaction for loyalty.

- 86.7% retention rate at credit unions is popular with seniors.

- 8.2 years average customer tenure at U.S. retail banks.

Savings Patterns and Retirement Income Management Among Seniors

- The median retirement income for U.S. households age 65+ is $56,680 per year.

- The average retirement income for that group is $87,260.

- 78% of retirees receive Social Security, and 91% of retirees age 65+ depend on it.

- 56% of retirees have income from a pension, 50% have interest or dividends, and 32% receive labor income.

- Over half of non-retired adults expect Social Security to cover necessary retirement expenses.

- Median retirement savings around $200,000 limit long-term income flexibility.

- Only 46% of adults have three months of emergency savings in 2025.

- Many seniors remain financially fragile if unexpected expenses arise.

Use of Credit Cards, Loans, and Other Credit Products by Seniors

- Baby Boomers average $6,795 in credit card debt in 2025.

- 47% of adults 50+ with debt use credit cards for living expenses.

- 17% of seniors rely on credit cards monthly for basics.

- 78% of adults over 50 carry debt into retirement in 2025.

- Silent Generation averages $5,649 in credit card debt on fixed incomes.

- $9,600 average credit card balance for ages 45-60 in 2025.

- 37% of older adults report increased credit card debt YoY.

- 32.2% of 65-74 year olds hold mortgage debt in 2022.

- $82,030 average debt for singles 55+ without children.

Investment and Wealth Management Behavior in Later Life

- 41% of adults 65+ receive retirement income from pensions, IRAs, or 401(k)s.

- Median retirement savings for 65-74 stands at $200,000 in 2025.

- 55-64 year olds hold median savings of $185,000 in retirement accounts.

- $45.8 trillion total U.S. retirement assets as of Q2 2025.

- 49.2% financial literacy rate among seniors 55+ limits investments.

- 78% of retired Americans rely on Social Security for expenses.

- $56,680 median income for U.S. households 65+ annually.

- $1.6 million average savings among wealthy retirees in 2025.

- $609,230 median savings for ages 65-74 per Federal Reserve data.

Financial Literacy Levels Among Older Adults

- U.S. adults average 49% correct on financial literacy questions.

- Only 48% answered more than half of the questions correctly.

- Risk comprehension is lowest, at 36% correct.

- Baby Boomers and the Silent Generation average 55% correct.

- Nearly half of older adults struggle with essential financial concepts.

- Men average 53% correct vs. women at 45%.

- Low literacy correlates with financial fragility.

- Retirement fluency remains low for many older Americans.

Impact of Financial Literacy on Senior Financial Behavior

- Seniors 55+ show a 49.2% financial literacy rate in 2025.

- Boomers 61+ average 55% on financial literacy assessments.

- Low literacy adults are twice as likely to be debt-constrained.

- Very low literacy triples financial fragility risk vs. high literacy.

- 36% average score on risk comprehension among all adults.

- Financially literate seniors are 35% more likely to maintain positive credit.

- 49% U.S. adults correctly answer financial index questions.

- 37% correct on retirement fluency questions among seniors.

- Higher literacy correlates with better retirement planning behaviors.

Accessibility and Usability of Banking Services for Seniors

- 78% of seniors face technology discomfort when using online banking.

- 71% of U.S. adults prefer mobile/online banking over branches.

- User-friendly interfaces boost senior digital banking satisfaction.

- 57% of disabled seniors prioritize website accessibility.

- Voice recognition features enhance senior banking accessibility.

- Simplified menus reduce financial exclusion for seniors.

- 27 million 60+ households struggle with basic living costs.

Frequently Asked Questions (FAQs)

About 43% of U.S. adults age 65 and older have adopted mobile banking as of recent surveys.

55% of U.S. bank customers used mobile banking apps as their top method for managing their accounts.

Over 2 in 5 Americans (~42%+) now use a non‑traditional digital banking provider.

Conclusion

Senior citizens in the U.S. continue to rely heavily on a mix of Social Security, pensions, savings, and modest investment income to meet retirement needs. At the same time, nearly half carry credit card debt or loans, often used to cover basic living costs, while many maintain limited retirement savings and emergency funds. Low financial literacy remains widespread among older adults, constraining their ability to navigate investments, credit, and long-term retirement planning with confidence.

As a result, many seniors adopt conservative wealth management and banking behaviors, favoring accessible, low-cost banking services, maintaining liquidity, and managing debt cautiously. For banks, policymakers, and financial education providers, this reality highlights the urgency of expanding accessible, senior-friendly banking services and targeted education programs aimed at enhancing financial security and quality of life in later years.