In 2009, when Bitcoin quietly entered the world, few could predict it would ignite a financial revolution. Fast forward to today, crypto assets are at the center of a regulatory tug-of-war between two of the most powerful financial watchdogs in the United States: the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

This clash isn’t about ego. It’s about ensuring investor protection, fostering innovation, and maintaining the integrity of financial markets. Understanding the current state of SEC and CFTC regulations on cryptocurrencies has never been more important. Whether you’re a retail investor, a blockchain startup founder, or an institutional player, the rules of the game are changing fast.

Editor’s Choice

- As of 2025, the SEC classifies roughly 70–80% of ICOs and token sales as securities under the Securities Act of 1933.

- As of Q1 2025, approximately 71% of U.S.-based crypto exchanges are under active SEC or CFTC investigation.

- SEC actions resulted in $2.6 billion in investor restitution and penalties, the highest on record for crypto-related cases.

- The CFTC’s whistleblower program awarded over $42 million with crypto tips, accounting for about 28% of submissions.

- SEC crypto enforcement comprised 33 cryptocurrency‑related actions, a 30% decline from 47 actions.

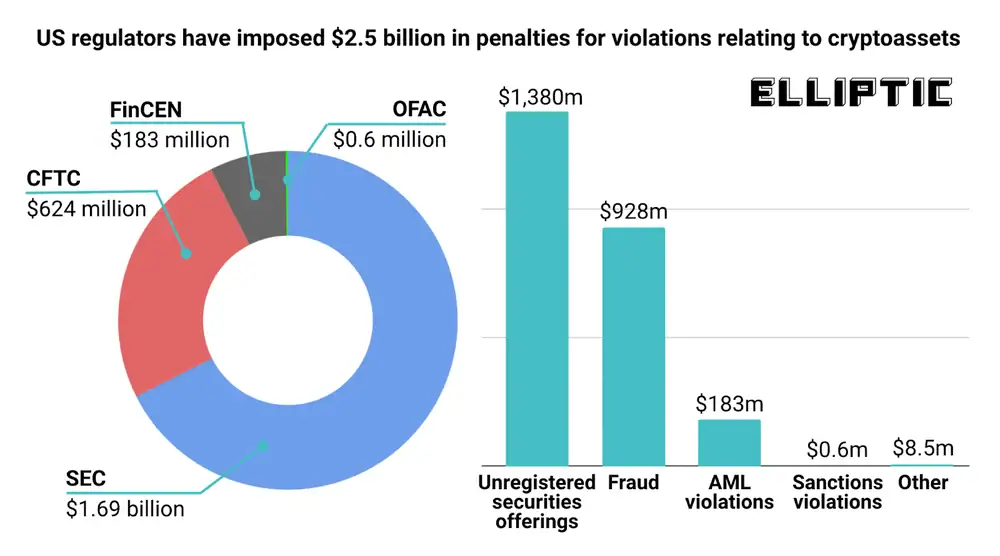

US Crypto Enforcement: Key Penalties and Violation Breakdown

- $2.5 billion in total crypto-related penalties have been imposed by US regulators.

- The SEC led enforcement with $1.69 billion in fines, followed by the CFTC with $624 million.

- FinCEN issued $183 million in penalties, while OFAC imposed just $0.6 million.

- The largest violation category was unregistered securities offerings, totaling $1.38 billion in fines.

- Fraud cases accounted for $928 million, making it the second-largest penalty source.

- AML violations resulted in $183 million in fines across multiple agencies.

- Sanctions-related breaches led to just $0.6 million in penalties, while other violations totaled $8.5 million.

Overview of SEC and CFTC Roles in Cryptocurrency Regulation

- CFTC-regulated platforms cleared over $9.8 billion in Bitcoin and Ether derivatives, a 22% YoY increase.

- About 58% of SEC crypto enforcement actions targeted alleged unregistered securities, up from the low 50% range

- LabCFTC engaged with over 250 blockchain startups, with roughly 60–65% of contacts

- SEC FinHub and related teams held around 45–50 crypto outreach events in 2025.

- Joint SEC–CFTC initiatives conducted at least 27 coordinated investigations, a 35% rise.

- The pending DCCPA in Q1 2025 would give the CFTC authority over crypto commodities like Bitcoin and Ethereum, which make up over 60% of the market cap.

- CFTC-regulated exchanges cleared roughly $9.8 billion in crypto derivatives, representing 30–35% of regulated volume.

- The SEC applied the Howey Test in about 75–80% of crypto enforcement actions, with 79% explicitly citing Howey factors.

Enforcement Penalties and Fines Issued by SEC and CFTC

- The CFTC obtained roughly $2.6 billion in civil monetary penalties, contributing to more than $17.1 billion in total monetary relief across markets.

- Combined SEC and CFTC crypto fines totaled over $4.3 billion, with 60% imposed alone.

- The largest single crypto penalty exceeded $400–450 million, from an SEC action against a DeFi platform.

- CFTC enforcement produced roughly $300 million in penalties against major crypto derivatives exchanges

- Crypto fraud cases accounted for about 60–65% of SEC penalties, with the remainder from registration and disclosure violations.

- Whistleblower awards from the SEC and CFTC surpassed $20–25 million, with digital-asset cases growing in share.

- By Q1 2025, about $750 million in investor restitution orders had been fulfilled through SEC settlements.

- At least three US-focused crypto firms each paid over $100 million to resolve CFTC enforcement actions.

SEC Enforcement Actions Related to Cryptocurrencies

- The SEC brought 33 cryptocurrency-related enforcement actions, a 30% decline from 47 actions.

- Roughly 60% of SEC crypto cases included allegations of unregistered securities offerings, while fraud claims remained the most common allegation overall.

- SEC crypto matters generated about $2.6 billion in combined disgorgement and civil penalties, roughly 20–25% higher than.

- The SEC’s Crypto Assets and Cyber Unit expanded staffing by around 20%, bringing the team to roughly 50 dedicated professionals.

- A major DeFi lending platform case concluded in Q4 with more than $120 million in penalties and monetary relief imposed on the project and its principals.

- The SEC whistleblower program received approximately 24,980–25,000 tips with an estimated 180–200 (about 1%) specifically tied to crypto misconduct.

- Around 40–45% of SEC crypto enforcement actions were settled without trial, most resolved through consent orders and agreed monetary sanctions.

- Roughly 80–85% of token issuers named in SEC crypto cases failed to register offerings or seek valid exemptions under federal securities laws.

- By January 2025, the SEC had obtained injunctions, or asset freezes, in at least 31 crypto-related cases to protect investor assets during ongoing litigation.

Trends in Investor Protection and Fraud Prevention

- Investor complaints on crypto assets rose by 20–22% with the SEC logging nearly 30,000 total complaints.

- About 43% of SEC-prosecuted fraud cases involved deceptive marketing promising guaranteed or outsized crypto returns.

- SEC restitution programs returned roughly $350 million to harmed investors, a 15% increase.

- Ponzi and pyramid schemes represented roughly 25–30% of CFTC crypto fraud enforcement actions.

- CFTC initiatives supported over 1,000–1,100 outreach events targeting retail investors and vulnerable groups.

- The SEC investigated more than 15–20 major crypto hacks, recovering over $100–120 million in stolen assets.

- Regulators proposed or advanced about 10–12 new rules on investor disclosures, transparency, and cybersecurity.

Cross-Border Regulatory Cooperation and Joint Enforcement Actions

- The SEC and CFTC opened 27 joint investigations with foreign regulators, a 35% increase.

- Interpol and Europol assisted the CFTC in 8 major cross-border crypto fraud enforcement actions.

- The SEC entered into 14 new information-sharing arrangements with international securities regulators to streamline cross-border compliance reviews.

- Roughly $1.1 billion in seized crypto assets was repatriated to US investors from foreign jurisdictions via joint enforcement efforts.

- The Financial Stability Board issued global crypto regulatory guidance co-signed by both the SEC and CFTC, covering activities representing over 70% of global crypto exposure.

- Joint SEC–CFTC task forces targeting unlicensed offshore exchanges led to 12 platform shutdowns, affecting approximately 250,000 US investors.

- The CFTC worked with the UK Financial Conduct Authority in about 5 investigations into suspected crypto derivatives market manipulation.

- IOSCO’s 2025 work program explicitly includes crypto risk mitigation, with direct participation from SEC and CFTC representatives across at least 20 key jurisdictions.

- Cross-border enforcement actions by the SEC and CFTC yielded about $600 million in collective penalties against foreign-based crypto entities.

- Loint crypto regulatory training programs with counterparts from 20 countries, emphasized blockchain analytics and forensic accounting techniques.

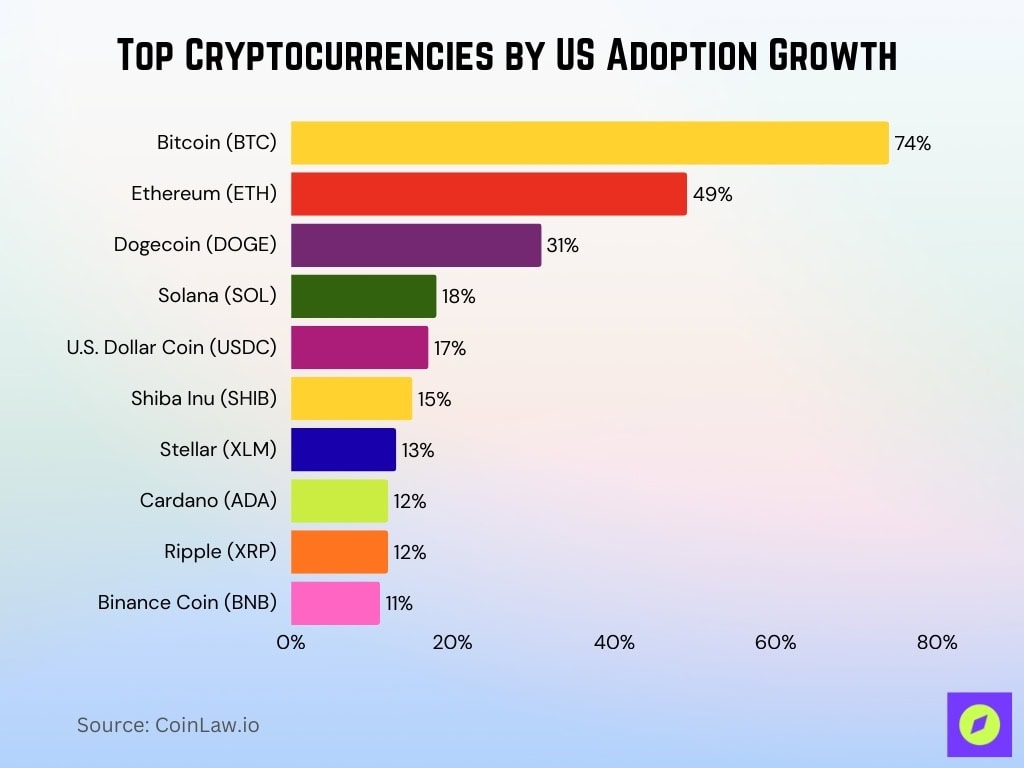

Top Cryptocurrencies by US Adoption Growth

- Bitcoin (BTC) remains the most adopted crypto, with 74% of users reporting usage or interest.

- Ethereum (ETH) follows with a strong 49% adoption rate, solidifying its place as the top smart contract platform.

- Dogecoin (DOGE) saw surprising momentum, reaching 31% adoption, outperforming many altcoins.

- Solana (SOL) rose to 18%, reflecting increased interest in high-speed DeFi and NFT use cases.

- U.S. Dollar Coin (USDC) hit 17%, showing growing trust in regulated stablecoins.

- Shiba Inu (SHIB) secured 15%, riding meme coin popularity with consistent traction.

- Stellar (XLM) reached 13%, backed by remittance and cross-border payment utility.

- Cardano (ADA) and Ripple (XRP) both stood at 12%, showing steady ecosystem engagement.

- Binance Coin (BNB) rounded out the list at 11%, driven by Binance ecosystem integration.

Recent Developments in SEC and CFTC Cryptocurrency Regulations

- SEC’s proposed Rule 223-1 affects advisers with over $100 million in digital assets, requiring custody safeguards and proof-of-reserves.

- CFTC’s 2025 digital asset pilot targets crypto derivatives platforms handling tens of billions of dollars in notional volume.

- Mid-2025 SEC guidance clarified that only certain centralized or bundled staking services are securities, excluding some liquid/protocol-level staking.

- The Digital Commodities Consumer Protection Act could give CFTC oversight of crypto commodities, representing over 60% the global market cap.

- Updated Regulation S guidance now covers crypto token sales to foreign investors, affecting hundreds of millions of dollars in annual offerings.

- CFTC mandates near real-time reporting for crypto derivatives covering $10–15 billion in daily notional trading.

- SEC alerts warn that 20–30% of NFT fundraising schemes may qualify as investment contracts due to fractionalized or revenue-sharing NFTs.

- Rule 223-1 requires crypto custodians to implement enhanced audit and cybersecurity standards, including annual independent attestation by Q3 2025.

- CFTC supported the first regulated DEX concepts in early 2025, opening on-chain derivatives to thousands of US institutional users.

- Draft SEC–CFTC guidance for stablecoin reserves emphasizes daily reporting, quarterly third-party audits, and 100% liability coverage with high-quality liquid assets.

Frequently Asked Questions (FAQs)

Roughly 80–85% of token issuers named in SEC crypto enforcement actions were cited for failing to register offerings or seek valid exemptions under federal securities laws.

Digital-asset cases accounted for almost 50% of the CFTC’s enforcement docket in the most recent fiscal year, with related actions helping drive more than $17 billion in total monetary relief.

By early 2025, the CFTC’s Digital Commodities Enforcement Program had generated about $2.3 billion in fines and penalties tied to digital-asset cases.

Conclusion

As cryptocurrencies mature, the SEC and CFTC are tightening the regulatory web to protect investors and stabilize markets. Their increased enforcement, expanded oversight, and cross-border cooperation are reshaping the industry landscape. While challenges remain, particularly regarding jurisdictional clarity and innovative product regulation, this year marks a turning point toward a more structured and transparent regulatory environment. For investors and crypto projects alike, understanding these regulations isn’t just good practice; it’s essential for long-term success.