The stablecoin landscape today is evolving rapidly, and one newcomer that is commanding industry attention is Ripple USD (RLUSD). Specifically, backed 1:1 by U.S. dollars and designed for institutional use, RLUSD is already influencing cross-border payments and corporate treasury operations. For instance, a multinational currently leverages RLUSD to settle international invoices without foreign-exchange friction. Similarly, a fintech startup uses RLUSD to manage USD liquidity on the XRP Ledger for faster settlements. Consequently, read on for an in-depth look at RLUSD, including its launch history, exchange listings, and price performance.

Editor’s Choice

- Year-to-date, RLUSD posted a growth rate of around 1,278% in market capitalization.

- Launched in December 2024, RLUSD already ranks among the top 10 USD-pegged stablecoins by market cap.

- As of mid-2025, the total stablecoin market cap stood at $246 billion, and the Ethereum network holds approximately 70% of the stablecoin supply.

- RLUSD’s circulating supply surpassed $500 million within seven months of launch (July 2025).

- RLUSD supports issuance on both the XRP Ledger and the Ethereum.

- Institutional adoption and humanitarian partnerships are cited as key drivers of RLUSD’s rapid growth.

Recent Developments

- The token’s YTD growth of approximately 1,278% places it among the fastest-growing stablecoins in 2025.

- Circulating supply hit over $500 million by July 2025, only seven months post-launch.

- RLUSD daily trading volume ranged from $26 million in July to peaks of $174 million in November, averaging $64 million–$75 million in late 2025.

- The firm behind RLUSD, Ripple Labs, applied for a U.S. national bank charter in mid-2025, signaling deeper regulatory ambitions.

- Network integration, RLUSD supports both Ethereum and XRP Ledger infrastructures.

- Partnerships and institutional use-cases cited as catalysts for RLUSD growth beyond retail trades.

RLUSD Key On-Chain Statistics

- RLUSD’s Total Value reached $1.02 billion, reflecting a +29.51% increase over the past 30 days.

- Monthly Transfer Volume hit $5.05 billion, despite a slight 2.29% decline from the previous month.

- The stablecoin now counts 38,166 holders, up 3.14% over the last 30 days.

- Monthly Active Addresses stand at 4,642, showing a 3.73% rise in network engagement.

- RLUSD maintains 0 RWA assets, confirming its supply remains fully USD-backed.

- Tokenized Asset Value climbed steadily from near $0 in Sept 2024 to almost $1.2 billion by Nov 2025.

- Growth accelerated sharply between May and Sept 2025, rising from roughly $600 million to over $900 million.

- The RLUSD curve now approaches the $1.1–$1.2 billion range, marking its largest historical valuation to date.

RLUSD Launch Date and History

- RLUSD officially launched on December 18, 2024.

- RLUSD reached over $500 million in circulating supply within 7 months of launch.

- Issued by Ripple Labs through custodian Standard Custody & Trust Company, LLC.

- RLUSD maintains a strict USD-backed 1:1 peg for redemption.

- Designed for cross-border payments and enterprise liquidity solutions.

- RLUSD tokens operate on both XRP Ledger and Ethereum, ensuring interoperability.

- Launch coincided with heightened regulatory scrutiny of stablecoins and the GENIUS Act’s passage in December 2024.

- Within three months, RLUSD saw over 20 institutional partners integrate its liquidity solutions.

- By mid-2025, RLUSD processed more than 2 million transactions across supported networks.

- RLUSD adoption was propelled by major banking and fintech pilots during Q1 2025.

Exchange Listings

- RLUSD had a market cap of approximately $1.15 billion as of late 2025.

- RLUSD ranked about #60 among all cryptocurrencies by market cap as of November 2025.

- The 24-hour trading volume of RLUSD was around $64 million in late 2025.

- Circulating supply stood at approximately 1.2 billion tokens nearing year-end 2025.

- RLUSD trading pairs include XRP/RLUSD, RLUSD/USDC, BTC/RLUSD, and ETH/RLUSD on major platforms like Bitget and Uniswap.

- RLUSD is listed on both centralized and decentralized exchanges due to its dual Ethereum and XRP Ledger deployment.

- This dual-chain strategy supports institutional and retail liquidity and accessibility.

- RLUSD reached top 10 USD-pegged stablecoin status in under one year post-launch.

- Daily trading volumes for RLUSD reached up to $136 million, comparable to stablecoins PayPal USD and Dai.

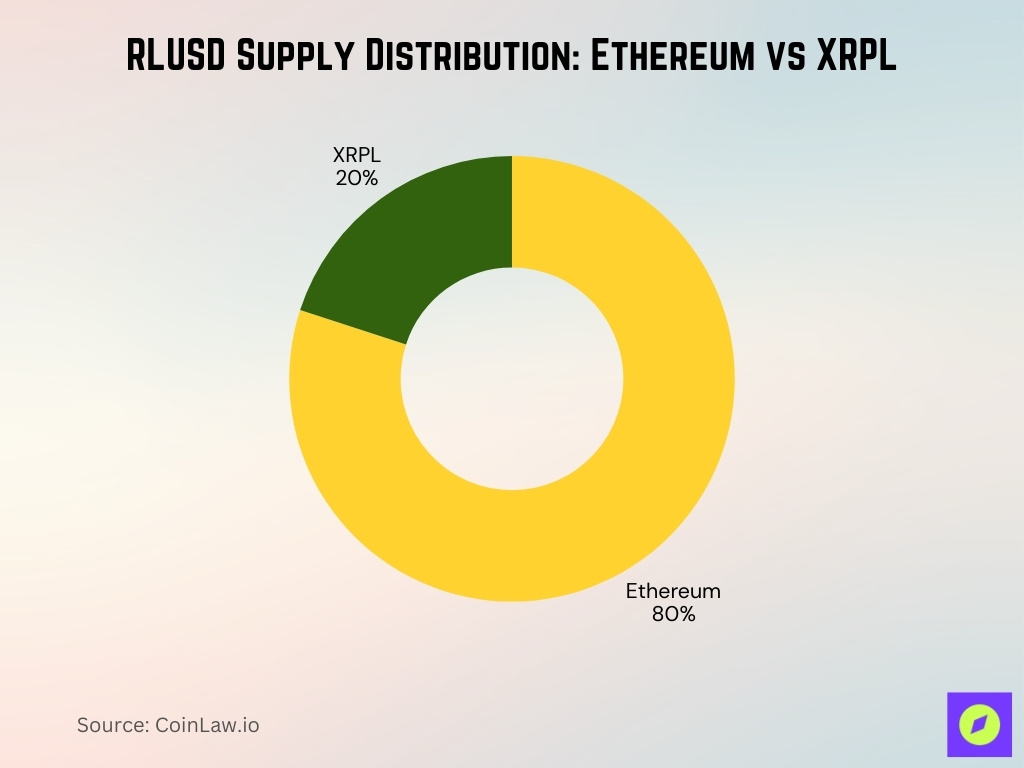

- Ethereum-based RLUSD accounts for approximately 80% of the supply, with XRP Ledger-based RLUSD at 20%.

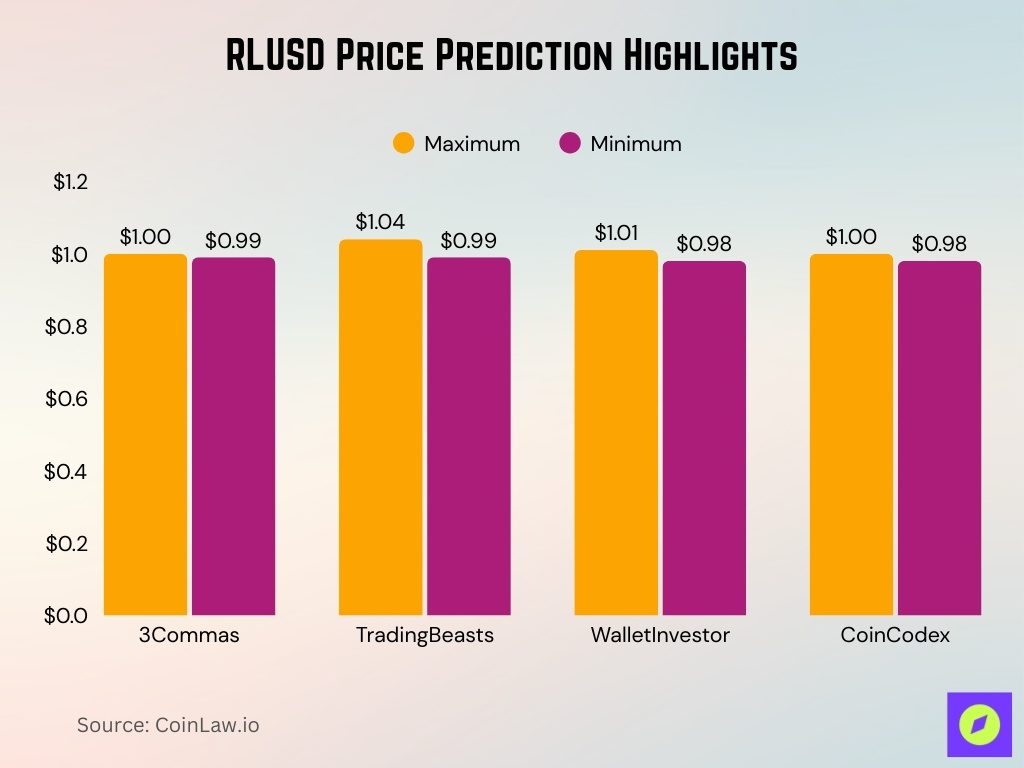

RLUSD Price Prediction Highlights

- 3Commas forecasts a narrow range between $1.00 and $0.99, indicating a highly stable USD peg with minimal volatility.

- TradingBeasts projects a maximum of $1.04 and a minimum of $0.99, supporting expectations of consistent near-$1 pricing.

- WalletInvestor estimates a maximum of $1.01 and a minimum of $0.98, highlighting very low volatility and continued peg reliability.

- CoinCodex predicts values between $1.00 and $0.98, portraying RLUSD as stable and broadly aligned with standard USD fluctuations.

Adoption and User Growth

- The Ripple USD (RLUSD) stablecoin’s circulating supply rose by ~47% in June 2025, jumping to approximately $455 million.

- On-chain data show that 85% of RLUSD supply resides on the Ethereum network, with the remainder on the XRP Ledger (XRPL).

- RLUSD, originally aimed at institutions, is also gaining retail traction via self-custody wallets and platforms.

- By November 2025, there were 38,166 RLUSD holders recorded on public data.

- Regional expansion, RLUSD added institutional access in Africa through three new partnerships as of September 2025.

- Year-to-date growth in market cap, RLUSD’s increase of ~1,278% by November 2025.

Reserve Composition and Transparency

- RLUSD is backed 1:1 by U.S. cash, Treasury bills, and equivalent liquid assets, supporting strong price stability.

- By November 20, 2025, the circulating supply reached $1,141.6 million, while reserves totaled $1,191.7 million, preserving a reliable buffer.

- The stablecoin functions under NYDFS supervision via a trust company charter, providing a solid regulatory foundation.

- Its reserve framework depends on dollar deposits and short-term U.S. government securities, delivering high-quality collateral across holdings.

- By late 2024, RLUSD had surpassed 100% collateralization, demonstrating early reserve strength.

- It currently upholds a 103% reserve ratio, reflecting a conservative approach to liquidity and backing.

Blockchain Networks, Ethereum, and XRPL

- As of late 2025, RLUSD’s circulating supply is split: 80% on Ethereum and 20% on XRPL.

- RLUSD is issued on Ethereum and XRP Ledger (XRPL), providing multi-chain access for diverse users.

- As of June 2025, supply totals ~$390 million on Ethereum and ~$65.9 million on XRPL, showing network distribution.

- XRPL processes over 1,500 TPS with transaction speeds of 3–5 seconds and minimal fees (~$0.0002), enabling rapid settlement.

- Dual deployment facilitates institutional adoption in payments, settlement, and tokenized assets.

- The dual-chain approach combines Ethereum’s extensive DeFi ecosystem with XRPL’s high-speed payments.

- This architecture supports exchange listings, multiple trading pairs, and global distribution across both networks.

- The multi-chain model accommodates institutional and retail flows, optimizing activity across blockchains.

Speed and Settlement Times

- The Ripple USD (RLUSD) on the XRP Ledger delivers settlement speeds of under 3–5 seconds, positioning it as a high-performance option for rapid transfers.

- On Ethereum, transaction times range from 15 seconds to several minutes, influenced by network congestion and gas-price fluctuations, creating a noticeable contrast in speed.

- By mid-2025, RLUSD had reached over $1 billion in daily settled flows, reflecting strong operational usage across networks.

- When compared with traditional cross-border bank transfers that require 1–3 days, RLUSD cuts settlement latency by roughly 90% or more, offering a significant efficiency upgrade.

- In a U.S.–Africa payment-rail pilot, RLUSD reduced FX and fiat-on-ramp processing from ~48 hours to under 30 minutes, demonstrating substantial gains in corridor performance.

- Full redemption for institutional clients is completed within 24 hours in regulated jurisdictions, showing streamlined off-ramp capability.

- On-chain distribution, approximately 80% on XRPL and 20% on Ethereum, shows that most RLUSD activity relies on XRPL’s faster infrastructure.

- This reduced latency opens the door for real-time treasury operations, remittances, and other time-sensitive financial flows, enabling broader utility.

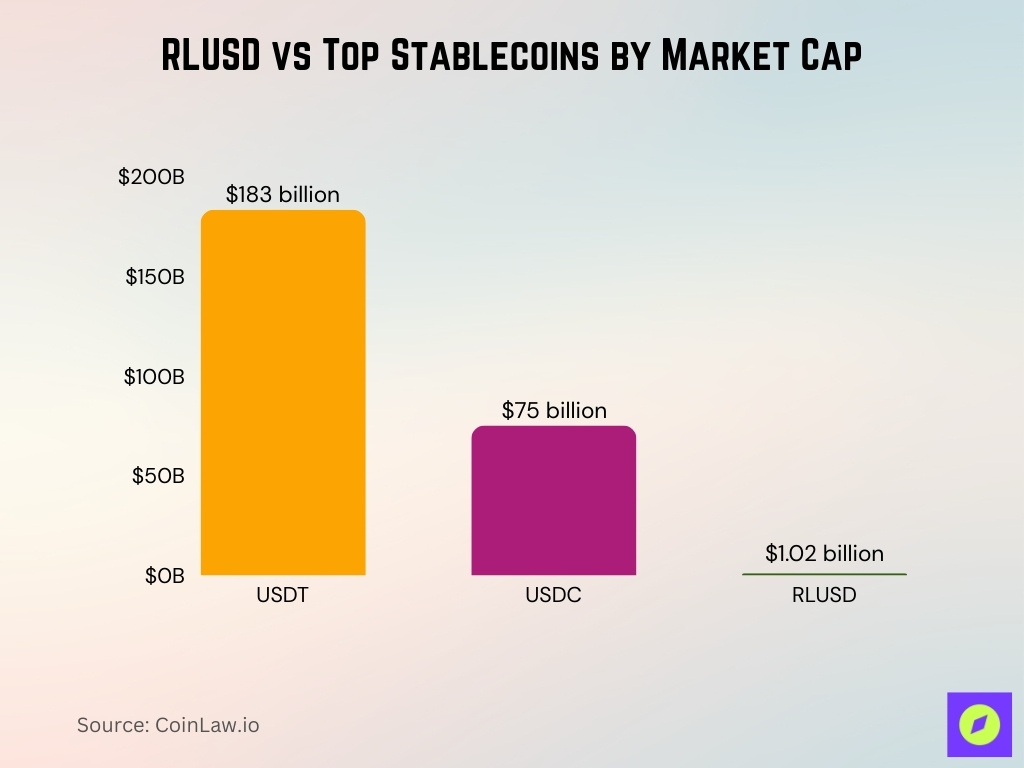

RLUSD Ranking Among Stablecoins

- RLUSD has a market cap of approximately $1.02 billion as of November 2025.

- Despite rapid growth, RLUSD remains far behind leaders like Tether’s USDT at $183 billion and Circle’s USDC at $75 billion.

- RLUSD is positioned around #60 in overall cryptocurrency market rankings by market cap.

- It also sits within the top 10 USD-pegged stablecoins worldwide, reflecting rising traction.

- Its entry into the top 10 followed a 14% jump in 24-hour trading volume, signaling stronger market activity.

- The stablecoin holds an “A” rating, placing it ahead of many competitors in trust and risk assessment.

- In the broader stablecoin category, RLUSD is currently ranked #14 as of November 2025.

- Its market cap aligns almost perfectly with its FDV, showing near-100% backing across reserves.

- RLUSD has posted a remarkable 1,278% year-to-date market-cap increase in 2025, reinforcing its upward trajectory.

Notable Milestones and Achievements

- RLUSD exceeded the $500 million circulating-supply milestone within seven months of launch, signaling rapid early adoption.

- Its market cap rose approximately 32.3% in Q3 2025, surpassing $600 million between June and July as momentum built.

- By late 2025, RLUSD entered the top 10 USD stablecoins by market cap, reflecting its strengthened competitive position.

- Integration into pilots with major card networks and banks enabled fiat settlement via stablecoin rails, expanding real-world use.

- The issuer publishes monthly reserve attestations and holds NYDFS approval, reinforcing transparency and regulatory compliance.

- RLUSD’s ecosystem roadmap emphasizes broader chain support and growing institutional asset flows, indicating continued expansion.

- The stablecoin achieved a 1,278% year-to-date market-cap increase in 2025, demonstrating exceptional growth.

- Ripple Prime’s launch, supported by a $1.25 billion acquisition of Hidden Road, advances RLUSD’s institutional adoption.

- As of late 2025, supply distribution sits at roughly 80% on Ethereum and 20% on XRPL, highlighting network preferences.

RLUSD vs Other Stablecoins Comparative Stats

- RLUSD’s Mcap of ~$1.02 billion is small compared with USDT (~$169 billion) and USDC (~$72 billion).

- RLUSD holds a backing ratio (Mcap/FDV) near 100%, which is comparable with premium stablecoins but higher than some algorithmic coins.

- Rating scores, RLUSD’s stability score is ~0.91, governance is ~0.86, and management is ~0.84.

- XRPL/Ethereum split, RLUSD issuance ~80% on Ethereum vs ~20% on XRPL.

- RLUSD posted ~1,278% YTD market-cap growth, significantly ahead of many competitors.

- From a regulatory trust perspective, RLUSD leads with its A-rating and full compliance posture.

RLUSD Use Cases

- RLUSD reduces cross-border remittance settlement times and lowers foreign-exchange frictions by up to 70%.

- Corporate treasuries use RLUSD to manage dollar liquidity with an on-chain equivalent of $1 billion+ in cash holdings.

- RLUSD serves as collateral in both crypto and traditional finance, with daily collateral trading volumes surpassing $150 million.

- RLUSD is piloted for instant card transaction settlements in partnership with regulated banks and payment networks.

- RLUSD supports lending, borrowing, and programmable stablecoins via smart contracts on both Ethereum and XRP Ledger.

Future Outlook and Growth Projections

- The stablecoin market is projected to reach $500 billion by 2028, reflecting accelerating expansion.

- Ripple Labs has outlined its plan to extend RLUSD to additional chains such as Cardano between 2025 and 2026, signaling broader interoperability.

- At the same time, Ripple Labs is positioning RLUSD as a core stablecoin across global enterprise and DeFi payment ecosystems, reinforcing its strategic role.

- Demand for programmable stablecoins like RLUSD is expected to grow 30–40% annually through 2030, especially within institutional markets, pointing to sustained long-term adoption.

Community Sentiment and Social Metrics

- Social dominance for RLUSD as part of the XRPL ecosystem stands at around 3.05%.

- Sentiment ratio on social platforms measured ~83% positive during key adoption announcements.

- Trading volume spiked by ~85% in one 24-hour window, with RLUSD seeing ~$100 million in volume and ~20% market-cap growth.

- Community conversations focus heavily on RLUSD’s institutional integration, regulatory compliance, and payment-rail use cases.

- Mentions rose to ~40,750 over a reporting month, up ~15,690 from prior periods.

- Engagement metrics show a total of ~6.18 million interactions, a sign of moderate but growing community interest.

- RLUSD is viewed as a compliance-first stablecoin option, with mixed sentiment about how quickly it will challenge legacy leaders.

- Despite strong positive sentiment, awareness remains lower compared to top-tier stablecoins.

Frequently Asked Questions (FAQs)

It is the 10th-largest USD-backed stablecoin.

Roughly 1,278% since launch.

December 2024.

Approximately $819.7 million on Ethereum and $203 million on XRPL.

Conclusion

In just under a year since its launch, RLUSD has established itself as a serious contender in the stablecoin industry. Specifically, its multi-chain architecture, regulatory compliance, and growing use in enterprise and payment-rail contexts give it a distinctive profile. Nevertheless, RLUSD remains significantly smaller than giants like USDT and USDC, and therefore, its future trajectory will depend on scaling adoption, broadening liquidity, and navigating competition and regulation. For this reason, for crypto professionals and institutional users alike, RLUSD offers a fresh, compliance-oriented alternative worth tracking.