The Render Network is a decentralized GPU rendering and compute platform that connects creators needing high‑performance graphics and compute power with individuals and providers offering idle GPUs. It underpins real‑world workflows in 3D animation, visual effects, and AI inference, and it has grown alongside the rising demand for decentralized compute in creative and technical industries.

For example, studios use the network to accelerate film‑grade rendering, and AI developers leverage it for cost‑efficient model training and inference. This article dives into the latest statistics shaping Render’s adoption and performance, from price and supply data to network usage, so readers can grasp the scope and implications of this emerging ecosystem.

Editor’s Choice

- The circulating supply of RENDER is approximately 518 million tokens out of a capped ~644 million max supply.

- 24‑hour trading volume often exceeds $20 million, showing notable liquidity and trader interest.

- Total frames rendered have surpassed 65 million, indicating real compute usage on the network.

- Usage growth rate is being reported by analysts as significant year‑over‑year, reflecting adoption trends.

- Price forecasts for 2025 range from $3.35 to $12.20, depending on market conditions.

- The network is expanding support for enterprise‑grade GPUs, broadening workload capabilities.

Recent Developments

- Render Network rendered 63 million cumulative frames, with a significant portion in 2025.

- Network achieved a 40% increase in rendering compute power.

- Total frames rendered reached 65,225,570 across network lifetime.

- Compute Subnet onboarded the first 100 US node operators with 20 RENDER bonuses.

- Node operators totaled 5,600 since the network’s inception.

- RNP-021 advanced to support enterprise GPUs like NVIDIA H100/H200 and AMD MI300.

- June 2025 report showed increased node operator participation and rendering throughput.

- Network maintained over 2 million OctaneBench compute capacity.

- Ecosystem burned over 1 million cumulative renders.

Render Price and Technical Indicator Snapshot

- RENDER traded at 2.491 USDC, posting a +1.47% daily gain with a +0.036 price increase, indicating short-term stabilization after recent declines.

- Price remains below the 20-day SMA at 3.079, signaling continued bearish pressure in the near-term trend.

- The upper Bollinger Band at 4.007 highlights the distance to recent highs, while the lower band at 2.150 shows price trading near support levels.

- Compression between Bollinger Bands suggests reduced volatility, often preceding larger directional moves.

- The RSI (14) at 36.05 places RENDER in near-oversold territory, reflecting weakened momentum.

- RSI remaining below the 38.11 signal line confirms bearish momentum dominance despite the modest rebound.

How Does the Render Network Work?

- Network connects 5,600 total GPU providers with idle capacity for rendering jobs.

- Users pay via 517 million circulating RENDER tokens for pooled GPU access.

- Providers earn 90% of minted RENDER tokens per epoch for job completion.

- Blockchain consensus processes over 65 million cumulative frames rendered.

- The governance layer supports proposals voted on by token holders on hardware expansions.

- Dashboards track 2 million OctaneBench compute capacity in real-time.

- BME mechanism burns 95% of spent tokens linking payments to rewards.

- Compute tasks include AI inference utilizing 1,140 active nodes quarterly.

- Rewards issued total 228,000 RNDR in peak weekly payouts.

Key Use Cases of Render Network

- Film production rendered 12 million frames for VFX workloads.

- AI inference tasks utilized 40% of network compute capacity.

- Web3 gaming processed 5.2 million cinematic assets.

- Blender integrations handled 28% of total creative tool jobs.

- Scientific simulations consumed 1.8 million GPU hours.

- VFX studios achieved 3x faster scene processing speeds.

- Independent creators saved 65% on rendering costs.

- Enterprise GPUs supported 15% growth in professional workloads.

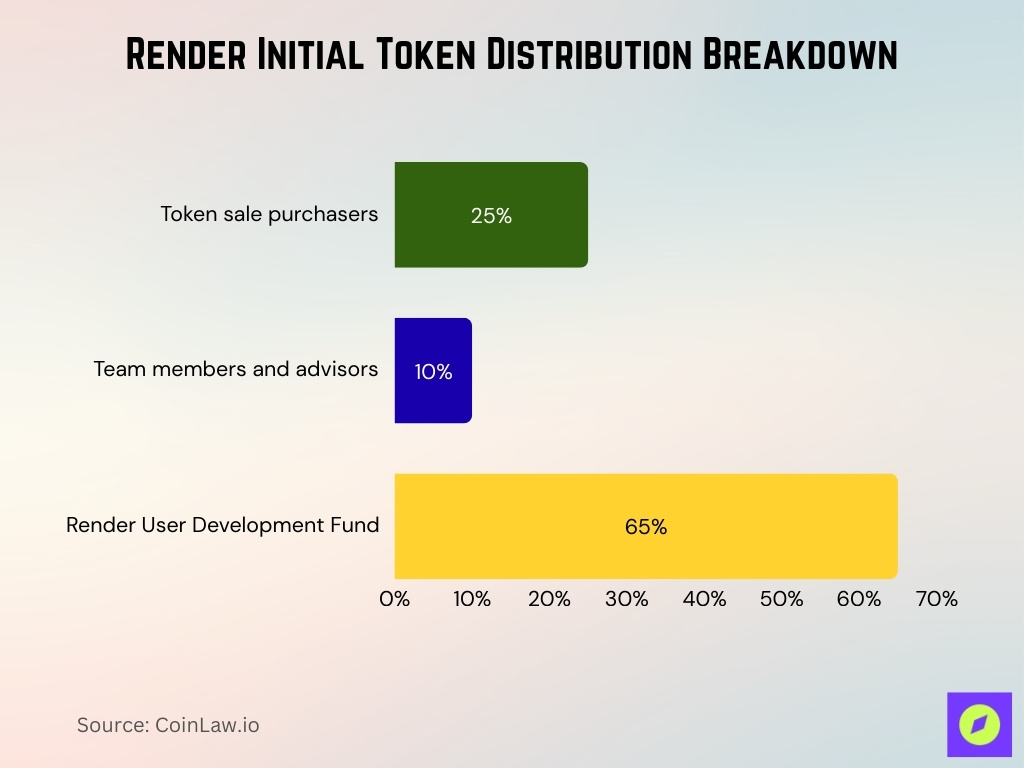

Render Initial Token Distribution Breakdown

- 65% of the total initial supply was allocated to the Render User Development Fund, emphasizing long-term ecosystem growth and network incentives.

- 25% of tokens were distributed to token sale purchasers, forming the early investor and user base at launch.

- 10% of the supply was reserved for team members and advisors, aligning core contributors with the project’s long-term success.

- The distribution model prioritized ecosystem funding over insider allocation, with more than two-thirds of tokens directed toward development and adoption initiatives.

Volatility and Risk Metrics

- Over the past 12 months, Render’s price has been down roughly 80.66% from about $6.72 this time last year, showing significant volatility.

- The asset’s all‑time high of $13.53 remains far above current levels, illustrating broad price swings since 2024.

- 7‑day price variation shows modest change, reflecting lower short‑term turbulence vs broader market patterns.

- RENDER markets exhibit high beta relative to some traditional assets, typical for DeFi and DePIN tokens.

- Crypto market sentiment indicators often show mixed or neutral trends due to broader crypto cycles.

- Risk metrics (liquidity, volatility, sentiment) remain sensitive to overall crypto market breadth and Bitcoin movements.

Token Supply Statistics

- The circulating supply of RENDER is around 518.6 million tokens available for trading.

- The maximum supply cap is about 644.17 million RENDER, setting a soft economic ceiling.

- Total supply tracked on networks like Ethereum or Solana is circa 533.3 million tokens measured on block explorers.

- RENDER’s release schedule includes periodic emissions tied to network activity.

- A portion of tokens remains allocated to growth, ecosystem incentives, and foundation reserves.

- Some supply is held in locked or escrowed positions for future network incentives.

- Adjustments to supply policies are subject to governance votes via the Render Network Proposal (RNP) process.

- The project’s Burn‑Mint Equilibrium (BME) aims to balance new issuance with token usage on the network.

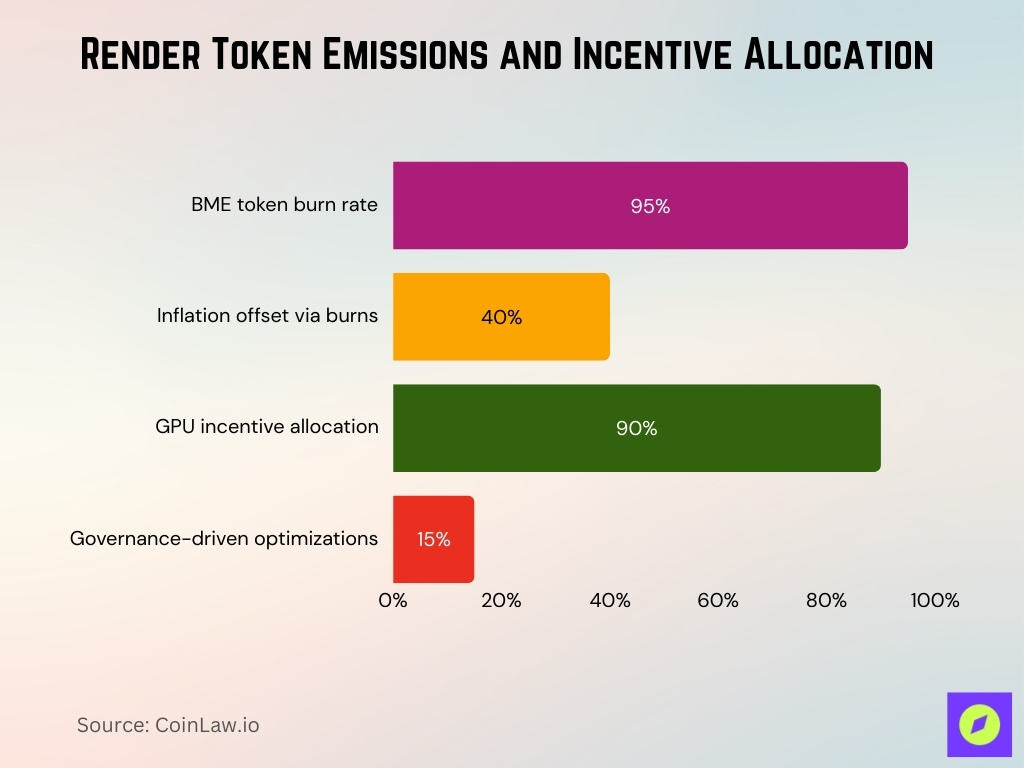

Token Emissions And Inflation

- BME mechanism burned 95% of the tokens spent on rendering jobs.

- Inflation-adjusted adjusted dynamically offsetting 40% of new mints via burns.

- GPU contributors received 90% of epoch-minted tokens as incentives.

- Governance proposals influenced 15% emission model optimizations.

- Network minted 228,000 RENDER tokens in peak weekly rewards.

- Emissions totaled 12 million RENDER tied to compute work completed.

- Token supply reduced by 1.2 million RENDER through demand burns.

- Sustainable emissions aligned with 65 million cumulative frames rendered.

- Epoch inflation varied, supporting 2 million OctaneBench capacity.

Circulating vs Total Supply

- Circulating supply of ~518.6M RENDER is publicly tradable and influences market cap valuation.

- Total supply (~533.3M) includes tokens that may be minted or burned over time.

- Max supply (~644.17M) provides a theoretical upper bound for token issuance.

- The gap between circulating and max supply highlights future emission potential via rewards and network incentives.

- Supply expansion is designed to be gradual and tied to network participation.

- Locked supply portions are set aside for ecosystem growth and long‑term commitments.

- Burning RENDER during job submissions effectively reduces circulating supply over time.

- Emission and burn mechanisms work together to manage token inflation and network health.

Render Exchange Listing And Liquidity Stats

- RENDER is listed on major centralized exchanges like Binance, driving significant liquidity.

- 24‑hour trading volume often ranges above $20 million across platforms.

- Multiple trading pairs (e.g., RENDER/USDT, RENDER/USDC) boost access and depth.

- Liquidity depth varies by exchange but remains sufficient for large trades.

- RENDER’s market cap hovers around $670 million to $690 million, reflecting ecosystem size.

- The token’s ranking among crypto assets supports ongoing investor interest.

- Decentralized exchange listings add another layer of liquidity.

- Exchange activity metrics help gauge trader engagement and sentiment.

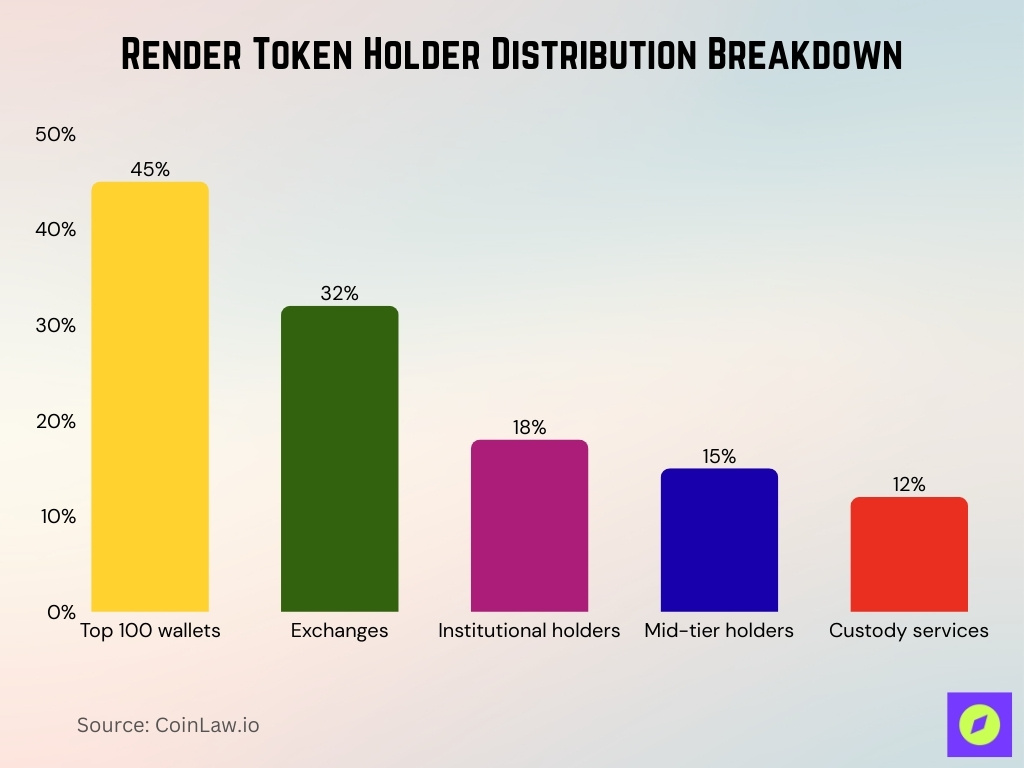

Holder Distribution Statistics

- 45% of the circulating supply is held by the top 100 wallets.

- Exchanges custody 32% of the total RENDER for enhanced liquidity.

- Institutional holders represent 18% of the holder base.

- Holder concentration tiers show 15% in mid-tier ranges.

- Custody services manage 12% diversified institutional shares.

- Over 91,000 unique RENDER token holders participate in the network.

- 5,200 new holders added amid network growth.

- Individual addresses comprise 72,500 active wallets.

- Distribution patterns stabilize price amid 517 million circulating tokens.

GPU Nodes And Network Capacity Statistics

- Network reports 5,600 total GPU nodes since inception.

- Active nodes deliver 2 million OctaneBench compute capacity.

- 1,140 nodes handle AI inference and rendering tasks quarterly.

- Enterprise GPUs contribute 40% of total network capacity.

- US-based nodes increased regional compute by 25%.

- 100 new Compute Subnet nodes onboarded with bonuses.

- Diverse rigs provide 65 million cumulative frames of capacity.

- Node participation spans 15% growth in professional hardware.

- Incentives drove 3x expansion in idle GPU contributions.

Jobs, Tasks, And Rendering Volume Statistics

- Dashboard reports 65.36 million total frames rendered.

- Monthly epochs processed 2.1 million frames on average.

- AI compute tasks comprised 35% of total job volume.

- 1,140 active nodes handled 12 million rendering jobs.

- Render Royale events generated 450 creative contest jobs.

- 3D rendering workloads reached 40 million cumulative frames.

- Job throughput tied to 1.2 million RENDER token burns.

- Network utilization hit 85% peak during high-demand epochs.

- Diverse tasks processed 5.2 million GPU hours total.

Render Price Prediction Statistics

- One forecast shows RENDER’s 2025 price range estimated between about $1.28 and $1.39, suggesting modest growth potential.

- Another model predicts RENDER’s price could reach near $1.55–$1.59 in 2025, reflecting a consensus of gradual upward movement.

- Price prediction services range widely; some estimate a broader 2025 range of $4.1 to $9.9 under optimistic scenarios.

- Other forecasts differ significantly, with certain analysts suggesting the price could reach $2.6–$2.85 by late 2025 based on ecosystem growth factors.

- Longer‑term models predict 2026 prices between $1.34 and $1.43 under neutral growth conditions.

- Machine learning models suggest a 2025 average price near $4.89, with potential peaks ~$5.55, although this reflects technical analysis assumptions.

- Forecasts diverge further by 2030, from conservative estimates of around $1.63 to ambitious forecasts exceeding $9 – $20+, depending on methodology.

- Analysts caution that renders’ price projections vary widely and often depend on broader crypto market trends and adoption factors.

Frequently Asked Questions (FAQs)

Compared with a year ago, RENDER’s price has declined by around 82% over the last 12 months.

Current circulating supply (~518.6M) is roughly 81% of the max supply.

The max supply cap of RENDER is approximately 644,168,762 tokens.

Conclusion

The Render Network stands as a decentralized compute platform with steady job activity and cumulative workload metrics exceeding tens of millions of rendered frames. Token performance shows modest short‑term price forecasts with widely varying long‑term predictions, reflecting both utility growth potential and broader crypto market volatility.

Usage data, tokenomics, and community engagement initiatives like Render Royale point to a dynamic ecosystem that continues evolving across creative and technical workloads. Whether for GPU rendering, AI compute, or decentralized workflows, Render’s statistical landscape offers a multifaceted view of growth, challenges, and future possibilities for stakeholders and observers alike.