PwC, one of the world’s largest professional services networks, released its financial and operational data showing modest growth amid broader economic challenges. Known for its assurance, tax, and advisory services, PwC serves a majority of the Global 500 and remains a key player in shaping global business practices. In the U.S., companies across sectors lean on PwC for audit integrity and strategic guidance, while multinationals rely on its tax and consulting insights. This article explores the latest statistics, offering a clear view into PwC’s performance and positioning.

Editor’s Choice

- $56.9 billion PwC global gross revenue in FY25, up ~2.9% year‑over‑year.

- 364,000+ PwC people are employed across 137 countries and territories.

- PwC serves 82% of the Fortune Global 500 clients.

- Advisory services continue to be a major contributor to revenue growth.

- Americas region reported ~5.5% revenue increase in FY25.

- PwC invested $3.1 billion in strategic initiatives, including AI.

Recent Developments

- For FY25 ending June 30, 2025, global gross revenues reached $56.9 billion, growing ~2.7% in local currency and 2.9% in US dollars over FY24.

- PwC reduced its global headcount by about 5,600 people, lowering total staff below 365,000.

- The firm abandoned its mid‑2026 goal to hire an additional 100,000 employees amid a slowing revenue environment.

- About $1.5 billion was directed toward expanding and scaling AI capabilities.

- Advisory services saw stronger relative growth vs assurance and tax services in FY25.

- Americas region revenues grew roughly 5.5%, outpacing other geographies.

- In contrast with competitors, PwC’s growth rate lagged Deloitte and EY in 2025.

- PwC continued investing in acquisitions and strategic partnerships with 12+ deals announced in FY25.

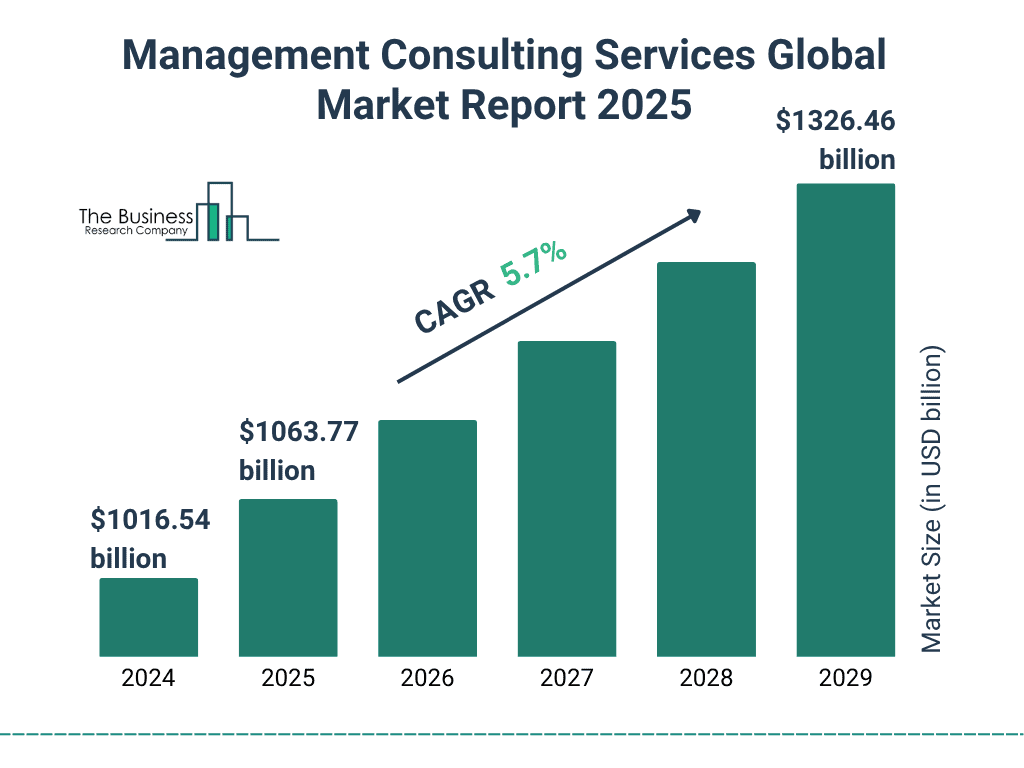

Management Consulting Services Global Market Growth

- The global management consulting market increased to $1,063.77 billion in 2025, signaling steady year-over-year expansion.

- Continued growth is projected through 2026–2028, with market value rising from $1,124 billion to $1,256 billion as enterprises invest in digital and operational consulting.

- By 2029, the global management consulting market is forecast to reach $1,326.46 billion, marking a significant expansion over the five-year period.

- The market is expected to grow at a 5.7% CAGR between 2024 and 2029, supported by strong demand across strategy, technology, and management advisory services.

PwC Statistics Overview

- 364,000+ people worked in the PwC network as of 2025.

- The network spans 137+ countries and territories.

- PwC serves around 82% of the Fortune Global 500 companies.

- FY25 revenue of $56.9 billion surpasses FY24’s $55.4 billion.

- Advisory services are the largest contributor within the firm’s service mix.

- Assurance and tax services remain core revenue sources despite slower growth.

- PwC’s workforce number marks a net decrease from previous years.

- Investments in technology and AI represent a prioritization of digital services.

Global Revenue and Growth Trends

- FY25 global revenue: $56.9 billion, ~2.9% growth compared to FY24.

- FY24 revenues were $55.4 billion, up roughly 3.7% over FY23.

- Growth continues but at a slowing pace over recent years.

- In the Americas, revenues climbed approximately 5.5% in FY25.

- EMEA saw steady but moderate contributions to revenue.

- Advisory services contributed significantly to overall revenue growth.

- Assurance and tax lines showed slower gains compared with advisory.

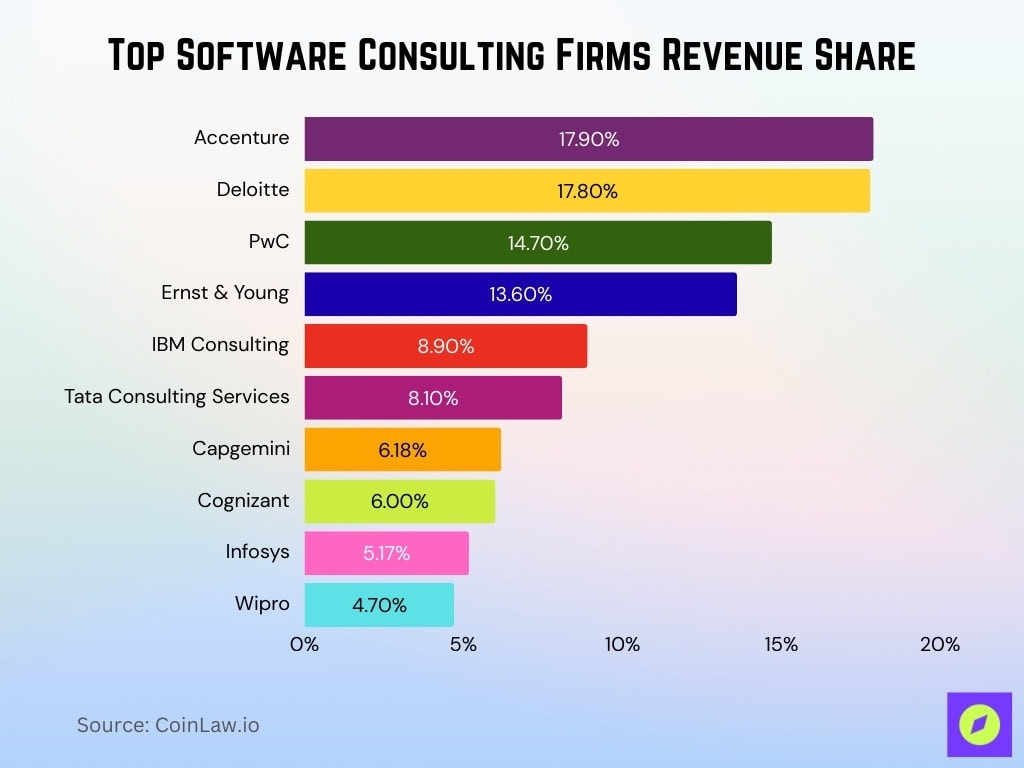

Top Software Consulting Firms Revenue Share

- Accenture leads the global software consulting market with a 17.9% revenue share, highlighting its scale in digital transformation and enterprise technology services.

- Deloitte follows closely at 17.8%, reinforcing its position as a top-tier consulting provider with a diversified advisory and technology portfolio.

- PwC captures 14.7% of market revenue, reflecting strong demand for its consulting, assurance, and technology-enabled services.

- Ernst & Young holds a 13.6% share, supported by growth in digital strategy, risk, and enterprise modernization projects.

- IBM Consulting accounts for 8.9% of total revenue, driven by hybrid cloud, AI, and enterprise software advisory services.

- Tata Consulting Services represents 8.1% of market share, leveraging global delivery models and large-scale IT transformation programs.

- Capgemini controls 6.18% of revenue, supported by demand for cloud migration and systems integration work.

- Cognizant holds 6.0% of the market, maintaining a strong presence in application services and digital engineering.

- Infosys captures 5.17% of global revenue, reflecting steady enterprise technology consulting demand.

- Wipro rounds out the top ten with a 4.7% share, anchored by managed services and digital operations consulting.

Number of Employees and Global Workforce

- PwC’s 2025 workforce was about 364,000 globally.

- Headcount fell by ~5,600 employees year‑over‑year.

- Reduction marks the first global workforce shrinkage since 2010.

- Advisory teams continued to be focal hiring areas despite broader cuts.

- Workforce changes reflect efficiency gains from AI and restructuring.

- PwC serves 82% of Fortune Global 500 clients with its workforce.

- Headcount in FY24 was reported above 370,000.

- Significant hiring shifts occurred across professional levels and regions.

Offices and Geographic Presence

- PwC operates in 137 countries and territories worldwide in FY25.

- The global network serves 82% of the Fortune Global 500.

- PwC employs 364,000 people across 136 countries.

- EMEA region delivers $22.5 billion in revenue, growing 2.5%.

- Asia Pacific revenue stands at $8.8 billion, down 4.1%.

- PwC maintains offices in approximately 700 global locations.

- Middle East employs over 12,000 staff across the region.

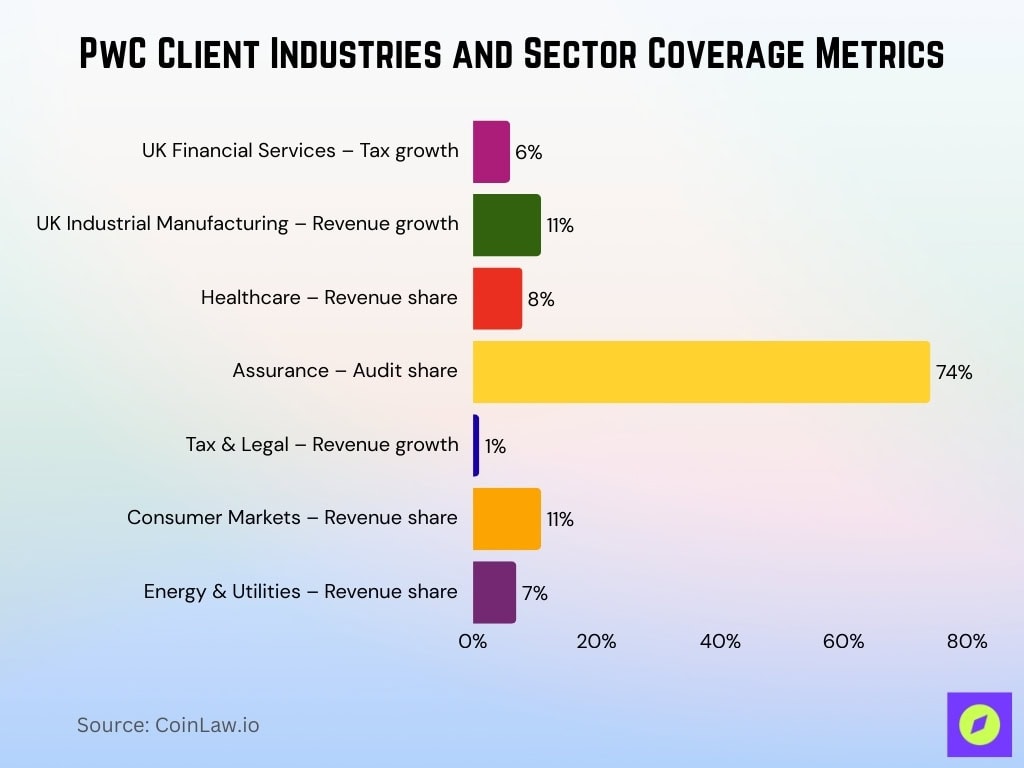

Client Industries and Sector Coverage

- In the UK, Financial Services clients supported 6% revenue growth within the Tax line of service as regulatory and reporting demands increased.

- PwC UK’s Industrial Manufacturing & Services segment delivered 11% growth, making it one of the firm’s strongest-performing industry sectors.

- Healthcare and health-related industries account for roughly 8% of PwC’s client revenue mix, serving a global healthcare market valued at over $4.5 trillion.

- Assurance services produced $19.8 billion in revenue, with core audit work representing about 74% of the assurance portfolio across industries.

- Tax and Legal Services revenues rose 1.0% in U.S. dollar terms to $12.7 billion as clients navigated complex global tax and regulatory changes.

- Consumer markets, including retail and consumer goods, represented about 11% of PwC’s global client revenues, supported by growing Managed Services and transformation work.

- Energy, utilities, and resources clients contributed around 7% of PwC’s client revenues, with increased demand for sustainability reporting and climate-related assurance.

Assurance Services Statistics

- Assurance services generated $19.8 billion in global revenues.

- Revenue reflects 1.7% growth at constant exchange rates.

- Assurance growth reached 1.9% in US dollar terms.

- Audit services comprise 74% of total Assurance revenues.

- PwC invests $1 billion in Next Generation Audit platform.

- Assurance supports thousands of global audit engagements.

- ESG and AI assurance areas drive accelerating growth.

Advisory and Consulting Services Statistics

- Advisory services generated $24.3 billion in global revenues.

- Segment achieved 4.5% growth at constant exchange rates.

- Revenue increased 6.8% in US dollar terms.

- Strategy consulting drives 28% of advisory revenues.

- Digital transformation services grow 12% year-over-year.

- Deals advisory supports $1.2 trillion in client transactions.

- Cybersecurity engagements rise 15% amid rising threats.

- AI deployment consulting serves 70% of Fortune 500 clients.

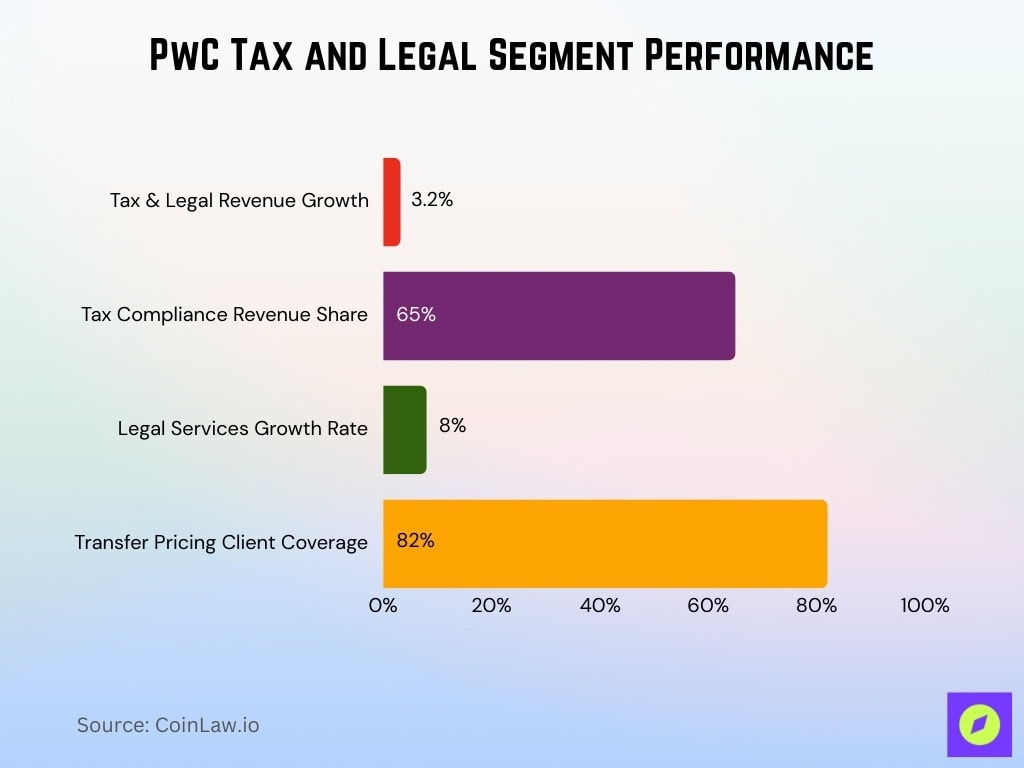

Tax and Legal Services Statistics

- Tax and Legal services generated $12.7 billion in global revenues.

- Revenue increased 3.2% in US dollar terms.

- Tax compliance services drive 65% of segment revenues.

- Legal services grow 8% in integrated practice markets.

- Pillar Two reforms boost demand across 137 countries.

- Transfer pricing advisory supports 82% Fortune Global 500 clients.

- Tax technology investments reach $500 million annually.

- Cross-border tax strategies serve thousands of multinationals.

PwC U.S. Business Statistics

- PwC’s U.S. operations represent a core component of its global business, contributing to the Americas’ revenue of $25.5 billion in FY25.

- The U.S. arm employs roughly 75,000+ professionals, about 20% of PwC’s global workforce.

- Approximately 1.5% of U.S. business‑services staff (~150 employees) were laid off in late 2025 as part of efficiency restructuring tied to automation and AI integration.

- PwC’s U.S. layoffs follow earlier reductions in 2023 and 2024, with ~3,300 roles cut in advisory, audit, and tax support roles before 2025.

- U.S. business services roles include functions like IT, HR, operations, finance, and communications.

- Regional revenue growth in the Americas was ~5.5% in FY25, indicating stronger demand in the U.S. market relative to global averages.

- U.S. clients increasingly seek PwC expertise in digital transformation, risk management, and ESG reporting.

- Despite layoffs in support roles, PwC continues to invest in AI training and talent development across the U.S. business unit.

PwC Asia‑Pacific Statistics

- In FY25, Asia Pacific revenues for PwC were $8.8 billion, falling roughly 4.1% year‑over‑year.

- This decline contrasts with growth in the Americas and EMEA regions.

- PwC’s Asia Pacific CEO Survey found 55% of regional CEOs expect global economic improvement over the next year.

- Only 7% of revenue over the past five years in Asia Pacific came from fundamentally new businesses, signaling slower innovation uptake.

- 64% of Asia Pacific CEOs reallocate less than 20% of financial resources toward reinvention efforts.

- 70% of these CEOs reallocate less than 20% of their workforce to new growth areas.

- Roughly 35% of regional CEOs report venturing into new industries beyond their core sector.

- Talent shortages and tech disruption are cited by ~25% of Asia Pacific CEOs as the biggest business challenges.

Financial Performance and Profitability Metrics

- Global gross revenues for PwC in FY25 reached $56.9 billion, up 2.9% in U.S. dollars and 2.7% in local currencies over FY24.

- Net revenues, after client assignment costs, rose 3.0% to $54.5 billion in FY25.

- The Americas region posted revenue gains of ~5.5% to $25.5 billion, leading PwC’s regional growth performance in FY25.

- EMEA revenue increased by ~3.7% to $22.5 billion.

- Advisory services contributed the largest share of growth, expanding by ~4.6% in 2025.

- Assurance services grew by approximately 1.9% in FY25.

- Tax & Legal services posted ~1.1% revenue growth in the same period.

- Although revenue rose, growth was slower than key competitors such as Deloitte and EY.

- PwC’s slower growth in FY25 reflects broader industry pressures and reduced client spending in certain sectors.

Productivity and Revenue per Employee

- With ~364,000 employees in FY25, PwC’s estimated revenue per employee is roughly $157,000, based on $56.9 billion in gross revenue.

- PwC data shows that early AI adopters among client companies generate up to 3x more revenue per employee compared with slower adopters.

- Investment in AI capabilities (nearly $1.5 billion in FY25) aims to enhance productivity across service lines.

- Upskilling programs have seen 315,000 PwC professionals trained in AI‑related skills since 2023.

- Continued focus on automation and analytics is expected to improve revenue productivity.

- Workforce restructuring via AI and tech is reshaping roles toward higher‑value advisory work.

- Despite cuts, productivity investments signal a shift away from headcount growth toward efficiency gains.

- Productivity tracking remains a key KPI for PwC’s strategic planning in 2026.

Digital Transformation and Technology Services Statistics

- PwC invested $3.1 billion across its global network for digital expansion.

- Strategic alliances formed with 6 major tech leaders, including Microsoft and AWS.

- Assurance for AI service launched, supporting thousands of AI systems.

- AI Centres of Excellence have been established in 137 countries.

- Digital transformation drives 12% of total advisory revenues.

- Value in motion initiative identifies $7.1 trillion redistributed value opportunity.

- Cloud adoption engagements grow 18% year-over-year.

- Cybersecurity services protect 82% Fortune Global 500 clients.

- Data analytics platforms are deployed across 364,000 employees.

Sustainability and ESG Reporting Statistics

- More than 50% of surveyed companies report increased pressure to share sustainability data in 2025.

- 70% of firms surveyed say sustainability reporting delivered significant or moderate strategic value beyond compliance.

- Use of AI in sustainability reporting nearly tripled to 28% in 2025, up from ~11% last year.

- PwC highlights ESG reporting as a strategic priority for CFOs and leadership teams.

- Corporate governance and compliance remain top priorities for executives navigating regulatory shifts.

- Demand for sustainability assurance services continues to grow as disclosure requirements intensify.

- ESG frameworks now influence supply chain, investor relations, and workforce strategies.

- PwC’s own sustainability goals include a 73% reduction in scope 1 & 2 emissions versus a 2019 baseline and the use of 99% renewable electricity in territories.

Frequently Asked Questions (FAQs)

Revenue grew 2.7% in local currency and 2.9% in U.S. dollars year‑over‑year.

PwC operates in 137 countries and territories globally.

PwC served 82% of the Fortune Global 500 clients.

PwC reduced its workforce by 5,600 employees in FY25.

Conclusion

PwC’s performance shows a firm adapting amid shifting economic, technological, and regulatory landscapes. While global revenue growth remained modest, strategic investments in AI, digital transformation, and sustainability services are shaping future readiness. U.S. business‑unit adjustments, Asia‑Pacific challenges, and productivity enhancements reflect a network in transition. Sustainability and ESG reporting are rising as strategic priorities, with technology playing a central role in compliance and value creation. As PwC continues to align services with evolving client needs, its statistical profile today underscores both the firm’s resilience and the structural changes defining professional services in the Intelligence Age.